Top 6 Quicken Alternatives to Consider in 2024

One does feel comfortable and at ease when a tool offers functions to help you manage your finances. Quicken is one such tool with wide-ranging capabilities to help you track your budget, transactions, account balance, investment, and more.

However, there are many Quicken alternatives in the current market that can boost the efficiency and speed of your financial management system.

Below, we will analyze the top six Quicken alternatives to consider for your finance management.

List of Quicken Alternatives

- ZarMoney

- YNAB

- Mint

- Bills.com

- Tiller Money

- DollarBird

1. ZarMoney

ZarMoney is a great financial management software that is an ideal Quicken alternative, especially for business accounting. While Quicken primarily focuses on personal finance, ZarMoney extends its features to support complex business finances as well. From real-time inventory tracking to detailed financial reports, it offers a range of functions to help businesses get a detailed overview of their financial situation.

Top Features of ZarMoney

- Real-Time Inventory Tracking

- Invoicing and Estimates

- Expense Management

- Employee Timesheets

- Customer Relationship Management (CRM)

- Multi-User Access Controls

- Comprehensive Reporting

- Bank Reconciliation

- Purchase Orders

Top 3 Features of ZarMoney

1. Real-Time Inventory Tracking

ZarMoney's real-time inventory tracking is a standout feature. Unlike Quicken and other Quicken alternatives, which are more focused toward personal finance, ZarMoney allows businesses to have a real-time understanding of their inventory, which is invaluable for managing supply and demand effectively.

2. Invoicing and Estimates

ZarMoney allows businesses to generate invoices and estimates. This feature is important for a company looking to manage its spending habits. It not only replaces but also outdoes Quicken's limited invoicing capabilities.

3. Expense Management

Managing expenses is important for both personal and business finances. ZarMoney takes this a notch higher by offering a wide range of expense tracking and management features that provide a detailed insight into spending patterns.

Pros of ZarMoney

- Great customer service.

- User-friendly interface and easy to use.

- Tutorials to help you learn the platform.

- Multiple products to help with your retail accounting needs

Cons of ZarMoney

-

It has limited credit card processing options.

ZarMoney Pricing

- Small business: $20/month for 2 users

- Enterprise: $350/month

Supported Platforms

- Windows

- macOS

- Linux

- iOS mobile app

- Android mobile app

Testimonials

Final Verdict on ZarMoney

As a Quicken alternative, ZarMoney excels in offering a range of business accounting features that Quicken lacks. Its real-time capabilities provide an advantage for businesses looking to optimize their financial management.

While it might require a slight learning curve, its wealth of features makes ZarMoney an excellent tool for personal and business financial planning.

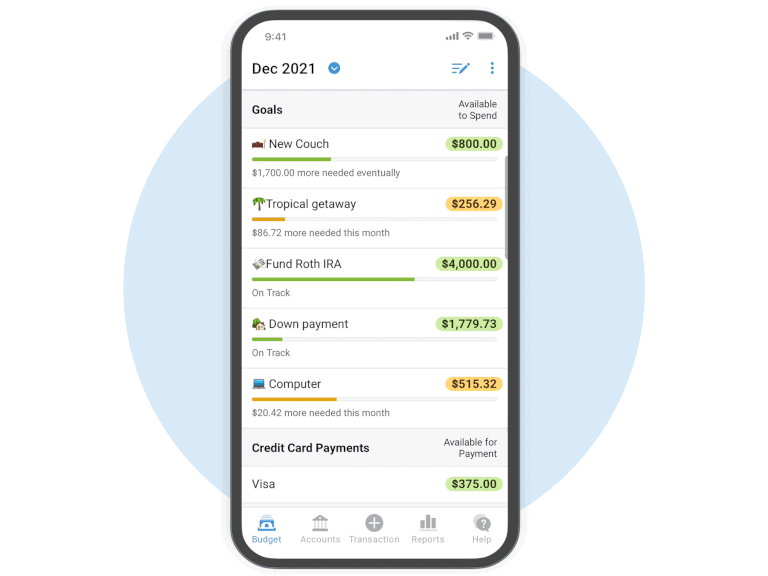

2. YNAB

YNAB is handy for tracking your spending, managing your finances, and staying within budget. It stands out because it follows guaranteed financial methods that help you proactively budget and save every month.

For instance, it prompts you to assign a job to every dollar in your account. You create expense categories for your income, which enables you to manage it efficiently. YNAB is a great choice for teams and businesses looking for quicken alternatives.

YNAB Features

- Budgeting

- Bank connections

- Automatic synchronization

- Data import/export

- Analytics and reports

- Loan Calculator

- Goal tracker

YNAB Top 3 Features

1. Goal tracking

With YNAB, you can set financial goals and stay on track with them. The app offers target-setting, through which you can simultaneously set savings targets for one or multiple things. The progress bar will give you visibility into the status – how far or close you are to hitting your target for a particular goal.

