Xero vs Freshbooks vs ZarMoney: Detailed Review

If you're diving into cloud-based accounting software, you've likely stumbled upon the debate surrounding Xero vs. FreshBooks, not ZarMoney. All three of these platforms have made significant waves in the financial software community, but when it's time to select the perfect fit for your business, which should you go for? Well, buckle up, my friend!

In this review, we're diving into the competitive arena of Xero vs. FreshBooks, with an added contender, ZarMoney. Xero, known for its comprehensive financial tools, is a powerhouse for businesses that require intricate accounting solutions. FreshBooks, often heralded as a top choice for freelancers and service-based companies, shines with its invoicing capabilities and project management features.

However, in the Xero vs. FreshBooks debate, ZarMoney stands out with its flexible, scalable, and user-friendly offerings tailored to diverse business needs. Let's get deeper into what each platform brings to the table.

1. ZarMoney

ZarMoney, praised by many as the ultimate cloud-based accounting software, doesn't just deliver the basic features but goes the extra mile to streamline your entire accounting process. It shines when we talk about Xero vs. FreshBooks and has robust components that make accounting a breeze for businesses of all sizes.

Diving deep into cloud-based accounting software, one might often encounter discussions revolving around FreshBooks alternatives and the classic debate of Xero vs. FreshBooks. ZarMoney, while less globally recognized than FreshBooks or Xero, distinguishes itself uniquely. What truly sets ZarMoney apart in this competitive landscape, especially when considering the Xero vs. FreshBooks discussion, is its expansive range of features and excellent customer service.

While FreshBooks is often hailed as a top choice for freelancers and Xero is known for its comprehensive financial tools suitable for a broad audience, ZarMoney offers features that cater to businesses of all sizes. From intricate inventory management that provides real-time stock updates to its capabilities of offering unlimited time tracking for projects and real-time financial reports that give a snapshot of a business's financial health, ZarMoney goes toe-to-toe with its more famous counterparts.

Moreover, the platform's adaptability and scalability mean it can adjust to varying business needs, ensuring growth without the hassle of switching tools. For business owners exploring options beyond the famous names in the Xero vs. FreshBooks narrative, ZarMoney emerges as a comprehensive one-stop solution.

Features List

ZarMoney offers basic accounts and excels with its advanced bookkeeping features, positioning it uniquely in the Xero vs. FreshBooks debate. Comprehensive inventory tracking, project tracking tools, and advanced payments are some areas where it shines. The following are the incredible features of ZarMoney:

- Invoicing

- Accept credit cards online

- Accept ACH payments

- Quotes/estimates

- Sales orders

- Quick sales

- Customer statement

- Accept prepayments

- Payment terms

- Notification via text & email

- Organize customers with custom fields

- Order status

- Credit limit & credit hold

- Recurring invoices

- Inventory management

- Manage multiple warehouses

- Create pick lists

- Split transactions with enhanced inventory receiving

- Price level

- Get real-time inventory data

- Customizable units of measures

- Barcode

- Product category

- Customizable product fields

- Item tracking and history

- Compare received inventory with POs

- 2-step warehouse transfer

- Bank connection

- Import bank dealings

- Divisions & classes

- Bank account reconciliation

- Chart of account

- Sales tax

- Bank deposits

- Fund transfers

- Journal entries

- Insight ™ (customizable reporting)

- 1099 reporting

- Profit & loss

- Balance sheet

- Trial balance

- Account receivable (A/R)

- Account payable (A/P)

- Comprehensive reporting

- Scheduler

- Advance user permissions

- File attachment

- Customizable dashboard

- Collaborate with your team

- Internal notes

- Access from everywhere and much more!

Best Features

The three standout features are:

1. User-Friendly Interface

Considering the discussions on Xero vs. FreshBooks, ZarMoney presents a clean, intuitive dashboard that even non-accountants can easily navigate. The simplicity of the design ensures that users can access the tools and functions they need without any significant learning curve.

This ease of use could be a deciding factor when comparing Xero vs. FreshBooks with other accounting software like ZarMoney.

2. Customizability

The software permits users to customize the interface, reports, and components according to their priorities. This adaptability and versatility make it a compelling FreshBooks alternative. It ensures that businesses of different scales and niches can make the most out of the tool, whether looking for a direct replacement for FreshBooks or simply exploring other options in the cloud accounting space.

3. Real-Time Collaboration

Within the accounting software debate of Xero vs. FreshBooks, many often overlook solutions like ZarMoney. ZarMoney supports multiple users, enabling teams to collaborate on real-time financial tasks. With permissions and role-based access, businesses can maintain security while ensuring that the right individuals can access the necessary data.

As users compare Xero vs. FreshBooks, it's vital also to consider other robust platforms like ZarMoney in their evaluation.

Pros

- User-friendly interface

- Scalable for various business sizes

- Customizable dashboards and reports

- Robust inventory management

- Advanced transaction tracking

- Multiple user permissions and roles

- Integrated CRM features

- Comprehensive financial reporting

- Cloud-based access and mobile compatibility

- Extensive third-party integrations

Cons

- It might seem like an expensive option, but it's worth the investment

- It takes a bit of time for traditional businesses to adapt

- A steep learning curve compared to essential accounting tools

Supported Platforms

ZarMoney is not just a mere finance tool; it's a comprehensive financial management solution designed for today's fast-paced world. Available on many platforms, including Android, iOS, and desktop versions, it guarantees seamless access to your financial data.

Whether in the office, traveling, or at home, ZarMoney ensures you can manage and oversee your finances with a click or a tap.

Pricing

ZarMoney offers its wide suite at a competitive rate of $15 per month.

