The Cloud Accountant - Best Cloud Accounting Software

It is hard to imagine that accounting was purely a manual activity a few years ago. However, with the advent of technology, cloud-based software has revolutionized the business accounting sector. As a result, today, we have some of the best cloud account software that makes accounting a breeze.

This article lists some of the best cloud accounting software in the market with their complete overview, and we'll highlight the best one among them.

1. ZarMoney

ZarMoney is a robust cloud-based accounting software that offers a comprehensive suite of tools to businesses so they can manage their financial processes. ZarMoney is a one-stop solution for all your accounting needs, from tracking income and expenses to generating detailed reports.

A Los Angeles-based company, ZarMoney promises to address all concerns of business owners regarding accounting and bookkeeping, making it easier to conduct business.

Features

- Accounts Payable and Receivable

- Time Tracking

- Detailed Financial Reporting

- Unlimited Invoices

- Bank Account Integration

- Expense Tracking

- Project Management

- Online Invoices and Payment Processing

- Audit Trails

- Cash Flow Forecasting

Top 3 Features

1. Unlimited Invoices

With ZarMoney, you can create and send an unlimited number of invoices. It's a fantastic feature for businesses that process many transactions daily.

Unlike other cloud accounting software, ZarMoney offers all-inclusive services to its users. Creating unlimited invoices is one of them. Our software allows you to create countless professional-looking invoices that can be customized to add your business logo and other elements of the business.

2. Detailed Financial Reporting

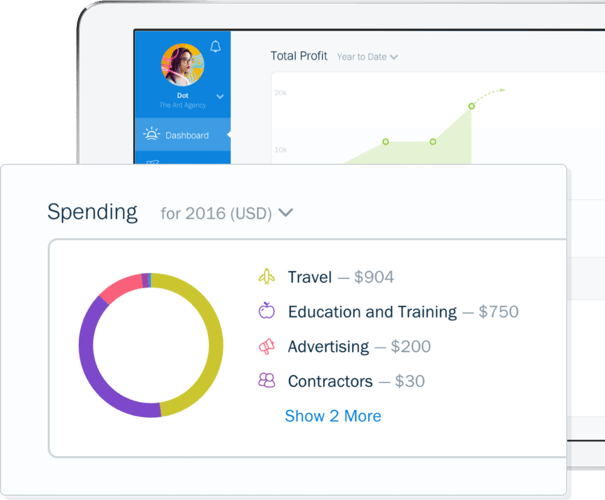

Financial reporting is a critical element in accounting. Accounts experts and business owners need regular updates on their financial health to make informed, data-driven decisions for their enterprises.

ZarMoney's detailed financial reporting provides insightful data into your business's financial health. It provides critical information such as profits, losses, cash flow, and expenses, helping you make informed business decisions.

3. Cash Flow Forecasting

The cash flow forecasting feature in ZarMoney allows businesses to project future cash inflows and outflows, enabling them to plan and manage their finances efficiently.

Our cloud accounting software features a centralized cash flow management and analysis, so you do not have to sift through data from multiple sources to understand transactions and cash flow. Our interactive, easy-to-use software lets you have a glimpse and detailed insight into your financial activity and adjust accordingly.

Pros

- Wide range of features

- Intuitive and user-friendly interface

- Excellent customer support

- Access to all accounting features in a single subscription plan

Cons

- Lack of built-in payroll services

- Limited integration with third-party apps

Customer Support

- Phone

- Live chat

- Help desk

- FAQs

Supported Platforms

- Windows

- Mac

- iOS

- Android

Pricing

- Entrepreneur, at $15 per month

- Small business, at $20 per month

- Enterprise, at $350 per month

Conclusion

ZarMoney is a comprehensive cloud accounting software suitable for businesses of all sizes. It's rich in features, and its user-friendly interface makes it a top choice for many businesses. Although some users find it "too simple," others love it for the same reasons. Overall, ZarMoney excels at serving its purpose and ensuring seamless cloud accounting.

