5 Best Xero Personal Alternatives To Consider

Ever felt like your usual Xero Personal just isn't cutting it anymore? It's time you know about some of the best alternatives to take your financial game a notch higher. Dive in as we explore the top-notch contenders in the online accounting software arena, each with unique strengths.

This article will delve deep into the top 5 Xero personal alternatives, discussing their features, pros and cons, and everything in between. You're in for an informative ride.

Overview of Top 5 Xero Personal Alternatives

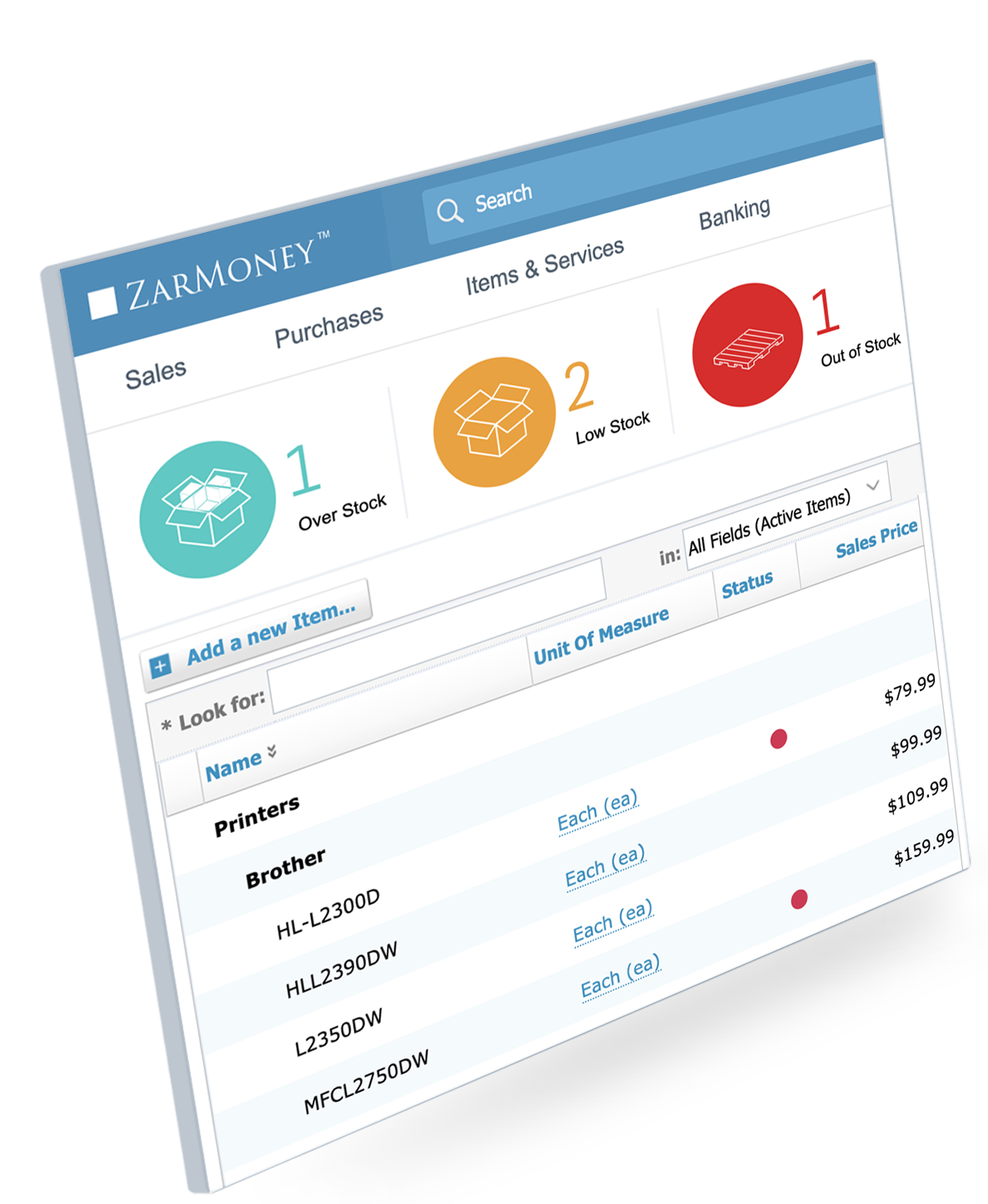

1. ZarMoney

A cutting-edge solution for modern businesses, ZarMoney stands out as an Xero personal alternative with its cloud-based infrastructure and real-time inventory tracking. Its customizable invoicing feature is another cherry on top for companies looking for flexibility and efficiency.

