10 Best Zoho Books Alternatives for Small Business

Starting a small business is tough, and keeping track of finances is even tougher.

That's where accounting software comes in handy.

Zoho Books is a popular choice, but it might not fit everyone's needs.

In this blog post, we'll check out the 7 best alternatives to Zoho Books that can help small businesses manage their money better.

Whether you're looking for more features, simpler interfaces, or more affordable options, there's something here for everyone.

1. ZarMoney

Kicking off our list at number one is ZarMoney, the top Zoho books alternative for small business.

ZarMoney stands out with its user-friendly design and powerful features, such as easy invoicing, financial reporting, and inventory tracking, making it an excellent choice for managing finances efficiently.

If you're searching for a reliable Zoho Books alternative that won't break the bank, ZarMoney could be the perfect fit for your business.

Features

- Detailed inventory management

- User role customizations

- Real-time financial tracking

- Cloud-based access

- Invoice creation and management

- Expense tracking

- Flexible Transaction Forms

- Automated bank reconciliation

- Multi-user access

- Reporting and analytics

- Purchase Order management

Top 3 Features of ZarMoney

1. Detailed Inventory Management

With ZarMoney, you can keep a keen eye on your inventory levels. The tool facilitates real-time tracking, ensuring you always stay supplied and have essential items.

2. Flexible Transaction Forms

Every business is unique, and ZarMoney understands this. Their transaction forms can be customized to fit your business sample, assuring effortless integration with your operations.

3. User Role Customizations

Delegate and define roles with precision. ZarMoney lets you customize user roles, ensuring team members access only the required data and functions.

Pros of ZarMoney

- Intuitive, user-friendly interface

- Scalable for different business sizes

- Offers extensive feature sets not usually found in other similar-priced alternatives

Cons of ZarMoney

- Might be overwhelming for absolute beginners

- The mobile version needs refinement

- Integration with third-party apps can be enhanced

Supported Platforms

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Pricing

ZarMoney has two pricing plans

- 15 Days Free Trial

- Small Business $20 / month / 2 users

- Enterprise $350 / month / 30+ users

Final Verdict on ZarMoney

If you're looking for a powerful yet affordable Zoho Books alternative, ZarMoney is the way to go. It's perfect for small businesses that need accounting tools without the complexity or high costs.

Looking for an affordable alternative to Zoho Books? Try ZarMoney today! Experience user-friendly accounting tools without breaking the bank. Start your free trial now and simplify your business finances!

Intuit's QuickBooks Online takes the second spot on our list of Zoho Books alternatives for small businesses.

It's well-known for its reliability and a range of features that cater specifically to small business needs.

QuickBooks Online makes it easy to manage invoices, track expenses, and handle payroll all in one place.

Features

- Income and expense tracking

- Invoice customization and management

- Cloud-based access

- Automated bank feeds and reconciliation

- Time tracking

- Payroll functionality

- Integrated ecosystem

- Reporting and analytics

- Multi-currency support

- Tax calculation and filing assistance

- Accounts payable and receivable management

Top 3 Features of QuickBooks Online

1 Automation with Bank Feeds

QuickBooks Online allows users to connect to their bank accounts, automatically import and categorize transactions, reducing manual data entry.

2 Integration Ecosystem

With a wide array of third-party app integrations, businesses can connect their operations, from e-commerce to CRM.

3 Payroll Functionality

QuickBooks Online offers in-built payroll solutions, ensuring smooth employee payment processes and tax calculations.

Pros of QuickBooks Online

- User-friendly interface

- Reliable mobile app for on-the-go management

- Strong reporting capabilities

Cons of QuickBooks Online

- It can get pricey with additional features

- Initial learning curve for beginners

- Some users report slow customer support

Supported Platforms

- Chat

- Knowledge Base

- 24/7 (Live rep)

- FAQs/Forum

- Email/Help Desk

- Phone Support

Pricing

- Simple Start: $18

- Essentials: $27

- Plus: $38

Final Verdict on QuickBooks Online

QuickBooks Online is a cloud-based accounting software solution for miniature and medium-sized enterprises. Developed by Intuit, this platform enables users to manage and track expenses, draft and send invoices, run financial statements, and oversee payroll and other financial commitments.

