Top 7 Alternatives to Sage Payroll for Efficient Employee Payment

Finding the right payroll software can be daunting. With the many options available, pinpointing the ideal alternative to Sage Payroll becomes more challenging.

If your business is seeking specialized features and a unique pricing structure or is curious about the variety of options beyond Sage Payroll, here are seven alternatives that could align with your requirements.

1. ZarMoney

ZarMoney is a cloud-based accounting solution created for companies of all measures. It presents a complete strategy as an alternative to Sage Payroll, having extensive feature integration and a user-friendly interface.

After integrating ZarMoney with Gusto, you can access a wide range of payroll services. Combining these two vital tools enables you to manage payroll efficiently for both larger and smaller companies.

Features of ZarMoney

- Accounting

- Accounts Receivable

- Tax compliance

- Financial reporting

- Payroll management

- Dynamic statements

- Invoice

- Billing

- Order management

- Payment reconciliation

Top 3 Features of ZarMoney

1. Comprehensive Payroll Management

Connecting ZarMoney to Gusto gives you access to various payroll services. The comprehensive payroll management includes calculating wages and bonuses, managing tax payments, and filing.

You can set up different pay types, deductions, and benefits, making it easy to customize payroll for your specific needs.

2. Tax Compliance and Reporting

One of ZarMoney's standout features is its tax compliance tools. It automates tax calculations and helps ensure your business complies with changing tax regulations.

Additionally, it generates essential tax reports and files them electronically, simplifying the often complex task of payroll tax management.

3. Dynamic Statements

Dynamic Statements feature allows instant verification of reported transactions against actual bank statements with a simple click. ZarMoney facilitates easy data annotation and comparison, putting control at your fingertips.

Effortlessly generate balance sheets, cash flow statements, and customized earnings reports to meet your business's specific needs.

Pros of ZarMoney

- Affordable Pricing Structure.

- Effortless Invoicing and Billing.

- Automate your sales tax calculation.

- Highly customizable invoices and flawless integration with accounting software.

Cons of ZarMoney

- The learning curve for new payroll platform users.

- An internet connection is required for cloud-based features.

Supported Platforms of ZarMoney

- Web

- Mac.com

- Windows

- Linux

- Chromebook

Pricing of ZarMoney

ZarMoney has three pricing plans

- 15 Days Free trial

- Entrepreneur $15 / month / 1 user

- Small Business $20 / month / 2 users

- Enterprise $350 / month / 30+ users

Final Verdict on ZarMoney

ZarMoney stands out as a strong Sage Payroll alternative, offering a user-friendly interface and affordability that makes it a top choice for payroll solutions. It combines complete payroll management, multi-state payroll capabilities, and exceptional security in one efficient, accurate, and easy-to-use package for professionals across various industries.

