7 Small Business Bookkeeping Services to Consider in 2022

Small business owners need bookkeeping services like the next large enterprise. However, the solutions seem limited if one considers the costs and hassle that can accompany bookkeeping.

As a small business owner, you might hire a full-time bookkeeper or outsource your bookkeeping tasks to a professional. Alternatively, you might swallow the bitter pill and find yourself doing your bookkeeping by yourself to save some dollars.

What if we told you there is another, better option?

Today, you can find comprehensive small business bookkeeping services at very affordable rates. By this, we mean software designed to automate and streamline the bookkeeping process. The right tool can help you take charge of it in a way that keeps your income statements, balance sheets, cash flow statements, legal matters, and more in spotless shape.

Don’t forget that bookkeeping is crucial to maintaining your business’ financial health. In the long run, it can make or break your business. Manual methods of keeping your books can give rise to delays and errors.

On the other hand, intuitive software ensures integrity in your record-keeping system. It also offers important insights into your performance, empowering you to improve your budgeting and make better decisions for consistent growth.

Since a reliable bookkeeping tool will track your income and expenditure, you can reduce time and inaccuracies. You can also ensure your taxes are filed on time and your business complies with the law. You will have a clear defense if the IRS audits your business. Furthermore, a bookkeeping tool will help you enhance your cash flow management, help you pay your bills on time, and use a reliable centralized system to manage your finances.

We believe these are enough reasons to consider opting for small business bookkeeping services seriously and that you are already halfway convinced to look into it. Let’s explore our top seven list to get you fully on board!

1. ZarMoney

Product Overview

ZarMoney is a cloud-based bookkeeping service. This intuitive bookkeeping software automates and centralizes your financial management systems. You can go completely paperless with this tool, as all your invoices, bills, tax documents, and more are stored in the cloud.

This also means you can access your updated records from anywhere and at any time - quite convenient, isn’t it? Say goodbye to keeping stacks of files forever!

ZarMoney helps you with your account receivables and payables. It provides you with a secure online payment processing platform. You can start offering your customers to pay you online while this tool records your incoming and outgoing expenses in the cloud database.

It will also do account reconciliation with just a few clicks, saving you time and worry. Have your sales tax computed, get your hands on accurate financial statements and gain valuable metrics about your performance with this service.

Features

- 1099 preparation

- Accounts receivable and payable transactions

- Online payment processing

- Approval process control

- Bank reconciliation

- Billing

- Invoicing

- Cash management

- Customer statements

- Customizable invoices

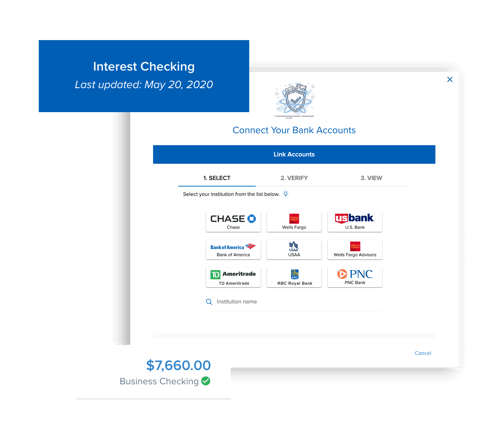

- Connection with over 9600 banks

- Multi-login

- Multi-location support

- Multi-currency support

- Automated taxation

- Profit and loss statements

- Alerts and reminders

Top Three Features

The top three features of ZarMoney include:

1. Bill Management

ZarMoney helps you maintain a Payables Calendar to track your outgoing expenses. You can use this feature to manage all your bills efficiently. Pay multiple vendors simultaneously, streamline your recurring payments with just a few clicks, and print checks individually or in batches - this service lets you do it all. You can also track the status of your bills, create payments against your balance, generate invoices and upload receipts to the database effortlessly.

2. Tax Automation

ZarMoney streamlines your tax reporting through its advanced sales tax feature. You can tweak the settings to match your tax zone, specific to your store location. With each transaction, the sales tax is automatically computed and saved. Since this tool files your taxes automatically, you won’t miss tax deadlines and remain compliant easily.

