ZarMoney vs Sage vs Wave: Top Accounting Tools Compared

In the realm of online accounting software, three prominent names consistently emerge: ZarMoney, Sage, and Wave. Their reputation is built on robust features, high reliability, and positive user feedback.

As cloud-based accounting solutions, they provide businesses with efficient tools to manage their financial operations seamlessly. The question often arises for many businesses is: Which is the best fit?

Each software has strengths and potential drawbacks, depending on specific business requirements.

To assist in making an informed decision, this article will compare several categories, detailing what each platform can offer. Let's delve into the comparison.

Sage vs Wave vs ZarMoney

|

|

ZarMoney |

Sage |

Wave |

|

Customers & Account Receivable |

|||

|

Create and email Invoices |

|

|

|

|

Recurring Invoices |

|

|

|

|

Credit Limit & Credit Hold |

|

× |

× |

|

Accept Online Payments |

|

|

|

|

Receive ACH Payments |

|

|

|

|

Quotes / Estimates |

|

|

|

|

Sales Orders |

|

× |

× |

|

Order Status |

|

× |

× |

|

Customer Statement |

|

× |

× |

|

Scheduler |

|

× |

× |

|

Accept Pre-payments |

|

× |

|

|

Notification via Text & Email |

|

|

|

|

Vendors & Account Payable |

|||

|

Bills |

|

|

|

|

Expenses |

|

|

|

|

Automatic matching |

|

|

|

|

Payable Center & Calendar |

|

|

× |

|

Approve Bills |

|

× |

× |

|

Payment Discounts |

|

× |

|

|

Receipt Attachment |

|

|

|

|

Related Transactions |

|

× |

|

|

Automatic Expense Recording |

|

|

|

|

Productivity |

|||

|

Customizable Dashboard |

|

|

|

|

Collaborate with your team |

|

