ZarMoney: Best Invoice Reconciliation Software

In the fast-paced and ever-evolving landscape of modern business, the efficient management of financial transactions, the maintenance of precise and up-to-date records, and the seamless execution of reconciliation processes have become essential and pivotal for achieving sustained success. As technology continues redefining how businesses operate, the days of labor-intensive manual reconciliation processes are fading into the past, making room for a new era of automated solutions that not only streamline operations but also significantly enhance financial accuracy.

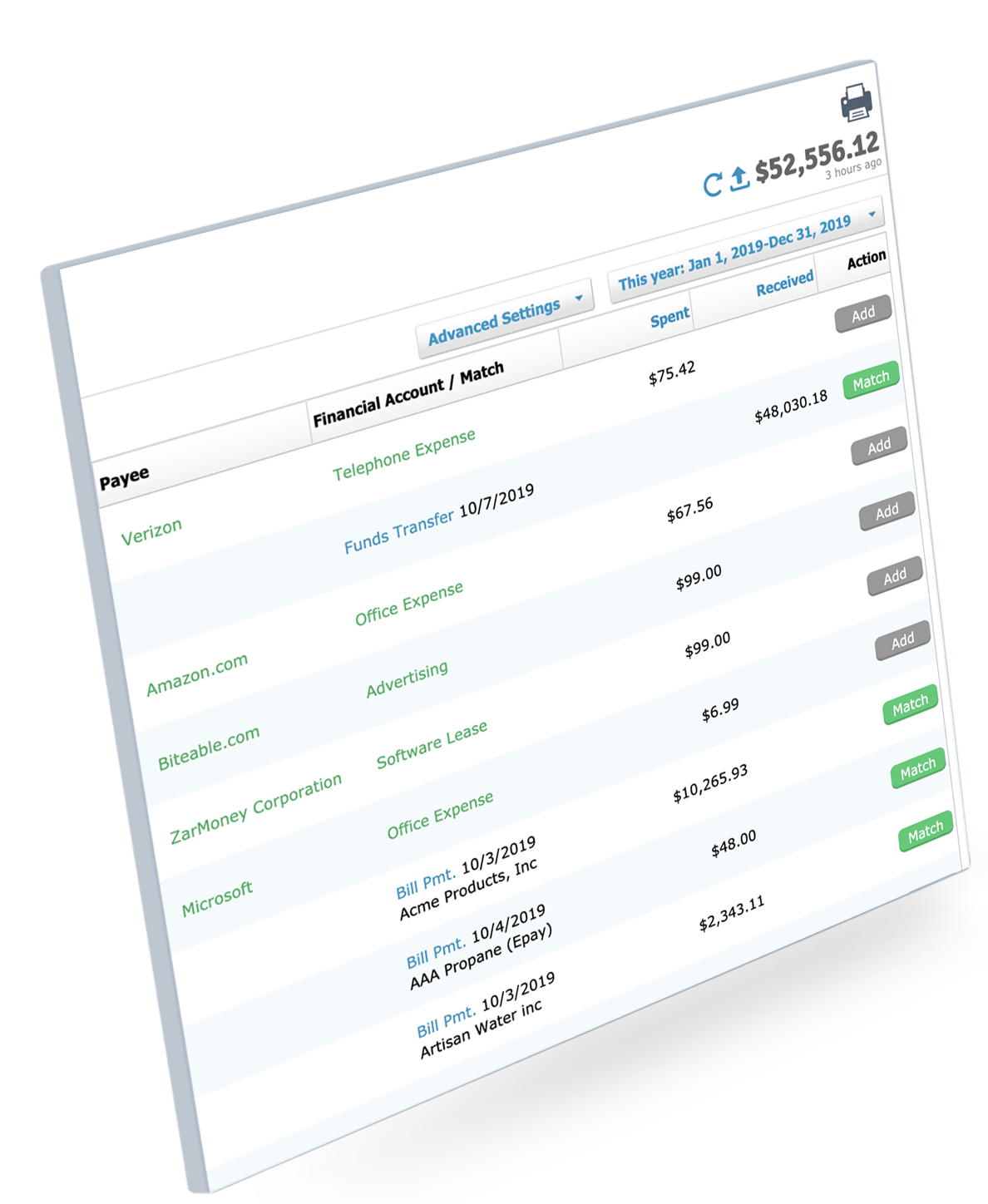

ZarMoney stands out from the crowd with its remarkable range of features tailored to meet the unique needs of businesses, regardless of size or industry. Disclosing the Power of ZarMoney: Key Features Clarified