3. FreshBooks

FreshBooks claims the third spot on our list of Zoho Books alternatives for small businesses.

It's particularly popular for its ease of use and exceptional customer support. FreshBooks helps small businesses manage their invoicing, expenses, and time tracking with minimal hassle.

Its mobile app also makes accounting tasks manageable on the go.

Features

- Automated invoicing

- Expense tracking

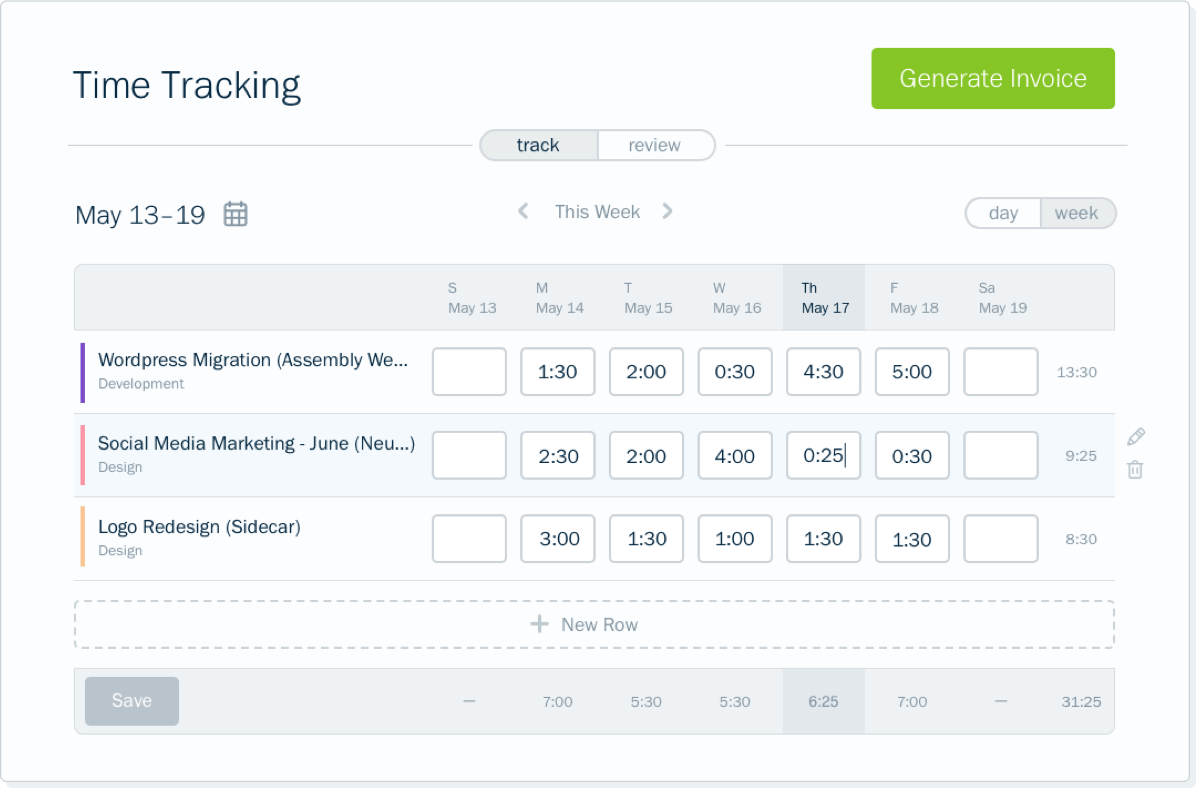

- Time tracking

- Project management

- Estimates and proposals

- Payments

- Reporting

- Accounting and bookkeeping

- Client Portal

- Mobile apps

- Multi-currency

- Recurring billing

- Automated bank reconciliation

- Team collaboration and permissions

Top 3 Features of FreshBooks

1. Automated Invoicing

FreshBooks lets users create professional-looking invoices that can be automated, saving time and ensuring timely payments.

2. Expense Tracking

This software simplifies expense tracking by categorizing and managing them, thus providing clarity on spending.

3. Integrated Time Tracking

FreshBooks effortlessly integrates time tracking, allowing businesses to bill for hours worked directly.

Pros of FreshBooks

- User-friendly interface is suitable for those new to accounting

- Supports multiple currencies and languages

Cons of FreshBooks

- Fewer bank connections.

