8 Best Invoicing Software for Businesses

Generating invoices and dispatching them to customers for payments is a tedious and time-consuming process if done manually. Hence, businesses have started seeking solutions to automate laborious processes like invoice processing and management to boost efficiency and optimize resource capacity.

Finding a solution that’s the right fit for your business isn’t easy especially when there are countless alternatives with more or less similar features and capabilities. And, it’s certainly not feasible to test all of them to figure out which one is more suitable for your operations.

If you’ve been seeking an invoicing solution best suited for your needs, let us help you out with that.

Buyer’s Guide to Invoicing Software

In this article, we will recommend the 8 best invoicing solutions. We have conducted thorough research and selected the top most preferred invoicing solutions for you. Our recommendations are based on detailed scrutiny of features, prices, pros & cons, customer reviews, value-added benefits, and more.

1 - What is an Invoicing Software?

Invoicing software is a billing solution that enables users to automatically or manually generate bills or payment transcripts for products or services offered. The perks offered by an invoicing platform vary from industry to industry as businesses but to its core, an invoicing solution facilitates businesses with timely collection of payments from customers or settlement of payables to vendors.

2 - What Makes a Great Invoicing Software?

There are many invoicing solutions available in the market, each with its distinct set of features and unique selling propositions offered to customers. The features offered by an invoicing platform may vary according to the business needs or industry best practices. Here are some of the key characteristics that make an invoicing solution worth investing in:

- Invoice creation

- Recurring invoices

- Billing automation

- Creation and maintenance of customer records

- Credit card processing

- Invoicing templates

- Multiple currency options

- Quotes and estimates

- Online payment

- Reporting and analytics

- Tax calculation

3 - Why Use an Invoicing Solution?

An invoice is an accounting instrument that facilitates both buyers and sellers - serving as proof or record of the transaction. Invoices also come in handy for tracking the due payments or amount that is owed. However, maintaining invoices is a hectic process and involves a lot of number crunching.

An invoicing solution not only automates the menial tasks for creating, maintaining, and processing invoices but also minimizes the chances of human error. With a feature-rich invoicing software at disposal, users can maintain a sales record against listed products or services, provide quotes or estimates, dispatch bills, collect payments, and calculate taxes seamlessly without having to rely on manual processes.

4 - Use Cases

There’s a variety of use-cases from business or customer point-of-view. Here’s how invoicing platforms serve businesses and their respective customers.

Client Management

Used by business account administrators for keeping client records for maintaining healthy and lasting relationships.

Supplier Management

Enables businesses to manage suppliers by maintaining contacts and information about the goods purchased.

Accounts Management

Used by businesses to manage accounts for clients or suppliers for seamless repeated transactions.

Quotes or Estimates

Used by businesses to create and dispatch quotes to potential buyers - giving them an estimate of payment for required products or services.

Invoice Creation

Used by accountants or businesses to automate the billing workflows and seamlessly create invoices for payable or receivable amounts.

Credit Management

Used by businesses to record and manage credit transactions against payable or receivable amounts.

Payment Collection

Used by businesses to securely collect online payments for products sold or services offered and transfer funds directly into the bank account(s).

Tax Calculation & Payment

Used by businesses to automate the menial taxation process - calculating the amount payable for the earned profits and its payment without any hassle.

Quote Request

Used by customers to request a quote or estimated amount payable for required products or services by a company.

Online Payment

Used by customers to pay online securely and hassle-free for products ordered, services availed, or subscriptions.

Sales Orders or Invoices

Used by customers to receive and store a transcript that serves as proof of products purchased or services availed.

5 - Key Features to Look for in an Invoicing Solution

Most invoicing solutions offer a variety of features with some focusing on the dynamics of the industry they’re targeting. However, we have generalized some of the core characteristics of invoicing tools. Here are the key features to consider when choosing an invoicing solution:

- Invoice creation

- Invoice scheduling

- Recurring invoices

- Quotes and estimates

- Quote to invoice conversion

- Client management

- Credit management

- Payment reminders

- Sales orders or receipts

- Payment gateways

- Online payment

- Advance payment

- Payment discounts

- Invoice customization

- Custom templates

- Custom fields

- Expense tracking

- Mileage tracking

- Time tracking

- Billing automation

- Multiple currencies

- Reports and analytics

- Roles and permissions

- Tax calculation and payment

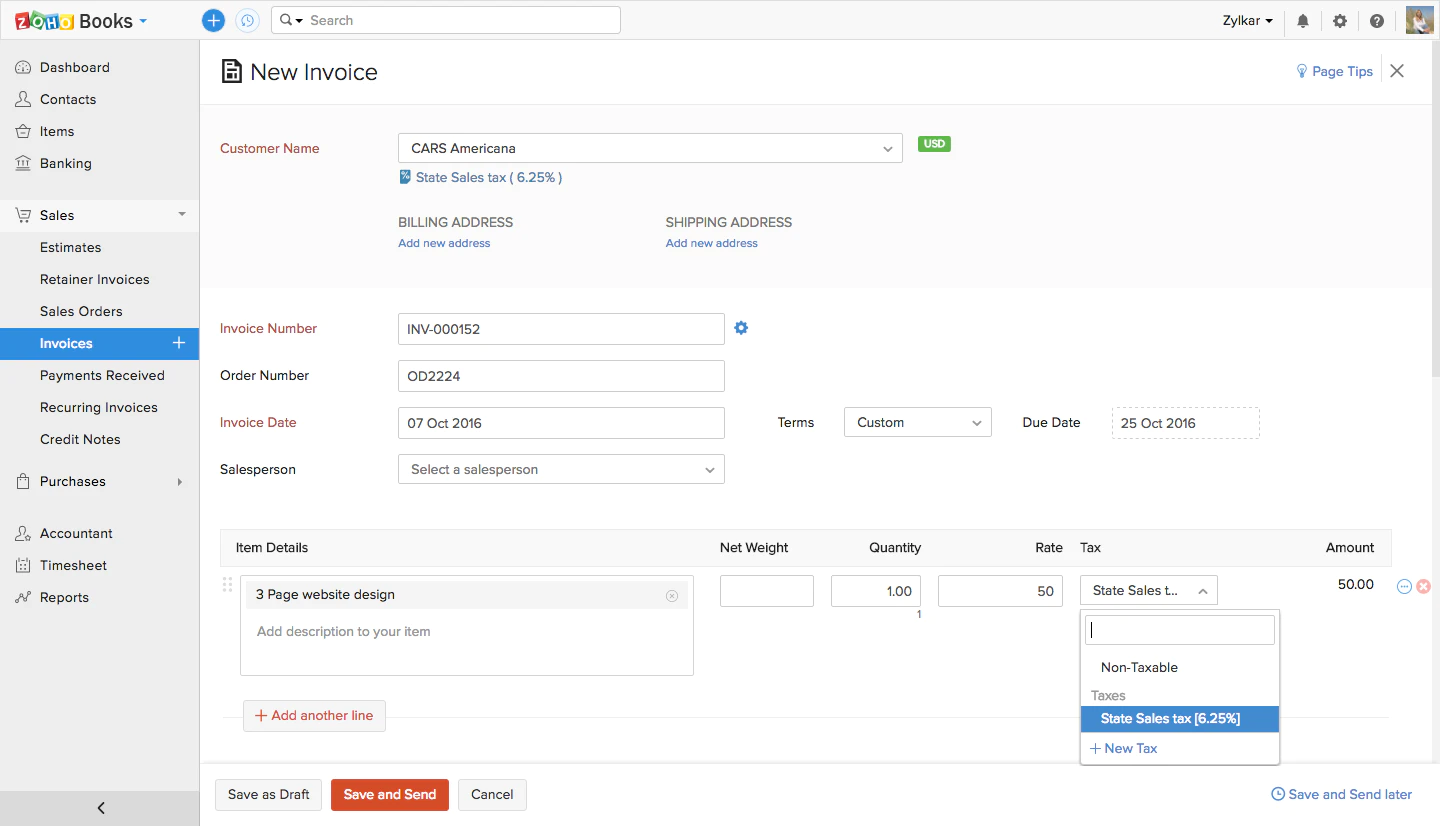

Invoice Creation

Invoice creation is the core feature of any invoicing solution to look for - giving users the ability to generate invoices for the amount payable or receivable.

Invoice Scheduling

Invoice scheduling is an important feature to look for in an invoicing solution as it empowers users to automatically send out an invoice on a future date without having to do it manually.

Recurring Invoices

Recurring invoices refer to an invoicing software’s ability to generate invoices for transactions occurring at repeated intervals. This minimizes the hassle of creating the invoices from scratch for similar transactions that have happened in past or have been happening concurrently.

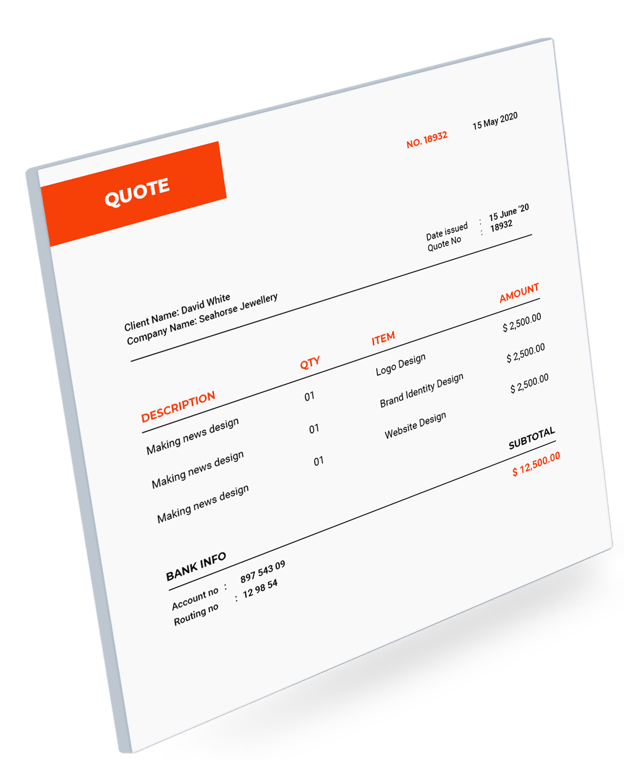

Quotes or Estimates

The quotes or estimates feature of an invoicing tool allows sellers to give buyers an estimation of payable amount for selected products, services, or a project. This is not only is a handy feature for sellers or service providers but also facilitates buyers’ budgetary decisions - allowing both parties to carry out future transactions without any misunderstanding or likelihood for conflict.

Quote to Invoice Conversion

The quote-to-invoice conversion feature of an invoicing solution enables users to automatically generate an invoice for the estimated amount once it has been agreed upon by concerned parties and approved. This helps users automate the invoicing process - minimizing the menial tasks involved.

Client Management

The client management feature of invoicing software enables users to maintain lasting relationships by storing records of all transactions along with customer information. Some solutions also come with a client portal for users’ potential customers - fueling buyer-seller collaboration as clients can access all their transactions from a single platform and inquire in case of any query.

Credit Management

Not all transactions are done via cash, some involve credit. This is where the credit management feature of invoicing software comes in handy - enabling users to maintain records of unpaid invoices or amounts receivable by customers with respective client information.

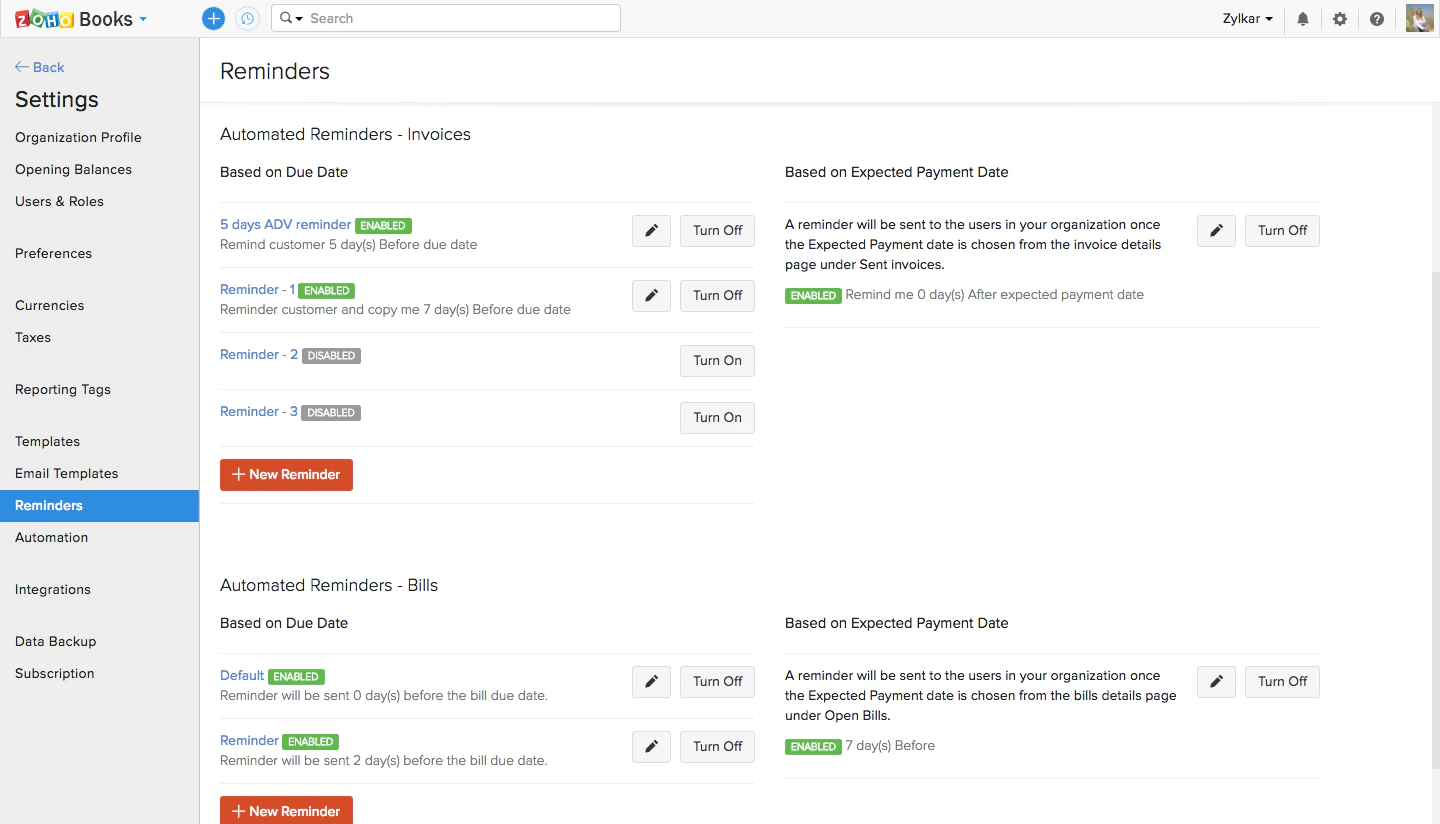

Payment Reminders

Payment collection is one of the nightmares to encounter when operating in credit-based transactions. Buyers have to repeatedly poke and remind customers of the outstanding amounts. This is where the payment reminder feature of an invoicing platform can help - allowing users to chase payments by sending automated reminders for the due amounts.

Sales Orders or Receipts

An invoicing solution’s ability to create sales orders enables users to generate transcripts specifying details of products purchased or services paid for. The benefit of generating sales orders or receipts is that these documents not only serve as a verifiable record for audit but also facilitate as a proof of transaction for customers.

