7 QuickBooks Payroll Alternatives for Efficient Payroll Management

While QuickBooks Payroll is widespread, several alternatives offer similar features and benefits. They often provide more flexible pricing options, catering to the budgetary constraints of small to medium-sized businesses. This variety allows businesses to select a payroll solution that not only meets their financial management requirements but also improves operational efficiency through more user-friendly interfaces and advanced automation capabilities.

This article will explore seven QuickBooks Payroll alternatives that can help you automate your payroll processes and make sure your employees are paid accurately and on time.

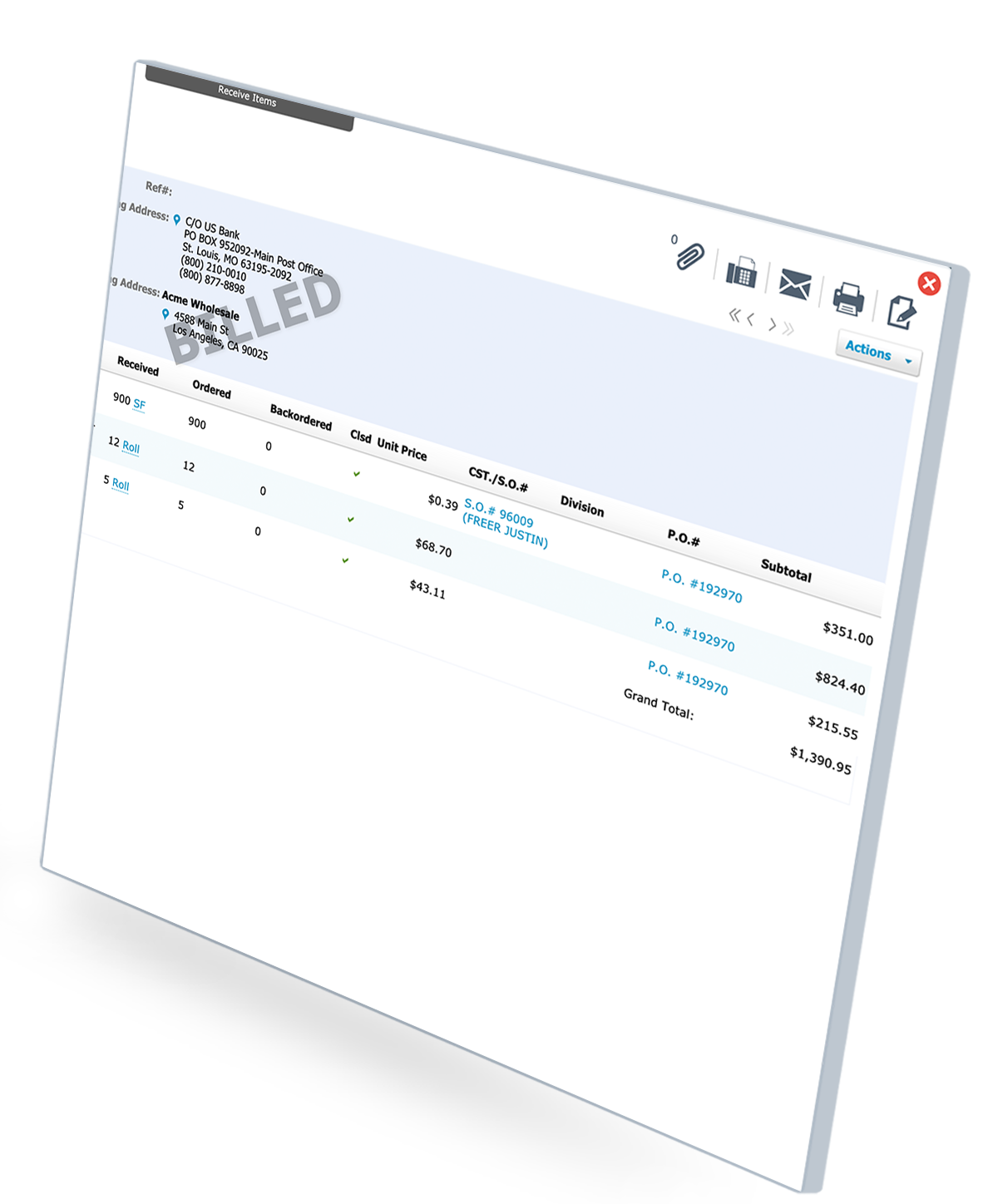

1. ZarMoney

ZarMoney is an accounting software that offers effortless integration with payroll processes, making it an excellent QuickBooks Payroll alternative. Using ZarMoney, you can effectively oversee your payroll, monitor payments, and produce financial reports.

ZarMoney offers advanced features like expense tracking, detailed financial reports, and a customizable dashboard.

