10 Best Sage Accounting Alternatives To Consider

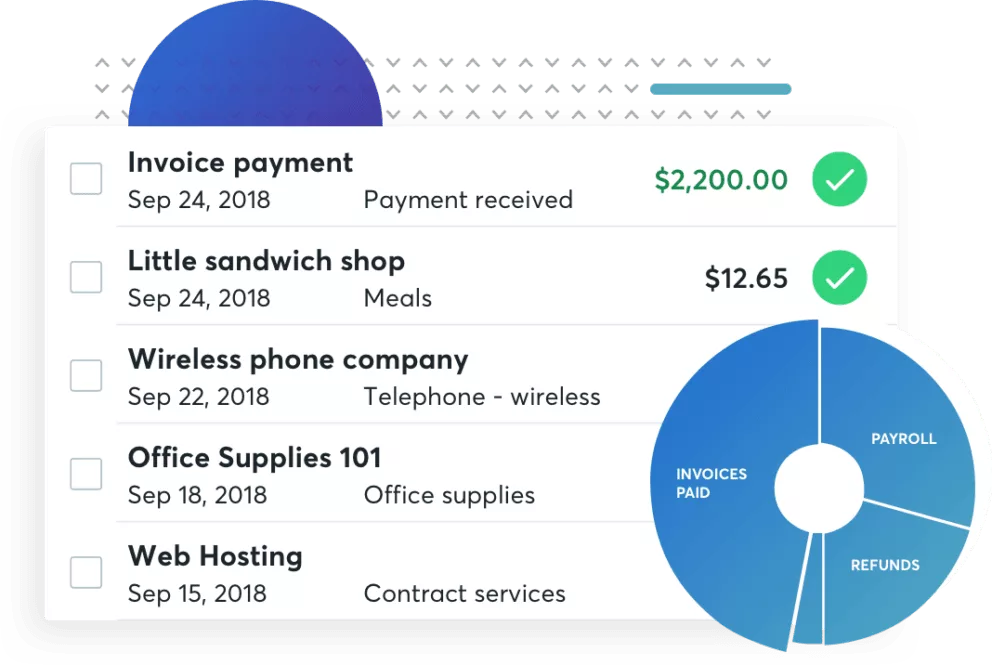

Business accounting is a complicated process. Recurring invoices, payment processing, expense tracking, cash flow management, bookkeeping – the list goes on. While managing accounting can be stressful, it is an indispensable part of your business.

Small business owners can rely on online accounting software to send invoices, pay bills, reconcile their accounts, calculate taxes, and maintain audit trails, among other functions.

Sage Accounting is an online accounting software that helps simplify and automate small business's accounting systems, but it only caters to some business needs.

You can look into the following list of Sage accounting alternatives, explore their functions, and decide on one that fits your requirements better.