× |

× |

|

File Attachment |

|

|

|

|

Access from everywhere |

|

|

|

|

Mobile App |

Coming soon |

|

|

|

Internal Notes |

|

× |

× |

|

Advance user Permissions |

|

× |

× |

|

Restricted IP Access |

|

× |

× |

|

App Store |

Basic |

Google Play |

Google Play |

|

Notification via Text & Email |

|

|

|

|

Organize Customers with Custom Fields |

|

× |

× |

|

Inventory |

|||

|

FIFO Cost Methods |

|

|

|

|

Inventory Management |

|

|

× |

|

Manage Multiple Warehouses |

|

× |

× |

|

2 Step Warehouse Transfer |

|

× |

× |

|

Price Level |

|

× |

× |

|

Barcode |

|

× |

× |

|

Customizable Units of Measures |

|

|

× |

|

Get real-time inventory data |

|

|

× |

|

Product Category |

|

|

× |

|

Customizable Product Fields |

|

|

× |

|

Item Tracking and History |

|

|

× |

|

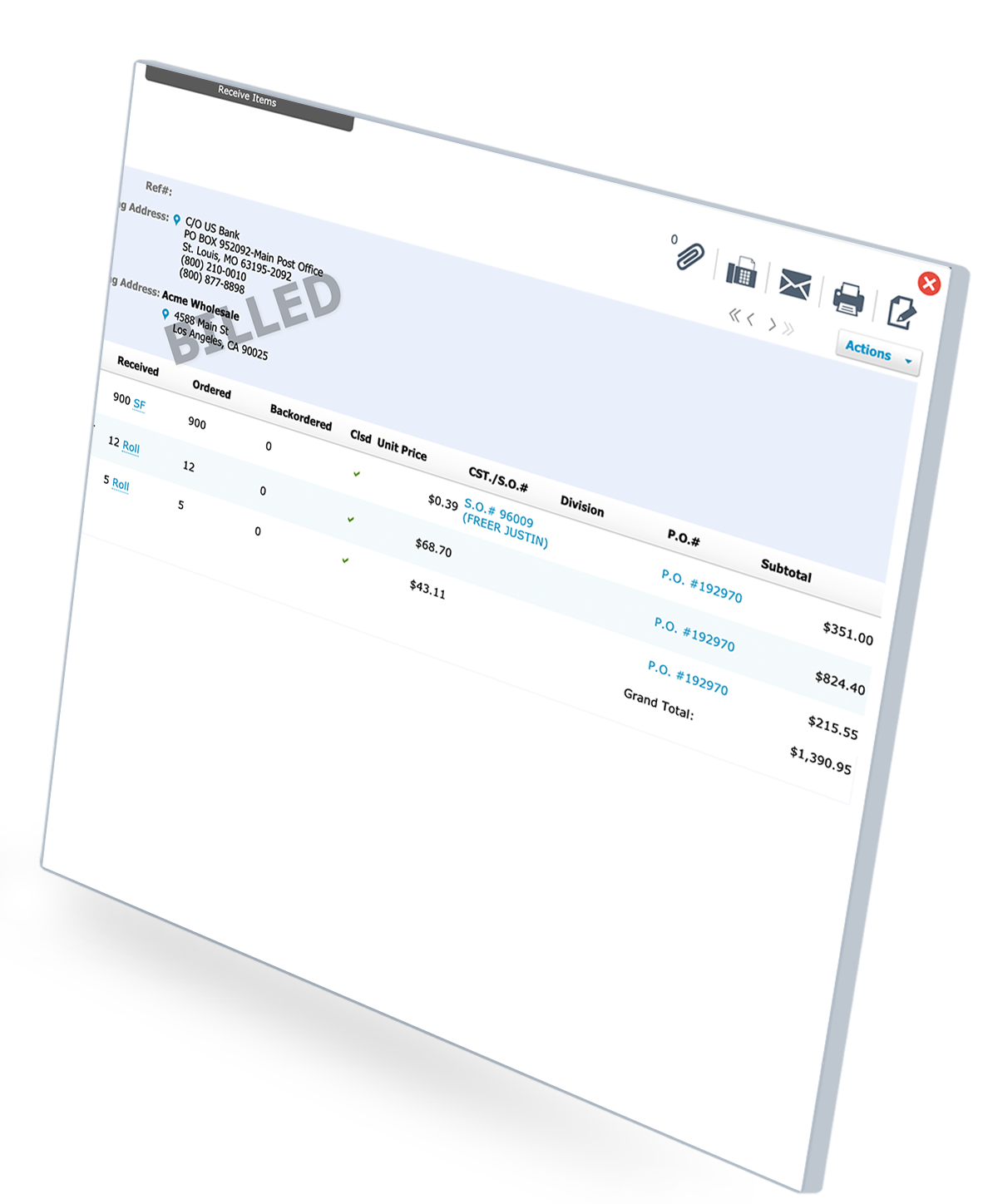

Compare Received Inventory with PO’s |

|

× |

× |

|

Create Pick Lists |

|

× |

× |

|

Split Transactions with Enhanced Inventory Receiving |

|

× |

× |

|

Accounting |

|||

|

Bank Connection |

|

|

|

|

Bank Account Reconciliation |

|

|

|

|

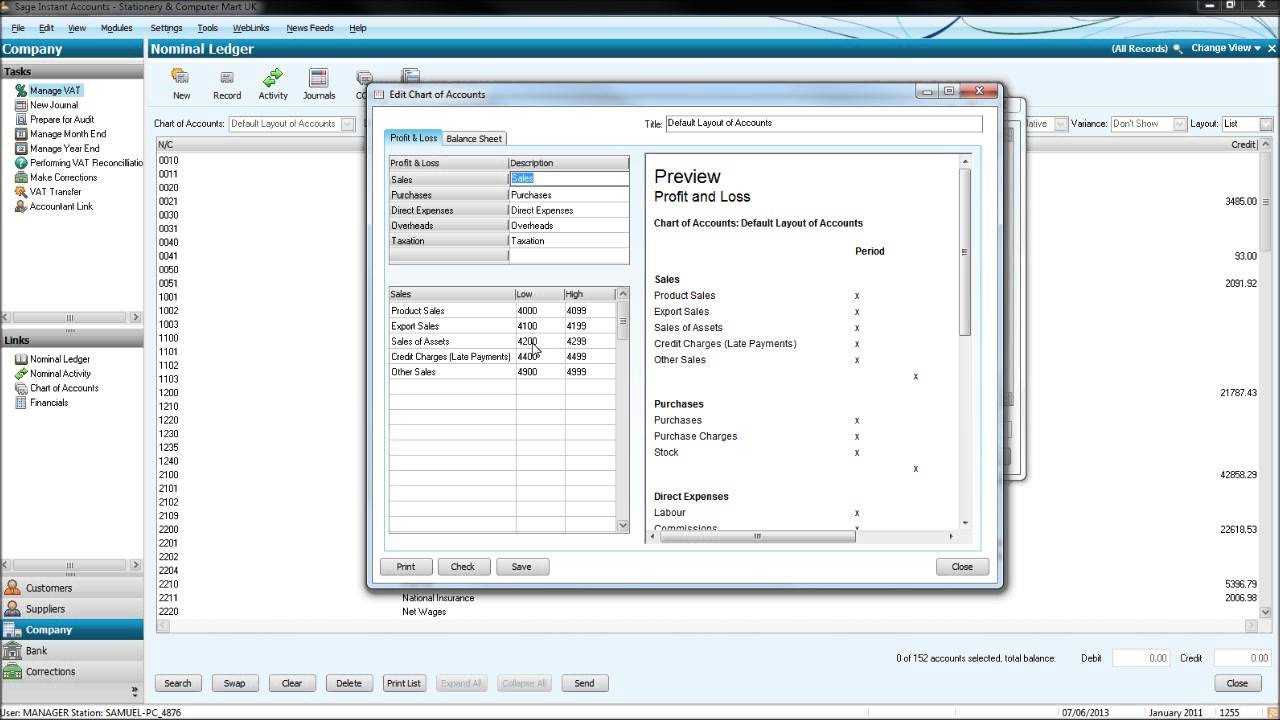

Profit & Loss |

|

|

|

|

Sales Tax |

|

More advance |

|

|

Bank Deposits |

|

|

|

|

Import bank transactions |

|

|

|

|

Fund Transfers |

|

|

|

|

Journal Entries |

|

|

|

|

Reporting |

|||

|

Insight ™ |

|

× |

× |

|

1099 Reporting |

|

|

× |

|

Balance sheet |

|

|

|

|

Trial Balance |

|

× |

× |

|

Account Receivable (A/R) |

|

|

|

|

Account Payable (A/P) |

|

|

|

|

Comprehensive Reporting |

|

|

|

Sage vs Wave vs ZarMoney: A Quick Overview

1. ZarMoney