Key Features

- Invoicing

- Accept Credit Cards & ACH Payments

- Quotes/Estimates

- Bills & Expenses

- Bank Connection & Reconciliation

- Inventory Management

- Sales Tax

- Profit & Loss Reporting

- Balance Sheet

- Access from Everywhere

Top 3 Features

1. Cloud-Based Access

The future of accounting lies in the clouds, quite literally. With ZarMoney's cloud-based solution, manage your finances anytime, anywhere. No more being chained to a desk; your financial statements, from income statements to cash flow records, are just a click away.

2. Real-time Inventory Tracking

Keep an eagle's eye on your inventory with ZarMoney. ZarMoney ensures you're always stocked up by offering advanced inventory management capabilities. You can say goodbye to those embarrassing "out of stock" moments with real-time updates.

3. Customizable Invoicing

With ZarMoney, every invoice reflects your brand. Enjoy the luxury of customizable, professional invoices that look beautiful and resonate with your brand's essence.

Pros

- Highly flexible and scalable.

- User-friendly interface.

- The cloud-based system ensures accessibility.

Cons

- It might be overwhelming for new users.

- It requires regular online connectivity.

- Advanced features might come at an additional cost.

Supported Platforms

ZarMoney is available on Web-based.

Pricing

ZarMoney provides a 30-day free trial for its accounting software. Their pricing plans are as follows - Entrepreneur at $15 per month, Small Business at $20 per month, and the Enterprise plan starting from $350 per month.

Customer Support

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Reviews & Ratings

Bottom Line

With its cloud-based platform and customizable features, ZarMoney is a formidable contender as a Xero personal alternative. Its affordability and advanced tools make it a top choice for business owners.

