5 Best Wave Accounting Alternatives

While Wave Accounting is a popular choice, the demand for efficient and affordable accounting software keeps rising, especially for startups and small businesses.

The market is rich with online accounting software products, each offering unique financial management capabilities. Some focus on complex accounting features, while others prioritize affordability and ease for daily accounting tasks.

If you're searching for cloud-based software that handles your finances better, exploring Wave Accounting alternatives might be the answer. Take a look and see what works best for your finances!

List of the Best Wave Accounting Alternatives for 2024

- ZarMoney

- Xero

- Quickbooks Online

- ZipBooks

- Freshbooks

1. ZarMoney

ZarMoney stands out among Wave Accounting alternatives with its comprehensive, cloud-based solution for various business accounting needs. Like Wave, it offers core accounting features but excels in managing invoices, purchase orders, expense tracking, and online payments. ZarMoney is user-friendly for beginners and includes custom invoicing, thorough bank reconciliation, and detailed financial reports.

Features of ZarMoney

- Smooth Invoicing and Billing

- Bank Synchronization

- Account Reconciliation

- Automated Tax Calculation & Payment

- Adaptive Statements

- Payables Calendar

- Financial Reporting

Top 3 Features of ZarMoney

1. Smooth Bank Integration

ZarMoney connects with over 9,600 global financial institutions through its unified cloud-based system. This system allows users to handle the company's banking operations from anywhere and modify transactions directly on the platform.

2. Accurate Tax Management

ZarMoney simplifies tax calculations and related paperwork. This software ensures smooth accounting while staying in line with regional tax guidelines, making it a must-have accounting software for businesses.

3. Advanced Financial Reporting

ZarMoney offers clear financial insights for all types of businesses. With its tools, you can fully view your financial history and predict future trends.

Pros of ZarMoney

- Optimized professional accounting

- Affordable pricing structure

- Plug-and-play functionality

- Feature-rich capabilities

- Reliable human support.

Cons of ZarMoney

-

Requires an internet connection for cloud-based functionalities.

Pricing of ZarMoney

ZarMoney offers 15 days free trial and three pricing plans:

- Entrepreneur: $15 / month / 1 user

- Small Business: $20 / month / 2 users

- Enterprise: $350 / month / 30+ users

Integrations of ZarMoney

- Gusto

- PayPal

- Stripe

- Zapier

- Google Calendar

- Quickbooks Payments

- Braintree

- Authorize.Net

- CyberSource

- MMC Receipt

Customer Support of ZarMoney

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

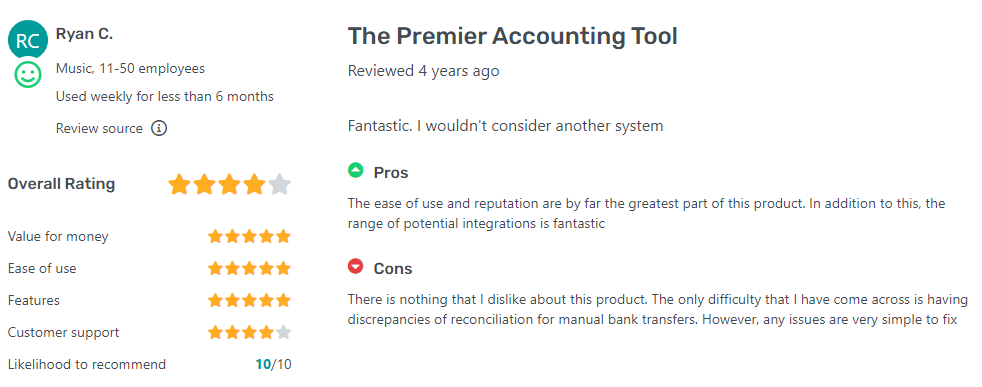

Testimonials/Reviews

Rating

ZarMoney’s average rating, according to the top three software directories, is 4.7.

Bottom Line

ZarMoney is among the top solutions for high-quality accounting and caters to the needs of both small and large-scale enterprises. Its user-friendly design provides a smooth experience. This software is positioned as one of the best Wave Accounting alternatives as it offers numerous features in cost-effective pricing.