- Users can’t shift to other software.

- Expensive to expand.

Supported Platforms

- Email/Help Desk

- Phone Support

- Chat

- FAQs/Forum

- Knowledge Base

Pricing

- Lite $19 / month

- Plus $33 / month

- Premium $60 / month

Final Verdict on FreshBooks

FreshBooks is a great alternative for small businesses that need an effective tool for managing their finances. It’s especially good for those who appreciate support at their fingertips and the convenience of handling accounting from anywhere.

4. Wave

Wave takes the fourth spot in our list of Zoho Books alternatives for small businesses.

It's well-liked for being completely free to use, offering essential features like invoicing, expense tracking, and financial reporting without any cost.

Wave is particularly suited for freelancers and small business owners who are just starting out and need to keep overhead low.

Features

- Invoicing

- Expense tracking

- Accounting and financial reporting

- Receipt scanning

- Payroll (available in certain countries)

- Payments (credit card processing)

- Bank account and credit card connections

- Recurring billing

- Personal finance tracking

- Multi-currency support

Top 3 Features of Wave

1. Free Unlimited Invoicing

Wave does not cap invoicing, making it perfect for businesses on a tight budget.

2. Integrated Payment Solutions

Accept credit cards and bank payments easily and swiftly.

3. Receipt Scanning

Snap and save receipts, making expense tracking more straightforward.

Pros of Wave

- 100% free for basic features

- User-friendly dashboard and reports

- Secure encryption and backup

Cons of Wave

-

There is no dedicated mobile app for accounting (only for invoices and receipts)

Supported Platforms

- Email/Help Desk

- Phone Support

- Chat

- FAQs/Forum

- Knowledge Base

Pricing

- Starter is free

- Pro: $16/month

Final Verdict on Wave

If you’re looking for a cost-effective Zoho Books alternative, Wave is a standout choice. It’s perfect for small businesses and freelancers who need basic accounting tools without the financial burden of a subscription fee.

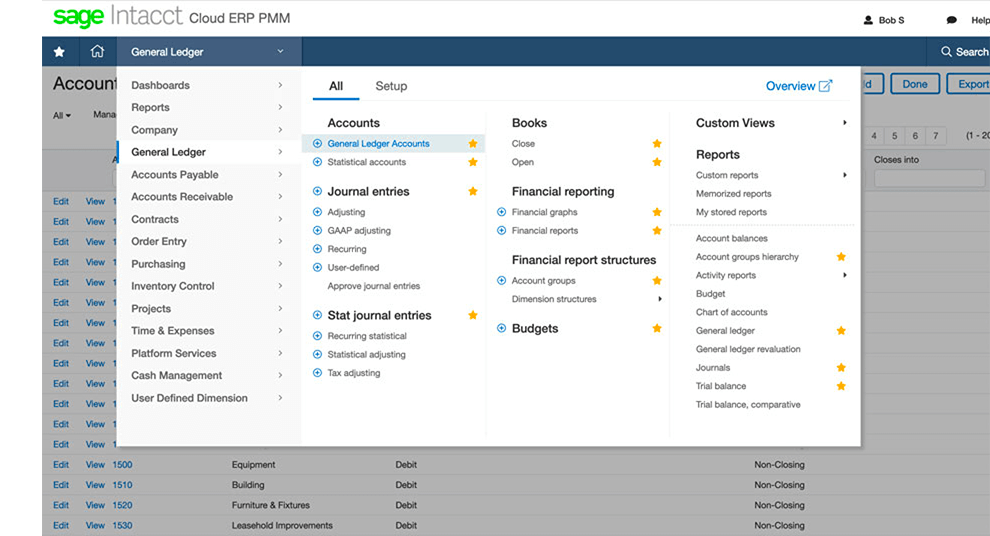

5. Sage Intacct

Next comes Sage Intacct. It is renowned for its advanced financial management capabilities and extensive customization options.

Sage Intacct stands out with its cloud-based approach, allowing for real-time financial insights from anywhere.

This feature is particularly effective for businesses looking to scale, providing features like advanced analytics, multi-entity support, and automated workflows.