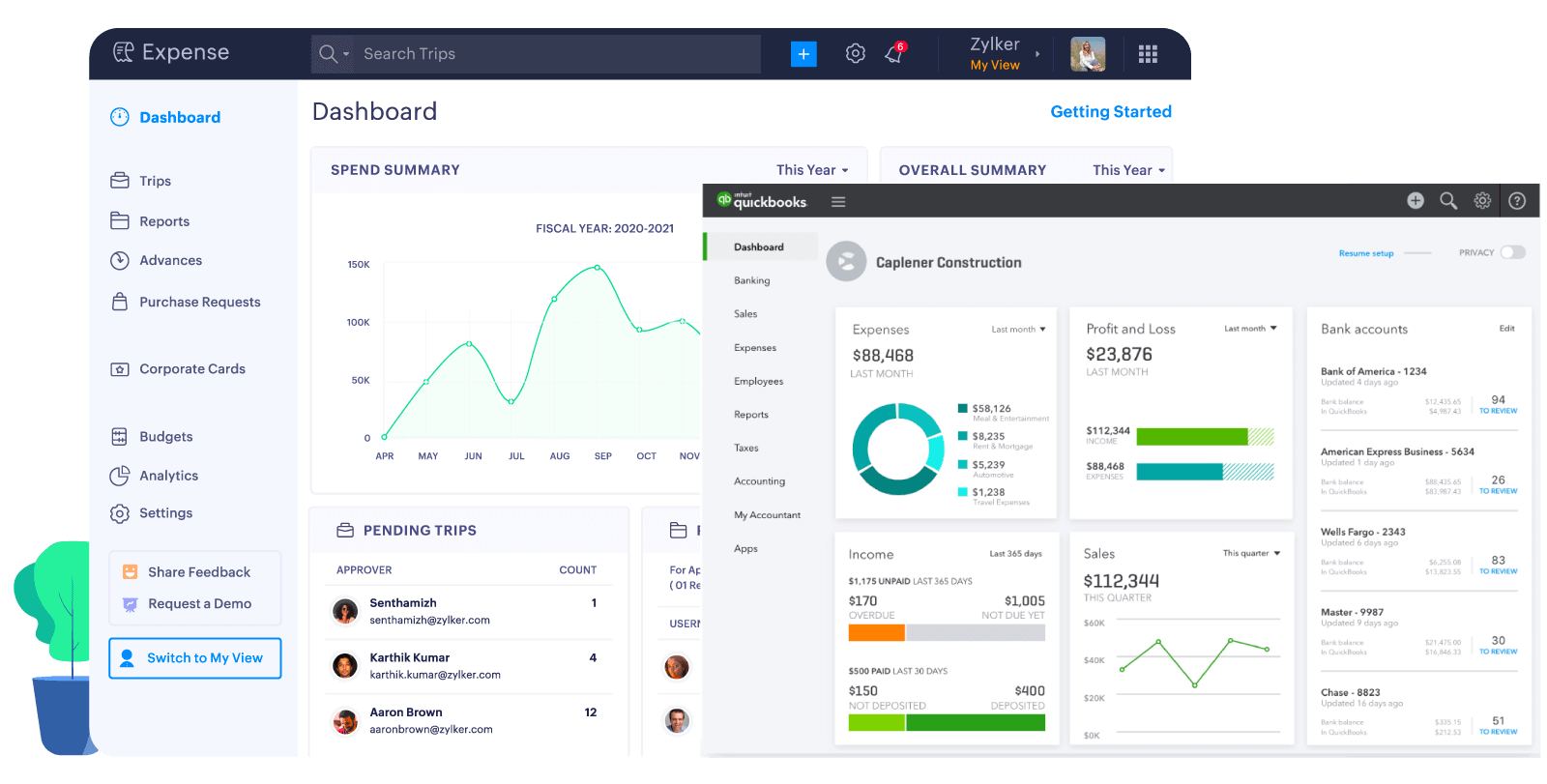

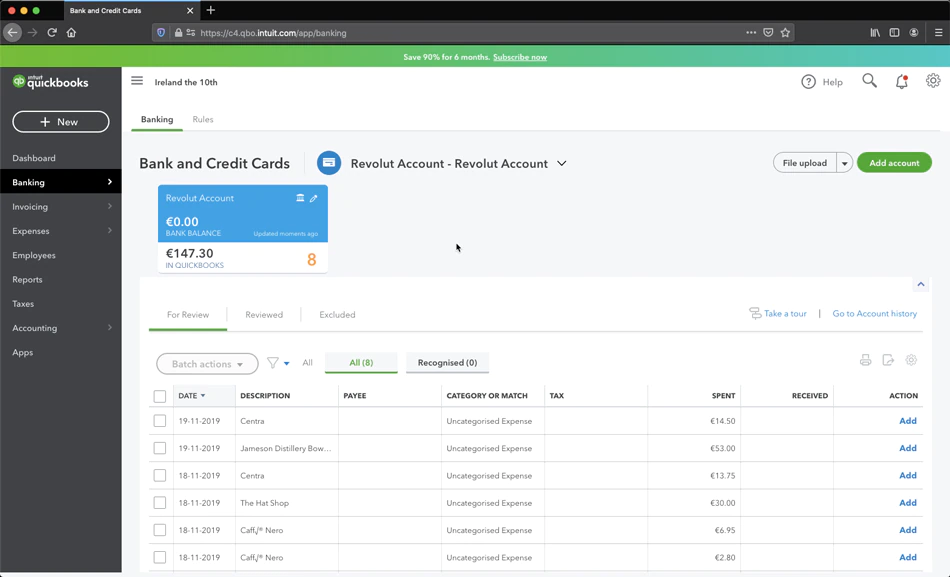

2. QuickBooks Online

QuickBooks Online isn't just a household name in the world of accounting software; it's a force to be reckoned with. As one of the market leaders in Xero personal alternative, this powerful accounting tool is renowned for its comprehensive financial solutions tailored to suit businesses of varying sizes. QuickBooks Online's dynamic features cater to all, from sole proprietors to larger enterprises, ensuring a streamlined accounting experience.

Key Features

- Expenses

- Payroll

- Bank Feeds

- GST & BAS and GST & VAT

- Payment

- Inventory

- Capture & Organize Receipts

- Mobile App

- Insights and Reports

- Multi-currency Support

- Security

Top 3 Features

1. Expense Tracking

Take advantage of every penny! With QuickBooks Online, businesses can easily monitor and manage their expenses. This tool offers a comprehensive breakdown, ensuring users know where every cent goes. With this, budgeting and financial planning become hassle-free.

2. Custom Invoicing

Make every invoice uniquely yours. QuickBooks Online provides a platform for businesses to create customized invoices that reflect their brand's essence. With many templates and personalization options, ensure that every invoice you send out resonates with your brand's identity.

3. Automated Reporting

Say goodbye to manual data entry and hello to automated efficiency. QuickBooks Online offers automated reporting, ensuring your financial data is always up-to-date. From profit and loss statements to balance sheets, get real-time updates without lifting a finger.

Pros

- Comprehensive and detailed expense tracking.

- A vast range of customizable invoicing options.

- Automated reporting saves time and reduces errors.

Cons

- It might be overwhelming for beginners.

- Pricing can be on the higher side for small businesses.

- Some features may require additional integrations or add-ons.

Supported Platforms

It's available on a Web-based platform.

Pricing

QuickBooks Online offers a 30-day trial with no credit card required, and you can cancel anytime. Their pricing plans are:

- Simple Start: Aimed at those starting their business, priced at US$18 monthly. However, a promotional offer of US$1 per month saves US$17 for the first 6 months.

- Essentials: This plane is designed for running your business, priced at US$27 per month. With the current promotion, you can get it for US$1 per month, saving US$26 for the initial 6 months.

- Plus: For businesses looking to grow, priced at US$38 per month. A special offer of US$1 per month lets you save US$37 for the first 6 months.

