Xero vs Wave vs ZarMoney - Best Accounting Software Showdown

Whether you're a seasoned business owner or a budding entrepreneur, choosing the right accounting software is pivotal for your financial success. Xero vs Wave and ZarMoney are the top contenders for the best accounting software.

Which one will prove to be the champion for your business? This article delves deep into the three competitors, Xero vs Wave vs ZarMoney, focusing on their features, advantages, and everything in between to understand each comprehensively.

But first, let's quickly glimpse a cloud accounting software to make a perfect choice from Xero vs Wave vs ZarMoney.

Quick Overview of Xero vs Wave vs ZarMoney

1 - ZarMoney

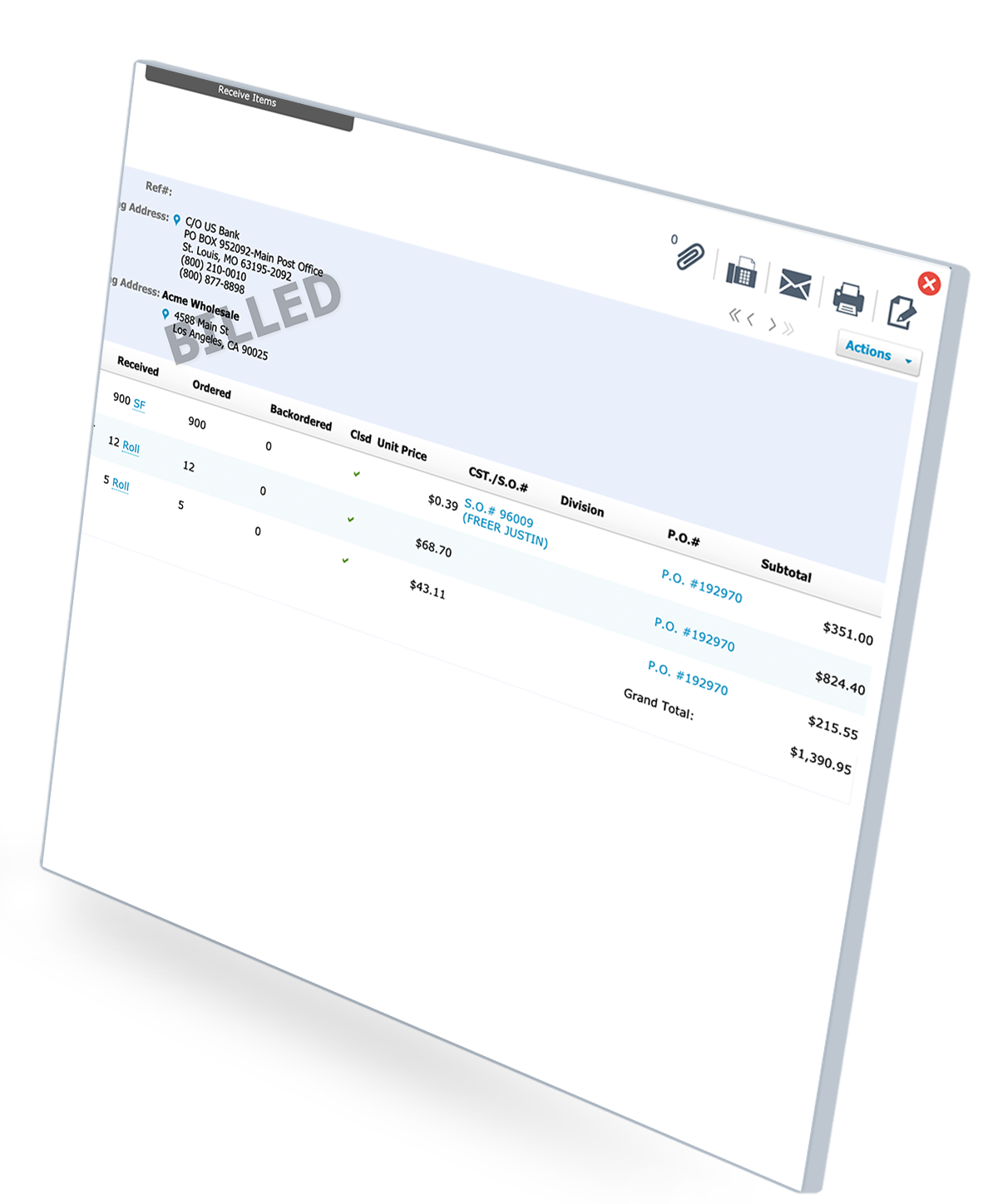

In the vast world of accounting software, ZarMoney shines bright in Xero vs Wave vs ZarMoney with its comprehensive solution tailored for businesses of all sizes. Established to simplify the complexities of financial management, ZarMoney isn't just another accounting solution. It's your financial companion, aiming to streamline operations and boost productivity.