2. Xero

Xero is a wave accounting alternative for businesses of all sizes, including small startups, medium-sized businesses, and even large enterprises. What makes it one of the most reliable online accounting software is its ability to keep financials and cash flow updated in real-time. Its cloud-based nature enables easy access from both PC and mobile devices, facilitating easy import of bank transactions.

Features of Xero

- Accounting dashboard

- Contact management

- Bill payment

- Bank connections

- Project tracking

- Bank reconciliation

- Quotes and estimates

- Multi-currency support

- Manage fixed assets

- Analytics and Reporting

Top 3 Features of Xero

1. All-Inclusive Financial Tools

Xero offers a complete and all-inclusive financial management solution suitable for businesses of all sizes.

2. Unlimited Invoicing & Expense Tracking

Xero has the ability to generate unlimited invoices. The platform allows customizable invoice templates, which are perfect for businesses handling numerous clients. Xero also offers in-depth expense tracking, which makes business accounting more effective.

3. Integration Flexibility & Collaborative Access

Xero's cloud-based accounting software integrates easily with project management and inventory tracking systems.

Pros of Xero

- Recurring transactions.

- Easy to set up.

- Integration flexibility.

Cons of Xero

- It is impossible to assess subsidiaries' performance in real-time.

- Limited bank connections.

Pricing of Xero

- Starter: $29/month

- Standard: $46/month

- Premium: $62/month

Integrations of Xero

- Google Drive

- PayPal

- Dropbox Business

- Google Workspace

- Microsoft 365

- Google Forms

- Mailchimp

- QuickBooks Time

- Shopify

- FreshBooks

- Zoho CRM

- Zapier

Customer Support of Xero

- Email/Help Desk

- Chat

- Knowledge Base

- FAQs/Forum

- 24/7 (Live rep)

Testimonials

Rating

Rating

Xero has been given an average rating of 4.4 out of 5 on Software Advice.

Bottom Line

Xero is our second pick when considering Wave Accounting alternatives. It offers features like unlimited invoices, detailed financial reporting, and third-party app compatibility that make it suitable for different businesses.

3. Quickbooks Online

QuickBooks Online is an online accounting software used by small—to medium-sized businesses as a Wave Accounting alternative. It simplifies tasks like accounting, managing income, and expense tracking.

QuickBooks Online uses cloud-based technology and handles sales receipt recording, cash flow checks, account balance monitoring, detailed transaction reviews, and effective expense management.

Features of Quickbooks Online

- Creating Invoices

- Expense Tracking

- Bank Feeds

- GST & VAT

- Inventory Management

- Record & Organize Receipts

- Mobile App

- Insights & Reports

- Multi-currency Support

Top 3 Features of Quickbooks Online

1. Efficient Expense Management

QuickBooks Online is best known for its expense tracking feature. It enables users to import and categorize expenses automatically. The ability to adjust or redefine categories and the option to edit transactions in bulk provide more control over financial records.

2. Financial Overview with Charts of Accounts

QuickBooks Online's chart of accounts gathers data which gives users an immediate insight into their financial standing. This Wave Accounting alternative not only fast-tracks decision-making but also eliminates the need for external accounting experts.

3. Detailed Financial Reports

QuickBooks Online excels at providing detailed financial reports, allowing business owners to understand the financial health of their business and make informed decisions. These insights are important for ensuring stable cash flow and effective financial management within any business.

Pros of Quickbooks Online

- Custom invoices

- Expense tracking

- Quick transaction reports

Cons of Quickbooks Online

- Too many error messages

- Limited number of fields

- File size issues

Pricing of QuickBooks Online

- Simple Start: $20 per month

- Essentials: $40 per month

- Plus: $70 per month

- Advanced: $150 per month

Integrations

- PayPal

- WordPress

- Mailchimp

- QuickBooks Time

- Wix

- Rippling

- Shopify

- Eventbrite

- Gusto

- Vagaro

- Time tracker

Customer Support of QuickBooks Online

- Chat

- Knowledge Base

- 24/7 (Live rep)

- FAQs/Forum

- Email/Help Desk

- Phone Support

Testimonials

Rating

QuickBooks Online has been given a rating of 4.3 out of 5 on Software Advice.

