Xero Payroll Alternatives: Best Accounting Solutions

Navigating the vast landscape of accounting tools can be overwhelming. For many businesses, Xero has been a trusted companion. However, searching for a potent Xero Payroll Alternative often leads to discovering tools offering enhanced features and functionalities.

As businesses diversify and their needs become more intricate, a potent Xero Payroll Alternative often surfaces as the key to unlocking enhanced functionalities. This comprehensive guide embarks on a journey into these alternatives, aiming to demystify the offerings and empower businesses to harness the full potential of modern accounting software solutions.

So dive right into the list of top Xero payroll alternatives and enhance your financial health.

1. ZarMoney - A Premier Xero Payroll Alternative

When seeking an efficient Xero Payroll Alternative, ZarMoney stands out. It offers robust features for businesses of all sizes and has been recognized for its advanced capabilities. This cloud-based accounting software not only enhances accounting processes but also optimizes financial management. Especially for professionals who desire more than what Xero offers, ZarMoney is the answer with its customizable dashboard and detailed reporting features.

Features

- Multi-

- User Access

- Expense Tracking

- Accounts receivable

- Unlimited Invoices

- Accounting Tools

- Bank Reconciliation

- Financial Health Monitoring

- Customer Portal

- Order Management

- Billing

- Inventory Management

- Advanced Reporting

Top 3 Features of ZarMoney

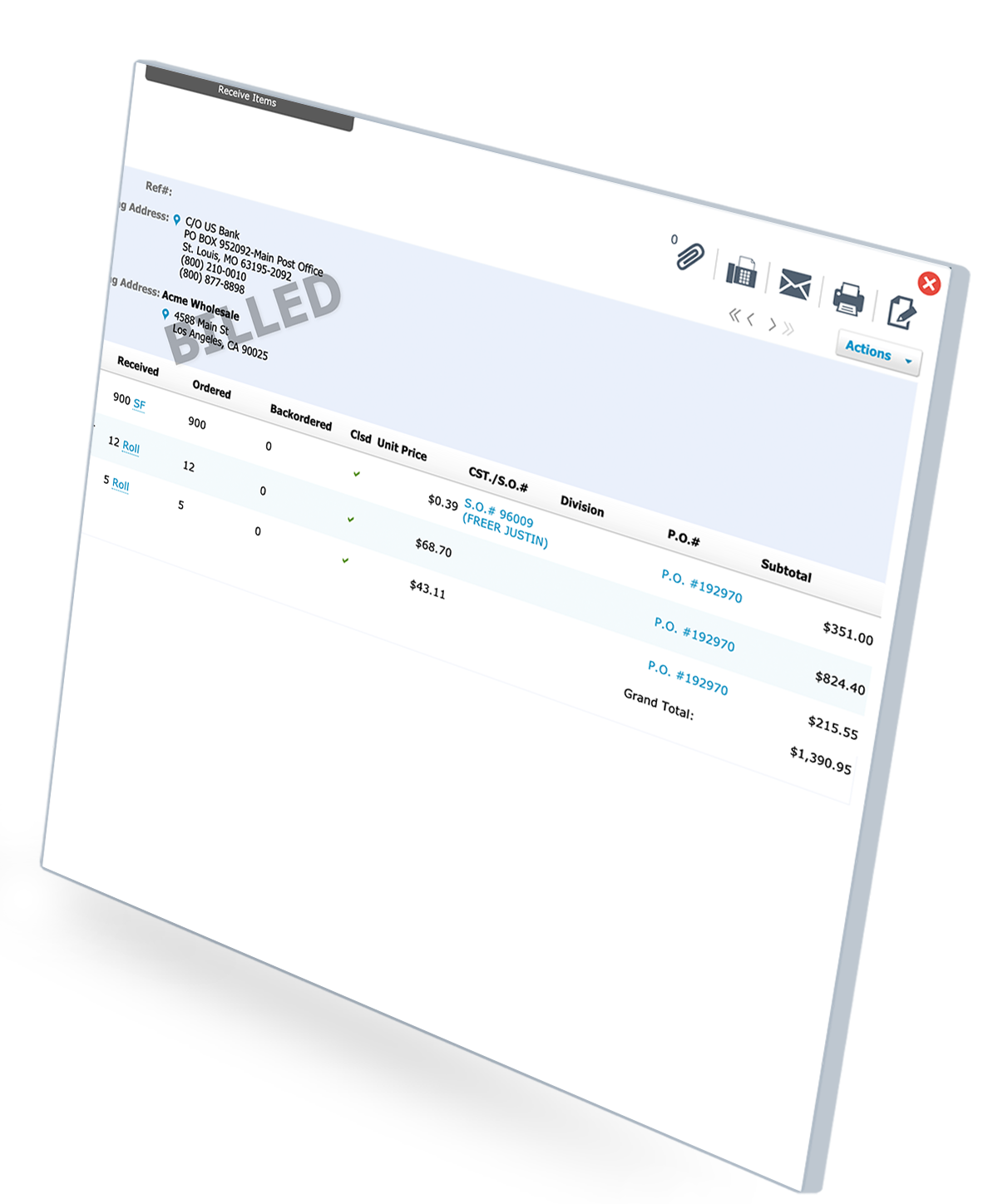

1. Account Receivable

ZarMoney's advanced features, primarily its Account Receivable feature, revolutionize the way businesses manage their financial health. This key feature of Xero payroll alternative not only allows you to track unlimited invoices and online payments with ease but also offers an integrated customer portal. By providing such robust features, ZarMoney ensures that businesses can efficiently monitor their account receivables, maintain positive cash flow, and foster stronger relationships with their clientele.