In today's digital business world, ZarMoney emerges as a front-runner. ZarMoney is a robust financial management platform, not just an ordinary accounting software perfectly suited for a spectrum of businesses, from budding startups to established enterprises.

Its cloud-based nature ensures real-time insights into financial metrics, a crucial aspect in the rapidly changing business landscape. What sets ZarMoney apart is its adaptive design: whether you're a freelancer looking to track single invoices or a large corporation with complex accounting needs, ZarMoney scales, and molds to fit your requirements.

Its sleek interface and state-of-the-art financial reporting make business accounting less of a chore and more of a strategic operation. When you use ZarMoney, you're not just choosing software but aligning with a financial partner that grows with you.

2. Sage Business Cloud Accounting

Navigating the Sage vs Wave discussion, Sage Accounting emerges as a formidable contender. With its rich legacy in financial software, Sage Business Cloud Accounting offers a blend of tried-and-tested functionalities with modern innovations.

It’s not just software; it's a comprehensive ecosystem tailored for micro and medium businesses. Its strength lies in its adaptability. The platform seamlessly caters to the unique challenges different business sizes and types face.

The cloud-based nature ensures your data is secure and accessible anytime, anywhere. Sage Business Cloud Accounting transcends traditional accounting, offering tools that record financial transactions and provide actionable insights. It's not just about numbers; it's about understanding what those numbers mean for your business's future.

