Top 7 Alternatives to Xero for Farming Management

Financial management is a pivotal pillar for success in today's digitally-driven farming landscape. From tracking daily expenses to mapping out long-term investment strategies, managing a farm's finances is an intricate task that demands precision, efficiency, and adaptability. Enter the world of financial software – digital tools designed to streamline financial processes, making them more transparent, manageable, and optimized for profitability.

While Xero Farming has been a household name in this domain, an entire spectrum of alternatives offers varied functionalities to suit different business models and scales. These Xero Farming Alternatives provide the necessary financial tracking and management features and come equipped with innovative functionalities tailored to the unique needs of the agricultural sector.

In this article, we tackle beyond the known horizons of Xero Farming and shine a spotlight on some of the most noteworthy competitors in the market. Whether you're a small-scale family farm or a vast agricultural enterprise, our curated list aims to help you find the perfect software companion for your financial journey. Explore and unearth the best fit for your farm's financial future!

1. ZarMoney

In the ever-evolving world of financial management, businesses must have strong, flexible, and user-friendly tools. Among the myriad options available, ZarMoney emerges as a beacon for those searching beyond traditional platforms like Xero Farming. Setting itself apart with a unique blend of innovation, ease of use, and adaptability, ZarMoney provides business owners with a meticulous and expansive array of tools.

Designed with the modern entrepreneur in mind, the platform is more than just an alternative; it's a revelation for anyone keen on mastering their financial landscape with precision and efficacy. Whether you're a seasoned business owner or just embarking on your entrepreneurial journey, ZarMoney offers a solution that is both comprehensive and tailor-made to ensure efficient financial tracking.