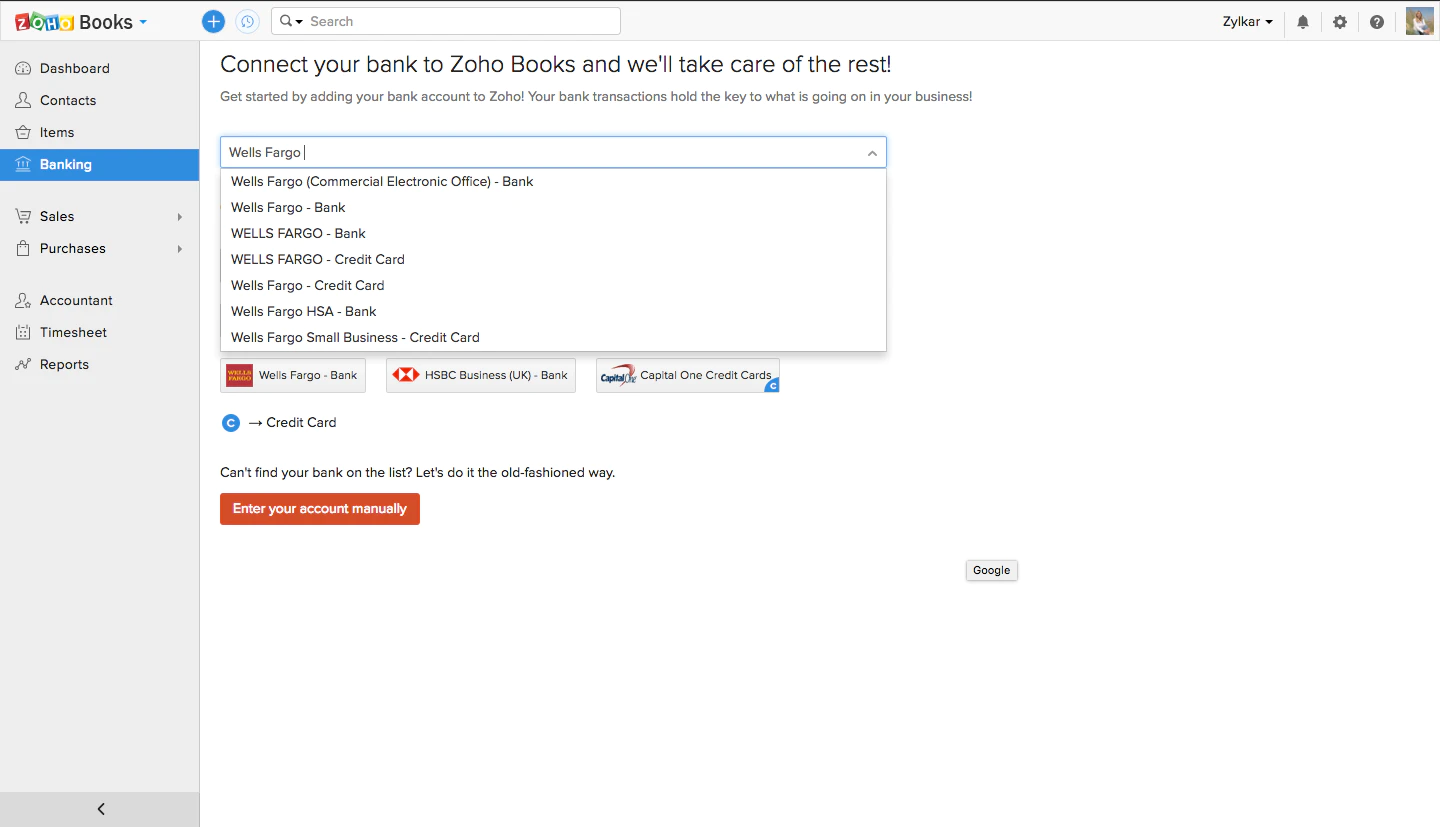

Payment Gateways

Payment gateway support refers to an invoicing software’s ability to facilitate payments transactions routed by a variety of payment providers such as PayPal and Stripe. The more payment gateways supported by an invoicing platform the merrier.

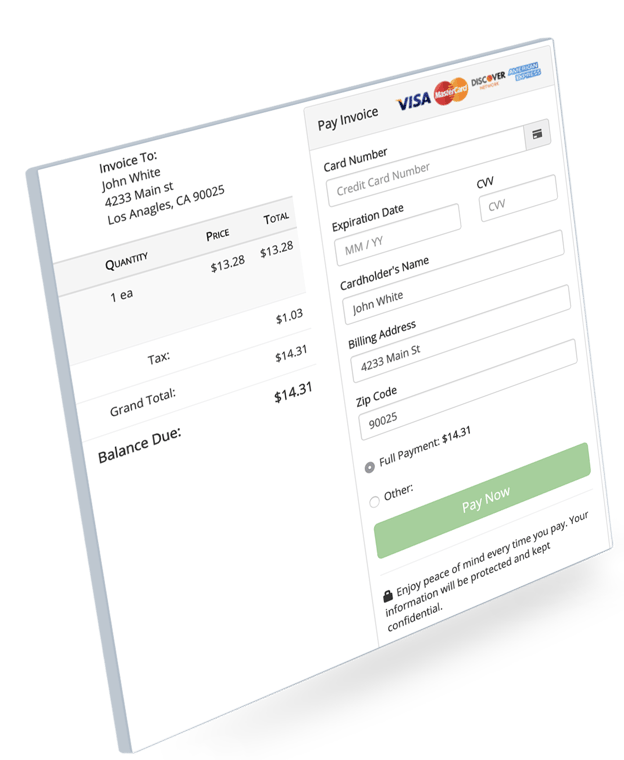

Online Payment

The online payment feature of an invoicing solution refers to the ability of an invoicing platform to process and accept payments against the bills generated and dispatched to customers. A few of the solutions even enable customers to pay directly from the invoice - minimizing the hassle for customers to switch screens or access different platforms to pay for products or services.

Advance Payments

With the advance payments feature of invoicing solutions, users can enable their customers to pay a fraction, or total amount for products and services upfront using retainer invoices. This feature is extremely handy for businesses that deal in credit. With the advance payment feature, users can collect a certain percentage of the quote provided and record the remaining amount as receivable.

Payment Discounts

The payment discount feature of an invoicing solution enables users to offer discounts and adjust the amount automatically in the invoice without having to do it manually. This comes in handy when closing new deals or rewarding loyal customers to build lasting relationships.

Invoice Customization

The invoice customization feature of the solution allows users to customize the structure and layout of the invoice as per the industry best practices or brand persona.

Custom Templates

Custom templates provided by invoicing solutions are blank but structured invoices that are ready to be populated. Most invoicing solutions offer ready-to-use invoice templates with customization capabilities or enable users to create templates best suited for their needs from scratch.

Custom Fields

Custom fields in an invoicing solution enable users to customize the invoice templates by adding extra data fields as per the requirements of the business.

Expense Tracking

The expense tracking feature of an invoicing solution allows users to classify their expenses in categories best suited for their needs and automatically track expenses incurred. This feature comes in handy for adjusting expenses from revenue without having to do it manually and for seamless business reporting.

Mileage Tracking

The mileage tracking feature of invoicing solutions is similar to that of expense tracking but it specifically caters to vehicle expenses - enabling users to adjust billable miles or transportation costs in invoices for payment.

Time Tracking

The time tracking feature of invoicing solutions is very beneficial for solopreneurs and freelancers. This feature allows users to track hours spent working on a particular project and bill invoices automatically based on the time incurred.

Billing Automation

The billing automation feature of invoicing solutions eliminates the menial workflows of the billing cycle. Through this feature, users can dispatch invoices for payments on set dates and automate the collection of payments hassle-free.

Multiple Currencies

Not all customers transact in the same currencies. The multiple currency feature of invoicing software automatically converts the seller’s invoice amount into the currency preferred by the customer for seamless transactions.

Reports and Analytics

The reports and analytics feature offered by invoicing solution enable users to dive deep into the data and extract valuable insights to make informed decisions. The feature also comes in handy for compiling financial reports and presentations to gauge performance.

Roles and Permissions

The roles and permissions refer to a user’s ability to invite other members to manage the data or engage in the invoicing process or other related operations without having to share personal login credentials. This gives fuels collaboration and gives administrators a complete audit trail of activities performed.

Tax calculation and Payment

The tax calculation & payment feature automates the taxation process - enabling users to pay their taxes without having to calculate them manually. The feature takes into account all taxation-related requirements and deliverables - leaving no room for error. Users can also provide customers a detailed breakdown of the taxes applicable on products or services.

6 - Pros of Invoicing Software

There are many pros to using invoicing software. Listed below are some of the key advantages:

Automation

Invoicing is a time-consuming process if done manually. It requires a lot of number crunching and feels almost like rubbing your head against a cheese grater. An invoicing takes the hassle out of the process and enables users to automate menial workflows and focus on things that matter the most.

Faster Billing & Recovery

The manual invoicing process requires a lot of steps and processes to generate a single invoice. Using an invoicing solution, businesses can generate invoices instantly and acknowledge faster billing and recovery. You can attach an invoice with shipped products or email it to customers for delivered services. Faster invoicing means quicker payments.

Enhanced Capabilities

Invoicing software comes with a variety of features and capabilities - additional to invoice processing. Most of the invoicing solutions enable users to track payments, manage expenses, provide estimates, manage customers, collect advance payments, offer discounts, and more.

Ensured Receiving

Invoicing solutions enable users to track invoices and ensure that they’ve been received by the recipients. Most of the solutions facilitate users with invoice delivery reports - enabling them to know if it’s received by the customer.

No More Lost Invoices

When you mail an invoice via post, there’s always a risk of losing it - whether it’s in transit or by the recipient. Lost invoices mean delayed payment. An invoicing solution can solve this problem faced by businesses for years - enabling them to send invoices via modern modes of communication and get paid instantly.

Remote Accessibility

Online invoicing solutions facilitate businesses to access their billing and payment records from anywhere in the world. All users need is a device of their liking and an internet connection. This enables business owners to stay connected with their billing workflows remotely even if they’re on a vacation.

7 - Cons of Invoicing Software

Extra Cost

Invoicing solutions add extra cost to your operational expense. It’s not necessarily a con but for businesses that are on a strict budget or just getting started, spending extra money for invoicing platform subscriptions may seem like one.

The Learning Curve

Every software requires some time to get used to, especially when they facilitate intricate operations like invoicing. This may be another con for invoicing solutions as not everyone is tech-savvy and the available solutions have some sort of a learning curve to utilize their capabilities to full potential. Now, whether this curve is steep or the software is easy to learn, that’s a different scenario.

Undelivered Invoicing

Most businesses schedule their invoices for delivery when using invoicing software. These invoices are dispatched to recipients via emails that are either marked as spam by mailing services or end up in the junk due to their repeated occurrence in the mailbox. This leads to delayed payment recovery as the invoices are not received by customers.

Offline Operations

In this era, the majority of people have access to the internet but that’s not the case for everyone. Even if someone has access to the web, they may at times be out of reach or prefer old-school ways of doing things. This can be marked as a con for online invoicing solutions as a majority of them cannot facilitate offline operations.

8 - Ease of Use

Compared to the process of generating invoices manually, using an invoicing solution is a lot less tedious. The manual invoicing process is inconvenient and time-consuming. Compared to this, an invoicing solution enables users to automate invoice and billing workflows seamlessly. Using an invoicing solution is not that difficult. There are many solutions available in the market that come with a variety of capabilities. Granted, a new solution takes some time to get used to but thanks to technological advancements, invoicing solutions of today have improved and come with drag-and-drop simplicity. Most of them offer 24/7 live support and facilitate users at every step of the way.

9 - Integrations to Look for When Choosing an Invoicing Solution

Invoicing solutions support external integrations to facilitate workflows additional to or supportive of the invoicing and billing process. The following applications are important to look for when choosing an invoicing solution for operations:

- Slack

- Spreadsheets

- Gmail

- Outlook

- Google calendar

- Google Drive

- HubSpot

- PayPal

- Stripe

- Zapier

- Gusto

- Authorize.Net

- Mailchimp

- AutoEntry

10 - How to Choose an Invoicing Software

The best way to choose an invoicing solution is to learn whether the features offered by the solution serve your needs well or not. There are a variety of options available in the industry and choosing one best suited for your business operations can be tricky. It seems like all of them offer similar features or capabilities but these solutions vary with respect to a lot of characteristics such as ease-of-use, user experience, operational simplicity, pricing, and some other USPs.

So, before opting for an invoicing solution, make sure that you’ve done your research and explored available solutions and the key differences in features offered. Once you’re explored available invoicing solutions and key differences in their capabilities, you’d be able to make an informed decision based on facts. Or, you can just save time and use our research instead. In this article, we will recommend the 8 best invoicing solutions best suited for your needs.

11 - What is an Invoicing Solution Not a Good Fit For

An invoicing solution pairs its core capabilities with a variety of features to facilitate the invoicing and billing workflows. One of these features is time tracking. There are a lot of invoicing platforms that enable users to track time spent on activities, tasks, or projects. This capability is best suited for freelancers or solopreneurs - facilitating them to calculate time spent on a particular project to calculate an invoice and bill clients accordingly. However, this feature just facilitates time-based invoicing workflows. So, invoicing software is not a good fit for attendance tracking or people management at a workplace.

12 - FAQs (Frequently Asked Questions)

What is an invoice?

An invoice is a document that contains a list of products purchased or services availed along with the billable amount - issued by a seller to the buyer for transactional purposes.

What is the invoicing process?

An invoicing process refers to the phase in which invoices are created or generated by sellers to be dispatched to buyers via email, courier, or fax.

What is electronic invoicing or e-invoicing?

Electronic invoicing, also known as e-invoicing, is a modern form of invoicing process which caters to a more collaborative approach when it comes to business transactions. These digital invoices can be accessed by buyers online or inquired about in real-time without the hassle of back-and-forth communication.

How to generate invoices automatically?

There are a variety of invoicing solutions that can help users automate the workflows - enabling them to generate, dispatch, and process invoices automatically - getting paid securely and hassle-free.

Which is the best invoicing software?

This question will be answered later in this article as we will recommend the 8 best invoicing solutions best suited for businesses worldwide.

Best Invoicing Software Product’s Overview

1 - ZarMoney

ZarMoney is a cloud-based software that enables users to automate invoicing workflows by generating and dispatching invoices in seconds. With ZarMoney, you can get paid instantly - empowering customers to pay directly from received invoices without having to switch screens. The tool facilitates users to search and locate invoices with a single click and streamline the billing process. In addition to offering invoice and billing automation solutions, ZarMoney facilitates businesses with a variety of capabilities and offers a seamless user experience.

Feature List

ZarMoney offers many features to streamline invoicing workflows. Here are the core features that ZarMoney has to offer:

- Automated invoicing and billing

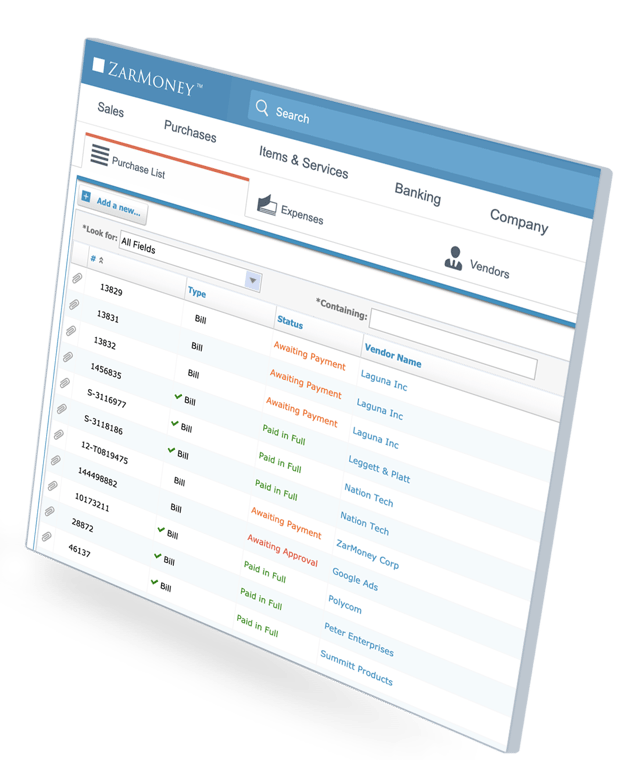

- Bills management

- Quotes and estimates

- Accounts receivable management

- Accounts payable management

- Sales orders

- Purchase orders

- Expense tracking

- Automated taxation

- Multiple users

- Access permissions

- Online payments

- Bank connections

- Account reconciliation

- Inventory management

- Reporting and analytics

- External integrations

Top 3 Features

ZarMoney is a feature-rich solution. Here are the top 3 features offered by ZarMoney to fuel your invoicing operations.

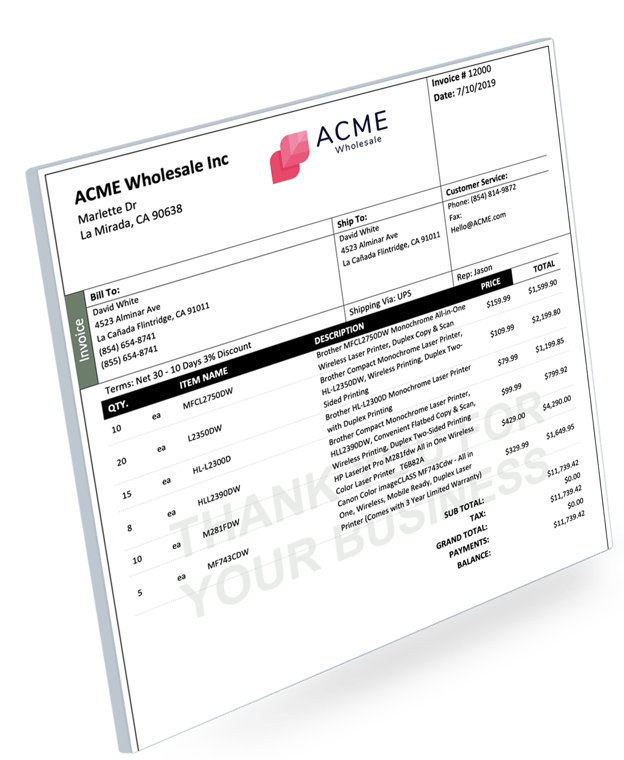

Simple Invoicing

ZarMoney is an invoicing solution with drag-and-drop simplicity and an easy-to-navigate user interface. The tool allows you to create custom invoices best suited for your needs in seconds and dispatch them to get paid instantly. With ZarMoney, your customers can pay directly from your invoice - depositing the amount directly into your bank account.