List of 10 Best Sage Accounting Alternatives

- ZarMoney

- Xero

- QuickBooks Online

- Wave Accounting

- FreshBooks

- Zoho Books

- FreeAgent

-

NetSuite

-

Acumatica

-

TallyPrime

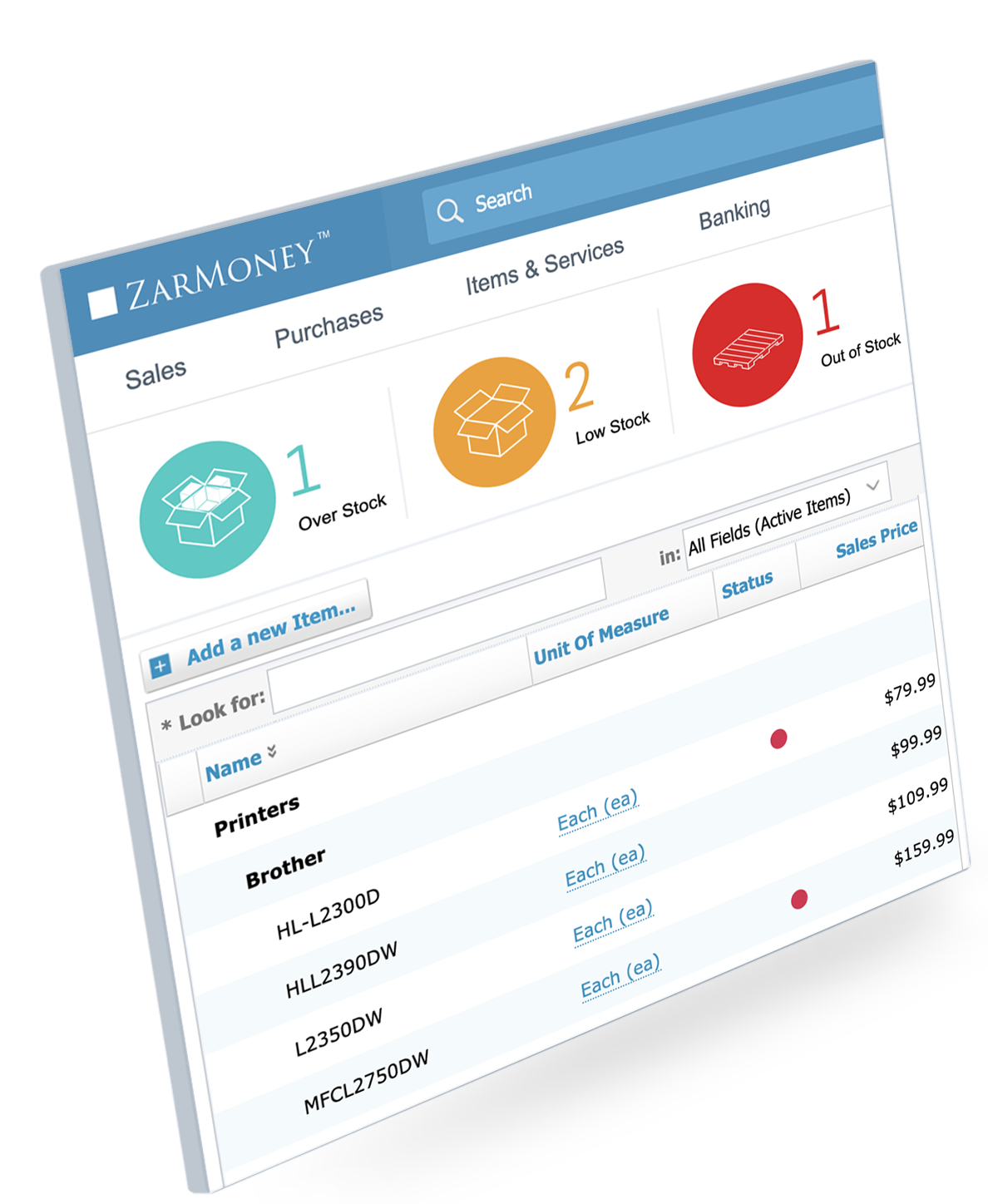

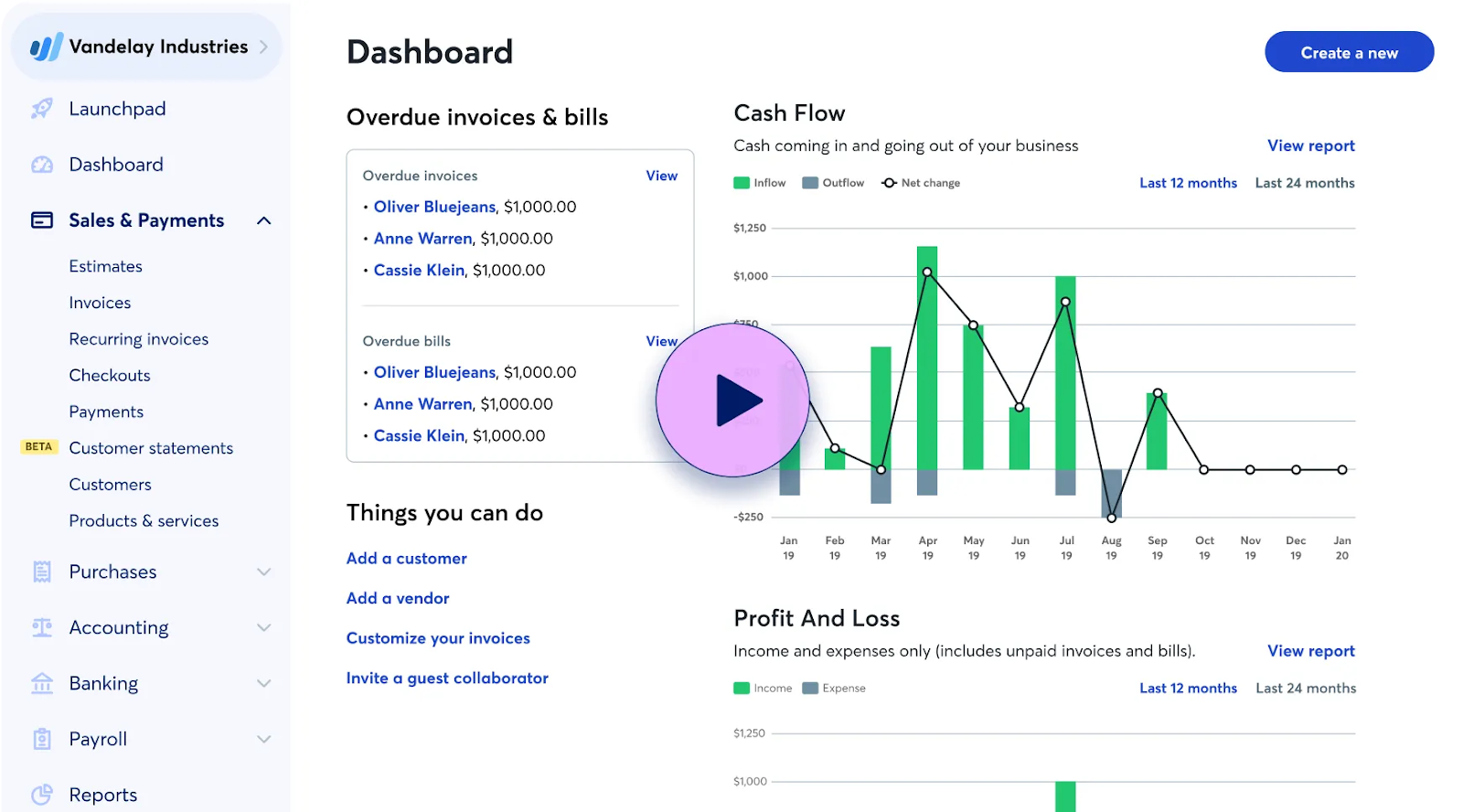

1. ZarMoney

Compared to Sage Accounting, ZarMoney ranks higher in ease of use, features, and value for money. If you are looking for a top Sage accounting alternative accounting platform, ZarMoney is it.

It performs essential functions small businesses require, like invoicing, billing, expense tracking, and bank reconciliation.

Below are the key features of ZarMoney that fit your business’s needs.