Let's check out the key features that set ZarMoney apart:

1. Accept Credit Cards Online

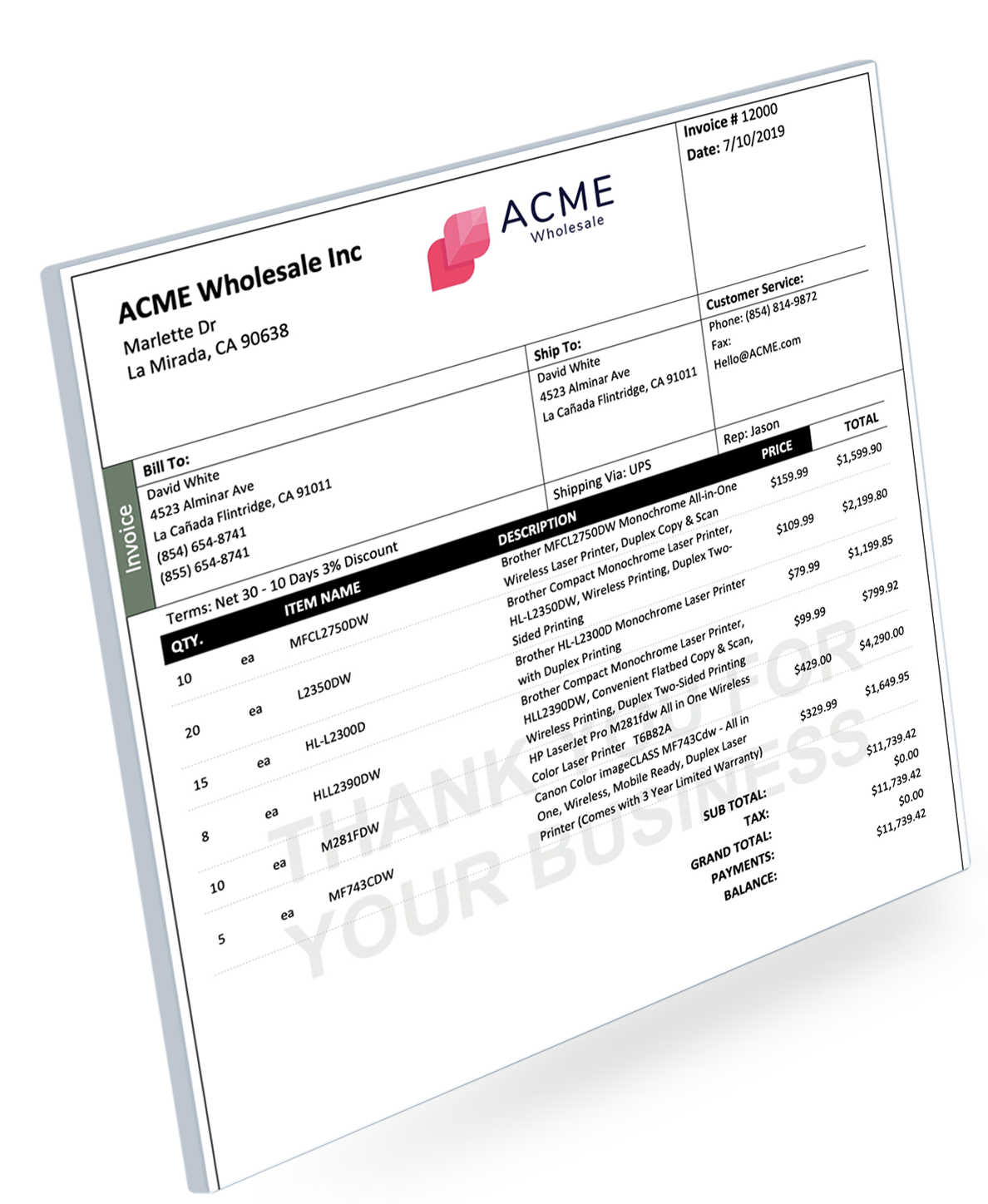

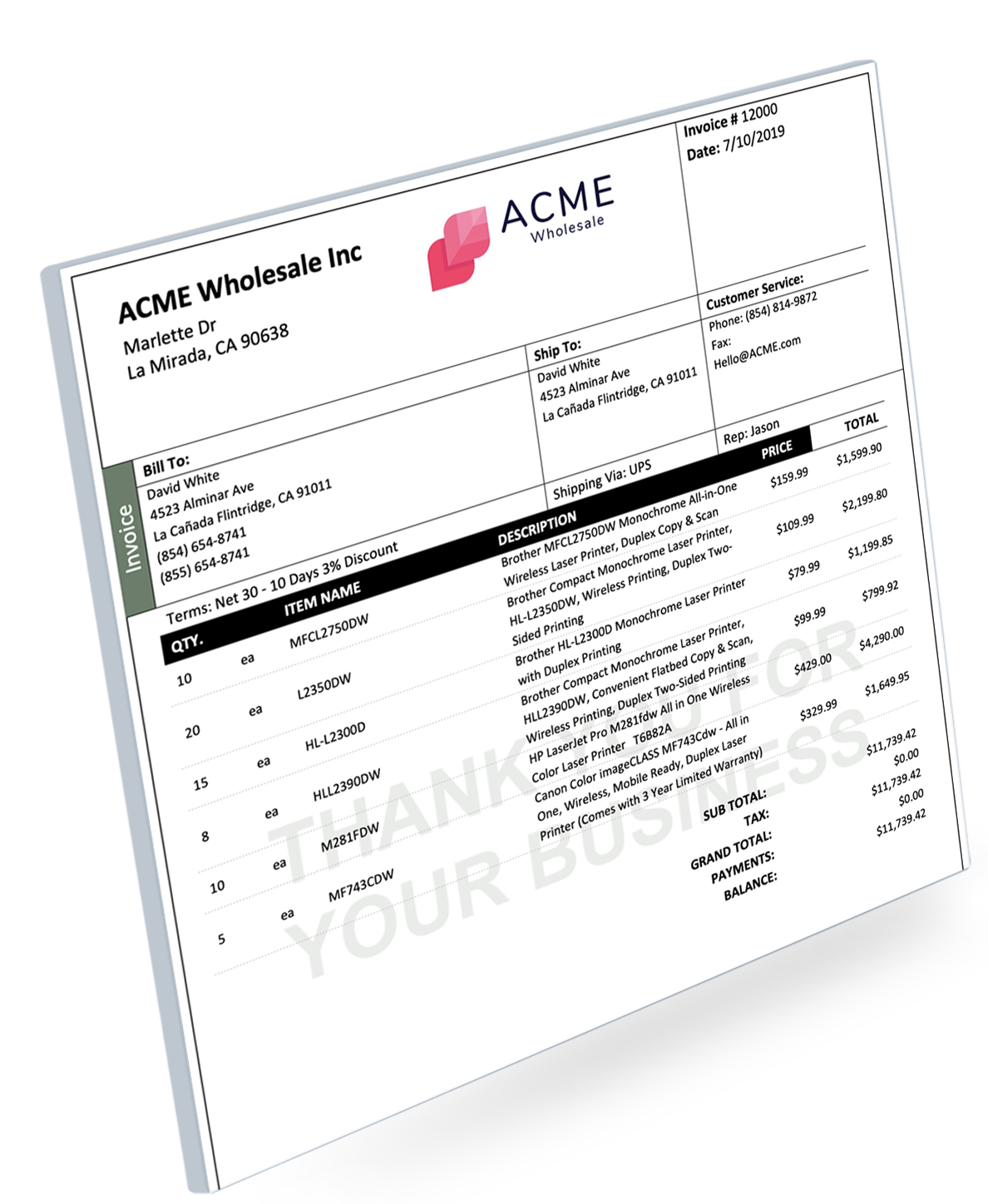

ZarMoney's credit card processing integration simplifies transactions, allowing customers to pay seamlessly and securely directly from their invoices or online store. Its Invoice Reconciliation software is the way to go.

ZarMoney's credit card processing integration simplifies transactions, allowing customers to pay seamlessly and securely directly from their invoices or online store. Its Invoice Reconciliation software is the way to go.

It removes the need for physical entry of credit card information, reducing the risk of errors and enhancing the overall payment experience for your clients. With ZarMoney's credit card processing, your business can effortlessly adapt to this digital landscape, capturing a broader market and catering to the preferences of tech-savvy consumers.

2. Quotes / Estimates

ZarMoney takes the hassle out of creating and managing quotes and estimates, providing you with a seamless and efficient solution. In the business world, first impressions matter, and ZarMoney empowers you to make a lasting one by offering a user-friendly platform to craft professional and enticing quotes. The process begins with the ability to generate quotes that reflect the value and scope of your products or services.