Expense Tracking

ZarMoney enables users to track and incorporate expenses in the invoices hassle-free. Whether it’s the mileage cost or hours incurred in a task, ZarMoney facilitates you to incorporate your expenses in the billable amount for seamless business transactions.

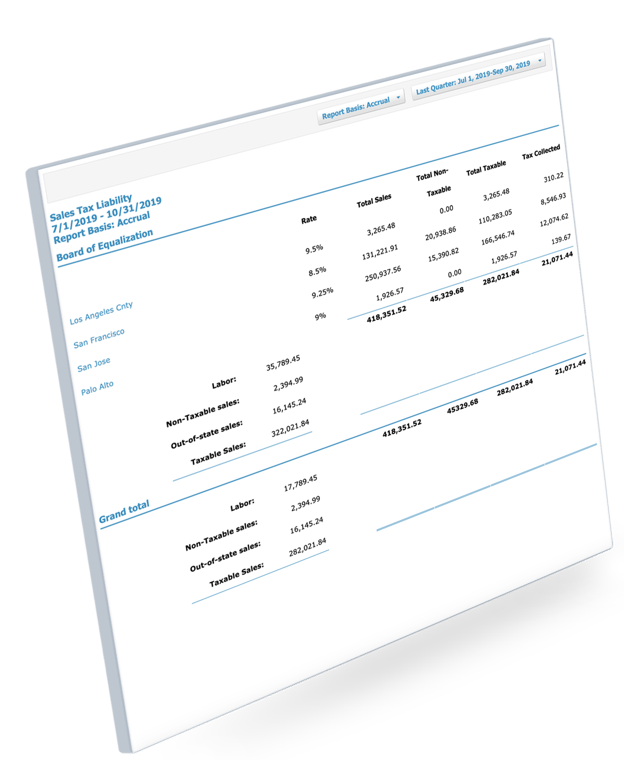

Automated Sales Tax

With ZarMoney, users can configure different tax regulations for respective regions. The tool facilitates legal compliance as it calculates your taxes and files them automatically. You can override this feature if you wish to do your taxes the old-school way.

Pros and Cons

Pros

- Does not have a steep learning curve.

- Scalable invoicing solution

- Invoice and billing automation

- Enables users to collect payments directly from an invoice

- Supports more than 9600 bank connections

- Single-click account reconciliation

- Automates tax calculation and filing process

- Order lifecycle management

- Multiple user support

- Multi-currency support

- Reporting and analytics

- Advanced access permission settings

Cons

- Doesn’t offer a free plan

- Bank connections represent the U.S. and Canada regions only

Pricing

ZarMoney has 3 different pricing plans to choose from - Entrepreneur, Small Business, and Enterprise.

- Entrepreneur: This plan costs $15 per month for single-user access, unlimited transactions, and all standard features that are offered by ZarMoney along with the 24/7 customer service.

- Small Business: This plan costs $20 per month and includes 2 user accesses, unlimited transactions, and all standard features - paired with 24/7 customer service.

- Enterprise: This plan starts from $350 per month for 30+ users, custom features, specialized training, dedicated account representative, and priority support.

Integrations

There is a variety of integrations supported by ZarMoney, here are the main third-party apps that can be used with this invoicing solution:

- Zapier

- Stripe

- AutoEntry

- Authorize.Net

- Mailchimp

- Gusto

- Shopify

- And more

Average Rating from Software Directories

For the average rating of ZarMoney, we explored its reviews on reputable sites and tech forums like Capterra, GetApp, and G2. The average rating of ZarMoney via the above-said software directories is 4.73.

Testimonials and Reviews

Here are a few of the testimonials submitted by ZarMoney users on leading tech forums like GetApp. Check out this review by Shawn G.

“ZarMoney is very easy to use and perfect for my small businesses. They quickly answered any questions I had although it was so fast and easy to set up so I didn't need much help. In less than a week I set up five small companies included entering all transactions for the prior year and some further back.”

And here’s another review by David B.

“After extensive research and comparison with several web-based accounting programs, I narrowed down to 4 and then selected Zar Money. Understanding the program and setup was fairly straightforward, and the features offered and functionality were better than the competition. After using the program for a while, however, some things became cumbersome to manage, such as daily and journal entries and inventory management. On top of this, I was not satisfied with the inadequate display options for the dashboard. At this point, I am still undecided on continued use of Zar Money when compared to the program I was already using.”

Customer Support Options

ZarMoney facilitates its users with three customer support options at the moment. You can either contact their customer support via live chat, reach out to the help desk through email, or speak with the representatives using the contact details provided on the site.

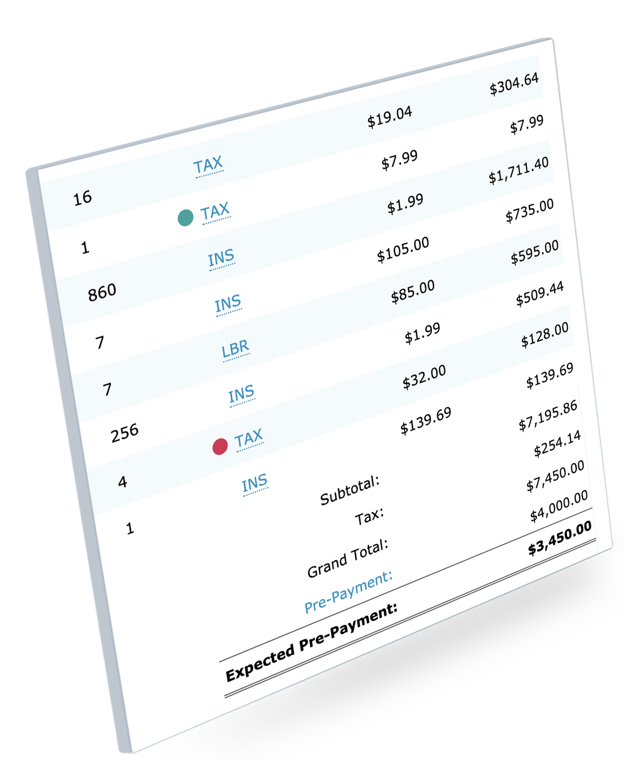

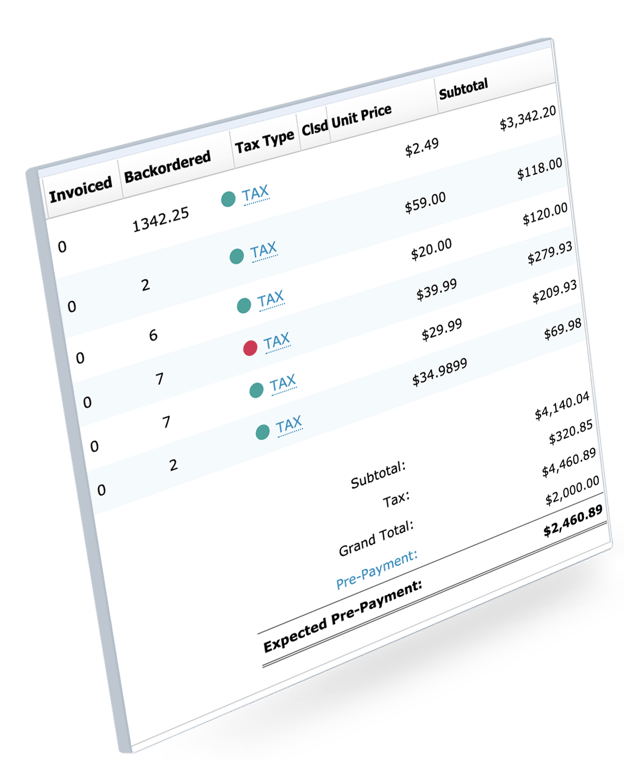

Product Screenshots

Bottom Line

ZarMoney is a cost-effective yet scalable invoicing solution that comes with a variety of features - facilitating small to large size businesses. It’s a feature-rich solution that doesn’t have a steep learning curve. That’s probably the reason why it got an average score of 4.73 on 3 of the leading tech forums.

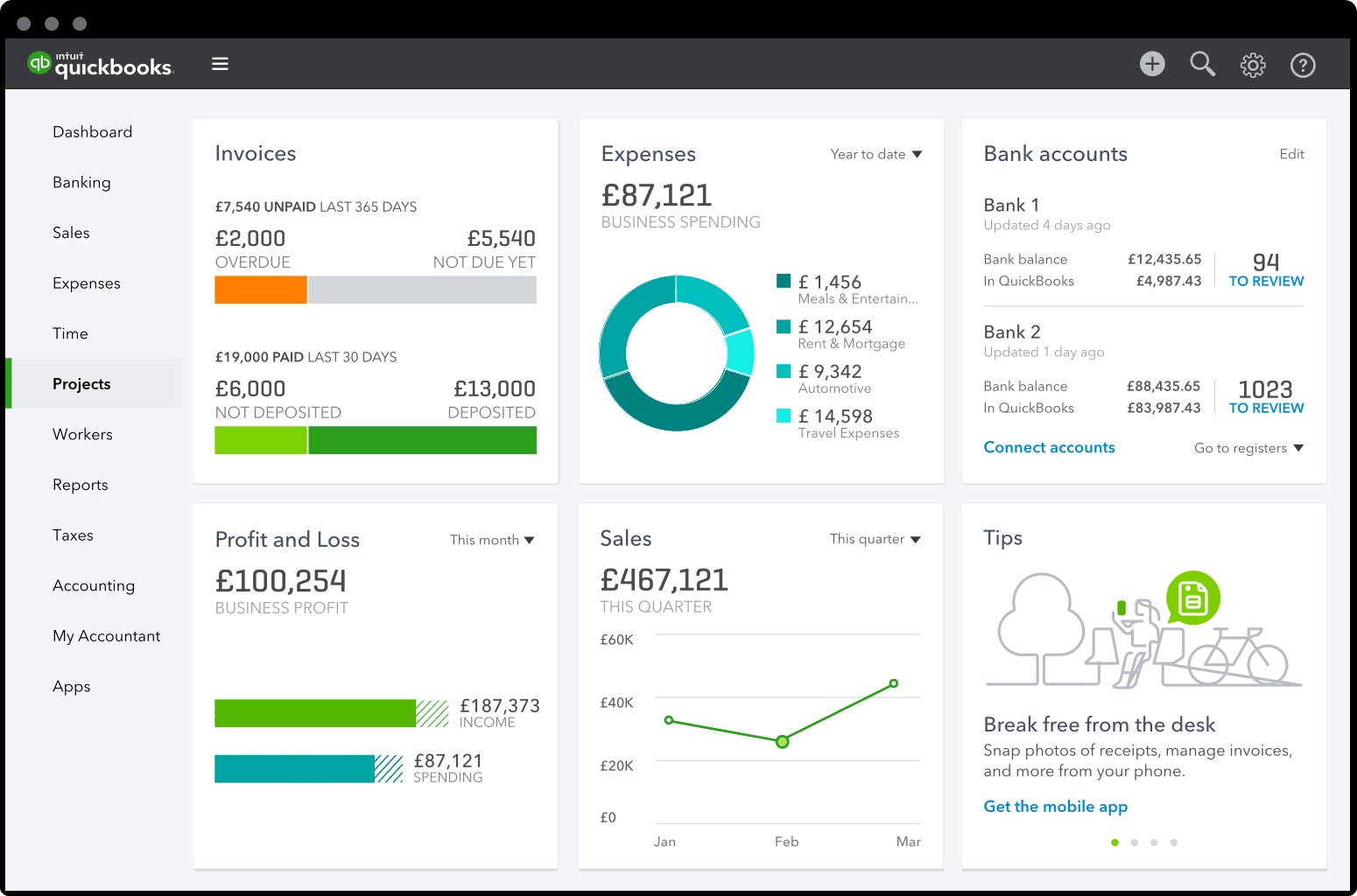

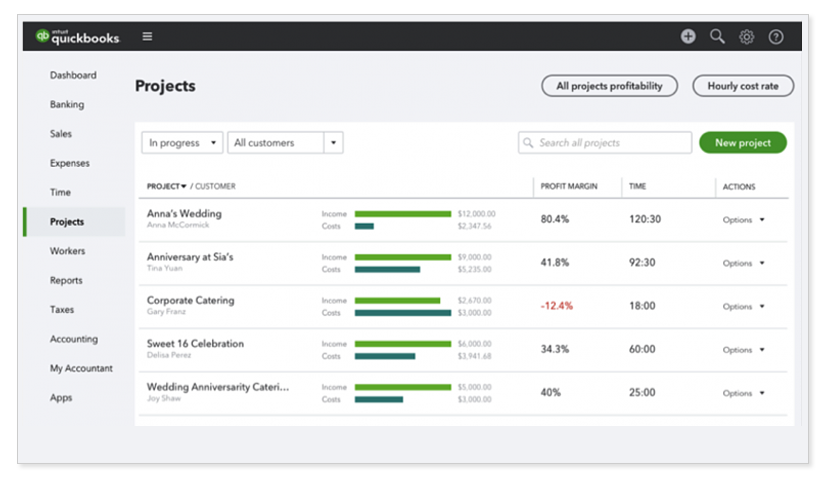

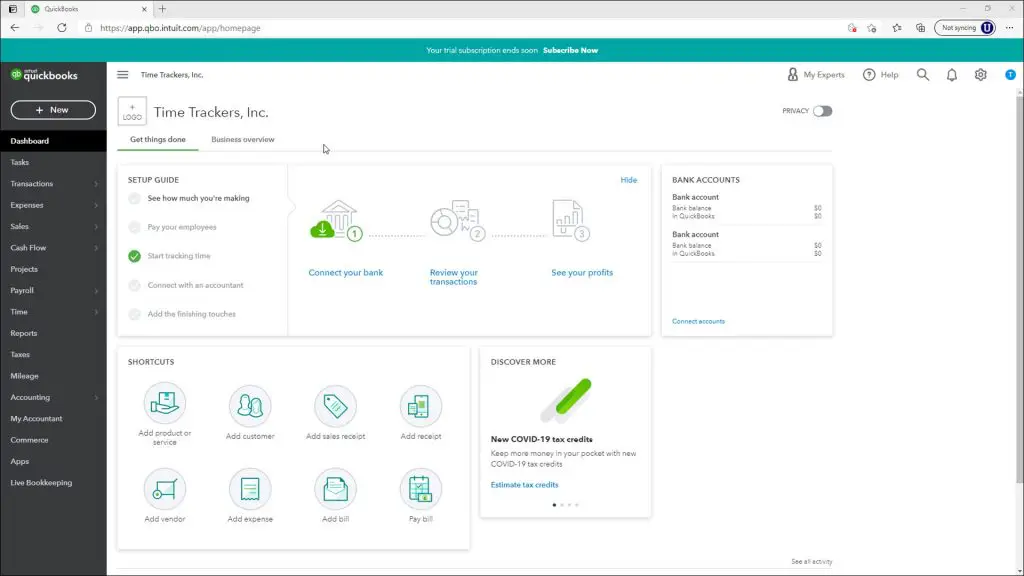

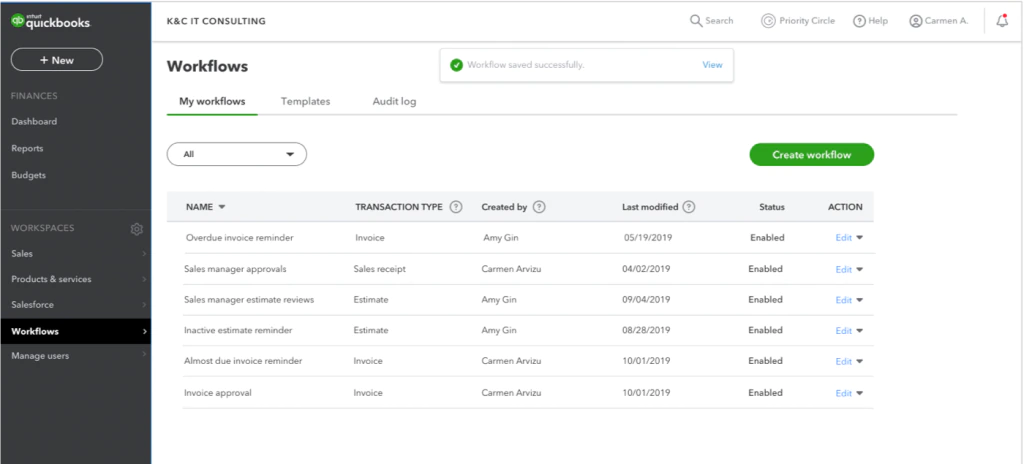

2 - Quickbooks

QuickBooks Online is a web-based extension of the brand. The solution has almost all the capabilities that the desktop version has to offer but doesn’t require a desktop app for operations. Quickbooks Online is a feature-rich app for small and medium-sized businesses that serves a variety of users - offering scalable features and flexibility.

Feature List

Quickbooks Online comes with a wide variety of features to facilitate invoicing workflows. Here are some of the core features the solution has to offer:

- Automated invoicing workflows

- Bills management

- Quotes and estimates

- Expense tracking

- Time tracking

- Automated taxation

- Multiple users

- Online payments

- Inventory tracking and management

- Reporting and analytics

- External integrations

Top 3 Features

In this section, we will mention 3 top features offered by Quickbooks Online to facilitate invoicing processes of businesses.

