8 Best Alternatives to QuickBooks Payroll

The world of online payroll and accounting software has grown vast, with names like QuickBooks Online, Zoho Books, and QuickBooks Online Payroll dominating the scene. Finding a suitable Alternative to QuickBooks Payroll can be a daunting challenge.

Every business, be it a budding startup or a seasoned enterprise, desires an interface that is robust and intuitive. Features like expense tracking, seamless management of multiple bank accounts, and unlimited payroll runs can make all the difference.

Whether you're a small business owner keeping a keen eye on expense reports and payroll taxes or an individual seeking an enhanced user experience with project management capabilities, the right software is paramount. Among the wide range of options available, especially when seeking an alternative to QuickBooks payroll, ZarMoney stands out. With its custom pricing and intuitive interface, it promises functionalities akin to big names like QuickBooks and brings its unique offerings.

1. ZarMoney

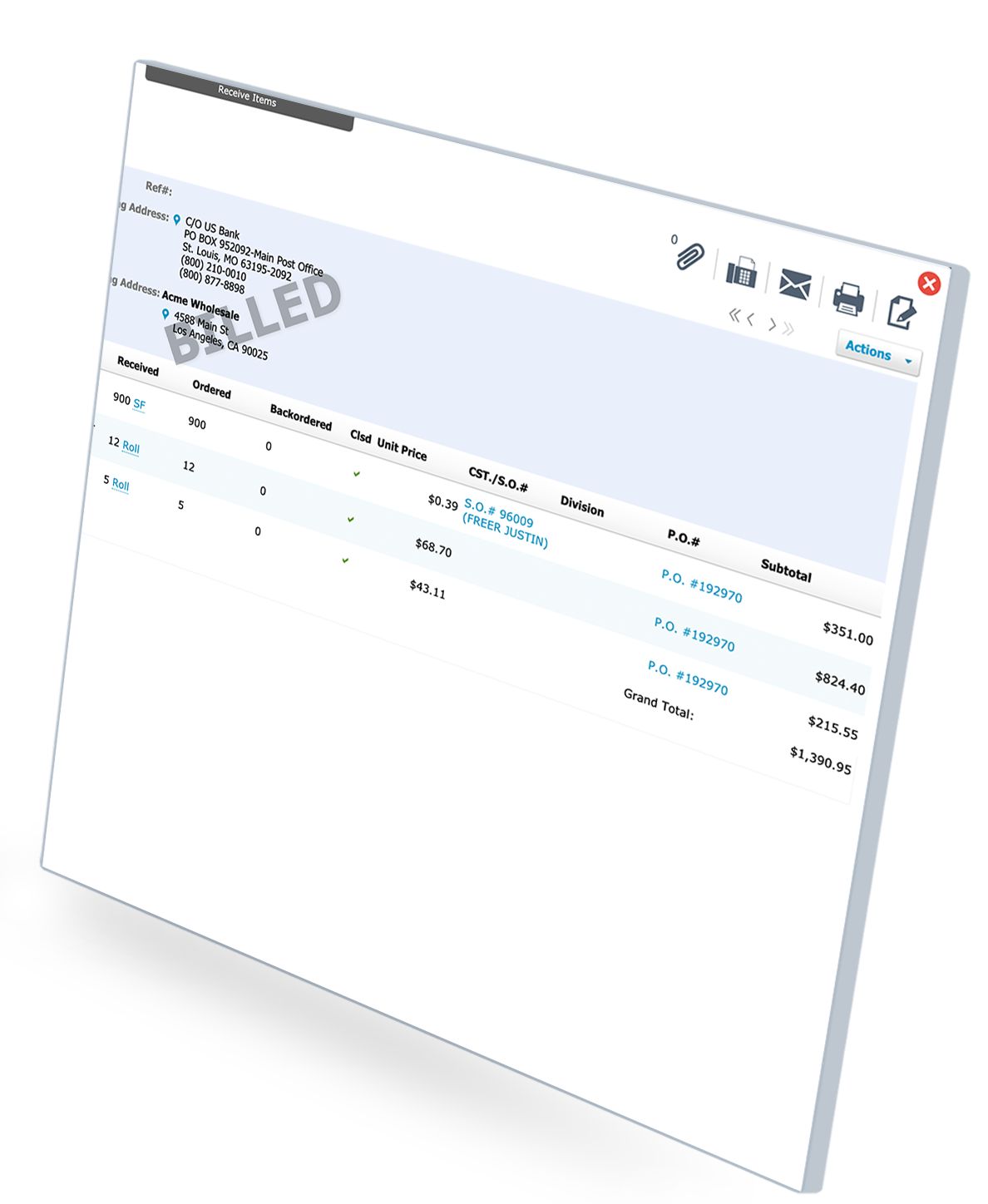

As one of the most intuitive interfaces in the business, ZarMoney stands tall as the best product among alternatives to QuickBooks payroll. Its cloud-based accounting software assures easy access, positioning it as a leading choice for businesses of all measures when seeking an alternative to QuickBooks payroll.