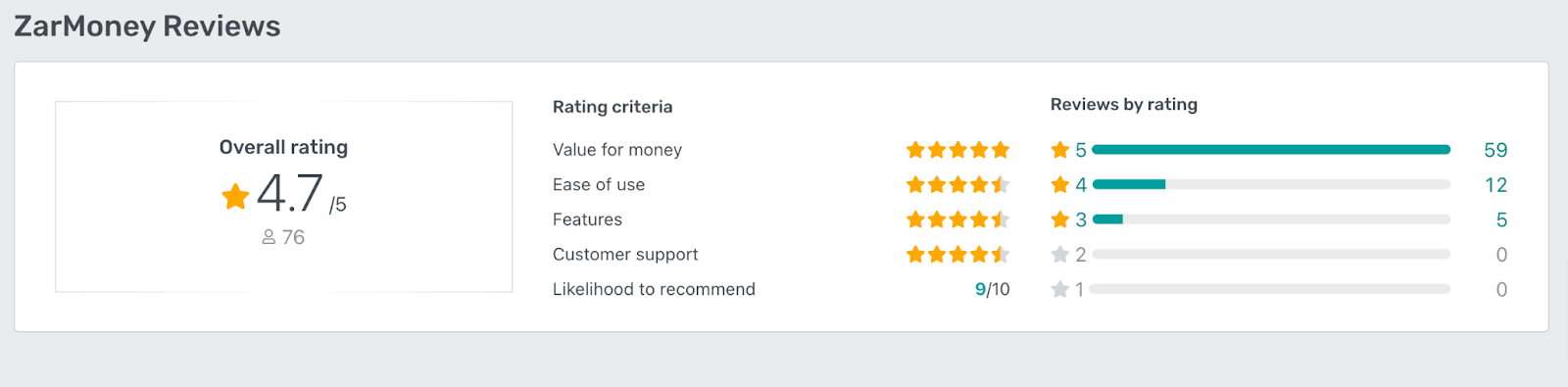

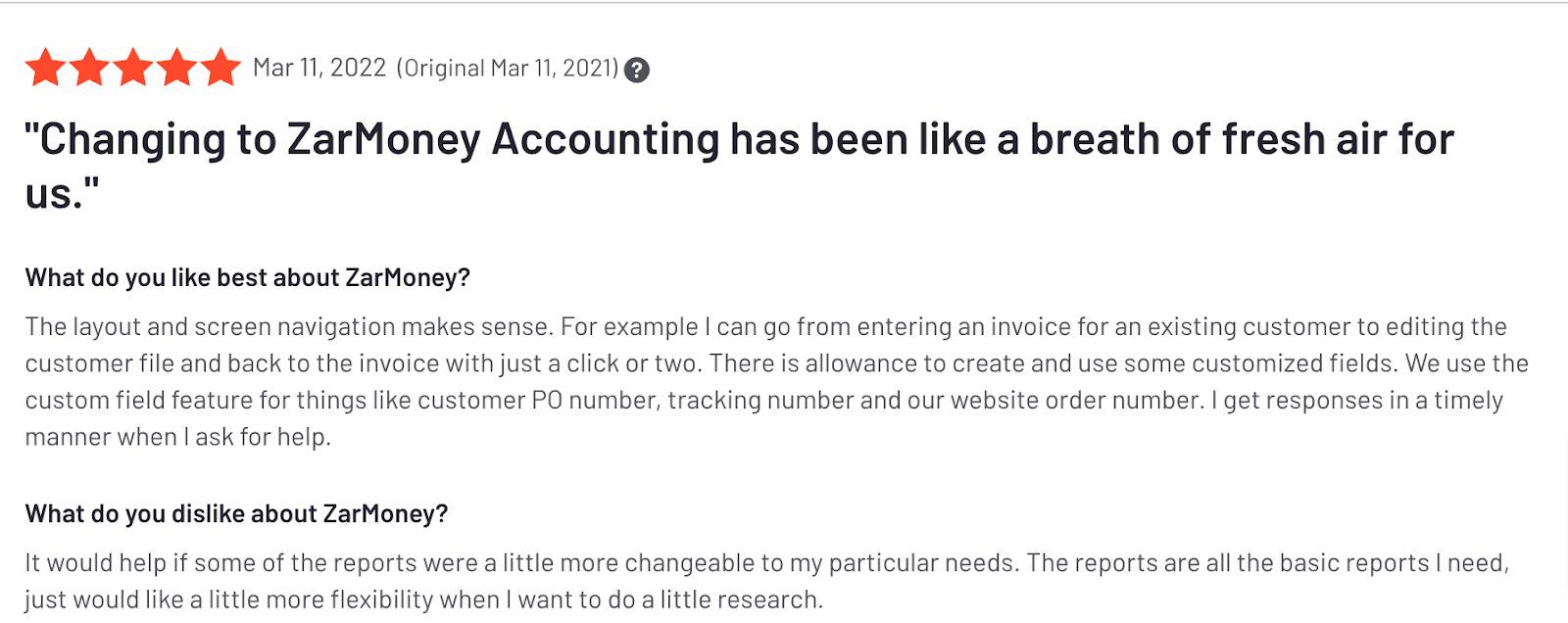

Ratings and Testimonials

Rated 4.7 out of 5, users frequently mention ZarMoney's robust features and superb customer service. Sarah, a cafe owner, said, "ZarMoney transformed how we handle our finances at our coffee shop. The unlimited invoices feature is a game-changer.

Final Verdict

Zarmoney is robust and offers various features tailored to multiple business needs. With its user-friendly interface, it aids businesses in managing their finances, inventory, and day-to-day operations seamlessly. Its features include customizable invoices, real-time inventory tracking, and comprehensive reporting tools. The platform also offers scalability, meaning it can adapt and grow with a business over time.

Additionally, when comparing Xero vs. FreshBooks, it's worth noting that ZarMoney stands out for its flexibility in user roles and permissions, allowing business owners to have fine-grained control over who can access and modify specific data.