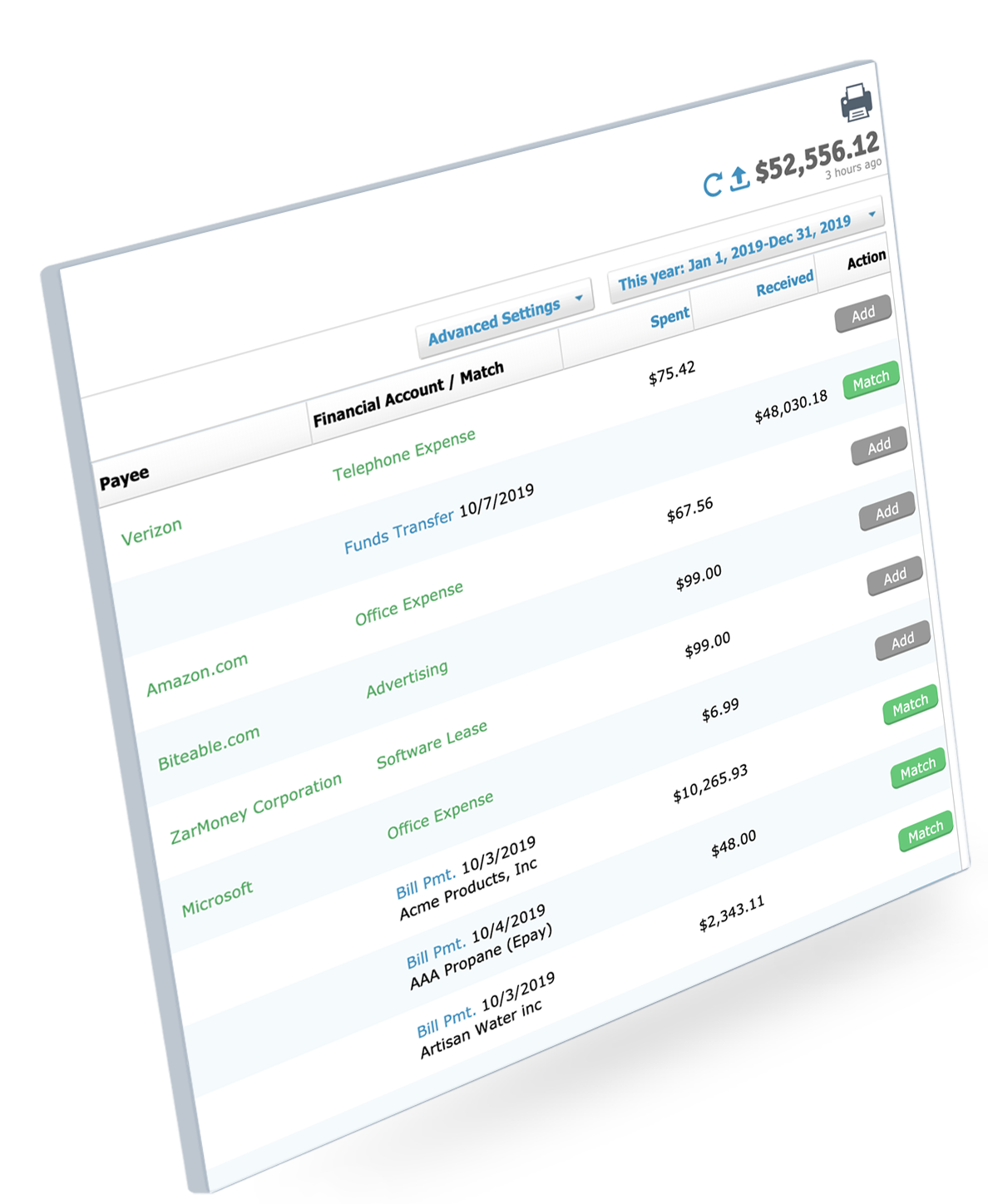

2. Advanced Accounting

ZarMoney genuinely exemplifies the pinnacle of financial management. Its accounting tools embrace both the depth of double-entry accounting and the simplicity of user-friendly interfaces, irrespective of whether it's a single user or a plethora of unlimited users accessing the platform. Features like expense tracking and mileage tracking, which are crucial in a comprehensive Xero Payroll Alternative, are integrated seamlessly. Businesses, from fledgling startups to established medium-sized companies, can benefit from its holistic approach. ZarMoney's powerful accounting feature ensures that it's not just another alternative but a front-runner in the competitive landscape of Xero Payroll Alternatives.

3. Financial Reporting

Understanding your business's financial performance is the cornerstone of strategic planning. ZarMoney offers robust financial reporting capabilities, ensuring that businesses can generate detailed accounting reports and financial statements effortlessly. These reports, enriched with key features like cash flow forecasting and detailed reporting, enable businesses to glean deep insights into their financial health. With ZarMoney's comprehensive financial reporting, business owners and accountants alike can make informed decisions, capitalizing on opportunities and mitigating challenges.

Pros

- Offers unlimited users, ideal for medium-sized companies.

- Advanced project management capabilities.

- Comprehensive expense tracking tools.

- Detailed financial health insights.

- Cloud-based solution, accessible anywhere.

Cons

- Might have additional costs for some features.

- Learning curve for those new to accounting software products.

- Limited mileage tracking.

- Expensive plan for additional features.

- Some user reviews mention a complex user interface.

Pricing

- Entrepreneur: $15 Per month (One User)

- Small Business: $20 Per month (Two Users)

- Enterprise: Starts from $350 Per month

Conclusion

ZarMoney, as a prominent Xero Payroll Alternative, elevates financial management for professionals. Its detailed features and user-centric design make it a top choice among accounting software solutions.