With a wide range of features, from financial reports to inventory management, ZarMoney promises an all-encompassing user experience that's hard to match.

Features

- Cloud accounting

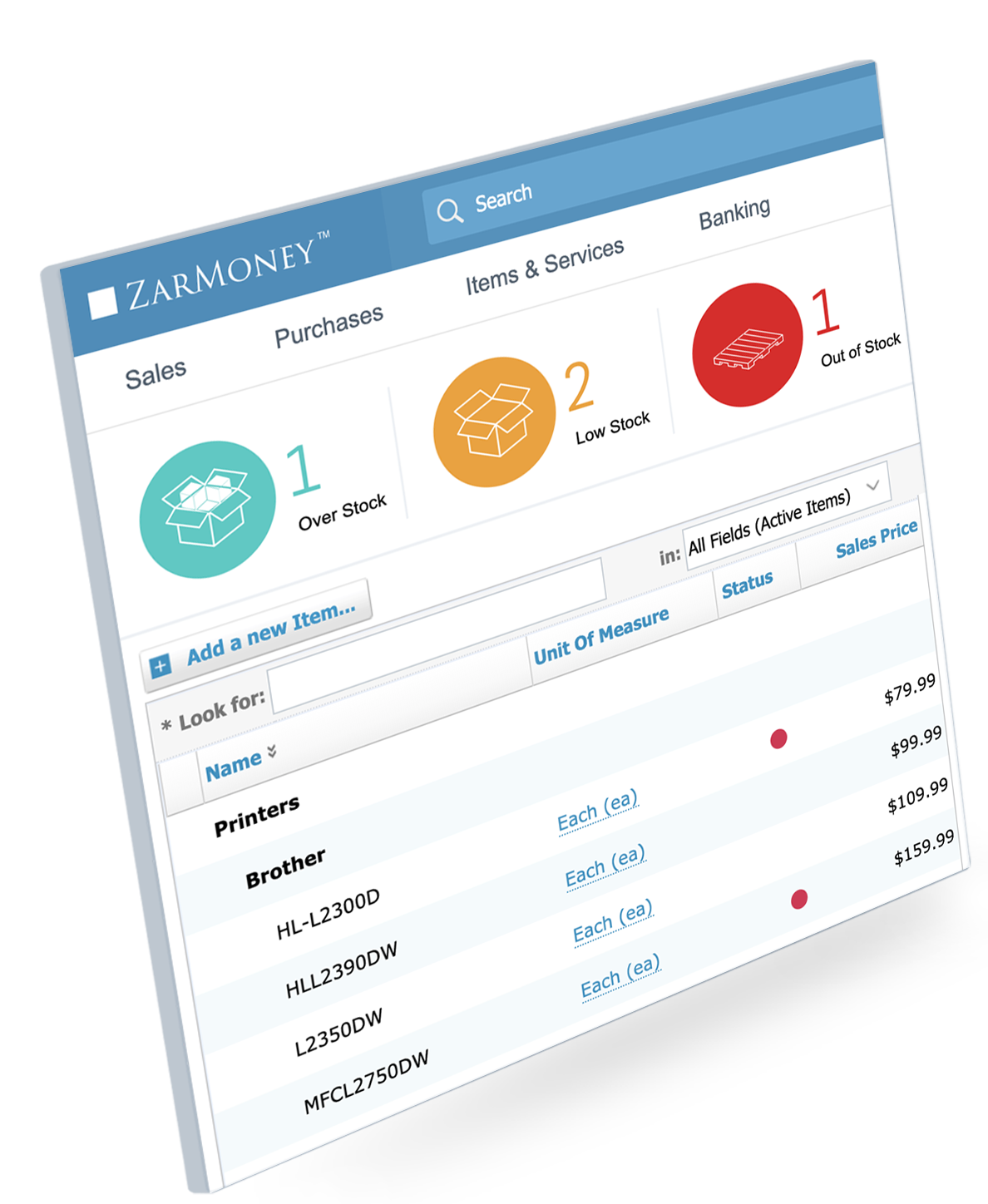

- Inventory management

- Invoicing & billing

- Purchase order management

- Expense tracking

Top 3 features of ZarMoney

1. Customizable Financial Reports

Gone are the days of static financial statements. ZarMoney's customizable financial reports allow businesses to tailor reports based on their needs, making it a boon for analytical minds.

