7 Best Ecommerce Accounting Software That Can Scale Your Business

Starting an e-commerce business means you'll deal with a lot of numbers and transactions.

Keeping track of all that money can be tough, but the right accounting software can make it much easier.

In this blog post, we'll explore the best e-commerce accounting software out there. These tools can help you manage your finances better and grow your business.

Whether you're just starting or looking to improve your current system, there's something here for everyone.

Let's check out the options and find the perfect fit for your business.

List of the Best Ecommerce Accounting Software That Can Scale Your Business

- ZarMoney

- QuickBooks

- Xero

- FreshBooks

- Bench Accounting

- Kashoo

- Wave

1- ZarMoney

ZarMoney is an all-inclusive ecommerce accounting software designed to simplify financial management for online businesses. It offers a range of features that are specifically tailored to meet the unique needs of ecommerce enterprises, helping you keep track of all financial aspects of your business with ease.

Features of ZarMoney

ZarMoney comes packed with features that cater to the specific requirements of ecommerce accounting, including:

- Inventory Management

- Multi-Channel Sales Integration

- Automated Billing and Invoicing

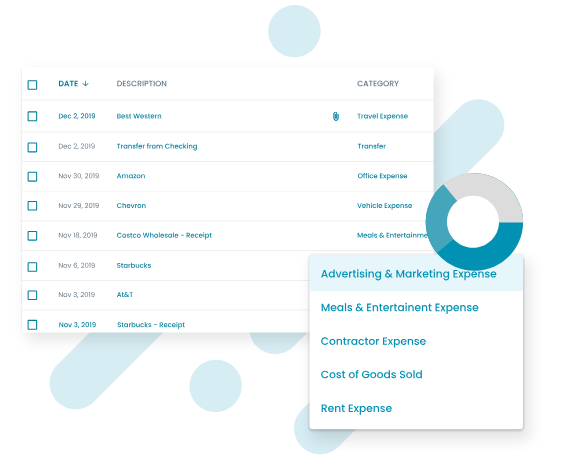

- Expense Tracking

- Financial Reporting

- Order Management

- Tax Compliance

- Customer and Vendor Management

Top 3 Features of ZarMoney

1. Automated Billing and Invoicing

Automated billing and invoicing automate your payment processes, making it faster and reducing errors. This feature ensures that invoices are sent out on schedule and payments are tracked accurately.

2. Order Management

ZarMoney is a modern order management system designed for growing businesses. It helps reconcile payments, upscale sales, and streamline multichannel order processes. With features like live inventory management and real-time access, ZarMoney offers tools to manage inventory, track orders, and ensure customer satisfaction efficiently and cost-effectively.

3. Inventory Management

Effective inventory management is essential for ecommerce businesses. ZarMoney provides real-time tracking of stock levels, alerts for low stock, and data on product performance, which helps in making better purchasing decisions.

Pros of ZarMoney

- Easy integration with ecommerce platforms

- Real-time financial reporting and analytics

- Efficient inventory and order management

- Simplifies tax preparation and compliance

Cons of ZarMoney

- Can be overwhelming for beginners due to its extensive features

Pricing of ZarMoney

ZarMoney has two pricing plans

- 15 Days Free trial

- Small Business $20 / month / 2 users

- Enterprise $350 / month / 30+ users

Customer Support of ZarMoney

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Supported Platforms of ZarMoney

- Windows

- macOS

- Linux

- iOS mobile app

- Android mobile app

Reviews

Rating

ZarMoney has been given a rating of 4.7 out of 5 on Software advice.

Final Verdict on ZarMoney

ZarMoney is an excellent choice for ecommerce businesses looking to automate their accounting processes. With features like automated billing, sales integration, and inventory management, ZarMoney is a tool that can truly scale your business. No matter the size of your business, ZarMoney can surely make your financial management much simpler and more efficient.

2. QuickBooks

QuickBooks is a well-known ecommerce accounting software that makes managing your business finances efficient. It’s designed to help online businesses keep their finances in check with various features that cater specifically to the ecommerce sector.

Features of QuickBooks

QuickBooks offers several essential features that are beneficial for ecommerce accounting:

- Automated Expense Tracking

- Effortless Integration with Ecommerce Platforms

- Advanced Inventory Management

- Detailed Financial Reports

- Sales Tax Calculations

- Invoice and Payment Processing

Top 3 Features of QuickBooks

1. Effortless Integration with Ecommerce Platforms

This feature allows QuickBooks to easily connect with your ecommerce platform, making sure all your sales data is synced. This helps maintain up-to-date financial records without manual data entry.

2. Advanced Inventory Management

Manage your inventory efficiently with QuickBooks’ advanced tools. It updates your stock levels in real-time and provides alerts for reorder points, ensuring you never run out of your best sellers.