Features

- Invoicing

- Accept credit cards online

- Accept ACH payments

- Quotes/estimates

- Sales orders

- Quick sales

- Customer statement

- Accept prepayments

- Payment terms

- Notification via text & email

- Organize customers with custom fields

- Order status

- Credit limit & credit hold

- Recurring invoices

- Inventory management

- Manage numerous warehouses

- Create pick lists

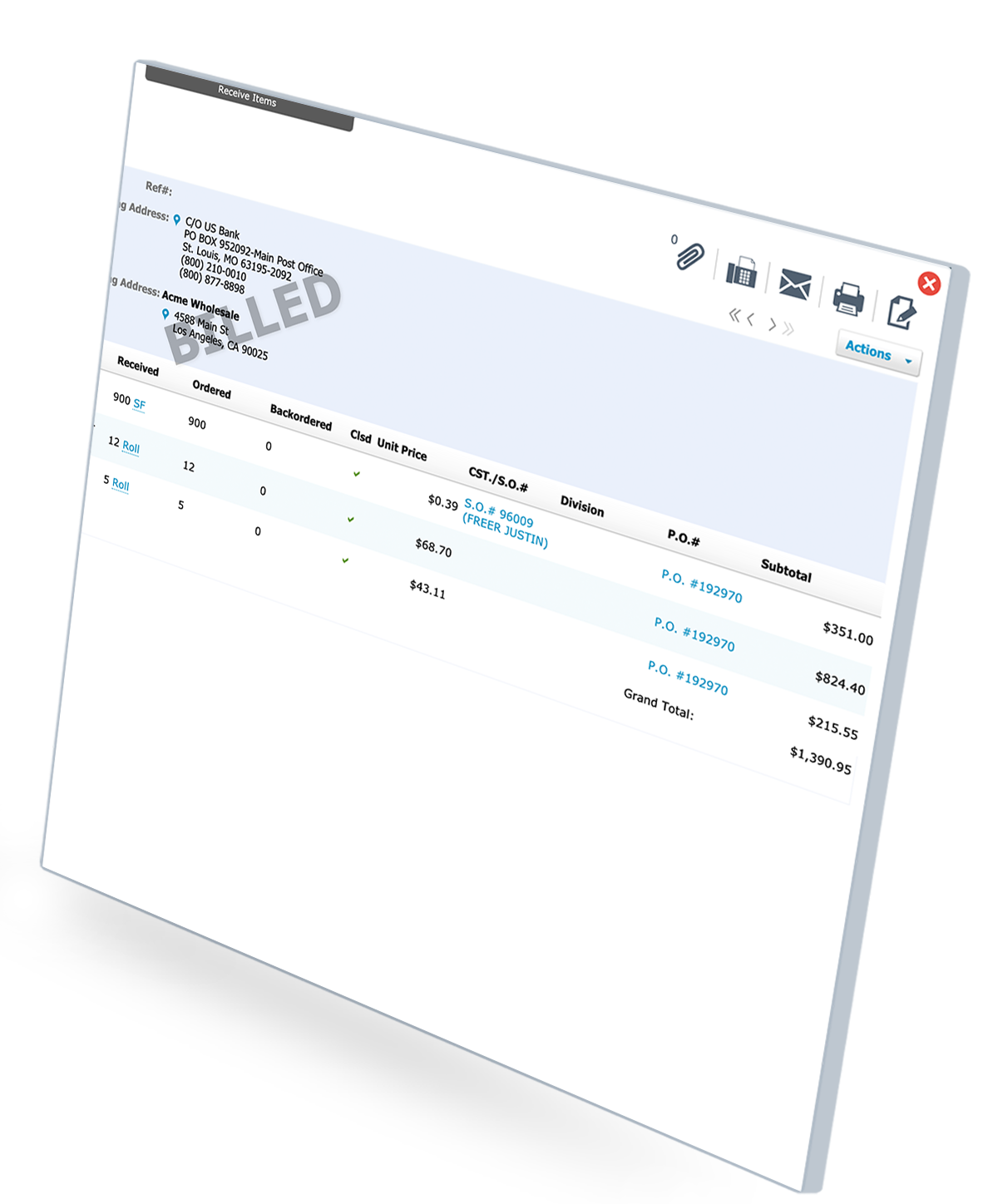

- Split transactions with enhanced inventory receiving

- Price level

- Get real-time inventory data

- Customizable units of measurements

- Barcode

- Product classification

- Customizable product fields

- Item tracking and history

- Compare obtained inventory with POs

- 2-step warehouse transfer

- Bank connection

- Import bank transactions

Top 3 features of ZarMoney

1. Inventory Tracking & Management

ZarMoney shines with its award-winning inventory tracking system. It lets you manage inventory items precisely, ensuring business owners always have a pulse on their stock.

2. Customizable Financial Reports

With ZarMoney, generating financial statements becomes a breeze. Its versatile feature permits customization to meet the specific needs of each business, making it a popular choice for many.

3. Purchase Order & Sales Order Management

Streamline your sales with ZarMoney. Its intuitive system efficiently manages purchase and sales orders, eliminating possible hiccups in the business process.

Pros of Zarmoney

- Advanced inventory functionality to aid businesses

- A broad span of customizable financial report templates

- Efficient management of purchase and sales orders

Cons of Zarmoney

- Might be overwhelming for first-time users

- Not as established as some other options

- It might require a learning curve for certain businesses

Supported Platforms

Zarmoney's web-based interface is available from any device with an internet association.

Pricing

Zarmoney's pricing is $15 per month.

Final Verdict on ZarMoney

ZarMoney stands out with its advanced inventory management and customizable financial reports when considering the best Xero farming alternatives.

Though newer to the scene, it's making waves with its innovative design and comprehensive feature set. A definite contender for businesses seeking a fresh alternative!

2. Quickbooks

If you're looking for Xero farming alternatives, Quickbooks is a name that often pops up. As one of the market leaders in the business finance sector, Quickbooks provides various accounting features suitable for business owners.

With its handy feature of bank feeds and billable expenses, it promises to streamline your business finance management.

Features

- Invoicing

- Expense tracking

- Accounting reports

- Cash flow management

- Sales tax

- Bill management

- Multi-user access

- Payroll

- Inventory tracking

- Time tracking

- Project management

- Bank reconciliation

- Mobile app access

- Purchase orders

- Class and location tracking

- Budgeting and forecasting

- Mileage tracking

- Payment processing

- Employee time tracking

Top 3 Features of Quickbooks

1. Income and Expense Tracking

It is a crucial feature that helps business owners get an insight into their income vs. expenses, ensuring they make informed decisions.

2. Invoicing & Payment Processing

With customizable invoice templates, Quickbooks facilitates prompt billing and seamless payment processing using credit and debit cards.

3. Cash Flow Management

Its excellent reporting options and real-time updates make managing and forecasting cash flows a breeze.

Pros of Quickbooks

- Real-time financial statements

- Wide range of inventory items and expense reports

Cons of Quickbooks

- A slightly pricier base plan for startups

- It takes time to understand all functionalities for first-timers

- The desktop version requires periodic upgrades

Supported Platforms

It's accessible through QuickBooks Online, which is web-based, along with dedicated mobile apps for iOS and Android.

Pricing

The software costs $1 monthly for the first six months, making it an excellent deal for startups and established businesses.

Final Verdict on QuickBooks

Suppose you're a business owner seeking freedom of movement in managing your finances while getting the best out of your investment. In that case, Quickbooks offers a robust set of tools that warrant its position in the top Xero farming alternatives.

