Top 6 Alternative To Xero Invoicing

When managing your business finances, the importance of a seamless invoicing process can't be overstated. Xero has been a go-to for many, but with an ever-evolving competition, the search for an alternative to Xero invoicing is on the rise.

This article will explore the top 6 alternatives to Xero invoicing that could revolutionize how you handle invoices.

1 - ZarMoney

ZarMoney strides confidently into the financial software arena, presenting itself as a dynamic and comprehensive alternative to Xero invoicing, offering a seamless approach to invoicing and accounting. Its robust features are crafted to cater to modern businesses looking for an edge in financial management.

Key Features of ZarMoney

- Create professional invoices in seconds.

- Invoice templates

- Invoice reports

- Send invoices via email and text.

- Automatic invoice reminders

- Recurring invoices

- Accept online payments

- Create and send quotes and estimates.

- Track sales orders

- Offer payment terms and early payment discounts.

- Customize customer fields and tags.

Top 3 Features of ZarMoney

1. Create Professional Invoices in Seconds

ZarMoney transcends the basic invoicing feature by enabling users to generate professional invoices quickly. This pivotal tool not only injects efficiency into the invoicing process but also reflects the financial health and professionalism of a business. By utilizing customizable templates, businesses can maintain brand consistency across all financial documents.

2. Invoice Reports

A robust invoicing tool is complete with detailed reporting, and ZarMoney delivers this with finesse. The platform's invoice reports provide in-depth insights into financial performance, allowing businesses to track sales, monitor expenses, and stay on top of cash flow. This advanced reporting capability ensures that businesses can make informed decisions.

3. Recurring Invoices

ZarMoney's recurring invoices feature epitomizes the platform's understanding of the need for efficient financial management. By setting up recurring invoices, businesses can streamline their billing process, save valuable time, and reduce the margin for error. This feature is a boon for maintaining consistent cash flow, particularly for businesses with subscription-based models or regular clients.

Pros of ZarMoney

- Simplifies the invoicing process with fast, professional invoices

- Advanced invoice reporting for improved financial oversight

- Streamlines billing with reliable recurring invoices

Cons of ZarMoney

- Zarmoney may offer fewer third-party integrations than competitors like Xero, potentially limiting seamless connectivity with other business tools.

Pricing of ZarMoney

- Entrepreneur: $15 Per month

- Small Business: $20 Per month

- Enterprise: Starts from $350 Per month

Customer Support of ZarMoney

- FAQs/Forum

- Knowledge Base

Supported Platforms of ZarMoney

- Web

Testimonials

Final Verdict of ZarMoney

ZarMoney is an outstanding invoicing and accounting solution that provides various features tailored to enhance financial workflows. It is a prime candidate for businesses looking for a Xero alternative that can handle everything from custom invoice creation to detailed financial reporting and efficient recurring billing.

2 - QuickBooks Online

QuickBooks Online emerges as a formidable player in the online accounting software landscape, bringing with it impressive features designed to streamline and enhance the financial operations of businesses. As a Xero alternative, it stands out with its user-friendly interface, advanced features for comprehensive financial management, and a scalable approach to accommodate everyone from sole traders to larger enterprises.

Key Features of QuickBooks Online

- Create and customize invoices.

- Automate your invoicing

- Track your invoices

- MulticurrencyMulticurrency invoicing

- Estimates

- Sales receipts

- Invoice templates

- Invoice notes

- Invoice terms

- Invoice attachments

Top 3 Features of QuickBooks Online

1. Track Your Invoices

At the core of QuickBooks Online's invoicing solution lies the ability to meticulously track every invoice. This feature assures businesses that they can monitor their invoice's journey from creation to payment. The real-time tracking ensures that businesses stay informed about the status of their transactions, thus enhancing customer management and tightening control over cash flow.

2. Invoice Notes

The invoice notes feature in QuickBooks Online is an invaluable addition to its invoicing system, allowing for seamless client communication and record-keeping. This robust feature is a digital memo pad, enabling users to add pertinent information and special instructions to invoices, fostering clarity and personalization in client relationships. This nuanced touch not only enhances the invoicing process but also enriches the overall customer experience.