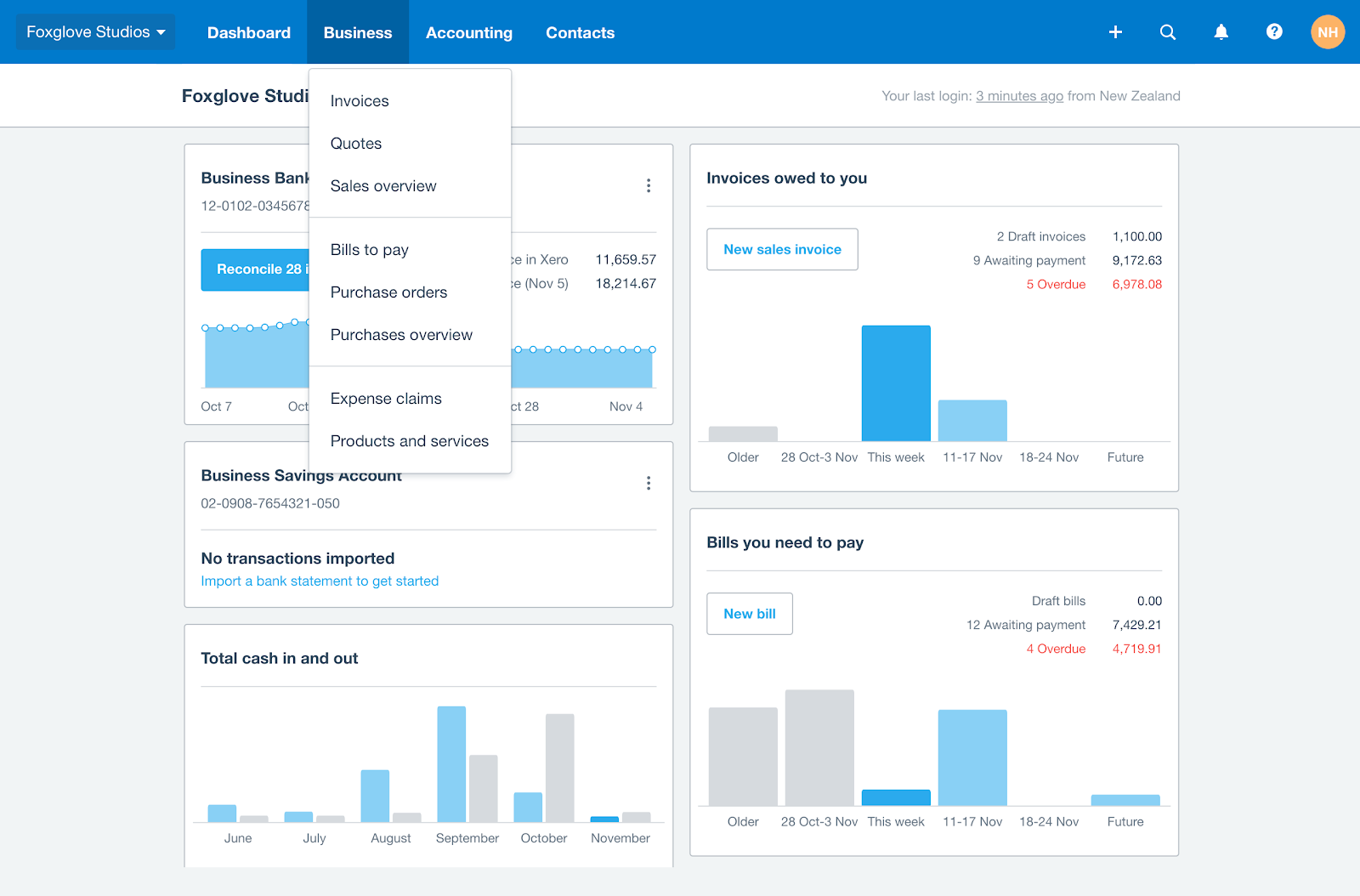

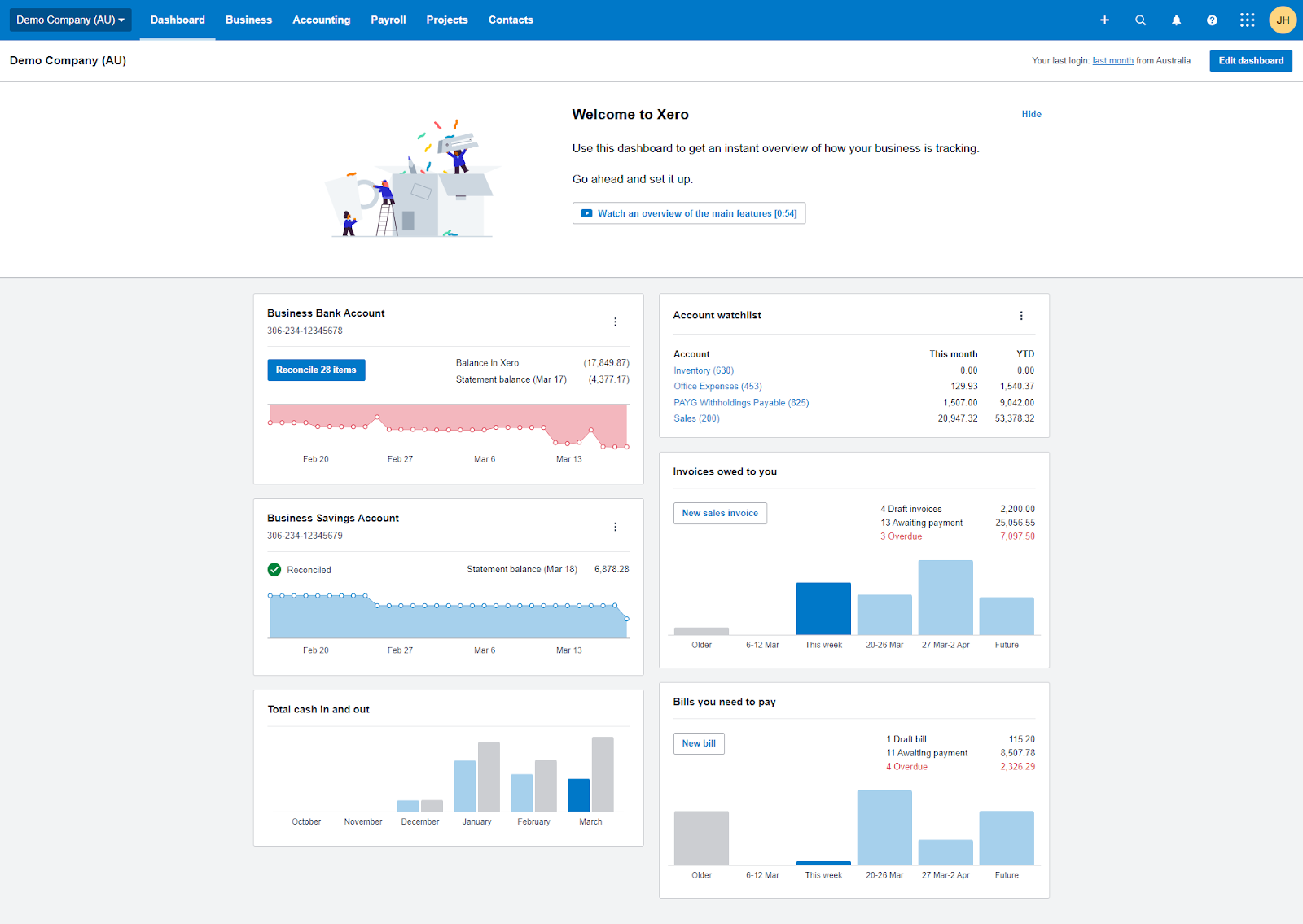

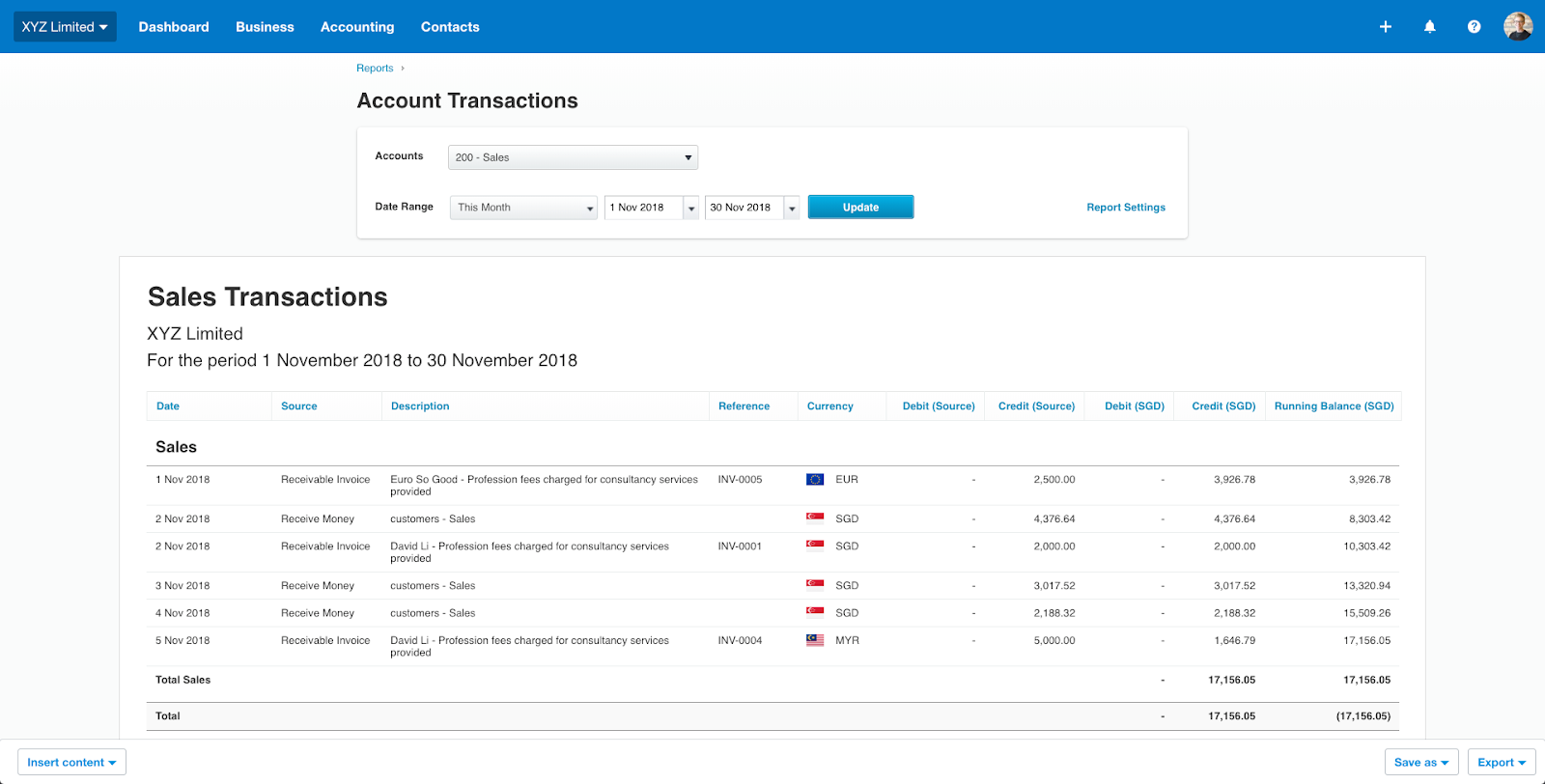

2. Xero

Xero, originating from New Zealand, is renowned in the business world for its easy-to-use cloud accounting software. It is favored by small to medium businesses, simplifies accounting processes, and offers a neat user interface. On the other hand, with its intuitive design and robust feature set, FreshBooks has garnered a significant following among freelancers and SMEs.