Key Features of ZarMoney

- Accounts receivable and payable

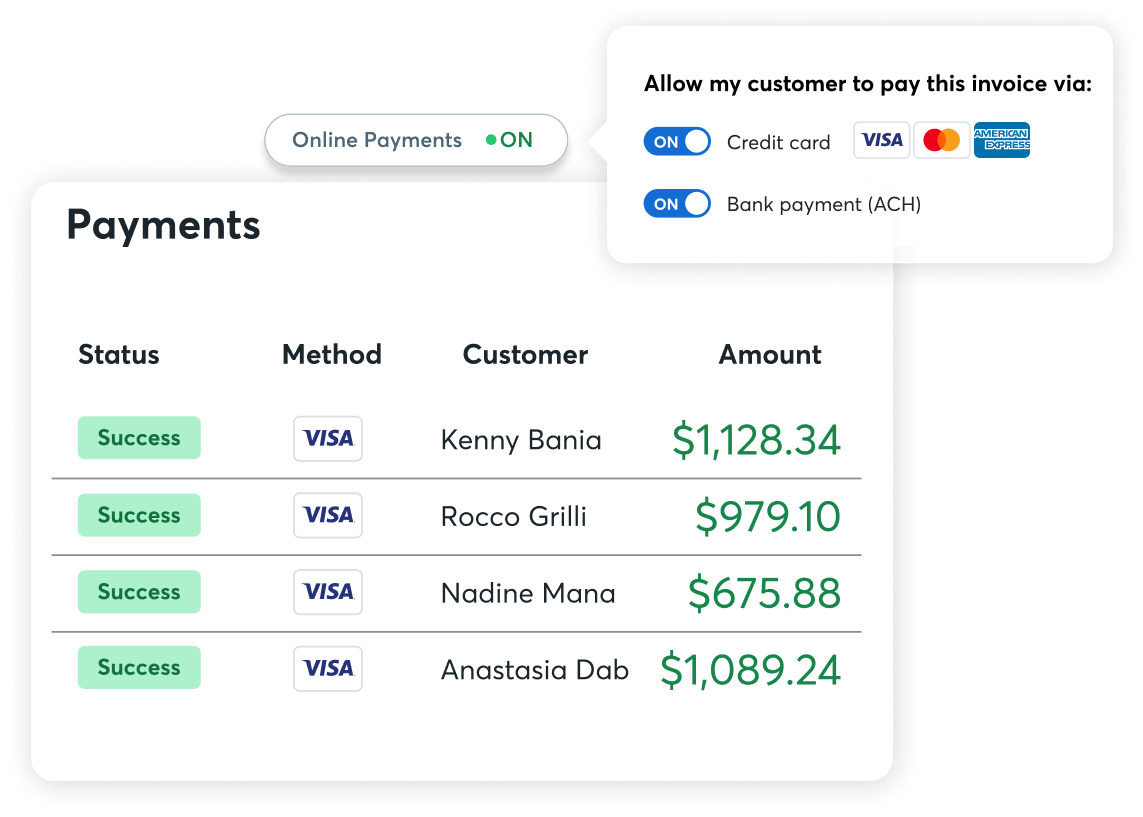

- Online payment processing

- Bank reconciliation

- Billing and invoicing

- Cash management

- Check processing

- Customer statements

- Customizable invoices

- Connection with over 9600 banks

- Automated taxation

- Custom tax order

- Journal entries

- Profit and loss statements

- Alerts and reminders

Top 3 Features of ZarMoney

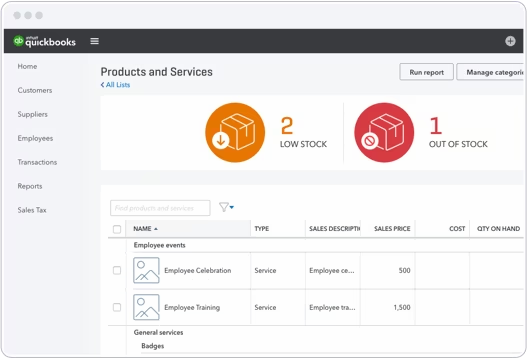

1- Project and Inventory Management

ZarMoney is a prominent online accounting software with excellent project management features. It helps businesses keep track of how projects are going and allocate resources efficiently.

Inventory tracking is important for any business, and ZarMoney does a great job. The software gives real-time updates on stock levels, making it easier to make smart decisions.

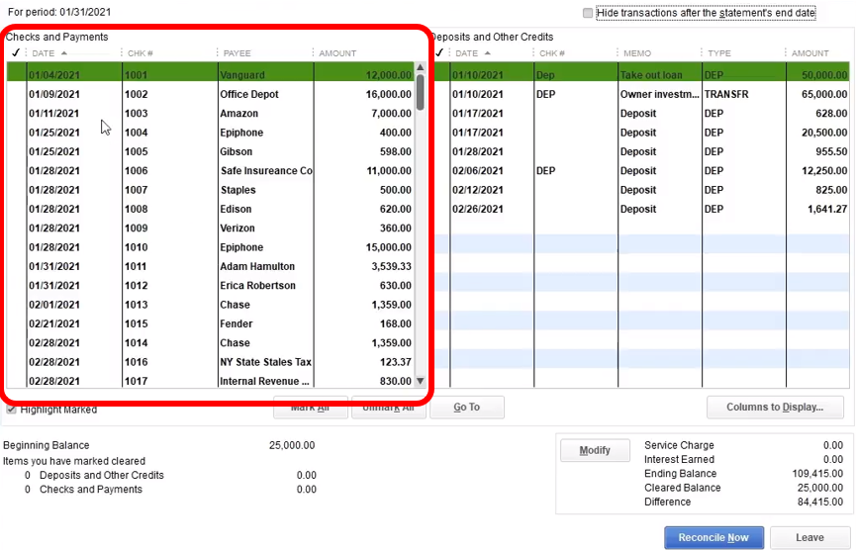

2- Financial Management with Bank Reconciliation

ZarMoney isn’t just another cloud accounting software, it’s a full financial management tool. Its bank reconciliation feature helps you match your bank statements with recorded transactions, reducing manual entry errors.

This keeps your balance sheet accurate and clearly shows your business’s financial health better than competitors like Sage Business Cloud Accounting.

3-Expense Tracking with Online Payment Integration

ZarMoney makes handling expenses easy with a user-friendly tracking system.

It sorts and records each business expense. With online payment integration, businesses can manage cash flow, send invoices, and accept payments smoothly.

Pros of ZarMoney

- Optimized professional accounting

- Affordable

- Ease of use

- Feature-rich

- Easy setup

- Several third-party integrations

- It is scalable, depending on the needs of your small business

- It uses data analytics to help you understand your financial performance

Cons of ZarMoney

-

No manual input option

Pricing of ZarMoney

ZarMoney offers three pricing plans.

- Entrepreneur: $15 / month / 1 user

- Small Business: $20 / month / 2 users

- Enterprise: $350 / month / 30+ users

- Free trial for 15 days

Customer Support of ZarMoney

- Knowledge Base

- FAQs/Forum

- Phone Support

- Email/Help Desk

- Chat

- 24/7 (Live rep)

Supported Platforms of ZarMoney

ZarMoney can be accessed on the following platforms:

- Web

- Mac

- Windows

- Linux

- Chromebook

Final Verdict on ZarMoney

When looking for alternatives to Sage accounting, ZarMoney stands out. It's a great option for everyone, from sole traders to medium-sized businesses and larger companies.

ZarMoney is easier to use than traditional platforms like Sage 50 Cloud and Sage Business Cloud Accounting. It has all the essential accounting tools you need, and its user-friendly interface makes it simple for business owners to manage their finances.