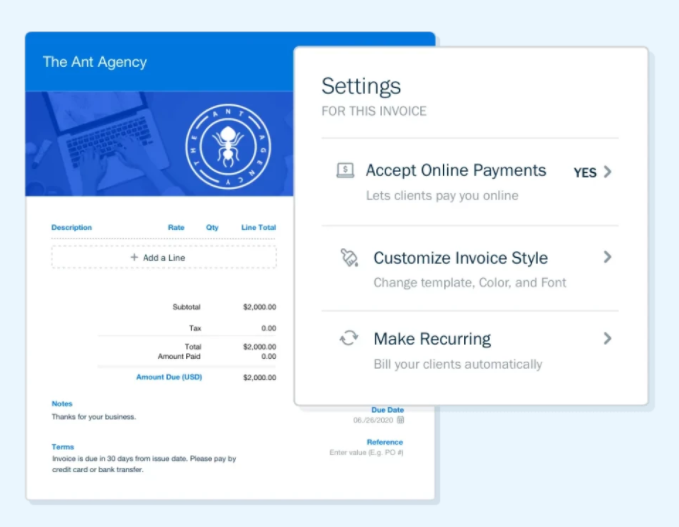

3. Automate Your Invoicing

Automation stands as a cornerstone of QuickBooks Online, revolutionizing the way businesses approach their financial workflows. By automating the invoicing process, QuickBooks Online significantly reduces manual entry, minimizes errors, and frees up valuable time for business owners to focus on growth strategies. This capability to automate, including the setting up recurring invoices and automatic payment reminders, confirms the platform's status as a leading choice for an accounting solution that values efficiency and precision.

Pros of QuickBooks Online

- Automates invoicing for time-saving and efficiency

- Detailed invoice tracking enhances financial oversight.

- Customizable invoices uphold brand consistency and professionalism.

Cons of QuickBooks Online

- Some users may find the extensive features overwhelming initially.

- Higher pricing plans may be expensive for smaller businesses.

Pricing of QuickBooks Online

- Simple Start: $15

- Essentials: $30

- Plus: $45

- Advanced: $100

Customer Support of QuickBooks Online

- Chat

- Knowledge Base

- 24/7 (Live rep)

- FAQs/Forum

- Email/Help Desk

- Phone Support

Supported Platforms of QuickBooks Online

- Web

- Android

- iPhone/iPad

Testimonials

Final Verdict of QuickBooks Online

QuickBooks Online is a compelling alternative to other popular business accounting software like Xero and Sage, offering a cloud-based solution rich with features such as advanced invoice tracking, note-adding capabilities, and automation of invoicing processes. It stands out as an excellent reporting option with strong bank connectivity and reconciliation capabilities, suitable for businesses of various sizes looking for a robust, cloud-based accounting solution.

3 - Sage Business Cloud Accounting

Sage Business Cloud Accounting is an advanced cloud-based accounting solution that empowers small to mid-sized businesses with intuitive and comprehensive financial tools. Aimed to serve as an alternative to traditional accounting systems and a Xero alternative, it provides capabilities such as online invoicing, digital payments, and financial reporting.

Key Features of Sage Business Cloud Accounting

- Create and send invoices in multiple currencies.

- Customize invoice templates with your company logo and branding.

- Track invoice status and send payment reminders

- Accept online payments via Stripe.

- Create recurring invoices to save time.

- Manage customer accounts and track payments.

- Generate invoice reports to get insights into your business performance.

Top 3 Features of Sage Business Cloud Accounting

1. Create and Send Invoices in Multiple Currencies

Sage Business Cloud Accounting alleviates the complexities of international transactions by allowing users to create and send invoices in various currencies. This feature is pivotal for businesses with a global clientele, ensuring accurate and professional invoices are issued regardless of geographic and currency boundaries.