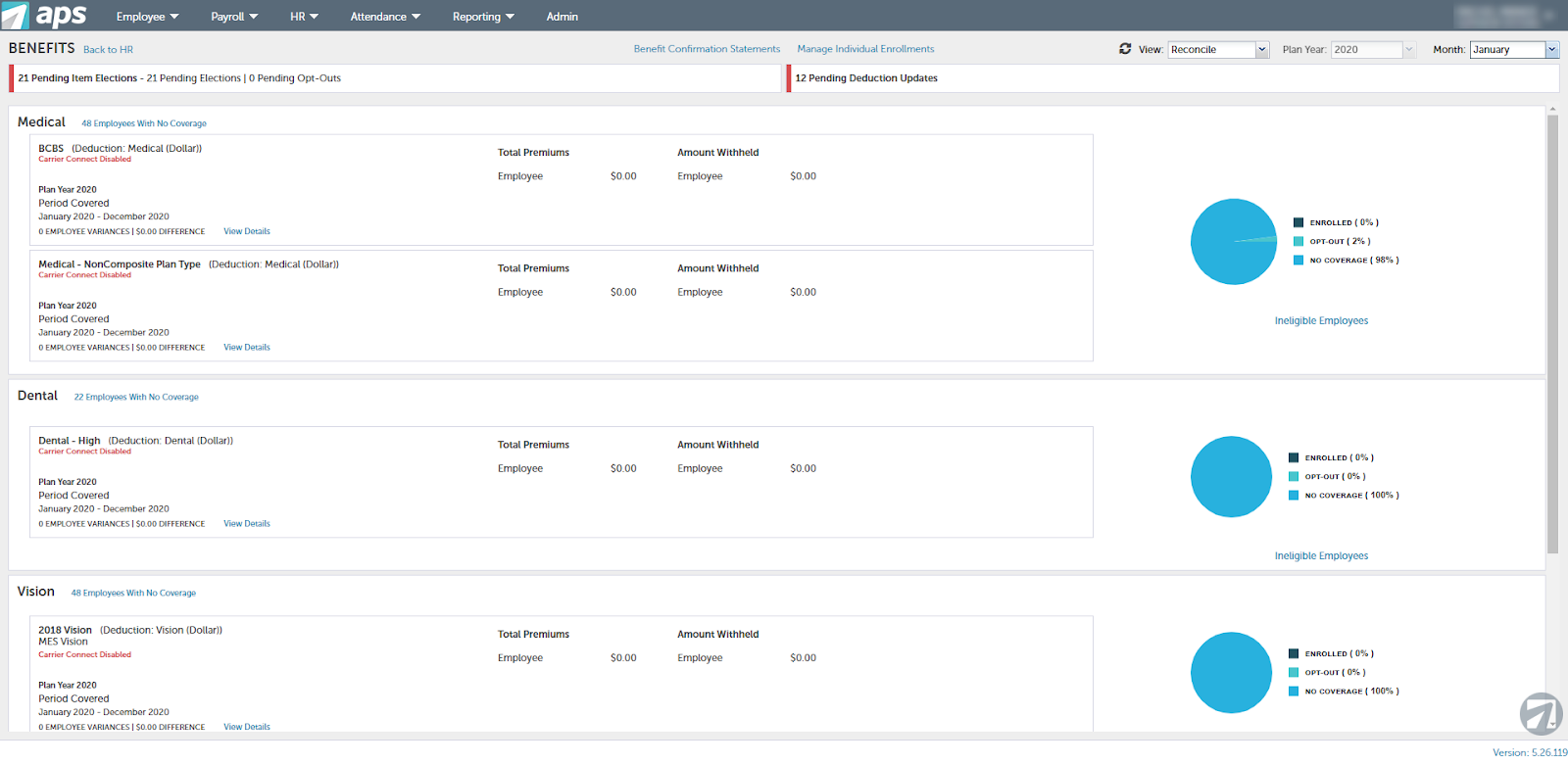

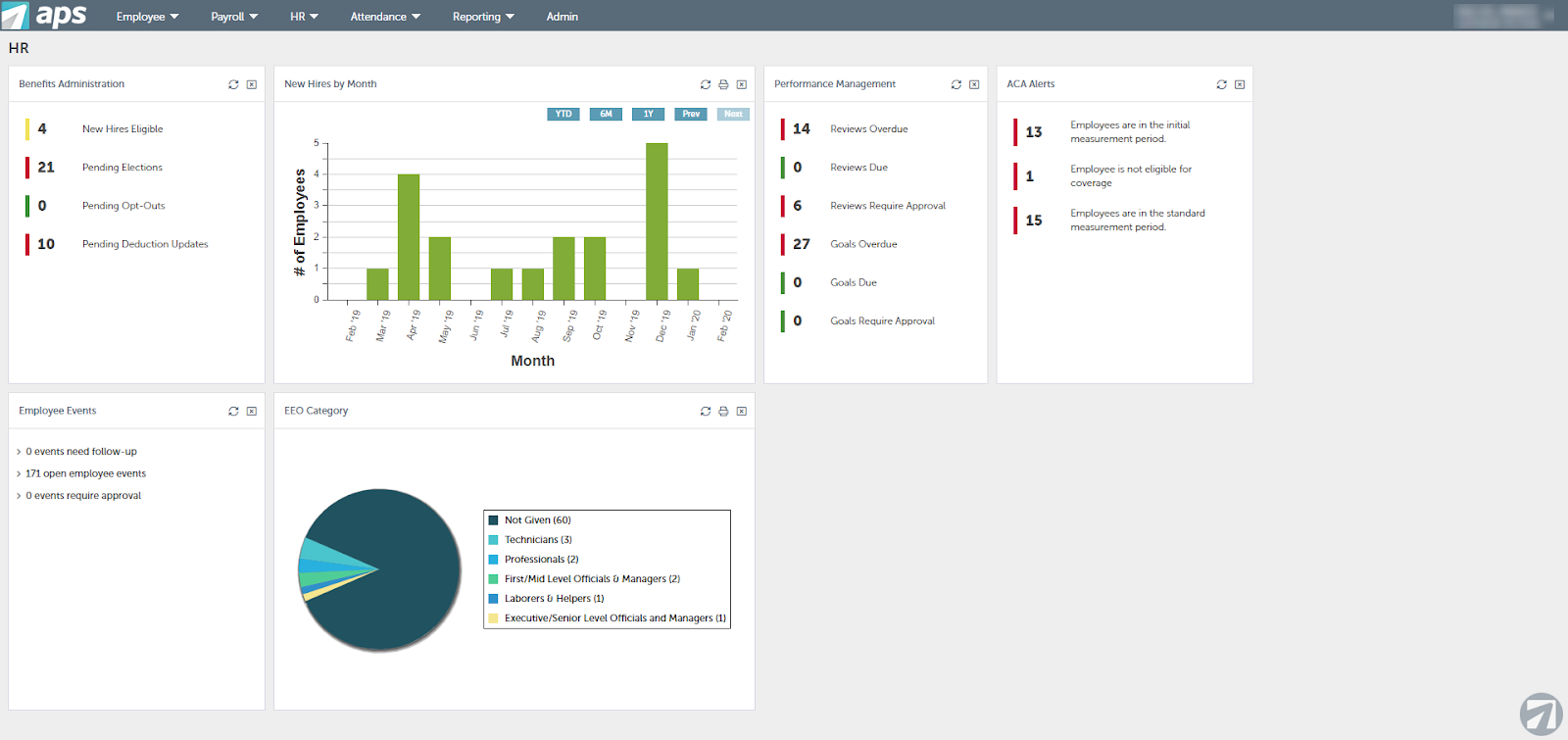

2. APS Payroll

APS Payroll, an amazing alternative to Sage Payroll, has established itself as one of the leading payroll and HR solutions providers. You get everything you need to make sure everyone gets paid correctly and on time, like easy-to-use tools for calculating pay, handling taxes without errors, and options for direct deposit.

Basically, it's user-friendly and backed up with good support, making it a stress-free choice for small to large companies.

Features of APS Payroll

- Payroll management

- Recruiting and onboarding

- Attendance

- Analytics

- Reporting

- Employee self-service

- Payroll imports and exports

- Tax compliance

Top 3 Features of APS Payroll

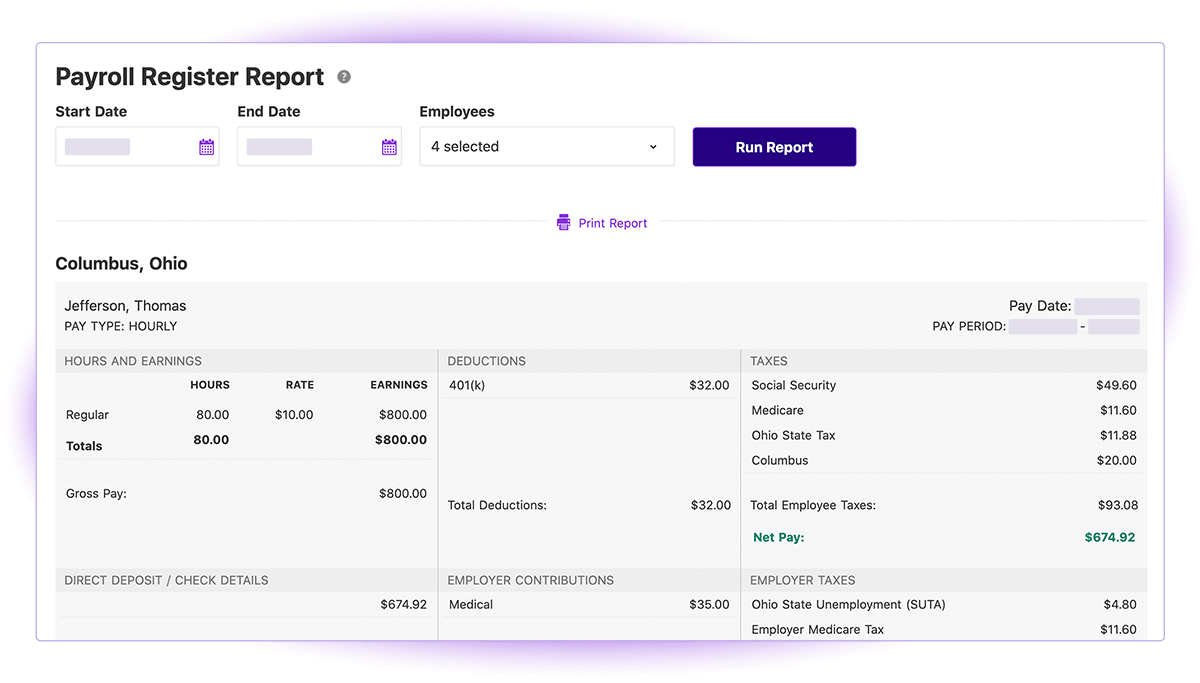

1. Payroll Management Solution

The payroll management solution from APS provides a centralized system where businesses can manage and process their employee payrolls efficiently.

It includes working employee hours, overtime, deductions, and other payroll-related data.