2. Inventory Management

Keeping track of inventory can be a nuisance, but not with ZarMoney's inventory management solution. This feature ensures businesses can keep an accurate count and avoid overstocking or understocking issues.

3. Cloud-Based Access

With remote teams becoming more common, cloud-based access ensures that team members, regardless of location, can access essential features without a hitch.

Pros of ZarMoney

- User-friendly interface that's straightforward to navigate

- Affordable prices with a wide range of features

- Seamless integration with bank feeds

Cons of ZarMoney

- It might be overwhelming for those new to accounting apps

- Customized pricing may be a obstacle for some

Supported Platforms

ZarMoney's cloud-based accounting software is accessible via web browsers, ensuring platform-agnostic availability.

Pricing

ZarMoney offers its comprehensive suite at a competitive rate of $15 per month.

Final Verdict on ZarMoney

ZarMoney stands out in the market as an alternative to QuickBooks payroll with its advanced features, affordable pricing, and cloud-based access.

It's a well-rounded solution for businesses, ensuring all your accounting needs are met efficiently and precisely.

2. Paylocity

Paylocity isn't just a simple payroll alternative to QuickBooks payroll; it's a robust platform that goes beyond traditional payroll functionalities.

Offering a blend of time management, benefits administration, and an extensive employee self-service portal, Paylocity redefines the payroll experience. It's the ideal combination of solid software and intuitive user experience.

Features

- Online payroll processing

- Human Capital Management (HCM)

- Time & attendance

- Benefits administration

- Employee self-service portal

- Reporting & analytics

- Talent management

Top 3 features of Paylocity

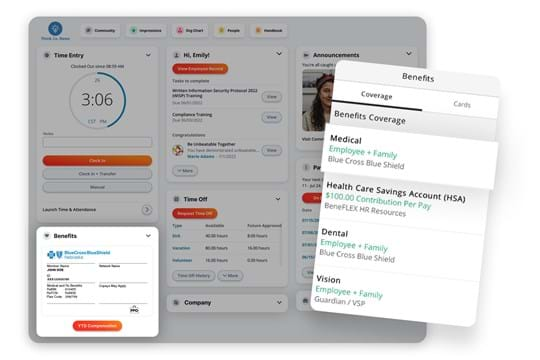

1. Comprehensive Employee Self-Service Portal

One of the most vital assets of Paylocity, an alternative to QuickBooks Payroll, is its employee portal. This dedicated space empowers employees to manage their data, view pay stubs, tax information, and even access learning and development resources.

It fosters transparency between the employer and the employees, streamlining HR tasks.

2. Time and Labor Tracking

Paylocity ensures that employees' hours are tracked with precision. Their integrated timekeeping tool captures all necessary data and adjusts to various scheduling needs.

It ensures compliance and accurate payroll every time.