Features of ZarMoney

- Accounting

- Bookkeeping

- Accounts receivable

- Invoicing

- Billing

- Payment processing

- Invoice & estimate

- Order management

- Inventory management

Top 3 Features of ZarMoney

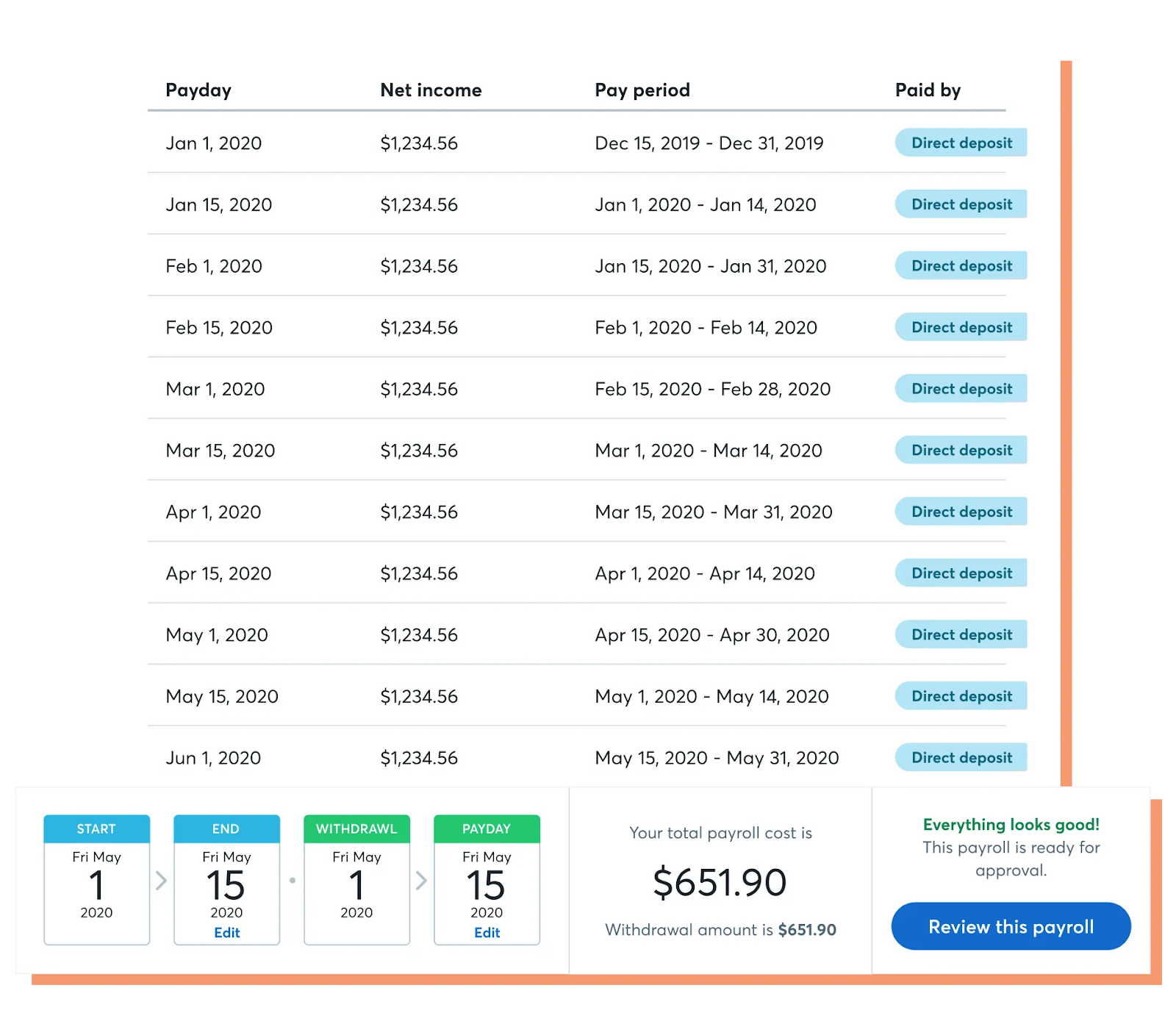

1. Payroll Integration

ZarMoney simplifies payroll management by automating essential functions. It allows you to set up and define pay schedules, tax rates, and deductions.

2. Tax Compliance

ZarMoney provides up-to-date tax tables and permits you to comply with federal, state, and local tax conditions.

It calculates payroll taxes accurately, generates tax forms, and assists in filing payroll tax returns, helping you avoid costly penalties and audits.

3. Direct Deposit and Pay Options

ZarMoney offers adaptable payment opportunities for workers, including direct deposit. This feature allows you to pay your employees electronically, which is convenient for them and reduces the administrative burden of printing and distributing physical checks.

ZarMoney also supports other payment methods, such as printing checks if needed.

Pros and Cons of ZarMoney

Pros

-

Comprehensive financial management.

-

Wide range of features.

-

It has an intuitive user interface.

-

It is cost-effective.

-

It supports multiple locations.

-

ZarMoney offers app integration capabilities.

-

Comprehensive inventory module.

Cons

-

Limited user reviews

-

Learning curve

Supported Platforms of ZarMoney

- Web

- Mac

- Windows

- Linux

- Chromebook

Pricing of ZarMoney

ZarMoney has three pricing plans.