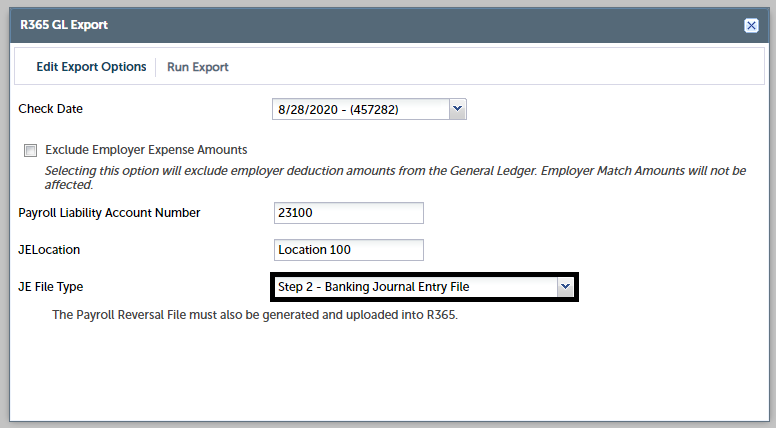

2. Payroll Imports and Exports

The ability to import and export data is critical for businesses that use multiple systems. APS allows effortless integration with other software solutions, smoothing platform data flow.

Depending on the business's unique requirements, the import/export feature allows customization to handle specific data fields.

3. Tax Compliance

Tax laws and rates are ever-changing. APS makes sure its software is always up-to-date with the latest tax tables, including compliance with federal, state, and local tax regulations.

The software can auto-generate necessary tax filings based on the payroll data, reducing manual work and the possibility of errors in tax submissions.

Pros of APS Payroll

- Intuitive design, easy for all tech skill levels

- Ensures compliance with tax laws and payroll regulations

- User-friendly interface

Cons of APS Payroll

- Higher cost for advanced features

- Challenges integrating with other software

- The learning curve for new users

Supported Platforms of APS Payroll

- Browser access on Windows, macOS, Linux

- Mobile apps available for iOS and Android for access anywhere

Pricing of APS Payroll

- Payroll starts at $5 per employee/month + $50 base fee/month.

- Payroll + Attendance starts at $8 per employee/month + base fee.

- Payroll + HR + Attendance starts at $11 per employee/month + base fee.

Final Verdict on APS Payroll

APS Payroll, a Sage Payroll alternative, focuses on HR tasks, offering efficient employee management, benefits administration, and compliance. However, its features beyond HR are more limited compared to broader business management solutions.

The pricing for the complete package of APS Payroll is also considered somewhat expensive.

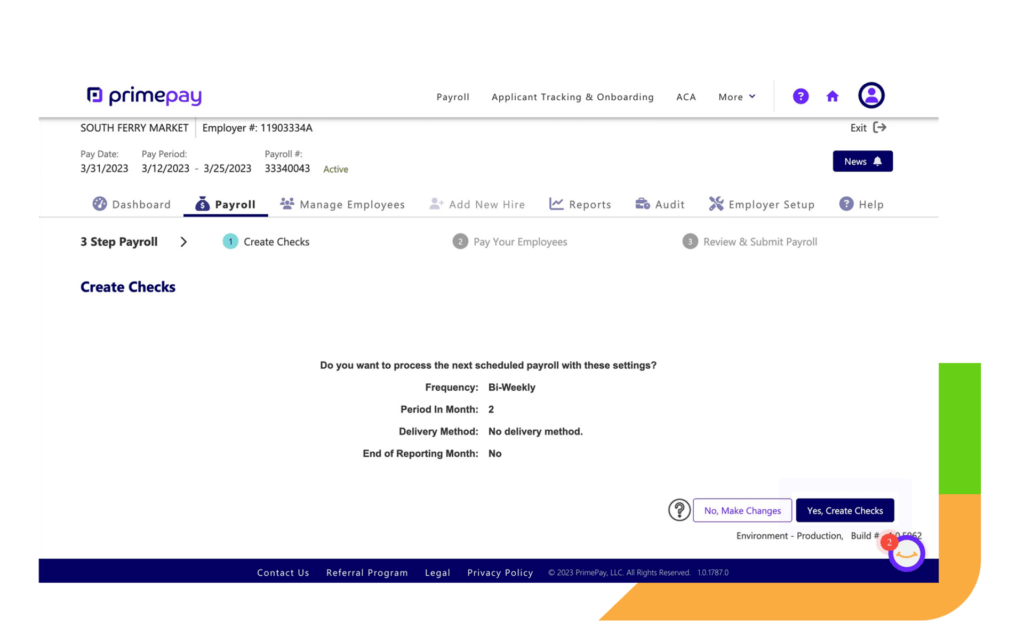

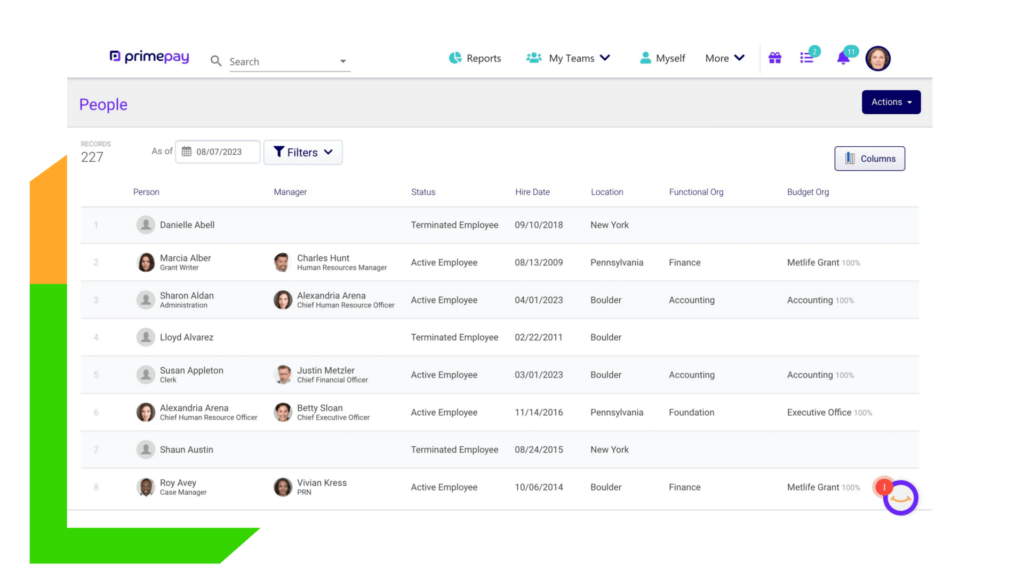

3. PrimePay

PrimePay steps in as another excellent choice for businesses looking to switch from Sage Payroll for their employee payment needs. It covers all the bases – from accurate tax management to timely payments for every team member, including direct deposit options.

PrimePay is built to be easy to use, aiming to reduce the usual time and stress associated with payroll tasks. It suits businesses of all sizes, offering a clear and efficient solution for payroll management without complications.

