Best Accounting Software for Tech Companies

The unprecedented rise in the tech industry has led to a boom in the establishment of tech companies. Today countless small, medium, and even large corporations provide complete tech solutions to clients. However, these enterprises need an accounts expert to maintain flawless accounts and oversee everyday financial operations.

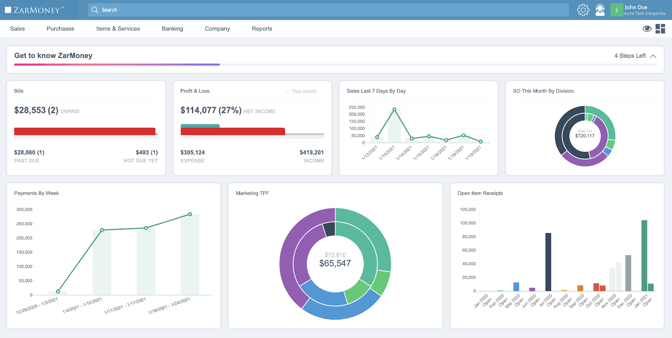

Your tech company needs the most efficient tools to stay competitive in the rapidly evolving technological world. One of these tools is business accounting software. Among various accounting software solutions, ZarMoney stands out as the best accounting software for tech companies, and for good reasons. Let's dive into its features, discuss its superiority over competitors, and answer some commonly asked questions.

1. Accounts Payable and Receivable

Accounts payable and accounts receivable are fundamental to managing your cash flow and ensuring your business maintains a solid financial footing. The accounts payable feature allows you to manage all your payable transactions, deadlines, and supplier relationships effectively.

Similarly, the accounts receivable feature ensures you stay on top of owed money and have the funds you need to grow your business. Especially as a new setup, your tech company might need a continuous, error-free system that helps you stay updated with your accounts payable and receivable so you can maintain a consistent cash flow.

ZarMoney distinguishes itself as a premium cloud accounting software by offering a fully integrated, highly automated system for managing accounts payable and receivable. Not only does this save time and reduce errors, but it also improves the accuracy of your financial statements. In addition, the platform seamlessly handles credit card transactions, integrates online payments, and even provides payment reminders to ensure all transactions are accounted for timely and efficient.

2. Bank Reconciliation

Bank reconciliation is the process of matching your internal financial records against the statements issued by your bank. This function is crucial to identifying and rectifying any discrepancies, preventing potential financial losses, and maintaining the accuracy of your financial records.

ZarMoney shines with its automatic bank reconciliation feature. Connecting to your bank accounts quickly matches your internal records with bank transactions. In addition, the intuitive interface, detailed audit trails, and customizable reports provided by ZarMoney allow you to quickly identify discrepancies, ensuring your balance sheets accurately reflect your financial health.

With ZarMoney, you can be assured that none of your financial transactions go under the radar. With all your transactions compiled and organized on one platform, you can direct your focus on attracting satisfied customers to your tech company and providing the best IT services.

3. Integration with Payroll Management Systems

Payroll management can be complex, especially for tech companies with various employment types (full-time, part-time, contractors) and potentially different states or countries. For example, you might need to pay your maintenance team and workers, rent or bills, and whatnot.

A sound payroll system must handle payment calculations, deductions, and disbursements while ensuring compliance with various laws and regulations. Above all, this system must ensure there are no errors in payments.

ZarMoney seamlessly integrates with a flexible payroll management system such as Gusto. It accommodates different employment types, manages calculations automatically, and ensures tax compliance. Its user-friendly interface simplifies payroll processing, making it easy even for non-accountants.

4. Financial Reports

Every company needs to keep a close eye on its financial performance. Therefore, financial reports such as profit & loss statements, balance sheets, and cash flow statements are indispensable. These reports provide valuable insights into your company's financial health, enabling you to make informed strategic decisions.

If your tech company's financial records show more loss than profit, you can reflect on the reasons and plan accordingly. Your cash flow statements help you decide for the future and have productive team discussions on financial health.

ZarMoney stands above the competition with its robust financial reporting features. It automatically generates comprehensive reports, including profit & loss statements, balance sheets, and cash flow statements, providing a real-time snapshot of your company's financial status. The reporting features are also customizable, allowing you to create detailed reports that fit your company's unique needs.

5. Tax Preparation

Tax preparation can be a daunting task for any business. It involves managing tax obligations, applying correct tax rates, and generating tax-related reports, all requiring meticulous attention to detail to avoid penalties.

What makes tax preparation an absolute nightmare is the fear of inaccuracies that can lead to penalties that cost businesses dearly. As a startup, you would want an accounting software for your tech company that looks after the accounts and helps you successfully slay the dragon: tax filing.