Customer Support

- Knowledge Base

Reviews & Ratings

Bottom Line

As a cornerstone in accounting software, QuickBooks Online continues to impress with its robust features and intuitive interface. Its focus on expense tracking, custom invoicing, and automated reporting ensures that businesses always remain on top of their financial game. QuickBooks Online is a solid choice if you seek a dependable and efficient Xero personal alternative.

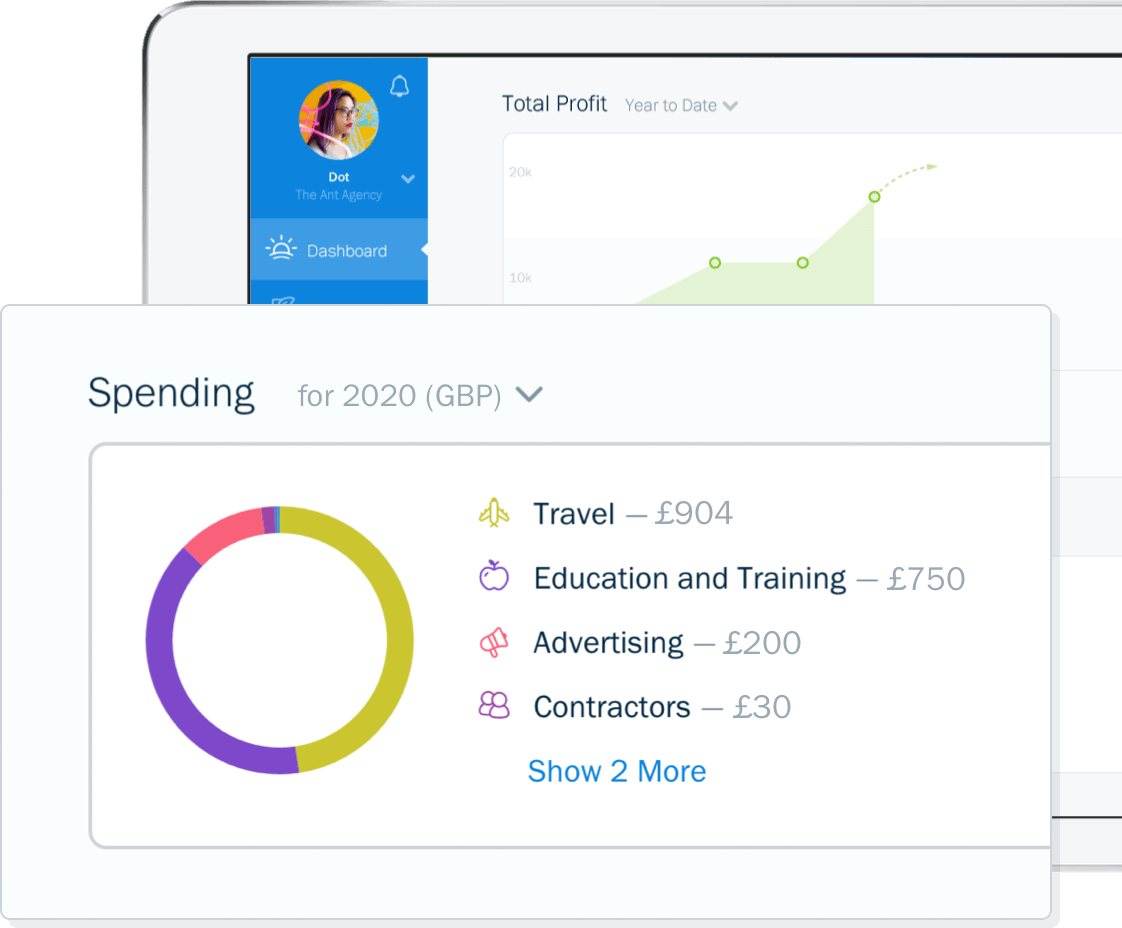

3. FreshBooks

Renowned for its user-friendly interface and robust features, FreshBooks is a game-changer in small business accounting. Whether you're a freelancer, a small business owner, or managing a growing enterprise, FreshBooks provides the tools to ensure your financial operations are smooth, efficient, and streamlined - a comprehensive choice for Xero personal alternative.