Features of PrimePay

- Payroll

- Taxes

- HR management

- Time and attendance

- Compliance

- Employee direct deposit

- Tax processing

Top 3 Features of PrimePay

1. Payroll

PrimePay's payroll system is designed to be user-friendly, ensuring businesses can efficiently process their payroll without the hassle.

The software automates calculations, thus reducing the chance of errors. It's built to integrate with various HR systems, time & attendance solutions, and other tools to make the payroll process seamless.

2. Employee Direct Deposit

Direct deposit means workers get their wages credited straight to their bank accounts. It is faster and eliminates the need for paper checks, making the process more environment-friendly and efficient.

Employees can split their pay between different accounts for better financial management.

3. Tax Processing

PrimePay calculates, files, and pays the employer's federal, state, and local taxes. This automation ensures businesses are on time for their tax payments and avoid penalties.

Pros of PrimePay

- All-in-one platform for payroll, HR, and benefits

- Wide range of features

- Auto-calculates deducts, pays, and files payroll taxes

Cons of PrimePay

- Potential for a learning curve if new to payroll systems.

- Integration issues with existing HR or financial software.

- Limited customization options for unique business needs.

Supported Platforms of PrimePay

- Web-based: Access from any internet-enabled device

- Mobile apps for iOS and Android for access anywhere

Pricing for PrimePay

PrimePay offers customizable pricing plans that are custom-made to meet the specific payroll needs of any business.

Each plan, from Payroll Essentials to HCM Premium, is designed to provide flexible and comprehensive solutions with optional managed services for added support.

Final Verdict on PrimePay

PrimePay, a great alternative to Sage Payroll, is an all-inclusive payroll service provider known for its comprehensive solutions for small to medium-sized businesses.

With features ranging from payroll processing to HR and benefits administration, it offers businesses an integrated approach to managing employee-related functions efficiently.