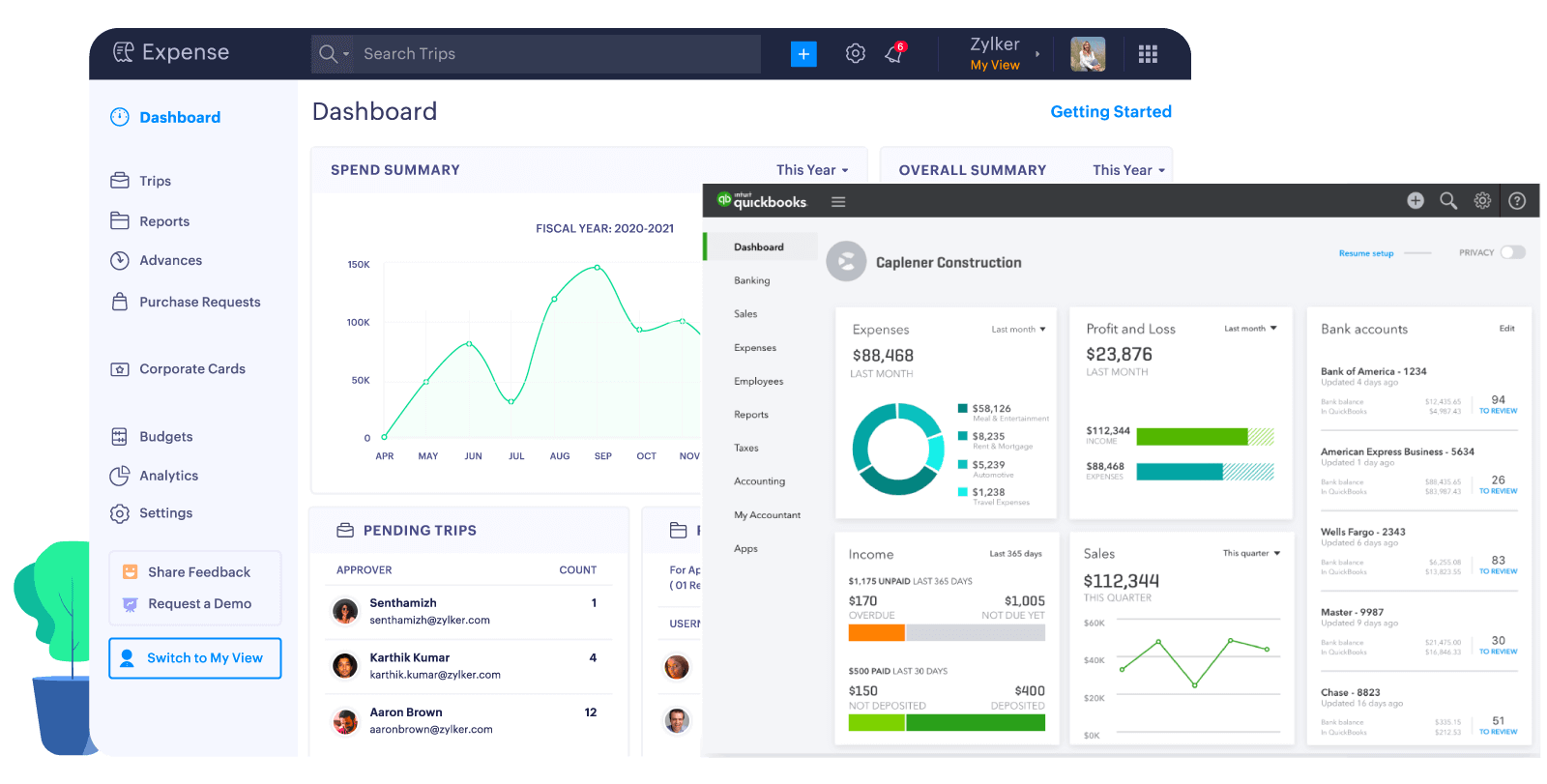

2. QuickBooks Online- A Comprehensive Xero Payroll Alternative

When it comes to trusted Xero Payroll Alternatives, QuickBooks Online shines with its wide array of accounting features and tools. Recognized globally as a leading cloud-based accounting software, it boasts tools that enhance financial management, streamlining accounting functionality, and boosting financial performance for professionals.

Features

- Unlimited Invoices

- Mileage Tracking

- Advanced Features for Reporting

- Double-Entry Accounting

- Cash Flow Statements

- Digital Payments Integration

- Sales Tax Management

- Inventory Tracking

- Financial Reporting

Top 3 Features of QuickBooks

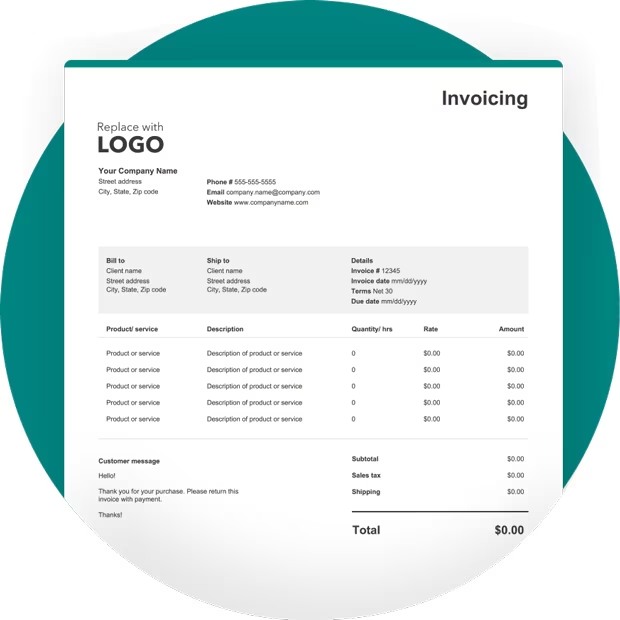

1. Unlimited Invoices

For businesses juggling multiple clients, unlimited invoicing is invaluable. QuickBooks Online offers customizable invoicing features, allowing professionals to seamlessly generate and send detailed bills. Whether it's for client communication or internal records, this tool guarantees accuracy, enhancing cash flow forecasting and improving overall financial health.

