Wave vs Freshbooks vs ZarMoney - Detailed Review

In today's fast-paced business environment, accounting software plays a pivotal role in keeping finances in check and ensuring that businesses can focus on what they do best. When choosing the best one for your needs, the decision can be overwhelming.

Enter Wave, FreshBooks, and ZarMoney - three heavyweight contenders in the accounting software arena. This article will delve into the top accounting software competitors, highlighting their features, pros and cons, and all the essential details you must know.

Quick Overview of Wave vs FreshBooks vs ZarMoney

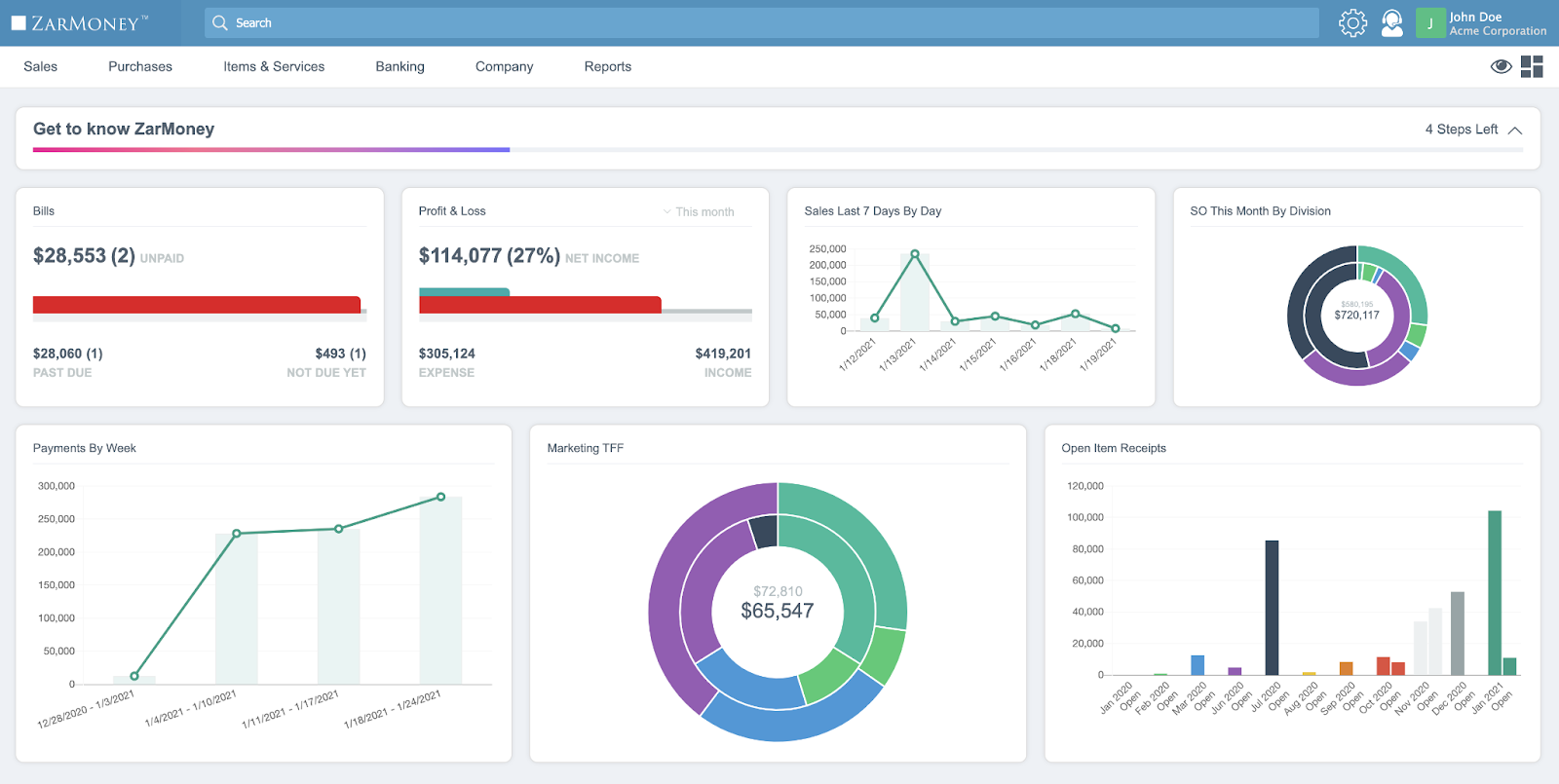

1 - ZarMoney

ZarMoney's core mission is to revolutionize how businesses handle their accounting. It simplifies complex processes and provides intuitive solutions tailored to modern businesses' needs, making ZarMoney the top contender in Wave vs FreshBooks vs ZarMoney.

Key Features

- Invoice and billing

- Inventory management

- Purchase orders

- Expense tracking

- Financial Reporting

- Vendor and customer management

Top 3 Features

1 - Invoice and Billing

One of ZarMoney's standout features is its invoicing and billing system. This feature allows businesses to generate professional invoices efficiently and get paid faster. It streamlines the process by offering customizable templates, automated recurring billing, and real-time invoice tracking to ensure timely payments.

2 - Inventory Management