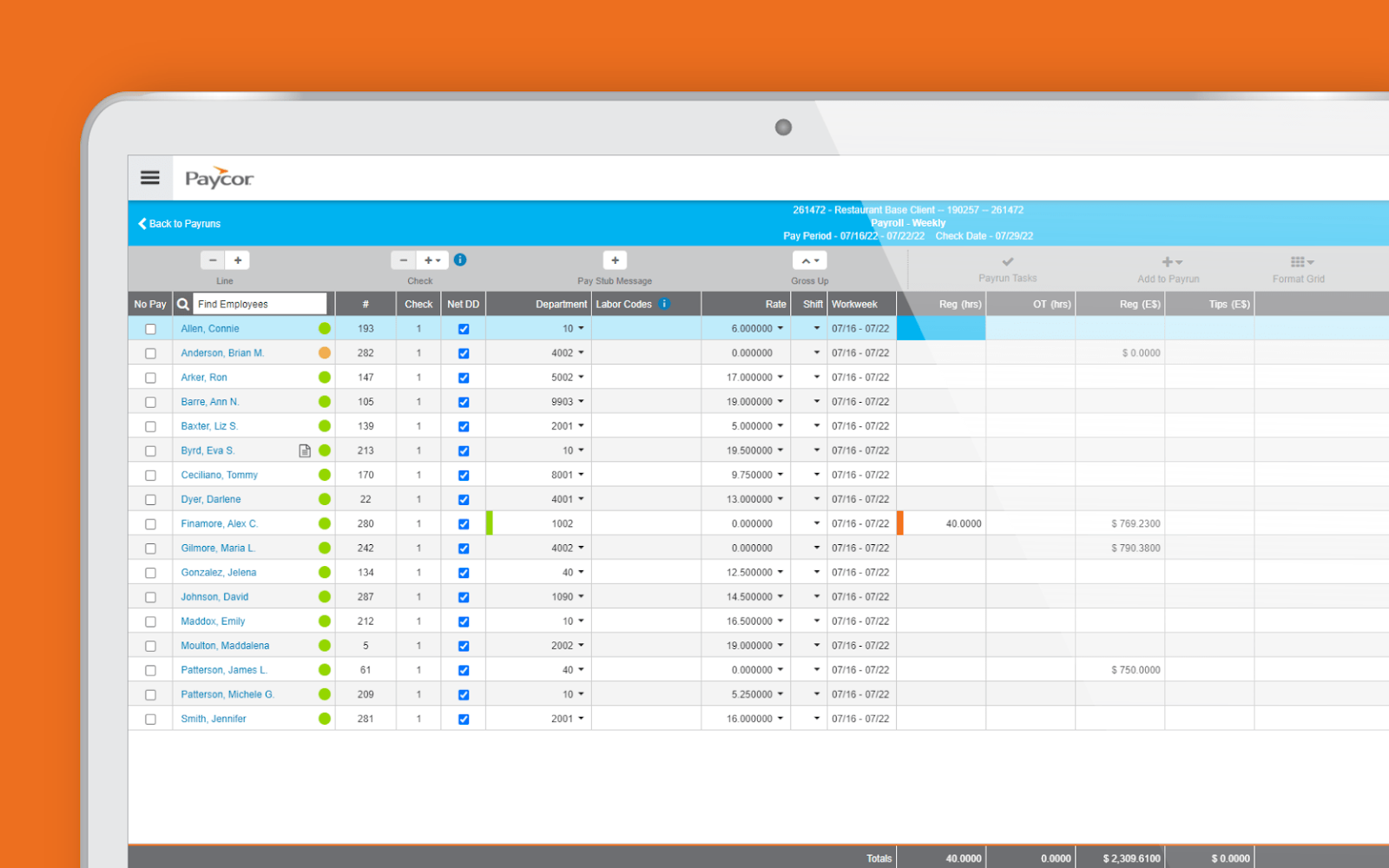

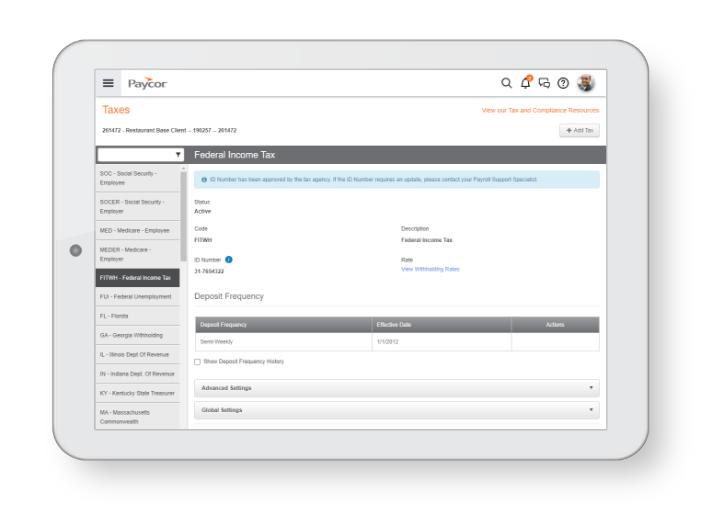

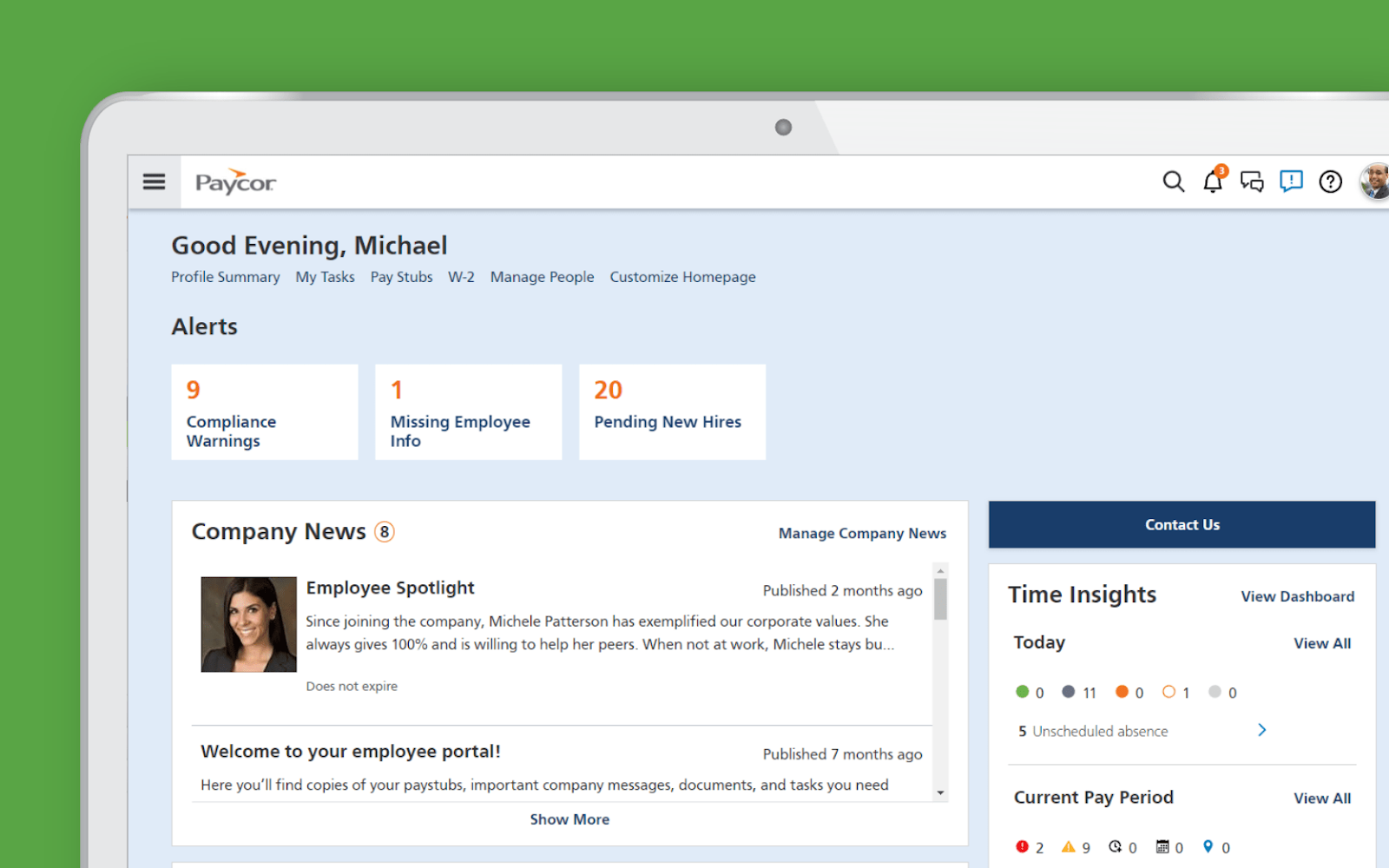

4. Paycor

Paycor, a great alternative to Sage Payroll, is another industry-leading solution that provides modern and intuitive payroll, HR, and timekeeping services. Known for its ease of use and functionalities, Paycor has carved a niche among businesses of varying sizes.

It's designed to integrate effortlessly with other HR tools, making the entire HR process smoother.

Features of Paycor

- Payroll processing

- Tax compliance

- Expense management

- Compensation planning

- Pay solutions

- Video interviewing

- Reporting

- Analytics

- Employee self service

Top 3 Features of Paycor

1. User-Friendly Payroll Processing

Paycor allows users to run payroll with a single click, optimizing the process and reducing the time spent on payroll calculations.

Before finalizing, users can preview payroll to ensure everything is correct. It helps in detecting any mistakes or differences.

2. Tax Compliance

Paycor handles federal, state, and local tax calculations for timely tax filings. It minimizes the likelihood of mistakes and subsequent penalties.

3. Employee Self-Service

Employees access pay stubs, tax information, and other relevant data through Paycor's mobile application.

It offers numerous payment possibilities, including direct deposit and pay cards, catering to diverse worker preferences.

Pros of Paycor

- Features timekeeping, recruiting, and learning management beyond payroll

- Suitable for small to large businesses

- Strong analytics and reporting

Cons of Paycor

- Setup and implementation can be challenging

- Advanced features may incur extra costs

- Occasional system outages or glitches are reported

Supported Platforms of Paycor

- Web-based interface available

- Mobile apps for iOS and Android

Pricing of Paycor

Paycor delivers customizable HR and payroll solutions for businesses, small to large, with pricing according to company size and needs.

Final Verdict on Paycor

Paycor is equipped with tools for recruiting, HR, timekeeping, and benefits administration, among others.

Catered to a range of businesses, from small startups to larger enterprises, Paycor is recognized for its user-friendly interface and insightful analytics.

5. Gusto

Gusto, an incredible alternative to Sage Payroll, is primarily known for its payroll services and also offers a range of HR tools that make it easier for businesses to onboard, pay, insure, and support their team.

With a user-friendly interface and a focus on simplifying complex processes, Gusto is a favorite among many startups and SMEs.