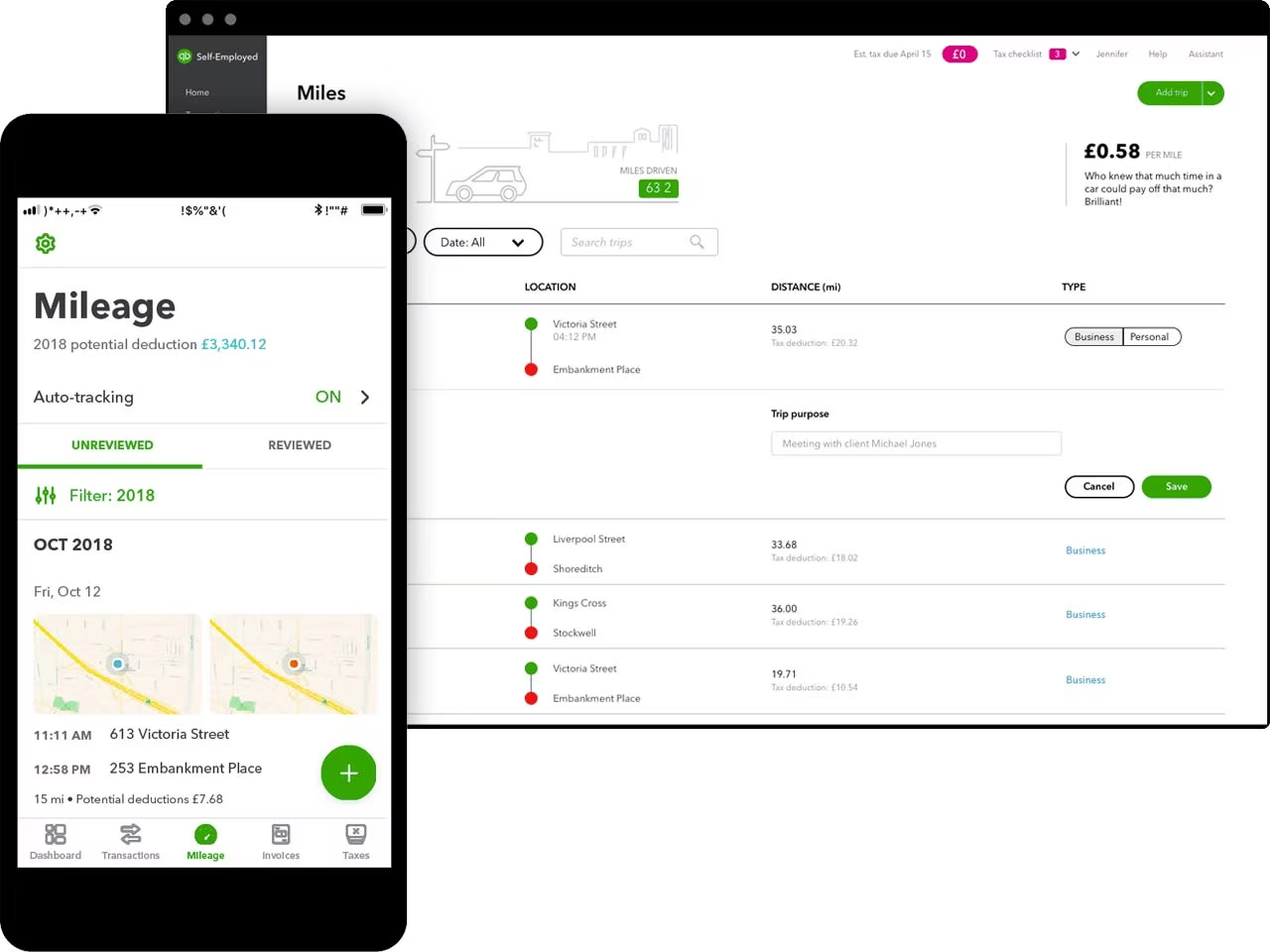

2. Mileage Tracking

Professionals on the move need a reliable way to monitor their travel for reimbursement or tax purposes. QuickBooks Online's mileage tracking is intuitive and precise. By leveraging this, finance experts can ensure they're compensated for every mile, optimizing expense management and reducing unnecessary out-of-pocket expenses.

3. Inventory Tracking

With events or meetings, managing resources is paramount. QuickBooks Online's inventory tracking tool allows professionals to monitor supplies, ensuring they're always prepared. Whether it's tracking promotional items or essentials for a meeting, this feature ensures everything is accounted for, thus averting any last-minute scrambles and enhancing overall efficiency.

Pros

- Renowned cloud-based accounting software solution.

- Detailed reporting enhances financial performance.

- Mileage tracking benefits on-the-go professionals.

- Direct integration with bank accounts.

- Customizable invoicing templates to suit branding.

Cons

- Some users find the software slightly complex initially.

- Additional costs for premium features.

- Integration with certain third-party tools may be limited.

- Expensive plan when scaling.

- Needs regular updates for smooth functioning.

Pricing

- Simple Start: $18 Per month

- Essentials: $27 Per month

- Plus: $ 38 Per month

Conclusion

QuickBooks Online, a noteworthy Xero Payroll Alternative, provides a comprehensive suite of tools. It's a holistic solution for professionals seeking advanced features and impeccable financial management capabilities.