ZarMoney simplifies tax preparation with its comprehensive feature set. It keeps track of all your tax obligations, applies the correct tax rates based on your location, and generates necessary tax reports. In addition, the software keeps up-to-date with the latest tax laws, ensuring you're always compliant. ZarMoney's tax preparation features integrate seamlessly with its other accounting features, ensuring that your tax data is always accurate and up-to-date.

6. Inventory Management

Like all other companies, tech companies also deal with physical goods. They must keep track of their hardware, machines, and spare parts such as disk drives, etc. thus, efficient inventory management is essential. The software should have features to track inventory accurately, helping avoid overstocking or understocking situations.

ZarMoney offers a robust inventory management system that enables you to track your inventory levels, sales, and purchases in real time. It allows for easy categorization of inventory, quick updates on inventory levels, and even sends alerts when stock levels are low. In addition, unlike much other accounting software, ZarMoney's inventory tracking is integrated with other modules like sales and purchase, ensuring accuracy and efficiency.

7. Integration with Other Systems

In the digital era, businesses use a variety of software solutions for different needs, including payment gateways and productivity tools. As a result, you cannot expect to truly succeed when a significant part of your time goes into switching between software and trying to integrate data from multiple sources.

Your accounting software should be able to integrate with these systems for data consistency and efficient operations. ZarMoney excels in this aspect with its robust integration capabilities. It seamlessly integrates with various other software, ensuring smooth data flow across different systems.

This helps eliminate data silos, reduce manual data entry, and prevent errors. Whether you need to pull customer data or with a project management tool, ZarMoney makes it simple and straightforward.

8. Expense Tracking

Every setup incurs some expenses. In addition, there are running costs such as bills and salaries and unexpected expenses such as repairs or machine replacement. Therefore, your business will stay afloat only when you carefully plan all your expenses and thoroughly check where your money goes.

Keeping track of expenses can be challenging with a distributed or mobile workforce. However, an efficient expense tracking system is essential for managing costs, ensuring policy compliance, and streamlining reimbursements.

ZarMoney provides a comprehensive expense tracking feature that enables your employees to log their expenses easily, upload photos of receipts, and submit expense claims. Managers can review and approve these claims directly within ZarMoney, streamlining the process. Additionally, all expense data is automatically integrated into your financial reports, giving accurate insights into your company's spending.

Comparison with Competitors

ZarMoney outshines its competitors - Sage Accounting, FreshBooks, Xero, and Wave - in all essential features. While these accounting software solutions offer basic features, ZarMoney provides a comprehensive suite of robust features, whether it's inventory management, multi-currency support, or integration capabilities.

It stands out with unlimited users and unlimited invoice offerings, even at its lowest pricing tier, giving it a competitive edge.

|

ZarMoney |

Sage Accounting |

FreshBooks |

Xero |

Wave |

||

|

Financial Reports |

✅ |

✅ |

✅ |

✅ |

✅ |

|

|

Access to All Features in a Single Subscription Plan |

✅ |

❌ |

❌ |

❌ |

❌ |

|

|

Tax Preparation |

✅ |

✅ |

✅ |

✅ |

❌ |

|

|

Integrations |

✅ |

✅ |

❌ |

✅ |

✅ |

In conclusion, ZarMoney's robust features, designed with the unique needs of tech companies in mind, make it an exceptional choice for your accounting needs. Its comprehensive set of features, top-notch customer service, and ease of use all contribute to its reputation as the best accounting software for tech companies.

By choosing ZarMoney, you're not just opting for software; you're choosing a strategic partner dedicated to your company's financial success.

Frequently Asked Questions (FAQs)

1. How do I choose the right accounting software for my tech company?

When choosing accounting software for your tech company, there are a few factors you should consider, including:

- Your budget: How much are you willing to spend on accounting software?

- Your needs: What features do you need from accounting software?

- Your users: How many users will need to access the accounting software?

- Your integrations: Do you need the accounting software to integrate with other software you use?

2. Why is ZarMoney the best accounting software for tech companies?

ZarMoney's comprehensive features and robust integration capabilities make it the best accounting software for tech companies.

3. Can ZarMoney handle credit card transactions?

Absolutely. ZarMoney seamlessly integrates credit card transactions into its accounting processes, making tracking and managing payments easy.

4. Is ZarMoney suitable for startups?

ZarMoney's scalable features and pricing tiers make it a perfect fit for startups and midsize companies. What makes ZarMoney stand out is the fact that it offers all benefits to users in a single price plan instead of making them pay more to access more.

5. Can ZarMoney integrate with other systems?

Yes, ZarMoney integrates seamlessly with various systems, including Shopify, Gusto, and Zapier, to name a few.