Income Tracking

This feature of Quickbooks Online enables users to sort transactions from connected accounts automatically into tax categories - facilitating users to track their income after tax deductions for hassle-free funds organization.

Invoicing and Payments

Quickbooks Online enables users to generate custom invoices and dispatch them to customers with ease. Collect payments faster - allowing customers to pay via credit card or bank transfer from an invoice.

Expense Tracking

Quickbooks Online empowers its users to track and record expenses effortlessly. The tool also enables you to track mileage using your smartphone’s GPS feature and adjust the cost in a billable amount.

Pros and Cons

Quickbooks Pros

- Cloud-based solution

- Automated invoicing and billing

- Easy navigation

- Doesn’t have a steep learning curve

- Detailed reporting

- Payroll support

- Accurate mileage tracking via GPS

Quickbooks Cons

- A bit on the expensive side compared to alternatives

- Categorization may be clunky at times

- Laidback online support

Quickbooks Pricing

Quickbooks Online offers 4 price plans to its users: Simple Start, Essential, Plus, and Advanced Plan.

- Simple Start: This plan costs $25 per month for single-user access and comes with basic invoicing features.

- Essential: This plan costs $50 per month, can be accessed by 3 users, and offers standard invoicing functionalities of Quickbooks Online.

- Plus: This plan costs $80 per month, includes 5 multi-user accessibility, and offers standard invoicing capabilities of Quickbooks Online.

- Advanced: This plan costs $180 per month, supports 25 users, and facilitates users with advanced invoicing features of Quickbooks Online.

Quickbooks Integrations

There is a variety of integrations supported by Quickbooks Online, here are some important third-party apps supported:

- PayTraQer

- Snyder

- Time Tracker by eBillity

- Freedom Merchants

- eBay

- Practice Ignition

- Invoice Sherpa 2.0

- Squarespace

- BigCommerce

- Bill & Pay

- AR Collect

- And more

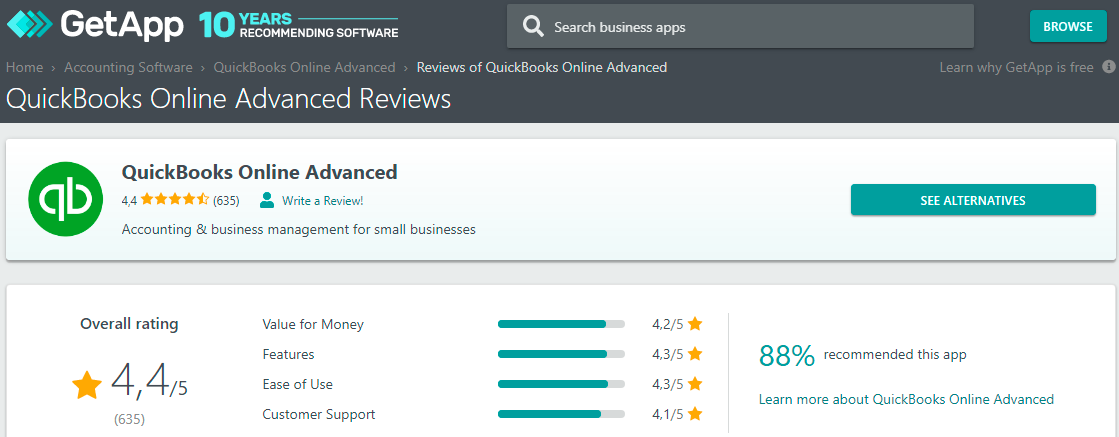

Average Rating from Software Directories

For the average rating of Quickbooks Online, we explored its reviews on leading tech forums and review sites: Capterra, GetApp, and G2. Based on the reviews given by the users, the average rating of Quickbooks Online is 4.26.

Testimonials and Reviews

To serve as social proof, we collected some of the testimonials submitted by Quickbooks Online users on GetApp. Check out this review by Harmony F.

“Our overall experience with QBO Advanced has been pretty good. I think, with the development and implementation of more features or customization of different "modules" to be customer-specific, it would serve us perfectly. And hey, the price is WONDERFUL!”

And here’s another review by Sondra C.

“Customer support was terrible. My clients found it not user-friendly and I have taken most of them off of it. When it was converted back to the desktop it took me 4 months to clean up the mess. They obviously don't want you to go back to the desktop. Doing a bank reconciliation is more complex than the desktop version. There was a problem with the AZ withholding and they have never fixed it. Payroll is geared to them doing it all. Reports are harder to customize. Overall I hated it.”

Customer Support Options

Quickbooks Online has two customer support options to choose from. The first option is to contact their representatives through live chat and the second option is to contact them on a provided number. However, the on-call support is sales-specific and not for customer queries and concerns.

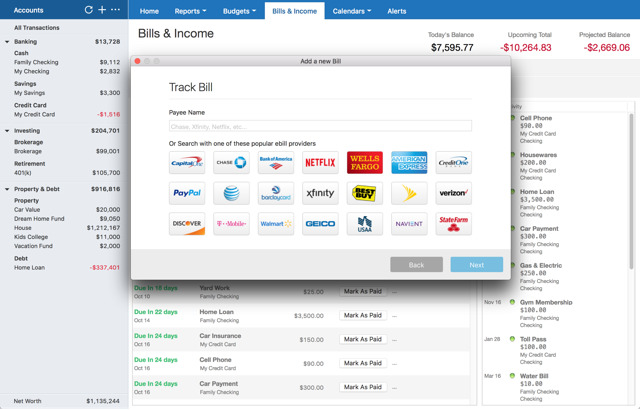

Product Screenshots

Bottom Line

Bottom Line

Quickbooks Online is a flexible invoicing solution that comes with a variety of third-party integration options. The tool gives access to a wide range of features - automating invoicing workflows, making payment collection effortless, and setting taxes on autopilot. Furthermore, the solution comes with an easy-to-navigate user interface. However, the customer support of Quickbooks Online is a bit lackluster, and that’s probably the reason why it has an average ranking of 4.26.

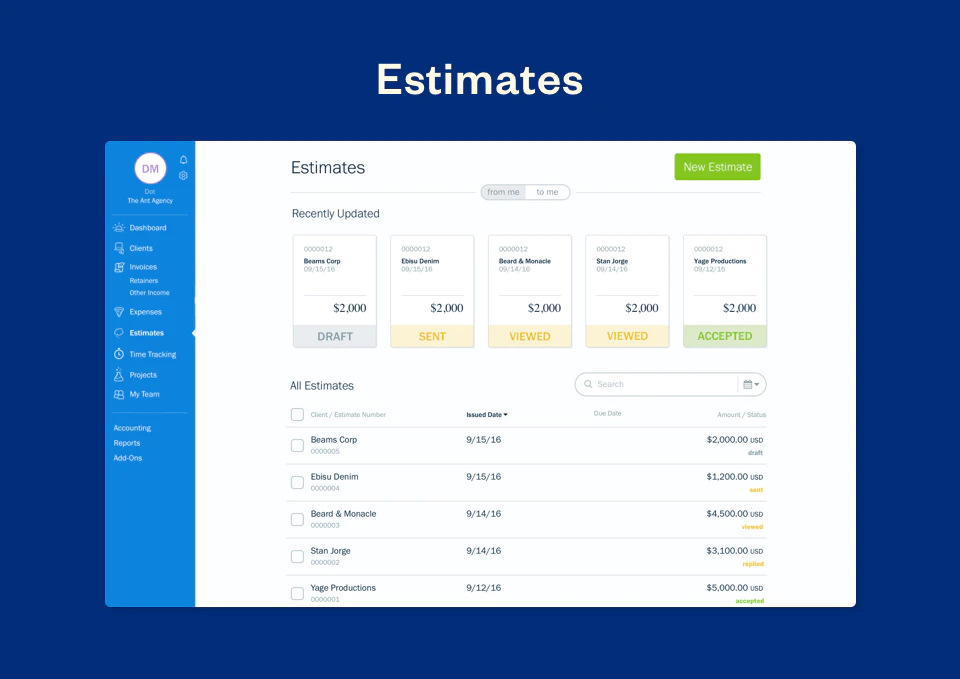

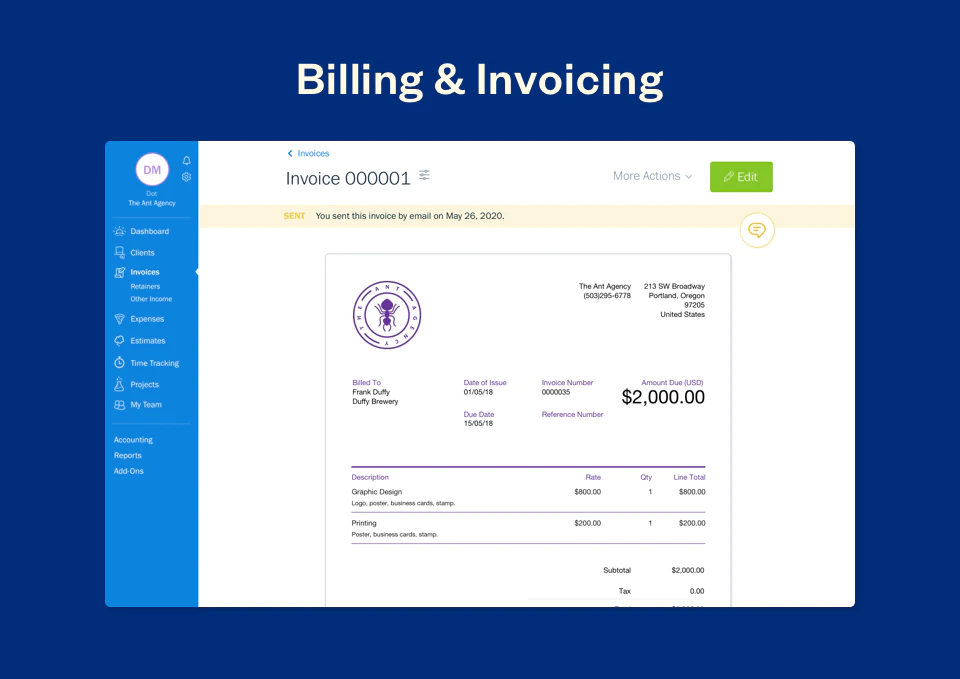

3 - Freshbooks

Freshbooks is a leading invoicing solution that comes with a variety of features and capabilities - enabling users to create custom invoices, send receipts, track time, monitor expenses, and collect payments with ease. The tool is best suited for small to medium-size businesses and can be accessed from anywhere in the world, being a cloud-based solution.

Freshbooks Feature List

There are a lot of features that Freshbooks has to offer. Here, we have mentioned a few important ones:

- Seamless invoicing

- Custom invoices

- Quotes and estimates

- Expense tracking

- Mileage tracking

- Time tracking

- Online payments

- Payment tracking

- Alerts and notifications

- Reporting and analytics

- External integrations

Top 3 Features of Freshbooks

Here are the 3 of the most important features offered by Freshbooks.

Automated Invoicing

Create professional-looking invoices within seconds and get paid instantly online. Get paid faster without having to chase customers for payments. FreshBooks enables users to create custom invoices and send payment reminders effortlessly to customers.

Quotes and Estimates

Freshbooks allows its users to provide quotes or estimates to their customers. Freshbooks facilitates users to win new projects by helping them design competitive proposals. Once a quote has been approved, users can transform the estimates into payable invoices in an instant.

Expense Tracking

Freshbooks allows its users to connect their respective bank account details or credit cards to FreshBooks - automating data entry workflows. You can also record billable expenses such as mileage and adjust the amount automatically to clients' invoices. Freshbooks helps you stay on top of business expenses without having to track things manually.

Freshbooks Pros and Cons

Pros

- Free trial

- Multi-platform support

- Simple user interface

- Tax automation

- Device compatibility

- Quick customer support

Cons

- Expensive compared to alternatives

- Comparatively fewer features

- Lack of multi-currency support

Freshbooks Pricing

Freshbooks offers four different price plans to its users - Lite, Plus, Premium, and Custom Plan for specialized features.

- Lite: Offered at $7.5 per month, this plan offers very basic functionalities of Freshbooks to its users.

- Plus: Offered at $12.5 per month, this plan comes with moderate level efficiency and features - best suited for small companies.

- Premium: Offered at $25 per month, this plan facilitates users to bill unlimited clients using advanced capabilities that Freshbooks has to offer.

- Custom Pricing: The custom pricing feature facilitates users with features that are specialized and tailored for a particular business or industry.

Freshbooks Integrations

Here are some of the integration options given by Freshbooks:

- Zoom

- DropBox

- Stripe

- Gusto

- HubSpot

- SquareSpace

- GSuite

- 123Form Builder

- 2Ship

- Shopify

- Everlance

- And more

Average Rating from Software Directories

In this section, we will explore the average rating earned by Freshbooks as an invoicing solution on renowned tech forums like Capterra, GetApp, and G2. After reviewing the said forums and published reviews, we found that Freshbooks average rating is 4.5.

Testimonials and Reviews

Now, let’s hear it from the users of Freshbooks themselves and know what they have to say about their experience. Check out this review by Manuel D.

“I have seen a lot of benefits for maintaining normal bookkeeping, for a complex one I did not find this product useful. Maybe I am wrong but I could find it”.

Here’s another one by Herman T.

“One word comes to mind: Horrendous”.

Customer Support Options

Freshbooks offers a wide range of customer support options. You can reach out to their help desk via email and get your issue resolved by their representatives. Freshbooks also gives you the option of getting live support via chat. And, if you’re looking for urgent solutions, you can reach out to their representatives via call.

Product Screenshots

Bottom Line

Bottom Line

Freshbooks is one of the user-friendly accounting and invoice management solutions available in the market. The tool is best suited for small to medium size businesses especially if they offer services to their customers instead of products. Freshbooks also facilitates solopreneurs or professionals such as freelancers, lawyers, IT professionals, independent graphic designers, web designers, and more. With an average rating of 4.5, on leading tech forums, Freshbooks seems like a competent invoicing solution among the available alternatives.