Features of Gusto

- Automated payroll processing

- Employee benefits

- HR

- Attendance

- Onboarding

- Insights and reporting

- Compliance and tax fillings

- Advanced integrations

Top 3 Features of Gusto

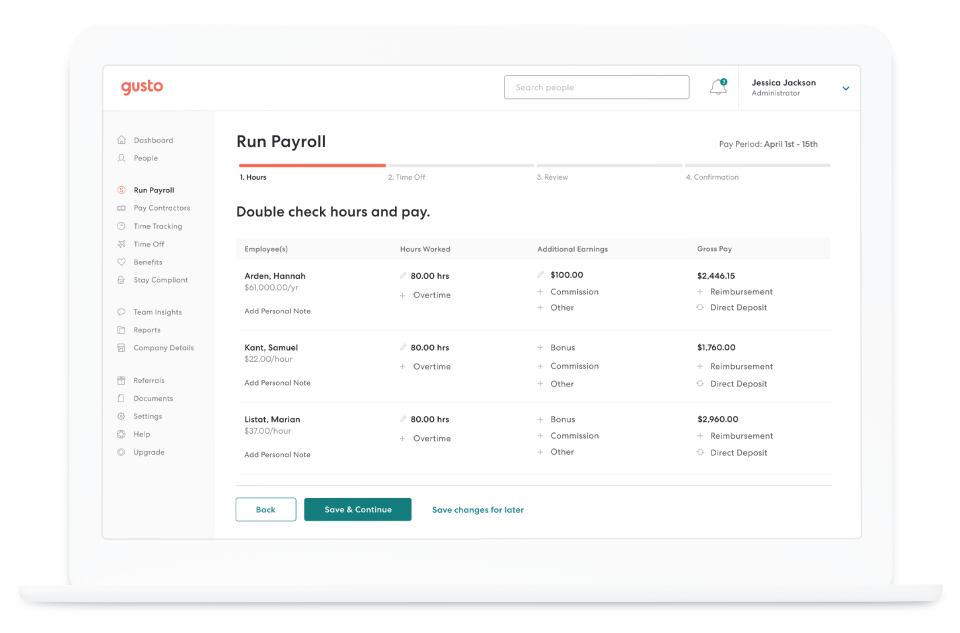

1. Automated Payroll Processing

Gusto offers an automatic payroll system. Beyond mere calculation, the service guarantees taxes are submitted to the appropriate government agencies with every payroll run.

Unlike other providers who may levy additional charges for this essential feature, it's provided here at no extra cost.

2. Compliance and Tax Filings

Gusto handles all tax-related compliance for businesses. The software automatically computes, pays, and files employees' applicable local, state, and federal taxes.

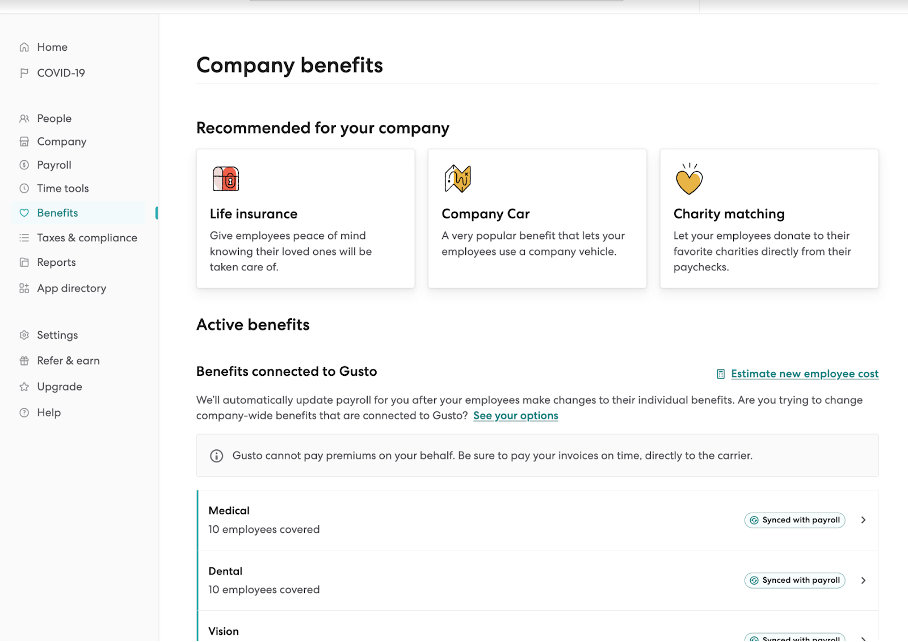

3. Integrated Benefits Administration

Besides the primary payroll features, Gusto also offers benefits administration. Employers can directly manage health insurance, retirement plans, HSAs, and more through the platform.

These benefits comply with federal regulations and sync with payroll to deduct benefits costs automatically.

Pros of Gusto

- The intuitive interface simplifies startup

- Range of HR tools available

- Manages payroll taxes automatically

Cons of Gusto

- Not ideal for large businesses

- HR features lack comprehensiveness

- Limited third-party integrations

Supported Platforms of Gusto

- Web-based interface

- Some mobile/on-the-go capabilities via third-party apps and integrations

Pricing of Gusto

- Simple plan: $40/month

- Plus plan: $60/month

- Premium has exclusive pricing

Final Verdict on Gusto

Gusto is popular with small to mid-sized businesses, but its limited integration with third-party apps may reduce its appeal. Despite its user-friendliness and core HR functions, this limitation can affect firms needing broader tool compatibility.

Additionally, Gusto's cost may be high for smaller businesses on strict budgets.

6. Patriot Payroll

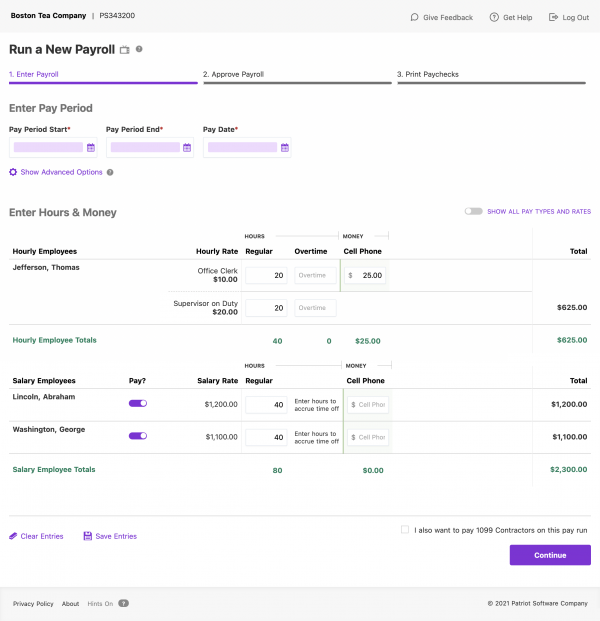

Patriot Payroll is a cloud-based payroll processing solution customized primarily for small businesses. It offers an intuitive platform to manage employee payments and handle federal, state, and local payroll taxes.

Patriot Payroll takes charge of calculating, filing, and depositing payroll taxes with the appropriate federal, state, and local agencies.