3. Quick Sales

For those rapid transactions that require immediate attention, ZarMoney steps up to the plate with its quick sales feature, offering a streamlined solution that empowers you to generate invoices swiftly. In the fast-paced business world, seizing opportunities in real-time can often make a significant impact, and ZarMoney ensures that you take advantage of these chances.

4. Customer Statement Keep your customers well-informed and engaged with their financial obligations through ZarMoney's detailed and user-friendly customer statements. In business relationships, clear communication is vital, and ZarMoney's customer statements provide a tool to enhance transparency and strengthen client interactions.

Keep your customers well-informed and engaged with their financial obligations through ZarMoney's detailed and user-friendly customer statements. In business relationships, clear communication is vital, and ZarMoney's customer statements provide a tool to enhance transparency and strengthen client interactions.

5. Payment Terms

Customize payment terms for different clients to align with your business's financial requirements, ensuring timely payments and efficient cash flow management. ZarMoney recognizes that flexibility is vital in financial interactions, and its platform empowers you to tailor payment terms to each client's specific needs.

Customize payment terms for different clients to align with your business's financial requirements, ensuring timely payments and efficient cash flow management. ZarMoney recognizes that flexibility is vital in financial interactions, and its platform empowers you to tailor payment terms to each client's specific needs.

6. Notification via Text & Email

ZarMoney goes the extra mile to ensure effective communication and transparency in your financial interactions. With its advanced notification system, the platform keeps you and your customers well-informed by sending notifications via text and email for crucial events, ranging from creating invoices to payment reminders and overdue notices.

7. Organize Customers with Custom Fields

ZarMoney simplifies financial management and offers a comprehensive solution for effective customer relationship management. One of its remarkable features is the ability to tailor your customer's record to suit your business's unique needs. By adding custom fields that capture specific information relevant to your operations, ZarMoney empowers you to achieve a higher level of organization, resulting in accurate records and more effective communication.