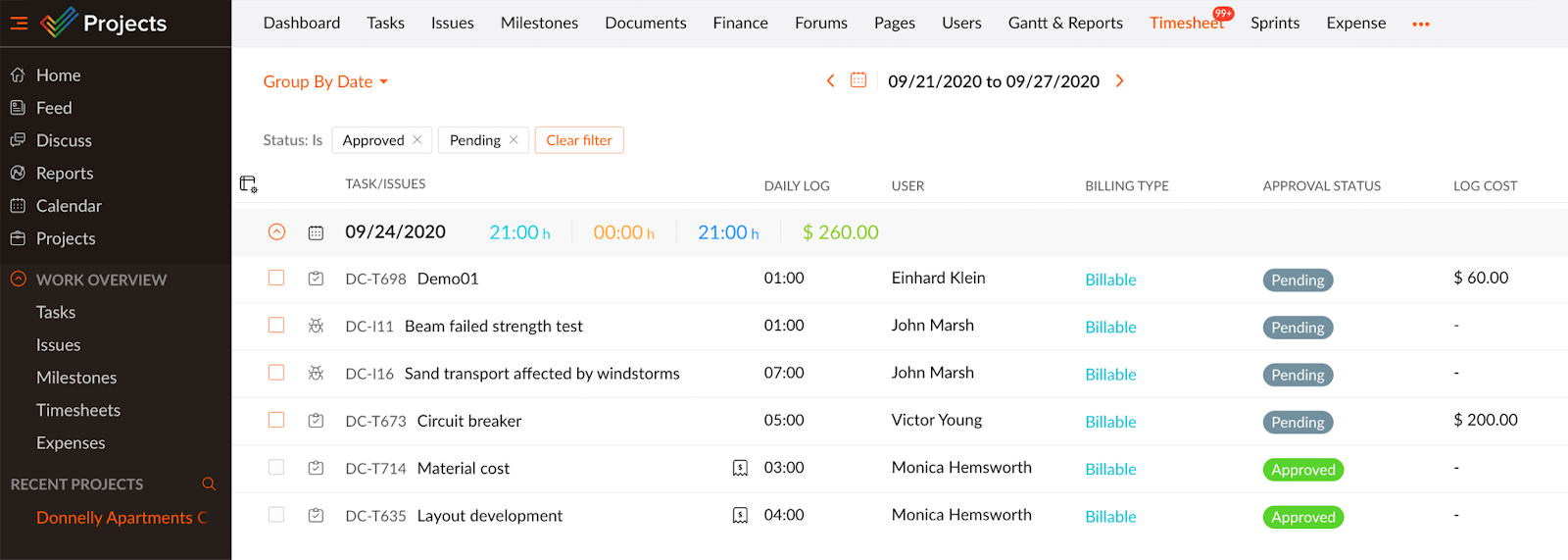

3. Zoho Books

Zoho Books stands out for its innovative design and user-friendly interface when discussing Xero farming alternatives.

It's not just accounting software; it's a comprehensive financial solution for business owners, offering a wide range of features from bank connectivity to expense tracking.

Features

- Invoicing

- Expense tracking

- Time tracking

- Inventory management

- Sales order management

- Investment order management

- Client portal

- Multi-currency

- Project management

- Tax compliance

- Reporting and analytics

- Recurring transactions

- Manual journals

- Budgeting

Top 3 Features of Zoho Books

1. Contact (Client & Vendor) Management

Zoho Books understands the vibrancy of building and maintaining solid relationships with buyers and vendors. Therefore, its Contact (Client and vendor) Management features are meticulously designed to cater to this need

2. Automated Banking Feeds

In the digital era, efficiency is paramount, especially in financial management. ZohoBooks has recognized this necessity and introduced its Automated Banking Feeds feature, ensuring businesses can keep up with their rapid pace of transactions.

3. Time Tracking & Invoicing

Regarding managing your finances and projects efficiently, Zoho Books offers a seamless solution with its Time Tracking and Invoicing feature.

Pros of Zoho Books

- Intuitive dashboard with real-time updates

- Excellent customer support team available round the clock

- Multi-currency support for global businesses

Cons of Zoho Books

- Restricted third-party integrations in the base plan

- Not appropriate for businesses requiring advanced inventory functionality

- There is minor customization in invoice templates

Supported Platforms

It offers a web-based interface accessible from all browsers and mobile apps for iOS and Android platforms.

Pricing

At $10 per month, it provides value for money with its myriad of features tailored for businesses of all sizes.

Final Verdict on Zoho Books

In an era where businesses need more than just transactional data, Zoho Books steps in as a comprehensive solution. Its user-friendly design, precision, and integration of key features such as time tracking and invoicing ensure businesses can manage their finances effortlessly and efficiently.

By offering a holistic approach to financial management, Zoho Books transcends traditional accounting software, solidifying its position as a top choice for modern businesses. Whether you're a startup or an established enterprise, Zoho Books promises a refined experience that aligns perfectly with today's dynamic business landscape.

