What is Payroll Tax and How is it Calculated?

Payroll tax is a percentage of an employee's salary paid to the government to fund social insurance programs. Learn about payroll taxes and how it is calculated here.

As a business owner, it is understandable that you are tasked with many responsibilities, from starting a business to employing qualified staff, training workers, compensating them for work done, and so on. However, you must pay your employees accurately and timely while also making the appropriate deductions and remittances to the federal/ provincial government. Therefore, the need to understand what payroll tax is and how it is calculated.

From the first day of hiring your first employee, calculating payroll, and making deductions has become a part of your responsibilities as a business owner.

The interesting thing is that payroll tax calculations and deductions are not the type of responsibility you must carry out yourself. Payroll tax may look simple but they can also be complicated, and errors made during deductions can be costly to your business and may even attract penalty charges.

However, as a business owner, whether you are doing your payroll tax calculations and deductions in-house or using a payroll service provider, you still need to understand payroll, payroll tax, and how it is calculated.

You won’t become a payroll tax guru overnight, but in this guide, we will cover the basics of payroll tax deductions, and you may even become an expert in payroll calculations sooner than you’d expect.

What is Payroll?

When an employee or set of employees are said to be on a payroll, they receive expected compensations and at a specified period.

Payroll is more than just signing a few checks each month or during pay periods such as weekly, bi-weekly, or monthly.

It also involves the whole process of keeping track of worked hours, calculating wages, printing and delivering checks, withholding taxes and other deductions, and remitting them to the government during each pay period.

What is Payroll Tax?

A payroll tax is the percentage withheld from an employees’ income before they are issued a paycheck. It is the responsibility of a business owner to deduct payroll l taxes and remit it to the government on behalf of the employees.

Payroll tax is not necessarily a one-way thing as deductions can be from employees’ wages and the employer’s taxes based on their salaries. The employee pays part of these taxes through a payroll deduction, and the employer pays the rest directly to the Internal Revenue Service (IRS).

What is the Difference Between Payroll and Income Taxes?

There are significant differences between a payroll tax and an income tax, and as a business owner, you must understand the differences. As discussed earlier in this post, a payroll tax is a two-way deduction paid by both the employer and employee and go to Medicare and Social Security.

However, payroll and income taxes are standard payroll tax that should be withheld by employers when they make payroll deductions. In 2021, both the employer and employee should pay 7.65% on the first $142,800, then 1.45% on earnings above that figure.

While for those earning $200,000 and above, there is an additional Medicare tax of 0.9%.

In contrast, income taxes are paid by employees alone and are used to fund government spending and public services. Income taxes are progressive and only paid if employees earn over a certain threshold; those who earn more pay more.

Often, the lower percentage of your salary will end up as payroll tax since payroll taxes are regressive the more you earn.

Also, these two taxes are used for different purposes. How income taxes are spent solely depends on the independent decisions by the federal, state or local government, while federal payroll taxes are used to fund specific programs.

What are the Standard Payroll Tax Deductions?

Now that you understand payroll, payroll tax, and the differences between payroll and income taxes. What are the payroll tax deductions that should be withheld from your employee’s income?

Before you can decide what amount to withhold, you need to know that the appropriate amount to be withheld from an individual’s paycheck depends on their gross wages, where they reside, and where they work.

You may want to check the Filing Season Statistics for every year on the official website of the IRS. The standard payroll tax deductions are mandatory, legislated, and required by law. These payroll taxes are;

- Federal income tax withholding

- Social Security tax withholding

- Medicare tax withholding

- Additional Medicare tax withholding

- State income tax withholding

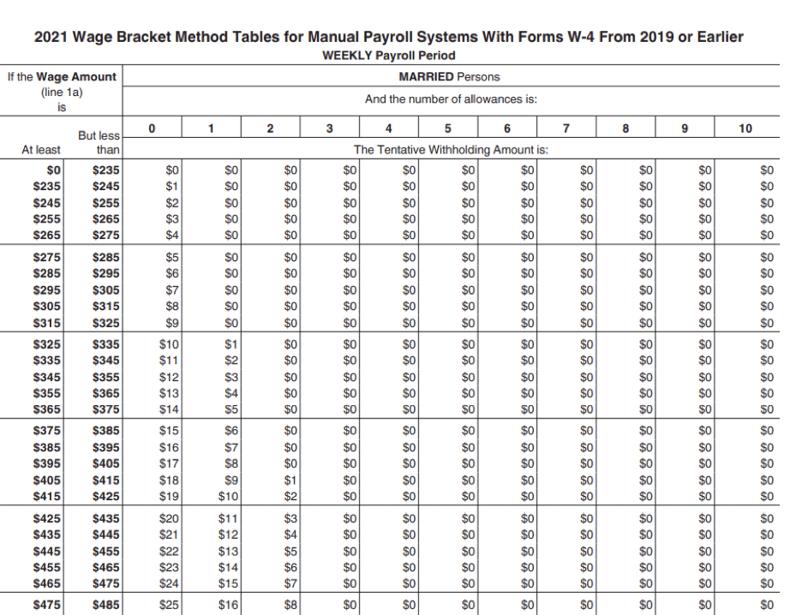

- Federal Income Tax Withholding: Employees are expected to fill out w4 forms when hired. An employer uses this form to determine how many dependents an employee wishes to claim. You take up this information with your employees’ wages and look up the IRS publication 15T for how much federal income taxes to withhold from their paycheck.