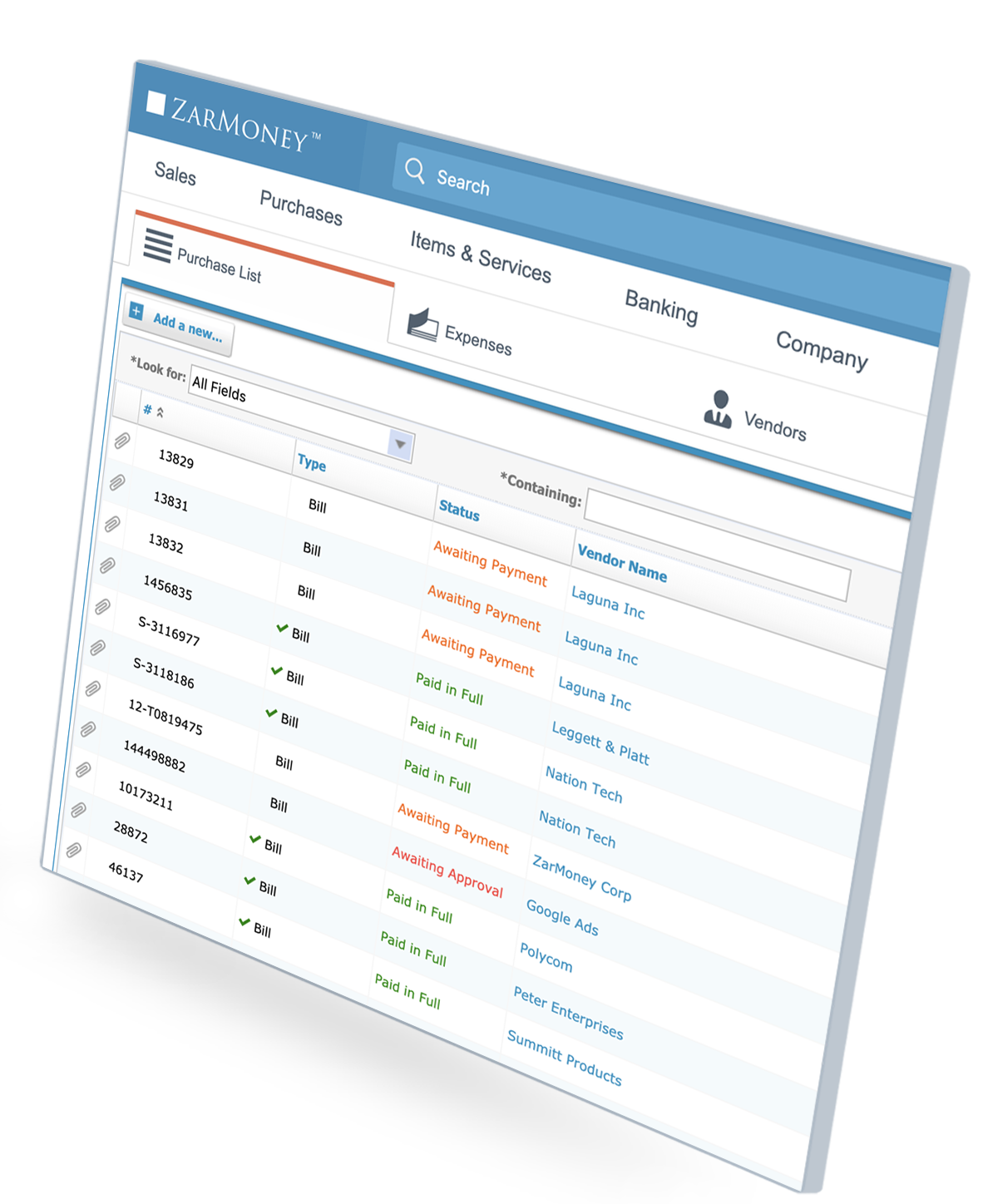

8. Order Status

ZarMoney takes your business's operational efficiency to the next level by providing a real-time order tracking feature that enables you to monitor the entire journey of orders, from creation to fulfillment. In the fast-evolving world of business, staying informed about the status of orders is crucial, and ZarMoney ensures you have the tools to make well-informed decisions promptly.

9. Credit Limit & Credit Hold

ZarMoney empowers you with comprehensive tools to manage customer accounts effectively, and one of its outstanding features is the ability to maintain control over credit limits and utilize credit holds. Balancing boosting sales and reducing risk is essential in financial management, and ZarMoney's functionality ensures you can achieve this equilibrium.