Key Features

- Invoicing

- Payments

- Time Tracking

- Accounting

- Expenses & Receipts

- Reports

- Mileage Tracking App

- Projects

- Proposals

- Payroll

Top 3 Features

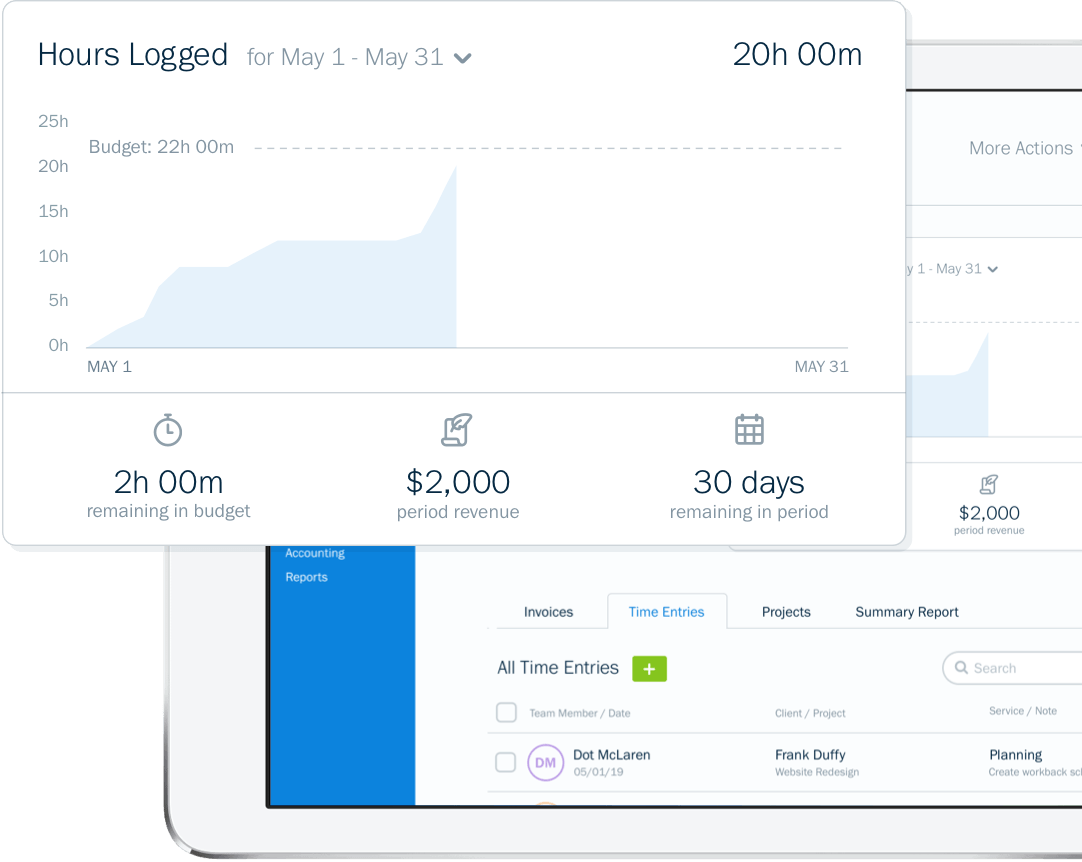

1. Time Tracking

Time is money, and with FreshBooks, you ensure every moment is well-spent. The software's intuitive time-tracking feature aids professionals in logging hours, managing team time sheets and even directly converting those hours into invoices.

2. Expense Organizing

With FreshBooks' exceptional expense organizing capabilities, stay on top of your financial game. From categorizing receipts to monitoring recurring expenses, this feature makes it simple to get a comprehensive view of your outgoings, ensuring you always stay within budget.

3. Easy Invoices

Make a lasting impression on your clients with professional-looking invoices tailored to your brand. FreshBooks offers customizable invoice templates that enable businesses to capture their essence and stand out, all while ensuring prompt and organized payment processes.

Pros

- Seamless time tracking enhances productivity.

- Expense organization is intuitive and comprehensive.

- Multiple customizable invoice templates to resonate with brand identity.

Cons

- Some advanced features might be locked behind higher-tier plans.

- Larger enterprises might find scalability a challenge.

- Integration with third-party apps might require additional steps.

Supported Platforms

FreshBooks is available across Web-based platforms and has dedicated apps for iOS and Android devices, ensuring uninterrupted access regardless of where you are.

Pricing

FreshBooks offers a variety of pricing options: The Lite plan is priced at $8.50 per month with a 50% discount for the first 5 months. Their most common plan, Plus, is $15.00 monthly, with a 50% discount for 5 months. The Premium plan is $27.50 monthly, with the same 50% discount for the initial 5 months. For businesses with unique needs, the Select plan is customizable, and FreshBooks invites potential users to discuss tailored solutions.

Customer Support

- Phone Support

- Email/Help Desk

- Chat

- FAQs/Forum

- Knowledge Base

Reviews & Ratings

Bottom Line

In the vast ecosystem of Xero personal alternatives, FreshBooks carves a niche for itself, especially among freelancers and small businesses. Its emphasis on time tracking, expense organization, and customizable invoices make it a favourite for many seeking simplicity without compromising features. FreshBooks is worth considering if your business demands an efficient and user-friendly accounting solution.