- 15 Days Free Trial

- Entrepreneur $15 / month / 1 user

- Small Business $20 / month / 2 users

- Enterprise $350 / month / 30+ users

Final Verdict on ZarMoney

ZarMoney is a solid choice for small businesses and startups seeking an affordable and user-friendly payroll solution. ZarMoney is a magnificent QuickBooks Payroll alternative due to its cost-effectiveness and user-friendly interface.

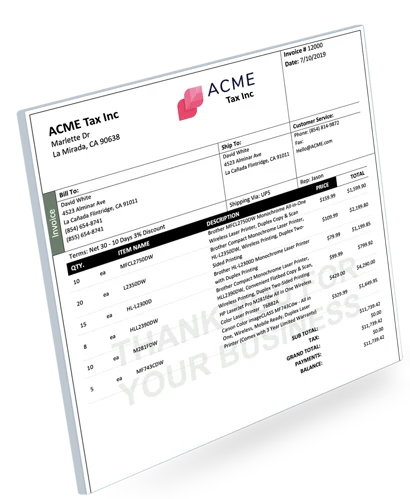

2. Wave Payroll

Wave Payroll is a cloud-based payroll and human resource management answer for small companies and entrepreneurs.

Managing payroll is key for companies of all sizes, and finding the right payroll software can significantly simplify this process. Wave Payroll is one such prospect that has earned attention in the market.

Features of Wave Payroll

-

Invoicing

-

Payments

-

Accounting

-

Mobile receipts

-

Payroll

-

Advisors

Top 3 Features of Wave Payroll

1. Payroll Processing

Wave Payroll automates payroll calculations, tax deductions, and employee payments. This component optimizes the payroll operation and helps minimize mistakes.

2. Tax Compliance

Wave Payroll guarantees businesses comply with tax rules, including federal, state, and local taxes. It strives to stay current with tax regulations and updates its tax tables and calculations accordingly.

3. Direct Deposit and Check Printing

Wave supports direct deposit for employee payments, offering a convenient and paperless payment option. It also allows for check printing if needed.

Pros and Cons of Wave Payroll

Pros

-

Cost-effective.

-

It integrates well with other Wave accounting and financial management tools.

- It has an intuitive user interface.

Cons

-

Restricted advanced features.

-

Some users have noted problems with customer support response times and availability.

Supported Platforms of Wave Payroll

-

Windows

-

macOS

-

Linux

Pricing of Wave Payroll

-

STARTER Plan: $0

-

PRO Plan: $16/month (billed monthly)

-

Run payroll: From $20/month

Final Verdict on Wave Payroll

Wave Payroll is an affordable and user-friendly payroll solution, particularly well-suited for small businesses and startups. It is recognized for effectively simplifying payroll processing and tax compliance.

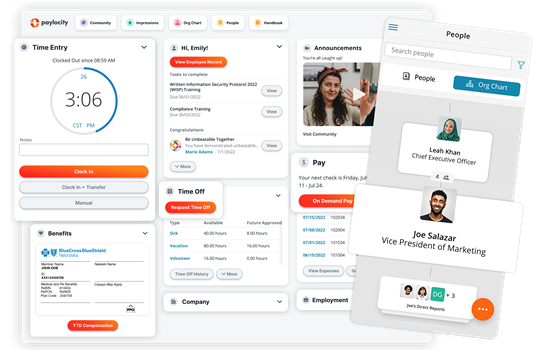

3. Paylocity

Paylocity is a cloud-based HCM software designed to help organizations smoothly run payroll processes and manage HR tasks effectively. It includes payroll processing, time tracking, benefits management, talent management, and employee self-service portals. Paylocity enables efficient workforce management, boosts employee engagement, and ensures HR and payroll compliance.

Features of Paylocity

-

Payroll

-

Human resources

-

Benefit administration

-

Recognitions

-

Integrations

-

Compliance

-

Expense

Top 3 Features of Paylocity

1. Automated Payroll Processing

Paylocity simplifies payroll by automating various tasks, including calculating employee salaries, taxes, and deductions. It allows businesses to set up payroll schedules so employees are paid accurately and on time.

2. Employee Self-Service

Paylocity provides employees with an easily navigable self-service portal, granting them convenient online access to essential payroll information, including pay stubs, tax documents, and benefit particulars.

3. Tax Compliance and Reporting

Paylocity helps businesses stay compliant with ever-changing tax regulations. It automatically calculates and withholds the correct federal, state, and local taxes, reducing the risk of errors and penalties.

Pros And Cons of Paylocity

Pros

-

Paylocity offers a complete suite of HR and payroll services.

- Rich feature set.

- Generates detailed reports to gain insights into your payroll procedures.

Cons

-

Paylocity may not be unrestricted in all areas.

-

Some users may find it takes time to get used to the software.

Supported Platforms of Paylocity

- Android

- iOS platforms

Pricing of Paylocity

Paylocity is priced per employee per month (PEPM) depending on the features you choose for your plan. A Paylocity subscription can range from approximately $22 to $32 per employee per month.

Final Verdict on Paylocity

Whether you're a small startup or a large corporation, Paylocity offers scalable solutions that can adapt to your payroll needs. The payroll features make it an attractive choice for businesses aiming to optimize their payroll processes efficiently.