2. Customize Invoice Templates with Company Logo and Branding

Customization is a core component of Sage Business Cloud Accounting's invoice management capabilities. It recognizes that the details matter, allowing users to customize invoice templates to include their branding and company logo. This not only ensures consistency across all business documents but also conveys a professional image to customers.

3 - Track Invoice Status and Send Payment Reminders

Effective invoice management extends beyond creation; it also encompasses tracking and follow-ups. Sage Business Cloud Accounting excels with its tracking invoice status and automated payment reminders functionality. This feature helps businesses stay on top of their accounts receivable by providing instant insights into which invoices have been paid, are due, or are overdue, thus facilitating better cash flow management and financial planning.

Pros of Sage Business Cloud Accounting

- User-friendly interface that simplifies accounting processes.

- Extensive customization options for invoices, enhancing brand consistency.

- MulticurrencyMulticurrency support aids businesses in international trade.

- Comprehensive financial reports assist in making informed business decisions.

Cons of Sage Business Cloud Accounting

- Advanced features may come at a higher price point.

- It may not cater to the very complex accounting needs of larger enterprises.

Pricing of Sage Business Cloud Accounting

Subscription-based pricing varies based on the number of users and selected features.

Customer Support of Sage Business Cloud Accounting

- Email/Help Desk

- Phone Support

- FAQs/Forum

- 24/7 Live rep

- Chat

- Knowledge Base

Supported Platforms of Sage Business Cloud Accounting

- Android

- Web

- iOS

Testimonials

Final Verdict on Sage Business Cloud Accounting

Sage Business Cloud Accounting stands out in the accounting software market with its powerful features tailored to small and medium-sized businesses. The cloud-based solution's emphasis on multicurrency support, customizable invoices, and advanced reporting makes it a preferred choice for companies looking for an alternative to Xero invoicing to streamline their financial operations.

4 - FreshBooks

FreshBooks is a leading online invoicing and accounting solution that positions itself as a prominent alternative to Xero invoicing and a compelling alternative to other accounting software like QuickBooks Online and Sage Business Cloud Accounting. It aims to simplify and automate financial management for sole traders, freelancers, and small to medium-sized businesses with its comprehensive invoicing and accounting tools.

Key Features of FreshBooks

- Create and send beautiful invoices quickly and easily

- Automate recurring payments for client convenience

- Keep a meticulous record of invoice history

- Accept online credit card payments with ease

- Monitor payments with robust invoice-tracking tools

- Generate detailed invoice reports for financial insights

- Craft professional estimates to streamline client proposals

- Implement late payment fees to encourage timely payments

- Automate the sending of payment reminders to clients

- Utilize deposits to manage cash flow and client payments effectively

Top 3 Features of FreshBooks

1. Track Invoice History

Tracking the history of invoices is a basic feature that FreshBooks elevates to an advanced accounting feature. With this, users can see the full journey of an invoice from creation, sending, and viewing to payment, which is essential for maintaining accurate financial records and ensuring the financial health of a business.

2. Automate Recurring Payments

Automation is a hallmark of modern cloud accounting software, and FreshBooks stands out with its ability to automate recurring payments. This feature is a timesaver for businesses with monthly subscriptions or ongoing client services. By setting up recurring billing profiles, FreshBooks users can ensure consistent cash flow and minimize the time spent on manual billing.

3. Track Invoice Payments

Payment tracking is another vital component of FreshBooks' comprehensive suite of features. It provides users with real-time updates on invoice statuses, enabling them to see which invoices have been paid and which are still outstanding. This is invaluable for maintaining cash flow and managing client accounts effectively. The feature's integration with bank feeds and payment acceptance options means that all financial information is in one place.

Pros of FreshBooks

- Intuitive interface streamlines accounting processes for non-accountants.

- Advanced features support detailed financial management and reporting.

- Unlimited invoices and automated payment capabilities maximize efficiency.

Cons of FreshBooks

- Pricing plans can become expensive as additional users and advanced features are added.

- Some users may find limited functionality in inventory tracking and complex accounting needs.