2. Account Sync

Get a real-time overview of your finances through YNAB. This app syncs all details across various devices - whether you use the desktop, tablet, or mobile version. You can track your budget easily from anywhere.

3. Spending Reports

Gain quick insights into your financial progress through visual data. YNAB prepares visual reports containing charts and graphs to show you how exactly you have been faring when it comes to your money matters.

YNAB Pros

- It has a mobile app that’s very easy to use

- The app is intuitive

- It can connect to several banks, making data import easy

YNAB Cons

- It is not free and can be considered expensive compared to other options.

- It does not categorize expenses automatically

- It can be challenging to use for first-timers

YNAB Pricing

- Monthly Plan: $14.99

- Annual Plan: $98

Supported Platforms

- Web

- Android

- Apple Watch

- Mobile

- Alexa by Amazon

YNAB Testimonials

Final Verdict on YNAB

Instead of getting a list of expenses at the end of the month, with YNAB, you can take a more proactive approach and take charge of your money like never before. Use the free trial to learn how useful it proves for you. However, be prepared to invest time and money to use this tool beneficially for the long term.

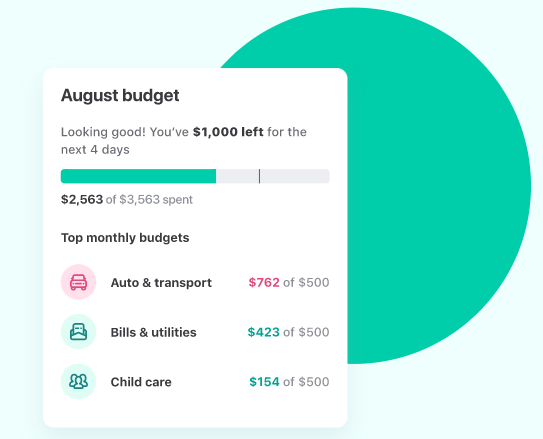

3. Mint

Mint helps you manage your finances from a consolidated dashboard. This app can track your finances, investments, debts and loans, expenditures, credit, and more.

It is a cloud-based software that stands out in the market as a Quicken alternative, meaning you can access it anywhere and anytime. It also has a mobile app, making accessing it easier for users who want to learn their spending and other details to manage their finances better.

Mint Features

- Activity Dashboard

- Alerts/Notifications

- Budgeting/Forecasting

- Data Visualization

- Financial Management

- Monitoring

Mint Top 3 Features

1. Budgeting

You get to learn your top monthly expenditure, find out how much your budget remains, and be notified before you overspend. You can also create categories of expenses per your specific needs and track outgoing expenses for each type accordingly.

2. Bill Payment Tracker

Mint helps you track all your bills on its app. Whether it is your utility, credit card, or subscription bills, the app lets you know what you must pay in the current month. Since the app updates you about the deadlines and due dates, you will remember to pay bills or incur penalty fees.

3. Credit Score Report

Mint lets you know your credit score so you know where you stand. All you have to do is verify your identity, and the app provides you with your credit report summary in minutes. Since your accounts are also accessible on the same app, you do not have to visit a third-party app or sign in somewhere else to access this vital financial information.

Mint Pros

- It is easy to use

- The starter plan is entirely free of cost

Mint Cons

- It comes with a lot of ads, which can be annoying for users

- The reporting feature is limited

- The automatic categorization can sort out transactions incorrectly sometimes.

Mint Pricing

- Free Version

- Monthly Mobile Plan: $4.99

Mint Testimonials

Supported Platforms

- Web

- Android

- iPhone

- Apple watches

Final Verdict on Mint

Use Mints to consolidate your accounts and financial management on one platform. You can rely on this app to pull information from your link accounts and maintain records effortlessly if you are looking for a Quicken alternative. You can track your budget and do much more through the app, which offers you a clear picture of your finances, empowering you to make wiser decisions.

4. Bills.com

Bills.com is a good Quicken alternative for people who want to manage their bills and finances - in addition to their budgeting, they can also use this tool if they run a small business. You might be looking to use a single tool to track all your personal and business-related spending. If that’s the case, bill.com is a good option as a Quicken alternative. You can also use the Essential plan to manage your account payables effectively.

Bill.com Features

- Activity Dashboard

- Alerts/Notifications

- Bank Reconciliation

- Billing & Invoicing

- Budgeting/Forecasting

- Cash Flow Management

Bill.com Top 3 Features

1. Bill Management

Bill.com allows you to pay your domestic or international bills quickly. Just choose one of the several electronic payment options and deliver them with just a few clicks. It saves time.