Thus, when weighing Xero vs. FreshBooks, the decision between the two should be based on the specific functionalities desired, the nature of the business, and the user's familiarity with the platforms. When comparing Xero vs. FreshBooks vs. ZarMoney, Xero's charm lies in its simplicity. It's designed to cater to those who might not have an extensive accounting background, making bookkeeping an accessible task for business owners.

Features List

When comparing Xero vs. FreshBooks, it's essential to highlight their unique strengths. Xero's offerings range from basic to advanced, focusing on double-entry and bench accounting reports. The following are the fantastic features of Xero;

- Pay bills

- Claim expenses

- Bank connections

- Accept payments

- Accounting dashboard

- Analytics

- Capture data

- Finance reports

- Stock inventory

- Invoices

- Online file storage

- Track projects

- Bank reconciliation

- Multi-currency

- Manage Xero contacts

- Create and send investment orders

- Online quotes

- Automatically calculate sales taxes on transactions

Best Features

Here are the top 3 features offered by this tool;

1. User-Friendly Interface

In the debate of Xero vs. FreshBooks regarding user experience, Xero's design stands out as intuitive and user-friendly. Even if users need to be better-versed in accounting, the software makes it easy to navigate through various functionalities. Its clean design and clear prompts guide users effectively, reducing the learning curve.

2. Cloud-Based Access

When comparing Xero vs. FreshBooks, both platforms offer outstanding features and cater to various user needs. Being cloud-based, Xero provides the comfort of accessing financial data from anywhere, at any time. It is particularly advantageous for businesses with remote teams or those constantly moving.

Plus, data is stored securely and backed up automatically. While FreshBooks is often favored by freelancers and service-based businesses for its invoicing and project management capabilities, Xero shines with its comprehensive financial tools suitable for a broader range of companies.

3. Expense Management

With the ongoing debate of Xero vs. FreshBooks, it's evident that each platform has its unique strengths. For instance, with Xero, tracking and managing expenses have become more streamlined. Users can capture receipts and bills on the go, making expense claims and reimbursements hassle-free.

Pros

- Comprehensive financial reporting

- User-friendly interface

- Multi-currency support

- Payroll processing capabilities

- Cloud-based accessibility

- Real-time cash flow updates

- Automated bank feeds

- Inventory management

- Fixed assets tracking

- Collaborative tools for teams

- Scalable for different business sizes

Cons

- Limited to a certain number of invoices per month in the basic plan

- Additional users come at an extra cost

- Larger businesses may find it less comprehensive

Supported Platforms

Xero is not just confined to desktops or laptops. Recognizing the evolving needs of modern businesses, Xero has expanded its accessibility to mobile platforms such as Android and iOS. It ensures that entrepreneurs and business managers have the flexibility they need to oversee their business finances no matter where they are.

Whether traveling at a coffee shop or between meetings, with the Xero mobile app, your business's financial health is just a tap away.

Pricing

Pricing Plans start at $11 per month, but the premium components come at a higher price point.

Ratings and Testimonials

When comparing Xero vs. FreshBooks, it's worth noting that Xero receives positive feedback, too. With a 4.5 out of 5 rating, users applaud Xero for its user-friendly interface, highlighting the ongoing debate between the two platforms on usability and features. James, a digital agency owner, remarked, "Xero is my go-to for quick invoicing capabilities and real-time bank transactions."

Final Verdict

When comparing Xero to FreshBooks and ZarMoney, some distinct features and offerings set each apart. When set against FreshBooks and ZarMoney, Xero best suits businesses looking for simplicity and integrations. While FreshBooks is tailored primarily for freelancers and small business owners with its intuitive interface and expense tracking, ZarMoney caters to a broader range of businesses with its advanced inventory management and customizable user roles.

On the other hand, Xero stands out with its vast ecosystem of third-party app integrations and a straightforward user interface. However, one must consider that the limited features in Xero's basic plan can be a drawback for some, especially when compared to the more comprehensive programs offered by its competitors.

It chooses the best platform, whether it's Xero vs. FreshBooks, contingent on the specific needs and priorities of the business.