3. Bank Reconciliation

You already know how exhausting reconciling your statements can be. It takes time and focus but still, errors occur. ZarMoney resolves this problem through its bank reconciliation feature.

You can automate the entire process and never reconcile your invoices manually again. Learn of discrepancies, if any, and ensure straight records.

Price Plans

- Entrepreneur: $15 / month / 1 user

- Small Business: $20 / month / 2 users

- Enterprise: $350 / month / 30+ users

- Free trial

Pros

- Affordable for small businesses

- The dashboard is user-friendly and easy to use

- The tool offers detailed and visual reports giving insights into your business’ performance

Cons

- The app does not offer a free plan

Integrations

- AutoEntry

- PayPal

- Stripe

- Google Calendar

- QuickBooks Payment

- Braintree

- CyberSource

- Authorize.Net

- Gusto

- Mailchimp

- Zapier

- Shopify

Average Rating from Top 3 Software Directories

ZarMoney’s average rating, according to the top three software directories, stands at 4.73.

Testimonials

Customer Support Options

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Support Platforms

- Web

- Mac

- Windows

- Linux

- Chromebook

Bottomline

ZarMoney enables you to automate your bookkeeping process, bringing down errors as well as the need for manual intervention exponentially. You can keep complete audit trails, ensure smooth cash flow, pay all your bills and file your taxes on time. This cloud-based bookkeeping service is made with small businesses' needs.

2. Kashoo

Product Overview

Kashoo is a simple bookkeeping service that enables you to perform complex functions efficiently and in less time. You can use the tool to automate your bookkeeping process. With this tool, you can track your invoices, manage your bills, and facilitate credit cards and other online payment methods for your customers. You can also do automatic account reconciliation, saving more time.

Additional features provided by Kashoo include access control, OCR, and receipt matching. This means you must upload an image of a bill or receipt on the software’s dashboard, and Kashoo will easily match it to the relevant transaction.

It’s a capability that comes in handy for small businesses pressed for time and resources to enter data manually. The automation ensures your records are updated at all times.

Features

- Accounts payable

- Accounts receivable

- ACH payment processing

- Audit trail

- Bank reconciliation

- Billing

- Invoicing

- Cash management

- Expense tracking

- Financial reporting

- Income & balance sheet

- Invoice processing

- Multi-currency

- Online invoicing

- Online payments

- Partial payments

- Profit/loss statement

- Receipt management

- Receivables ledger

- Tax calculation

Top Three Features

The top three features of Kashoo include:

1. Invoice Tracking

With Kashoo, you can track all your invoices easily. You can determine whether the invoices are paid by the deadline or are still overdue. Send reminders to your customers, provide online payment options and get your dues effortlessly.

2. Bank Connections

Kashoo allows you to connect to over 5000 banks and credit unions. Connect all your bank accounts to this app and ensure all transaction records are tracked and updated in real time. The data protection measures keep sensitive data at all times.

3. Reporting and Analytics

Get your hands on detailed business reports with Kashoo. The app generates reports quickly and provides them on the dashboard for easy access and viewing. You can also share the reports with whoever you want, whether your team or financial advisor, without paying extra.

Price plans

- $30 /month flat rate

- Free trial

Pros

- The software is easy to use for people with no knowledge of accounting

- The feature of adding users and adjusting access privileges is handy

- It is very affordable

Cons

- The customer billing feature can be cumbersome to use

- Manual adjustment of settings is a complicated process

- The invoice template selection is limited

Integrations

- Google Workspace

- FreshBooks

- Stripe

- 1Password

- Square Point of Sale

- SurePayroll

- Pepperi

- Payment Evolution

Average Rating from Top 3 Software Directories

Kashoo’s average rating, per the top 3 software directories, stands at 4.5.

Testimonials

Customer Support Options

- FAQs/Forum

- Chat

- Email/Help Desk

- Phone Support

Support Platforms

- Web

- Android

- iPhone

- iPad

Bottomline

Kashoo is a straightforward bookkeeping solution with valuable functionalities. It has an affordable price point, especially considering that it allows you to add unlimited users to the app. You can still access automation features to perform various accounting tasks efficiently.