-Feb-17-2025-05-08-26-6504-PM.png?width=6912&height=3456&name=Alternative%20ZarMoney%20banner%20(1)-Feb-17-2025-05-08-26-6504-PM.png) 2. QuickBooks Online

2. QuickBooks Online

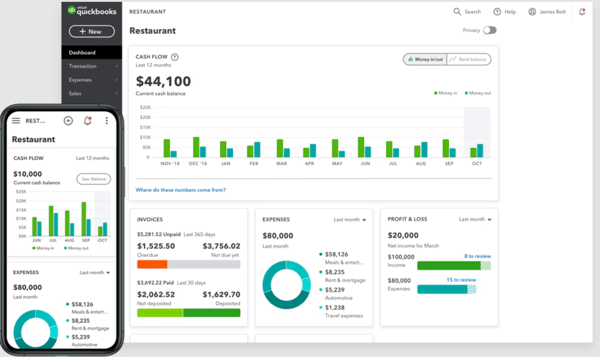

QuickBooks Online is a renowned cloud accounting software developed by Intuit. It is designed for small to medium-sized businesses to manage their accounting processes efficiently. It is a user-friendly interface, and robust features have gained popularity among accounting professionals and business owners.

Features

- Income and Expense Tracking

- Accounts Payable and Receivable

- Time Tracking

- Financial Reports

- Invoice Management

- Bank Account Integration

- Payroll Services

- Tax Management

- Project Tracking

- Mobile App

Top 3 Features

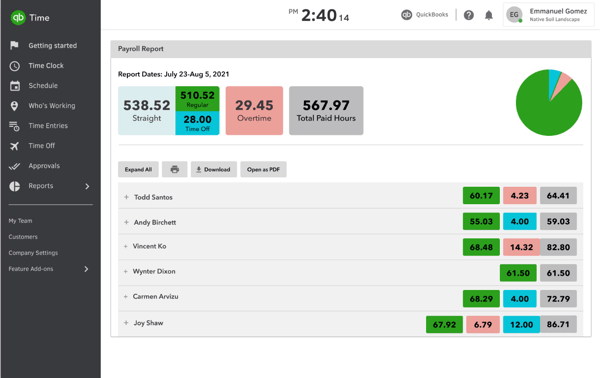

1. Time Tracking

QuickBooks Online caters to the accounting needs of freelancers and large corporations. Therefore, it includes features that offer convenience to all. For example, it offers a built-in time tracking feature that enables businesses to track billable and employee work hours, making it easy to manage payroll and invoicing.

Time tracking benefits small businesses and freelancers who provide services instead of products. Since they charge hourly, accurate time tracking is critical for such businesses.

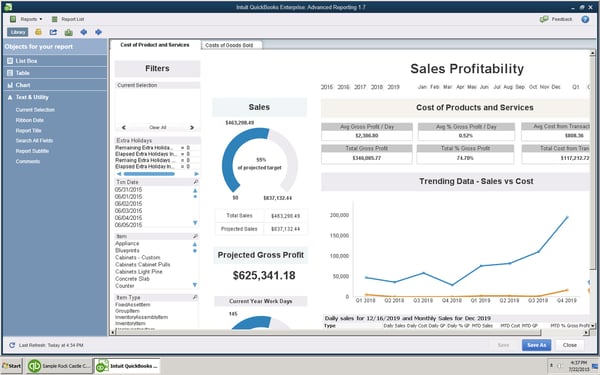

2. Advanced Reporting

QuickBooks Online provides advanced reporting tools to help businesses gain valuable insights into their financial data. Even better, these reports are customizable, allowing users to access only their most needed metrics.

These customizable reports help track income, expenses, cash flow, etc. Users can stay on top of their expenses and business transactions and make swift decisions based on their analytics.