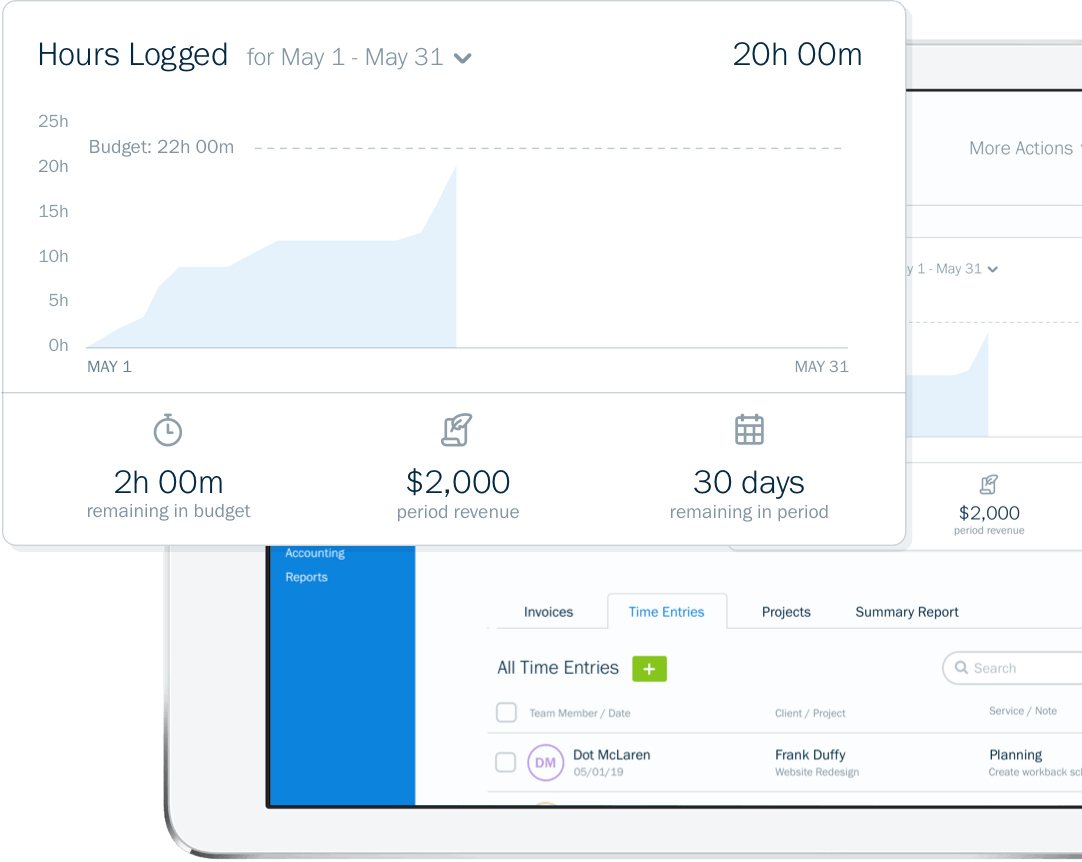

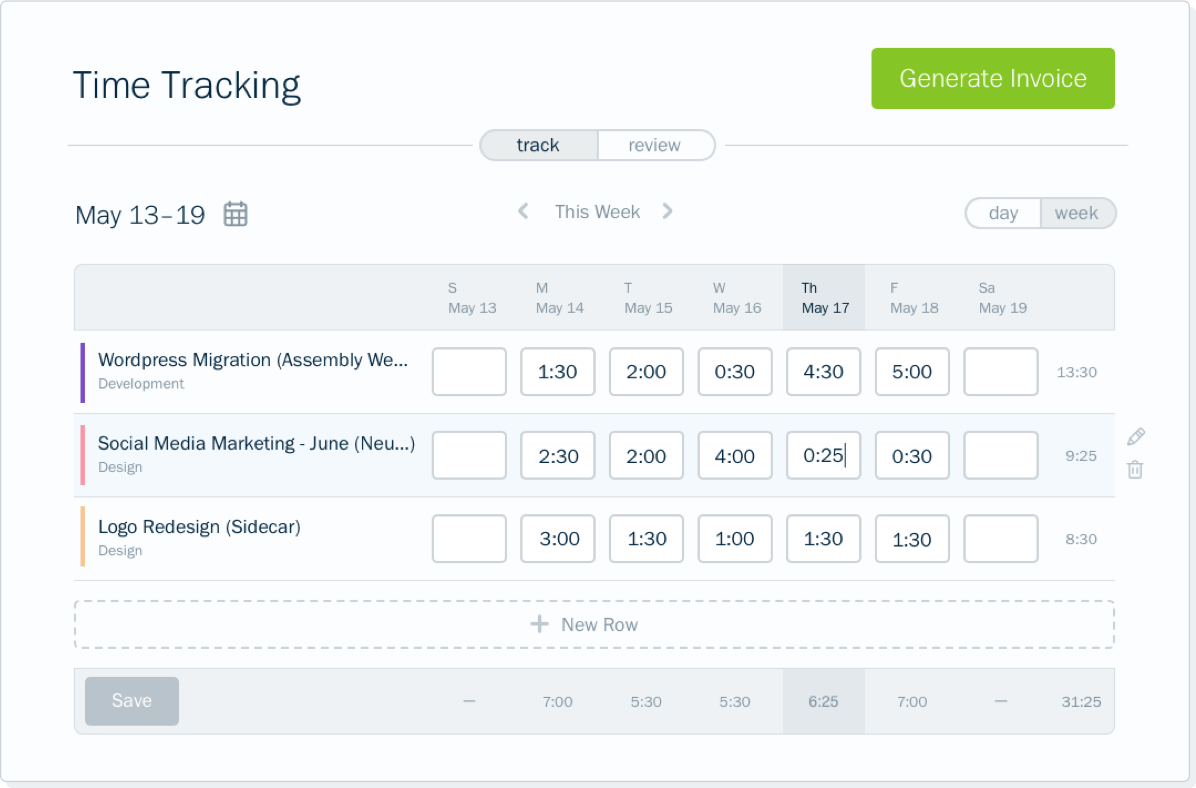

4. Freshbooks

Freshbooks stands out as a luminary in the expansive universe of Xero farming alternatives, charting a path of innovation and efficiency. Driven by a vision to transform the financial landscape for business owners, Freshbooks harnesses the power of cloud technology to offer streamlined invoicing and robust collaborative tools.

It's not just an accounting platform; it's a holistic financial solution tailored to the unique needs of freelancers and SMEs. By merging simplicity with powerful functionalities, Freshbooks is reshaping how businesses engage with their finances, marking a new era of financial management.

Features

- Invoicing

- Expense tracking

- Time tracking

- Projects

- Payments

- Reporting

- Estimates

- Proposals

- Clients

- Accounting and bookkeeping

- Mobile app access

- Bank reconciliation

- Double-entry accounting

- Financial reports

Top 3 Features of Freshbooks

1. Cloud Invoicing

Send invoices quickly and get paid faster with Freshbook's cloud invoicing.

2. Time and Expense Tracking

No more guesswork. Track every minute of your work and every penny of your expenses seamlessly.

3. Project Management & Collaboration Tools

Organize your projects effectively and cooperate with your team in real-time.

Pros of Freshbooks

- Real-time project tracking with budget alerts

- Bank reconciliation capability with multiple bank accounts

- Detailed financial statements at your fingertips

Cons of Freshbooks

- Lacks advanced inventory features for large businesses

- Limited tax options for global businesses

- Additional costs for extra team members

Supported Platforms

FreshBooks has a web-based platform specially designed for browsers and mobile apps on both Android and iOS.

Pricing

With monthly plans starting from $8.50, Freshbooks ensures you get the best bang for your buck.

Final Verdict on FreshBooks

For freelancers and small team leaders, navigating the complexities of financial management can often seem daunting. However, the process becomes streamlined and intuitive with Freshbooks at your disposal.

Offering a comprehensive suite tailored to the unique needs of independent professionals and smaller teams, Freshbooks ensures that every financial aspect, from invoicing to expense tracking, is handled quickly and precisely.

In a world where time is money, Freshbooks stands out as a reliable partner, enabling you to focus on your core tasks while it takes care of the numbers. Whether you're just starting or looking to optimize your financial processes, Freshbooks is the efficient solution you've been searching for.