3. Xero

Product Overview

Xero provides a full-scale bookkeeping solution that can cater to the needs of small, mid-sized, and large businesses. While it has rich features, it offers affordable price plans, making it ideal for small businesses. This service can monitor your invoices, automate account reconciliation, manage your finances, and track your budget. It is also easy to use, so you won’t spend much time learning and implementing it into your existing system.

With Xero, you can gain visibility into your business’ profits and loss trajectory. In short, you can learn how well you are performing through financial reports. Furthermore, you can get accurate records such as income and profit statements.

Features

- 401(k) tracking

- ACH payment processing

- Accounts payable & receivable

- Automated quoting & billing

- Bank reconciliation

- Billing & Invoicing

- Budgeting

- CPA firms

- Currency conversion

- Customer statements

- Customizable invoices & reports

- Financial analysis

- Income & balance sheet

- Multi-channel management

- Online invoicing & payments

- Real-time reporting

Top Three Features

The top three features of Xero include:

1. Online Payments

Xero allows you to add the ‘Pay Now’ option to your invoices that you can send to your customers easily online. When they open the invoices and see the option, they have to click on the button, and voila! The payment is made. This way, you get paid faster and ensure your cash flow remains unhindered.

2.Bank Connections

Xero has an automated bank feeds capability. This enables you to connect all your bank accounts to this tool, ensuring easy import of transaction history. You no longer have to enter financial information manually and risk introducing errors. This automatically saves you time, too.

3. Real-Time Cash Flow

With Xero, you can stay completely updated with your cash flow position. Get daily updates about your finances from your bank accounts and credit cards. The information is reflected on your app dashboard and in shareable reports.

Price Plan

- Starter - $22 / month

- Standard - $35 / month

- Premium - $47 / month

- The app offers a free trial

Pros

- It is easy to implement

- It offers a wide range of useful bookkeeping features at an attractive rate

- The tool comes with a mobile app, and you can use it easily on the go

Cons

- The app can sometimes glitch, requiring manual entry of bank statements

- The app updates regularly, which can pose a challenge for new users who are just getting onboard

- It can be difficult to focus on the individual expense category

Integrations

- Google Drive

- PayPal

- Dropbox Business

- Microsoft 365

- Google Workspace

- Mailchimp

- Google Forms

- Acuity Scheduling

- QuickBooks Time

- Gusto

- HubSpot Marketing Hub

- Shopify

- Eventbrite

- FreshBooks

- Stripe

- HubSpot CRM

- Zoho CRM

- Zapier

- Quickbooks Online

- Squarespace

- Square Point of Sale

Average Rating from Top 3 Software Directories

Xero’s average rating, per the top 3 software directories, stands at 4.3.

Testimonials

Customer Support Options

- Email/Help Desk

- Chat

- Knowledge Base

- FAQs/Forum

- 24/7 (Live rep)

Support Platforms

- Web

- Android

- iPhone

- iPad

Bottomline

Xero provides an easy bookkeeping service to you at an affordable rate. The app is stored in the cloud and is accessible through mobile phones and iPad. So you can access your records 24/7. The automation features ensure your bookkeeping processes become seamless and hassle-free, requiring little manual intervention.

4. ZipBooks

Product Overview

ZipBooks provides a comprehensive bookkeeping solution to your needs. The tool manages your accounts receivable and payable, tracks your payments, and provides payroll management options. At the same time, it enables you to customize and send quick invoices to your customers for faster payment online through various convenient platforms such as PayPal and Stripe.

In addition, this service lets you track your budget and get visible financial forecasts. You can also track time spent on work and access detailed financial reports showcasing your performance. The data-based insights and complete audit trail can put you in the right direction to improve your bottom line and aim for greater profits as your small business grows.