Key Features

- Invoice and billing

- Inventory management

- Purchase orders

- Expense tracking

- Financial Reporting

- Vendor and customer management

Top 3 Features

1 - Invoice and Billing

Regarding expense tracking, ZarMoney provides a robust platform that effortlessly manages incoming and outgoing funds. The customizable invoices feature stands out, allowing businesses to reflect their brand identity while ensuring clear and precise billing.

2 - Inventory Management

ZarMoney's inventory management is a solid option for businesses dealing with tangible products. It gives real-time insights into stock levels, helping make informed purchase decisions. With the software's advanced features, businesses can track sales, understand product performance, and optimize inventory levels to maximize profitability.

3 - Financial Reporting

Understanding the financial health of a business is about more than just knowing the numbers. It's about interpreting them. ZarMoney's financial reporting provides many features, from basic accounting features to more intricate financial statements. With this, businesses can assess their performance, spot trends, and make data-driven decisions to ensure continued growth.

Pros

- User-friendly interface

- Comprehensive inventory tracking

- Efficient expense tracking

- Detailed financial reporting

- Versatile vendor and customer management tools

Cons

- Limited integrations compared to competitors

- Advanced features are available only in higher-tier plans

Pricing

ZarMoney pricing offers a range of plans to suit different needs. Start with the free version to get a feel, and as your needs grow, consider the Entrepreneur plan at $15, Small Business at $20, or go big with the Enterprise at $350.

Supported Platforms

ZarMoney is available on the web.

Customer Support

For any questions, you can rely on their stellar customer support via;

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Reviews & Ratings

User reviews highlight the ease of use and the robust feature set of ZarMoney as a prime choice in accounting software.

Final Verdict

If you're seeking a dynamic accounting software that combines various essential features under one roof, ZarMoney is worth a close look between Xero vs Wave vs ZarMoney. Its user-friendly design and comprehensive features make it an appealing choice for businesses of all sizes.