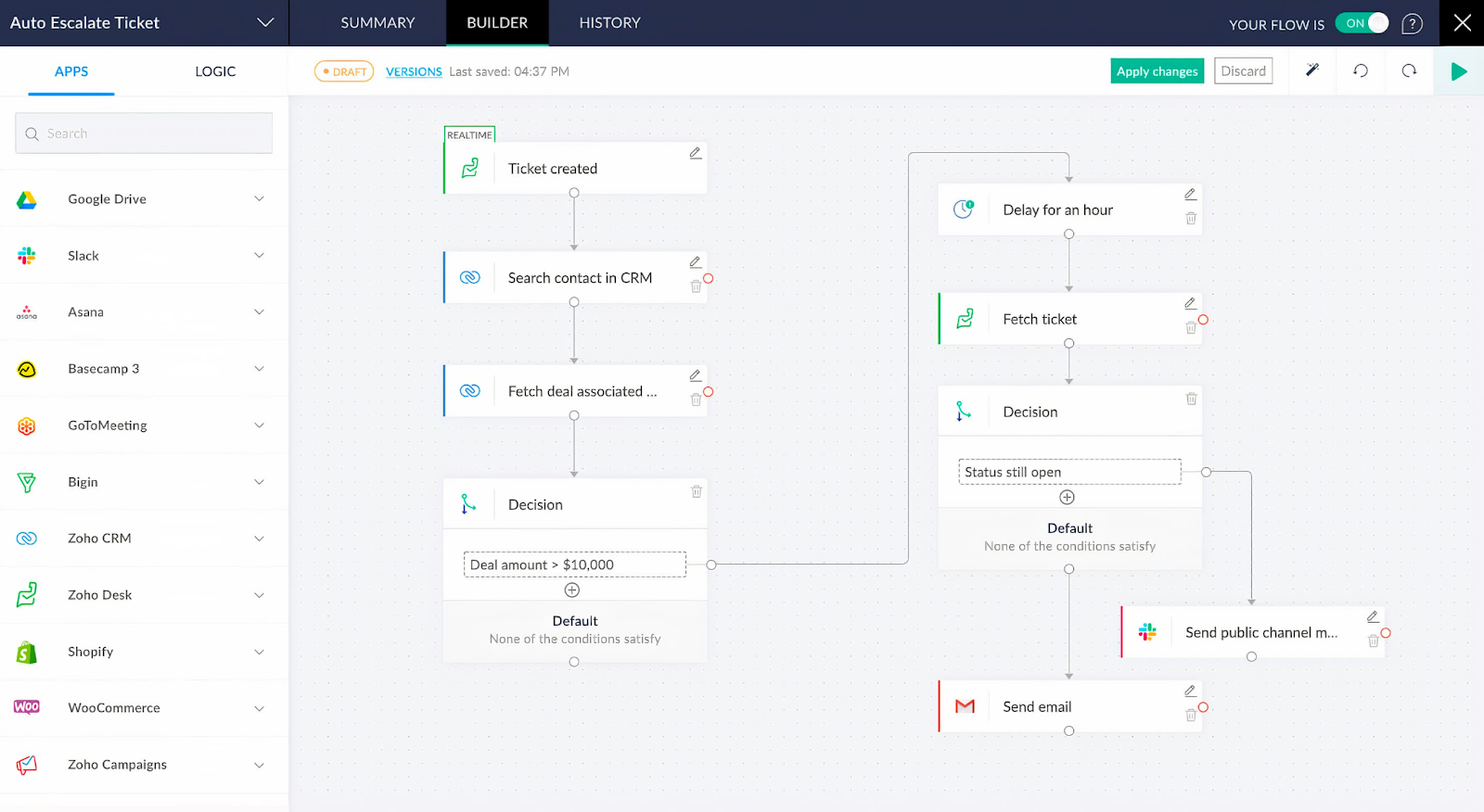

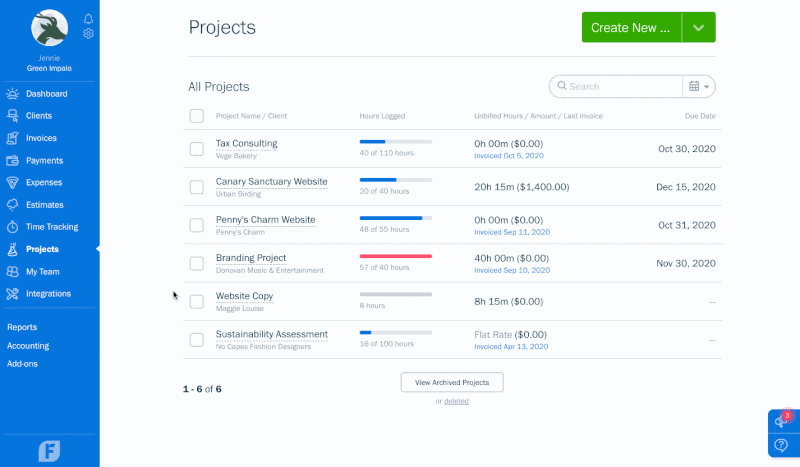

5. One Up

In the various landscapes of financial and business management tools, One Up shines as a compelling contender against Xero Farming. Designed with precision and user-friendliness, One Up simplifies accounting and inventory management and brings various features, from CRM integrations to automated invoicing.

Tailored for businesses prioritizing efficiency and ease of use, One Up presents a holistic solution, ensuring every aspect of your business operations is seamlessly addressed. Dive in and discover how One Up is redefining the standards of business management tools.

Features

- Invoicing

- Expense tracking

- Sales automation

- Inventory management

- Purchase orders

- Multi-user access

- CRM (Customer Relationship Management)

- Mobile app access

- Financial reporting

- Bank reconciliation

- Accounting and bookkeeping

- Time tracking

- Project management

Top 3 Features of OneUp

1. Inventory Management

OneUp's inventory management ensures you always stay well-stocked and overstocked. The system offers real-time tracking, allowing businesses to have an up-to-date understanding of their stock quantities.

It provides timely restocking, reducing potential revenue losses from out-of-stock situations or unnecessary storage costs from overstocking.

2. CRM Integration

The intuitive interface brings together all CRM functionalities under one roof. From here, users can quickly glance at recent interactions, upcoming tasks, and pending sales leads.