Features

- Core financials

- Multi-dimensional general ledger

- Accounts payable

- Accounts receivable

- Cash control

- Order management

- Purchasing

- Multi-entity and global consolidations

- Revenue recognition

- Time and expense management

- Project accounting

- Advanced dashboards

- Automated processes

- Digital board book

- Contract and subscription billing

- Inventory management

Top 3 Features of Sage Intacct

1. Multi-dimensional General Ledger

It lets users capture transactional data and create reports based on multiple variables.

2. Advanced Dashboards

Visual, customizable dashboards offer insights into financial performance from any perspective.

3. Automated Processes

Automated procure-to-pay and order-to-cash processes make financial operations seamless.

Pros of Sage Intacct

- Extensive financial reporting features

- Scalable to accommodate growing businesses

Cons of Sage Intacct

- Learning curve compared to other solutions

- It can be on the more expensive side for smaller businesses

Supported Platforms

Sage Intacct is cloud-based and accessible via web browsers, but there's no native mobile application.

Pricing

-

Pricing is quote-based and customized according to business requirements.

Final Verdict on Sage Intacct

Sage Intacct is an excellent choice for small businesses that need a Zoho Books alternative with an extensive feature set capable of supporting growth and complexity. If your business is expanding and you require a powerful accounting solution, Sage Intacct could be the right tool.

6. Kashoo

Kashoo makes it to the seventh position in our list of Zoho books alternative for small business.

It’s known for its straightforward approach to accounting, offering tools that are both easy to use and effective.

Kashoo provides features like automatic bank reconciliation, simplified invoicing, and real-time financial reporting.

Features

- Automatic Bank Reconciliation

- Simplified Invoicing

- Real-time Financial Reporting

- Expense Tracking

- Multi-Currency Support

- Cloud-Based Access

- Secure Data Storage

- Dashboard Overview

- Tax Compliance Tools

- Mobile App Availability

- Double-Entry Accounting

- Collaboration Tools

Top 3 Features of Kashoo

1. Automatic Bank Reconciliation

Kashoo quickly matches your transactions with your bank records, saving you lots of time.

2. Simplified Invoicing

Creating and sending invoices is easy and fast, helping you get paid quicker.

3. Real-time Financial Reporting

See up-to-date financial reports anytime, so you always know where your money stands.

Pros of Kashoo

- Simple interface, easy to navigate

- Excellent for managing basic accounting needs

- Provides clear financial reporting

Cons of Kashoo

- Limited integration with other tools

- Fewer advanced features compared to competitors

Supported Platforms

- Web (Browser-based)

- iOS (iPhone and iPad apps)

- Android app

Pricing

- Truly small Accounting: $216/Yr

- Advanced: $324/Yr

Final Verdict on Kashoo

Kashoo is a fantastic choice for small business owners who need a no-fuss Zoho Books alternative. It’s particularly suitable for those who prefer a clear, uncomplicated tool to manage their finances efficiently.