2 - Xero

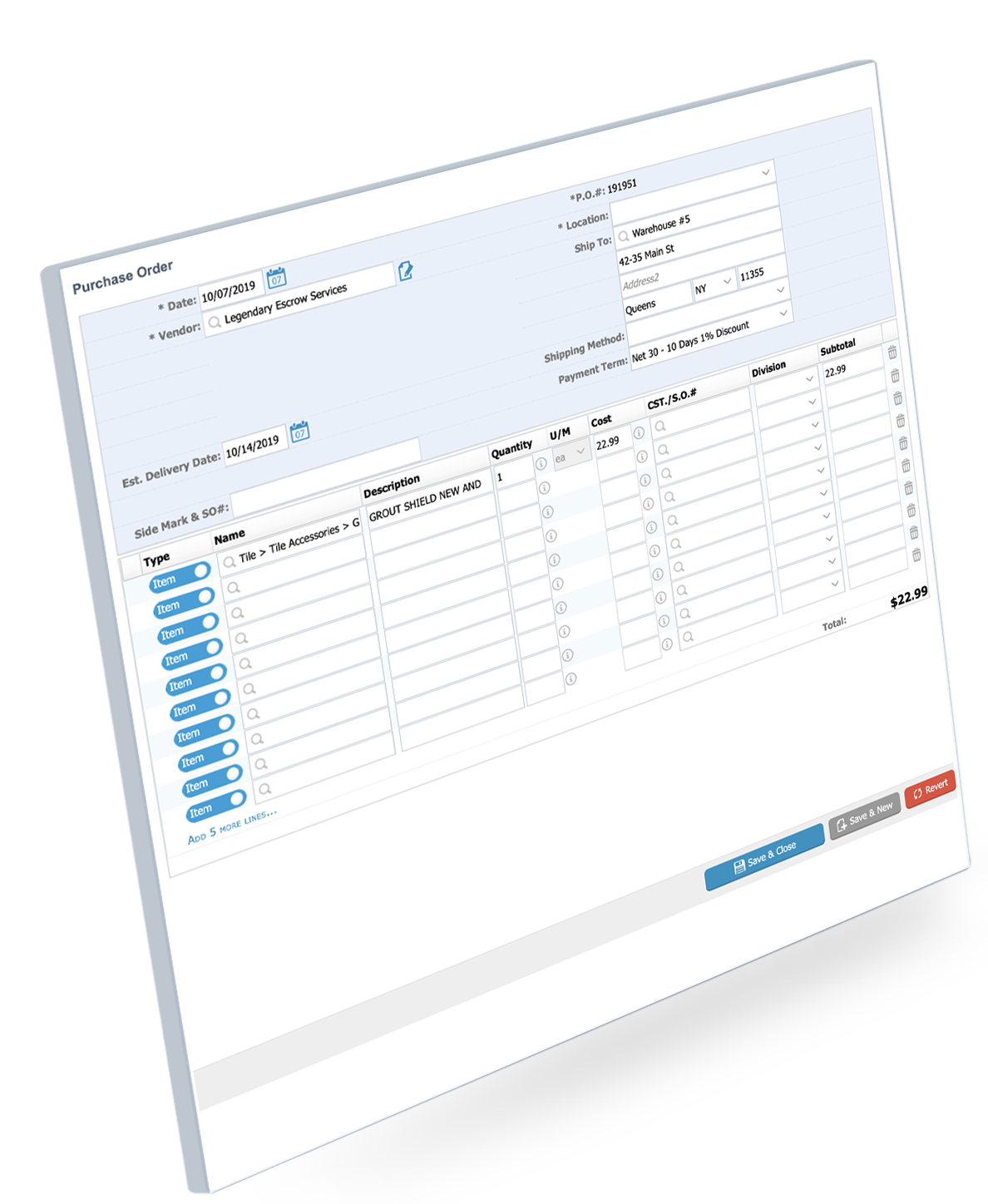

Enter the world of Xero, an impressive accounting software that promises businesses both efficiency and accuracy in financial management. With a growing demand for cloud-based accounting software, Xero offers a comprehensive solution in Xero vs Wave, challenging its competitors in every aspect. As the Xero vs Wave debate heats up among the business community, understanding the unique features and advantages of each is crucial for every business owner.

Key Features

- Online invoicing

- Bank connections

- Expense claims

- Inventory tracking

- Project tracking

- Purchase orders

- Bills payment

- Multi-currency

- Fixed assets

- Reporting

Top 3 Features

1 - Online Invoicing

Creating and sending customizable invoices has always been challenging. With Xero's online invoicing feature, businesses can seamlessly draft and distribute unlimited invoices. Its user-friendly interface ensures invoice templates cater to specific needs, providing clarity and efficiency in every transaction.

2 - Bank Connections

One of the strengths of Xero lies in its seamless bank reconciliation. It directly connects to bank accounts, and with the continuous flow of bank feeds, users can reconcile bank transactions in real-time. This streamlines cash management and provides a clear view of the business's financial health, day in and day out.

3 - Reporting

With a wide range of features, Xero offers a robust reporting mechanism. From basic accounting features to more advanced financial statements, businesses can analyze their operations deeply. Customizable reports ensure every business owner gets insights tailored to their needs, promoting informed decision-making.

Pros

- Xero is known for its intuitive and easy-to-use interface.

- Being cloud-based means users can access their financial data anytime, anywhere, as long as they have an internet connection.

- Xero can automatically import bank and credit card transactions, reducing the manual data entry work and ensuring up-to-date financial records.

- Xero's ability to handle multiple currencies is invaluable for businesses that operate internationally. It can track and manage currency fluctuations and conversions in real-time.

Cons

- While Xero offers a range of features, it can be pricier than other accounting solutions.

- Although Xero is perfect for small to medium-sized businesses, more giant corporations or those with complex accounting needs might need more advanced features or capabilities

Pricing

Xero's Pricing base plan, the starter subscription plan, comes at a mere $25/month and standard plan comes in $40. On the other hand, for businesses seeking a more comprehensive range of features and more advanced options, the premiumplan is available at $54/month.

Supported Platforms

Xero ensures its software is accessible. With Web, iPad, iPhone, and Android platforms, every transaction, whether expense tracking or inventory management, can be monitored in real-time.