3. Detailed Financial Reports

QuickBooks offers reporting tools that give you a clear understanding of your financial health. These reports can help you make informed decisions by showing trends and financial forecasts.

Pros of QuickBooks

- Extensive integration options with ecommerce platforms

- Real-time inventory and sales tracking

- User-friendly interface

Cons of QuickBooks

- Higher cost compared to some other options

- Too many error messages.

- A limited number of fields.

- File size issues

Pricing of QuickBooks

- Simple Start: $18 per month

- Essentials: $27 per month

- Plus: $38 per month

- Advanced: $76 per month

Customer Support of QuickBooks

- Chat

- Knowledge Base

- 24/7 (Live rep)

- FAQs/Forum

- Email/Help Desk

- Phone Support

Supported Platforms of QuickBooks

- Windows

- macOS

- iOS mobile app

- Android mobile app

Reviews

Rating

QuickBooks Online has been given a rating of 4.3 out of 5 on Software advice.

Final Verdict on QuickBooks

QuickBooks is a great ecommerce accounting software choice for businesses of all sizes. Its ability to integrate effortlessly with online sales platforms and provide detailed financial insights makes it a powerful tool for managing your ecommerce finances efficiently. With QuickBooks, you can easily optimize your business's financial management.

3. Xero

Coming in at number 3 on our list, Xero is an accounting software that offers a wide range of features to manage your business finances effectively. This software is designed to streamline various accounting tasks, making it easier for you to focus on growing your business.

Features of Xero

Xero provides several features specifically designed for ecommerce businesses, including:

- Pay Bills

- Claim Expenses

- Bank Connections

- Accept Payments

- Online Invoicing

- Multi-currency Accounting

- Purchase Orders

- Quotes

- Sales Tax

- Analytics

- Accounting Dashboard

Top 3 Features of Xero

1. Bank Connections

Xero simplifies financial management by connecting with thousands of banks globally. This feature saves you hours each week by automatically importing and categorizing bank transactions.

2. Online Invoicing

Send professional invoices and set up recurring billing with ease. Xero’s online invoicing system allows you to manage payments more efficiently, ensuring you get paid faster.

3. Analytics

The analytics tools in Xero provide valuable insights into your business's financial health. Upgrade to Analytics Plus for even deeper analysis and cash flow forecasting, helping you make informed business decisions.

Pros of Xero

- Automated features for billing, expenses, and payroll

- Advanced reporting and analytics tools

- User-friendly interface with accessible customer support

Cons of Xero

- Impossible to assess subsidiaries' performance in real-time

- Limited bank connections

- Tedious to remove transactions

Pricing of Xero

- Starter Plan: $29 per month

- Standard Plan: $46 per month

- Premium Plan: $62 per month

Customer Support of Xero

- 24/7 online support

- Dedicated help center

- Community forums

- Regular webinars and training sessions

Supported Platforms of Xero

- Windows

- macOS

- iOS

- Android

Reviews

Rating

Xero has been given an average rating of 4.4 out of 5 by its patrons according to Software advice.

Final Verdict of Xero

With its wide range of features and integrations, Xero can significantly simplify your financial management tasks, letting you focus more on business growth. Xero provides the tools required by both small businesses and established enterprises to maintain a healthy financial system.

4. FreshBooks

FreshBooks is a user-friendly ecommerce accounting software that helps you manage your business finances efficiently. It's perfect for small to medium-sized online businesses that need a simple yet effective accounting solution.

Features of FreshBooks

FreshBooks offers several key features designed for ecommerce accounting:

- Invoicing

- Expense Tracking

- Time Tracking

- Payment Processing

- Financial Reporting

- Project Management

- Estimates

- Recurring Billing

- Multi-Currency

Top 3 Features of FreshBooks

1. Invoicing

FreshBooks makes it easy to create and send professional invoices. You can customize them with your logo and brand colors. Moreover, you can get paid faster with clear and easy to understand invoices.

2. Expense Tracking

Automatically track your expenses with FreshBooks. It categorizes them for you, making it simple to see where your money is going and stay on top of your budget.

3. Payment Processing

FreshBooks lets you accept payments directly from your invoices. Clients can pay via credit card or ACH, which means you get paid faster and more efficiently.

Pros of FreshBooks

- Easy to use with a simple interface

- Automated invoicing and expense tracking

- Mobile app for on-the-go accounting

Cons of FreshBooks

- Limited customization options for reports

- May not be suitable for very large businesses

- Some advanced features require higher-tier plans

- Integration options can be limited

Pricing of FreshBooks

- Lite Plan: $19 per month

- Plus Plan: $33 per month

- Premium Plan: $60 per month

Customer Support of FreshBooks

- 24/7 email support

- Phone support during business hours

- Extensive help center with articles and tutorials

- Live chat support

Supported Platforms of FreshBooks

- Windows

- macOS

- iOS

- Android

Reviews

Rating

The average rating for FreshBooks is 4.5 out of 5.