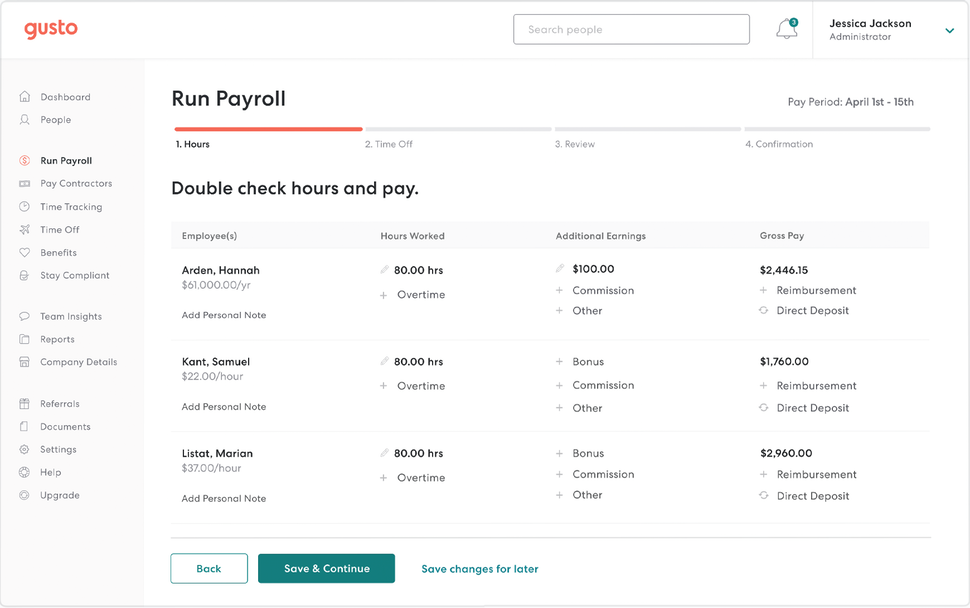

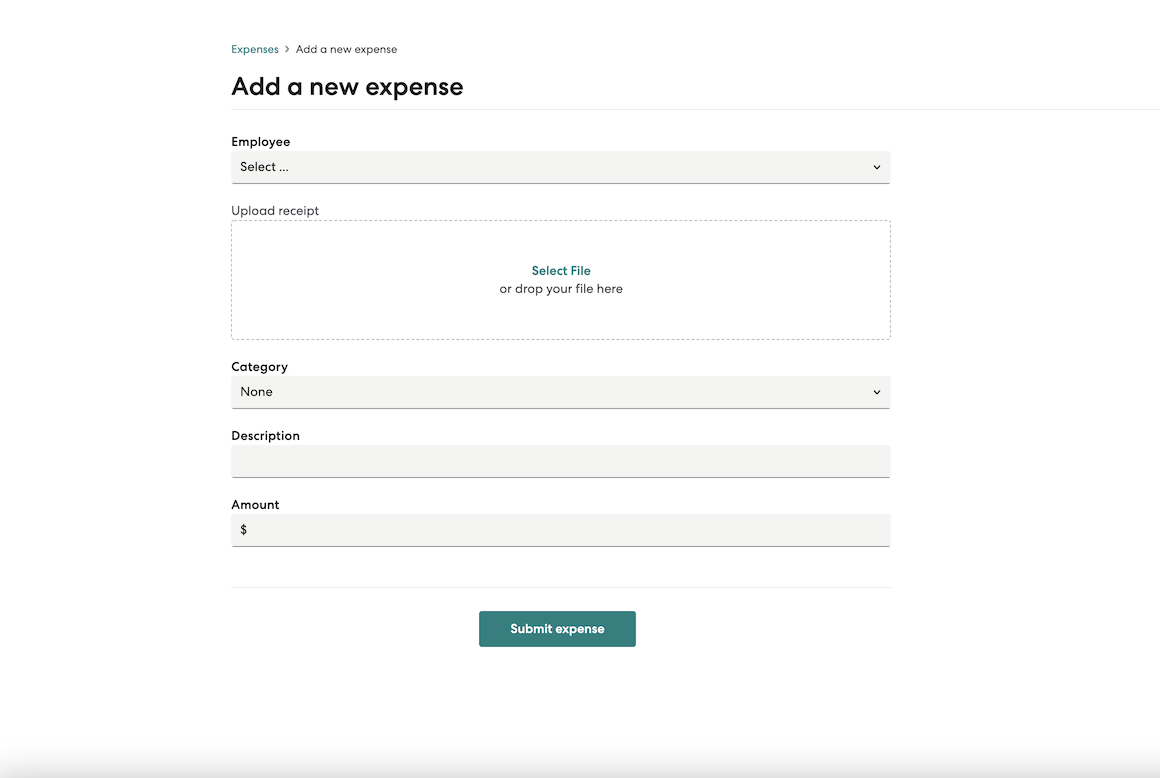

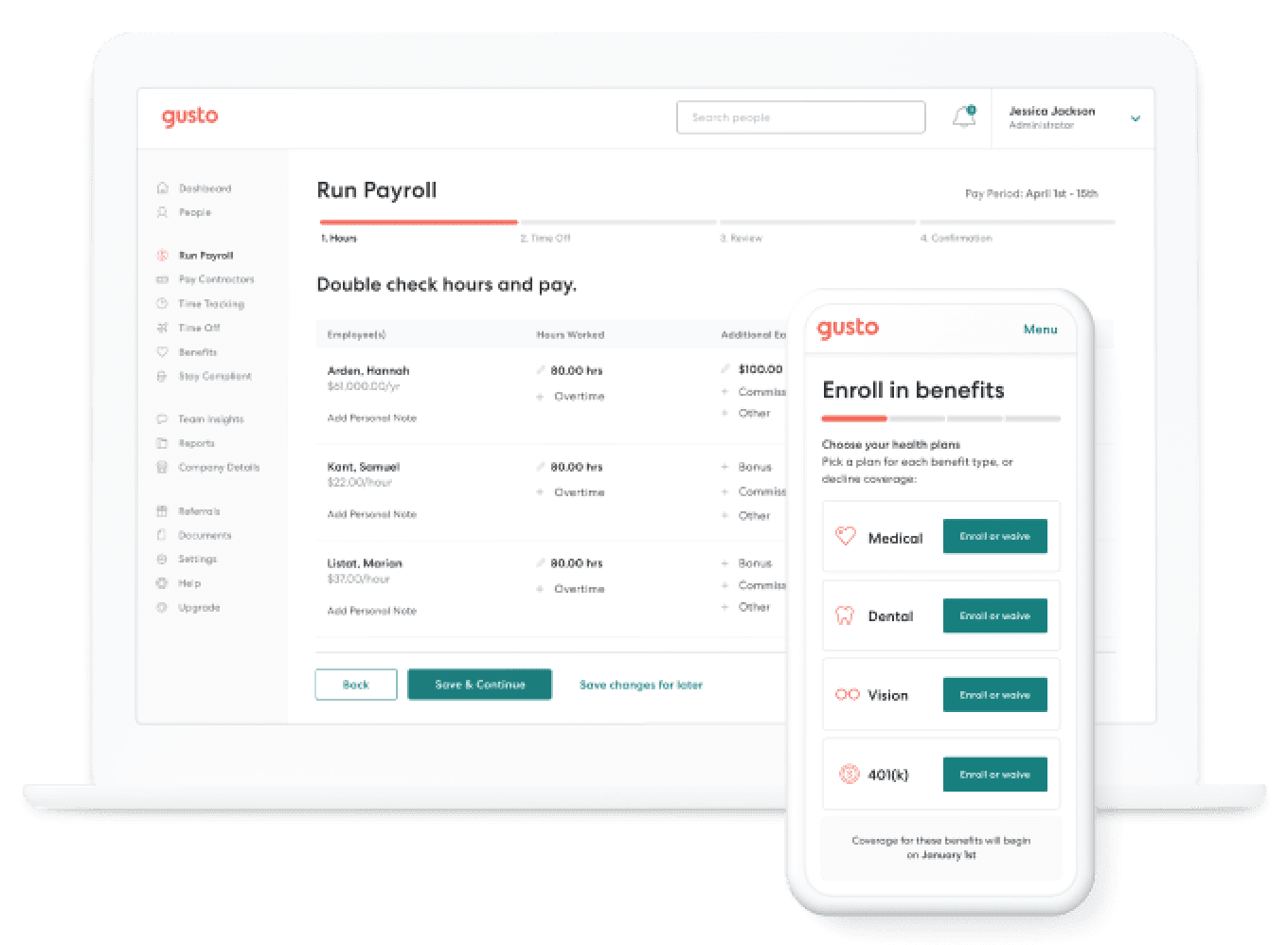

3. Gusto- An Advanced Xero Payroll Alternative

For professionals looking beyond Xero for robust accounting solutions, Gusto emerges as a standout Xero Payroll Alternative. Specifically designed for accountants and other professionals, it integrates modern accounting tools with innovative features. This cloud-based solution is highly recommended for its versatility and unmatched financial management capabilities.