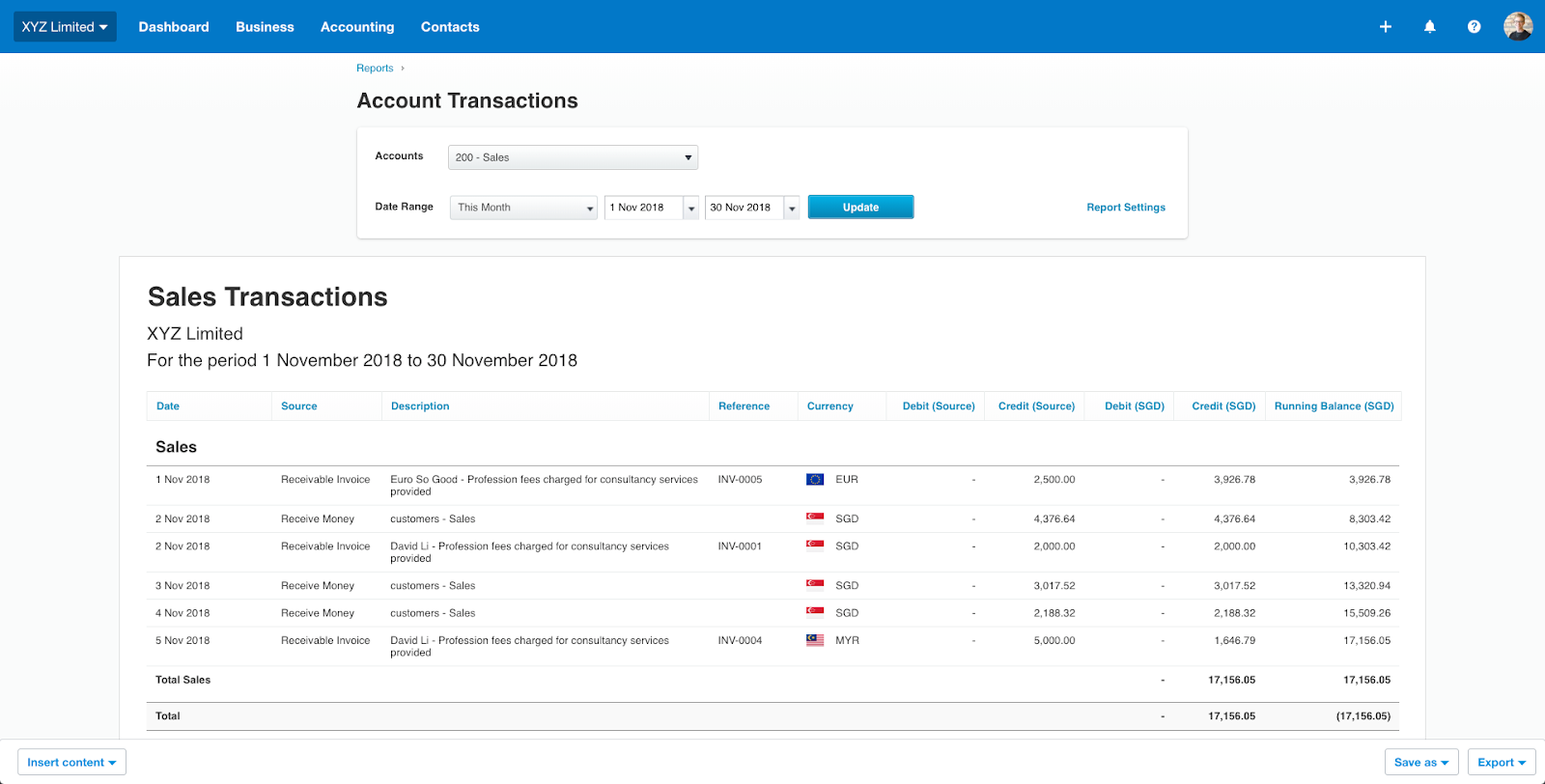

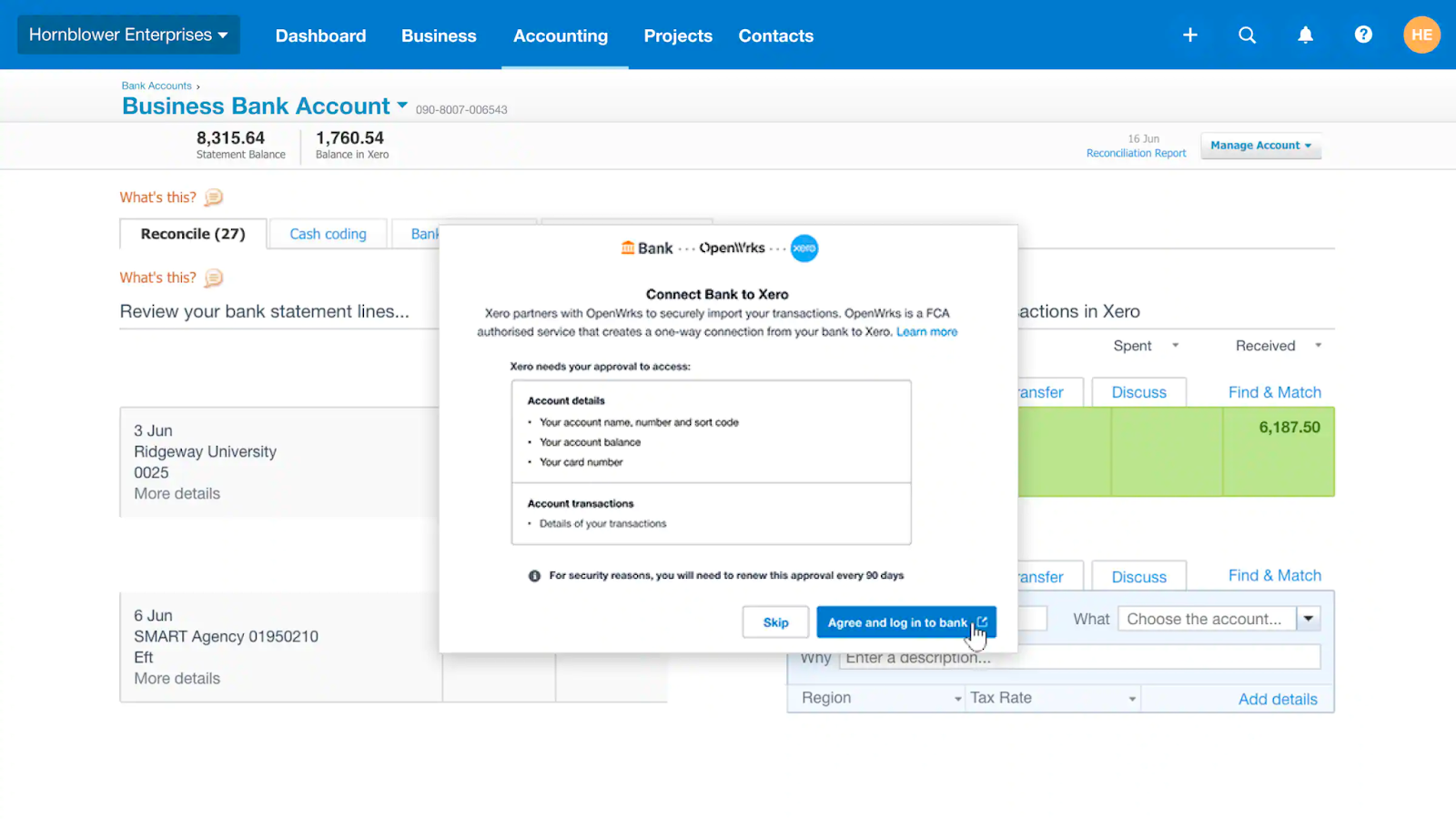

2. Xero

Compared to Sage, Xero offers greater flexibility in two key areas of small business accounting: multi-user login and payroll, making it a wide choice as a Sage accounting alternative.

Sage offers limited users on a single accounting dashboard, and Xero allows you to add more team members. If you have a bigger team and want them to collaborate with you on your accounting tool, you can go for Xero.

Key Features of Xero

- 401(k) tracking

- ACH payment processing

- Accounts payable & receivable

- Automated quoting & billing

- Bank reconciliation

- Billing & Invoicing

- Budgeting

- Currency conversion

- Customer statements

- Customizable invoices & reports

- Financial analysis

- Income & balance sheet

- Multi-channel management

- Online invoicing & payments

- Real-time reporting

Top 3 Features of Xero

1- Comprehensive Financial Management

Xero is a cloud-based accounting platform that's great for everyone, from solo business owners to medium-sized companies.

It offers a mix of financial tracking and essential accounting tools, making it a strong competitor to Sage accounting.

2- Efficient Bank Reconciliation and Expense Tracking

Xero makes bank reconciliation easy by automatically matching bank transactions.

It also helps manage expenses and integrates online payments and credit card processing for smooth financial operations.

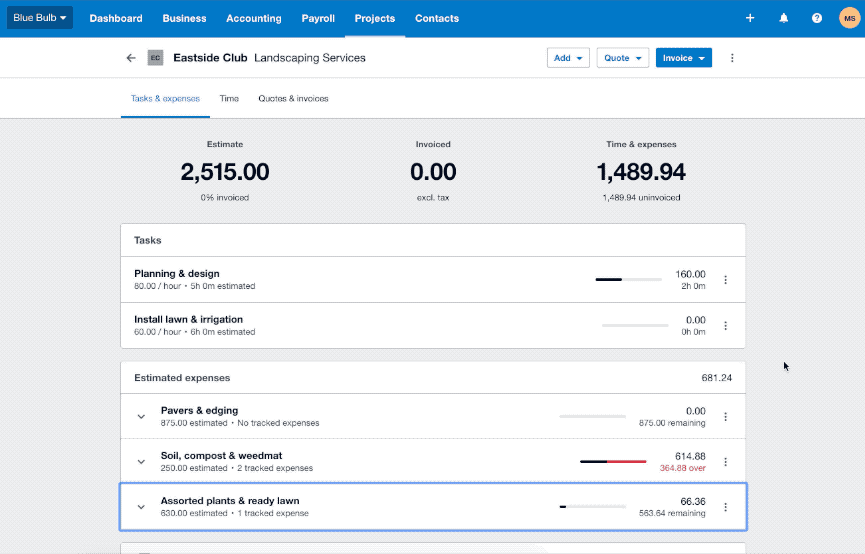

3- Project Accounting and Management