Customer Support

When it comes to customer satisfaction, Xero steps up its game, Beyond that, Xero Central is a comprehensive help center for all users:

- Email/Help Desk

- Chat

- Knowledge Base

- FAQs/Forum

- 24/7 (Live rep)

Reviews & Ratings

User reviews highlight the ease of use and the robust feature set of Xero as a prime choice in accounting software.

Final Verdict

In the ever-evolving debate of Xero vs Wave and other competitors, Xero firmly establishes itself as a leading contender. Its comprehensive features, paired with its user-friendly interface, make it a go-to for many businesses. However, every business owner needs to assess their specific needs, business size, and budget before settling on an accounting solution.

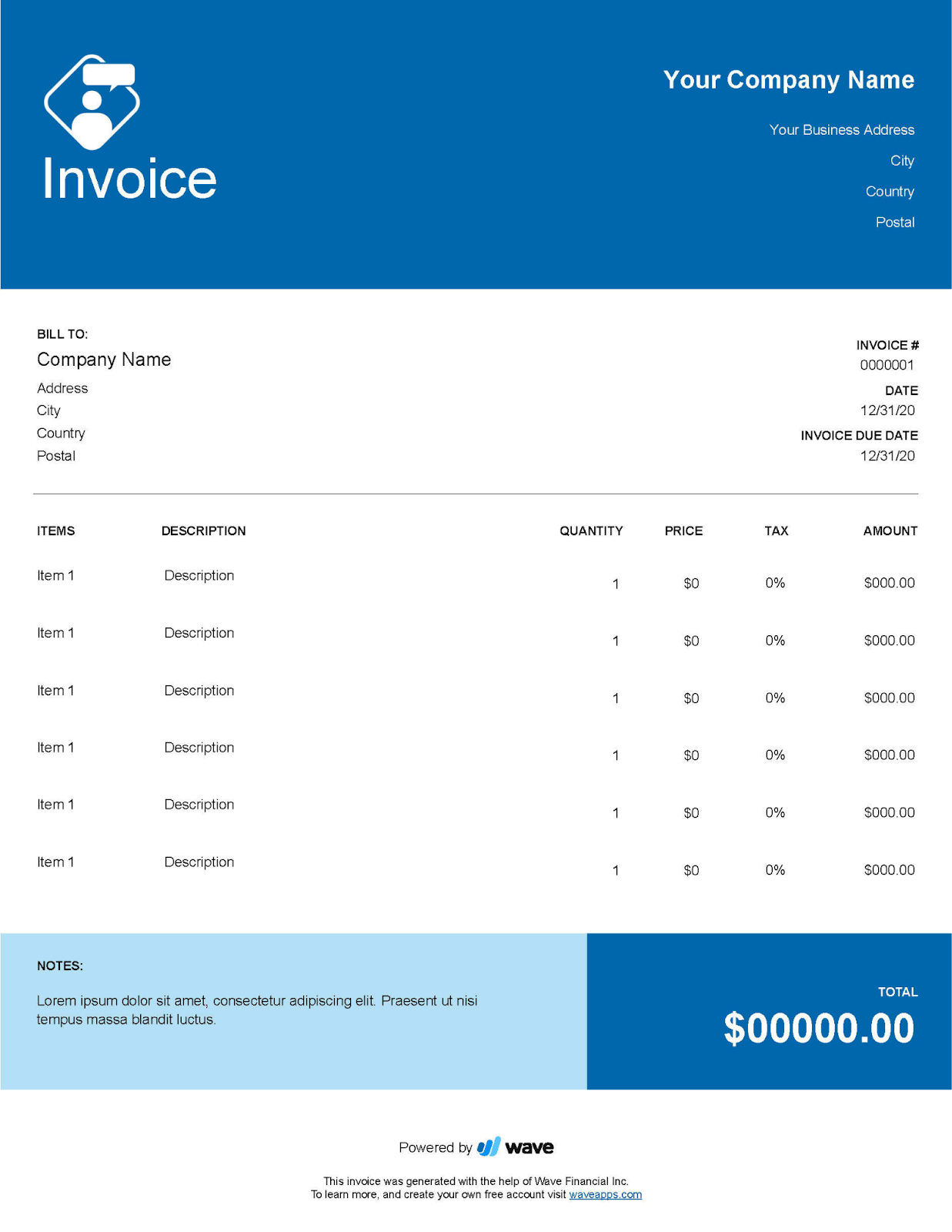

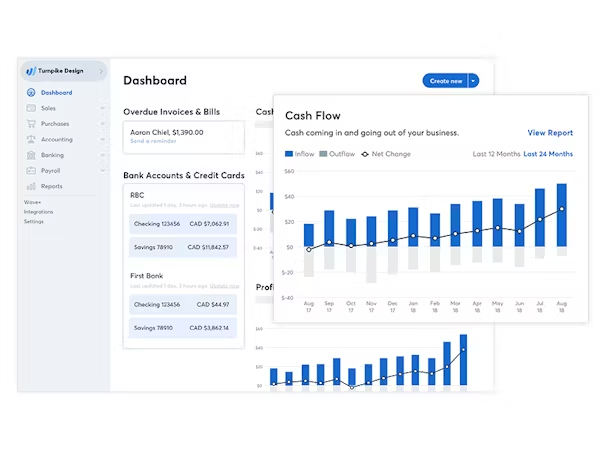

3 - Wave

For small business owners, solopreneurs, and independent contractors, finding a cloud-based accounting software that offers a comprehensive solution without breaking the bank is crucial. Enter Wave is a software changing game, especially when pitting the Xero vs Wave debate.

Key Features

- Invoice Creation

- Expense Tracking

- Payroll Processing

- Mobile Receipts

- Payments

- Advisors

Top 3 Features

1 - Invoice Creation

Wave offers a user-friendly interface, allowing businesses, especially small businesses and freelancers, to easily create and manage professional invoices. This feature facilitates the quick generation of invoices and provides customization options, such as adding a business logo or adjusting the layout, ensuring that the invoice reflects the brand's image.

2 - Expense Tracking

One of the most essential aspects for any business is to keep a close eye on their expenditures. Wave's expense tracking feature simplifies this task by categorizing and organizing expenses, offering a clear overview of where the money is being spent. Whether it's for tax deductions or to understand the financial health of a business, Wave ensures that businesses can accurately and efficiently log and review their expenses.

3 - Payroll Processing

Wave provides a comprehensive payroll processing system for businesses operating in supported countries. This feature automates the often tedious and complicated task of managing employee salaries, tax deductions, and other payroll-related matters. With an intuitive interface, businesses can ensure that their employees are paid on time and accurately.