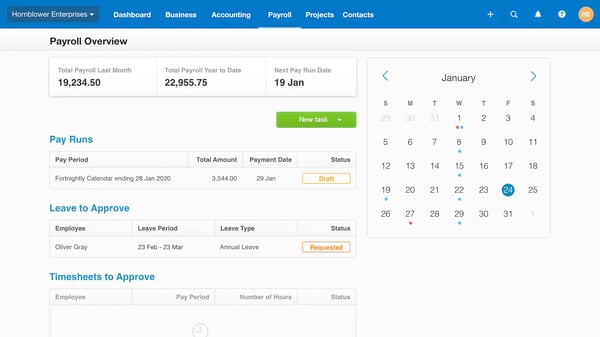

3. Payroll Services

With integrated payroll services, QuickBooks Online simplifies the payroll process, allowing businesses to seamlessly manage employee payments, tax deductions, and direct deposits.

This feature also benefits small businesses where the owners are their own accountants and HR managers. The easy-to-use payroll services make it convenient for users to create payroll with minimum chances of error.

Pros

- Comprehensive features for small and medium-sized businesses

- User-friendly interface

- Integration with third-party apps

Cons

- Limited customization options for invoices

- It can be expensive for larger businesses

Customer Support

- Phone

- Live chat

- Help Desk

- FAQs

- Forums

- Knowledge Base

Supported Platforms

- Windows

- Mac

- iOS

- Android

Pricing

- Monthly Plans

- Simple Start, at $17

- Essential, at $26

- Plus, at $36

- Yearly Plans

- Simple Start, at $183.60

- Essential, at $280.80

- Plus, at $388.80

Conclusion

QuickBooks Online is a reliable and widely used cloud accounting software suitable for small and medium-sized businesses. Its robust features and convenient operations make it a top choice.

However, Quickbooks Online has relatively high price plans that can discourage some users from subscribing.

3. Xero

Xero is a leading cloud-based accounting software for small businesses and their advisors. With its intuitive interface and powerful features, Xero has become a favorite among entrepreneurs and accounting professionals worldwide.

Features

- Bank Feeds and Reconciliation

- Invoicing and Quotes

- Expense Tracking

- Payroll Services

- Financial Reporting

- Inventory Management

- Project Management

- Multi-currency Support

- Mobile App

- Third-party App Integrations

Top 3 Features

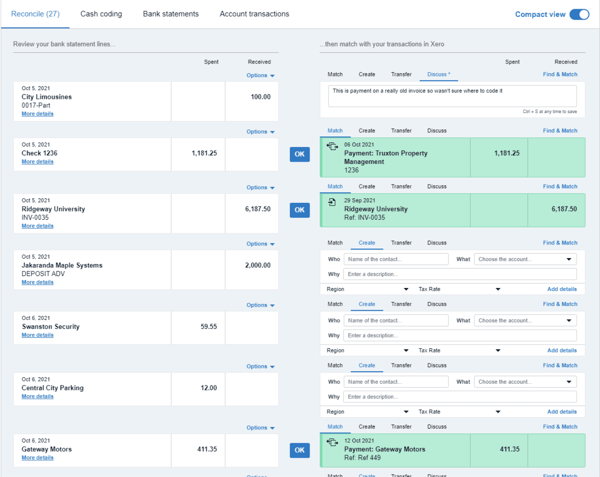

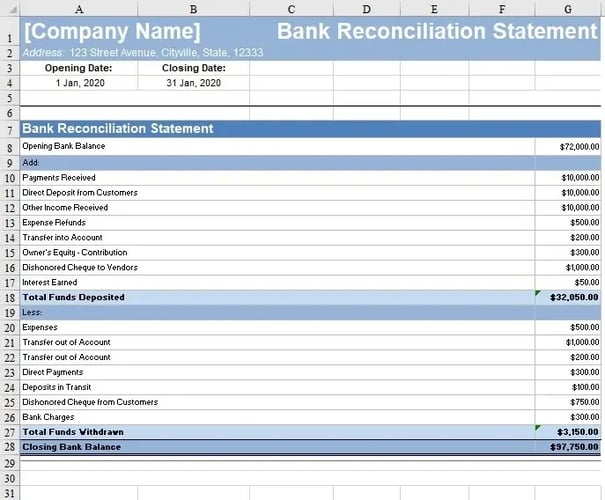

1. Bank Feeds and Reconciliation

Bank reconciliation is a critical feature in recent cloud accounting software. This feature allows the accounting software to link with banks to read transaction information. Doing so provides a centralized report on all financial transactions for reporting and decision-making purposes.