Pricing of FreshBooks

- Lite: $8.50 per month

- Plus: $15 per month

- Premium: $27.50 per month

Customer Support of FreshBooks

- Phone Support

- Email/Help Desk

- Chat

- FAQs/Forum

- Knowledge Base

Supported Platforms of FreshBooks

- Web

- Android

- iPhone/iPad

Testimonials

Final Verdict on FreshBooks

As an online accounting software designed with an intuitive interface and a comprehensive suite of financial tools, FreshBooks emerges as an excellent choice for those seeking an alternative to Xero invoicing and other popular business accounting software. Its track record for facilitating quick online invoicing, effective expense tracking, and user-friendly project management makes it a preferred choice for small businesses and sole proprietors.

5 - Zoho Books

Zoho Books emerges as a user-friendly interface and a versatile cloud-based solution that competes as a friendly Xero alternative in the accounting software market. It is recognized for its extensive suite of invoicing and financial tools, making it a compelling alternative to Xero invoicing and a more cost-effective choice for small to medium-sized businesses, as well as sole traders.

Key Features of Zoho Books

- Seamlessly manage recurring invoices and ensure timely payments

- Quickly create and send professional invoices with customizable templates

- Utilize e-invoicing for efficient digital payments

- Accept online payments, simplifying the payment acceptance process

- Maintain vigilance with detailed invoice tracking

- Employ invoice reminders to reduce outstanding invoicing

- Customize invoices to reflect your brand and professionalism

- Generate comprehensive invoice reports for financial insights

- Enable multilingual invoicing for a diverse clientele

- Conduct Business globally with multicurrency invoicing capabilities

- Add personal touches to invoices with notes

- Automate tax calculations to save time and reduce errors

Top 3 Features of Zoho Books

1. Invoice Customization

Zoho Books takes custom invoicing to new heights with its advanced invoicing features, allowing businesses to create customized invoices that resonate with their brand identity. The platform provides a selection of customizable templates that can be tailored to the specific needs of a business, adding elements such as logos, color schemes, and custom fields.

2. Multilingual Invoicing

Zoho Books' multilingual invoicing feature is a powerful feature that addresses the needs of today's globalized business environment. By allowing businesses to send invoices in multiple languages, Zoho Books eliminates language barriers and enhances client communication, making it a prominent alternative for businesses with an international client base. This feature ensures that clients receive invoices in their preferred language, which is an additional step towards professional services and customer satisfaction.

3. Invoice Tracking

The invoice tracking feature in Zoho Books provides businesses with real-time updates on the status of every invoice, from viewed to paid. This feature is essential for maintaining tight control over the cash flow records and financial management tools. By using Zoho Books' invoice tracking, businesses can reduce the time spent chasing payments and improve their cash flow forecasting.

Pros of Zoho Books

- Robust features support every aspect of invoice and financial management.

- Multilingual and multicurrency support makes it a versatile tool for global Business.

- A User-friendly interface ensures ease of use even for those without accounting expertise.

Cons of Zoho Books

- Some advanced accounting features might be overwhelming for sole proprietors.

- The most advanced features come with more expensive plans that can be a significant investment for smaller businesses.

Pricing of Zoho Books

- Standard: $10 per month

- Professional: $20 per month

- Premium: $30 per month

- Elite: $100 per month

- Ultimate: $200 per month

Customer Support of Zoho Books

- Knowledge Base

- Chat

- Email/Help Desk

- FAQs/Forum

- Phone Support

Supported Platforms of Zoho Books

- Web

- Android

- iPhone/iPad

Testimonials

Final Verdict on Zoho Books

Zoho Books stands out in the accounting software market as an alternative to Xero invoicing that caters to many businesses. It offers a strong set of features, from basic invoicing to advanced reporting options. It is a popular choice for businesses that require a complete accounting solution with the flexibility of a cloud-based platform. Zoho Books is a professional accountant-friendly platform that promises to streamline financial processes, making it an excellent choice for anyone seeking an alternative to Xero invoicing.