Features

- Time Tracking

- Expense Management

- Financial Health Insights

- Unlimited Users

- Employee Benefits Management

- Payroll Automation

- Digital Payments Integration

- Advanced Reporting Tools

- Employee Onboarding

- Compliance Management

Top 3 Features of Gusto

1. Time Tracking

Gusto’s time tracking is a game-changer for accountants. With numerous events, tasks, and appointments to manage, Gusto allows professionals to keep tabs on every minute spent on client projects. This ensures billable clients are accurately charged and aids in resource allocation, ensuring maximum productivity and profitability.

2. Expense Management

Finances can quickly get chaotic, especially when handling multiple client accounts. Gusto’s expense management tool offers an all-encompassing view of outgoing funds. For professional accounting heads, this feature is paramount. From tracking expenses for client meetings to managing overhead costs, Gusto ensures every penny is accounted for, thereby enhancing overall financial performance.

3. Payroll Automation

Gusto’s payroll automation simplifies what traditionally is a complex process. With a few clicks, salaries, benefits, and bonuses can be disbursed without hassle. This saves time and reduces errors, ensuring staff is paid accurately and on time.

Pros

- Simplified payroll automation streamlines processes.

- Advanced reporting tools offer a deep dive into financial health.

- Comprehensive employee management tools.

- Cloud-based solution ensuring data accessibility anywhere.

- Seamless integration with major bank accounts.

Cons

- Limited features in the basic plans.

- May incur additional costs for more advanced features.

- Some user reviews mention a steep learning curve.

- Integrations with specific third-party apps can be limited.

- The user interface might be overwhelming for some.

Pricing

- Simple: $40 Per month

- Plus: $80 Per month

- Premium: Exclusive pricing

Conclusion

Gusto, with its forward-thinking features, is an impeccable Xero Payroll Alternative. Companies seeking to upgrade their financial management will find Gusto’s offerings both comprehensive and professional.

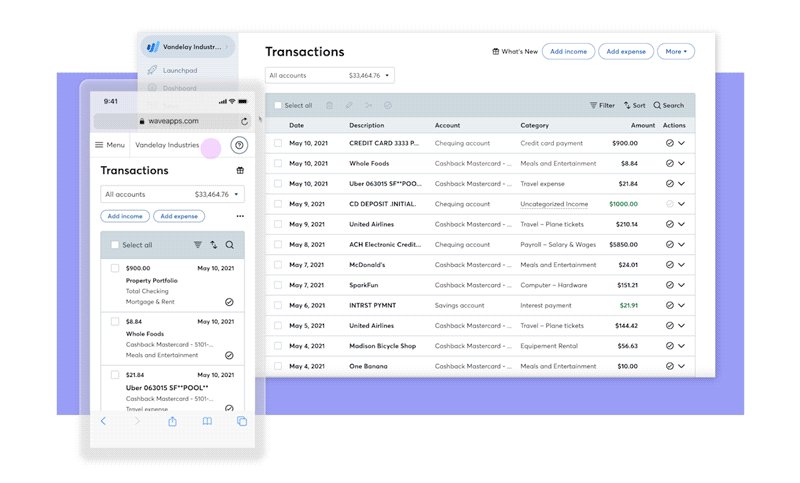

4. Wave- A Cost-effective Xero Payroll Alternative

Wave stands tall as a leading Xero Payroll Alternative, especially tailored for professionals such as accountants. Its intuitive design paired with efficient accounting solutions makes it a favorite among many. With Wave, professionals get to experience a seamless integration of basic and advanced features, all wrapped in a cloud-based solution that offers real-time financial insights.

Features

- Unlimited Invoicing

- Expense Tracking

- Cash Flow Insights

- Double-entry Accounting

- Digital Payments Integration

- Bank Reconciliation

- Financial Reporting

- Receipt Scanning

- Payroll Services

- Sales Tax Management

Top 3 Features of Wave

1. Unlimited Invoicing

Wave's unlimited invoicing feature is a godsend for a meeting planner juggling multiple events, clients, and vendors. This tool lets professionals craft, customize, and send invoices instantly. The customizable invoicing templates allow professionals to tailor each invoice to reflect their brand, enhancing client communication and ensuring prompt online payments.

2. Expense Tracking

Financial prudence is crucial for professionals. With Wave's expense tracking, every expenditure is accounted for, no matter how minuscule. Xero payroll alternatives ensures businesses can maintain a clear view of their financial health, from overheads to event-specific costs. Integrated receipt scanning further streamlines this process, allowing planners to digitize and store receipts, aiding in accurate financial reporting.

3. Cash Flow Insights

Understanding cash flow is fundamental for any business. Wave offers detailed cash flow forecasting, enabling professionals to anticipate and prepare for financial highs and lows. For business professionals, this means a clearer picture of income versus expenditures, ensuring budget adherence and profitability. Wave's insights empower professionals to make informed financial decisions, optimizing their business's financial performance.

Pros

- Absolutely free for essential accounting features.

- User-friendly interface makes navigation a breeze.

- Real-time bank reconciliation ensures accuracy.

- Digital payment integrations facilitate easy transactions.

- Receipt scanning simplifies expense management.

Cons

- Payroll services come at an additional cost.

- Limited inventory management tools.

- Might lack some advanced features for larger businesses.

- Occasional delays in bank transactions have been reported.

- Third-party integrations are somewhat limited.

Pricing

- Sign up for free

- Invoicing: $0

- Accounting: $0

- Payroll: starts at $40 per month

- Mobile receipts: starts at $8 per month

- Advisor (Bookkeeping): starts at $149 per month

Conclusion

Wave is an outstanding Xero Payroll Alternative that combines essential accounting tools with ease of use. Its array of features, specially tailored for professionals, ensures comprehensive financial management at your fingertips.