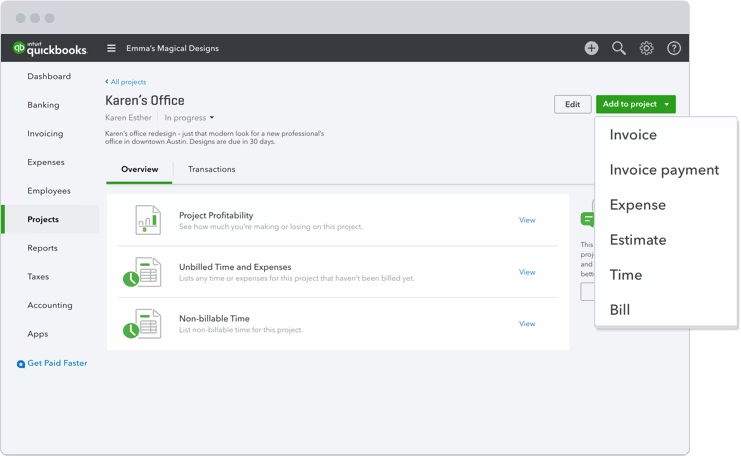

Xero stands out with its project management and accounting capabilities, from online invoicing to project time tracking.

Its user-friendly interface ensures a smooth experience, making it a preferred choice over Sage accounting alternatives.

Xero Pros

- Easy to implement and use.

- Affordable in pricing.

- Customer billing portal.

Xero Cons

- Features for inventory and purchase order management are not extensive.

- Its reporting function keeps changing, making it difficult for many business owners to use.

- Limited bank connections.

Pricing of Xero

- Starter: $29 / month

- Standard: $46 / month

- Premium: $62 / month

Supported Platforms of Xero

- Web

- Mac

- Windows

- Linux

- Android

- iOS

Final Verdict on Xero

Xero is a prominent choice among Sage accounting alternatives, offering a complete suite of online accounting software features. With capabilities ranging from tax management, bank reconciliation, and project accounting to inventory management and expense tracking, Xero stands out among many online accounting platforms.

3. QuickBooks Online

Compared to Sage, QuickBooks is a very easy-to-use accounting software, making it a great choice for Sage's accounting alternative. Both tools offer entry-level accounting functions.

However, while Sage has a steep learning curve, QuickBooks requires no training and very little time to use. It provides a financial reporting feature that helps you and your team gain insights into your financial standing.