Efficiently managing stock is crucial for any business dealing with physical goods. ZarMoney's inventory management system ensures companies can track inventory levels, manage stock in multiple locations, and receive alerts for low-stock items. This helps in reducing wastage, preventing stock-outs, and maximizing profitability.

3 - Financial Reporting

In the dynamic business world, making informed decisions is paramount. ZarMoney's financial reporting feature provides companies with comprehensive reports that cover all financial aspects. Whether it's profit and loss statements, balance sheets, or cash flow statements, this feature ensures that businesses have all the data they need at their fingertips.

Pros

- Comprehensive feature set

- Intuitive interface

- Versatile inventory management tools

- Robust reporting capabilities

- Value for money

Cons

- The software does not offer a mobile app but provides mobile availability through the web.

Pricing

Starting with a Free version that offers basic functionalities, ZarMoney has an Entrepreneur plan at $15, a Small Business plan for $20, and an extensive Enterprise plan for $350.

Supported Platforms

ZarMoney is a web-based solution accessible from any device with a browser.

Customer Support

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Reviews and Testimonials

These are the reviews and ratings of users of ZarMoney as accounting software;

Final Verdict

When looking for a comprehensive and intuitive accounting solution tailored for businesses of all sizes, ZarMoney stands out. With its focus on simplifying complex accounting tasks and a price point that caters to varied business needs, it's undoubtedly a top contender in the competition of Wave vs FreshBooks vs ZarMoney.