3. Wave

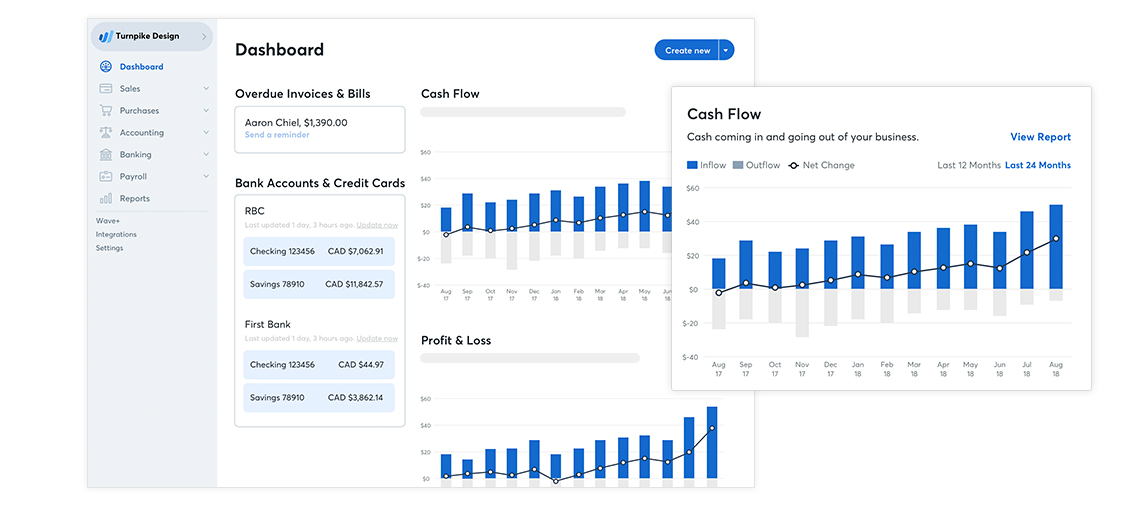

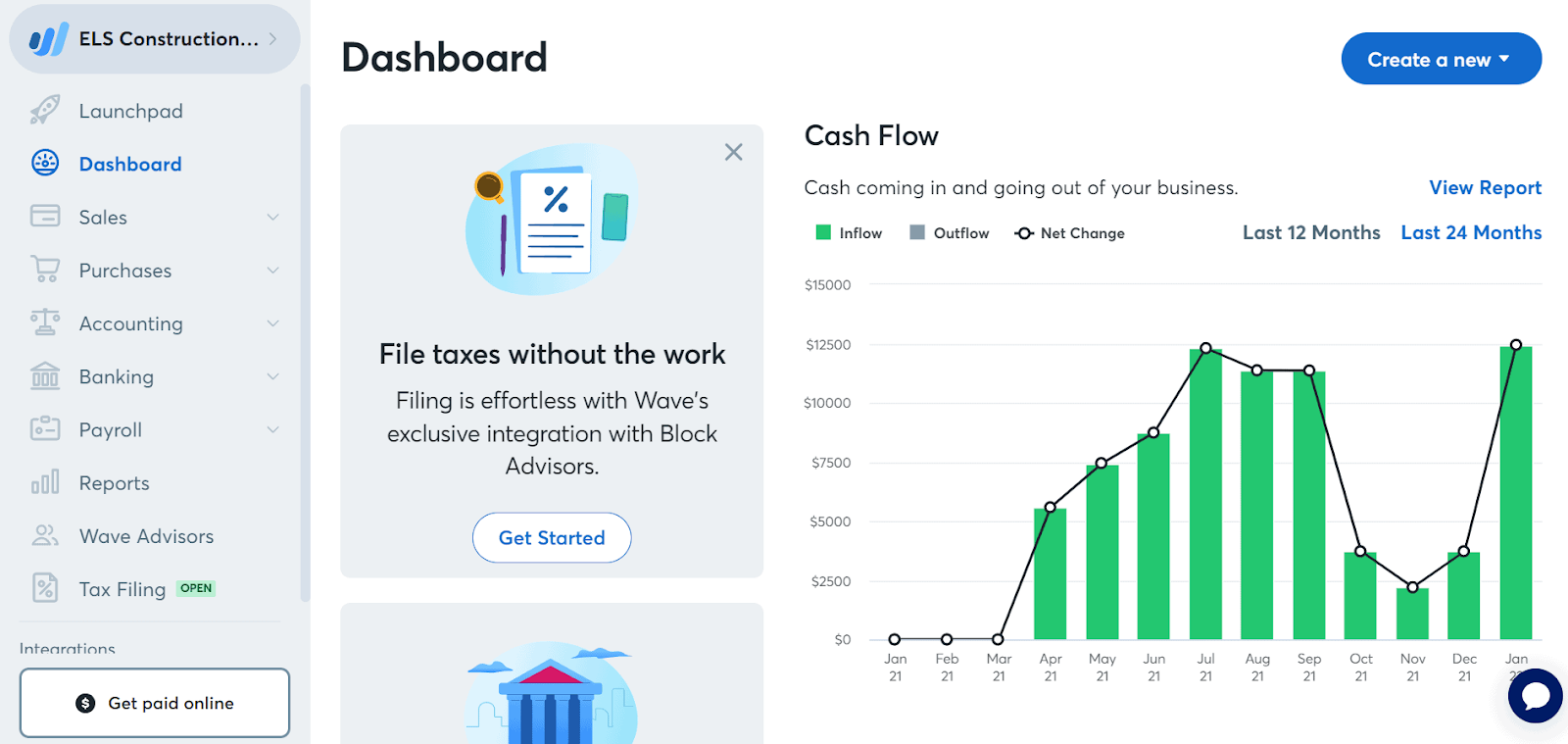

In the debate of Sage vs Wave, Wave App brings its unique flair to the table. Specifically designed for freelancers, entrepreneurs, and small businesses, Wave Accounting is more than just an accounting software. It's a financial ally.

With its user-friendly interface, Wave ensures that even those unfamiliar with accounting can easily manage their books. Wave's charm lies in its simplicity combined with its powerful capabilities. From professional invoice creation to detailed financial reports, every feature is designed keeping the user in mind.

Moreover, being cloud-based, it provides the flexibility to manage your finances on the go. Wave's offering of free basic accounting features is a game-changer for businesses on a tight budget.