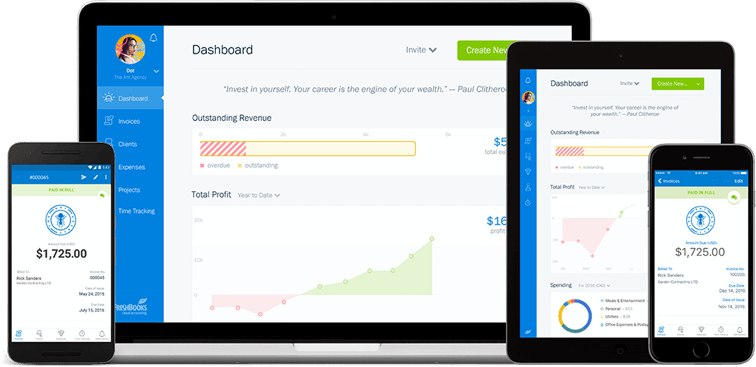

3. FreshBooks

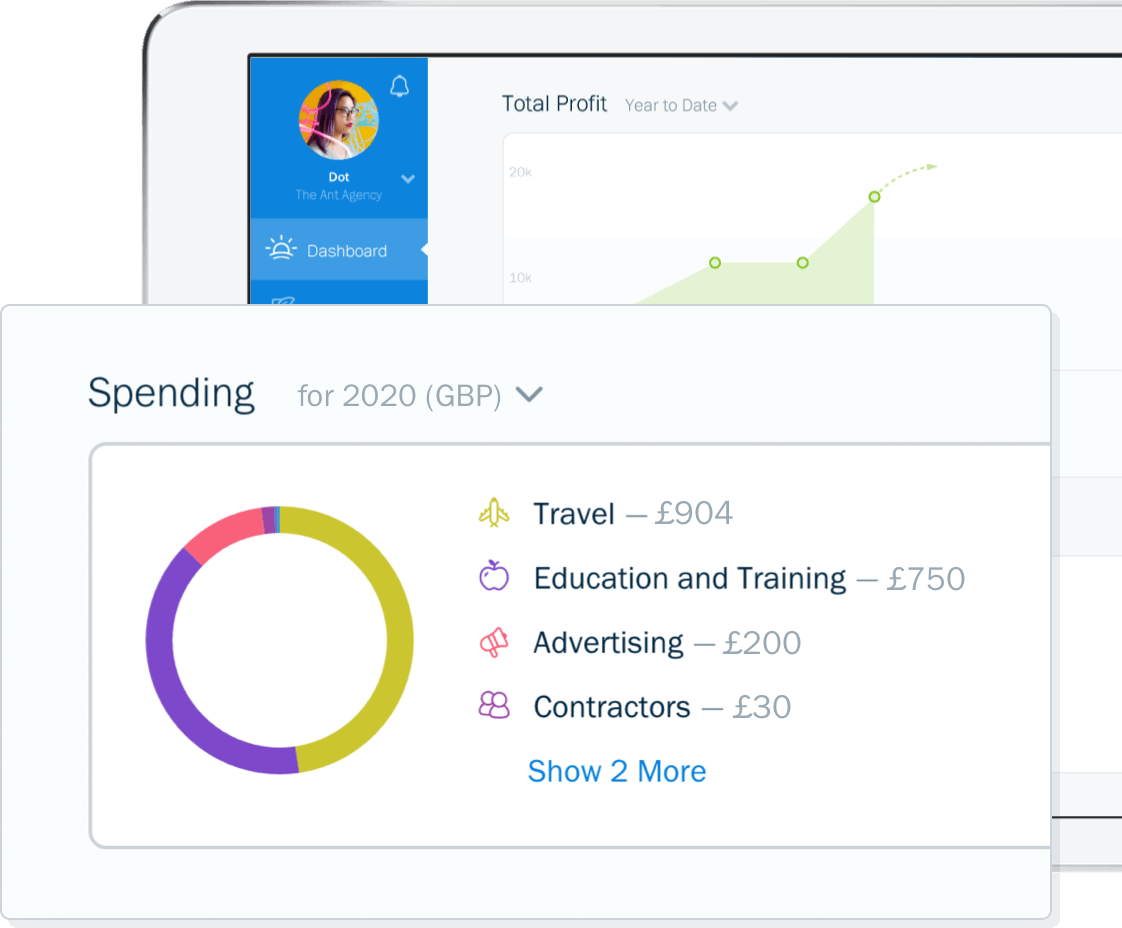

The debate in the accounting software realm often circles Xero vs. FreshBooks. FreshBooks, often the preferred choice for freelancers and service-based businesses, emphasizes its invoicing capabilities and project management features. The platform is especially renowned among those who bill clients by the hour, offering tools and functionalities that simplify and enhance this process.

Conversely, Xero provides a more comprehensive accounting solution catering to enterprises of various rankings and industries. The decision between the two should hinge on the desired functionalities, the company's nature, and the user's familiarity with the platforms.

Features List

In the debate of Xero vs. FreshBooks, one must consider the unique offerings of each platform. FreshBooks offers payment processing options, customizable invoices, and developed time-tracking tools. Following are FreshBook's marvelous features;

- Invoicing

- Expenses tracking

- Time tracking

- Projects

- Estimates

- Payments

- Reporting

- Multi-currency

- Client Portal

- Mobile apps

- Chart of accounts

- Bank reconciliation

- Automatic tax categorization

- Double-entry accounting

- General ledger

- Trial balance

- Balance sheet

- Profit & loss statement

- Expense reports

- Invoice-to-payment insights

- Tax time reports

- Team timesheets

- Collaboration & permissions

- Accept online credit card payments

- Automated recurring invoices

- Automated late payment reminders

- Automated late fees

- Retainers

- Client credit

- Mileage tracking (certain versions)

- Proposals

Best Features

Here are the top 3 features offered by this tool;

1. Ease of Use and Intuitive Interface

In the debate of Xero vs. FreshBooks, one of the standout elements of FreshBooks is its user-friendly interface. Fresh users can quickly acquaint themselves with the dashboard and its functionalities. Straightforward and intuitive design elements ensure detailed tasks like invoicing, expense tracking, and reporting.

It reduces the learning curve and allows users to start managing their finances without extensive training.

2. Customizable Invoices

FreshBooks permits users to produce professional-looking invoices that can be customized to match brand colors and logos. It lends businesses a touch of professionalism. The software also provides the option to set up recurring invoices, automatically bill clients for tracked time, and even set up automated payment reminders for clients.

3. Expense Tracking

With FreshBooks, you can effortlessly log and organize expenses. Connecting bank accounts can automatically import, categorize, and track expenses. Users can also take snapshots of their receipts and store them digitally; when considered in debates like Xero vs. FreshBooks, this feature is pivotal in helping with tax preparation and ensuring that all business expenditures are accounted for.

Pros

- User-friendly interface

- Customizable invoices

- Integrated time tracking

- Comprehensive expense tracking

- Seamless collaboration tools

- Robust reporting and analytics

- Mobile app functionality

- Online payment options

- Automated workflows and reminders

- Outstanding customer support

- Multi-currency support

- Recurring billing features

Cons

- Expensive plan when adding more team members

- Lacks comprehensive inventory management

- Limited to specific bills per month in the basic plan

Supported Platforms

Available for both Android and iOS, FreshBooks provides freelancers with a versatile toolset designed for on-the-go professionals. Whether meeting clients at a café, traveling to different cities, or working remotely, they can effortlessly send invoices, track time, manage expenses, and get an overview of their business financials.

The app's intuitive interface and robust features mean freelancers no longer need to be tethered to a desktop to handle their accounting needs.