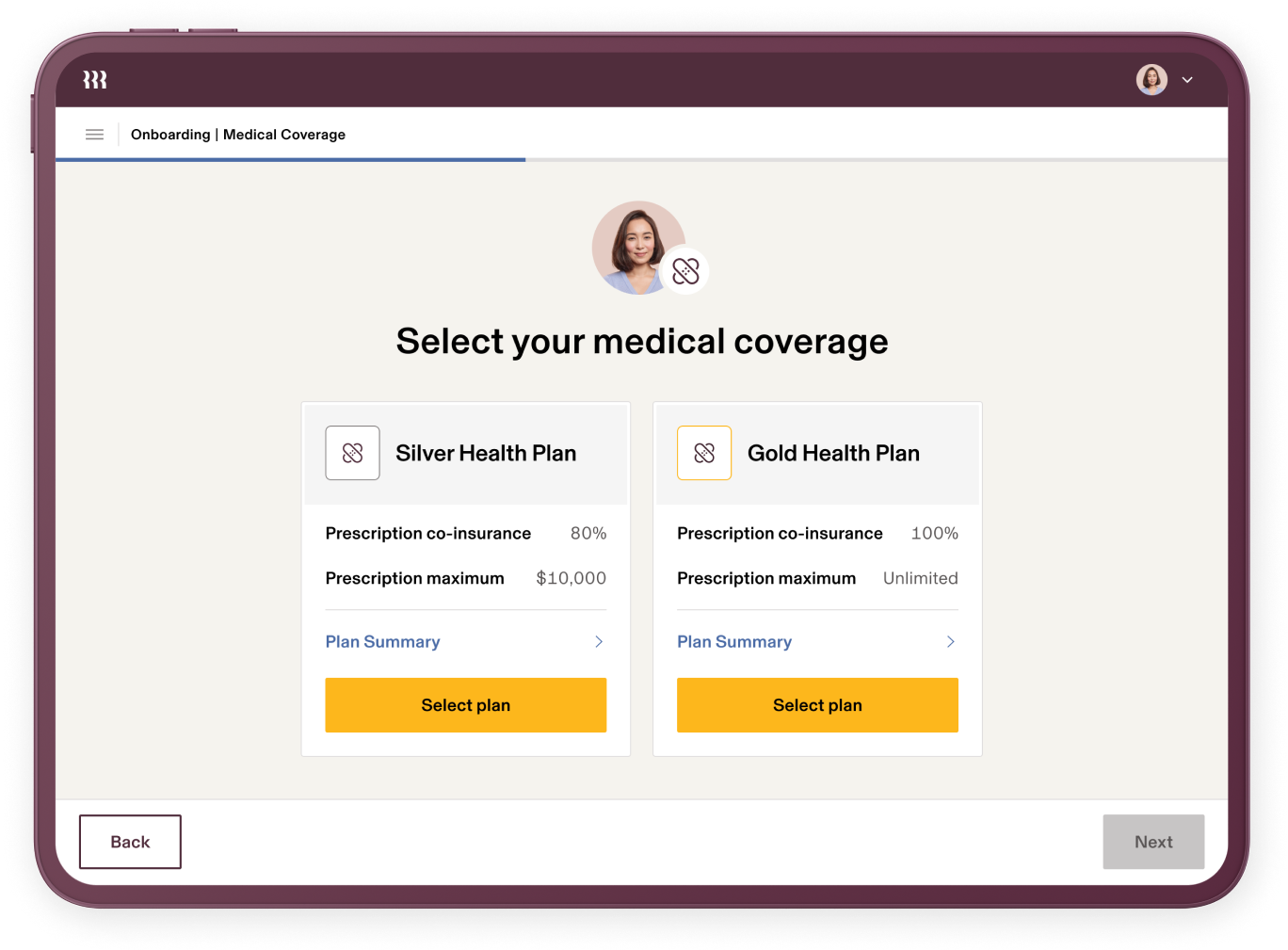

3. Benefits Administration

As businesses grow, managing benefits becomes more complex. Paylocity, an alternative to QuickBooks payroll, simplifies benefits administration by integrating it into the payroll system.

It allows for streamlined benefits enrollment, management, and compliance.

Pros of Paylocity

- Offers a library of training and development resources

- Intuitive and user-friendly interface

Cons of Paylocity

- It might be slightly overwhelming for tiny businesses

- Price can be on the higher side depending on the modules selected

- Additional features can come with extra costs

Supported Platforms

Paylocity, an alternative to QuickBooks Payroll, offers a comprehensive cloud-based payroll service. It's accessible through web platforms and also provides mobile apps for both Android and iOS, allowing for remote payroll and HR tasks management.

Pricing

The cost of using Paylocity's platform varies based on the size of the organization, chosen modules, and other specific requirements. It's recommended to contact Paylocity directly for a tailored quote.

Final Verdict on Paylocity

Paylocity, with its extensive feature set, is undoubtedly a formidable player in the payroll space. It's suitable for businesses of all sizes, ensuring every payroll and HR task is just a click away.

Its robustness might be a bit much for smaller companies, but its scalability makes it a perfect investment for growing enterprises.

3. Wagepoint

Wagepoint is explicitly created for miniature companies, focusing on plainness and automation. It caters to US and Canadian markets, offering straightforward payroll processing with compliance in mind.