Comparison of Features List and Best Features

In this section, we are going to compare the features of ZarMoney, Sage, and Wave. So, let’s get on with it!

ZarMoney Features

- Customers & Account Receivable

- Invoicing

- Accept Credit Cards Online

- Accept ACH Payments

- Quotes / Estimates

- Sales Orders

- Quick Sales

- Customer Statement

- Accept Pre-payments

- Payment Terms

- Notification via Text & Email

- Organize Customers with Custom Fields

- Order Status

- Credit Limit & Credit Hold

- Recurring Invoices

- Vendors & Account Payable

- Bills

- Expenses

- Print Checks

- Purchase Orders

- Payable Center & Calendar

- Approve Bills

- Payment Discounts

- Email Purchase Order

- Receipt Attachment

- Related Transactions

- Automatic Expense Recording

- Automatic matching

- Productivity Scheduler

- Advance user Permissions

- File Attachment

- Customizable Dashboard

- Notification via Text & Email

- Collaborate with your team

- Internal Notes

- Access from everywhere

- Restricted IP Access

- Advance Inventory

- Inventory Management

- Manage Multiple Warehouses

- Create Pick Lists

- Split Transactions with Enhanced Inventory Receiving

- Price Level

- Get real-time inventory data

- Customizable Units of Measures

- Barcode

- Product Category

- Customizable Product Fields

- Item Tracking and History

- Compare Received Inventory with PO’s

- 2 Step Warehouse Transfer

- FIFO Cost Methods

- Accounting

- Bank Connection

- Import bank transactions

- Divisions & Classes

- Bank Account Reconciliation

- Chart of Account

- Sales Tax

- Bank Deposits

- Fund Transfers

- Journal Entries

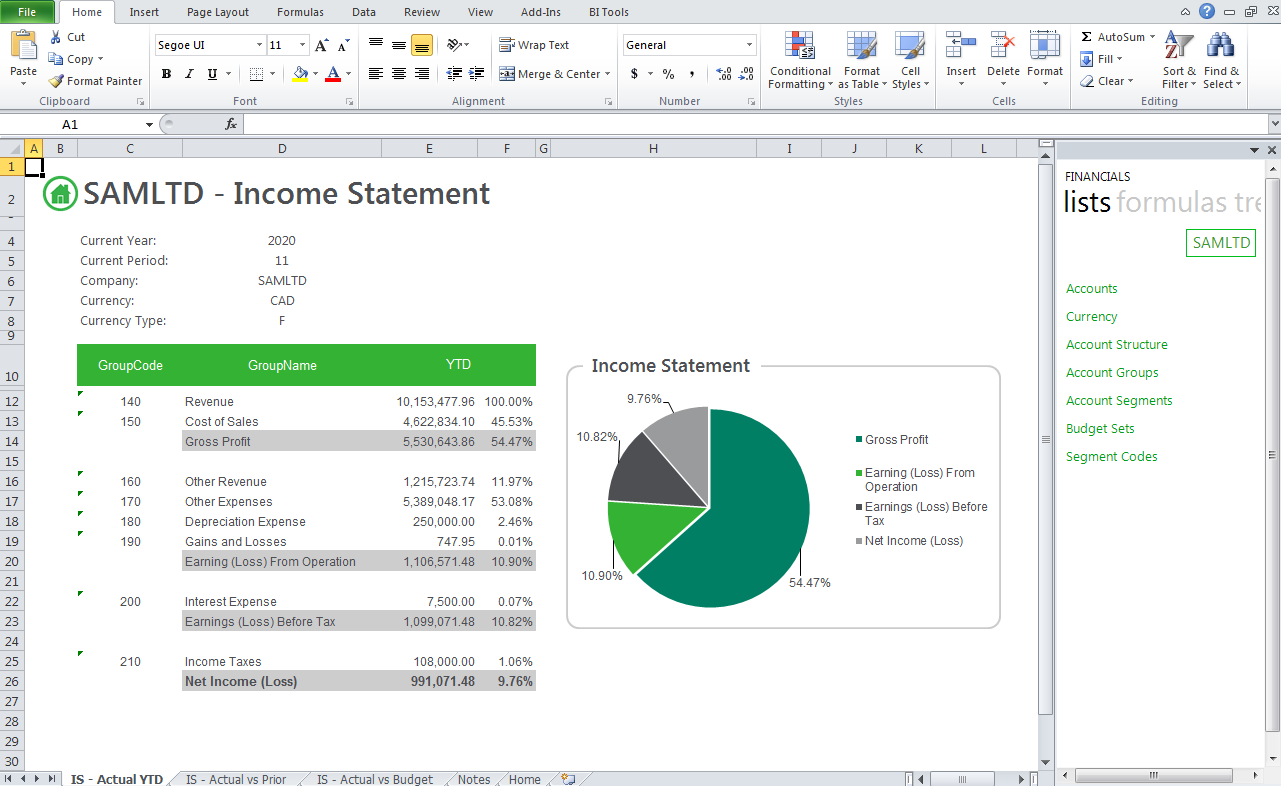

- Reporting

- Insight ™ (customizable reporting)