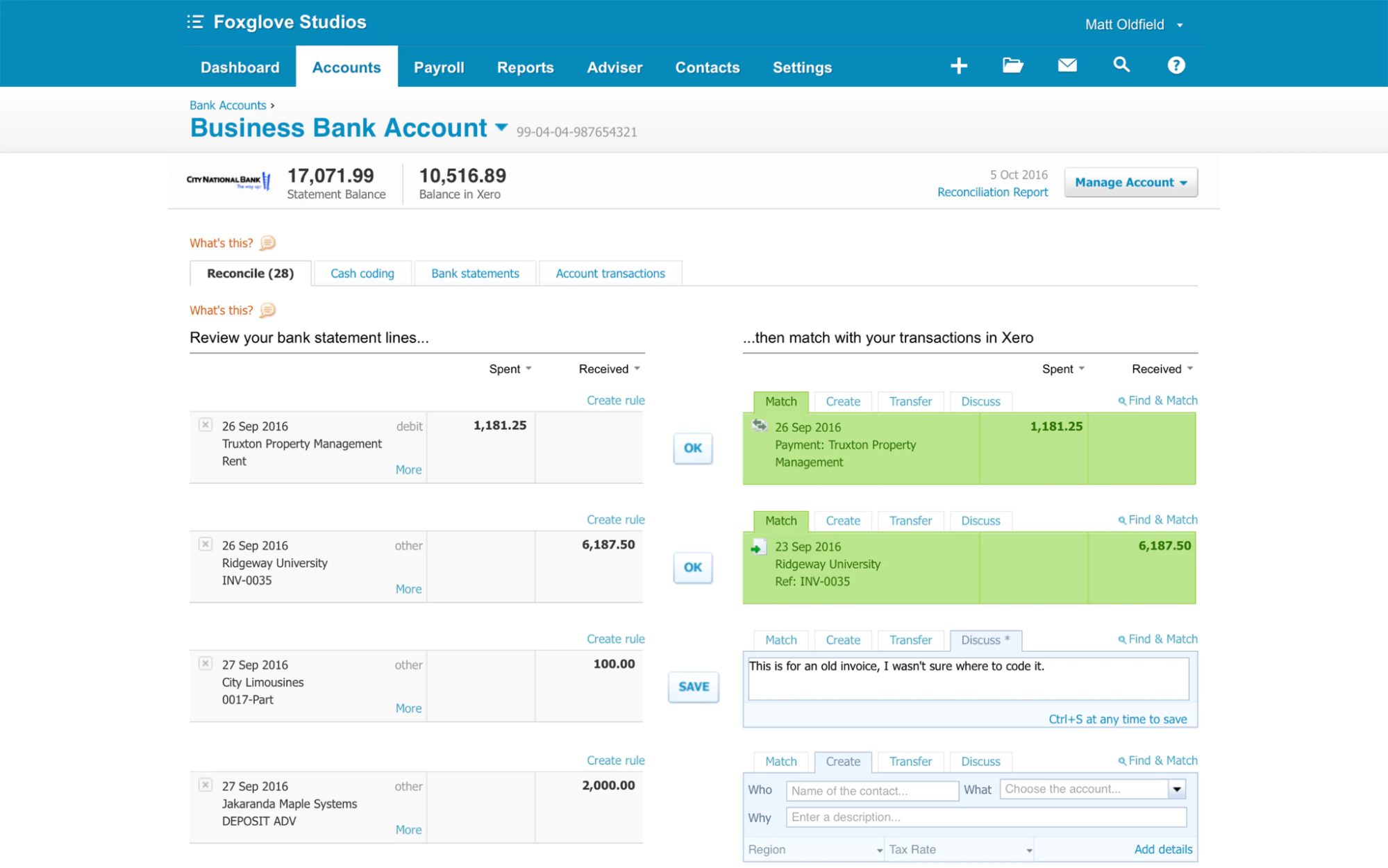

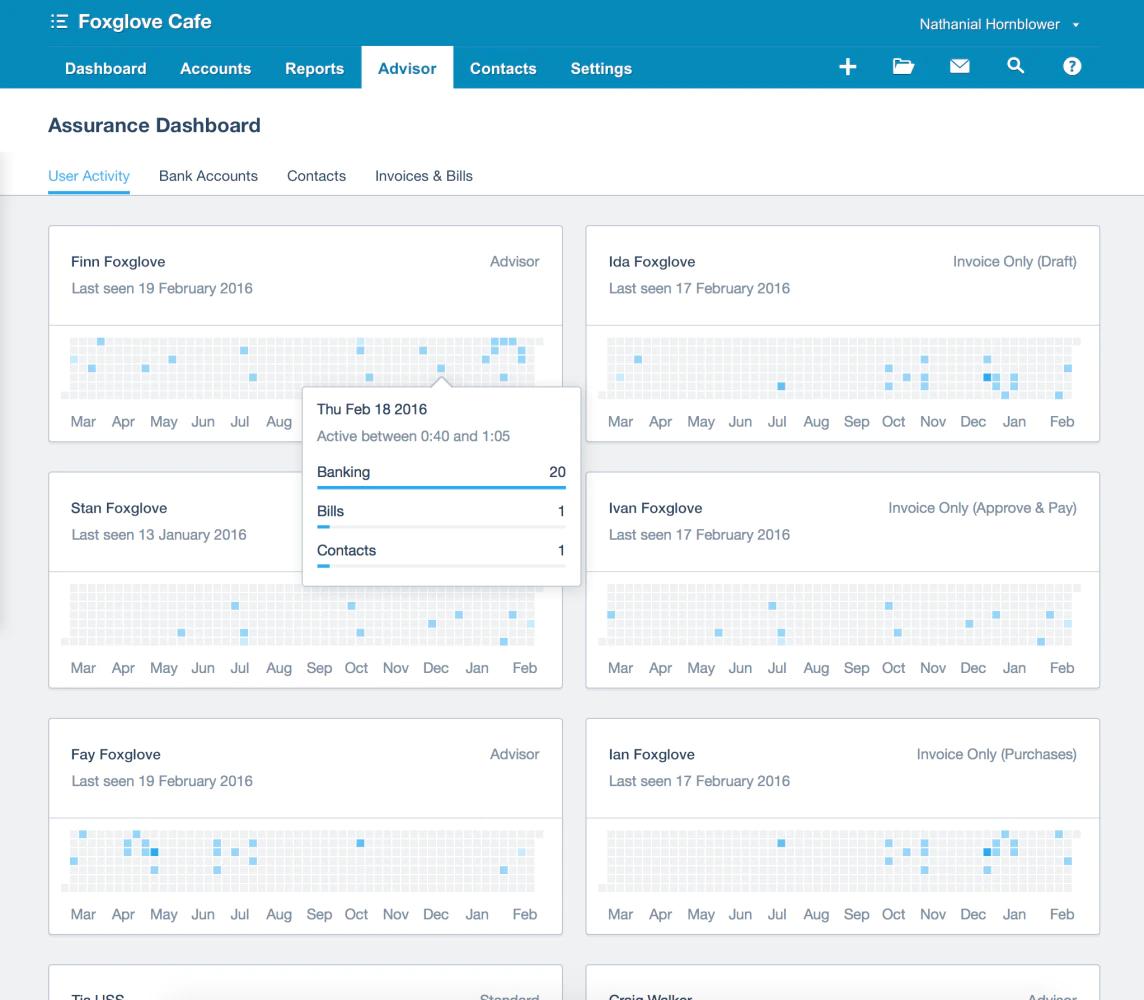

4 - Xero

Xero is a globally acclaimed and feature-rich invoicing solution preferred by many businesses. Xero enables users to generate custom invoices and track payments hassle-free. Getting paid is easy with Xero, all you have to do is generate a payment link containing an invoice and empower your customers to pay directly via PayPal or credit card. Xero is best suited for small to large size enterprises and facilitates independent professionals like consultants and freelancers.

Xero Feature List

Xero comes with a variety of capabilities. Here are a few of the important features offered by the invoicing platform:

- Automated invoicing workflows

- Custom invoices

- Expense tracking

- Purchase orders

- Quotes and estimates

- Sales tax

- Payroll

- Project management

- Account reconciliation

- Bank connections

- Inventory management

- Multi-currency support

- Reporting and analytics

Top 3 Features

Here are the 3 of the most important features offered by Xero.

Effortless Invoicing

With Xero, users can automate invoicing workflows and receive payments seamlessly from anywhere in the world. Xero facilitates users with an intuitive invoicing solution - enabling them to generate professional invoices, dispatch bills, accept payments online, and send reminders for delayed payments securely and hassle-free.

Quotes and Estimates

With Xero, users can create custom quotes, accept estimates, and convert accepted quotes into invoices without having to enter the data manually. The quotes or estimates can be shared or received easily from phone or desktop.

Sales Tax

Xero enables users to configure and use custom sales tax rates. The software will automatically apply the set tax rates on respective transactions. Xero then uses the sales tax reports to prepare sales returns seamlessly without the user having to crunch numbers manually.

Xero Pros and Cons

Pros

- Cloud-based solution

- Scalable

- Easy-to-use

- Affordable

- Simple user interface

- Real-time bank feeds

- Tax automation

- Device compatibility

- External integrations

Cons

- Steep learning curve

- You have to pay extra to unlock the payroll option

- Doesn’t support ETPs

- Poor customer service

Xero Pricing

Xero offers three price plans to choose from - Early, Growing, and Established.

- Early: Currently being offered at $5.5 per month, this package comes with very limited features and is best suited for independent professionals.

- Growing: Best suited for small to medium-size businesses, the Growing plan is offered at $16 per month and unlocks moderate to advanced level functionalities.

- Established: This plan charges $31 per month and comes with all the capabilities Xero has to offer except for the payroll option - users have to spend an additional $39 per month to unlock that.

Xero Integrations

Here are some of the preferred third-party integration options facilitated by Xero:

- Hubspot

- Mailchimp

- Outlook

- Google Contacts

- Stripe

- Hubdoc

- AutoEntry

- Paymo

- Gusto

- Expensify

- PipeDrive

- And more

Average Rating from Software Directories

Xero is a renowned invoicing solution preferred by professionals worldwide. Let’s hear it from the users themselves and know what they have to say about their experiences. For that, we explored the reviews of Xero published on leading tech forums like Capterra, GetApp, and G2. And, we found that the average rating of Xero according to the experiences shared by users is 4.3.

Testimonials and Reviews

To explore what users like or dislike about Xero, we also explored individual reviews by users. Let’s hear what Ryan C. has to say about Xero.

“Fantastic. I wouldn't consider another system”.

Here’s another one by Jonathan P.

“Overall, Xero costs us a lot of time we didn't spend before, does things on its own such as create new suppliers for an expense and to me, it seems the software was written by ex Bookkeepers who didn't really understand bookkeeping anyway and had a good go at designing a software package that would compete I am guessing with the likes of Sage and failed abysmally. We use Xero because our accountants do the bookkeeping for us and this is what they use, if not for this, I wouldn't touch Xero if my life depended on it”.

Customer Support Options

Xero has three customer support options: 24/7 live support, chat and help desk. You can reach out to their representatives via email or chat, whichever seems more feasible to you. Xero also facilitates users with 24/7 live support for urgent queries and concerns.

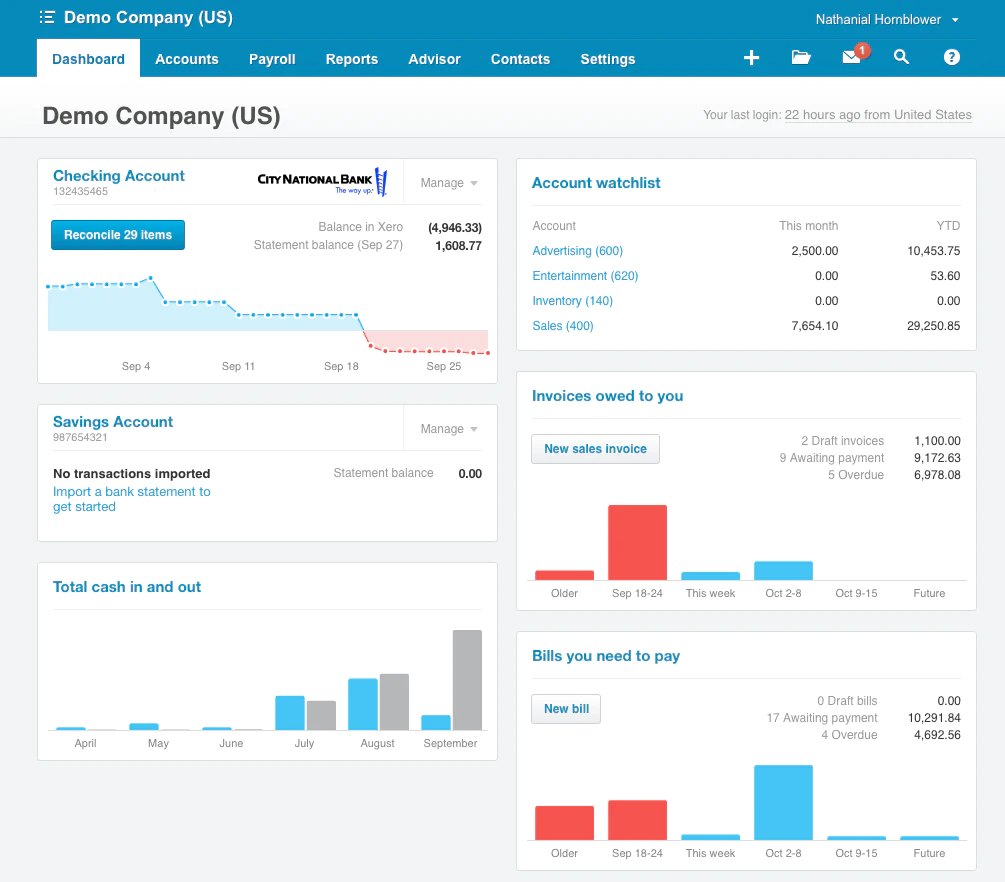

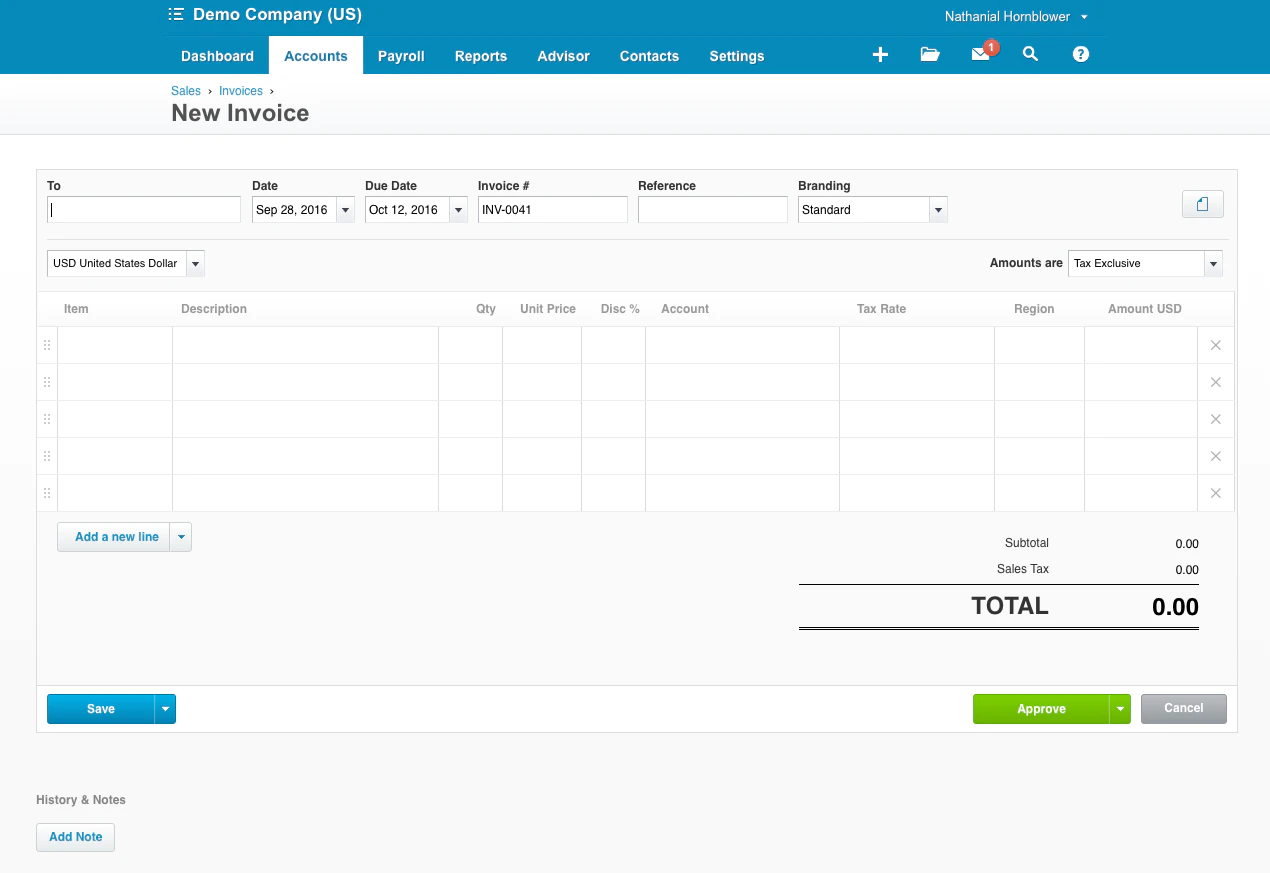

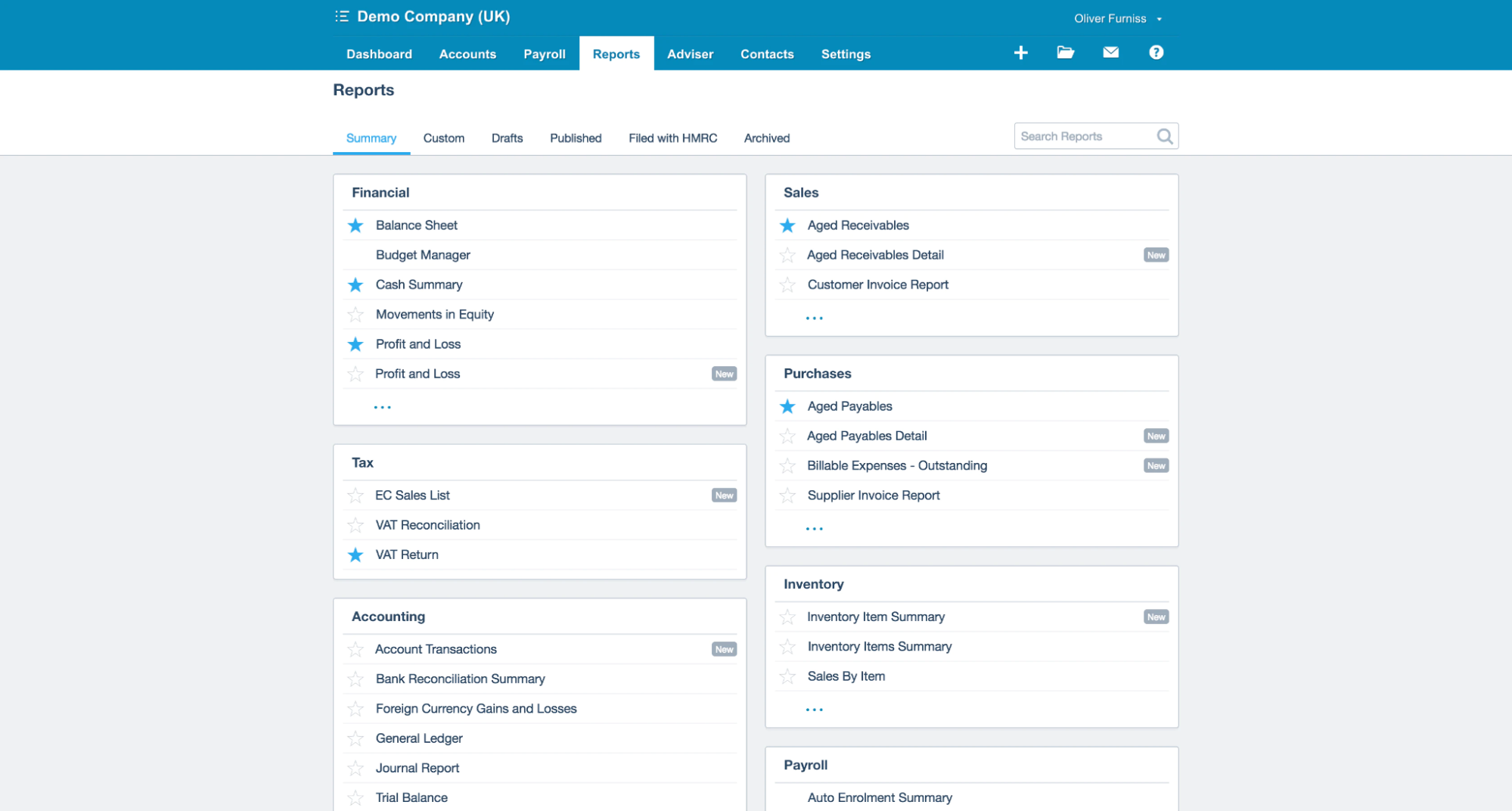

Product Screenshots

Bottom Line

Bottom Line

Xero is a renowned invoicing solution - preferred by small to large size businesses worldwide although the tool has a steep learning curve. It’s an affordable and scalable solution that comes with a variety of perks and privileges. With an average rating of 4.3 on leading tech forums, it can be said that Xero is an invoice management software worth considering. However, the pay-to-unlock payroll feature can be a letdown to a few.