Pros

- Wave offers a holistic solution for businesses, combining financial tracking, invoicing, expense categorization, and payroll processing all under one platform.

- Its intuitive design is particularly beneficial for freelancers and small businesses without a dedicated finance team.

- With core features like accounting, invoicing, and receipt scanning available for free, businesses can maintain their finances without significant upfront costs.

Cons

- Some users might find the invoice and report customization options less extensive.

- Features like payroll processing are only available in certain supported countries, limiting its applicability to global businesses.

Pricing

Wave offers free invoicing and accounting services. Payments have varied fees; Wave offers a range of pricing options for its services: 'Accounting & Invoicing' and 'Receipt Management' are free. For 'Credit card processing,' they charge $0.30 plus 2.9% per transaction.

'Bank payment/ACH processing' comes at a rate of 1% per transaction with a minimum fee of $1. Their 'Payroll' service varies based on the state's tax service - in tax service states, it's a $35 monthly base fee plus $4 for each active employee and $4 for every independent contractor paid. In self-service states, the base fee is $20 per month, with the exact per-person charges.

Supported Platforms

Wave is available on the web, android, iPad, and iPhone.

Customer Support

Wave's online help center contains articles, FAQs/Forum, and community forums. For those opting for services like Wave Advisors, one-on-one support becomes available, enhancing customer satisfaction, such as:

- Email/Help Desk

- Chat

- Knowledge Base

Reviews & Ratings

User reviews highlight the ease of use and the robust feature set of Wave as a prime choice in accounting software.

Final Verdict

Putting Xero vs Wave, Wave emerges as a strong contender, especially for businesses looking for a lightweight solution with a comprehensive feature set. Its user-friendly interface, combined with its free core offerings, makes it a popular option for many. While midsize businesses might lean towards other solutions with a broader range of features, Wave holds its ground firmly in cloud-based accounting software.