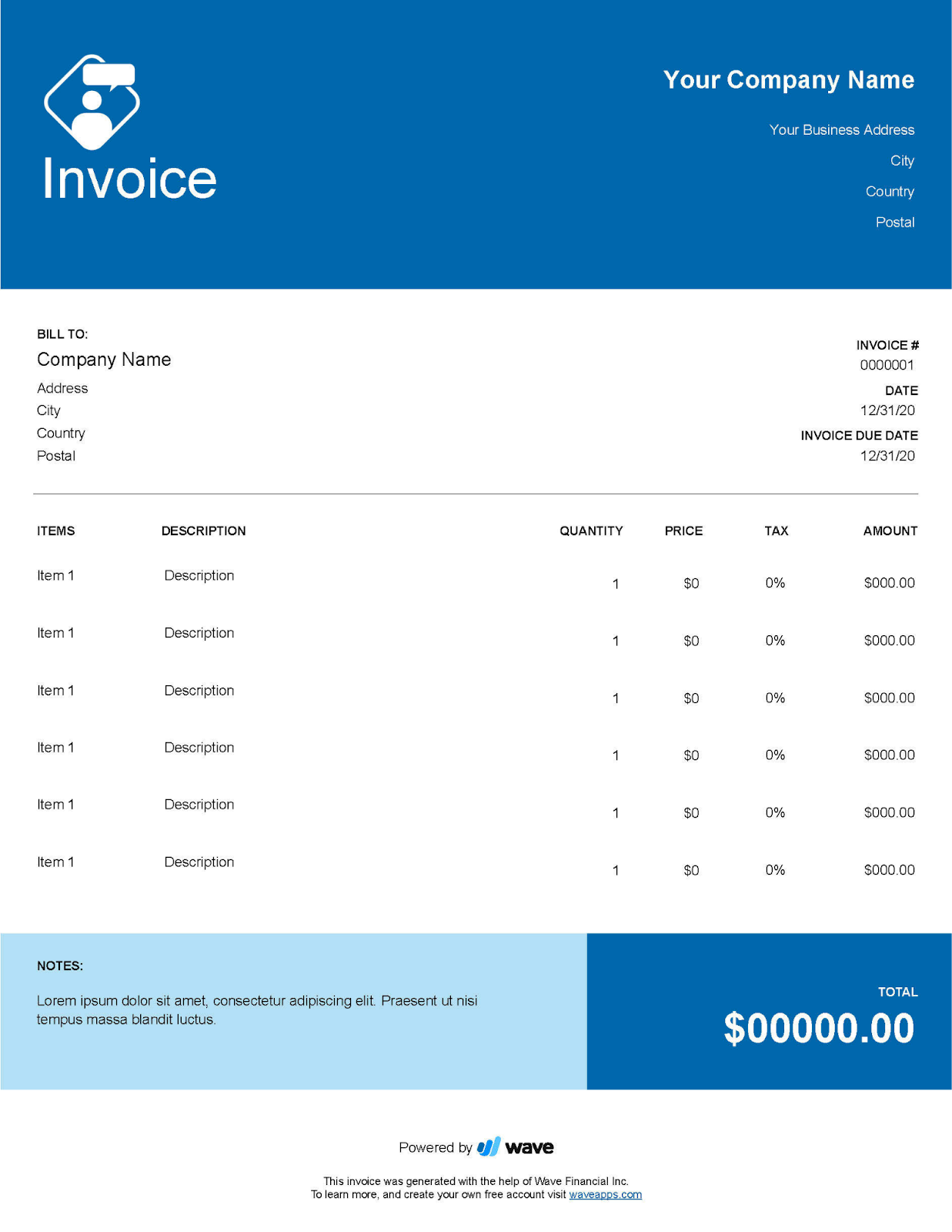

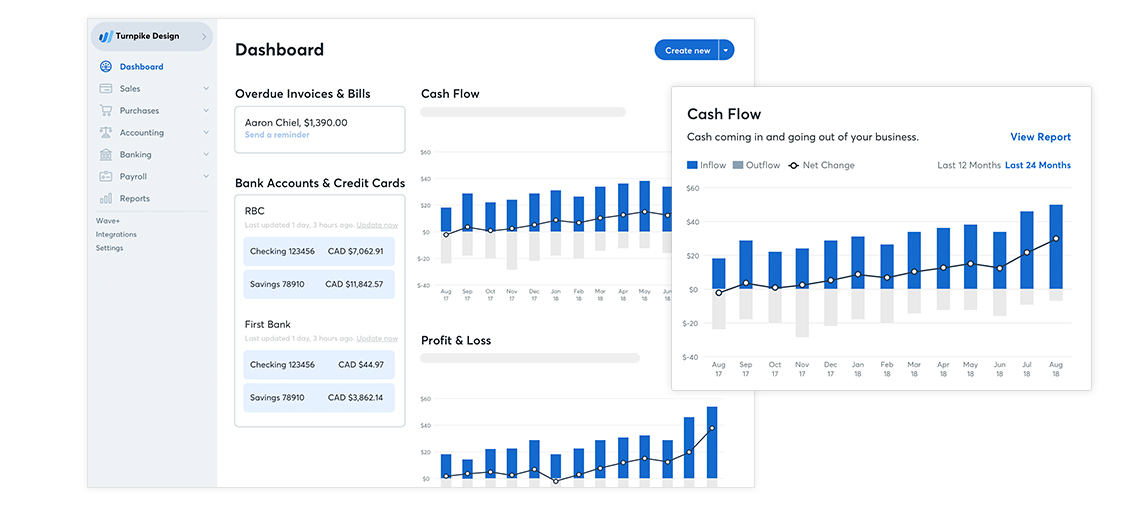

2 - Wave

In the vast landscape of online accounting software tools, Wave is a prominent choice for businesses, especially when comparing options like Wave and FreshBooks. Wave offers a comprehensive accounting solution catering to micro-businesses and independent contractors. Wave's key features range from essential accounting tools to advanced payments designed to enhance the user experience and streamline financial processes.

Key Features

- Free financial tracking and accounting

- Invoice creation and management

- Expense tracking and categorization

- Recurring billing and scheduled payments

- Bank and credit card connection

- Payroll processing (in supported countries)

Top 3 Features

1 - Invoice Creation

At the heart of Wave's invoicing software is the ability to create customizable invoices. Whether you send regular invoices to billable clients or need a unique invoice template for specific projects, Wave has you covered. Its robust invoicing features can accommodate various payment types, including credit cards and electronic payments.

2 - Expense Tracking

A standout feature in Wave's range of accounts is its impeccable expense tracking. The importance of tracking expenses must be considered when discussing online accounting. Knowing where your money is going is crucial whether you're an independent contractor or a small business. Wave lets users connect their business bank accounts, ensuring real-time expense tracking.

3 - Payroll Processing

Dive into Wave Payroll, and you'll discover various features that make payroll processing a breeze. Whether you have a handful of employees or work with a team of independent contractors, Wave handles everything from direct payroll to tax services. With the additional bonus of bank account syncing, users can ensure that their financial records remain accurate.

Pros

- Wave offers a robust set of accounting features for small businesses and entrepreneurs at no cost.

- Wave's user interface is intuitive and easy to navigate, making it accessible for users with varying levels of accounting expertise.