2. On-the-Go Payment

View, manage, and send all your bills, even on the go. Bill.com allows you to stay updated with your upcoming payables and allows you to pay swiftly and without hassle, even when you are on the go.

3. Credit Card Payments

With bill.com, you can pay your bills through your card quickly. All you have to do is add your card to the app, whether Visa, Mastercard, American Express, or Discover. Choose the bills you want to pay using your card and approve payment quickly.

Bill.com Pros

- The implementation is easy

- Its direct deposit feature is quite useful

- The customer support is very responsive

Bill.com Cons

- It can be difficult to link it to pay orders

- The website can glitch sometimes

- Customization options are limited

Bill.com Testimonials

Bill.com Pricing

- Individual: $39/month

- Teams: $49/user/month

- Large Groups/ Corporations: $69/user/month

- Enterprise: Custom Quote

Supported Platforms

- Android

- iPhone/iPad

Final Verdict on Bill.com

Use bill.com to manage your account payables, whether it is your personal finances or your small business. This tool is ideal for small business owners who can gain visibility into their spending, both personal and business-related.

5. Tiller Money

Tiller Money helps you manage your finances through optimal automation capabilities. You can link your bank accounts to this app, which will automatically import transaction details. Not only that, but it also categorizes your transactions through automation into a spreadsheet.

You can use one of the foundation templates that the tool offers, such as Monthly Budget or Categories Sheet, and get your hands on the financial information you need in the form of a comprehensive sheet.

Tiller Money Features

- Money Feeds

- Auto-Categorization

- Foundation Template

- Customizable Templates and Categories

- Daily Email

- Automated Tracking

- Basic Financial Reports

Tiller Money's Top 3 Features

1. Auto-Categorization

With Tiller, you do not have to sort out your payments and transactions into categories. This app automatically categorizes your expenses and transactions in Google Sheets. This allows you to track your finances and budget easily on a daily basis.

2. Foundation Template

Tiller provides you with a foundation template to speed up the process of using automatic financial feeds. You can use one of the several foundation templates available, including monthly budget, transaction sheets, quick insights sheet, and categories sheet and connect it to your bank feed.

3. Daily Email

Tiller can send you emails daily to give you an overview of all your connected accounts. Gain complete visibility of your finances, including balances and transactions done, whether from credit card or cash from the bank accounts and cards you have linked to the app.

Tiller Money Pros

- It has a user-friendly interface

- It updates account details automatically, requiring no manual intervention

- It has a mobile app that makes it convenient for use from anywhere 24/7

Tiller Money Cons

- The reporting feature is not detailed

- It does not offer an investment tracking feature

- It is expensive compared to other tools

Tiller Money Testimonials

Tiller Money Pricing

- Free trial

- Monthly Plan: $6.58

Supported Platforms

-

Web

Final Verdict on Tiller Money

You can use Tiller to manage your personal as well as business expenses. With its automation, budgeting, tax reports, and more, it can help you manage income from not one but several accounts.

6. DollarBird

DollarBird helps you track your budget easily. You can manage your spending on a day-to-day basis. With this app, there is no need to learn too much information simultaneously – start from daily expenses and move on from there. You can track your expenses and income while also forecasting finances for the future and planning ahead.

DollarBird Features

- Calendar-based financial management

- Project cash flow

- Expense tracking

- Spend patterns

- Budgeting collaboration

DollarBird Top 3 Features

1. Calendar-based Management

DollarBird gives you a calendar view of your finances. You can add your current and future transactions to the app. In addition, you can also add your recurring expenses, such as subscriptions. This allows you to easily track your incoming and outgoing money and plan accordingly.

2. Joint Budgeting Use DollarBird to collaborate on budgets with whoever you want to – for instance, your spouse, business partner, or a team. You can share your expense calendar with them so they know the finances.

3. Spend Tracking

DollarBird helps you track all your expenses easily from your phone. You can learn where you spend your money and when. The app also calculates your balance automatically, whether for a day, a month, or the whole year.

DollarBird Pros

- It helps you track your income and expenses easily

- It provides you with a view of your spending patterns

- It is available on mobile

DollarBird Cons

- It does not offer integration with other financial apps

- It is not very intuitive

- It can be difficult to navigate the app

DollarBird Testimonials

DollarBird Pricing

- Pro Version: $4.99/month

- Pro Unlimited Subscription: $6.99/month

- Business/ Enterprise: Custom Quotes

Supported Platforms

- Web

- iPhone

- iPad

Final Verdict on DollarBird

DollarBird helps you track your expenses as well as your incomes. It provides you insights into your spending patterns and also gives you a view of your cash flow for up to five years ahead.

With this information, you can make better financial decisions today for a better tomorrow in choosing the better Quicken alternative.