- 1099 Reporting

- Profit & Loss

- Balance sheet

- Trial Balance

- Account Receivable (A/R)

- Account Payable (A/P)

- Comprehensive Reporting

Best features

1. Cloud-Based Accounting

One of the groundbreaking features of ZarMoney is its cloud-based architecture. This ensures that business owners have real-time access to their financial data from anywhere, anytime. In a fast-paced business environment, having your data on the cloud means instant access to financial statements, enabling quick decision-making. This feature not only promotes flexibility but also reduces the hassle of software installations and updates.

2. Customizable Invoices

What truly sets ZarMoney apart is its customizable invoicing feature. Whether you're a solo entrepreneur or a larger business with varied accounting demands, ZarMoney scales to fit your needs. Its flexibility ensures that your accounting software grows with you as your business grows, without the need for cumbersome transitions or learning new platforms.

3. Real-time Financial Reporting

In the modern business landscape, outdated financial data can be detrimental. ZarMoney's real-time financial reporting ensures that business owners always have their finger on the pulse. Be it cash flow statements, profit and loss accounts, or balance sheets, ZarMoney provides up-to-the-minute reports, allowing businesses to react swiftly to financial trends.

Sage Features

- Actionable financial insights

- Secure cloud-based storage

- Tailored for diverse business types

- Advanced reporting capabilities

- Multi-device accessibility

- Bank feed connections

- Professional invoice templates

- Advanced inventory tracking

- Sage Intelligence integration

- Credit card payment facilitation

- Accounting and Payroll

- Accounts payable

- AutoEntry

- Bank reconciliation

- Billing

- Connect my bank

- Reporting

- Invoicing

- Mobile app

- Multi-currency

- Self-assessment

- Stock management

- Tax and VAT management

Best features

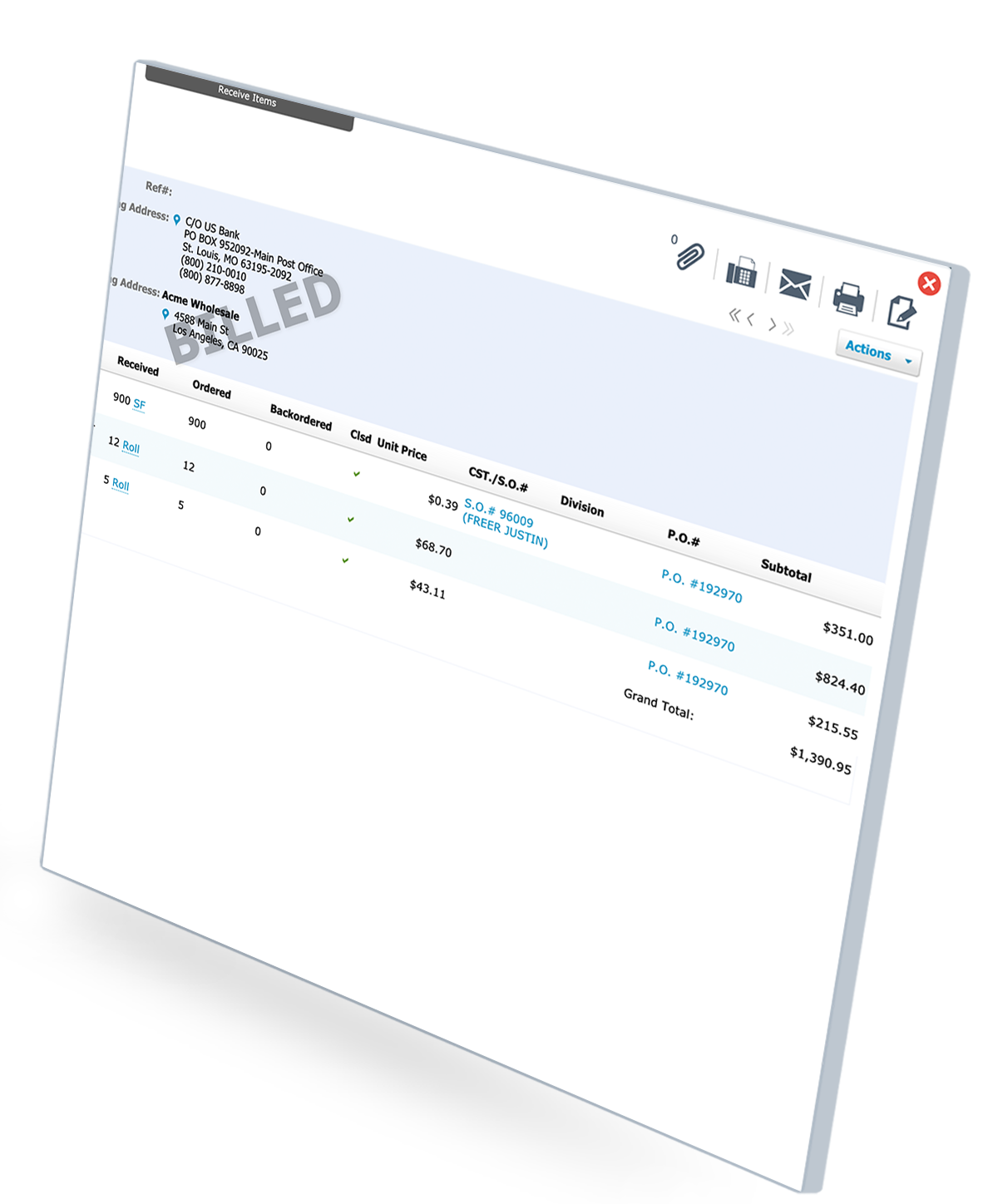

1. Versatile Accounting

The versatility of Sage Business Cloud Accounting lies in its ability to cater to both micro and medium businesses. It provides tailored accounting and bookkeeping tools and functionalities for various business needs, ensuring that whether you're just starting out or expanding, Sage has got you covered.

2. Actionable Financial Insights

It's not enough to just record financial data; understanding it is crucial. Sage goes beyond traditional accounting by offering insights derived from your financial data. These insights can guide business strategies, helping owners make informed decisions that propel growth.

3. Secure Data Storage

In an age where data breaches are prevalent, Sage prioritizes security. Its cloud-based platform is fortified with advanced encryption, ensuring your financial data remains safe. Moreover, regular backups mean that data loss is virtually impossible, providing peace of mind to businesses.

