Fundamentals of Financial Accounting For Small Business Owners

For start-ups, SMEs, and businesses with multiple locations, accounting can be a nightmare, but nobody can escape their accounting responsibilities. Non-profit organizations, such as the Financial Accounting Standards Board (FASB), set out to improve the Generally Accepted Accounting Principles (GAAP), but they often don’t help business owners grasp the basic concepts.

Certified Public Accountants (CPA) can assist with Balance Sheets, managing your assets and keeping your Cash Flow Statement up to date. However, when it comes to the daily running of your company, you need to understand concepts such as debits and credits, invoicing and retained earnings. In this article, we’ll detail some essential concepts as an aid to familiarize yourself.

Interested in the topic? Learn more about Balance Sheet here or discover more about the Cash Flow Statement here.

CPA is the title of qualified accountants. It is equivalent to the chartered accountant. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, almost every state (49 out of 50) has passed mobility laws to allow CPAs from other states to practice in their state. To be able to have a CPA practise requirements vary, but minimum standards include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting related experience.

Learn more about CPAs and their importance for SME here.

Organizing Your Business Finances: A Brief Overview

If you have little to close to zero accounting experience, you need to learn the following terms:

- Gross revenue – the sum of all monies your business has taken in without deducting expenses.

- Expenses – rent, payroll, taxes, interest, debt, material cost, and utilities are expenses. Essentially, all the money you spend to operate your business equals your expenses.

- Net profit – the amount you have left over after deducting your expenses from your gross revenue.

- Cash flow – in basic terms, this refers to how much cash you have on hand. Even if you turn over a profit, you can still fall short of having enough ready money to purchase inventory or pay the bills.

- Breakeven – this is the point where your revenue equals your total expenses.

Using the details above, you can start filling out the following documents:

- Balance Sheet – this is a snapshot of your financial standing at a particular point in time. It lists the equity, assets and liabilities your business holds, allowing you or your accountant to calculate the value of your company. It’s also known as a statement of financial position.

- Income statement – a summary of your company’s expenses and revenues per year.

- Cash flow statement – this reflects your incoming and outgoing transactions during a specific period.

- Revenue forecast – a prediction of how much gross revenue you’ll generate in the upcoming year. You need this to work out how much you can afford to spend and estimate your overall profit.

Accounting software makes managing your financial information clear-cut. In some cases, powerful digital platforms can fill in the documents and statements detailed above automatically as well as handle complex calculations such as double entry where each transaction has equal and opposite effects in a minimum of two different accounts, to minimize the risk of costly errors.

What You Should Know About Taxes

Almost all businesses regardless of size have state and federal tax obligations. You must comply with the law surrounding taxation, or you could face criminal charges, hefty fines and losing your company. There are four types of federal tax:

- Income tax – you need to pay income tax based on your revenue. These taxes are paid on a ‘pay-as-you-go basis,’ meaning you need to pay the tax as you earn or receive income during the year.

- Estimated tax - make estimated tax payments if you expect to owe tax of $1,000 or more when you file your return.

- Self-employment tax – this applies to anybody who works for themselves.

- Employment taxes – how much tax you need to pay on behalf of your workers.

You may also have to contribute towards costs such as social security, withholding taxes, unemployment tax, and excise tax, making it imperative to seek advice from a reliable, professional accountant.

State taxes can vary, with some states having additional requirements such as unemployment insurance and mandated workers’ compensation. Again, discussing your company’s needs with a registered accountant working according to the FASB (Financial Accounting Standards Board) reporting standards in your local area is crucial to find out what you need to pay.

Understanding Your Credit Score

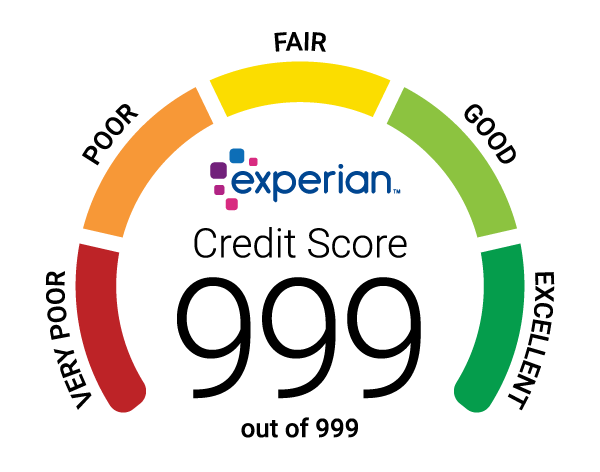

How much business credit you can access primarily depends on your credit rating. Business credit can refer to loans, credit cards, and property leases. By maintaining a solid credit score, you can access more borrowing options for your company.

You can boost your credit score by:

- Paying all your loan bills on time

- Avoiding defaults, judgements, foreclosures, and bankruptcy

- Staying within your limit on your credit card

- Monitoring your credit reports for inaccuracies and discrepancies

- Having a mix of credit, provided you always pay your loan repayments on time

Once you have an employer identification number, you can start building a business credit score in addition to your private rating. Boosting your business credit score revolves around how well you manage money and debt. We recommend discussing ways to improve your business credit score with a professional accountant but using software to make accurate predictions and prevent human error will undoubtedly help.

Learn more about Credit Score here.

Alright, you may say, how to know what's my credit score? I almost never come to work with it, this is what people in bank work with. Are they going to charge me for that?

So first things first. You can view your Credit Score at your local credit union/credit reporting institution. Among the largest ones there are:

- Equifax,

- TransUnion, and

- Experian

Here is a list of Credit Reporting Agencies in the US.

By law, you are entitled to a free credit report from all three major credit reporting agencies once a year. How much is good and when should you start to worry?

- The score under 629 is considered really bad and you should worry

- The score between 630 and 689 is considered still bad, but it's not catastrophic

- The score between 690 and 719 is already fairly good

- The score above 720 is very good and you have no reason to worry

Getting to Grips with Loan Options

Whether it’s to grow your business or handle cash flow challenges, you’ll likely require a business loan at some point. Some of the most common forms of financing include:

- Equipment financing

- Business lines of credit

- Short-term loans

- SBA loans

- Capital investors

- Friends and family

- Crowdfunding

Before 2008, you’d likely need to visit a bank to apply for a loan, but there are now other options available, meaning you may be able to secure funding even if you’re just starting. Term loans can vary between lenders, making it essential for you to understand what you’re signing up to before committing to borrowing. Ask your accountant for advice before taking out a loan you may not be able to afford.

Learn more about business finances in How To Start-Up Financing, AKA What Are New Business Options article or in this guide The Best Ways to Secure More Business Funding For Your Company.

Learn More about Financial Accounting and How We Can Help

Getting to grips with the accepted accounting principles in GAAP and monitoring your financing activities can be made more straightforward with the use of our sophisticated, cloud-based software solutions. At ZarMoney, we’ve been developing digital platforms to help accountants manage their clients’ records since 2006, and we can tailor solutions to meet your unique requirements.

If you have any questions about managerial accounting or the concepts detailed above, we welcome you to contact us. Alternatively, if you’d like to give ZarMoney a test run, you can try it for one month FREE of charge, and you don’t need to supply us with your credit card information until you’re ready to sign up.