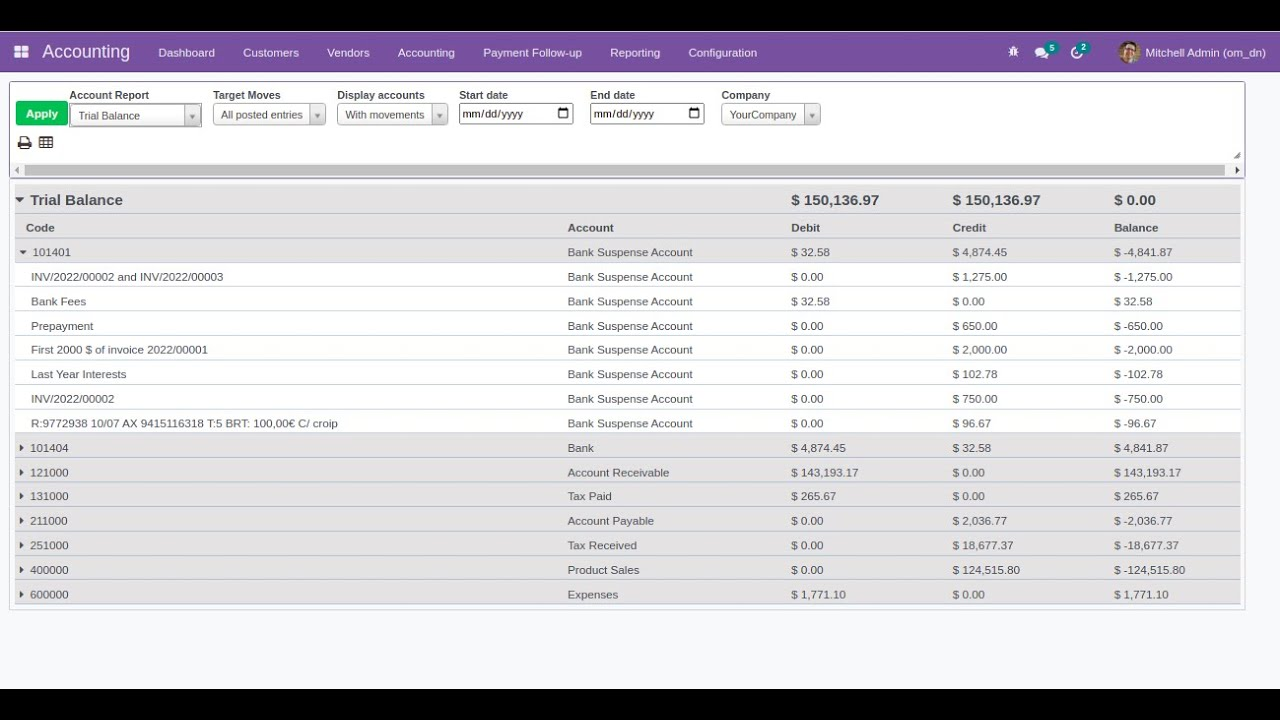

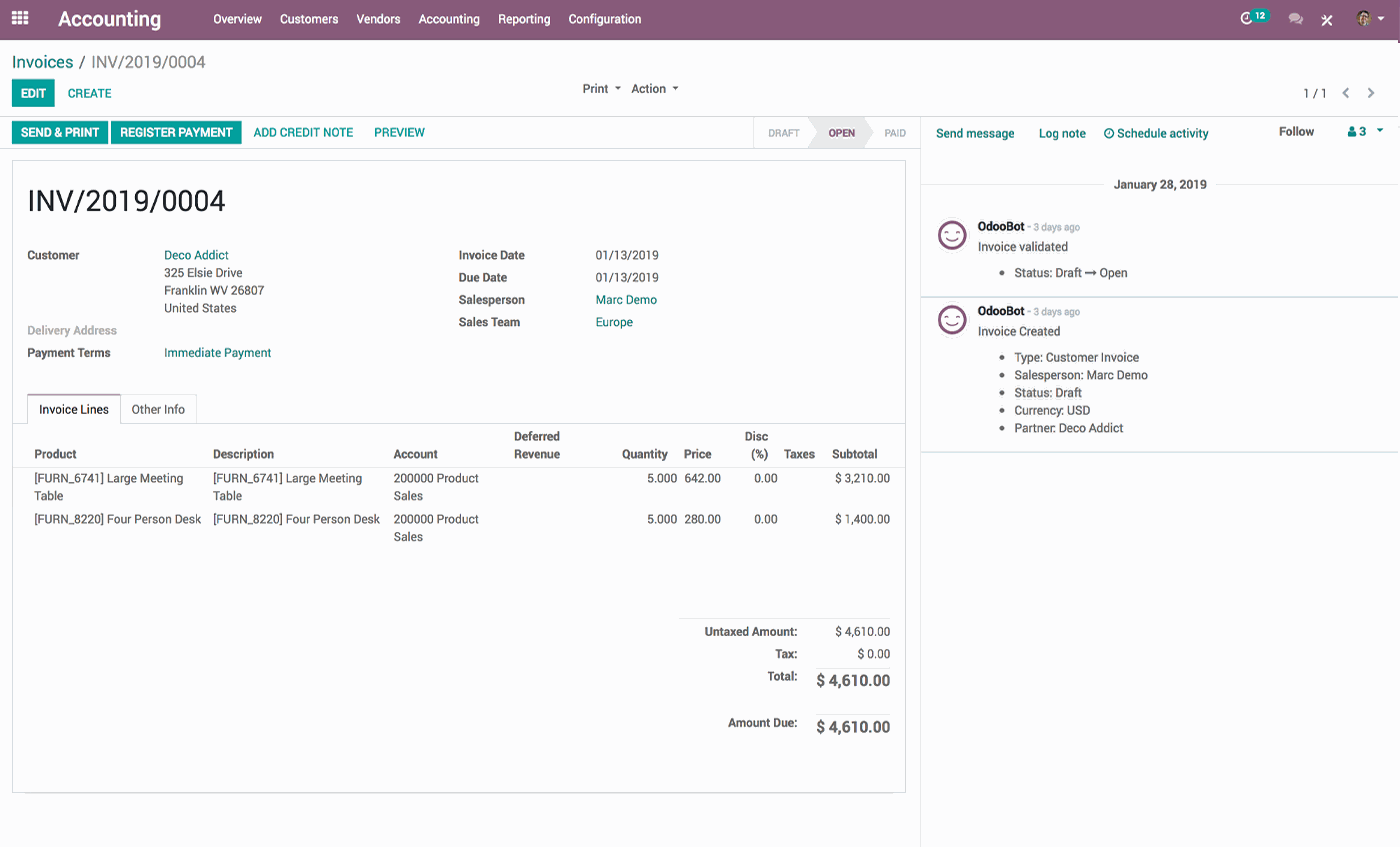

7. Odoo Accounting

Odoo Accounting rounds out our list at number seven among the Zoho Books alternatives for small businesses. Being a part of the Odoo suite, it offers diverse financial tools, from invoicing to complex operations like multi-currency support.

Odoo's modular approach enables businesses to use and pay for only the necessary tools.

With a strong community behind it, Odoo has positioned itself as a customizable and extensive business software solution.

Features

- Invoicing

- Bank synchronization

- A/R & A/P management

- Multi-currency support

- Dynamic reports

- Asset management

- Reconciliation

- Expense management

- Budget management

- Analytic accounting

- Automated bank feeds

- Cash rounding

- Tax calculation

- Payment terms

- Check printing

- Import & export data

- E-invoicing

- Automatic payment follow-ups

Top 3 Features of Odoo Accounting

1. Automated Bank Sync

Automatically syncs transactions with the bank and reconciles statements.

2. Dynamic Reports

Create balance sheets, gain and loss, and cash flow statements effortlessly.

3. Electronic Invoicing & Online Payments

Odoo Accounting helps you send invoices via email and get paid online.

Pros of Odoo Accounting

- Open-source with a strong community

- Scalable with modular design

Cons of Odoo Accounting

- Some advanced features require paid modules

- The interface might be less reflexive compared to opponents

Supported Platforms

- Web browser

- Mobile apps are also available for both Android and iOS.

Pricing

- Odoo has a modular pricing structure, where you pay for the apps/modules you need.