- Wave provides tools for creating professional invoices and seamlessly integrating payment processing, allowing businesses to get paid faster and more efficiently.

Cons

- While Wave is great for basic accounting needs, it may require more advanced features than larger businesses or those with complex financial structures.

- Wave's free nature means customer support is less robust than some paid alternatives.

- Users may need longer response times and more support options than premium accounting software solutions.

Pricing

Wave offers a range of pricing options for its services: 'Accounting & Invoicing' and 'Receipt Management' are free. For 'Credit card processing,' they charge $0.30 plus 2.9% per transaction.

'Bank payment/ACH processing' comes at a rate of 1% per transaction with a minimum fee of $1. Their 'Payroll' service varies based on the state's tax service - in tax service states, it's a $35 monthly base fee plus $4 for each active employee and $4 for every independent contractor paid. In self-service states, the base fee is $20 per month, with the exact per-person charges.

Supported Platforms

Wave provides a web-based application (accessible through browsers). They also have mobile apps for both iOS and Android, specifically for invoicing and receipt scanning.

Customer Support

- FAQs/Forum

- Email/Help Desk

- Chat

- Knowledge Base

Reviews and Testimonials

These are the reviews and ratings of users of Wave as accounting software;

Final Verdict

In comparing Wave and FreshBooks vs ZarMoney accounting software, it's clear that both have their strengths and weaknesses. Wave is an excellent choice for small businesses and freelancers looking for a cost-effective solution. It offers a robust set of accounting features, including invoicing and payment processing, and is particularly appealing due to its free pricing model.

3 - FreshBooks

In the vast landscape of business accounting software, FreshBooks stands out in Wave vs FreshBooks with its features tailored to small businesses and independent contractors. When one compares it to a head-to-head battle like Wave vs FreshBooks, FreshBooks' specialized offerings become even more evident.