Features

- Accounts payable & receivable

- ACH payment processing

- Bank reconciliation

- Billing & invoicing

- Bookkeeping services integration

- Budgeting

- Cash management

- Expense tracking

- Financial reporting

- Income & balance sheet

- Mobile payments

- Multi-currency

- Online invoicing & payments

- Payment processing

- Profit/loss statement

- Receipt management

- Tax management

Top Three Features

The top three features of ZipBooks include:

1. Effortless Reporting

ZipBooks allows you to get detailed reports about your accounts, invoices, payments, and more. Share the reports quickly with the relevant personnel on the dashboard, and allow effortless collaboration to ensure seamless bookkeeping. Just add the team members you want to allow access to the reports, and the job is done. There is no need to send chains of emails anymore.

2. Account Receivable

ZipBooks monitors all your account receivables, so you know your processed and pending payments. Stay updated about overdue and unpaid bills and send reminders to customers to ensure payment. This way, you can keep accurate financial records of due payments and gain insights into late payment trends.

3. Taxation

ZipBooks enables you to calculate all taxes, including sales tax, easily. Whenever you prepare invoices, the sales tax is calculated and added to them. You can further keep track of other kinds of taxes to ensure you pay your taxes on time.

Price Plans

- Starter - free of cost

- Smarter - $15 / month

- Sophisticated - $35 / month

- Accountant - Custom pricing

Pros

- The app is easy to use interface

- It is customizable per user’s requirements

- The support system is very responsive

Cons

- The data export option is limited

- The reporting feature is not very detailed

- It can be cumbersome to send invoices through the mobile app

Integrations

- Google Drive

- PayPal

- Slack

- Google Workspace

- Asana

- Gusto

- Spiceworks

- Enrollsy

Average Rating from Top 3 Software Directories

ZipBooks’ average rating from the top 3 software directories stands at 4.5.

Testimonials

Customer Support Options

- Email/Help Desk

- FAQs/Forum

- Knowledge Base

- Chat

Support Platforms

- Web

- Android

Bottomline

ZipBooks is a capable and easy-to-use bookkeeping service for small businesses. You can use it to gain control over your expense tracking, automate your accounting system, and oversee your spending. Since the app offers a free plan, you can try it out before deciding whether it matches your requirements.

5. Sage Intacct

Product Overview

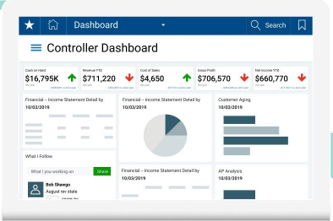

Sage Intacct can resolve bookkeeping bottlenecks efficiently through its powerful automation features. It allows CFOs capabilities of integrated management. They can also access financial reports and gain insights into the business’ performance. Relying on the analytics and reports, you can make sound business decisions geared toward growth in the future.

With Sage Intacct on your side, you no longer have to maintain countless spreadsheets. Just shift to the easy-to-use cloud system and start maintaining a database online that is regularly updated with your incoming and outgoing expenses. The process is automated, so you do not have to spend your time making manual entries.

Features

- Accounts payable & receivable

- ACH payment processing

- Audit trail

- Bank reconciliation

- Billing & invoicing

- Budgeting/forecasting

- Customer statements

- Financial management & reporting

- Income & balance sheet

- Invoice management & processing

- Mobile payments

- Multi-currency

- Profit/loss statement

- Recurring invoicing & payments

- Sales tax management

- Tax calculation

Top Three Features

The top three features of Sage Intacct include:

1. Account Payable

Sage Intacct automates your account payables. There is no need to manually run through your records to learn whether the pending payments have been made. Just rely on this tool to know pending payables and get paid easily. This improves your cash flow management while optimizing your workflow as well.

2.Financial Reporting

Sage Intacct enables you to rely on AI and upgrade your bookkeeping systems. Since the tool is cloud-based, you can quickly adapt it to the changing technology and access intelligent features. Gain control of your processes by setting up your workflows, entering transactions, and reporting them across various financial standards easily. Ensure accuracy and consistency in your finances at all times.

3. Cash Management

Sage Intacct improves your cash management processes by providing complete visibility and control over your existing practices. Learn how efficient they are, change them to improve control, and simplify your cash management system through this tool. This will save time while boosting your growth.

Price Plans

- Custom quote available on request

- Free trial.

Pros

- Customer support is responsive and helpful

- The app can be used from various locations easily

- The app upgrades to introduce new technologies regularly.