Features

- Online payroll processing

- Tax reporting & compliance

- Direct deposit

- Workers' compensation

- Year-end reporting

Top 3 features of Wagepoint

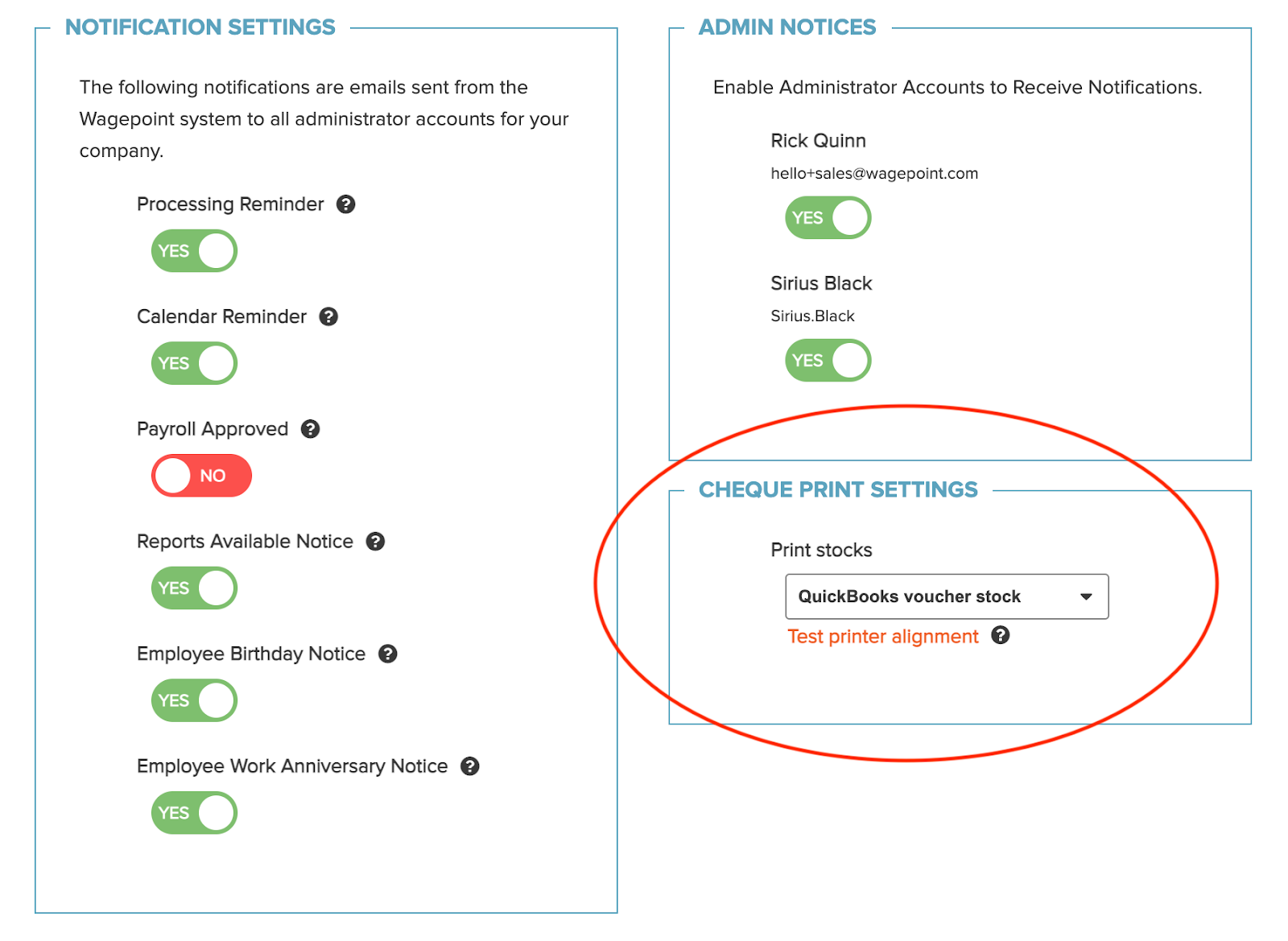

1. Automatic Tax Calculations & Remittances

Wagepoint prides itself on automating the tedious aspects of payroll, making it a viable alternative to QuickBooks payroll. Taxes are calculated and remitted automatically, ensuring compliance and accuracy.