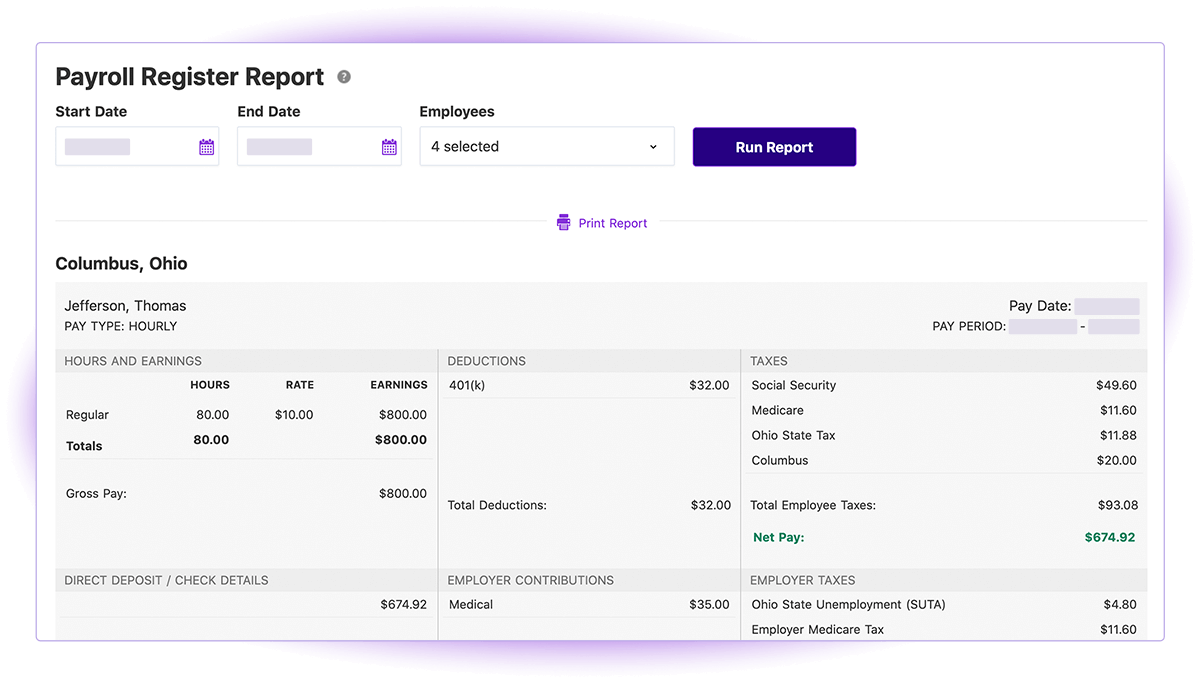

4. Patriot

Patriot Payroll is recognized for its simplicity and its focus on serving the payroll needs of small businesses. This makes it a popular choice for entrepreneurs and small business owners who want to manage payroll efficiently without breaking the bank.

Features of Patriot

-

Multiple pay rates

-

Unlimited payrolls

-

All pay frequencies

-

Multiple locations

-

Customizable hours, money, deductions

-

Mobile friendly

-

Accounting software integration

Top 3 Features of Patriot

1. Payroll Processing

Users can enter employee information, hours worked, deductions, and other relevant data. The software automatically calculates gross pay, deductions, and net pay, making it easier to guarantee accurate and timely payroll processing.

2. Payroll Reporting

Employers can produce payroll documents, including payroll registers, reports on tax obligations, and summaries of year-to-date figures. These documents offer valuable information regarding payroll costs and assist in managing accounting and tax-related tasks.

3. Direct Deposit and Payment Options

Patriot, a QuickBooks alternative, supports direct deposit, which permits businesses to pay their workers electronically. This component comforts employers and employees, eradicating the need for paper checks and reducing administrative tasks.

Pros And Cons of Patriot

Pros

-

Patriot is accessible to small businesses.

-

Simplify the method of reconciling your bank accounts.

-

The intuitive interface provides a smooth experience for users.

Cons

-

Restricted advanced characteristics.

-

It operates on a single database, which may not be eligible for more extensive operations.

Supported Platforms of Patriot

- Windows

- macOS

- Linux

Pricing of Patriot

- Basic Payroll: $17 per month

- Full Service Payroll: 37 per month

Final Verdict on Patriot

Patriot is not the best fit for larger companies with more complex payroll needs, as it caters primarily to small businesses and startups. Patriot Software simplifies the payroll process, allowing users to set up and run payroll quickly. It automates calculations for taxes and deductions for accuracy and compliance.

5. Wagepoint

Wagepoint is a payroll software designed for small to medium-sized businesses, providing an automated, user-friendly platform to streamline payroll processes. It focuses on essential functionalities needed by SMBs, avoiding unnecessary complexity and making it an effective choice for straightforward payroll management.

Features of Wagepoint

-

Payroll

-

Online access

-

Time & Attendance

-

Direct deposit

-

Check printing

Top 3 Features of Wagepoint

1. Payroll Processing

Wagepoint allows businesses to efficiently process payroll by entering employee hours, salaries, and other compensation details. It automatically calculates deductions, taxes, and net pay, simplifying the payroll process.