6 - Wave Accounting

Wave Accounting positions itself as a prominent alternative to Xero invoicing, offering a range of features tailored for sole traders and small business owners. With its no-cost entry point for invoicing and accounting, Wave stands out as a user-friendly and cost-effective solution in the accounting software market.

Key Features of Wave Accounting

- Real-time tracking of invoice status

- Ability to create and send unlimited invoices

- Facilitation of online payment acceptance

- Comprehensive customer management system

- Generation of detailed financial reports

- Customizable invoices to suit your branding

- Convenient setup for recurring invoices

- Automated sending of payment reminders

- Effective expense tracking for financial management

- Creation and conversion of estimates to invoices

- Capability to send invoices in multiple languages

Top 3 Features of Wave Accounting

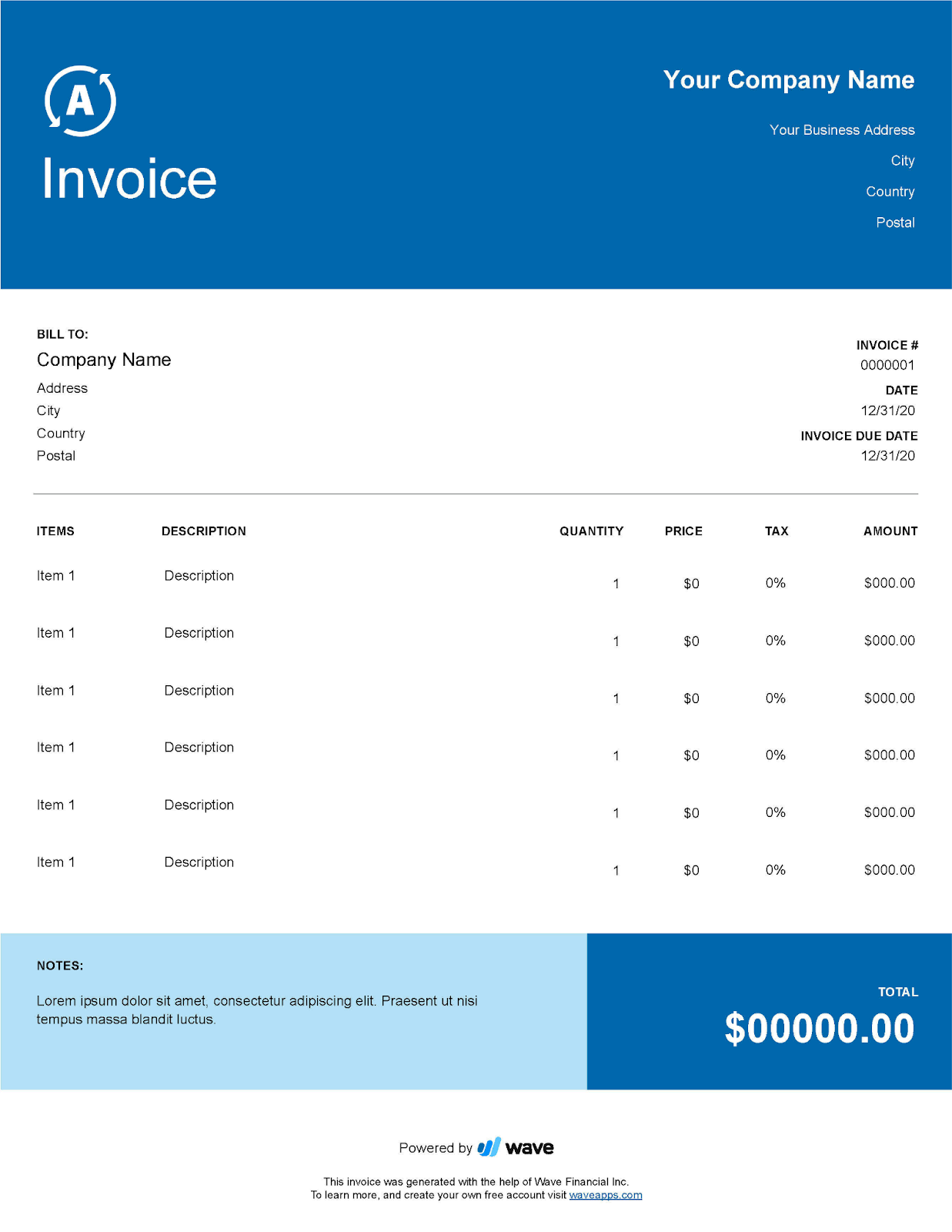

1. Send Invoices in Multiple Languages

Wave Accounting's multilingual invoicing capability is a testament to its user-friendly interface and attention to the needs of a diverse customer base. This feature ensures businesses can communicate with clients in their preferred language, enhancing client communication and payment acceptance. By offering invoices in various languages, Wave provides a client portal that feels personalized and professional.

2. Convert Estimates to Invoices

This feature simplifies project accounting and client proposals, allowing business owners and freelancers to send estimates and then, upon approval, transform these estimates into invoices with just a few clicks. This saves time and ensures that the invoicing systems remain organized and efficient.

3. Generate Reports

Generating reports with Wave Accounting is a straightforward process that allows businesses to gain insights into their financial health. With an internet connection, users can access instantaneous reports, such as profit and loss statements, sales tax reports, and cash flow records. This detailed reporting functionality helps businesses monitor their financial performance and make informed decisions.

Pros of Wave Accounting

- Offers powerful features set for free, including unlimited invoices and unlimited users.

- Intuitive and user-friendly interface, making it accessible even for those with limited accounting knowledge.

Cons of Wave Accounting

- Payroll services come with a fee, which may be a consideration for businesses with employees.

- Different levels of advanced accounting features than some paid services, such as inventory tracking or advanced payment gateways.