Cons

- The user interface is not very intuitive

- The customization options are limited

- Uploading invoices can be a cumbersome process

Integrations

- PayPal

- Microsoft Excel

- Salesforce Sales Cloud

- ADP Workforce Now

- Rippling

- Emburse Certify Expense

- Expensify

- Emburse Nexonia Expenses

- BigTime

- Paychex Flex

- Replicon

- Sisense

- Adobe Commerce

- Bill.com

Average Rating from Top 3 Software Directories

Sage Intacct’s average rating from the top 3 software directories stands at 4.2.

Testimonials

Customer Support Options

- 24/7 (Live rep)

- Chat

- Knowledge Base

- Email/Help Desk

- Phone Support

- FAQs/Forum

Support Platforms

- Web

- Android

- iPhone

- iPad

Bottomline

Sage Intacct can come in handy if you need bookkeeping but also want to combine software usage with ERP management. The app has multiple functionalities and can cater efficiently to the financial requirements of small businesses, allowing them to become more productive and profitable quickly.

6. Wave Accounting

Product Overview

Wave is a modern bookkeeping service that caters to small businesses. While it offers extensive capabilities, you can select the features you want to use and only pay for them; there is no need to pay higher costs for features you wouldn’t use. Its capabilities include tracking account payables and receivables, account reconciliation, online payment processing, automatic bank connections, billing, and invoicing.

With all the required features available on a single platform, it becomes easier to keep an audit trail. Your work processes become streamlined as every incoming and outgoing expense is stored on the online cloud-based server. Furthermore, since the system is automated with Wave, you can skip entering information manually. The app can effortlessly import all transactions and other bank-related details through its bank connection feature.

Features

- ACH payment processing

- Account reconciliation

- Accounts payable & receivable

- Automatic billing

- Bank reconciliation

- Billing & Invoicing

- Budgeting

- Credit card processing

- Customer statements

- Email reminders

- Estimating

- Expense tracking

- Financial analysis

- Financial management & reporting

- Income & balance sheet

- Mobile app

Top Three Features

The top three features Wave include:

1. Invoice Tracking

Wave allows you to track all your invoices easily. You can learn about the payments that have been received and the payments that are due at a glance. All you have to do is go to the dashboard, and you can find the required details on a visual dashboard. You can enable notification to know when a customer views an invoice and pays it and when an invoice becomes overdue.

2.Online Payments

Wave gives you complete visibility and control over your payment system. Through this service, you can accept bank and credit card payments with a small due of 1% per transaction. Furthermore, the tool allows you to send scheduled payment reminders to remind customers of overdue bills. This ensures you get paid on time and maintain a healthy cash flow.

3. Bill Management

Wave provides you with an easy-to-use and visual dashboard. Through it, you can learn all about your outgoing expenses at a single glance. Just visit the dashboard and find out the payments that you have made and the due ones. Then, process overdue bills with a single click effortlessly.

Price Plans

- Accounting software - $0

- Credit card processing - $0.30 + 2.9% per transaction

- Bank payment/ACH processing - 1% per transaction ($1 minimum fee)

- Free trial

Pros

- It is very affordable

- It is easy to integrate into your existing system

- There is no hidden price

Cons

- The app glitches sometimes

- This tool may not offer advanced bookkeeping features

- The bank connection feature can sometimes give an error message

Integrations

- Google Drive

- PayPal

- Gmail

- Google Forms

- Stripe

- HubSpot CRM

- Zapier

- Microsoft Outlook

- Payment Rails

- CartonCloud

Average Rating from Top 3 Software Directories

Wave’s average rating from the top 3 software directories stands at 4.4.

Testimonials

Customer Support Options

- FAQs/Forum

- Email/Help Desk

- Chat

- Knowledge Base

Support Platforms

- Web

- Android

- iPhone/iPad

Bottomline

Wave enables you to carry out bookkeeping with minimum hassle. The automation features simplify the process, allowing you to eliminate errors and increase your work speed. Relying on this service, you will not have to hire additional resources just to do your bookkeeping. All in all, this tool can help you do simple bookkeeping easily while saving costs.