QuickBooks Key Features

- Cloud Accounting

- Automatic Billing

- Compliance Management

- Data Import/Export

- Expense Tracking

- Invoice Management

- Multi-Currency Support

- Payroll Management

- Sales Tax Management

- Third-Party Integrations

- Time Tracking

QuickBooks Top 3 Features

1- Bank Reconciliation

2- Inventory Management and Tracking

QuickBooks isn't just for accounting, it also manages inventory.

The software's inventory tracking helps small to medium-sized businesses keep detailed reports of their stock levels and sales.

3- Project Accounting and Management

QuickBooks offers a wide range of project management and accounting tools. It aids businesses in tracking the financial performance of individual projects, making sure that they remain profitable.

With its user-friendly interface, business owners can manage project time tracking, expense tracking, and even invoice creation all under one roof.

QuickBooks Pros

- Can be used for accounting, customer, and payroll management.

- Tracks expenses accurately.

- Manages global clients with multi-currency support, avoiding conversion issues.

QuickBooks Cons

- It has limited industry-specific functions.

- It allows you to add only a few users to the accounting dashboard.

- Too many error messages.

Pricing of QuickBooks

- Simple Start: $18 / month

- Essentials: $27 / month

- Plus: $38 / month

Supported Platforms of QuickBooks Online

- Web

- Mac

- Windows

- Linux

- Chromebook

- iOS

- Android

Final Verdict on QuickBooks

QuickBooks Online offers features like tax management, bank reconciliation, and project accounting.

Its inventory management and expense tracking are also impressive. With affordable pricing and a lot of features, it's a great option for modern businesses needing an alternative to Sage accounting.

4. Wave Accounting

Unlike Sage, Wave Accounting is perfect for small businesses, sole traders, and medium-sized businesses with simple accounting needs.

The app focuses on clear, easy-to-use functions at a reasonable cost. For example, it connects to your bank automatically, so you don't have to enter transaction data manually.

Wave Key Features

- ACH payment processing

- Accounts payable

- Accounts receivable

- Automatic billing

- Bank reconciliation

- Invoice management

- Cash flow management

- Customer statements

- Customizable branding

- Expense tracking

- Financial reporting

- General ledger

- Income & balance sheet

Wave Top 3 Features

1- Reliable Accounting Solution

Wave Accounting is a top alternative to Sage accounting software. It’s an online tool perfect for small businesses, sole traders, and medium-sized businesses.

The best part? Wave Accounting offers a free plan forever. This makes it a great choice for business owners looking to save money without compromising on essential accounting features.

2- Comprehensive Financial Management

Wave Accounting isn’t just a Sage alternative. It has many features, such as bank reconciliation, financial reports, and expense tracking.

These fearures help businesses understand their finances better.

3- User-friendly Interface with Online Payment Options

One of the biggest challenges for business owners when picking an accounting app is the user interface.

Wave Accounting does a great job here by offering a user-friendly interface that is easy for even beginners to use.

Wave Pros

- Prices are listed upfront, with no hidden fees.

- Offers free accounting software for small business owners.

- Modern, easy-to-use interface for beginners.

Wave Cons

- Sending recurring invoices is slow and tricky.

- The tool sometimes hangs.

- The accounting features are limited.

Pricing of Wave

- Invoicing and Accounting: $0 / month (free)

- Credit card processing: 2.9% per transaction

- Mobile Receipts: $8 / month

- Payroll: $40 / month

- Advisors: $149 / month

Supported Platforms of Wave

- Windows

- MacOS

- Android

- iOS

Final Verdict on Wave

Wave Accounting is a popular choice for small businesses and sole traders looking for an alternative to Sage.

Like ZarMoney and QuickBooks Online, Wave is an online accounting tool. It's very user-friendly, making it great for business owners and beginners.

Wave offers tools for managing taxes and reconciling bank accounts. If you need to add more users, consider other alternatives to Wave.

5. FreshBooks

FreshBooks is an easy-to-use cloud-based accounting software designed for small businesses. Known for its intuitive interface, it helps freelancers and small business owners manage invoices, track expenses, and maintain financial records efficiently. With a variety of features tailored for service-based businesses, it simplifies accounting without being overwhelming.

Features

- Invoicing and billing automation

- Time tracking and expense management

- Client management and reporting

- Integration with payment gateways

- Customizable invoice templates

- Multi-currency support

Top 3 Features of FreshBooks

1. Automated Invoicing

FreshBooks allows users to automate recurring invoices and send reminders for overdue payments, saving time and reducing administrative work.

2. Time Tracking

For service-based businesses, FreshBooks offers a built-in time tracker, which lets you log hours directly to invoices, ensuring accuracy and reducing errors.

3. Client Portal

FreshBooks features a secure client portal where clients can view and pay invoices, making transactions smoother and improving client relationships.

Pros

- Easy-to-use interface

- Fast invoicing and payment processing

- Excellent customer support

- Mobile-friendly app

- Reliable time tracking and project management

Cons

- Limited inventory management features

- Some advanced features require higher-tier plans

- Not ideal for businesses with complex accounting needs

Pricing

- Lite Plan: $4.75/month

- Plus Plan: $8.25/month

- Premium Plan: $15/month

- Custom Plan: Contact FreshBooks for a tailored quote

Customer Support Options

- Email/Help Desk

- Phone Support

- Chat

- FAQs/Forum

- Knowledge Base

Supported Platforms

- Google Drive

- PayPal

- Slack

- Google Workspace

- Trello

- WordPress

- MailChimp

- Shopify

- Zip Recruiter

- Zapier

- Hubspot CRM

- Calendly

Final Verdict

FreshBooks helps freelancers and small businesses that need simple, reliable accounting without the complexity. However, if you require advanced inventory management or payroll features, it may not be the best fit.

6. Zoho Books

Zoho Books is an accounting solution for small businesses that offers multiple features like invoicing, expense tracking, and tax management. It integrates well with other Zoho apps, which is helpful for businesses already using the Zoho.

Features

- Automatic bank feeds

- Multi-currency support

- Customizable invoices and estimates

- Tax management

- Payment gateway integrations (PayPal, Stripe)

Top 3 Features of Zoho Books

1. Automated Bank Feeds

Zoho Books automatically fetches and categorizes transactions from linked bank accounts, reducing manual data entry and saving time.

2. Project Management

Zoho Books offers project management tools to track time and expenses by project, helping you stay on budget and improve project profitability.

3. Tax Compliance

Zoho Books ensures you stay on top of tax regulations by automatically calculating taxes and generating tax reports based on the latest rates.