2. Tax Compliance

Wagepoint is a payroll software solution that plays a key role in helping businesses comply with federal, state, and local tax regulations. It simplifies the often complex process of payroll tax management by handling payroll tax calculations, withholding, and filing payroll tax forms on behalf of the employer.

3. User-Friendly Interface

Wagepoint features a clean and clear user interface, making it easy for users to guide and perform payroll-related tasks without comprehensive training. With its intuitive interface, Wagepoint automates payroll processing, tax calculations, and employee data management tasks.

Pros And Cons of Wagepoint

Pros

-

Wagepoint permits you to create as many invoices as required.

-

Customizes invoices to reflect your brand identity.

-

Ideal for startups and small businesses.

Cons

-

Wagepoint may not offer all the developed features needed by larger institutions.

-

There may be restricted user feedback compared to more established solutions.

Supported Platforms of Wagepoint

- Android

- iOS devices

Pricing of Wagepoint

- Solo Plan: $20/month plus $4 per employee/contractor

- Unlimited Plan: $40/month plus $5 per employee/contractor.

Final Verdict on Wagepoint

Wagepoint, a cloud-based payroll software customized for small to medium-sized businesses, stands out for its user-friendly interface and the convenience of remote accessibility. However, it presents limitations, particularly for larger businesses or those requiring advanced customization.

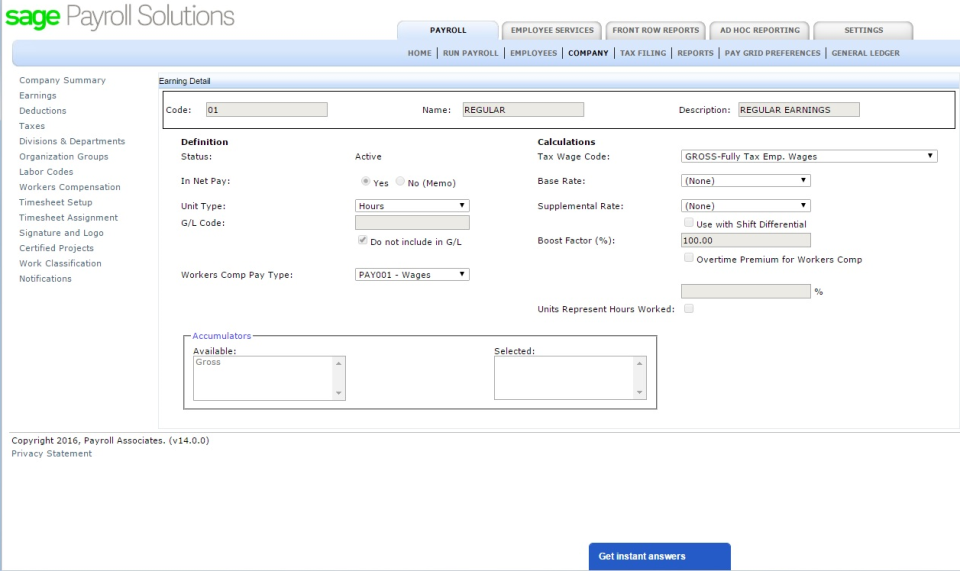

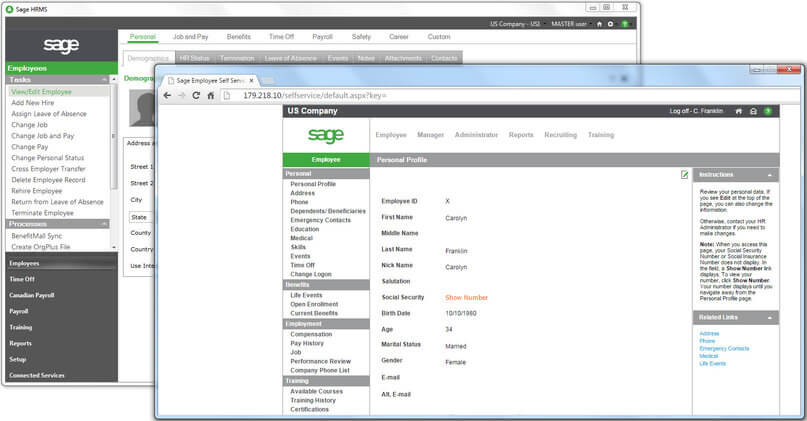

6. Sage

Sage offers a complete accounting and payroll software solution, serving as a potential alternative to QuickBooks Payroll for businesses needing integrated financial and payroll management. Its unified platform smoothly runs the operations, minimizes errors, and optimizes efficiency by combining accounting, payroll processing, tax calculations, and reporting in one system.

Features of Sage

-

Payroll

-

Accounting

-

Finance

-

Business management

-

Cash flow

-

Invoicing

-

Payments

-

Banking

Top 3 Features of Sage

1. Payroll Processing

Sage Payroll software allows businesses to process payroll for their employees efficiently. Users can calculate and manage employee salaries, wages, bonuses, deductions, and taxes.