Table Comparison - Top 6 Quicken Alternatives

|

Features |

ZarMoney |

YNAB |

Mint |

Bill.com |

Tiller Money |

Dollar Bird |

|

Budgeting |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Automatic Import |

✅ |

✅ |

✅ |

✅ |

✅ |

❌ |

|

Auto-categorization |

✅ |

✅ |

✅ |

✅ |

✅ |

❌ |

|

Reporting |

✅ |

✅ |

❌ |

✅ |

✅ |

❌ |

|

Goal tracker |

✅ |

✅ |

✅ |

❌ |

❌ |

❌ |

|

Forecasting |

✅ |

❌ |

✅ |

❌ |

✅ |

✅ |

|

Customization |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Free Trial |

✅ |

✅ |

✅ |

✅ |

✅ |

❌ |

|

Customer Support on Phone |

✅ |

✅ |

❌ |

✅ |

❌ |

❌ |

|

Pricing (Starting From) |

$9.99 |

$14.99 |

$0 |

$39 |

$6.58 |

$4.99 |

Best of Best - Top 3 Quicken Alternatives

1. ZarMoney

Zarmoney is an excellent Quicken alternative that takes care of your personal finances and business accounting. If you have complex financial goals that involve inventory tracking or time tracking, Zarmoney provides the necessary tools.

This financial tool enables you to manage your finances effectively. With the option to link to various types of accounts - be it credit cards or investment portfolios. Zarmoney offers a comprehensive financial dashboard. Its feature-rich platform even offers advanced expense tracking and goal tracking.

2. YNAB

YNAB stands out as the second-position tool that implements zero-based budgeting, which is ideal for people with specific financial goals. Unlike a basic budget, it allows you to allocate every dollar you earn, thus offering an accurate picture of your financial health. The app allows you to track spending, set monthly budgets, and even look into investment tracking.

3. Mint

Mint is an all-in-one Quicken alternative that excels in expense tracking and budgeting. It connects with various accounts, from bank accounts to financial accounts and even investment accounts. It's a fantastic tool for scrutinizing your spending habits, tracking upcoming bills, and monitoring your credit score. Mint provides a user-friendly interface and financial reports that are easy to understand.

Conclusion

In this blog, we explored the 6 best Quicken alternatives in 2024 and gave you a complete view of financial management and budgeting software in the market, so you can try them out and see if they fit your needs better than Quicken.

Experiment ZarMoney today, and who knows, tomorrow, you might have a tool better suited to your demands than you thought before reading this blog!

Frequently Asked Questions (FAQs)

1. What is the best Quicken alternative overall?

Mint is the best Quicken alternative because the app comes for free with various functions. In fact, it offers all the useful features that Quicken does. It makes up for the rest by providing integrations with mainstream accounting tools like QuickBooks and more.

2. What is the most suitable Quicken alternative for reporting?

Tiller Money is the right tool for a Quicken alternative with reporting functionality. Tiller not only helps you track your incoming and outgoing money, but it also gives you a detailed view of your expenses.

3. What is the most suitable Quicken alternative for automated budgeting?

ZarMoney is our recommended tool if you want automation. This tool provides automation, saving your time and eliminating room for error. It imports transaction details from your linked bank accounts and credit cards. The transaction record helps you track your spending and create realistic budgets, considering your regular expenditures.

4. Why would I consider a Quicken alternative?

While Quicken is a great personal finance software, it may not fit everyone’s financial situation. Some users seek alternatives for better budgeting tools, user experience, or pricing plans that better align with their needs.

5. Are Quicken alternatives suitable for tracking my credit card expenses?

Many Quicken alternatives offer excellent expense tracking features, which allow you to categorize and monitor credit card transactions, giving you a better understanding of your spending habits.

6. Can we set and track financial goals with Quicken alternatives?

Many Quicken alternatives offer goal-tracking features that can help you set and monitor financial goals, whether they’re related to savings, retirement planning, or paying off debt.

7. How secure are these Quicken alternatives?

Most Quicken alternatives prioritize user security, employing bank-level security measures to protect your data. Always read user reviews and research a platform’s security features before committing.

8. Do any of these alternatives offer free trials or free plans?

Some Quicken alternatives like ZarMoney offer 15-day free trials or even a free-forever basic plan. Always check the details to see the features of these trials or free versions.

9. Do these alternatives work for people with irregular incomes?

Some Quicken alternatives have features designed for those with irregular incomes, allowing you better to manage your budget and financial future despite income inconsistencies.

10. Are Quicken alternatives easy to use?

Ease of use varies among the different platforms. Still, many Quicken alternatives focus on a user-friendly interface and offer support and tutorials to help you get started, making it easier to manage your finances.