What Is a Cash Flow Statement And How Does It Work?

The cash flow statement is a very useful financial statement for evaluating a business or non-profit entity. Accountants prepare it for each accounting period, whether that’s yearly or quarterly for external users, or monthly and yearly for internal purposes. Cash flow statements show comparable information for corresponding periods of the prior one or two years, allowing financial statement readers to assess trends.

What is the Cash Flow Statement?

Generally Accepted Accounting Principles cover the Statement of Cash Flows, as described in ASC 230 which is a section of GAAP codification issued by the Financial Accounting Standards Board (FASB). Other financial statements are the Balance Sheet, which is also known as the Statement of Financial Position, and the Income Statement.

Companies often present a Statement of Stockholders’ Equity in addition to the three main financial statements. The Cash Flow Statement includes sources and uses of cash which are cash receipts and cash payments and gives insight into a company’s liquidity, capital resources, and solvency. It includes three separate sections for cash flow from the operations, investing, and financing.

Why is the Cash Flow Statement Important?

The cash flow statement is important because it shows whether the company has adequate cash generated from operations, how much the company is investing in long term assets like property, plant, and equipment through capital expenditures to expand its business, and the amount of cash, if any, that is provided by financing.

The cash flow statement indicates the ability of a company to meet its financial obligations and pay cash dividends to its shareholders. It also shows the degree of success of the projects in which it has invested in terms of their results to create abundant cash or generate inadequate returns. Through an analysis of the cash flow statement and financial ratios, a business and its stakeholders can make decisions.

How is restricted cash treated in the Cash Flow Statement?

A recent FASB Accounting Statement Update, ASU 2018-16, issued in November 2016 addresses the inclusion of restricted cash in the cash flow statement (Topic 230) as a separate line item or items. This update has implementation dates of 2018 for public business entities and 2019 for non-public business entities.

The FASB produced this update to eliminate inconsistency because some business entities were treating restricted cash as non-cash and not reflecting it in the cash flow statement, while others were treating restricted cash as a cash item. Instead of a total of cash and cash equivalents, the cash flow statement includes a total of cash, cash equivalents, and restricted cash. Cash equivalents, according to GAAP, are

...very short term, highly liquid investments easily convertible to known amounts of cash and that are so near their maturity that they present insignificant risk of changes in value because of changes in interest rates.

An example of a cash equivalent is a Money Market Fund. Restricted cash may include cash used as collateral for a construction loan or cash made to a non-profit entity that is designated for a specific purpose like a flood disaster donation to Red Cross.

How is GAAP applied to the Statement of Cash Flows?

A recent FASB Accounting Statement Update, ASU 2018-15, issued in August 2016 addresses classification of certain cash receipts and cash payments in the cash flow statement (Topic 230). This update has implementation dates of 2018 for public business entities and 2019 for non-public business entities.

The treatment of certain items in the cash flow statement related to recent GAAP is described in a table included in ASU 2018-15. For other items, applicable GAAP should be considered first.

In general, if cash receipts and payments have more than one possible classification, look at sources and uses by its nature and operating, investing, and financing classification, and, if still unclear, then the activity of predominant source or use of cash flows.

Direct vs. Indirect Cash Flow Statement Format

The cash flow statement can either be shown on a direct or an indirect basis. Non-profit entities are no longer required to show a reconciliation between indirect and direct cash flow, according to ASU 2016-14.

Direct Cash Flow Statement

The direct cash flow method shows the sources and uses of cash, cash equivalents, and restricted cash that flow through bank records. The direct cash flow statement includes the three sections for cash flow from operations, cash flow from investing, and cash flow from financing. It also shows the beginning and ending cash, cash equivalents, and restricted cash. Line items in the direct cash flow statement would include cash received from customers and cash paid to suppliers and employees.

Indirect Cash Flow Statement

The indirect cash flow method begins with the net income (or net loss) amount from the Income Statement in the cash flow from operations section of the cash flow statement. Net income is converted to cash flows through a reconciliation within the cash flow statement.

This reconciliation includes adding back non-cash items like depreciation, amortization, additions to the reserve for losses in accounts receivable, and any gain on the sale of assets. Operating cash flows are also determined by looking at changes in the working capital account balances classified as current assets and current liabilities on the balance sheet.

These include increases or decreases in accounts receivable and inventory and changes in the current liabilities section of the Balance Sheet like increases or decreases in the accounts payable balance. The indirect cash flow statement includes the three sections for cash flow from operations, cash flow from investing, and cash flow from financing. The cash flow statement also shows the beginning and ending cash, cash equivalents, and restricted cash (if restricted cash is material).

If the indirect method is used, then interest paid (net of amounts capitalized) and income taxes paid should be disclosed per ASC 230 and described more fully in ASU 2016-15.

Preference for Direct vs. Indirect Cash Flow Statement

Most businesses use the indirect cash flow statement because it is easier to prepare. In contrast, the FASB prefers but does not require, the direct cash flow statement format.