The income tax deduction varies, depending on the employee’s withholding status, but all employees pay 15.3 percent of their FICA tax earnings. Snippet of worksheet for employee with w4 form

Snippet of worksheet for employee with w4 form

Source: IRS Publication 15-A

- Social Security tax withholding: Social Security tax and Medicare tax withholdings are known as FICA (Federal Insurance Contributions Act). In 2020, the tax responsibility for individuals was 7.65%; 6.20% was Social Security tax, the remaining 1.45% was Medicare tax.

The employer responsibility was also 7.65%. However, the Social Security tax has a wage base limit, and in 2020, that limit was $137,700. So wages over $137,700 were not taxed with the Social Security tax that year.

- Additional Medicare tax withholding: The additional Medicare tax is withheld on employees earning over $200,000 as a single or head of house filer and $250,000 for married couples filing jointly. This deduction began as a standard payroll tax deduction in 2013, and the employee pays 0.9%.

- State and Local Income Tax: As an employer, it is also your responsibility to state and local payroll deductions from your employee’s earnings. State and local income tax will often cover a state, county, or municipality, and every state’s payroll tax rules are different. It is your responsibility as an employer to check the accurate list of your state’s taxing authority published by the Federation of Tax Administrators.

How to Calculate Standard Payroll Deductions:

Knowing what the different standard payroll tax deductions are just a part of understanding payroll tax in its entirety. Knowing how to calculate them is as important. Here are simple and straightforward steps to follow to calculate payroll taxes like an expert.

Federal Income Tax Withholding:The federal income tax can be calculated using the wage bracket method. Using IRS Publication 15-A, search for the “Wage Bracket Percentage Method Tables,” and select the table that corresponds to your employee’s pay period.

You should check your employees’ w4 form to see the number of benefits claimed and determine if they file their income tax as single or married.

Find the employee’s gross wage for the pay period in columns A and B, and subtract the amount found in column C.

Multiply the result by the percentage found in Column D. In cases where an employee requests additional tax to be withheld from each paycheck; you should add that amount to the final number.

The final result is the amount you should withhold from the employee’s paycheck for that pay period

Here is a link to the IRS Publication 15-A Wage Bracket for a breakdown

Social Security Tax Withholdings:

To calculate Social Security withholding, multiply your employee’s gross pay for the current pay period by the current Social Security tax rate (6.2%). i.e., if your employee’s gross pay for the current period is $7,000, then multiply the gross pay by 0.62%. In this case the social tax to be deducted will be $7,000 * 0.62 = $434.

Medicare Tax Withholding:

To calculate Medicare withholding, your employee’s gross pay should be multiplied by the Medicare tax rate which is currently (1.45%). This means that if your employee earns $7,000 gross income for the current period, the Medicare tax to withdraw will be $7,000 * 1.45 = $101.5

Additional Medicare Tax Withholding:

Considering the Additional Medicare Tax law, all income for an individual above $200,000 is subject to an additional 0.9% tax. Therefore, an employee’s additional Medicare Tax bill is $50,722 X 0.9% = $456. He has already paid (1.45% X $199,558) + (2.9% X $51,164) = $2,893.59 + $1,483.7 = $4,377.29 in Medicare taxes already.

State and Local Income Tax:

State, local and provincial taxes are calculated differently as individual states have their own payroll tax rules. Also, tax withholding tables can be used to determine employee’s local withholding. You can access your provincial tax withholding table from the official page of the IRS here.

Do I have to do Payroll Deductions Myself?

The answer is No! Calculating payroll tax deductions, yourself can become a daunting task, especially when you have many employees whose payments need to be processed timely and accurately.

There are professional payroll service providers that you can outsource your payroll processing, calculations, deductions, and remittance to.

These companies use payroll software that is easy to integrate with your business type and are law compliant. This means that you will never have to worry about updates in tax deductions, as this software will automatically inform you about tax changes and implement them at the click of a button.

Keep in mind, ZarMoney's seamless integration with Gusto, creates and syncs a detailed payroll journal entry into your ZarMoney account to make accounting for your payroll expenses a breeze.