Pricing of Wave Accounting

- Invoicing and Accounting: Free

- Payroll: $40 per month

- Mobile receipts: $8 per month

- Bookkeeping support: $149 per month

Customer Support of Wave Accounting

- FAQs/Forum

- Email/Help Desk

- Chat

- Knowledge Base

Supported Platforms of Wave Accounting

- Windows

- Android

- iOS

Testimonials

Final Verdict on Wave Accounting

Wave Accounting is a formidable player in the business accounting cloud, especially for those seeking a no-cost solution with a list of features capable of managing their essential financial tasks. It stands out as an excellent reporting option with its detailed reporting and financial reporting features, making it an excellent choice for businesses not requiring complex accounting systems or advanced inventory management tools.

Table Comparison - Top 3 Alternative To Xero Invoicing

|

Features |

ZarMoney |

QuickBooks Online |

Sage Business Cloud |

|

Professional Invoices |

✅ |

✅ |

✅ |

|

Custom Invoice Templates |

✅ |

✅ |

✅ |

|

Invoice Reports |

✅ |

❌ |

✅ |

|

Recurring Invoices |

✅ |

❌ |

✅ |

|

Accept Online Payments |

✅ |

✅ |

✅ |

|

Automatic Invoice Reminders |

✅ |

✅ |

❌ |

ZarMoney proves to be an excellent choice for businesses looking for an alternative to Xero invoicing, offering comprehensive features that are not uniformly available in QuickBooks Online and Sage Business Cloud Accounting.

Best of the Best - Top 3 Alternative To Xero Invoicing

1 - ZarMoney

As an outstanding alternative to Xero invoicing, ZarMoney takes the top spot in our Best of the Best list. It's a preferred choice for businesses of all sizes, from sole traders to larger organizations, due to its robust features for financial and invoice management and excellent reporting options.

This cloud-based solution ensures users have access to the real-time financial health of their business, bolstering their financial performance through detailed reporting and an intuitive interface.

2 - QuickBooks Online

QuickBooks Online is a prominent alternative in the accounting software market, renowned for its extensive suite of powerful features, which includes everything from expense tracking to advanced reporting. QuickBooks Online's mobile apps and user-friendly interface make it accessible for business owners on the go, providing an all-in-one accounting solution.

The platform offers an excellent choice for those looking for a Xero alternative with online payment options, bank feeds, and comprehensive project accounting capabilities.