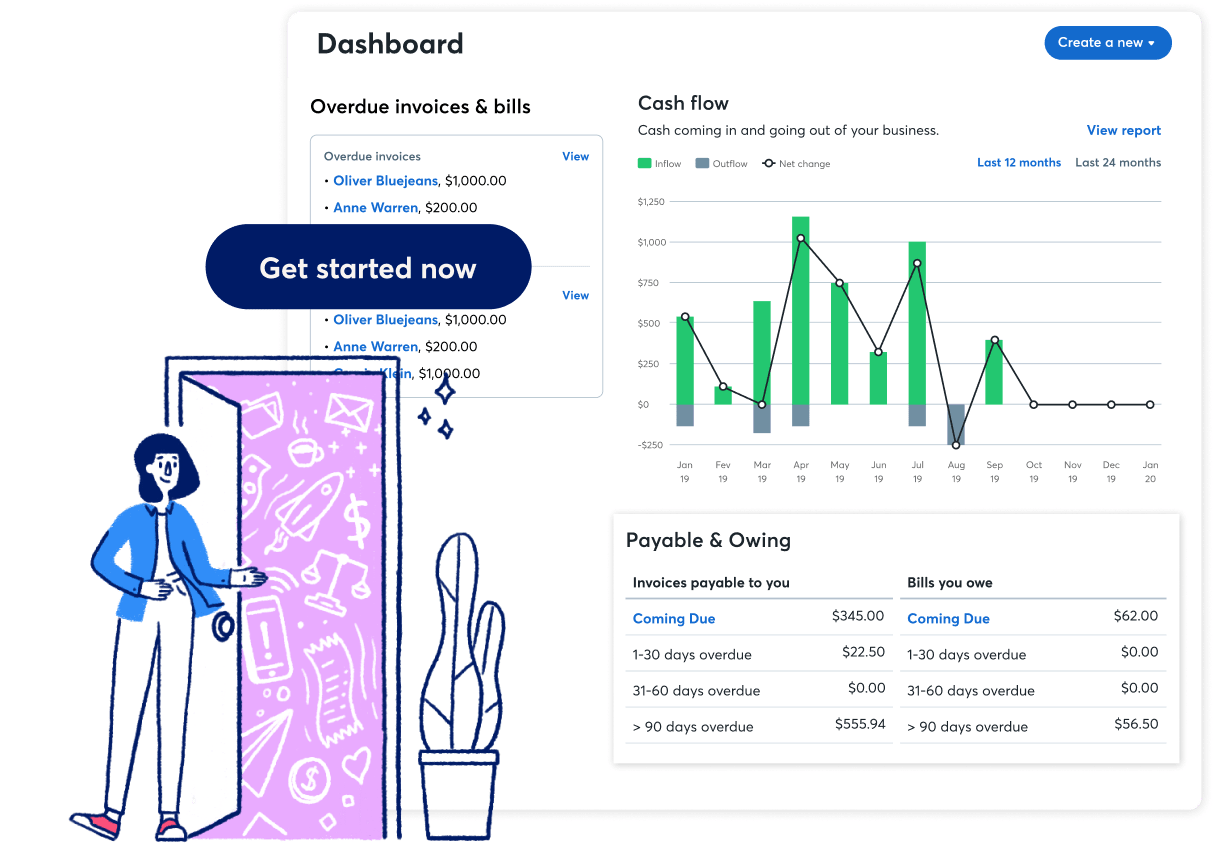

4. Wave

Steering away from the conventional pricing strategies of most accounting software, Wave stands out with its unique offer of core financial functionalities at no cost. Specifically designed for entrepreneurs, freelancers, and small businesses looking for Xero personal alternatives, Wave provides an intuitive platform to manage finances without straining your budget.

Key Features

- Invoicing

- Payments

- Accounting

- Mobile Receipts

- Payroll

- Advisors

Top 3 Features

1. Free Invoicing

One of the striking features of Wave is its free invoicing system. Businesses can create and send professional invoices without any hidden costs. This feature mainly benefits startups and freelancers who require an economical yet efficient invoicing solution.

2. Expense Tracking

Keeping an eye on your expenditures becomes hassle-free with Wave. The software offers a comprehensive expense tracking system that ensures you're constantly updated about your financial outflows, enabling more intelligent business decisions and budgeting.

3. Seamless Accounting

The heart of Wave lies in its robust accounting capabilities. It simplifies the complexities associated with financial bookkeeping, ensuring a clear and accurate picture of your financial status.

Pros

- Cost-effective solution with core functionalities available for free.

- User-friendly interface tailored for non-accountants.

- Transparent pay-per-use model for additional services.

Cons

- Advanced features might be limited compared to premium competitors.

- Mobile functionality is restricted to invoicing and receipts on iOS.

- Larger businesses might find it less suitable for complex needs.