Bottom Line

QuickBooks Online comes as a third choice for a Wave Accounting alternative on our list. This online accounting software offers a very user-friendly interface and makes expense tracking and invoicing simple.

Whether you're handling online payments, payroll, bank reconciliation, or generating professional financial reports, QuickBooks Online can be your go-to.

4. ZipBooks

ZipBooks is a great Wave Accounting alternative for small businesses that have just entered the business sector. It is well-equipped accounting software that makes creating invoices and tracking them online easier than ever.

This wave accounting alternative software has a user-friendly interface and a cleaner structure, and it works on any device. The best thing about ZipBooks is that it never adds watermarks to bills, sells your information, and doesn’t send you "partner" mailings.

Features of ZipBooks

- Expense Tracking

- Accountant Access

- Accounts Receivable

- Bank Connections

- Bank Reconciliation

- Auto-Categorization

- Chart of Accounts

- Project Accounting

- Tagging

Top 3 Features of ZipBooks

1. Detailed Expense Tracking

ZipBooks offers an expense tracking system that allows businesses, especially midsize ones, to monitor and categorize their expenses.

2. Insightful Online Accounting Reports

The importance of informed decision-making in business cannot be stressed enough. ZipBooks does so with its transparent online accounting reports. It provides business owners with a concise overview of their financial health and performance metrics.

3. Efficient Credit Card Processing

Cash flow is important for any business. ZipBooks simplifies the payment process with its integrated credit card processing feature, ensuring quick and efficient transactions. This not only facilitates revenue collection but also improves the customer payment experience.

Pros of ZipBooks

- Easy invoice automation.

- Business reports are available any day.

- Feedback Functionality available.

Cons of ZipBooks

- The customer service is appalling.

- Only supports American Banks.

- Lack of export options.

Pricing of ZipBooks

- Starter: Free

- Smarter: $15 / month

- Sophisticated: $35 / month

- Accountant: Custom Pricing

Integrations of ZipBooks

- Google Drive

- PayPal

- Slack

- Google Workspace

- Asana

- Spiceworks

- Gusto

Customer Support of ZipBooks

- Email/Help Desk

- FAQs/Forum

- Knowledge Base

- Chat

Testimonials

Rating

ZipBooks' average rating, according to the Software Advice, is 4.5.

Bottom Line

As a substitute for Wave Accounting, ZipBooks is ranked fourth on our list. It simplifies business operations by offering an intuitive platform for invoicing, time-tracking, and expense management. With ZipBooks, businesses can distribute tasks, monitor team progress with a real-time dashboard, and maintain accurate records of work hours and expenses.

5. FreshBooks

FreshBooks offers an innovative approach to financial tasks and comes fifth on the list of alternatives to Wave Accounting. FreshBooks optimize accounting processes by automating daily accounting tasks, including invoicing, payment acceptance, cost monitoring, billable time tracking, and financial reporting.

Features of FreshBooks

- Balance Sheet

- General Ledger

- Accounts Payable

- Accountant Access

- Trial Balance

- Cost of Goods Sold

- Chart of Accounts

- Journal Entries

- Automated Bank Reconciliation

- Tracking Payments

- Tax Calculation

Top 3 Features of FreshBooks

1. Accounts Payable & Expense Management

For business owners, ensuring bills and rents are paid on time is necessary to maintain a healthy financial status. FreshBooks offers an advanced accounts payable feature that not only simplifies the process of paying these obligations but also allows for automated expense tracking.

2. Automated Bank Reconciliation

FreshBooks' bank reconciliation feature helps you organize your transactions. It imports financial transactions and categorizes them based on purpose, supporting advanced features like double-entry accounting. This makes it easy to identify and classify equity, transfers, and refunds.

3. Tracking Payments

FreshBooks simplifies the process of tracking payments with its credits feature, which allows businesses to track prepayments, overpayments, and credit notes. This feature also enables businesses to apply these credits to upcoming invoices, helping smooth financial operations.

Pros of FreshBooks

- Quick invoice delivery and tracking.

- User-friendly interface.

- Task automation.

Cons of FreshBooks

- Fewer bank connections.

- Users can’t shift to other software.

- Expensive to expand.