3 - Sage Business Cloud Accounting

Sage Business Cloud Accounting is a compelling Xero alternative, particularly valued for its customizable invoicing solutions and multi-currency support. It is an ideal option for businesses with international transactions. It's an excellent reporting tool that offers an online invoicing solution with the flexibility of custom payment methods and payment gateways.

Sage Business Cloud Accounting ensures a smooth invoicing process and robust bank

connectivity, which appeals to users seeking solid bank reconciliation capability and financial reporting features.

Conclusion

Choosing the right online accounting software can revolutionize how you manage your business finances. ZarMoney emerges as a stellar alternative to Xero invoicing, with its user-friendly platform that doesn't skimp on advanced features or financial management tools. Whether you're a sole proprietor or running a full-scale operation, ZarMoney's blend of robust features and intuitive design ensures it's not just another option—it's the gateway to unlocking the full potential of your business's financial operations.

Frequently Asked Questions (FAQs)

1. Why should I consider ZarMoney an alternative to Xero for my invoicing needs?

ZarMoney is a compelling alternative to Xero invoicing because it provides a comprehensive suite of invoicing and accounting tools at a competitive price. With customizable invoicing templates and advanced features, ZarMoney delivers a robust platform suitable for businesses of all sizes.

2. How does the expense tracking in ZarMoney compare to that of Xero and other popular business accounting software?

ZarMoney provides detailed expense tracking that allows businesses to record expenses, categorize them, and reconcile them with bank transactions. This feature is on par with other popular accounting solutions like Xero, QuickBooks Online, and Sage Business Cloud Accounting.

3. Is ZarMoney suitable for sole traders and small businesses, or is it more aligned with larger companies?

ZarMoney is designed to be flexible and scalable, making it an ideal option for sole traders and small businesses due to its intuitive interface and customizable features. Yet, it also can handle the complex needs of larger organizations with its extensive suite of financial management tools.

4. What kind of customer support can I expect with ZarMoney?

ZarMoney offers a range of customer support options, including FAQs, an email help desk, and a knowledge base. This ensures that you have access to prompt and reliable assistance whenever you need it.

5. How does the pricing of ZarMoney compare to Xero and other online accounting software?

ZarMoney offers competitive pricing plans that can be a cheaper alternative to Xero and similar accounting solutions. It provides a great balance between cost and functionality, ensuring businesses receive value without compromising on essential accounting features.

6. Will I have access to advanced accounting features like inventory management and sales tax calculations with ZarMoney?

ZarMoney is not just a simple invoicing tool; it provides an extensive suite of advanced accounting features, including inventory management and comprehensive sales tax calculations. This makes it a robust and complete accounting solution that can accommodate the intricate financial management needs of a business.

7. Is there a trial option available for ZarMoney to evaluate if it's a suitable Xero alternative for me?

ZarMoney offers a 15-day free trial option (no credit card required), allowing you to thoroughly explore its features and determine its suitability as a Xero alternative for your business. This risk-free opportunity means you can make an informed decision about whether ZarMoney aligns with your accounting and invoicing needs.

8. How user-friendly is ZarMoney for those who are not accounting professionals?

ZarMoney is designed with a user-friendly interface that is intuitive enough for non-accounting professionals to navigate and use effectively. Its straightforward layout and clear instructions empower users to manage their financials with confidence, regardless of their accounting expertise.

9. Can I create custom invoice templates with ZarMoney to match my brand identity?

Yes, ZarMoney allows you to create custom invoice templates tailored to match your brand identity. This level of customization ensures that every invoice you send out reinforces your brand's image and professionalism.

10. What do user reviews say about ZarMoney as a Xero alternative and its customer management features?

User reviews often highlight ZarMoney as a prominent alternative to Xero, praising its comprehensive customer management features that allow for detailed client records, easy invoice and payment tracking, and a client portal for enhanced client communication. These reviews suggest that ZarMoney is a preferred choice for businesses looking for a seamless and efficient way to manage customer relations and finances together.