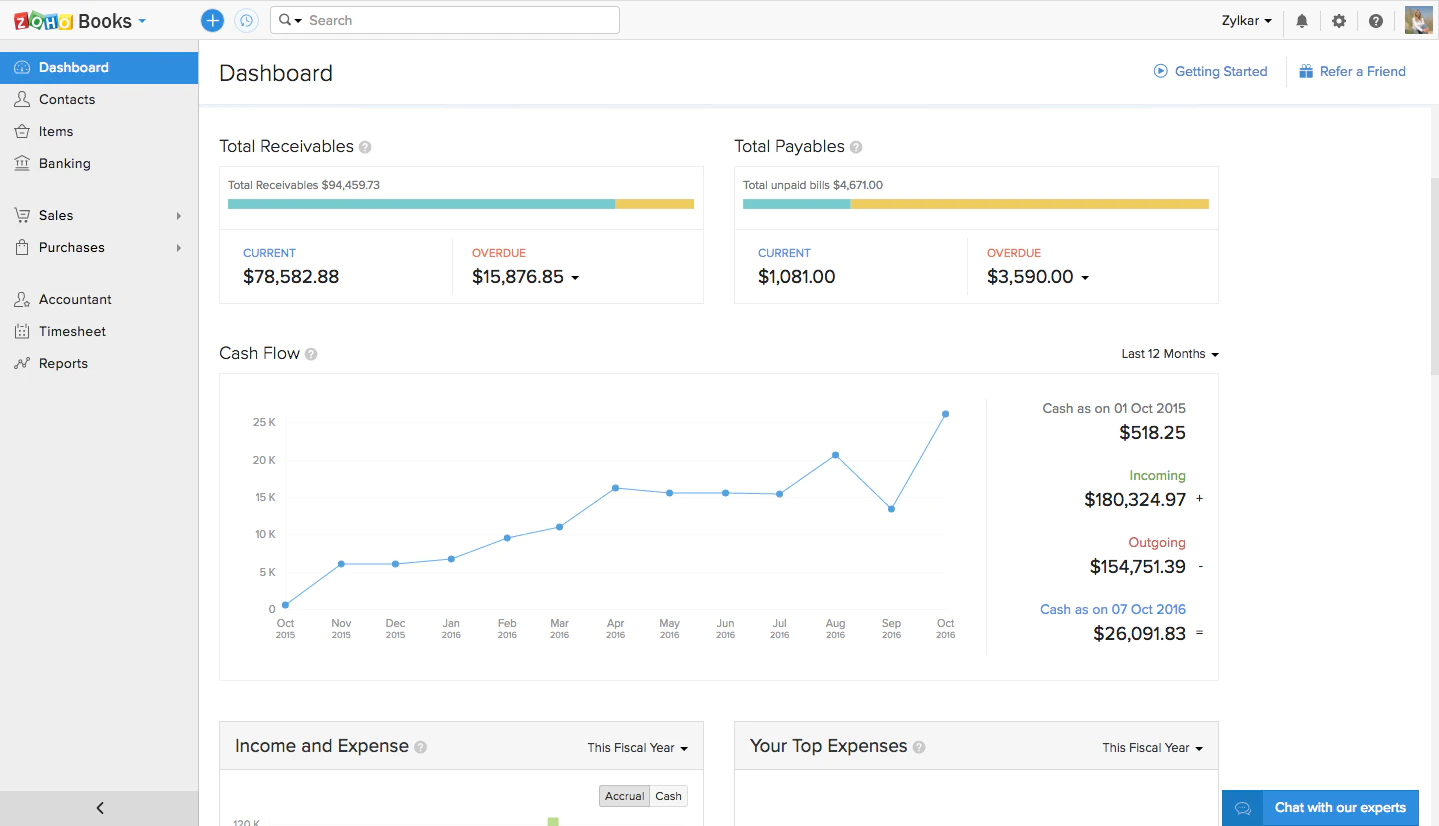

5 - Zoho Books

Zoho Books is one of the best invoicing solutions out there. It’s a cloud-based accounting tool that helps users with managing finances, automating invoicing workflows, providing quotes & estimates, tracking expenses, and more. Zoho Books takes care of all processes - from deal negotiations to getting paid. The solution enables you to automate menial processes so you focus on things that matter the most.

Zoho Books Feature List

Zoho Books has a variety of features to offer. Here are some of the core features the solution facilitates its users with:

- Automated invoicing

- Quotes & estimates

- Bills tracking

- Online payments

- Expense tracking

- Sales orders

- Accounts reconciliation

- Client and vendor portal

- Project management

- Inventory management

- Taxation

- Reports and analytics

Top 3 Zoho Books Features

In this section, we will discuss the top 3 features that Zoho Books has to offer.

Invoicing

Zoho Books enables its users to automate the tedious process of invoicing and collecting payments from customers. This empowers businesses to generate professional invoices in an instant and get paid effortlessly using a variety of online payment options supported by the tool.

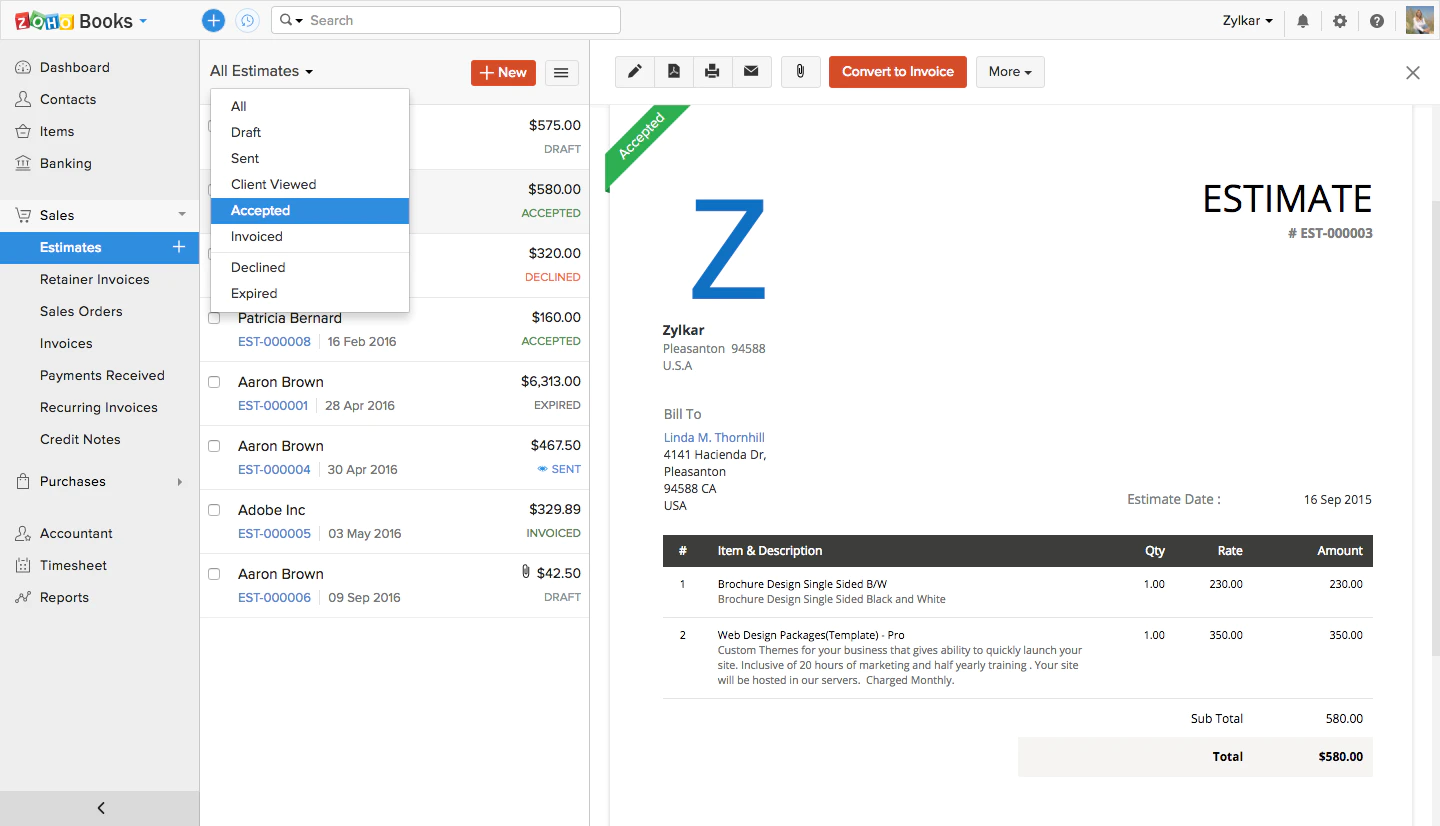

Quotes and Estimates

Zoho Books allows users to generate custom quotes and estimates for potential deals. Once a quote has been accepted and approved by the concerned parties, the platform allows you to use the details prescribed in the quote and generate an invoice in a single click - taking the hassle out of the process.

Client & Vendor Portal

Zoho Books has a client and vendor portal - serving users as a one-stop platform for collaboration. These portals enable your customers and vendors to view, manage, and inquire about their transactions from a single place - providing a seamless collaborative experience.

Zoho Books Pros and Cons

Pros

- Offers a free plan

- User friendly

- Simple to set-up

- Affordable

- Can be integrated with other Zoho apps

- Supports external apps

- Learned customer support

Cons

- Complex for custom reporting

- Mobile app crashes from time to time

- Doesn’t connect automatically with bank accounts

Zoho Books Pricing

Zoho Books has four different packages to choose from - Free Plan, Standard Plan, Professional Plan, and Premium Plan.

- Free: A single-user plan that doesn’t charge anything but comes with very limited functionalities and serves businesses with revenue less than $50K per annum.

- Standard: Charges $12 per organization in a month, supports up to 3 multi-logins and facilitates users with standard features of the tool.

- Professional: Best-suited for businesses. Supports up to 5 user connections. Comes with moderately advanced functionalities of the tool and charges $24 per organization in a month.

- Premium: Better serves large organizations or conglomerates. Supports up to 10 users. Comes with all the capabilities Zoho Books has to offer and charges $36 per organization in a month.

Zoho Books Integrations

Here are a few of the important app integrations supported by Zoho Books:

- Zoho apps

- Stripe

- PayPal

- Razorpay

- Paytm

- 2Checkout

- Braintree

- Authorize.Net

- Worldpay

- And more

Average Rating from Software Directories

In this section, we will explore what Zoho Books users have to say about the solution. For this, we will calculate the average ranking obtained by the platform on renowned tech forums like Capterra, GetApp, and G2. And, based on the customer reviews published on the aforesaid forums, the average rating of Zoho Books is 4.46.

Testimonials or Reviews

In this section, we will mention some of the reviews posted by Zoho Books users to know what they think of the invoicing solution. Let’s check out this review by Cheikh B.

“Zoho Books made my job easier and saved me a lot of time.”

And here’s another one by Kamron B.

“I really didn't like that none of the PayPal feeds including the fees and the currency rates were off, so when I try to match a PayPal payment to an invoice it straight up will not let me assign it to it because it doesn't match the invoice total. It expects me to look at the amounts in PayPal, and manually add an expense to make up the difference.”

Customer Support Options

Zoho Books currently offers three support options. Users can either contact Zoho Books 24/7 live support via chat, reach out to the help desk via email, and seek guidance from customer service representatives via call.

Product Screenshots

Bottom Line

Bottom Line

Zoho Books is a competent invoicing solution that comes with a variety of features and capabilities. The tool has a user-friendly interface and is really easy to set up. Zoho Books can be integrated with all other Zoho Apps along with other external applications and payment providers. With an average ranking of 4.46, Zoho Books is overall a decent invoicing solution to choose.