- A free version with limited features is also available.

Final Verdict on Odoo Accounting

Odoo Accounting is a great choice if you're looking for a Zoho books alternative for small business that can connect easily with other business operations. It’s especially useful for small businesses that appreciate having all their tools in one interconnected platform.

8. Xero

Xero is a cloud-based accounting software system that caters to small and midsize companies. It simplifies accounting workflows, providing tools for invoicing, expense tracking, inventory management, and payroll. Known for its intuitive interface, Xero is a popular business accounting software with features that support informed business decisions.

Features

- Automatic bank feeds

- Customizable invoicing

- Project tracking and task management.

- Payroll management with built-in time tracking and tax filing

- Audit trails and budgeting features.

Top 3 Features of Xero

1. Automatic Bank Reconciliation

Xero connects directly to your bank accounts, automatically importing and categorizing transactions. This feature streamlines financial compliance requirements and ensures accurate cash flow forecasting.

2. Customizable Invoicing

With Xero, businesses can create invoices with integrated payment processing options like Stripe and PayPal. It includes customizable invoicing capabilities that allow branding and sending automatic payment reminders to clients.

3. Project Tracking and Budgeting

Xero’s project task tracking feature allows businesses to monitor budgets, track billable hours, and manage resources, making it a perfect accounting product for project-based businesses.