Wave Features

- User-centric interface

- Professional invoice creation

- Free basic accounting tools

- Detailed financial reports

- Real-time expense tracking

- Seamless bank integrations

- Advanced customization options

- Email reminders for overdue invoices

- Foreign currency transactions

- Accounting software

- Invoicing software

- Mobile receipts

- Payments

- Payroll software

- Wave Advisors

- Pricing

- Credit card payments

- Bank payments

- Recurring billing

Best features

1. User-Friendly Interface

Wave stands out with its intuitive design, specifically crafted for those who might not have a background in accounting. This user-centric approach ensures that tasks like invoice creation or financial reporting become straightforward, empowering users to manage their finances with confidence.

2. Professional Invoice Creation

For freelancers and small business owners, creating professional invoices can be a game-changer. Wave excels in this domain, offering customizable invoice templates that not only look great but also provide all essential details, ensuring timely payments from clients.

3. Free Basic Accounting Features

In the Sage vs Wave debate, one cannot overlook Wave's offering of complimentary basic accounting features. This is a boon for startups and small businesses operating on a shoestring budget, allowing them to manage their finances efficiently without additional costs.

Comparison of Pros & Cons

In this section, we are going to compare the pros and cons of ZarMoney, Sage, and Wave. So, let’s get on with it!

ZarMoney

Pros

- Seamless real-time financial insights for proactive business decisions.

- Advanced cloud-based architecture for easy access and data security.

- Highly adaptive scalability, suitable for businesses of any size.

- A wide range of third-party integrations for streamlined operations.

- Comprehensive financial reporting for in-depth understanding.

Cons

- Might seem complex for newcomers initially.

- Third-party integrations might have an additional cost.

- Focus on advanced features can be overwhelming for some.

Sage Business Cloud Accounting

Pros

- Detailed, actionable financial insights for robust strategy formulation.

- Secure cloud storage ensures data safety.

- Custom tailored solutions for various business types.

- Advanced inventory tracking assists businesses with stock management.

- Sage Intelligence offers additional advanced reporting capabilities.

Cons

- Can be on the more expensive side with some plans.

- The advanced nature might require a steeper learning curve.

- Some features might be too advanced for micro-businesses.

Wave

Pros

- User-friendly interface ensures quick onboarding.

- Professional invoice creation enhances brand credibility.

- The core accounting features are free.

- Customization options allow businesses to align the software with their processes.

- Email reminders ensure you stay on top of overdue payments.