Features of Patriot Payroll

- Payroll setup

- Expert support

- Pay frequencies

- Unlimited payrolls

- Mobile friendly

- Time and attendance

Top 3 Features of Patriot Payroll

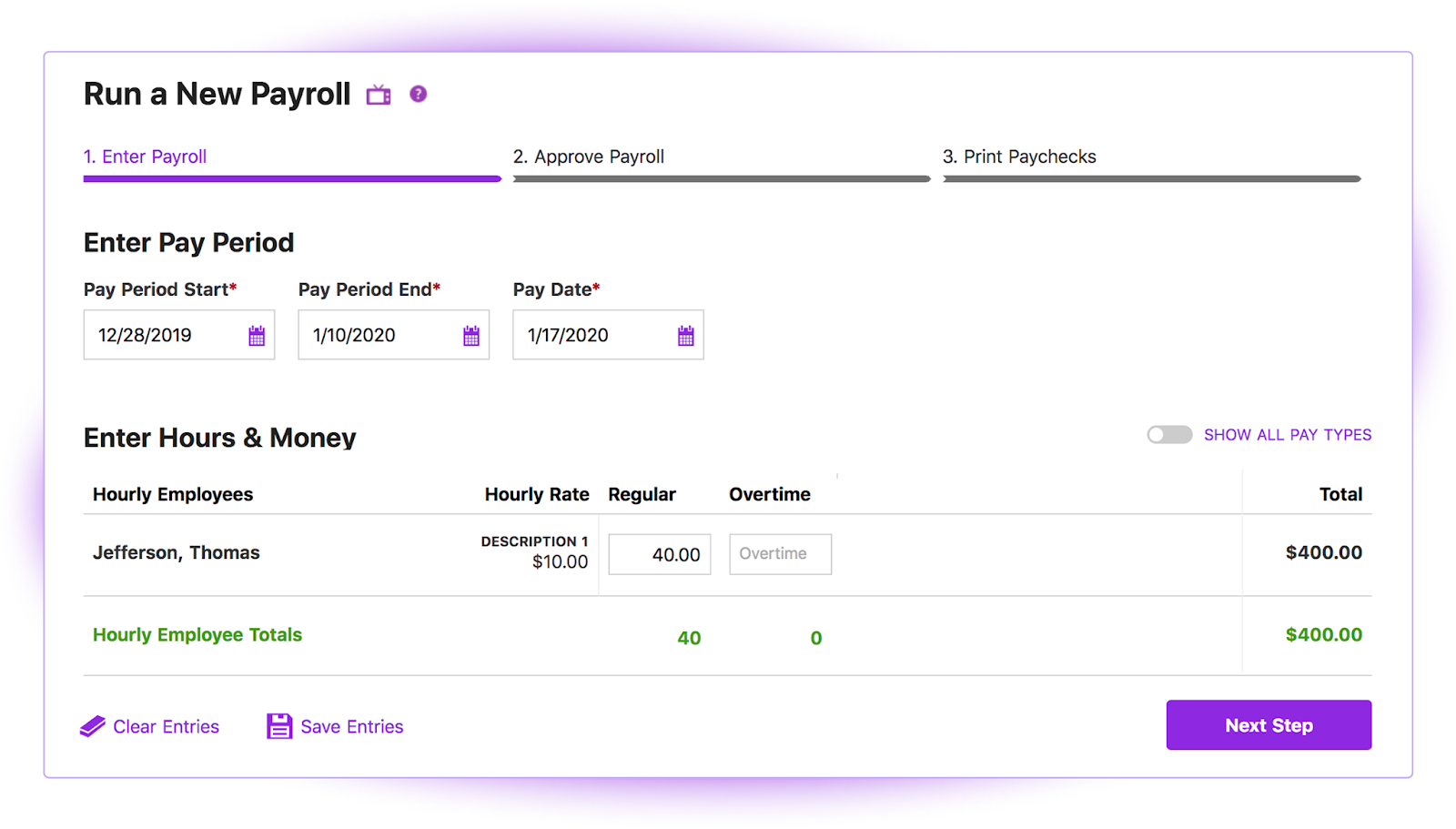

1. Payroll Setup

Setting up payroll can be daunting, especially for those unfamiliar with the process. One of the strengths of Patriot Payroll is its user-friendly interface.

Even those with limited payroll experience can set up their company's payroll without hassle.

2. Unlimited Payrolls

Regardless of how frequently a business runs its payroll (weekly, bi-weekly, monthly, etc.), Patriot Payroll allows an unlimited number of payrolls to be processed monthly. This flexibility is essential for businesses with varying payroll needs.

3. Time and Attendance

Patriot Payroll can integrate with time and attendance systems, guaranteeing employee hours are accurately logged and processed for payroll.

It decreases the chances of blunders, which can lead to overpayments or underpayments. Employees can log in to view their timecards, request time off, and check their attendance history.

Pros of Patriot Payroll

- Intuitive interface for easy learning

- Compliant payroll processing

- Strong customer support feedback

Cons of Patriot Payroll

- It has fewer HR features

- Limited reporting capabilities

- Limited software integration

Supported Platforms of Patriot Payroll

- Web browsers

- iOS

- Android

Pricing of Patriot Payroll

- Basic Payroll: $17/month

- Full-Service Payroll: $37/month

Final Verdict on Patriot Payroll

Businesses seeking a broader array of HR and integration features might be somewhat restrictive. It's best suited for those who want a focused payroll system without the frills of extended HR functionalities.

Its simplicity and focus on payroll make it less suited for organizations that require advanced HR functionalities and extensive integration with a wide range of business applications.

7. Rippling

Rippling, another alternative to Sage Payroll, is an all-in-one solution that integrates payroll with HR, IT, and other administrative functions.

Aimed at businesses of all sizes, it's more than just payroll software – it offers a comprehensive toolset for employee management, from onboarding to equipment management.

Features of Rippling

- Payroll

- Time and attendance

- Recruiting

- Learning management

- Unlimited Payrolls

- Performance management

Top 3 Features of Rippling

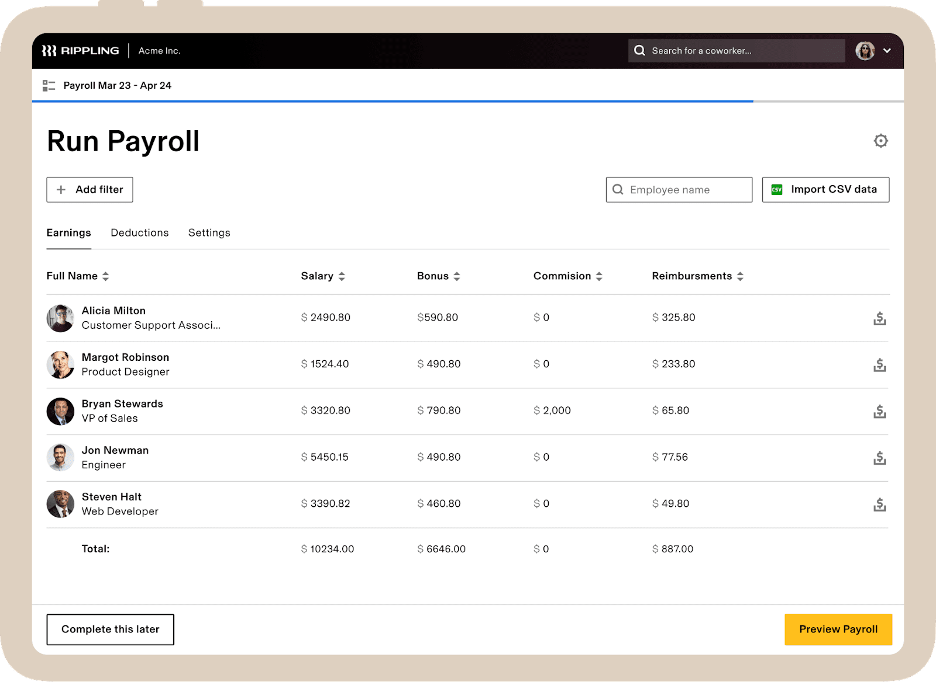

1. Payroll

Rippling's payroll system automates many tasks that typically take HR personnel a lot of time. It includes calculating pay based on hours worked, handling tax calculations, and distributing paychecks.