Key Features

- Invoicing and billing customization.

- Expense tracking and management.

- Time tracking and project management.

- Profit & loss and other essential reports.

- Payments and online payment facilitation.

- Recurring invoices and automated billable expenses.

Top 3 Features

1 - Customized Invoicing and Billing

FreshBooks elevates the experience of online invoicing with its customizable invoices. Unlike essential accounting tools or invoicing software that offer limited customization capability, FreshBooks allows users to create invoice templates tailored to their brand. The choice for businesses becomes apparent when considering the invoicing features in the debate of Wave vs FreshBooks.

2- Expense Tracking

In FreshBooks, expense tracking becomes a critical consideration. FreshBooks provides comprehensive tools to track expenses, making it fit for service professionals and micro-businesses.

3 - Time Tracking and Project Management

One of the areas where FreshBooks shines, especially when compared to a Wave vs FreshBooks scenario, is its robust time tracking feature and project management features.

Pros

- It offers robust tools for creating professional invoices and seamlessly integrating payment processing, helping businesses get paid faster.

- FreshBooks provides excellent customer support through email and phone, ensuring users receive assistance when needed.

- FreshBooks offers various advanced accounting features, making it suitable for businesses with more complex financial needs.

Cons

- FreshBooks is not free and can be relatively more expensive than other accounting software options.

- There may be better choices for businesses with significant inventory management requirements, as it lacks some advanced inventory features.

Pricing

Freshbooks offers a variety of pricing options. Monthly prices start from $17 per month. The 'Lite' plan is priced at $8.50/monthly, the 'Plus' plan at $15/monthly, and the 'Premium' plan at $27.50/monthly. The 'Select' plan offers customization for those seeking a tailored solution to fit specific business needs.

On an annual basis, the 'Lite' plan costs $141.10/year, the 'Plus' plan is $249/year, and the 'Premium' plan comes in at $456.50/year. Again, the 'Select' plan is available for customization upon discussion for businesses with unique requirements.

Supported Platforms

Available as a web-based platform and mobile applications on iOS and Android.

Customer Support

- Phone Support

- Email/Help Desk

- Chat

- FAQs/Forum

- Knowledge Base

Reviews and Testimonials

These are the reviews and ratings of users of FreshBooks as accounting software;

Final Verdict

FreshBooks has carved a niche in cloud accounting software, mainly catering to freelancers, agencies, and small businesses. Its intuitive user interface and tailored solutions make it a favorite among its target audience, making FreshBooks a comprehensive choice in Wave vs FreshBooks debate.

Table Comparison - Wave vs FreshBooks vs ZarMoney

|

Features |

ZarMoney |

Wave |

FreshBooks |

|

Accounting |

|||

|

Double-Entry Accounting |

✅ |

❌ |

❌ |

|

Financial Reports |

✅ |

✅ |

✅ |

|

Accounting Reports |

✅ |

✅ |

✅ |

|

Basic Accounting Tools |

✅ |

✅ |

✅ |

|

Online Accounting |

✅ |

✅ |

✅ |

|

Bank Reconciliation |

✅ |

❌ |

❌ |

|

Invoicing |

|||

|

Customizable Invoices |

✅ |

✅ |

✅ |

|

Invoice History |

✅ |

✅ |

✅ |

|

Invoice Creation |

✅ |

✅ |

✅ |

|

Payment Processing |

|||

|

Credit Card Payments |

✅ |

✅ |

✅ |

|

Online Payments |

✅ |

✅ |

✅ |

|

Payment Processor |

✅ |

❌ |

✅ |

|

Expense Management |

|||

|

Expense Tracking |

✅ |

✅ |

✅ |

|

Receipt Scanning |

❌ |

❌ |

✅ |

|

Expense Reports |

✅ |

❌ |

✅ |

|

Inventory |

|||

|

Inventory Tracking |

✅ |

❌ |

❌ |

|

Direct Integrations |

✅ |

❌ |

✅ |

|

Payroll |

|||

|

Payroll Processing |

✅ |

✅ |

✅ |

|

Payroll Coaching |

✅ |

✅ |

❌ |

|

User & Access Management |

|||

|

Unlimited Users |

✅ |

❌ |

❌ |

|

Accountant Access |

✅ |

✅ |

✅ |

Wave vs Freshbooks vs ZarMoney - Who Wins?