7. Yooz

Product Overview

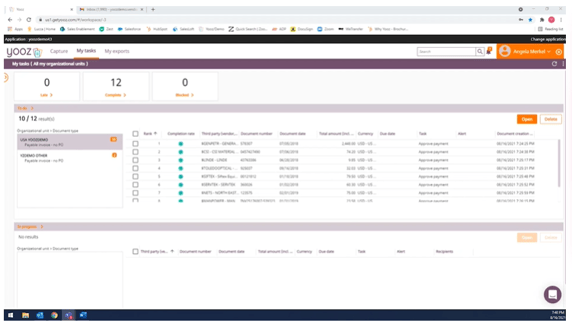

Yooz provides an intuitive and easy-to-use bookkeeping service. Its features are quite helpful in reducing manual intervention. For instance, you can upload pictures of your invoices on the dashboard, and the tool will automatically extract and store the relevant information from it.

Furthermore, the app offers tiered pricing, which means you can choose the features you want to use and only pay for them. This saves extra costs.

With Yooz, you can also count on a solution that scales up as your business grows. While you can add unlimited users to the dashboard, you can still add more features and increase the capabilities as and when you need them. The mobile app version allows you to access the information you need anywhere and anytime.

Features

- Approval process control

- Cash management

- Data extraction

- Duplicate payment alert

- Fraud detection

- Invoice processing

- PO reconciliation

- Vendor management

Top Three Features

The top three features of Yoozinclude:

1. Invoicing

Yooz puts you in control of your invoice process. You can get complete visibility of your invoices, whether they are in process or have been paid. The system is automated and secure so that you can count on greater speed and capabilities such as regulation compliance and AI-based fraud detection.

2. Billing Automation

Yooz uses smart technology to read your bills and receipts, whether payables or receivable. It extracts the information from the images, allowing you to go completely paperless. The app gets approval from the relevant persons (one or multiple) and processes the payments quickly. Furthermore, the workflow is customizable so you can set it up according to your business requirements.

3. Digital Invoice Payment

Yooz has the option of digital invoice payment, allowing you to get cashback. You can use the feature to approve payments and pay your invoices, whether individually or in batches. You can pay your vendors via paper checks, eChecks, virtual cards, and more. The invoice payment status is updated and reflected on the app to keep you in the loop.

Price Plans

- Free Trial

- Gold Edition - Tiered pricing, available at a custom quote

Pros

- Yooz saves images of invoices, removing the need to keep a paper trail of your invoices

- The AI features enable automatic documentation of the invoice, removing the need for manual entry

- The software implementation is a smooth and quick process

Cons

- The inbuilt feature of invoice scanning can sometimes combine invoices incorrectly

- Users can take some time to get accustomed to this tool

- The dashboard customization options are limited

Integrations

- Quickbooks Online

- Dynamics 365

- Xero

- QuickBooks Online Advanced

- NetSuite

- SAP Business One

- JD Edwards EnterpriseOne

- Coupa Business Spend Management

- Infor CRM

Average Rating from Top 3 Software Directories

Yooz’s average rating from the top 3 software directories stands at 4.4.

Testimonials

Customer Support Options

- Email/Help Desk

- Phone Support

- Chat

Support Platforms

- Web

- Android

- iPhone

- iPad

Bottomline

Yooz provides a quick and easy bookkeeping solution for small businesses. Since it is cloud-based, you can use the tool easily from anywhere. The automation capabilities ensure your work gets done faster and with accuracy.

In Conclusion

In this blog, we shared the top seven small business bookkeeping services to consider in 2022. We dived into detail about each service, exploring its top three features, integrations, price plans, user testimonials, average rating, support options, and more.

We did this to give you a clear overview of the bookkeeping services you can expect to gain from these tools against which pricing scale.

We hope you are ready to try these services out (good thing many offer free trials and plans!), and short-term and long-term rewards will be the most suitable for your business.

We recommend starting with ZarMoney, as the tool comes with smart capabilities, customization options, and an intuitive platform that you and your team will find easy to use in your day-to-day operations.

Don’t wait - start using a bookkeeping service today to gain short-term and long-term rewards!