Supported Platforms

While the software is primarily web-based, mobile users with iOS devices can access invoicing and receipt functionalities on the go.

Pricing

Setting it apart from the crowd, Wave offers its core financial software features, including accounting, invoicing, and receipts, for free, making it a casting choice for Xero personal alternative. They charge $0.30 plus 2.9% for each credit card transaction and 1% (with a minimum fee of $1) for bank payments. For payroll in tax service states, it's $35 monthly plus $4 per employee or contractor. In self-service states, it's $20 monthly plus the same per-person fee.

Customer Support

- FAQs/Forum

- Email/Help Desk

- Chat

- Knowledge Base

Reviews & Ratings

Bottom Line

Wave is a breath of fresh air in the accounting software landscape, especially for small businesses and freelancers operating on tight budgets. While it may lack some advanced features in premium software as an Xero personal alternative, its accessible core functionalities and transparent pricing model make it an attractive option for many. If cost-effectiveness coupled with essential financial management tools is what you're after, Wave deserves your attention.

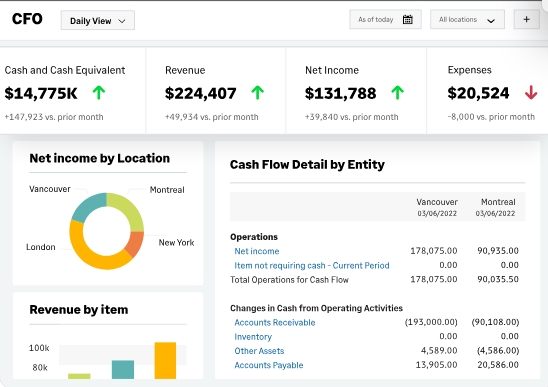

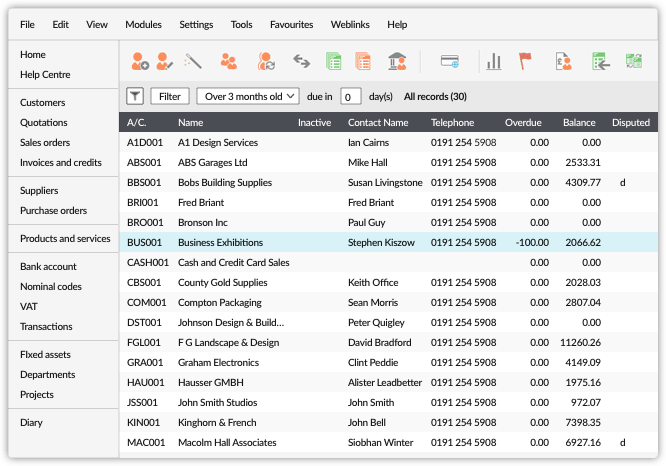

5. Sage Business Cloud Accounting

As a pioneer in business management solutions, Sage Business Cloud Accounting emerges as a powerful cloud-based tool tailored to enhance the financial strategies of small to medium enterprises looking for Xero personal alternatives. This software propels businesses towards fiscal success by integrating robust functionalities like mobile invoicing and cash flow management.

Key Features

- Core Financials

- Accounts Payable

- Accounts Receivable

- Dashboards and Reporting

- Dimensions

- Intelligent GL

- Platform services

- Analytics

Top 3 Features

1. Cash Flow Management

One of the paramount challenges businesses face is managing cash flow. Sage Business Cloud Accounting has developed a dedicated feature to address this, offering detailed insights into inflows and outflows, thus enabling businesses to make informed financial decisions.

2. Core Financials

Core Financials are the backbone of any accounting software, providing a comprehensive overview of a business's financial health. This feature encompasses the primary financial modules like general ledger, assets, liabilities, equity, income, and expenses.

3. Mobile Invoicing

In today's fast-paced business environment, the ability to create and send invoices on the go is invaluable. Sage's mobile invoicing feature caters to this need, ensuring businesses can promptly bill clients from any location.

Pros

- Streamlined and intuitive user interface.

- Comprehensive reporting tools for better financial analysis.

- Integration capabilities with other Sage products.

Cons

- The learning curve for newcomers may be steep.

- Advanced features require separate subscription plans.

- Customer support response times can vary.

Supported Platforms

Sage Business Cloud Accounting offers a flexible platform accessible both web-based and through mobile applications for iOS and Android users.

Pricing

Sage Business Cloud Accounting offers plans starting at $10 per month. Their 'Accounting Start' is £12, 'Accounting Standard' is £24, and 'Accounting Plus' is £30. You can add payroll to these plans at no extra cost, but VAT will be added.