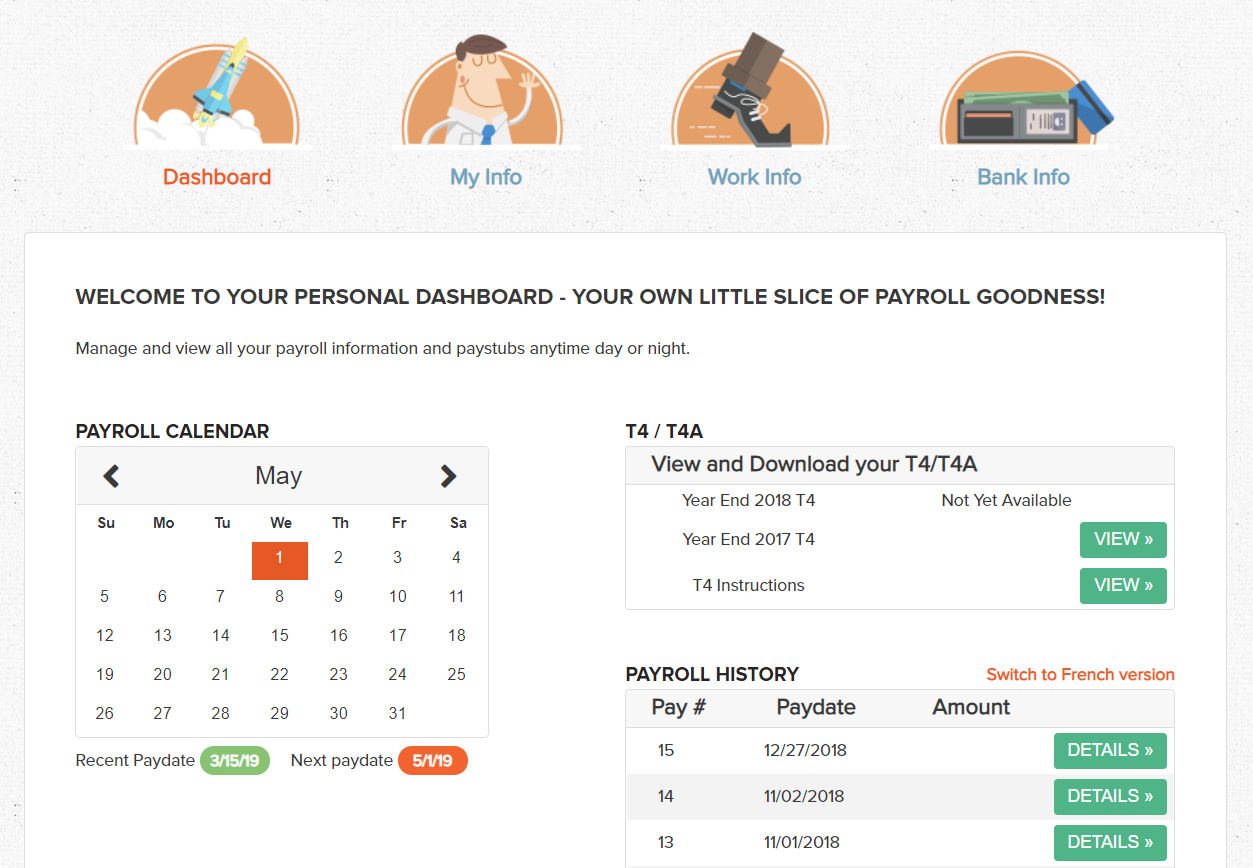

2. Employee Self-Service Portal

Employees can log in to view their salary stubs, tax records, and more. It reduces the back-and-forth between employees and HR, streamlining processes.

3. Direct Deposits & Year-End Reporting

Wagepoint can automatically deposit wages into employee bank accounts. Furthermore, the software manages year-end tax forms and reporting with ease.

Pros of Wagepoint

- Extremely user-friendly, perfect for businesses without a dedicated HR department

- Transparent pricing with no hidden fees

- Efficient customer support tailored for small businesses

Cons of Wagepoint

- Restricted developed HR features compared to other platforms

- It might not be appropriate for more extensive enterprises

- No integrated time-tracking feature

Supported Platforms

Wagepoint is cloud-based and can be accessed through any web platform. While it doesn't have a devoted app, its responsive design assures a smooth experience on mobile browsers.

Pricing

Wagepoint offers a simple pricing model based on a flat fee plus a charge per employee, making it predictable and straightforward for small businesses.

Final Verdict on Wagepoint

For small businesses seeking simplicity, Wagepoint is a dream come true. It handles the essentials of payroll efficiently and without fuss.

While it might lack some advanced features, its straightforwardness and focus on the needs of smaller enterprises make it a standout alternative to QuickBooks payroll.