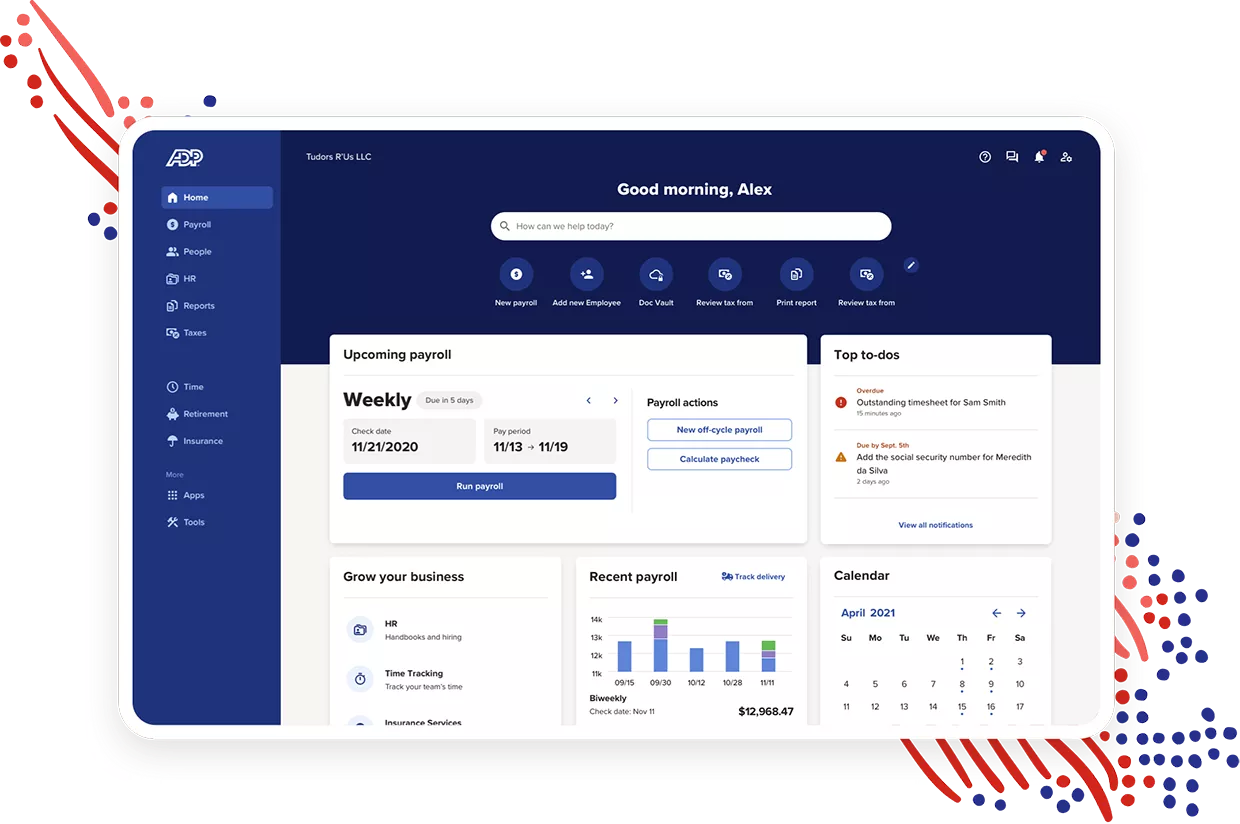

5. ADP - A Robust Xero Payroll Alternative

When professionals consider switching from Xero, ADP emerges as a formidable Xero Payroll Alternative. Primarily known for its advanced payroll solutions, ADP offers a spectrum of features ideal for mid-sized businesses. This business accounting software is renowned for its comprehensive financial management capabilities, ensuring every facet of monetary operations is handled with precision.

Features

- Advanced Payroll Services

- Time Tracking

- Expense Management

- HR Solutions

- Tax Compliance Management

- Digital Payments Integration

- Reporting and Analytics

- Employee Benefits Administration

- Retirement Services

- Talent Management

Top 3 Features of ADP

1. Advanced Payroll Services

ADP is a pioneer when it comes to payroll services. Especially for those managing a team, the comprehensive payroll solutions offered by ADP are unmatched. With the best Xero Payroll alternative that handle everything from basic salary disbursement to complex bonus structures, ADP ensures accurate, timely, and compliant payroll processing. The added benefit of tax deductions and other related services makes it an all-encompassing tool for payroll management.