Xero offers seamless bank feeds integration, allowing businesses to connect their bank accounts and automate reconciliation processes, reducing manual data entry and errors.

2. Payroll Services

Like other accounting software that extend their services for small businesses, Xero's integrated payroll services make managing employee payments, tax deductions, and direct deposits a breeze, simplifying payroll processes for small businesses.

With Xero, users can rest assured that their payrolls are accurate and updated, leaving little room for errors or discrepancies.

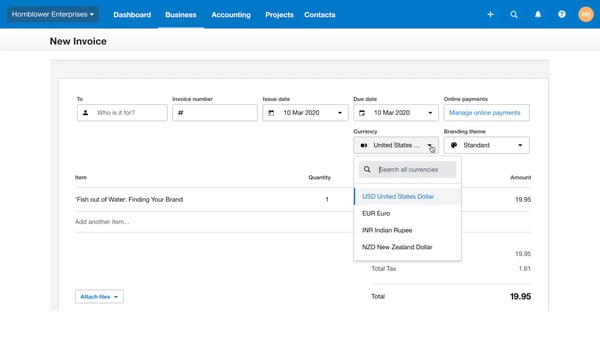

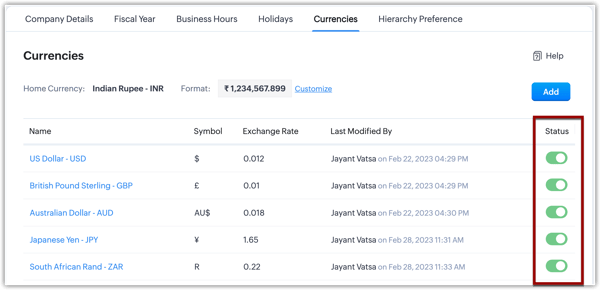

3. Multi-currency Support

Xero's multi-currency support enables businesses to manage transactions in multiple currencies, making it ideal for businesses with international operations.

Users can enjoy transactions in several currencies and make or receive payments seamlessly. This feature makes Xero a top choice for businesses that work with international clients.

Pros

- User-friendly interface

- Comprehensive features for small businesses

- Extensive third-party app integrations

Cons

- Limited functionality for more prominent businesses

- Payroll services are not available in all countries

Customer Support

- Forums

- FAQs

- Video tutorials

- Webinars

- Phone

- Chat

- Help desk

- Knowledge base

Supported Platforms

- Windows

- Mac

- iOS

- Android

Pricing

Starter, at $25 per month

Standard, at $40 per month

Premium, at $54 per month

Conclusion

Xero is a powerful and user-friendly cloud accounting software designed for small businesses. Its rich features, and extensive app integrations make it popular among entrepreneurs and accounting professionals.

Although the software has limited features and accessibility for large organizations and corporations, it works well for small and medium businesses. Xero can improve its reach by adding better features that cater to the needs of larger businesses.

4. FreshBooks

FreshBooks is an easy-to-use cloud accounting software for freelancers, self-employed professionals, and small businesses. With its intuitive interface and robust features, FreshBooks simplifies invoicing, expense tracking, and financial reporting for its users.