Customer Support

- Knowledge Base

- Chat

- Email/Help Desk

- Phone Support

- FAQs/Forum

Reviews & Ratings

Bottom Line

Sage Business Cloud Accounting is a formidable contender in business accounting software. Its emphasis on real-time financial insights and cloud adaptability makes it a vast choice for Xero personal alternative; it caters to the evolving demands of businesses. Though some might require a bit of a learning curve, its comprehensive feature set, especially at its price point, makes it a noteworthy option for businesses of all sizes.

Table Comparison - Top Xero Personal Alternatives

|

Features |

ZarMoney |

QuickBooks |

FreshBooks |

Wave |

Sage Business |

|

Expense Tracking |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Custom Invoicing |

✅ |

✅ |

✅ |

✅ |

❌ |

|

Automated Reporting |

❌ |

✅ |

❌ |

❌ |

❌ |

|

Time Tracking |

❌ |

✅ |

✅ |

❌ |

❌ |

|

Free Invoicing |

❌ |

✅ |

❌ |

✅ |

❌ |

|

Seamless Accounting |

✅ |

❌ |

❌ |

✅ |

✅ |

|

Cloud-Based |

✅ |

✅ |

✅ |

✅ |

✅ |

|

CashFlow Management |

✅ |

✅ |

❌ |

❌ |

✅ |

When it comes to finding the most comprehensive Xero personal alternative, ZarMoney stands out distinctly among its contemporaries. As evident in the table comparison, ZarMoney encompasses most of the pivotal features that businesses looking for Xero personal alternatives today demand.

Best of the Best - Top 3 Xero Personal Alternatives

1. ZarMoney

Undoubtedly the frontrunner, ZarMoney takes the crown as the Best Xero personal alternative. With its extensive suite of advanced features like project management, bank reconciliation, and online payments, ZarMoney is a powerhouse for business owners. Its unparalleled financial reports and accounting prowess make it a top choice for personal finance management and business requirements.

2. QuickBooks Online

Boasting a comprehensive set of tools, QuickBooks Online offers various essential features for entrepreneurs and sole proprietors. Its automatic bank feeds, expense tracking, and advanced inventory management are highly beneficial for accurate record-keeping. The software's solid financial reporting options, currency features, and bank reconciliation capabilities support businesses' financial health, making it the vast choice of Xero personal alternative.

3. FreshBooks

FreshBooks shines as a notable Xero personal alternative with its exceptional invoicing features, client portal, and user-friendly interface. Sole traders and small business owners will appreciate its invoicing management, tax calculations, and sales tax functionalities. Although it might have fewer advanced features compared to the others, FreshBooks excels in simplicity and affordability, making it a strong contender for personal finance management.

Conclusion

In the evolving world of online accounting, finding the best Xero personal alternative can be a game-changer for your business. With tools like ZarMoney leading the charge, you're equipped to make the best financial decisions. So, why wait? Dive in and upgrade your accounting game!

Frequently Asked Questions (FAQs)

1. What is a Xero personal alternative, and why would I need one?

A Xero personal alternative is an accounting software solution that can replace Xero for personal finance or business accounting needs. It's a choice for those seeking alternatives to Xero for various reasons such as cost, features, or scalability.

2. What are some of the best Xero personal alternatives available?

Popular Xero personal alternatives include ZarMoney, QuickBooks Online, FreshBooks, Sage Business Cloud Accounting, and Wave Accounting.

3. How does QuickBooks Online compare to Xero as a personal accounting alternative?

QuickBooks Online offers similar features like expense tracking, bank reconciliation, online payments, and financial reporting. It's renowned for its user-friendly interface and a wide range of pricing plans.

4. Why consider ZarMoney as an alternative to Xero Personal for financial management?

ZarMoney offers an intuitive interface and robust customization, making it a user-friendly choice for financial management.

5. Can I consider Sage Business Cloud Accounting an alternative to Xero's financial reporting capabilities?

Sage Business Cloud Accounting provides advanced financial reporting features, including income and cash flow statements. It's a cloud-based solution suitable for business owners.

6. What key features should I look for when choosing a Xero alternative for personal finance management?

When choosing an alternative, prioritize features like expense tracking, bank connectivity, bank reconciliation capability, invoicing, online payment processing, and access to expert accountants.

7. How does Wave Accounting stand out as a potential Xero personal alternative?

Wave Accounting is a free cloud-based accounting software with powerful features like unlimited invoicing, expense tracking, and income statements. It's ideal for sole proprietors and small businesses.

8. Can you suggest an Xero personal alternative with advanced project management features?

For advanced project management features, ZarMoney, QuickBooks Online or Zoho Books offer tools to help manage projects alongside accounting tasks.

9. How do the pricing plans of Xero alternatives compare to Xero's plans?

Xero alternatives often provide a variety of pricing plans to suit different business needs and budgets. It's recommended to compare the features and costs of each alternative with Xero's plans to find the best fit for your requirements.