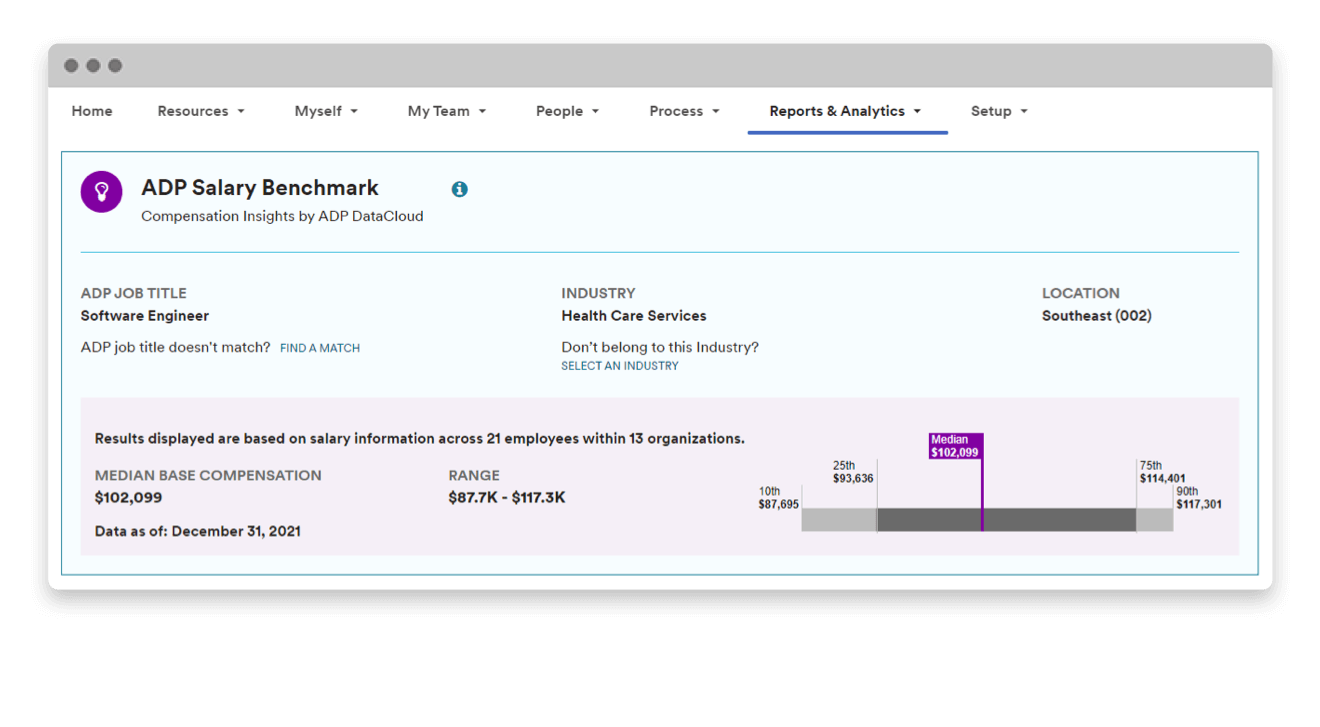

2. Reporting and Analytics

Understanding one's financial performance is vital for any professional. ADP's advanced reporting and analytics tools provide deep insights into financial health, allowing companies to make informed decisions. With customizable reports and real-time data analysis, professionals can track everything from expenses to profitability, ensuring sound financial management.

3. HR Solutions

Beyond just financials, ADP offers robust HR solutions that are essential for accountants, managing staff or teams. Every aspect of employee management is taken care of from recruitment to retirement. With integrated tools for talent management, benefits administration, and employee onboarding, ADP ensures that professionals can focus on their core tasks, leaving HR intricacies to the software.

Pros

- Industry-leading payroll solutions ensure smooth processing.

- Comprehensive HR solutions integrated with payroll.

- Advanced reporting tools offer insights into financial health.

- Robust tax compliance management reduces legal hassles.

- Cloud-based solution, enabling access from anywhere.

Cons

- Might be over-featured for very small businesses.

- Costs can add up with additional features.

- The user interface might require some getting used to.

- Customer service feedback is mixed, according to some user reviews.

- Some features might be complex for a single user or freelancer.

Pricing

- Get a quote for price

Conclusion

ADP stands out as a comprehensive Xero Payroll Alternative, offering a suite of advanced features tailored for professionals. Its balanced mix of payroll, HR, and financial management tools ensures that every business need is catered to efficiently.

Comparing Xero Payroll Alternative Solutions:

|

Feature |

ZarMoney |

QuickBooks Online |

Gusto |

Wave |

ADP |

|

Time Tracking |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Unlimited Invoices |

✔️ |

✔️ |

❌ |

✔️ |

❌ |

|

Expense Tracking |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Advanced Payroll |

❌ |

❌ |

✔️ |

❌ |

✔️ |

|

Digital Payments |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Bank Reconciliation |

✔️ |

✔️ |

❌ |

✔️ |

❌ |

|

Financial Reporting |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Tax Compliance |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

|

User Interface |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Best of the Best

1. ZarMoney

A powerful entrant in the world of Xero Payroll Alternatives, ZarMoney offers unparalleled flexibility. Its cloud-based solution provides real-time financial insights, making it indispensable for professionals. With unlimited users, detailed reporting, and customizable invoicing, ZarMoney’s robust features make it a front-runner in accounting software solutions.

2. QuickBooks Online

QuickBooks Online, renowned in the realm of accounting software products, offers an array of features that outshine many of its counterparts. From project management to expense tracking, its comprehensive tools ensure financial tasks are handled with precision. A reliable Xero Payroll Alternative, QuickBooks Online excels in delivering streamlined accounting processes.

3. Gusto

A blend of modernity and efficiency, Gusto emerges as a favorite Xero Payroll Alternative. Known for its user-friendly interface and comprehensive payroll solutions, it effortlessly integrates other key features, such as time tracking and financial health insights. Professionals seeking a holistic approach to financial management will find Gusto’s offerings to be top-notch.

Final Verdict

The realm of business accounting is no longer limited to traditional tools or rigid frameworks. Companies have the luxury of choice today, with numerous Xero Payroll Alternatives waiting in the wings, each vying to transform financial management processes with unique features.

Having delved deep into these alternatives, it's evident that the right tool can make a world of difference, from simplifying daily tasks to providing advanced insights for strategic decision-making.

While Xero remains a formidable contender, exploring its alternatives might just lead businesses to their next trusted partner in financial excellence. The future of accounting is here, vibrant and versatile, ready for those willing to embrace change.

Frequently Asked Questions (FAQs)

1. What are Xero Payroll Alternatives?

Xero Payroll Alternatives are various accounting software options that offer similar or enhanced functionalities compared to Xero, providing businesses a choice for comprehensive financial management tailored to their needs.

2. Why should a business consider switching from Xero to an alternative?

While Xero is a powerful tool, businesses might seek alternatives for reasons like additional features, better pricing, more integrative capabilities, or a more user-friendly interface.

3. Is data migration from Xero to its alternatives a smooth process?

Yes, most reputable Xero Payroll Alternatives have built-in migration tools or offer support to ensure a seamless data transition, minimizing disruption to business operations.

4. Do Xero Payroll Alternatives offer multi-currency support?

Many top accounting software solutions provide multi-currency support, enabling businesses to handle international transactions effortlessly.

5. How do these alternatives ensure data security?

Leading Xero Payroll Alternatives employ advanced encryption techniques, two-factor authentication, and other security measures to protect user data and maintain trust.

6. Are there Xero Payroll Alternatives suited specifically for small businesses or startups?

Definitely. Many alternatives cater specifically to small businesses, offering features and pricing structures that align with their unique needs and budget constraints.

7. Can businesses customize the features or interface of these alternatives?

Most Xero Payroll Alternatives come with customizable dashboards, invoicing templates, and reporting features, ensuring businesses can tailor the software to their preferences.

8. How do these alternatives handle tax compliance and updates?

These software options usually have built-in tax compliance features and regularly update to align with changing tax laws and regulations, simplifying tax processes for businesses.

9. Do Xero Payroll Alternatives offer mobile functionality?

Yes, a majority of these alternatives have dedicated mobile apps or mobile-optimized websites, ensuring business owners and accountants can manage finances on-the-go.

10. How do Xero Payroll Alternatives support client communication and collaboration?

Many of these software solutions offer client portals, integrated communication tools, and collaborative features, enabling businesses and their clients to interact and work together seamlessly.