Pricing

- Lite: $7.60 / month

- Plus: $13.20 / month

- Premium: $24 / month

Integrations of FreshBooks

- Google Drive

- PayPal

- Slack

- Google Workspace

- Trello

- WordPress

- MailChimp

- Shopify

- Zip Recruiter

- Zapier

- Hubspot CRM

- Calendly

Customer Support of FreshBooks

- Email/Help Desk

- Phone Support

- Chat

- FAQs/Forum

- Knowledge Base

Testimonials

Rating

The average rating for FreshBooks is 4.5 out of 5.

Bottom Line

FreshBooks features a highly user-friendly design that is simple to use and browse. So, even if you are not tech-savvy, you may easily understand the workings of Freshbook. It automates several accounting procedures and integrates with multiple platforms, making it a popular choice.

Table of Comparison - Top 5 Wave Accounting Alternatives

|

Features |

ZarMoney |

Xero |

QuickBooks |

ZipBooks |

FreshBooks |

|

Financial Reports |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Online Payments |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Inventory Management |

✅ |

✅ |

✅ |

❌ |

❌ |

|

Third-party App Integration |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Invoice |

✅ |

❌ |

❌ |

✅ |

✅ |

|

Chart of Account |

✅ |

❌ |

❌ |

✅ |

✅ |

Best of Best - Top 3 Wave Accounting Alternatives

1. ZarMoney

ZarMoney is at the top of the list of alternatives to Wave Accounting because of its amazing accounting and reporting capabilities. It uses a double-entry system for accurate financial records and provides detailed reports. Moreover, its cloud-based nature ensures real-time updates.

2. QuickBooks Online

QuickBooks Online is a known alternative to Wave Accounting. With a solid accounting core, it delivers detailed financial reports for businesses. It offers easy-to-use online payment features, including handling credit card transactions, which helps make finances smooth.

3. ZipBooks

ZipBooks also includes many features that a good accounting software must have. These features include financial reports, online payments, third-party app integration, invoice creation, and chart of accounts.

Conclusion

The right accounting software simplifies data entry and offers flexibility, letting businesses concentrate on tasks that are important. All the top Wave Accounting alternatives we evaluated above provide a free trial for a hands-on experience.

However, if we were to recommend the top pick, it would be ZarMoney. This accounting software is exceptional because of its scalable design, smooth operation, and user-friendly interface, which make it suitable for a wide range of businesses.

Frequently Asked Questions (FAQs)

1. Why is ZarMoney considered a top Wave Accounting alternative?

ZarMoney offers numerous accounting features with a user-friendly interface, making it the best choice for businesses of all sizes.

2. How does ZarMoney's pricing compare to Wave Accounting?

ZarMoney offers various features such as financial reports, online payments, inventory management, third-party app integration, invoice creation, and chart of accounts. It is among the top choices because it offers flexible pricing plans.

3. How easy is it to set up ZarMoney for my business?

Setting up ZarMoney is pretty easy. You can watch their guided tutorials or ask customer support for assistance. They would be happy to help!

4. How can accounting software assist in better financial management for modern businesses?

Accounting software like ZarMoney offers a number of benefits for small businesses, including automating bookkeeping tasks, providing real-time financial insights, improving accuracy, helping in financial analysis, controlling costs, simplifying compliance and tax management, and streamlining invoicing and payment processing.

5. Are there any free Wave alternatives?

Many leading alternatives provide trial versions, giving users an idea of how they work. ZarMoney, for instance, offers a trial that showcases its diverse set of features.

6. How does ZarMoney's financial reporting stack up against Wave Accounting?

ZarMoney's financial reporting is very detailed, and it offers a range of features, such as customizable reports, real-time insights, and diverse report formats.

7. Can Wave Accounting alternatives handle inventory management?

Yes, some Wave Accounting alternatives, such as ZarMoney, include inventory management features.

8. What are the key features of ZarMoney as a Wave Accounting alternative?

ZarMoney offers many features, including bank synchronization, automatic tax calculation and payment, financial reporting, and more. These features allow businesses to improve their accounting workflows and maintain compliance with regional rules.

9. Are Wave Accounting alternatives suitable for small businesses?

Yes, Wave Accounting alternatives like ZarMoney are often designed for small businesses. They provide essential accounting features and are scalable as the business grows.