The FASB’s preference for the direct cash flow statement is stated in paragraph 230-10-45-25 in ASC 230, as follows:

In reporting cash flows from operating activities, entities are encouraged to report major classes of gross cash receipts and gross cash payments and their arithmetic sum--the net cash flow from operating activities (the direct method).

According to The CPA Journal Article Preparing the Statement of Cash Flows Using the Direct Method, dated April 2017,

...in FASB’s view, the direct method better achieves the cash flow statement’s primary objective (to provide relevant information about the reporting entity’s cash receipts and cash payments) and the overall objective of financial reporting (to provide information that is useful to users in making investment and credit decisions). FASB also asserts that a direct method statement is more useful to a broad range of users and enhances their ability to predict cash flows, and to assess the relationship between amounts reported on the income statement and the statement of cash flows.

Example Cash Flow Statement with Classifications

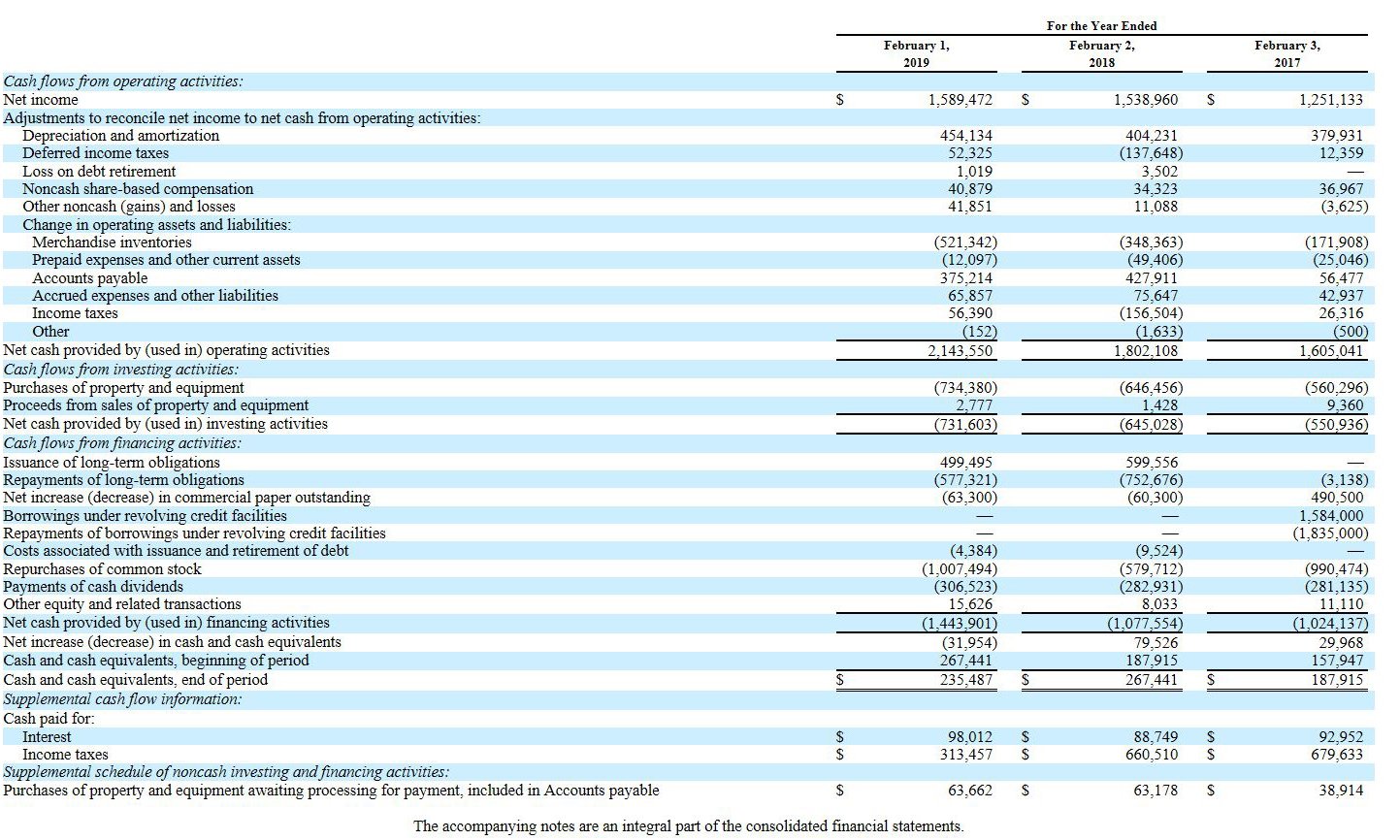

As an example, the Consolidated Statements of Cash Flows for the latest three years ended February 1, 2019 - 2017 from Dollar General’s Form 10-K filed with the SEC, using the indirect format is shown below:

As stated above, the Statement of Cash Flows includes three sections showing the type of cash flow:

Cash Flow from Operating Activities

This section begins with the reconciliation of net income to cash flow from financing activities through an adjustment for non-cash items.