One of the main strengths of Rippling is its capability to integrate with different systems.

2. Unlimited Payrolls

With unlimited payrolls, companies are free of the number of payroll runs they can have in a month. It is especially beneficial for businesses with varying pay cycles or needing off-cycle payrolls for bonuses or corrections.

Instead of being charged per payroll run, the unlimited feature means businesses can budget a fixed cost for payroll regardless of how many times they run it.

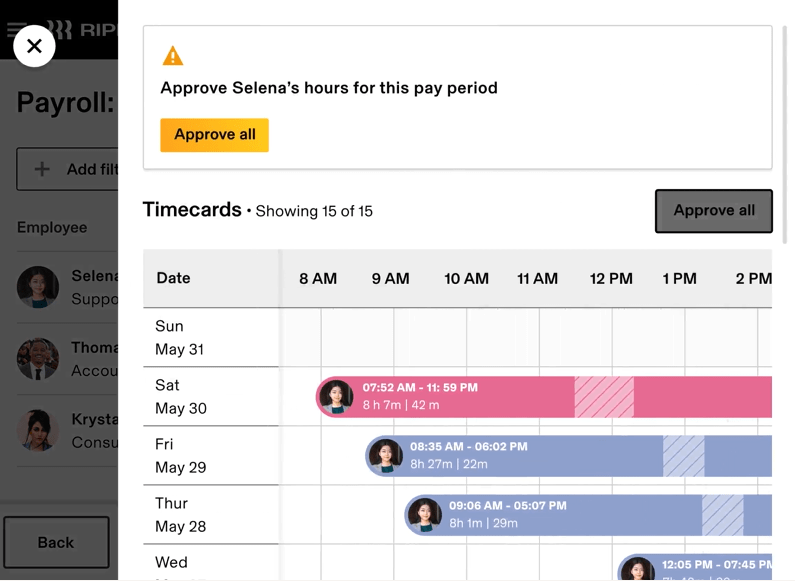

3. Time and Attendance

Rippling's time and attendance feature allows for precise tracking of employee hours, which can be critical for hourly workers or ensuring accurate payment.

One of the significant benefits is that the time and attendance data can be automatically fed into the payroll system, making the entire process more streamlined.

Pros of Rippling

- All-in-one solution for payroll, HR, IT, and more

- Extensive integrations with third-party apps

- Automation of administrative tasks reduces manual workload

Cons of Rippling

- Some users perceive it as expensive, especially with added features

- Not user-friendly

- Occasional glitches or bugs reported

Supported Platforms of Rippling

Rippling is cloud-based, allowing users to access its features from any device with a web browser and an internet connection.

Furthermore, Rippling has mobile applications available for iOS and Android, facilitating administrative tasks for users on the move.

Pricing of Rippling

- Starts at $8 per month

- Custom quote availability

Final Verdict on Rippling

Rippling's platform, while potentially more complex to initially learn due to its wide range of functionalities, is good for businesses that expect to grow or have varied administrative requirements.

Its comprehensive nature covers not just payroll but also a broad spectrum of HR and IT tasks, making it a versatile tool for organizations looking to automate multiple processes under one system.

Comparison Table

|

Feature / Software |

Zarmoney |

APS Payroll |

PrimePay |

Paycor |

Gusto |

Patriot Software |

Rippling |

|

Customizable Payroll |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Direct Deposit |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Tax Filing Services |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Employee Self-Service |

✅ |

✅ |

✅ |

❌ |

❌ |

❌ |

✅ |

|

HR Management |

✅ |

❌ |

✅ |

✅ |

✅ |

❌ |

✅ |

|

Benefits Administration |

✅ |

❌ |

❌ |

✅ |

✅ |

❌ |

✅ |

|

Time and Attendance Tracking |

✅ |

✅ |

✅ |

✅ |

❌ |

✅ |

❌ |

|

Compliance Management |

✅ |

❌ |

✅ |

❌ |

✅ |

✅ |

✅ |

|

Reporting and Analytics |

✅ |

✅ |

❌ |

✅ |

✅ |

✅ |

❌ |

|

Mobile Access |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Integration Capabilities |

✅ |

✅ |

❌ |

❌ |

✅ |

❌ |

❌ |

Best of Best

1. ZarMoney

ZarMoney is a standout choice compared to Sage Payroll, providing a variety of features for different business needs at an affordable price. It boosts efficiency by automating processes and offers flexible, customizable plans. With a user-friendly interface, it's easy to manage tasks.

Beyond payroll, it integrates with third-party apps for a thorough approach to business accounting and inventory management, making it a versatile tool for today's businesses.

2. PrimePay

PrimePay, a great alternative to Sage Payroll, offers payroll services, HR solutions, and benefits administration, making it a comprehensive business option.

It has a reputation for providing personalized support and services to its clients.

3. Gusto

Gusto, an alternative to Sage Payroll, is known for its simple, intuitive payroll interface, which is especially useful for small businesses without a dedicated HR department.

It provides transparent and upfront pricing, making it easier for businesses to budget.

Conclusion

While Sage Payroll remains a great solution for many businesses, many alternatives are available in the market, each with its strengths and specialties. Remember, the right payroll system optimizes financial processes, ensures compliance, and improves employee satisfaction.

With ZarMoney’s efficient, affordable approach to payroll management and level up your business's financial operations. Start today and experience the ease and effectiveness of ZarMoney's payroll solution.

Frequently Asked Questions (FAQs)

Q1. Why should I consider an alternative to Sage Payroll?

Different businesses have unique needs. While Sage Payroll might be suitable for some, others might find features, pricing, or user experience of alternatives more in line with their requirements.

Q2. What level of customer support and integration options do these alternatives offer for implementation into existing systems?

Effortless customer support and integration options ensure smooth onboarding and integration with existing systems, improving workflow efficiency.

Q3. Is transitioning from Sage Payroll to another platform easy?

It largely depends on the platform you're transitioning to. Most current software solutions offer data migration tools or assistance for a smooth transition.

Q4. Are the alternatives cloud-based, like Sage Payroll?

Many alternatives, including ZarMoney, offer cloud-based solutions for accessibility from anywhere and regular automatic updates.

Q5. How does ZarMoney's pricing compare to Sage Payroll?

Pricing can change based on the elements you require and the size of your company. It's best to compare the current pricing structures of both platforms directly.

Q6. Does ZarMoney offer support and training like Sage Payroll?

Yes, Zarmoney provides customer support and has unlimited resources that are unrestricted for training and onboarding.

Q7. How does ZarMoney stand out as an alternative?

ZarMoney is lauded for its user-friendly interface, customizable features, and affordability, making it an attractive option for many businesses.