2. Employee Self-Service

Multiple versions of Sage Payroll offer employee self-service portals, permitting employees to access and control their payroll information, such as pay stubs, W-2 forms, and personal details.

3. Compliance Updates

Sage frequently provides updates to confirm that your payroll software remains compliant with changing tax laws and regulations, reducing the risk of errors and penalties.

Pros And Cons of Sage

Pros

-

Sage provides an array of features for financial management.

-

Access your data securely from any gadget with internet connectivity.

-

Easy to user interface.

Cons

-

Some users may find Sage's advanced features challenging to master.

-

Users have reported glitches and freeze-ups.

-

About 41% of users find Sage's features to be complicated and overwhelming, particularly for small business owners.

Supported Platforms of Sage

- Microsoft Windows

- macOS

Pricing of Sage

- Pro Accounting at $595 per year for 1 user

- Premium Accounting starts at $970 per year for 1 to 5 users

- Quantum Accounting starting at $1,610 per year for 1 to 40 users

Final Verdict on Sage

Sage includes integrated payroll capabilities, making it suitable for businesses of all sizes. The payroll component of Sage simplifies various tasks, such as employee compensation management, tax calculations, and adherence to compliance requirements.

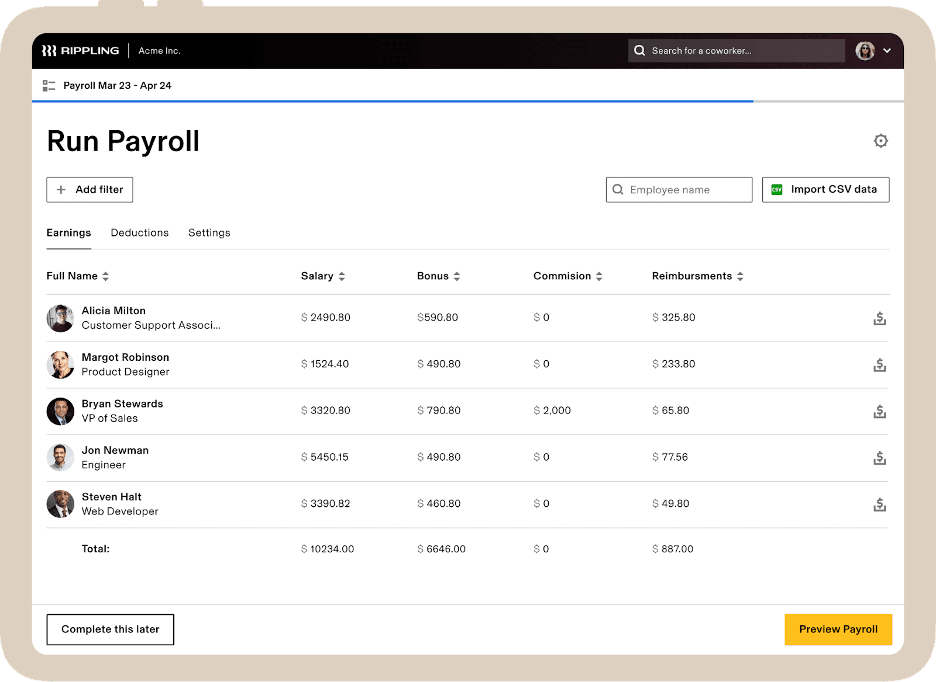

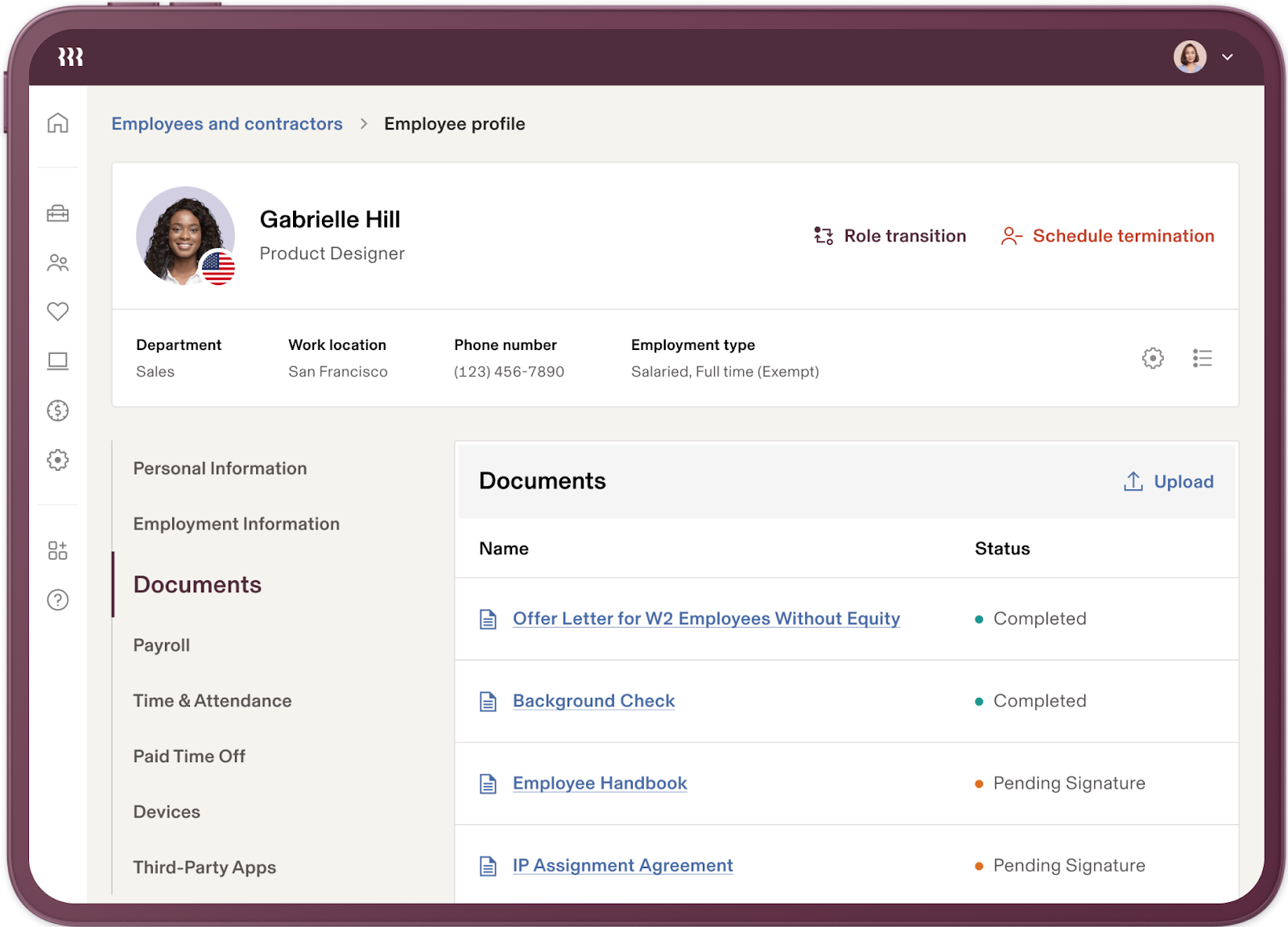

7. Rippling

Rippling is an all-in-one HR and payroll software platform aiming to automate and simplify business workforce management.

It offers a range of features and functionalities to help businesses manage their human resources, payroll, and related tasks more efficiently.

Features of Rippling

-

Payroll

-

Tax compliance

-

Global workforce management

-

Policy management

-

Custom workflows

-