Pros of Xero

- is user-friendly and easy to implement

- It offers Ita mobile app, allowing you to use it from anywhere

- Extensive integrations with over 1,000 apps, including eCommerce and payroll software

Cons of Xero

- Complex delivery dockets system

- Glitches in automatic bank feeds

Supported Platforms of Xero

- Web

- Android

- iPhone

- iPad

Pricing of Xero

- Free trial

- Starter: $29 / month

- Standard: $46 / month

- Premium:$69 / month

Final Verdict

Xero is a versatile cloud-based accounting software system designed for informed business decisions. With an intuitive interface and features like customizable invoicing and project tracking, it’s a great Zoho Books alternative for midsize businesses looking to advance their accounting workflows.

9: Oracle NetSuite

Oracle NetSuite is a powerful cloud-based solution that combines accounting software systems with ERP functionalities. It supports businesses with complex organizations by offering tools for financial management, inventory tracking features, and business performance analytics. With NetSuite, companies can manage accounting workflows, enhance collaboration with accountants, and gain insights into financial metrics.

Features

- Advanced financial reporting with real-time data metrics

- Inventory management for multi-location businesses

- Automation features for accounts payable and receivable

- Built-in tax compliance

- Project-based budgeting tools for large-scale accounting processes

Top 3 Features of Oracle NetSuite

1. Financial Reporting

Oracle NetSuite provides detailed reports and dashboards to track key performance indicators. Businesses can make informed decisions by accessing real-time insights into revenue and expenses.

2. Inventory Management Solutions

NetSuite offers inventory tracking features that help businesses manage stock across multiple channels, making it an excellent resource for eCommerce businesses.

3. Tax Compliance Tools

NetSuite simplifies financial compliance requirements with built-in tax calculators, audit trails, and industry-standard transaction fee management.

Pros

- Scalable for large enterprises

- Comprehensive compliance and audit features

- Strong multi-currency support

Cons

- Higher monthly costs compared to entry-level plans from competitors

- Complex implementation process

Supported Platforms of Oracle NetSuite

- Web application

- Mobile apps for iOS and Android

Pricing

-

Custom pricing: Based on the size and requirements of the business.

Final Verdict

Oracle NetSuite is an excellent choice for complex organizations seeking all-in-one platform to manage their accounting, inventory, and reporting needs. Its extensive features and automation capabilities make it a top Zoho Books alternative for growing businesses.

10. ProfitBooks

ProfitBooks is a user-friendly cloud-based accounting software designed for small businesses and freelancers. It focuses on simplifying accounting functions like invoicing, income tracking, and expense management. ProfitBooks stands out as an affordable solution for startups and smaller organizations, offering a basic accounting feature set with intuitive tools.

Features

- Automated bookkeeping

- Income and expense tracking

- Basic inventory management tools

- Customizable invoicing capabilities

- Integrated payment options

- Detailed reports

Top 3 Features of ProfitBooks

1. Automated Bookkeeping

ProfitBooks automates bookkeeping processes, helping businesses save time and focus on core operations. It’s a beneficial accounting perk for companies looking to minimize back-office costs.

2. Income and Expense Tracking

The tool allows businesses to track income and categorize expenses, providing real-time insights into their financial status.

3. Basic Inventory Management

ProfitBooks includes basic inventory tracking features, allowing users to monitor stock levels, making it suitable for small-scale businesses.

Pros

- Affordable pricing plans with flexible options

- Ideal for first-time users and freelancers

- Free plan available for startups and small businesses

Cons

- Limited integration options compared to competitors

- Lacks advanced automation features for larger businesses

Supported Platforms of the Tool

-

Windows

-

Mac

Pricing

- Free Plan: Includes basic accounting features for startups.

- Small Business Plan: $15 per month.

- Corporate Plan: $49 per month (with additional inventory features).

Final Verdict

ProfitBooks is a perfect solution for small businesses and freelancers looking for an affordable, easy-to-use accounting product. Its free plan makes it an excellent lower-cost option for startups. However, the limited integration options is a drawback.Table Comparison Against ZarMoney