Table Comparison of Xero vs Wave vs ZarMoney

|

Features |

ZarMoney |

Xero |

Wave |

|

Accounting |

|||

|

Basic Accounting Features |

✅ |

✅ |

✅ |

|

Bank Reconciliation |

✅ |

✅ |

❌ |

|

Real-time Financial Health Snapshot |

✅ |

✅ |

❌ |

|

Multi-Currency Support |

❌ |

✅ |

✅ |

|

Expense Tracking |

✅ |

✅ |

❌ |

|

Inventory |

|||

|

Inventory Tracking |

✅ |

✅ |

❌ |

|

Inventory Management |

✅ |

✅ |

❌ |

|

Invoicing & Payments |

|||

|

Customizable Invoices |

✅ |

✅ |

✅ |

|

Online Payments |

✅ |

✅ |

✅ |

|

Credit Card Processing |

✅ |

✅ |

✅ |

|

Employees & Payroll |

|||

|

Payroll Services |

✅ |

✅ |

✅ |

|

Active Employee Per Month Tracking |

❌ |

✅ |

✅ |

|

Customer Management |

|||

|

Customer Database |

✅ |

✅ |

✅ |

|

Customer Reviews |

✅ |

✅ |

✅ |

Xero vs Wave vs ZarMoney - Who Wins?

When the dust settles after this intense showdown of accounting software, it's evident that each has unique strengths. While Xero vs Wave has a loyal fan base and impressive features, ZarMoney subtly emerges as a holistic tool designed to cater to varied business needs. If you're still on the fence, why not give ZarMoney a whirl? Its user-centric approach is what you're looking for.

Conclusion

The Xero vs Wave debate stands out in the ever-competitive realm of cloud-based accounting software. Each offers a unique proposition tailored to diverse business needs.

However, businesses prioritizing advanced features and a more comprehensive range of integrations might lean towards ZarMoney. It's a classic debate of a complete solution versus a user-friendly, cost-effective platform. Choose wisely, considering your business's growth trajectory and financial management needs.

Frequently Asked Questions (FAQs)

Q1. How does Xero vs Wave compare regarding basic accounting features for a business owner?

Both Xero and Wave provide a robust suite of basic accounting features. While Xero is known for its comprehensive solution with a wide range of advanced features, Wave Accounting shines as a lightweight solution for small businesses.

Q2. For an independent contractor with limited transactions every business day. Which software would you recommend?

For independent contractors or those with a smaller volume of bank transactions, ZarMoney might be a more suitable choice. It offers a user-friendly interface, free basic functionalities, and customizable invoice templates, making it a popular option.

Q3. How do Wave vs Xero fare regarding financial health reports and real-time financial snapshots?

Both platforms allow you to assess your business's financial health in real-time. Wave gives you a straightforward business snapshot tailored for small to midsize businesses. Xero offers detailed financial reports suitable for a broader business size spectrum.

Q4. How effective is the bank reconciliation feature in these software solutions?

Xero and Wave provide efficient bank reconciliation features, seamlessly connecting with various bank accounts and credit card transactions. This ensures business owners have an updated and accurate view of their financial statements.

Q5. Is it possible to handle multi-currency accounting and foreign transactions using these platforms?

Yes, both Xero and Wave offer multi-currency support. This feature is crucial for businesses dealing with international clients or transactions, ensuring that financial statements remain accurate regardless of currency differences.

Q6. Which software provides better inventory tracking and management for e-commerce business?

While both Xero vs Wave offer inventory tracking features, ZarMoney might have a slight edge in depth and detail, especially tailored for e-commerce businesses or those with a more complex inventory management need.

Q7. Are there any additional fees for credit card processing or online payments?

Wave charges fees for credit card processing, depending on the transaction type. When paired with third-party apps, Xero might also have associated costs for online payments. It's essential to review the terms of pricing for each platform.

Q8. How do customer support and user reviews compare between Xero vs Wave?

Wave provides excellent customer support through its online help center and Wave Advisors for premium services. Xero, on the other hand, boasts a robust online community and extensive user reviews.

Q9. Which software offers a more user-friendly experience for someone with no accounting background?

ZarMoney Accounting is known for its user-friendly interface, making it a solid choice for those new to business accounting software.

Q10. Are there any options for payroll services within these platforms?

Yes, both platforms offer payroll services. Wave Payroll caters to specific supported countries with varying fees, while Xero provides a more global approach, integrating with various third-party payroll services.