Cons

- Might lack some advanced tools necessary for larger businesses.

- The free nature might mean limited customer support options.

- Dependence on third-party tools for some additional features.

Comparison Of Pricing Plans

In this section, we are going to compare the pricing plans of ZarMoney, Sage, and Wave. So, let’s get on with it!

ZarMoney

You can try this tool for free. However, there are paid plans available with more advanced features.

- Entrepreneur plan - $15/month (per user)

- Small business - $20/month (per user)

- Enterprise - starts from $350/month

Sage Business Cloud Accounting

- Starter plan - £14.00 per month / excl VAT*

- Standard plan - £28.00 per month / excl VAT*

- Premium plan - £36.00 per month / excl VAT*

Wave

- Invoicing and Accounting: $0 per month

- Mobile Receipts: $8 per month

- Payroll: $40 per month

- Advisor: $149 per month

Which one’s better?

Each software offers distinct advantages when deliberating on ZarMoney vs Sage vs Wave. Sage showcases formidable financial insights, Wave emphasizes user-friendliness, especially for micro-businesses. However, ZarMoney’s blend of real-time insights, scalability, and its extensive features make it a standout choice for businesses.

Comparison Of Customer Support Options

In this section, we are going to compare the customer support options of ZarMoney, Sage, and Wave. So let’s get on with it!

ZarMoney

- Live Chat

- Email Support

- Knowledge Base

Sage Business Cloud Accounting

- Phone Support

- Live Chat

- Sage Intelligence Tutorials

Wave

- Help Center

- Community Forum

- Email Support

Which One’s Better?

In the ZarMoney vs Sage vs Wave debate regarding customer support, Sage’s phone support offers direct assistance, and their Sage Intelligence Tutorials are insightful. However, ZarMoney’s combination of live chat, email support, and a comprehensive knowledge base ensures users have a wide range of quick and efficient support options at their fingertips, making it slightly ahead.

Comparison of Supported Platforms

In this section, we are going to compare the supported platforms of ZarMoney, Sage, and Wave. So, let’s get on with it!

ZarMoney

- Web Browser (Cloud-based)

- iOS and Android (Mobile Apps)-coming soon

Sage Business Cloud Accounting

- Web Browser (Cloud-based)

- iOS and Android (Mobile Apps)

Wave

- Web Browser (Cloud-based)

- iOS and Android (Mobile Apps)

Which One’s Better?

When contrasting platforms Sage vs. Wave, both offer robust mobile apps for iOS and Android, paralleling ZarMoney’s offerings. Yet, the cloud-based functionality across all three ensures real-time access to business financials. Given the parity, it's a close tie, but ZarMoney's seamless cloud interface might offer more user-friendliness for business owners on the go.

Ratings and Testimonials

In this section, we are going to compare the ratings and testimonials of ZarMoney, Sage, and Wave. So, let’s get on with it!

ZarMoney

Sage Business Cloud Accounting

Wave

Which One Is Better?

When evaluating the impact of testimonials, it's essential to consider the authenticity, volume, and relevance to potential users. While Sage and Wave have many positive reviews showcasing user satisfaction, ZarMoney’s testimonials consistently emphasize its ease of use, efficient customer service, and robust features, giving it a slight edge in user trust and credibility.

Best fit for?

Considering the broad spectrum of tools like Sage vs Wave, it's evident that every software caters to certain business types. Wave is more attuned to freelancers and small enterprises, while Sage offers tools for medium to larger businesses. Yet, ZarMoney emerges as an all-in-one tool, seamlessly catering to businesses of all scales with its adaptive features.

Sage vs Wave vs ZarMoney: So Who Wins?

In the battle of ZarMoney vs Sage vs Wave, it's clear that each accounting software brings value to the table. Wave, focusing on micro-businesses and freelancers, offers a gentle introduction to financial management.

On the other hand, Sage dives deep with its robust tools tailored for medium to larger businesses, offering advanced reports and actionable insights.

Yet, ZarMoney shines brightly in this trio. It strikes a fine balance between complexity and user-friendliness. The real-time financial insights it offers are not just numbers on a screen but actionable data points that can steer business strategies. It’s cloud-based, ensuring data is both secure and accessible. And its adaptability means it’s equally suited for a startup as it is for an established enterprise.

Integrating seamlessly with third-party tools and providing instant access to bank feeds further adds to its appeal. While Sage and Wave have their strengths and cater wonderfully to their target segments, ZarMoney offers a comprehensive suite that feels tailor-made for diverse business needs.

Regarding cost-effectiveness, adaptability, and the sheer breadth of features, ZarMoney makes a compelling argument for being the go-to choice for businesses seeking a holistic accounting solution.