|

Features/Software |

ZarMoney |

Wave |

FreshBooks |

Odoo |

Kashoo |

Sage Intacct |

QuickBooks Online |

Xero |

Oracle NetSuite |

ProfitBooks |

|

User-Friendly Interface |

✅ |

✅ |

✅ |

❌ |

❌ |

❌ |

✅ |

✅ |

✅ |

✅ |

|

Advanced Reporting |

✅ |

❌ |

❌ |

✅ |

❌ |

✅ |

✅ |

❌ |

✅ |

✅ |

|

Multi-Currency Support |

✅ |

❌ |

❌ |

✅ |

✅ |

✅ |

✅ | ❌ |

✅ |

❌ |

|

Customizable Invoices |

✅ |

✅ |

✅ |

❌ |

❌ |

❌ |

✅ |

✅ |

❌ |

❌ |

|

Payroll Integration |

✅ |

❌ |

✅ |

✅ |

❌ |

❌ |

✅ |

✅ |

❌ |

❌ |

|

Real-time Data Access |

✅ |

❌ |

❌ |

✅ |

✅ |

✅ |

❌ |

❌ |

✅ | ✅ |

|

Cloud-Based |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Customer Support |

✅ |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

Best of Best Section

1 . ZarMoney

ZarMoney is the best Zoho books alternative for small business , specially for those who’re looking for a complete accounting solution. It offers everything from customizable invoices and payroll integration to real-time data access and excellent customer support, all in a user-friendly interface.

2. QuickBooks Online

QuickBooks Online, being one of the best Zoho books alternative for small business, is known for its extensive features, including advanced reporting, multi-currency support, and cloud-based convenience. It's ideal for businesses that need reliable and comprehensive financial management tools.

3. Sage Intacct

Sage Intacct excels in advanced financial management for growing businesses. It supports complex processes with features like multi-entity support and advanced analytics, making it suitable for businesses that are scaling up.

Conclusion

Finding the right accounting software is essential for managing your small business effectively. While Zoho Books is a solid option, there are several great alternatives out there.

Among them, ZarMoney stands out as the best Zoho books alternative for small business. It offers features that cater to all your business needs, from invoicing to real-time data access, all with exceptional ease of use.

Whether you're just starting out or looking to upgrade your current system, consider these alternatives to find the one that best fits your business requirements.

Try ZarMoney today and experience seamless accounting and inventory management for your business!

Frequently Asked Questions (FAQs)

1. What are the best Zoho Books alternatives for small businesses?

ZarMoney is a great alternative for small businesses, offering a 30-day free trial, affordable pricing, and features like automated invoicing, expense tracking, and comprehensive financial reports.

2. How does ZarMoney compare to Zoho Books in terms of invoicing?

ZarMoney offers more customizable invoicing options, including templates and automatic reminders. It also has a mobile invoicing app, making it more flexible than Zoho Books’ invoicing system.

3. Is ZarMoney better for large-scale accounting compared to Zoho Books?

Yes, ZarMoney provides advanced accounting features like inventory management and detailed reporting, making it a better choice for larger businesses. Zoho Books is more suitable for smaller businesses.

4. Does ZarMoney integrate with third-party apps like Zoho Books?

Yes, ZarMoney offers hundreds of integrations with third-party apps, providing more flexibility than Zoho Books, which has fewer integration options.

5. How does ZarMoney handle payment reminders?

ZarMoney automates payment reminders for overdue invoices, streamlining the process and reducing manual follow-up. This feature is more seamless than Zoho Books’ reminder system.

6. What are the pricing tiers for ZarMoney compared to Zoho Books?

ZarMoney offers clear and affordable pricing with no hidden fees, while Zoho Books has more complex pricing tiers with occasional price increases.

7. Can ZarMoney manage multiple businesses like Zoho Books?

Yes, ZarMoney allows you to manage multiple businesses from a single account, providing better flexibility than Zoho Books for users with multiple entities.

8. What features make ZarMoney better for inventory management than Zoho Books?

ZarMoney provides advanced inventory tracking, including multi-location support and real-time updates. Zoho Books has basic inventory management features, making ZarMoney the better option for businesses with complex inventory needs.

9. Is ZarMoney suitable for detailed financial reports and compliance?

Yes, ZarMoney offers detailed financial reports and ensures compliance with features like double-entry accounting, making it a stronger choice than Zoho Books for businesses that need in-depth reporting.

10. How does ZarMoney’s customer service compare to Zoho Books?

ZarMoney is known for its responsive customer service, with expert support and a comprehensive help center. Zoho Books offers support, but ZarMoney’s more personalized approach sets it apart.

.png)