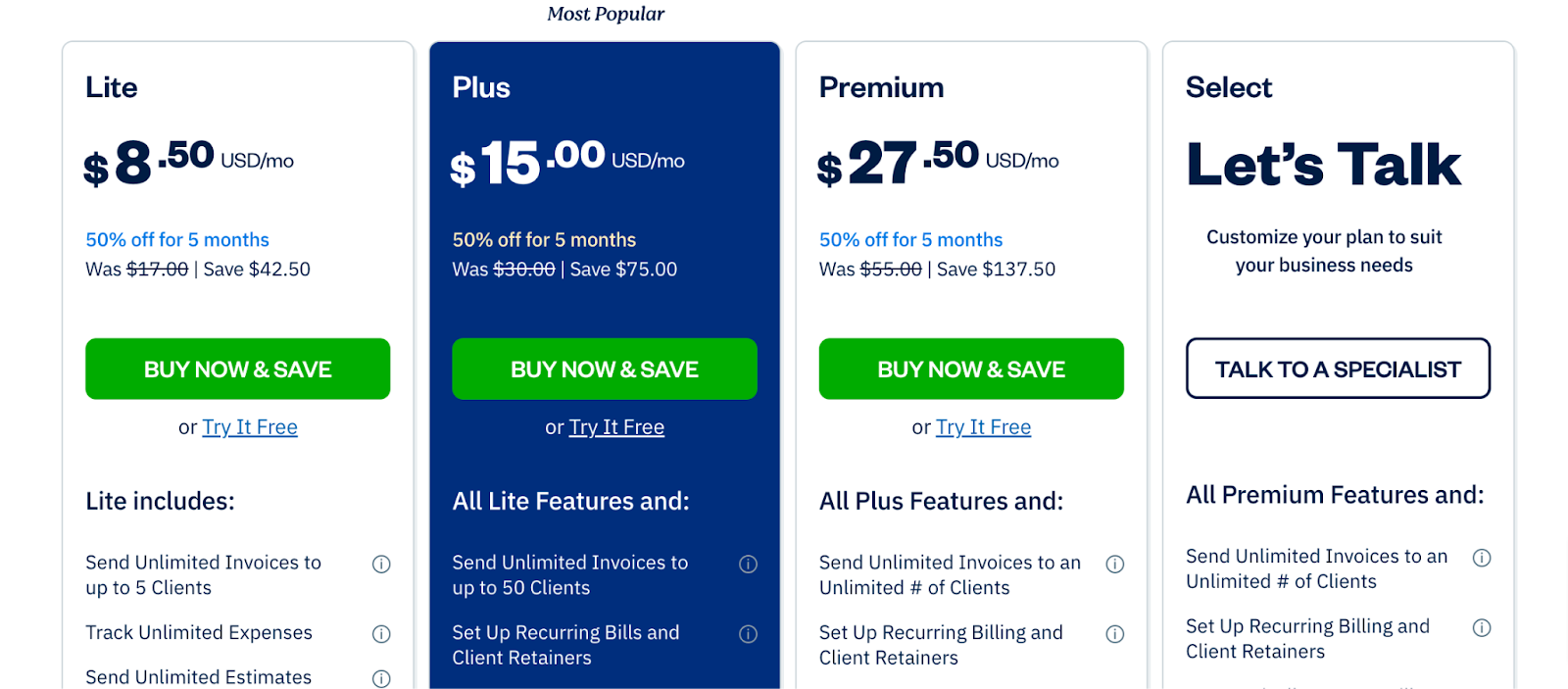

Pricing

Prices start at $15 per month, with different plans catering to varying sizes of enterprises and their needs.