Next, the change in operating assets and liabilities is shown by account type, generally including accounts receivable, inventories, accounts payable, and other accrued liabilities including interest payable and income taxes payable.

Dollar General has grouped accounts receivable with prepaid expenses and other current assets and includes interest payable in the Other line item.

Increases in accounts receivable result in a decrease in the amount of cash that was attributed to sales included in net income, whereas the collection of accounts receivable that decreases the accounts receivable balance are considered an increase in cash.

Increases in inventory decrease cash; reductions in inventory balances increase cash. (Non-cash accounts receivable and inventory adjustments are reconciliations to net income.)

Increases in liabilities like accounts payable increase cash (until paid).

Decreases in liabilities like accounts payable are accompanied by a payment of cash, which decreases cash.

This section concludes with the total of net cash provided by (used in) operating activities.

Cash Flow from Investing Activities

This section lists the investing activities by type. Investing activities include purchases or sales proceeds of long term assets including property plant and equipment, otherwise known as fixed assets, insurance proceeds received for damaged equipment, and investments in other companies’ equity or debt with either a short term or long term holding period.

Acquisitions of companies may be shown as one or more line items net of acquired cash included in the acquisitions. Purchases of fixed assets are considered capital expenditures.

The Dollar General cash flow statement shows purchases of property and equipment and proceeds from the sale of property and equipment as separate line items then total cash flow from investing activities.

Cash Flow from Financing Activities

This section lists the financing activities by type. Financing activities include bank financing including revolving credit lines, the issuance of debt or equity securities, the repurchase of stock as Treasury Stock, and the payment of cash dividends to shareholders.

The Dollar General cash flow statement shows financing activities, then totals cash flow from financing activities.

Cash, Cash Equivalents and Restricted Cash

The next line item is the net increase (decrease) in cash, cash equivalents, and restricted cash (if relevant) or net increase (decrease) in cash and cash equivalents.

The Dollar General cash flow statement does not mention restricted cash. If the business has restricted cash balances that aren’t material in amount, per generally accepted accounting principles, restricted cash doesn’t need to be separately disclosed.

Dollar General’s cash flow statement only refers to cash and cash equivalents. This section concludes with cash and cash equivalents, beginning balance and cash and cash equivalents, ending balance.

The cash balances should be the same numbers shown on the balance sheet.

Supplemental Disclosures on the Cash Flow Statement and Financial Statements

Supplemental disclosures include separate line items disclosures for the amount of cash paid for interest expenses and the amount of cash paid for income taxes. Supplemental disclosures also include non-cash items included in the cash flow statement that have not already been disclosed in the reconciliation of net income to operating cash flows.

The Dollar General cash flow statement includes the amount of property and equipment purchases for which cash has not yet been paid.

Disclosures in the financial statements should also include cash which isn't available for use i.e. restricted cash, according to ASC 230 paragraph 230-10-50-7.

Cash Flow-Related Disclosure required by the SEC

For public companies, Liquidity and Capital Resources is an element of the Management’s Discussion and Analysis (MD&A) section of the 10-K Annual Report. This section describes cash flows by operating, investing, and financing classifications and management’s assessment of the firm’s liquidity and ability to pay its financial obligations.

It includes disclosure of capital expenditures and a description of major types of sources and uses of cash.

Using Accounting Software to Generate the Cash Flow Statement

Creating the cash flow statement would be time-consuming without the use of accounting software that can automatically do the job. ZarMoney is a cloud-based accounting software package that generates the cash flow statement in addition to the balance sheet and income statement. Better yet, ZarMoney provides free or low-cost software to users, depending on their organization size and requirements. Check it out.

Interpreting and Analyzing Cash Flow

The cash flow statement in combination with financial ratio analysis gives stakeholders an understanding of the company’s cash and working capital status. Working capital includes cash and cash equivalents, accounts receivable, inventory and other current assets, offset by accounts payable and other current liabilities.

Some areas to analyze include:

- Is the business making investments that generate future growth and increased cash flow over time?

- Are accounts receivable and inventory balances under control, with a good rate of turnover through collection and sales, respectively?

- Are accounts payable stretched to the extent possible to still retain good relations with vendors? Is the company able to pay its liabilities?

- Does the company have the ability to obtain financing and repay that financing?

- Does it look like the company is on the verge of bankruptcy?

- Is the non-profit entity receiving increased cash donations each year and making cash payments within its ability to pay?

Key Takeaways

The Statement of Cash Flows is prepared under GAAP and required by all entities that prepare financial statements in conformity with FASB. The SEC requires public entities to include a cash flow statement and disclosures related to cash flows in their SEC filings.

The indirect cash flow presentation is more popular than the direct cash flow format. The cash flow statement is constructed from the balance sheet and income statement amounts.

ZarMoney, a cloud-based accounting software platform, can create the cash flow statement automatically to save you time.