Final Verdict on FreshBooks

FreshBooks’ user-friendly interface, automated features, and strong customer support make it a great choice for managing your business finances. If you are looking to streamline your accounting processes, FreshBooks should be your go-to as it offers the tools you need to stay organized and get paid faster.

5. Bench Accounting

Next up, Bench Accounting is a simple and reliable ecommerce accounting software that helps businesses keep track of their finances. With Bench, you get a team of professional bookkeepers to handle your accounting, making it easy for you to focus on growing your business.

Features of Bench Accounting

Bench Accounting offers several features customized for ecommerce businesses:

- Monthly Bookkeeping

- Financial Statements

- Expense Tracking

- Tax Preparation

- Cash Flow Management

Top 3 Features of Bench Accounting

1. Monthly Bookkeeping

A dedicated bookkeeper manages your financial records every month. This feature ensures your books are accurate and up-to-date, saving you time and effort.

2. Financial Statements

Receive detailed monthly financial reports, including income statements and balance sheets. These reports can help you understand your business’s financial health and make informed decisions.

3. Expense Tracking

Track and categorize all your business expenses easily. This feature helps you keep your spending in check and ensures you’re ready for tax time.

Pros of Bench Accounting

- Professional bookkeeping services included

- Detailed monthly financial reports

- Easy expense tracking

Cons of Bench Accounting

- Higher cost compared to DIY software

- Limited to cash-basis accounting

- No inventory management features

- Limited integrations with other software

Pricing of Bench Accounting

- Essential Plan: $249 per month

- Premium Plan: $399 per month

Customer Support of Bench Accounting

- Phone support

- Email support

- Live chat

- Dedicated bookkeeper for personalized support

Supported Platforms of Bench Accounting

- Web-based platform (accessible via any browser)

- iOS app

- Android app

Reviews

Rating

The average rating for Bench Accounting is 4.5 out of 5.

Final Verdict on Bench Accounting

Bench Accounting is a great choice for ecommerce businesses looking for reliable and professional bookkeeping services. With features like monthly bookkeeping, detailed financial statements, and easy expense tracking, Bench takes the stress out of managing your finances. If you want a hands-off approach to your accounting, Bench is a top option to consider.

6. Kashoo

Kashoo is ranked number 6 on our list of ecommerce accounting software. It's designed to help small businesses manage their finances easily and efficiently. With Kashoo, you can handle all your accounting tasks in one place.

Features of Kashoo

Kashoo offers several features that are perfect for ecommerce businesses:

- Automated Bookkeeping

- Invoicing

- Expense Tracking

- Financial Reporting

- Bank Reconciliation

- Tax Preparation

- Multi-Currency Support

Top 3 Features of Kashoo

1. Automated Bookkeeping

Kashoo automatically imports and categorizes your transactions, saving you time and reducing errors. This feature ensures your books are always up to date.

2. Invoicing

Easily create and send professional invoices to your customers. This feature allows you to customize your invoices and set up recurring billing.

3. Expense Tracking

Track and manage all your business expenses in one place. Kashoo helps you keep your spending organized and makes it easier to prepare for tax time.

Pros of Kashoo

- Simple and easy to use

- Automated transaction categorization

- Professional invoicing features

- Multi-currency support

Cons of Kashoo

- Limited integrations with other software

- Basic inventory management

- No payroll features

- Limited customization options

Pricing of Kashoo

- TrulySmall: $216 per year

- Kashoo Plan: $324 per year

Customer Support of Kashoo

- Email support

- Phone support

- Live chat

- Help center with articles and tutorials

Supported Platforms of Kashoo

- Web-based platform (accessible via any browser)

- iOS app

- Android app

Reviews

Rating

The average rating for Kashoo is 4.6 out of 5.

Final Verdict of Kashoo

Kashoo is a great choice for small ecommerce businesses looking for simple and effective accounting software. With features like automated bookkeeping, professional invoicing, and expense tracking, Kashoo makes managing your finances easy. While it may lack some advanced features, it offers everything you need to keep your business finances in order.

7. Wave

Being ranked number 7 on our list of ecommerce accounting software, Wave is a free tool that helps small businesses manage their finances easily. With Wave, you can handle everything from invoicing to expense tracking without spending a dime.

Features of Wave

Wave offers several features that are perfect for ecommerce businesses:

- Invoicing

- Expense Tracking

- Financial Reporting

- Bank Reconciliation

- Receipt Scanning

- Multiple Businesses

- Payroll Services

Top 3 Features of Wave

1. Financial Reporting

Generate detailed financial reports to understand your business's financial health. These reports help you make informed decisions and plan for the future.