Access & approval management

-

Workforce Analytics

Top 3 Features of Rippling

1. Automated Payroll Processing

Rippling automates the payroll process, helping businesses automate their payroll operations. It can calculate employee wages, taxes, and deductions automatically. It lets businesses manage their payrolls very efficiently.

2. Employee Self-Service Portal

Rippling offers an employee self-service portal that allows workers to access their payroll information, including pay stubs, tax documents, and benefit details. The portal helps workers independently control payroll-related questions and changes, lowering the administrative burden on HR teams.

3. Tax Compliance and Reporting

Ensuring compliance with tax restrictions can be a complex and time-consuming task. Rippling helps companies stay compliant by automatically calculating and withholding the proper amount of federal, state, and local payroll taxes.

Pros And Cons of Rippling

Pros

-

Rippling provides end-to-end HR and payroll solutions

-

The software's design provides a smooth user experience

-

It easily integrates with various business tools

Cons

-

Rippling may have a more increased price point corresponding to some other QuickBooks Payroll alternatives

-

Smaller businesses may find it has more features than required

-

Time-Consuming Setups

-

Steep Learning Curve

-

No Free Trial

Supported Platforms of Rippling

- Android

- iOS devices

Pricing of Rippling

Rippling's pricing starts at $8 per month.

Final Verdict on Rippling

While a comprehensive HR and payroll solution that integrates various components for HR processes and managing payroll, Rippling comes with certain drawbacks, particularly for larger organizations. Despite its advanced functionalities and scalability, Rippling is a potentially more suitable option for larger enterprises with complex HR and payroll needs.