Navigating the world of accounting software can be daunting, especially when deciding between heavyweights like ZarMoney, Wave, and FreshBooks. However, as this article unfolded, it's clear that there's more to the story. While FreshBooks offers a robust user experience with its invoicing software, project tracking tools, and vital invoicing feature, and Wave Accounting presents a comprehensive accounting solution for micro-businesses with its double-entry accounting and ZarMoney, a third contender emerges as a possible victor. ZarMoney, though lesser known, should be noticed. As an advanced business accounting software, it boasts various features rivaling FreshBooks and Wave.

Conclusion

The digital realm of accounting software is vast and often overwhelming. Navigating the differences, from Wave vs FreshBooks vs ZarMoney to the intricacies of Wave Accounting, can be daunting. Each platform has strengths, from double-entry accounting reports to user-friendly interfaces and payment processor integrations.

ZarMoney, while less globally renowned than some other giants in the industry, encapsulates a comprehensive business accounting solution tailored to independent contractors and more giant corporations.

Frequently Asked Questions (FAQs)

1 - When comparing Wave vs FreshBooks and ZarMoney, which software offers the most comprehensive features?

While Wave and FreshBooks are both strong contenders in the business accounting software domain, ZarMoney offers a robust range of features, effectively amalgamating the best aspects of its competitors.

2 - For independent contractors with a handful of employees. Which accounting solution would be most suitable for my needs?

ZarMoney is an excellent choice for independent contractors and businesses with smaller employee bases. Its variety of features, from project tracking to the ability to send unlimited invoices, positions it as a versatile option.

3 - How does ZarMoney's Free Trial compare to the trials offered by other online accounting platforms?

ZarMoney's free trial provides comprehensive access to its core features, allowing businesses to look in-depth before committing. While other platforms offer trials, ZarMoney's trial is extensive and gives users a good feel for its capabilities.

4 - Is ZarMoney adept at handling both payment processing and payroll processing?

Absolutely. ZarMoney not only has integrations for payment processing but also has tools for direct payroll. It caters to various business needs, whether credit card payments or payroll taxes.

5 - What software can help me with both expense tracking and financial reports? Does ZarMoney fit the bill?

Yes, ZarMoney is equipped with powerful expense-tracking tools and generates comprehensive financial statements, including balance sheets and cash-flow statements.

6 - How user-friendly is ZarMoney's interface compared to FreshBooks or Wave Accounting?

User reviews often highlight ZarMoney's intuitive user experience. While FreshBooks and Wave also prioritize usability, ZarMoney combines ease of use with its extensive features.

7 - Which software has customizable invoices and time-tracking features? How does ZarMoney assist in this?

ZarMoney offers customizable invoice templates and a strong invoicing feature. Its time-tracking feature also ensures you can accurately log time spent on projects and bill clients accordingly.

8 - Can I get late payment reminders with ZarMoney?

ZarMoney offers late and regular payment reminders, ensuring businesses can manage their finances efficiently.

9 - How efficient is ZarMoney in providing the necessary financial reports during tax season?

ZarMoney shines during tax season. Businesses can efficiently prepare for their tax obligations with a suite of accounting reports, including standard reports and more detailed financial reports.

10 - How do ZarMoney's pricing plans compare to FreshBooks Premium or Wave's higher-tier plans?

ZarMoney offers competitive pricing plans to cater to various business sizes and needs. Compared to FreshBooks Premium or Wave's higher-tier plans, ZarMoney balances cost and multiple features.