2. Invoicing

Create and send professional invoices with ease. Wave’s invoicing feature allows you to customize invoices and set up recurring billing, helping you get paid faster.

3. Expense Tracking

Track and manage all your business expenses effortlessly. Wave’s expense tracking helps you stay organized and makes tax time a breeze.

Pros of Wave

- Completely free to use

- Easy to set up and use

- Professional invoicing features

Cons of Wave

- Limited integrations with other software

- Basic inventory management

- No advanced reporting features

- Payroll services are not free

Pricing of Wave

- Free plan

- Payroll Services: Starts at $16 per month

Customer Support of Wave

- Email support

- Live chat support

- Help center with articles and tutorials

- Community forum for user discussions

Supported Platforms of Wave

- Web-based platform (accessible via any browser)

- iOS app

- Android app

Reviews

Rating

The average rating for Wave is 4.4 out of 5.

Final Verdict of Wave

With features like free accounting, professional invoicing, and easy expense tracking, Wave provides everything you need to manage your finances without breaking the bank. While it may lack some advanced features, it offers a solid foundation for any small business looking to stay organized and efficient. If you’re on a tight budget, Wave is definitely worth considering.

Table Comparison - Top 3 Ecommerce Accounting Software

|

Features |

ZarMoney |

QuickBooks |

Xero |

|

Automated Billing and Invoicing |

✅ |

✅ |

✅ |

|

Multi-Channel Sales Integration |

✅ |

✅ |

❌ |

|

Real-Time Inventory Management |

✅ |

✅ |

❌ |

|

Financial Reporting |

✅ |

✅ |

✅ |

|

Expense Tracking |

✅ |

✅ |

✅ |

|

Tax Compliance |

✅ |

✅ |

✅ |

|

Customer and Vendor Management |

✅ |

✅ |

❌ |

|

Advanced Analytics |

✅ |

❌ |

❌ |

|

Bank Reconciliation |

✅ |

✅ |

✅ |

|

Payroll Integration |

✅ |

✅ |

❌ |

|

User-Friendly Interface |

✅ |

✅ |

✅ |

|

24/7 Customer Support |

✅ |

❌ |

❌ |

|

Multi-Currency Support |

✅ |

✅ |

✅ |

Best of the Best

1. ZarMoney

ZarMoney is the best software for ecommerce accounting. It has everything you need, like automated billing, multi-channel integration, real-time inventory, and 24/7 support. It's a complete solution to manage your business finances easily.

2. QuickBooks

QuickBooks is great for e-commerce accounting, and it has features like invoicing, expense tracking, and inventory management. However, it lacks advanced analytics, 24/7 support, and seamless payroll integration.

3. Xero

Xero offers solid features like invoicing, expense tracking, and multi-currency support. But it misses out on multi-channel integration, advanced analytics, and 24/7 support, making it less comprehensive than ZarMoney.

Conclusion

Choosing the right ecommerce accounting software can make a big difference in how smoothly your business runs.

Each tool that we've covered offers unique features that can help you manage your finances better and grow your business.

For a powerful and user-friendly solution, ZarMoney stands out as an excellent choice. It's packed with features designed to help you manage your ecommerce finances efficiently.

With the right software, you can save time, reduce errors, and focus more on growing your ecommerce business.

Frequently Asked Questions

1. What is ecommerce accounting software?

Ecommerce accounting software helps online businesses manage their finances. It includes features like invoicing, expense tracking, and inventory management to keep your financial records accurate and up-to-date.

2. Why do I need ecommerce accounting software?

You need ecommerce accounting software to automate financial tasks, reduce errors, and save time. It helps you keep track of sales, expenses, and taxes, making it easier to manage your business finances.

3. Is there a free ecommerce accounting software?

Yes, ZarMoney offers a 15-day free trial with essential features like invoicing, expense tracking, and financial reporting. It's a good option for small businesses on a budget.

4. Can ecommerce accounting software integrate with my online store?

Yes, most ecommerce accounting software like ZarMoney, QuickBooks, and Xero can integrate with popular online stores and marketplaces, ensuring your sales data is automatically synced and accurate.

5. Which ecommerce accounting software is best for small businesses?

For small businesses, ZarMoney is highly recommended because it offers comprehensive features like automated billing, real-time inventory management, and 24/7 customer support, making it a complete solution for managing finances.

6. How do I choose the right ecommerce accounting software?

Choose the right ecommerce accounting software by considering your business needs, budget, and the features offered. Look for software that integrates with your online store, provides accurate financial reports, and offers good customer support.