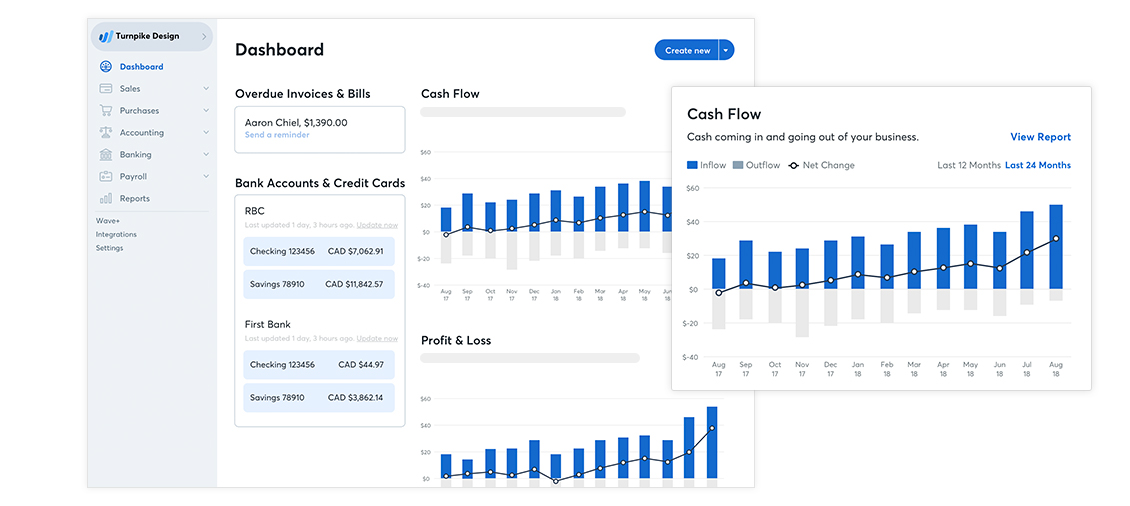

Table Comparison of QuickBooks Payroll Alternatives

|

Feature / Pricing |

Zarmoney |

Sage 50 |

Wave Payroll |

Paylocity |

Patriot Software |

Wagepoint |

Rippling |

|

Cloud-Based Access |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Direct Deposit |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Tax Filing Assistance |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Employee Self-Service Portal |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Mobile App |

✅ |

❌ |

❌ |

✅ |

❌ |

❌ |

❌ |

|

Customizable Reports |

✅ |

✅ |

❌ |

✅ |

✅ |

❌ |

✅ |

|

Integrated Accounting |

✅ |

✅ |

✅ |

❌ |

✅ |

❌ |

✅ |

|

Time Tracking Integration |

✅ |

❌ |

❌ |

✅ |

❌ |

✅ |

❌ |

|

Automated Payroll Runs |

✅ |

❌ |

✅ |

✅ |

✅ |

❌ |

✅ |

|

Compliance Management |

✅ |

❌ |

❌ |

✅ |

✅ |

❌ |

✅ |

|

Starting Price |

Best Value |

High |

Moderate |

Varies |

Low |

Moderate |

High |

|

Ease of Use |

✅ |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Customer Support |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

Best of Best

1. ZarMoney

ZarMoney is a software solution for small and medium-sized businesses, offering cloud-based capabilities for efficient financial management and simplified handling of various accounting functions.

Its integration with Gusto delivers advanced payroll solutions, making it an excellent business choice.

2. Rippling

Rippling is a comprehensive software solution offering various features and tools for payroll management and human resources tasks. It is known for its user-friendly interface and capacity to optimize payroll processing and HR administration.

Users can set up and customize payroll schedules, ensuring employees are paid accurately and on time.

3. Paylocity

Paylocity is a modern cloud-based payroll and HR software solution that simplifies business HR and payroll processes.

Paylocity's forum offers thorough components, including payroll processing, time and attendance tracking, benefits administration, and talent management.

Conclusion

Whether you run a small business or a larger enterprise, choosing a payroll solution that meets your needs and budget is essential. Take advantage of free trials and demos offered by these QuickBooks Payroll alternatives to find the ideal fit for your company.

You have several compelling options to consider for a QuickBooks Payroll alternative. Each alternative offers unique features, pricing plans, and user experiences. After a thorough evaluation, it was found that ZarMoney stands out as the best choice for most businesses.

Frequently Asked Questions (FAQs)

Q1. Which alternative is a leading QuickBooks Payroll alternative?

ZarMoney is a leading alternative to QuickBooks Payroll, offering a complete suite designed for businesses seeking a customized payroll and financial management solution.

Q2. Why should I consider a QuickBooks Payroll alternative?

Analyzing alternatives such as ZarMoney can help you find a solution that fits your business's requirements, budget, and components needed for efficient payroll management.

Q3. Can I integrate other business tools with these payroll solutions?

Many payroll services offer integrations with popular business tools and systems, such as time-tracking software, human resources management systems, and accounting software.

Q4. Which alternative is the most cost-effective?

ZarMoney offers one of the lowest starting prices, making it a cost-effective choice for small businesses.

Q5. Are these alternatives suitable for small businesses?

Many payroll software solutions cater to small businesses, offering scalable features, straightforward usability, and pricing structures that accommodate smaller operations.

Q6. How do I switch from QuickBooks Payroll to another service?

Switching involves several steps: researching and selecting a new payroll provider, exporting your current payroll data, setting up your account with the new provider, importing your payroll data, and testing to guarantee accuracy.

Q7. How does ZarMoney stand out as a QuickBooks Payroll alternative?

ZarMoney stands out by providing easy payroll integration, advanced expense tracking, and a customizable dashboard, all within a user-friendly interface. It simplifies payroll management with direct deposit options, making it an efficient and cost-effective QuickBooks Payroll alternative for businesses seeking straightforward financial tools.

Q8. How does ZarMoney simplify payroll management for businesses?

ZarMoney simplifies payroll management by offering automated features that streamline the setup and execution of pay schedules, tax rates, and deductions. Its direct deposit and tax compliance make it an efficient choice for businesses seeking a hassle-free payroll process.