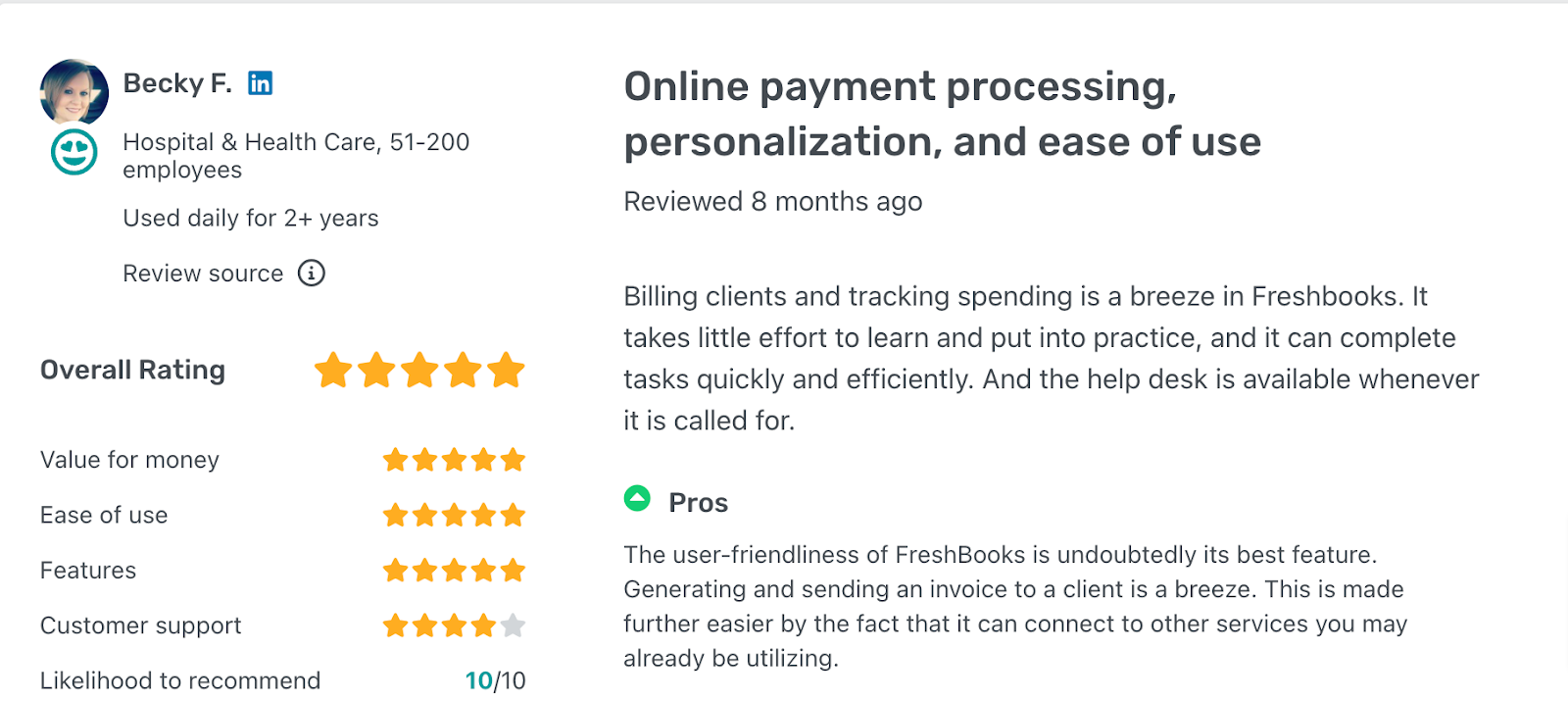

Ratings and Testimonials

Sporting a 4.5 out of 5, users commend FreshBooks for its dedicated client management tools, especially considering the debate of Xero vs. FreshBooks. A freelance graphic designer, Lisa said, "FreshBooks lets me focus on my design work, leaving the financial tasks streamlined."

Final Verdict

Final Verdict

When pondering Xero vs. FreshBooks, the latter shines for freelancers and smaller agencies due to its simplicity and intuitive features. However, compared with ZarMoney, FreshBooks might fall short for more extensive operations requiring a broader range of functionalities and scalability.

ZarMoney's comprehensive toolset, combined with its flexibility, can cater to larger enterprises better than FreshBooks. This distinction becomes even more apparent when considering businesses that demand advanced inventory management, extensive third-party integrations, and more granular financial controls.

Comparison Table

Regarding accounting and invoicing software, businesses have several top-tier options to consider. Among these, Zarmoney, Xero, and FreshBooks are renowned for their robust features and user-friendly interfaces. Understanding the subtle differences between these platforms can be pivotal for businesses aiming to optimize their financial management.

Here's a comparison table highlighting some basic features of these three software solutions:

|

Feature |

Xero |

FreshBooks |

ZarMoney |

|

Expense Tracking |

✅ |

✅ |

✅ |

|

Online Payments |

✅ |

✅ |

✅ |

|

Bank Reconciliation |

✅ |

✅ |

✅ |

|

Project Management |

❌ |

✅ |

✅ |

|

Unlimited Invoices |

❌ |

❌ |

✅ |

|

Customer Support Options |

✅ |

✅ |

✅ |

|

Bank Transactions |

✅ |

✅ |

✅ |

|

Unlimited Users |

❌ |

❌ |

✅ |

|

Pricing Tiers |

✅ |

✅ |

❌ |

|

Real Time |

✅ |

✅ |

✅ |

|

Inventory Management |

✅ |

❌ |

✅ |

|

Mileage Tracking |

❌ |

✅ |

❌ |

|

Payroll Management |

✅ |

❌ |

❌ |

|

Credit Card Payments |

✅ |

✅ |

✅ |

|

Monthly Payment |

✅ |

✅ |

✅ |

Vendor Neutral Buyer's Guide

Selecting the right accounting software solutions for your business can be daunting. When considering Xero vs. FreshBooks, remember to consider ZarMoney's unbeatable offerings. Think about the size of your business, the scalability you need, and the support options. While many software programs offer bank reconciliation features and billable hours tracking, you need a platform that aligns with your business model.

Trust me; the right software can smooth your accounting journey.

Conclusion

Your business's heartbeat is its finances. In the constant debate of Xero vs. FreshBooks, each platform offers distinct advantages tailored to specific audiences. Xero, known for its comprehensive financial tools, caters to many businesses. At the same time, with its specialized invoicing and time-tracking capabilities, FreshBooks is a favorite among freelancers and service-oriented companies.

However, amidst this competition, ZarMoney emerges as a versatile player suitable for businesses of all scales. With its expansive feature set, ranging from customizable invoices to real-time inventory tracking and a user-friendly interface, ZarMoney positions itself as the Swiss Army knife in cloud-based accounting software. But remember, in the end, it's not about having the most features but the right features. Dive deep, understand your unique business needs, and may your balance sheets always be in the green!

Go on, give ZarMoney a try, and witness an accounting transformation. The platform seamlessly integrates features to streamline your financial management, making complex tasks seem simple. Dive into the world of organized accounting and experience the difference for yourself!

Frequently Asked Questions (FAQs)

1. Which one is best for freelancers or solo entrepreneurs?

FreshBooks is a go-to accounting solution, especially among freelancers and solo entrepreneurs. Its popularity can be primarily attributed to its user-friendly interface that ensures even those with minimal accounting knowledge can easily navigate the platform. In addition to its intuitive design, FreshBooks boasts robust invoicing features.

2. Which software is the most user-friendly for those new to accounting?

All three platforms are designed with non-accountants in mind, but many users find FreshBooks' interface particularly intuitive for beginners.

3. Can I use them on mobile devices?

Yes, both Xero and FreshBooks offer mobile apps that allow users to manage finances. ZarMoney is cloud-based and can be accessed via browsers on mobile devices.

4. Which is the best for inventory management?

ZarMoney offers comprehensive inventory management features that might be more robust than Xero or FreshBooks.

5. What about integrations with third-party applications?

All three platforms offer various integrations with third-party apps. Xero, in particular, has a large ecosystem of add-ons.

6. Are they suitable for global businesses?

Xero and FreshBooks support multi-currency transactions, making them flawless for businesses that operate in multiple countries. You'd have to check the latest offerings of ZarMoney for global business support.