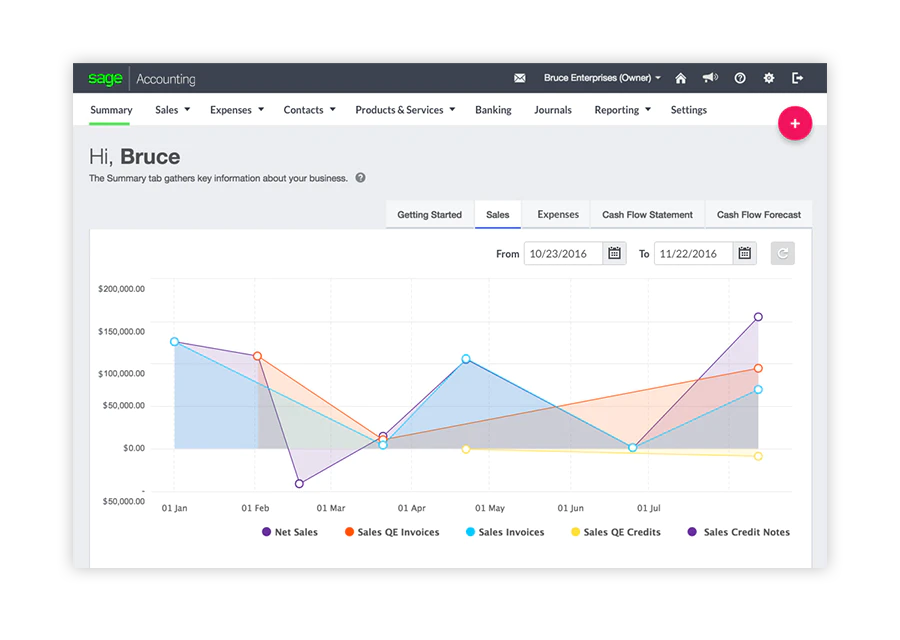

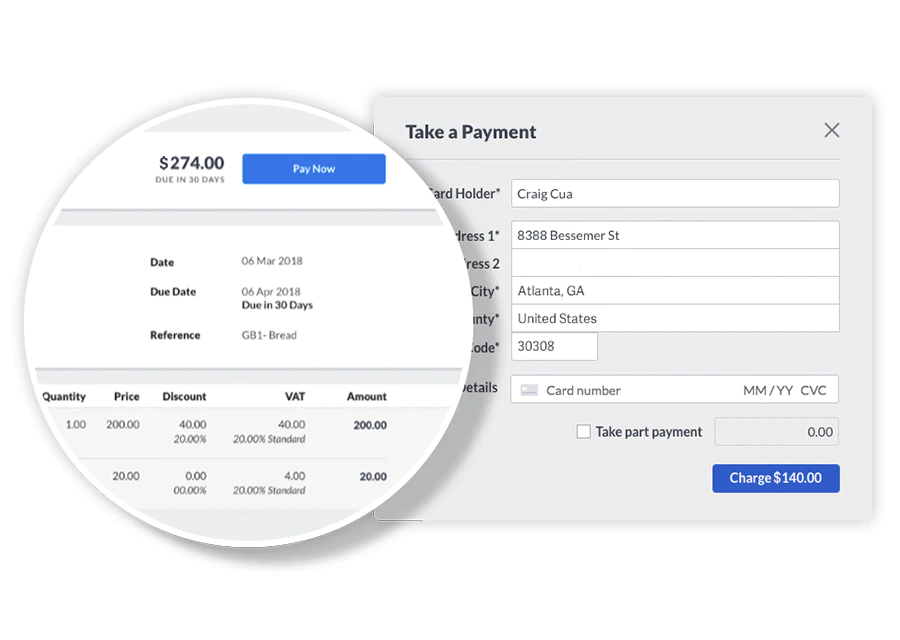

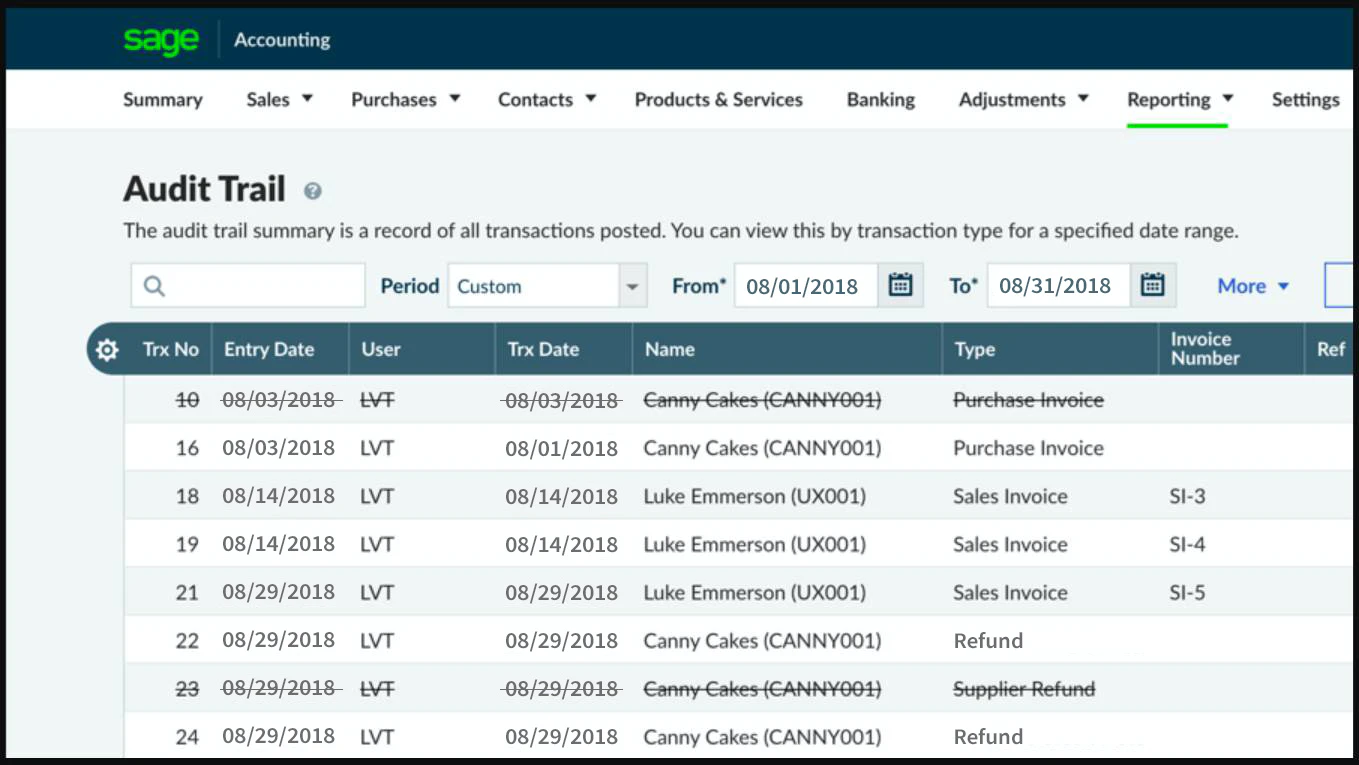

6 - Sage Accounting

Sage Accounting is a renowned invoicing solution that enables users to generate professional invoices, collect payments, and track business expenses hassle-free. Sage has a variety of features and offers different package plans. Being a web-based solution, Sage facilitates remote operations - allowing users to be on top of their invoicing workflows from anywhere in the world.

Sage Accounting Feature List

Sage comes with a wide range of features. Here, we have highlighted some of the important capabilities of the invoicing solution:

- Automated invoicing

- Custom invoices

- Quotes and estimates

- Multi-currency support

- Pay from invoice feature

- Payment tracking

- Online payments

- Alerts and notifications

- Reporting and analytics

- External integrations

Top 3 Features of Sage Accounting

Among all the features that Sage has to offer, the below-mentioned are the top 3 worth listing.

Quotes and Estimates

Sage enables users to provide quotes or estimates for upcoming deals or orders. Once a quote has been agreed upon by concerned parties and approved, it can be seamlessly converted to an invoice - saving users the hassle of entering entries or values all over again.

Pay from Invoice

With Sage, you can enable your customers to pay directly from an invoice without having to switch screens or accessing payment provider services. Your customers can pay from anywhere in the world securely and hassle-free with a single click on an invoice - routing them to proceed with payments via Stripe.

Currency Conversion

Say goodbye to the tedious and repetitive process of converting currencies manually. To facilitate users’ operations worldwide, Sage provides multi-currency support. The invoicing solution enables users to take into account global exchange rates, adjust billable amounts, and charge payments in the local currency of the recipient.

Pros and Cons of Sage Accounting

Pros

- Free trial

- A variety of features

- Simple user interface

- Multi-currency support

- Detailed reporting

- Audit trail

- Personalization features

- Desktop, cloud, and mobile access

Cons

- Steep learning curve

- Limited data storage

- No time tracking feature

- Poor customer service

Sage Accounting Pricing

Sage Accounting currently offers 2 price plans - Sage Accounting Start and Sage Accounting.

- Sage Accounting Start: Offered at $10 per month, the plan comes with very basic features - best suited for entrepreneurs or businesses that are just getting started.

- Sage Accounting: Offered at $25 per month, the plan comes with standard features and is best suited for medium to large-size businesses.

Sage Accounting Integrations

Here are some of the integration options given by Sage Accounting:

- AutoEntry

- Satago

- QuoteOnSite

- Stripe

- GoogleDrive

- And more

Average Rating from Software Directories

So far we have discussed features and capabilities of Sage Accounting. Now, let’s hear it from the users by exploring the ratings of the invoicing solution on leading tech forums like Capterra, GetApp, and G2. After reviewing Sage’s ratings on aforesaid forums, the average rating representing the solution is 4.13.

Testimonials and Reviews

Let’s check out a few of the reviews posted by the users of Sage Accounting. First, let’s hear it from Bruno S.

“Incredible experience, easy to use, and helpful to develop the business.”

Now, let’s see what Tom K. has to say about his experience.

“Confusing, complicated, and not suited for small business users”.

Customer Support Options

Sage offers three customer support options to choose from. You can either contact their help desk by writing an email, reach out to their live chat support, or talk to their customer support representatives on call.

Product Screenshots

Bottom Line

Bottom Line

Sage is a feature-rich invoicing solution that comes with a variety of capabilities. Although it’s marketed as a solution best suited for small to medium-size businesses, the reviews say otherwise. Be it the pricing of the tool, features offered, or the learning curve associated with the solution, Sage doesn’t seem to be a good option for small business owners. However, considering its features and average ranking on leading tech forums (4.13), it can be said that it’s a decent solution for medium to large enterprises.

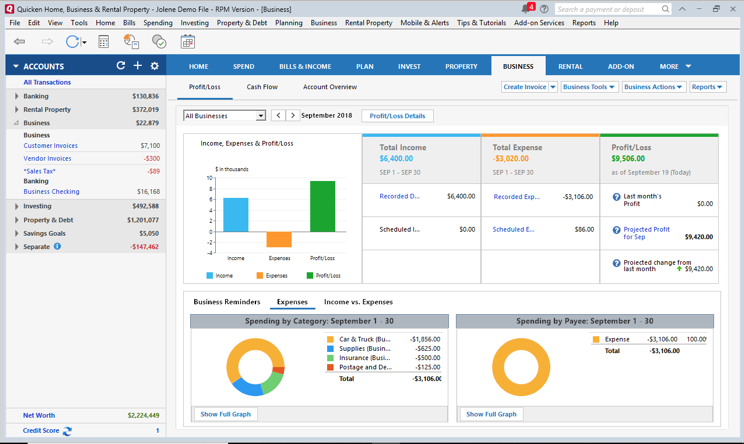

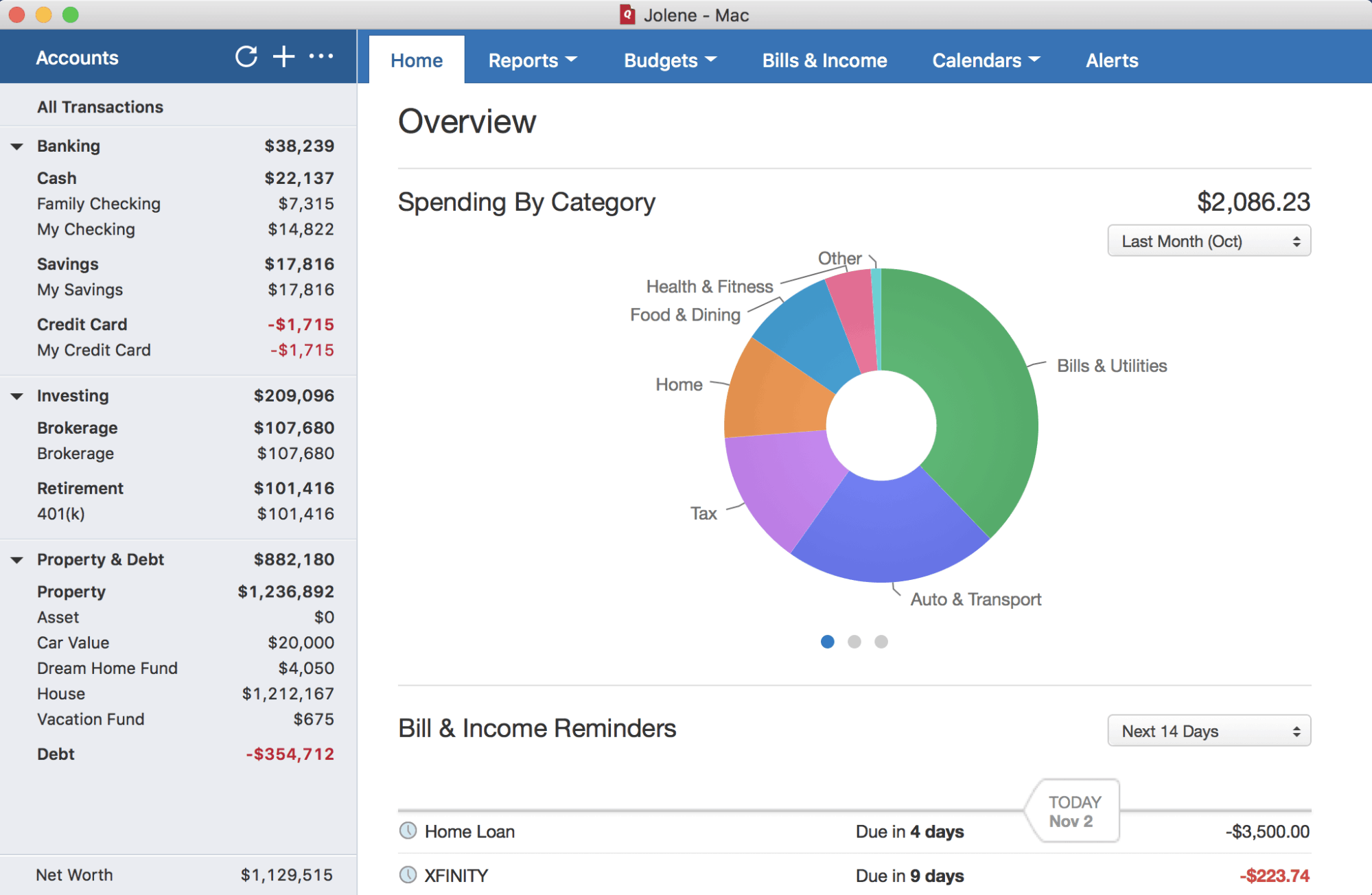

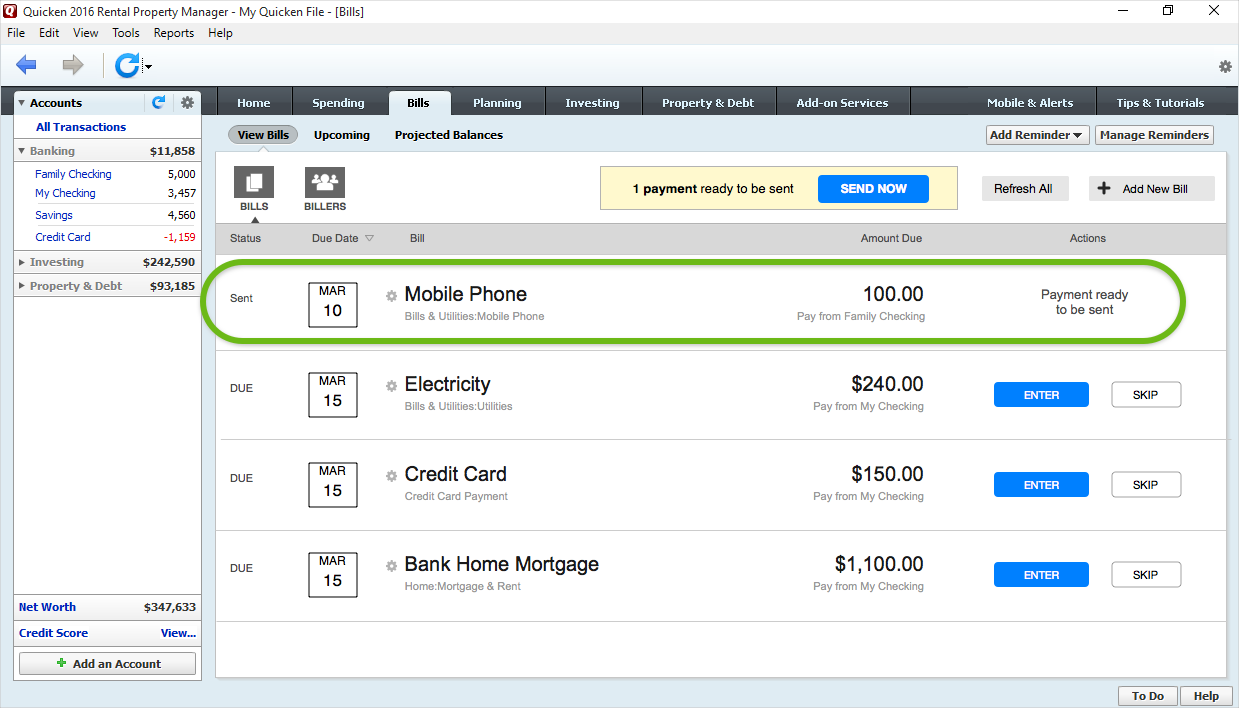

7 - Quicken

Quicken is a feature-rich finance management and invoicing software that comes with a wide range of features and capabilities. Despite having a steep learning curve and being a bit more expensive compared to other alternatives in the industry, Quicken is preferred by many businesses and professionals worldwide because it takes personalization to the next level.

Quicken Feature List

Quicken offers a variety of features to facilitate businesses worldwide. Here are some of the core features the solution has to offer:

- Automated invoicing

- Bills tracking

- Online payments

- Personalized financial management

- Income & expense categorization

- Split transactions

- Rollover budgeting

- Tax automation

- Alerts and notifications

- Reporting and analytics

- External integrations

Top 3 Quicken Features

Here, we will discuss the top 3 features that Quicken has to offer to its users.

Custom Invoicing

Quicken facilitates its users to generate professional-looking custom invoices and get paid effortlessly. Users can either print invoices and dispatch them to recipients via courier, or email invoices directly to get paid against the billable amount.

Money Management

Quicken also serves as a personal finance and money management solution. Professionals around the globe use Quicken to track spendings, create budgets, track investments, plan retirement, and more.

Bills Tracking

Quicken allows users to track bills hassle-free. The tool facilitates you with filter options and date range selection to search and retrieve payable or receivable bills within a given date range or matching a particular search query.

Pros and Cons of Quicken

Pros

- A wide range of features

- Affordable

- A variety of price plans to choose from

- Decent customer support

- Detailed reporting

- Personalized planning features

- Investment tools

Cons

- Steep learning curve

- Clunky user experience

Quicken Pricing

Quicken offers a variety of pricing plans to choose from - Quicken Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business.

- Quicken Starter: This package is suitable for entrepreneurs or businesses that are just getting started. It’s a Windows and Mac-compatible desktop app that costs $35.99 per year.

- Quicken Deluxe: The deluxe pack is suitable for small to medium-sized businesses - facilitating them to manage their finances and investments for $46.79 per year.

- Quicken Premier: This one is also a desktop app compatible with Mac and Windows that’s best suited for large businesses and costs $70.19 per year.

- Quicken Home & Business: This one is a Windows-compatible app only and costs around $93.59 per year.

Quicken Integrations

Here are a few of the important app integrations supported by Quicken:

- Quickbooks

- Itemize

- AutoShop

- MuniBilling

- SAM

- WebSelfStorage

- Polonious

- Faithful Steward

- NeatBooks

Average Rating from Software Directories

In this section, we will provide an average rating of Quicken based on the user reviews published on leading tech forums such as Capterra, GetApp, and G2. Based on the customer reviews published on the aforesaid sites, the average rating of Quicken is 3.96.