Features

- Customizable Invoices

- Expense Tracking

- Time Tracking

- Project Management

- Estimates and Quotes

- Online Payment Processing

- Financial Reports

- Client Portal

- Mobile App

- Third-party App Integrations

Top 3 Features

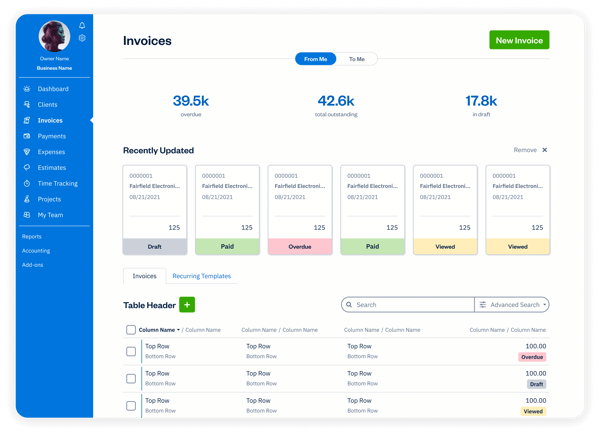

1. Customizable Invoices

Logos and templates are a business's identity. When their exclusive designs and other elements are reflected in their invoices, businesses successfully send a more professional image to their clients and earn a better reputation.

FreshBooks caters to these aspects and allows users to create professional and customizable invoices, adding their logo, colors, and personalized messages, helping businesses maintain a consistent brand image.

2. Expense Tracking

Expense tracking is an innovative feature in FreshBooks that exclusively addresses the concerns of businesses that offer manufacturing-based services such as stitching, baking, and other customized products.

Expense tracking helps these business owners track the expenses of buying raw materials to prepare the final product demanded by their clients. This feature allows them to charge accurately for any additional expenses without disputes.

Freshbooks simplifies expense tracking by enabling users to categorize expenses, attach receipts, and monitor spending in real time, making it easy to manage business finances.

3. Bank Reconciliation

FreshBooks' bank reconciliation feature allows users to import transactions from their linked bank accounts and approve or change payments within the Freshbooks software.

Even better, the bank reconciliation in Freshbooks is automated, so users do not have to repeat the process periodically or manually. Instead, they can access accurate transaction information regularly.

Pros

- Easy to use, especially for freelancers and small businesses

- Customizable invoicing

- Excellent mobile app

Cons

- Limited features for larger businesses

- No built-in payroll services

Customer Support

- Phone

- FAQs

- Forums

- Help desk

- Knowledge base

- Chat

Supported Platforms

- Windows

- Mac

- iOS

- Android

Pricing

- Monthly Plans

- Lite, at $8.50

- Plus, at $15

- Premium, at $27.50

- Yearly Plans

- Lite, at $132.60

- Plus, at $234

- Premium, at $429

- Freshbooks also offers customizable plans for large businesses with complex needs.

Conclusion

FreshBooks is an excellent choice for freelancers, self-employed professionals, and small businesses seeking simple, user-friendly cloud accounting software. Its features are tailored to meet the specific needs of these user groups. However, the software is not well-suited to the needs of large organizations which may have to search for alternative solutions.

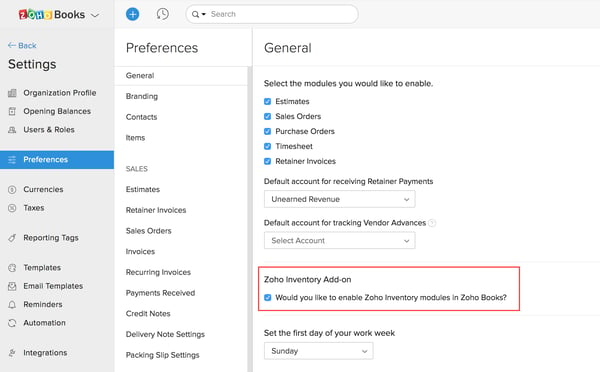

5. Zoho Books

Zoho Books is another cloud accounting software that offers comprehensive tools to help businesses manage their finances. As a part of the Zoho ecosystem, it integrates seamlessly with other Zoho applications, providing businesses with a unified platform to manage their operations.