3. Automated Invoicing and Banking

In the bustling business world, where every second counts, automation has advanced as a game-changer, changing conventional procedures and simplifying tasks. Automated entries integrated into OneUp's platform are a testament to this revolution, drastically cutting down on the manual workload and elevating the accuracy of financial transactions.

Pros of One Up

- In-built CRM for comprehensive business management

- Real-time inventory alerts for stock management

- Easy to navigate and user-friendly interface

Cons of One Up

- Limited third-party integrations

- The mobile app lacks some features found on the desktop version

- The learning curve for those new to accounting

Supported Platforms

Mobile apps on Android and iOS platforms complement the web-based interface for easy browser access.

Pricing

Plans start at $9 monthly, providing a cost-effective solution for businesses.

Final Verdict on One Up

One Up is a top contender if you're searching for an all-in-one business management tool that doesn't break the bank.

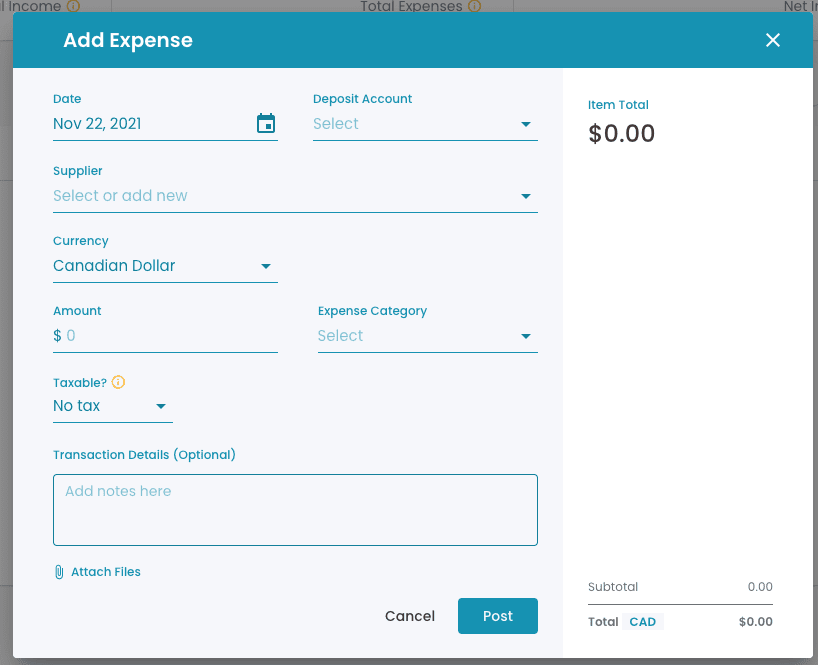

6. Wave Accounting

Wave Accounting is a free, cloud-based accounting software that's a superior choice when viewing Xero Farming alternatives. Designed for freelancers, advisors, and small business owners, it streamlines financial operations effortlessly.

Features

- Invoicing

- Expense tracking

- Accounting reports

- Receipt scanning

- Bank reconciliation

- Multi-currency

- Payroll processing (available in certain countries and at an additional cost)

- Sales tax calculations

- Personal finance tracking

- Credit card processing (through Wave Payments)

- Estimates

- Bill and invoice reminders

- Cash flow insights

Top 3 Features of Wave Accounting

1. Free Invoicing & Accounting

Having a cost-effective and reliable partner can make all the difference in the complex labyrinth of business finances. Wave's free invoicing and accounting feature is a standout offering in business financial management.

2. Payroll Services

Navigating the complexities of payroll is a daunting job for many businesses. However, Wave Accounting's Payroll services aim to simplify this process, making it both efficient and user-friendly.

3. Receipt Scanning

Keeping track of every receipt in business finance can take time and effort. Wave Accounting offers a powerful solution with its receipt scanning feature, ensuring businesses can keep a clear and organized record of all their expenses without sifting through stacks of paper.

Pros of Wave Accounting

- 100% free for accounting and invoicing

- User-friendly interface tailored for non-accountants

- Secure cloud storage for financial data

Cons of Wave Accounting

- Shortage of inventory management features

- Payroll features incur extra charges

- Limited customizability in reports

Supported Platforms

Primarily a web-based platform with a dedicated receipt-scanning app for Android and iOS.

Pricing

Free for accounting, invoicing, and receipt scanning. Payroll services come at additional costs.

Final Verdict on Wave Accounting

If budget constraints are a concern, Wave Accounting emerges as a game-changer with its free offerings and ease of use.

7. Kashoo

Kashoo, another noteworthy name in the realm of Xero Farming alternatives, offers a straightforward approach to business accounting, ensuring entrepreneurs stay on top of their game.