10. Recurring Invoices

ZarMoney takes the complexity out of the billing process by offering an automation justification for recurring invoices, streamlining operations, and enhancing efficiency. ZarMoney's recurring invoice automation empowers you to optimize your billing practices and ensure consistency across your financial transactions.

Comparison with Competitors: ZarMoney's Undisputed Excellence

|

Feature |

ZarMoney |

QuickBooks |

Xero |

|

Accept Credit Cards Online |

✔️ |

✔️ |

✔️ |

|

Quotes / Estimates |

✔️ |

✔️ |

✔️ |

|

Quick Sales |

✔️ |

✔️ |

✔️ |

|

Customer Statement |

✔️ |

✔️ |

✔️ |

|

Payment Terms |

✔️ |

✔️ |

✔️ |

|

Notification |

✔️ |

✔️ |

✔️ |

|

Custom Fields |

✔️ |

✔️ |

✔️ |

|

Order Status |

✔️ |

✔️ |

✔️ |

|

Credit Limit & Hold |

✔️ |

❌ |

❌ |

|

Recurring Invoices |

✔️ |

✔️ |

✔️ |

Why ZarMoney Triumphs: Unraveling the Superiority

ZarMoney's superiority in the market is noticeable through its diverse feature set. Its seamless credit card processing integration sets it apart, filling a void that QuickBooks and Xero leave. ZarMoney goes beyond by providing extensive features such as customizable fields, credit limit management, and automated recurring invoicing. These services streamline processes and permit businesses to achieve financial prowess. The capacity to tailor the software to specific needs, coupled with the ability to efficiently handle credit limits and automate invoicing, positions ZarMoney as an indispensable asset for enterprises aiming to elevate their financial operations.

In conclusion, ZarMoney emerges as the champion of invoice reconciliation software. With its comprehensive features, user-friendly interface, and unparalleled automation tools, ZarMoney empowers businesses to achieve financial accuracy, enhance operational efficiency, and drive growth. Say goodbye to manual reconciliation processes and embrace the future of financial management with ZarMoney – where efficiency meets excellence.

Frequently Asked Questions (FAQs)

1. Why do I need Invoice Reconciliation Software?

Invoice reconciliation software automates matching financial transactions, reducing human errors, ensuring financial accuracy, and enhancing operational efficiency. It saves valuable time, improves cash flow management, and provides real-time visibility into your financial processes.

2. How does ZarMoney's automation benefit my business?

ZarMoney's automation tools noticeably minimize the need for physical intervention, reducing the risk of errors and fraudulent activity. It results in accurate financial records, smoother audits, and streamlined accounting workflows.

3. Can ZarMoney help me comply with regulatory requirements?

Absolutely! ZarMoney's wide range of features enables you to maintain accurate financial records, ensuring compliance with industry regulations. The audit trail and real-time updates facilitate adherence to standards and regulations.

4. What about outstanding invoices and payment reconciliation?

ZarMoney's sophisticated features allow you to track outstanding invoices and automate the payment reconciliation process easily. It eradicates discrepancies, enhances customer payment experiences, and ensures timely payments.

5. How does ZarMoney compare in terms of cost and scalability?

ZarMoney offers a competitive pricing structure tailored to businesses of all sizes. Its scalability enables you to adapt as your business grows, ensuring you only pay for what you need.

6. Can invoice reconciliation software help prevent fraud?

Yes, invoice reconciliation software plays a vital role in fraud prevention. It detects irregularities and discrepancies in financial transactions, helping to identify potential fraudulent activities early. This proactive point of view protects your business from financial loss and reputational damage.

7. Does ZarMoney offer training and customer support?

Yes, ZarMoney typically provides training resources and customer support to assist users in effectively using their software. Whether through tutorials, documentation, or direct assistance, ZarMoney ensures users make the most of their platform.

8. What role does customization play in ZarMoney's software?

ZarMoney's software offers customizable fields, enabling you to tailor the forum to your business's needs. This flexibility allows the software to adapt to your specific workflows and requirements, enhancing its usability and effectiveness.