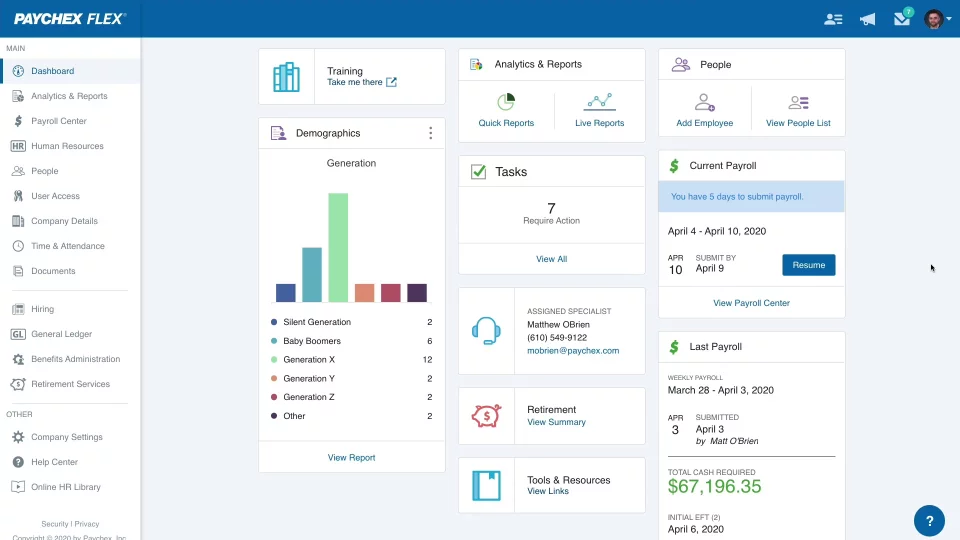

4. Paychex Flex

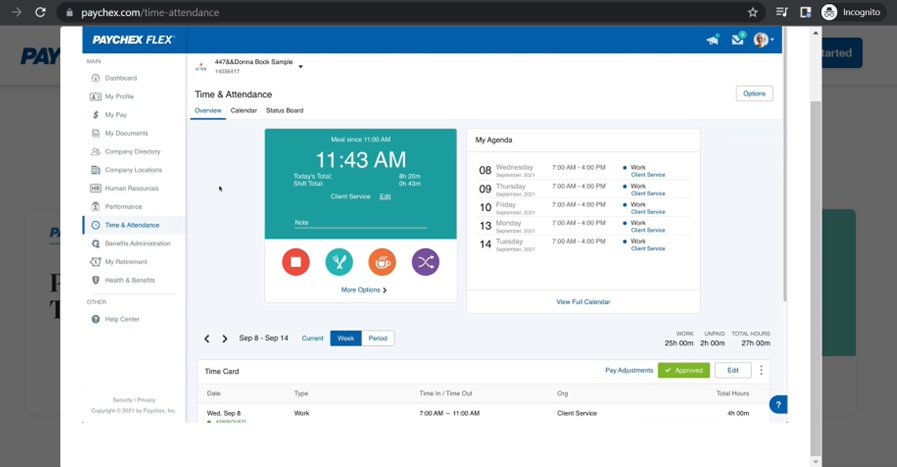

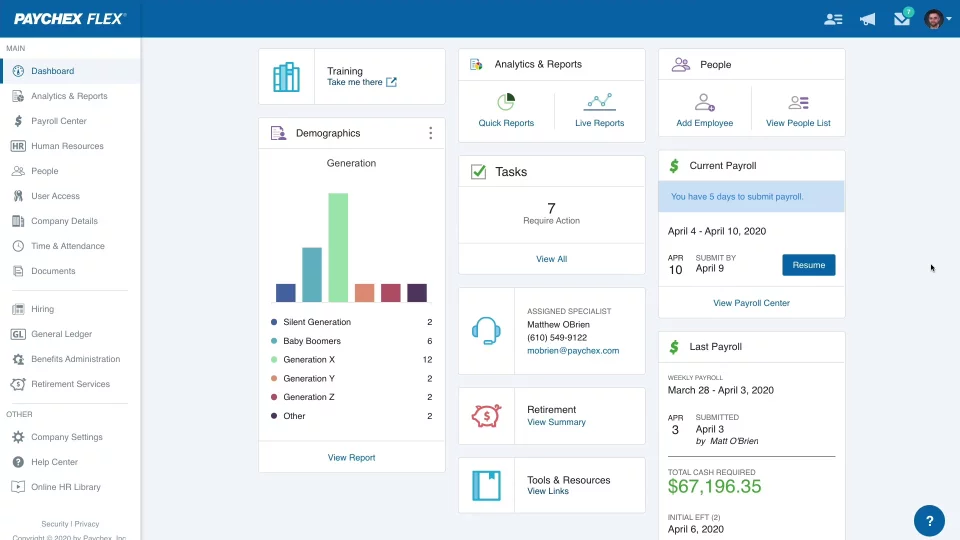

Paychex Flex offers scalable solutions tailored for businesses of all sizes. Known for its extensive suite of services, from payroll to HR and benefits administration, it provides a one-stop solution for business management.

Features

- Online payroll processing

- HR solutions

- Time & attendance

- Employee benefits

- Retirement services

- Hiring & onboarding

- Reporting & analytics

Top 3 features of Paychex

1. Modular Approach

Whether you need payroll services, HR solutions, or both, Paychex Flex's modular system allows you to pick and choose the services you need.

2. Advanced Reporting Tools

With an array of analytics and reports, businesses can gain insights into their operations, aiding in strategic decision-making.

3. Employee Benefits Management

Paychex Flex offers extensive benefits management tools, from health insurance to retirement plans, ensuring compliance and employee satisfaction.

Pros of Paychex Flex

- A comprehensive suite of services beyond just payroll

- Dedicated specialist support for each account

- Reliable uptime and security measures

Cons of Paychex Flex