Testimonials and Reviews

Want to know what Quicken users have to say about their experience so far? Check out this review by Anne F.

“Overall, my experience is excellent. It helps with tax preparation but is most important for keeping a handle on personal finances. An elegant software!”

And here’s another one by Mark L.

“Twice Quicken 2018 has lost data. The first time was when I simply ran a One Step Update. The second was when I added an existing checking account. Each time deposits were completely lost, categories missing, Payee names changed, and split info was lost Quicken support solution: Make sure I back up my data!!!!! Financial software that can’t retain data is useless'”

Customer Support Options

Quicken currently offers two support options to its users. You can either contact Quicken representatives via call or you can simply write to the Quicken help desk and get your issue resolved.

Product Screenshots

Bottom Line

Bottom Line

Quicken offers a variety of features to its users and comes with an array of capabilities. However, the platform is bleeding customers lately. Clunky user experience, data loss, poor functionality, and more problems are being increasingly reported by its customers. Due to these reasons, most of its loyal users are either seeking or have already switched to other effective alternatives. They say and we quote that Quicken has lost its way. And, that’s probably the reason the average ranking of Quicken is 3.96 on leading tech forums.

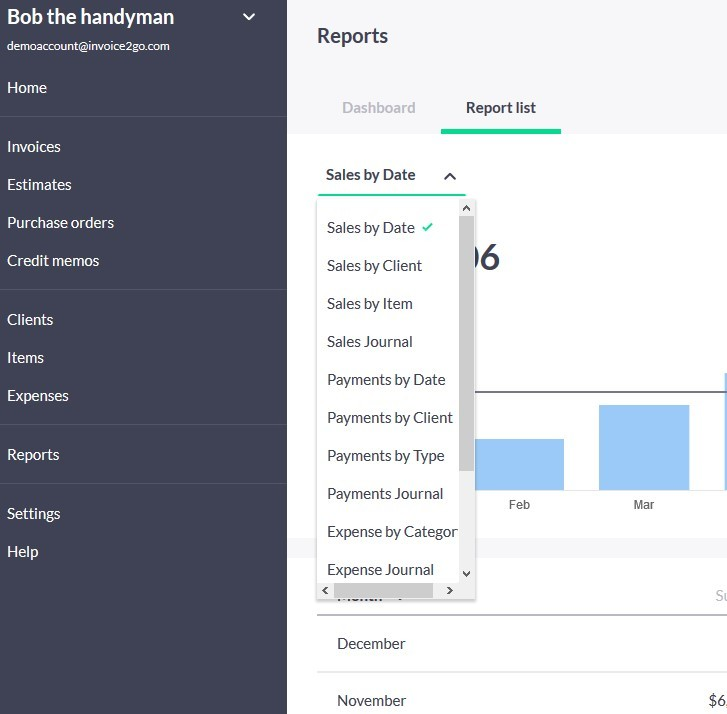

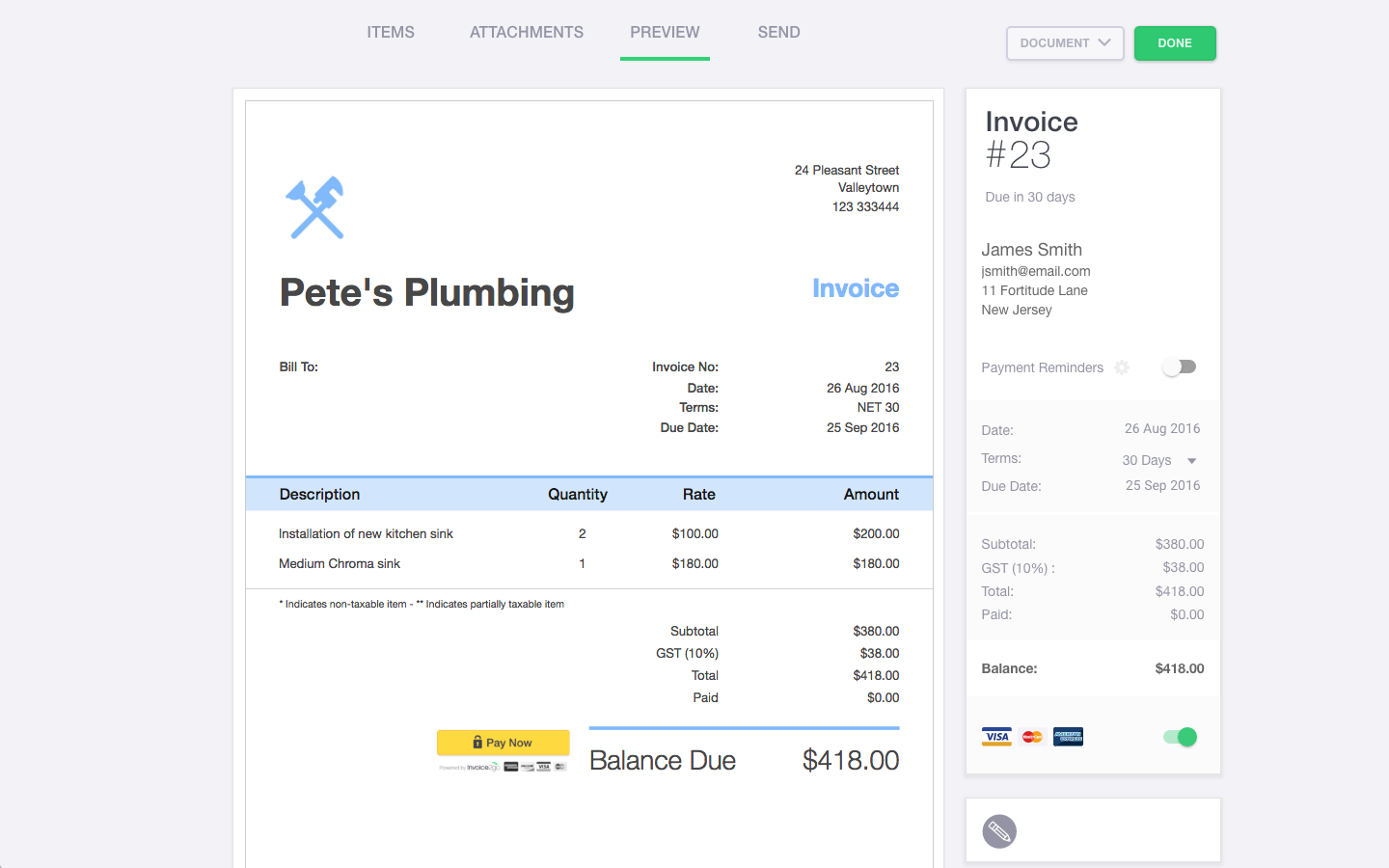

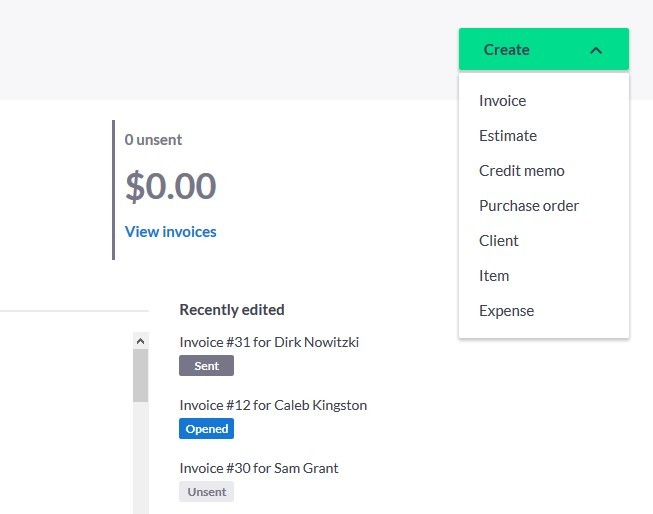

8 - Invoice2Go

Invoice2Go is an easy-to-use invoicing solution best suited for small businesses or independent professionals and freelancers. Invoice2Go is a basic yet effective invoicing and billing software that gets you paid instantly. It might not have a huge set of features to offer but the user interface is pretty straightforward to streamline invoicing workflows with ease.

Invoice2Go Feature List

Invoice2Go offers decent capabilities to automate invoicing workflows. Here are some of the important features:

- Automated invoicing

- Custom invoices

- Invoice tracking

- Payment reminders

- Quotes and estimates

- Online payments

- Project management

- Payroll option

- External integrations

- Bank connections

- Reporting and analytics

Invoice2Go Top 3 Features

Given below are 3 of the most important features offered by Invoice2Go.

Custom Invoicing

Invoice2Go enables users to customize invoices best suited for their business needs. Not only can you edit fields, but also the layout and format of invoices - personalizing them as per the use case. You can either opt for ready-to-use invoicing templates or create one from scratch by adding a logo, selecting colors, and finalizing the layout.

Quotes and Estimates

Win projects seamlessly with Invoice2Go. The tool allows you to send quotes and make your first impression count. Once approved, the estimates can be easily transformed into an invoice - saving you a lot of hassle and menial work.

Multiple Payment Options

Invoice2Go not only enables users to accept payments online but also empowers them to get paid via multiple payment options. This not only is beneficial for the users but also for their customers - giving them a variety of options to choose from.

Pros and Cons

Pros

- Cloud-based solution

- Easy-to-use

- Simple user interface

- Multiple payment options

- Customizable invoice templates

- Payroll option

- Device compatibility

- External integrations

Cons

- Limited features

- Limited integrations

- Expensive for what it has to offer

Invoice2Go Pricing

Invoice2Go offers three price plans to choose from - Starter, Professional, and Premium.

- Starter: Offered at $5.99 per month, the plan offers very limited and restricted features.

- Professional: This plan costs $9.99 per month and offers moderate-level features. However, the number of invoices allowed per month is quite less.

- Premium: This plan charges $39.99 per month and comes with all the features that Invoice2Go currently has to offer.

Integrations

Mentioned below are some of the key integration options supported and facilitated by Invoice2Go for its users:

- Quickbooks

- Xero

- Bench Accounting

- Gusto

Average Rating from Software Directories

In this section, we will explore users’ reviews about Invoice2Go and learn from their experiences. For this, we visited 3 of the leading tech forums Capterra, G2, and GetApp to know how users rate Invoice2Go as an invoice management software. And to our surprise, the software managed to score an average rating of 4.1 despite competing against some of the giants in the industry.

Testimonials and Reviews

To dig a little deeper, we also explored individual user reviews to know what users like or dislike about Invoice2Go and the features it has to offer.

Let’s hear it from Sarah N. first.

“I love the ease of this software. I have many clients and it is great to be able to send an invoice from my phone if I am away from my desk.”.

Now, let’s see what Marian C. has to say who had a completely different experience.

“Extremely disappointing, tried to contact them several times, always having an automated reply from a robot, there is NO customer service”.

Customer Support Options

Invoice2Go facilitates its users with 2 customer support options. You can either contact their help desk via email and get your queries resolved or reach out to their representatives via live chat. There is no on-call support option available at the moment.

Product Screenshots

Bottom Line

Bottom Line

Invoice2Go is an easy-to-use invoicing solution best suited for freelancers, professionals, or businesses that are just getting started. Though the platform managed to score an average rating of 4.1 on leading tech forums, the software falls short on a lot of aspects - mainly the feature variety and integration options. And, that’s the reason it’s sitting at the bottom of our list. However, they have a lot of things planned, so this ranking probably won’t be permanent.

Table Comparison

|

Features |

ZarMoney |

Quickbooks Online |

Freshbooks |

Xero |

Zohobooks |

Sage Accounting |

Quicken |

Invoice2Go |

|

Price per Month |

Starts from $15 |

Starts from $16 |

Starts from $15 |

Starts from $11 |

Starts from $12 |

Starts from $10 |

Starts from $12 |

Starts from $5.99 |

|

Custom invoices |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Online Payments |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Credit Limit & Credit Hold |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

❌ |

|

Quotes/Estimates |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Sales Orders |

✔ |

❌ |

✔ |

✔ |

✔ |

✔ |

❌ |

❌ |

|

Sales Receipt |

✔ |

✔ |

✔ |

✔ |

❌ |

✔ |

❌ |

❌ |

|

Scheduler |

✔ |

❌ |

✔ |

❌ |

✔ |

✔ |

✔ |

✔ |

|

Order Status |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

❌ |

❌ |

|

Customer Statements |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Pre-payments |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

❌ |

|

Payment Terms |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Alerts & Notifications |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Purchase Orders |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

❌ |

❌ |

|

Billing |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Expense Tracking |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Print Checks |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Payment Discounts |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Related Transactions |

✔ |

❌ |

✔ |

✔ |

❌ |

✔ |

❌ |

❌ |

|

Auto Expense Recording |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

Best of the Best - Top 3

After detailed scrutiny of the invoicing solutions available in the market and a comparison of their features offered, here are the 3 best options worth considering.

ZarMoney

ZarMoney is a feature-rich online invoicing solution that comes with a variety of features, an easy-to-use interface, flexible packages, and scalable capabilities. It’s a one-stop platform to automate invoicing workflows, manage sales or purchases, provide quotes or estimates, manage bills, track expenses, reconcile statements, get paid online, and set tax calculation and filing processes on autopilot. ZarMoney is not just a compelling solution for invoicing but also offers features that facilitate other operations. Hence, it’s sitting at the top of our top 3 recommendation list.

Freshbooks

Freshbooks earns the second spot in our top 3 recommendation list. The invoicing capabilities of Freshbooks are more or less on par with ZarMoney which makes it a solution worth considering. Freshbooks offers a wide range of capabilities to automate invoicing processes and comes with a simple straightforward user interface. However, the platform doesn’t offer multi-currency support at the moment and lacks value-added features that may facilitate workflows additional to invoicing.

Xero

The last invoicing solution to conclude our top 3 recommendation list is Xero. Xero is a cloud-based invoice management software that’s preferred by small to large size companies around the globe. The tool offers similar features to other recommended alternatives - ZarMoney and Freshbooks, however, there are some areas where the solution falls short in comparison. Xero is a feature-rich software, there’s no doubt about that, but there’s a steep learning curve for using the platform to its full potential. Moreover, Xero doesn’t support ETPs and you have to pay extra to unlock the payroll processing option. That’s why it’s currently at the bottom spot of our top 3 recommendation list.

FAQs

What are the best invoicing softwares for small businesses?

Based on our research, analysis of features offered, and evaluation of customer reviews, the best invoicing softwares for small businesses are - ZarMoney, Quickbooks, and Invoice2Go.

What are the best invoicing softwares for medium-sized businesses?

There’s a variety of invoicing solutions best suited for medium-sized businesses. The tendency to spare a little more budget than small businesses unlocks a lot of possibilities. Here are some of the options worth considering: ZarMoney, Freshbooks, and Zoho Books.

What are the best invoicing softwares for large companies?

Based on our analysis of features and capabilities offered, here are the best invoicing solutions suitable for large companies: ZarMoney, Freshbooks, and Xero.

What are the best invoicing softwares for freelancers?

Since freelancers struggle with limited budgets and seek the basic invoicing capabilities for project billing, here are the best-suited options for freelancers: Invoice2Go, Wave Apps, and InvoiceNinja.

What are the best invoicing softwares for Mac?

Considering the features, ease-of-use, and device compatibility, here are the best invoicing solutions recommended for Mac users: ZarMoney, Freshbooks, and Quickbooks.

What are the best billing softwares to get paid on time?

Just features and capabilities aren’t enough to get you paid on time. Your billing solution should enable you to send automated alerts to customers - reminding them of the payable amount. The ability to send alerts and reminders is available in all of the solutions recommended in this article. Check out the feature comparison table for more details.

Which is the cheapest invoicing app?

There are many cheap invoicing apps available in the market. However, efficiency and performance matter as well, not just the cost. Among the solutions recommended in this article, the cheapest option is Invoice2Go.

Which is the easiest invoice software?

This may sound a bit biased but ZarMoney is the easiest invoice software out there with a user-friendly interface and no steep learning curve.

Conclusion

Choosing the best invoicing software isn’t easy. There are a lot of alternatives available in the market that offer more or less similar features. Also, others spend millions on fake advertising - exaggerating the capabilities offered.

In this article, we recommended the 8 best invoicing software for businesses in 2021 among which ZarMoney, Freshbooks, and Xero stood tall in the top 3. And, ZarMoney outshined all as a top-of-the-line alternative for Xero, Quickbooks, Freshbooks, Zohobooks, Sage, Quicken, and Invoice2Go.

Based on the information presented in this article and our recommendations, you must have shortlisted a few options by now. You must keep a few things in mind before making a final decision. When seeking a solution best suited for their needs, people often neglect flexibility, scalability, and ease of use. In addition to the features offered, the aforesaid factors must also be taken into consideration.

Personal preference also comes into play here as easy-of-use is subjective. Since most of the recommended solutions offer a free trial, we suggest you take our recommended solutions for a spin and choose the one best suited for your needs.