Features

- Invoicing and Estimates

- Expense Tracking

- Bank Reconciliation

- Inventory Management

- Time Tracking

- Financial Reports

- Multi-currency Support

- Online Payment Processing

- Tax Management

- Mobile App

Top 3 Features

1. Inventory Management

Zoho Books offers a robust inventory management feature for businesses to track their stock levels, manage purchase orders, and stay on top of their inventory.

Inventory management is vital to the overall accounting process since users need to know their stock levels to better understand their sales and transactions. In addition, by constantly updating their inventory, business owners and accountants can make better decisions about their financial health and overall business performance.

2. Multi-currency Support

Zoho Books also offers multi-currency support for business owners with international clients. Users can easily make or accept payments in the desired currency to avoid conversion changes and depreciation.

Multi-currency support enables businesses to manage transactions in multiple currencies. This makes it an ideal choice for companies with international clients or operations.

3. Tax Management

Zoho Books simplifies tax management by automating tax calculations, generating tax reports, and helping businesses comply with tax regulations. This helps businesses manage their tax returns effortlessly and avoid unpleasant experiences with the regulatory departments.

Tax management is a helpful feature in cloud accounting software since it allows users to calculate their taxes and then determine their revenues or profits accordingly. This is also important for compliance for all businesses.

Pros

- Seamless integration with other Zoho applications

- Comprehensive features for small and medium-sized businesses

- Affordable pricing plans

Cons

- Limited customization options

- No built-in payroll services

Customer Support

- Phone

- Chat

- Help desk

- FAQs

- Forums

- Knowledge base

Supported Platforms

- Windows

- Mac

- iOS

- Android

Pricing

- Free plan for businesses with less than $50,000 annual revenue

- Monthly Plans

- Standard, at $12

- Professional, at $24

- Premium, at $36

- Elite, at $129

- Ultimate, at $249

- Yearly Plans

- Standard, at $10

- Professional, at $20

- Premium, at $30

- Elite, at $100

- Ultimate, at $200

Conclusion

Zoho Books is an affordable, comprehensive cloud accounting software suitable for small and medium-sized businesses. In addition, its seamless integration with the Zoho ecosystem makes it an attractive option for businesses already using other Zoho applications.

However, integrations can be complicated for non-Zoho users. In addition, users complain of problems in integration with Zoho Books if they are switching from other software.

Comparison Table

|

Feature |

ZarMoney |

QuickBooks Online |

Xero |

FreshBooks |

Zoho Books |

|

Payroll Services |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Multi-Currency Support |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Mobile App |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Advanced Inventory |

✅ |

❌ |

❌ |

❌ |

❌ |

|

Cash Flow Management |

✅ |

❌ |

✅ |

✅ |

❌ |

|

Budgeting Tools |

✅ |

✅ |

✅ |

❌ |

❌ |

|

CRM Integration |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Recurring Billing |

✅ |

✅ |

✅ |

❌ |

❌ |

|

Financial Reporting |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Free Trial |

✅ |

❌ |

❌ |

❌ |

❌ |

Best of the Best

1. ZarMoney – Best Overall Cloud Accounting Software

ZarMoney leads the cloud accounting software market with its comprehensive cloud-based accounting solution designed for business owners of all sizes. Offering double-entry bookkeeping, automated bank reconciliation, customizable invoicing capabilities, and real-time reporting, ZarMoney simplifies financial management while eliminating manual data entry. It provides third-party integrations, expense management, and inventory management, making it a full-featured accounting tool for businesses needing robust accounting solutions.

2. QuickBooks Online – Best for Growing Businesses

QuickBooks Online is one of the most recognized cloud-based accounting software examples, offering automated bank reconciliation, business performance tracking, and financial reporting options. It is ideal for businesses with complicated accounting requirements, providing tiers per user with a range of features from entry-level plans to highest-tier Select plans. While it includes excellent project accounting and business management tools, its additional users and higher-tier plans come at an additional cost.