Pros

- Customizable reports and invoicing

- Good customer support

- Multi-currency support

- Affordable pricing plans

Cons

- Limited payroll options

- Can be overwhelming for beginners

- Limited third-party integrations outside Zoho

Pricing

- Free Plan $0 per organization/month

- Standard Plan $10 per organization/month

- Professional Plan $20 per organization/month

- Premium Plan $30 per organization/month

- Elite Plan $100 per organization/month

- Ultimate Plan $200 per organization/month

Customer Support Options

- Knowledge Base

- FAQs/Forum

- Phone Support

- 24/5 Call

Supported Platforms

- Stripe

- PayPal and PayPal Business

- Razorpay

- Paytm Payment Gateway

- 2checkout

- Braintree

- Authorize.net

- CSG Forte

- Mercado pago

- Paygate

- PayEx

- Paystack

Final Verdict

Zoho Books is a great option for businesses already using other Zoho apps, offering quick integrations and a range of accounting features. It's an affordable choice for small businesses but may not be as beginner-friendly as other tools.

7. FreeAgent

FreeAgent is an accounting software that focuses on providing a user-friendly experience for freelancers and small businesses. It simplifies the accounting process by offering tools for invoicing, expense tracking, and financial reporting.

Features

- Time tracking

- Project management and invoicing

- Tax calculation

- Multi-currency support

- Reporting tools

- Mobile app

Top 3 Features of FreeAgent

1. Invoicing and Estimates

FreeAgent allows you to create and send professional invoices and estimates, track payments, and automate reminders to clients.

2. Tax Calculation

The software automatically calculates taxes based on your location, making it easier to stay compliant without manually figuring out rates.

3. Time Tracking

FreeAgent’s built-in time tracker is perfect for freelancers who bill clients by the hour, allowing you to track time directly on your invoices.

Pros

- Simple and intuitive interface

- Affordable for freelancers and small businesses

- Built-in tax filing features

Cons

- Limited inventory management

- Lacks more complex financial features for growing businesses

Pricing

- Billed monthly: $11/month

- Billed annually: $110/month

Customer Support Options

- Phone Support

- FAQs/Forum

- Email/Help Desk

- Chat

- Knowledge Base

Supported Platforms

-

PayPal

-

Google Drive

-

Google Workspace

-

Basecamp

-

Stripe

-

Zappier

-

ActiveCampaign

-

Float

Final Verdict

FreeAgent is a reasonable option for freelancers and small businesses looking for an easy way to manage invoicing and taxes. However, it might not be the best option for businesses with more complex accounting need due to its limited functionality.

8. NetSuite

NetSuite is a cloud-based ERP (Enterprise Resource Planning) software that provides comprehensive accounting features, inventory management, and financial reporting. It’s a good choice for businesses looking for a more scalable solution.

Features

- General ledger and accounts payable

- Multi-currency support

- Financial reporting and dashboards

- Inventory management

- Order management

- Tax compliance

- CRM and ERP integration

Top 3 Features of NetSuite

1. Comprehensive Financial Management

NetSuite offers a full suite of financial management tools, including budgeting, forecasting, and reporting, ideal for growing businesses.

2. Inventory Management

NetSuite integrates inventory management with financials, ensuring accurate stock levels, order tracking, and efficient supply chain management.

3. Customizable Dashboards

This tool provides customizable dashboards that give you real-time insights into your business’s financial health, operations, and key performance indicators (KPIs).

Pros

- Powerful financial reporting tools

- Scalability for growing businesses

- Inventory management

- Order management

- Integration with other business management functions

Cons

- High cost

- Steep learning curve

- Expensive for some businesses

Pricing

-

Contact NetSuite for pricing (customized)

Customer Support Options

- 24/7 support

- Knowledge base

- Implementation services

Supported Platforms

- Windows

- Mac

- iOS

- Android

Final Verdict

NetSuite is ideal for mid-sized businesses or those looking to scale. While it offers a lot of features, its high price point and complexity may make it unsuitable for small businesses or startups.

9. Acumatica

Acumatica offers cloud ERP solutions that provide a lot of basic accounting features, including accounts payable, receivable, and financial reporting. It’s especially well-suited for manufacturing and distribution businesses. Acumatica’s robust integration capabilities and customizable modules make it a scalable choice for growing businesses seeking end-to-end financial management.

Features

- Financial management tools

- Multi-currency

- Multi-location support

- Real-time reporting and analytics

- Inventory management

Top 3 Features of Acumatica

1. Real-Time Financial Analytics

Acumatica provides real-time insights into your financial data, allowing you to make informed decisions quickly.

2. Inventory and Supply Chain Management

Acumatica’s integrated inventory management system helps businesses track stock, manage orders, and optimize supply chain operations.

3. Cloud-Based Flexibility

As a cloud-based solution, Acumatica enables users to access their financial data from anywhere, making it a good choice for remote teams.

Pros

- Highly customizable

- Good support for manufacturing and distribution businesses

- Mobile-friendly

Cons

- Expensive for small businesses

- Complex interface

- Requires dedicated IT resources for customization

Pricing

-

Contact Acumatica for pricing (customized)

Customer Support Options

- Phone and email support

- Knowledge base

- Training resources

Supported Platforms

- Windows

- Mac

- iOS

- Android

Final Verdict

Acumatica is a solid choice for businesses looking for an all-in-one solution, especially in manufacturing or distribution. However, its cost and complexity may not be suitable for small businesses and beginner teams.

10. TallyPrime

TallyPrime is another accounting software that is designed to help businesses manage their finances efficiently. It's known for its ease of use, flexible features, and strong focus on Indian GST compliance. Whether you're a small business or a medium-sized enterprise, TallyPrime can handle financial statements, inventory management, and even payroll.

Features

- Financial Management

- Inventory Management

- GST Compliance

- Multi-User Access

- Customizable Reports

- Security

Top 3 Features of TallyPrime

1. Financial Management

TallyPrime simplifies financial management by giving you access to essential financial reports like balance sheets, profit & loss statements, and trial balances. These reports help businesses track income, and expenses, and ensure financial stability.

2. Inventory Management

The inventory management feature allows businesses to track stock levels, manage stock transfers, and create purchase orders and invoices. It helps in the stock management process, ensuring that businesses can maintain inventory accuracy.