Features

- Income and expense tracking

- Invoicing

- Payments

- Multi-currency support

- Bank reconciliation

- Mobile app access

- Financial reporting

- Sales taxes

- Chart of accounts

- Attachments (e.g., receipt images)

- Project tracking

Top 3 Features of Kashoo

1. Multi-Currency Support

In the age of globalization, where businesses often stretch across borders and continents, the ability to deal with multiple currencies is no longer just a bonus—it's a necessity. Recognizing this crucial need, Kashoo has infused its platform with a robust multi-currency support system.

2. Automated Expense Tracking

Navigating the financial maze can be daunting for any business, but with tools like Kashoo, the journey becomes notably easier and more efficient. One standout feature of Kashoo is its Automated Expense Tracking.

3. Simple Invoicing

The lifeline of any business lies in its revenue stream, and invoices play a pivotal role in ensuring that revenue flows smoothly. Kashoo's simple invoicing, designed with user experience in mind, transforms how businesses handle this crucial aspect of their operations.

Pros of Kashoo

- Intuitive dashboard for real-time financial insights

- Cloud-based access ensures availability anywhere, anytime

- Streamlined tax preparation with organized income and expense tracking

Cons of Kashoo

- Limited third-party app integrations

- Lacks advanced inventory tracking

- No payroll feature in the base offering

Supported Platforms

Web-accessible platform compatible with all browsers, complemented by an iOS mobile application.

Pricing

Offered at $19.95 per month, it provides a robust set of tools for small business owners.

Final Verdict on Kashoo

In the vast sea of accounting solutions, Kashoo shines as a beacon for self-starters and visionaries. Tailored for the unique demands of entrepreneurs and freelancers, it epitomizes simplicity without compromising functionality.

If the essence of your business pursuit is to find an accounting platform that's both intuitive and effective, then Kashoo is your perfect ally. Embrace the ease; prioritize your passion. With Kashoo, simplicity, and efficiency walk hand in hand.

Table Comparison

|

Feature/Software |

ZarMoney |

Quick |

Zoho Books |

Fresh |

One Up |

Wave Accounting |

Kashoo |

|

Cloud-based |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Mobile app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Invoicing |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Expense tracking |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Multi-currency |

❌ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Inventory management |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

❌ |

❌ |

|

Time tracking |

❌ |

✔️ |

✔️ |

✔️ |

❌ |

❌ |

❌ |

|

Payroll |

❌ |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

|

Project management |

❌ |

✔️ |

❌ |

✔️ |

❌ |

❌ |

❌ |

|

Recurring invoices |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Best of the Best

1. ZarMoney

In the competitive realm of financial software, ZarMoney stands out distinctly. Renowned for its superior reporting capabilities, this platform ensures that managing business finances is a routine and seamless, efficient experience.

For businesses aiming for precision and a holistic overview of their monetary operations, ZarMoney promises unparalleled clarity and ease.

2. Quickbooks

Quickbooks stands out not just as an alternative but as a formidable player in the dynamic realm of accounting software. With its unparalleled bank connectivity and an extensive suite of accounting tools, it offers businesses both convenience and in-depth financial management.

Whether you're a beginner or a seasoned entrepreneur, Quickbooks ensures your financial processes are as streamlined as they are thorough.

3. Zoho books

Zohobooks is a beacon in this realm. Catering to businesses with its advanced features, Zohobooks is a formidable choice for those pursuing excellence in managing their clientele.

Whether you're a startup seeking to understand your growing customer landscape or an established firm aiming for refined client interactions, Zohobooks offers solutions that resonate with precision and adaptability.

Conclusion

Navigating the world of business finance software can often feel like traversing a maze—endless choices, complex features, and an ever-evolving digital landscape. However, the journey becomes significantly simpler when equipped with the right compass. ZarMoney stands out as that pivotal instrument, guiding businesses through the intricacies of financial management.

As a leading Xero Farming alternative, ZarMoney isn't just about accounting; it's about providing a holistic platform that ensures seamless financial operations. From invoicing to reporting, its comprehensive suite of tools is designed for businesses prioritizing efficiency and accuracy.

Frequently Asked Questions (FAQs)

1. What are the uses of the best Xero Farming alternatives?

These alternatives help businesses handle finances, track inventory, generate reports, and streamline operations.

2 . What makes the best Xero Farming alternatives?

User-friendly interfaces, a wide range of features, customizable options, and robust customer support make the best alternatives.

3. What are Xero Farming alternatives?

Xero Farming alternatives refer to accounting software options that can be used instead of Xero, particularly tailored for agricultural and farming businesses.

4. Why would someone consider an alternative to Xero Farming?

While Xero Farming offers comprehensive features, some businesses might seek different pricing options, specific functionalities, or a more user-friendly interface.

5. Are these alternatives specifically tailored for farming businesses?

Some alternatives may cater specifically to the farming industry, while others might be general accounting software that offers modules or features relevant to agriculture.