3. Xero – Best for Businesses Needing Unlimited Users

Xero stands out in the cloud accounting ecosystem by offering unlimited users, making it a great choice for growing finance teams and businesses that need collaboration across departments. It provides customizable reporting, expense management, cash management, and banking transactions synchronization with direct bank integration. While its basic inventory management and additional payroll management services are useful, its higher-tier plans can become an expensive plan compared to more cost-effective alternatives like ZarMoney.

Conclusion

Choosing the right cloud accounting software is essential for business owners looking to streamline financial management, automate accounting processes, and improve financial performance. ZarMoney stands out among cloud accounting software providers by offering a comprehensive cloud-based accounting solution with automated bank reconciliation, customizable invoicing capabilities, and intelligent reporting.

Unlike desktop accounting software, ZarMoney provides a full-featured accounting experience that includes expense management, contact management, and inventory management. With seamless third-party integrations, connection with bank accounts, and automated reconciliation processes, businesses can eliminate manual data entry and focus on improving their accounting functionality.

Compared to other cloud accounting software products like QuickBooks Online and Zoho Books, ZarMoney offers cost-effective plans with unlimited users, mobile app access, and a wide range of features tailored for different business processes. Whether you need advanced payroll management services, business performance tracking, or a cloud accounting platform that scales with your business growth, ZarMoney provides an adaptable accounting solution that meets your needs.

Frequently Asked Questions (FAQs)

1. Why is ZarMoney the best cloud accounting software for business owners?

ZarMoney offers a comprehensive cloud-based accounting solution that simplifies financial management and automates accounting processes. With advanced bank reconciliation, customizable invoicing capabilities, and intelligent reporting, business owners can streamline operations without manual data entry.

2. How does ZarMoney compare to other cloud accounting software providers like Zoho Books and Wave Accounting?

Unlike Zoho Books and Wave Accounting, ZarMoney provides a full-featured accounting platform with automated bank reconciliation, double-entry bookkeeping, and a wide range of third-party integrations. It offers an adaptable accounting solution that scales with business growth.

3. Does ZarMoney offer automated bank reconciliation and bank synchronization?

Yes, ZarMoney connects directly with bank accounts, automating the reconciliation process by syncing bank statements, bank feed, and bank transactions. This feature eliminates errors and improves financial performance.

4. Can business owners use ZarMoney for online accounting and bookkeeping services?

Yes, ZarMoney is designed for online accounting, offering a cloud-based accounting platform that simplifies the bookkeeping process. It provides double-entry accounting reports, customizable reporting, and financial reporting options for accurate business accounting applications.

5. What invoicing features does ZarMoney provide for cloud accounting software?

ZarMoney supports customizable invoicing capabilities, electronic invoicing, automatic draft invoice creation, and estimates to invoices. It offers unlimited invoicing, attractive invoice templates, and intelligent reporting to streamline the accounting process.

6. Does ZarMoney offer third-party integrations for financial management?

Yes, ZarMoney supports a wide range of third-party apps and third-party tools, allowing businesses to enhance their accounting functionality. These integrations improve business processes, expense management, and contact management.

7. Can ZarMoney handle unpaid invoices and customer invoices efficiently?

Yes, ZarMoney’s cloud accounting ecosystem includes automated reminders, unlimited payments, and customizable invoicing options to manage unpaid invoices effectively. It ensures seamless documentation management and cash management.

8. What pricing plans does ZarMoney offer compared to lower-tier plans and premium plans of other cloud accounting software products?

ZarMoney provides cost-effective pricing options, including an advanced plan for businesses needing comprehensive business accounting solutions. Unlike expensive plans from competitors, ZarMoney offers scalable tiers per user at an additional cost for enhanced features.

9. Does ZarMoney offer mobile app access for cloud-based accounting software?

Yes, ZarMoney provides mobile app access, allowing finance teams and business owners to manage accounting tasks simpler from anywhere. It offers direct access to financial data, banking systems, and business books on the go.

10. How does ZarMoney support business management tools beyond accounting functionality?

ZarMoney offers functionality beyond accounting, including fixed asset management, e-commerce management, inventory management, and additional payroll management services. Its business management products help companies optimize operations efficiently.