3. GST Compliance

TallyPrime ensures businesses comply with India's GST regulations by offering GST-compliant invoicing, filing, and reporting. Its GST feature ensures your business stays up-to-date with tax laws and simplifies the filing process.

Pros

- Easy-to-use interface, especially for beginners

- Customizable financial reports

- Multi-user support

- Detailed and accurate GST compliance features

- Real-time inventory management

- Secure data management with encryption

Cons

- Limited scalability for larger businesses or those with complex needs

- Can be overwhelming for users without accounting knowledge

- Lacks advanced reporting features for big enterprises

- Limited online customer support compared to competitors

Pricing

- Single User (Silver): $630/year

- Multi-User (Gold): $1890/year

- Gold Rental: $9450/year

Customer Support Options of TallyPrime

- Phone support

- Email support

- Live chat (available for premium users)

- Online knowledge base

Supported Platforms

- Windows (TallyPrime is primarily a Windows-based software)

- Tally Cloud (for remote access)

Final Verdict

TallyPrime is a good choice for businesses looking for an affordable and simple accounting software solution Its ease of use and user-friendly interface make it a good fit for small to medium-sized businesses that need basic accounting features and inventory management. However, it may not be the best option for large enterprises with complex accounting needs or those requiring advanced features.

Table Comparison - Top 10 Sage Accounting Alternatives

|

Features |

ZarMoney |

Xero |

QuickBooks |

Wave |

FreshBooks |

ZohoBooks |

FreeAgent |

Netsuite |

Acumatica |

TallyPrime |

|

Bank Reconciliation |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

❌ |

|

Project Management |

✅ |

❌ |

✅ |

❌ |

✅ |

❌ |

✅ |

✅ |

✅ |

❌ |

|

Inventory Management |

✅ |

✅ |

✅ |

❌ |

✅ |

✅ |

❌ |

✅ |

✅ |

✅ |

|

Expense Tracking |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

❌ |

✅ |

✅ |

❌ |

|

Online Invoicing |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Online Payment |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Financial Reports |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

❌ |

✅ |

❌ |

✅ |

|

Unlimited Users |

✅ |

❌ |

❌ |

❌ |

❌ |

❌ |

✅ |

✅ |

✅ |

❌ |

|

Customer Relationship Management |

✅ |

❌ |

❌ |

❌ |

✅ |

✅ |

❌ |

✅ |

✅ |

✅ |

Best of Best - Top 3 Sage Accounting Alternatives

1. ZarMoney

ZarMoney is the best alternative to Sage accounting software. It offers a full set of financial tools that make managing money easy. With ZarMoney, you can quickly reconcile bank accounts and manage inventory efficiently.

It is cloud-based, so you can process payments and send invoices online. Business owners will appreciate its advanced features and easy-to-use interface.

2. Xero

Securing the second spot is Xero, a strong alternative to Sage accounting. Its unique features include financial tracking and inventory tracking. Xero offers bank transaction management and expense tracking, which are essential for business growth.

Xero is easy to use, even for beginners, thanks to its user-friendly interface. Its mobile app lets you manage finances on the go, making it perfect for small and mid-sized businesses that need flexible accounting software.

With Xero, users can easily reconcile accounts, understand their financial health, and improve financial management.

3. QuickBooks Online

QuickBooks Online's best strengths include project management, bank reconciliation, and the generation of financial reports.

Advanced features like asset management and processing credit cards make it even more attractive.

QuickBooks Online is the best alternative to Sage Accounting because of the competitive pricing plans and good online payment options for clients.

Conclusion

Sage Accounting is important for many businesses because it helps track finances easily. There are good alternatives to Sage Accounting that offer different features. ZarMoney, QuickBooks Online, Xero and FreshBooks, and all have unique tools that can help manage your business finances effectively.

Before buying new software, study your business needs. The accounting needs of a retail business are different from those of an e-commerce store. Also, determine your budget for the tool.

Now that you know the best Sage Accounting alternatives, what's stopping you? Explore and experiment. Start by trying out ZarMoney for free. Take the free trial today!

Frequently Asked Questions (FAQs)

1. Why would someone consider Sage accounting alternatives?

Businesses and individual users often look for Sage accounting alternatives to find a solution that better suits their financial tracking needs, user interface preferences, or specific accounting requirements concerning their business requirements.

2. Is QuickBooks Online a viable Sage accounting alternative?

Yes, QuickBooks Online is a good alternative to Sage accounting. It has features like online invoicing, bank reconciliation, and inventory tracking. Many businesses find it works well for their financial management.

3. What are some essential accounting features that Sage alternatives should offer?

Comprehensive features like bank reconciliation, tax management, project accounting, expense tracking, and online payment processing are essential accounting tools businesses often look for in Sage alternatives.

4. How do ZarMoney and other Sage accounting alternatives support businesses with project management?

Many Sage accounting alternatives, including ZarMoney, offer project management tools. These can help businesses track expenses, manage project time, and ensure efficient financial management throughout the project cycle.

5. What features are vital in Sage accounting alternatives for small to medium-sized businesses?

Medium-sized businesses and sole traders often prioritize features like online accounting software capabilities, cloud-based accounting software flexibility, and user-friendly interfaces in their Sage accounting alternatives.

6. Can Sage accounting alternatives handle inventory management?

Yes, many Sage accounting alternatives offer comprehensive tools for inventory management. This includes inventory tracking, ensuring businesses can monitor stock levels and manage sales orders efficiently.

7. Is it easy to transition to a Sage accounting alternative?

Making the switch to better and more effective Sage accounting options such as ZarMoney often means that users will have to learn new systems, though most often, they will use an easy-to-operate and master program. They often provide professional services to aid the transition so business accounting activities can continue.

8. Do most Sage accounting alternatives offer mobile capabilities?

Yes, a wide range of Sage accounting alternatives provide mobile capabilities in today's digital age. This ensures that businesses can manage their financial health, create invoices, or even perform bank transactions on the go.

9. Is there an affordable accounting software that can be considered an alternative to Sage 50cloud?

While Sage 50cloud is a comprehensive accounting platform, other affordable accounting software options exist in the market. Wave Accounting and other platforms often offer basic or even free-forever plans to cater to businesses with varying budgets.

10. How do Sage accounting alternatives support online payment processes?

Sage accounting alternatives typically provide various online payment options like ZarMoney, including credit card payments and online payment integrations. This ensures businesses have the flexibility to process payments in a way that suits their operations best.