- The platform can feel overwhelming for some due to its comprehensive components

- Pricing can get pricey, especially for smaller companies

- Initial configuration and customization can be time-consuming

Supported Platforms

Paychex Flex is cloud-based and offers mobile apps for both Android and iOS, guaranteeing business management on the go.

Pricing

Pricing is customized based on the modules and features chosen, so enterprises need to contact Paychex directly for a quote.

Final Verdict on Paychex Flex

Paychex Flex's comprehensive suite has its strengths and weaknesses. For corporations seeking an all-in-one solution, it's excellent.

However, it might be overkill for those needing just a payroll system. Still, its reliability and robustness make it a top contender.

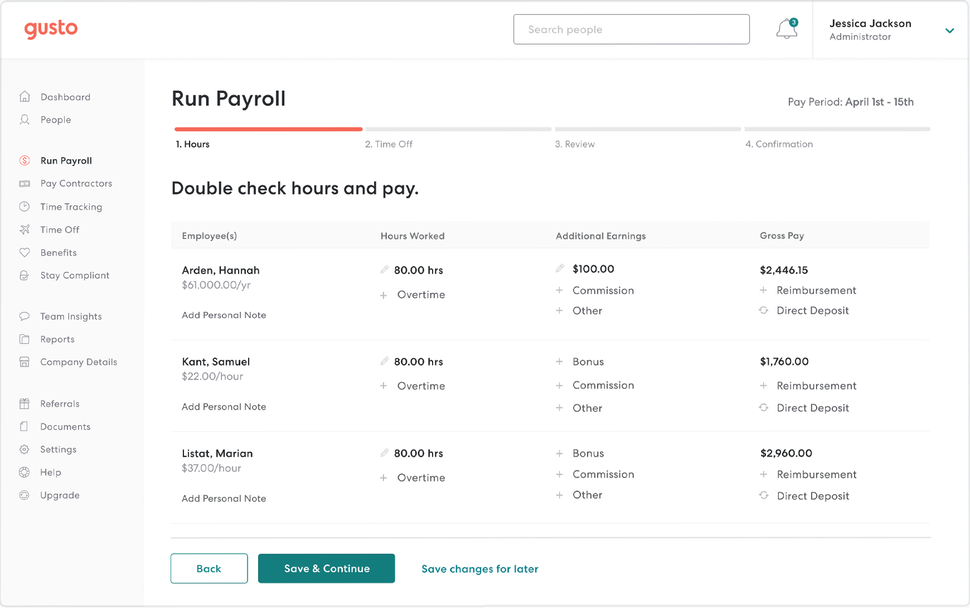

5. Gusto

Gusto offers a complete platform of modern, online people operations tools to help businesses onboard, pay, insure, and support their teams.

Their emphasis on user experience makes it a choice for many small businesses.

Features

- Full-service payroll

- Benefits administration & compliance

- Time tracking & PTO

- HR tools & advising

- Employee financial tools

- Hiring & onboarding

Top 3 features of Gusto

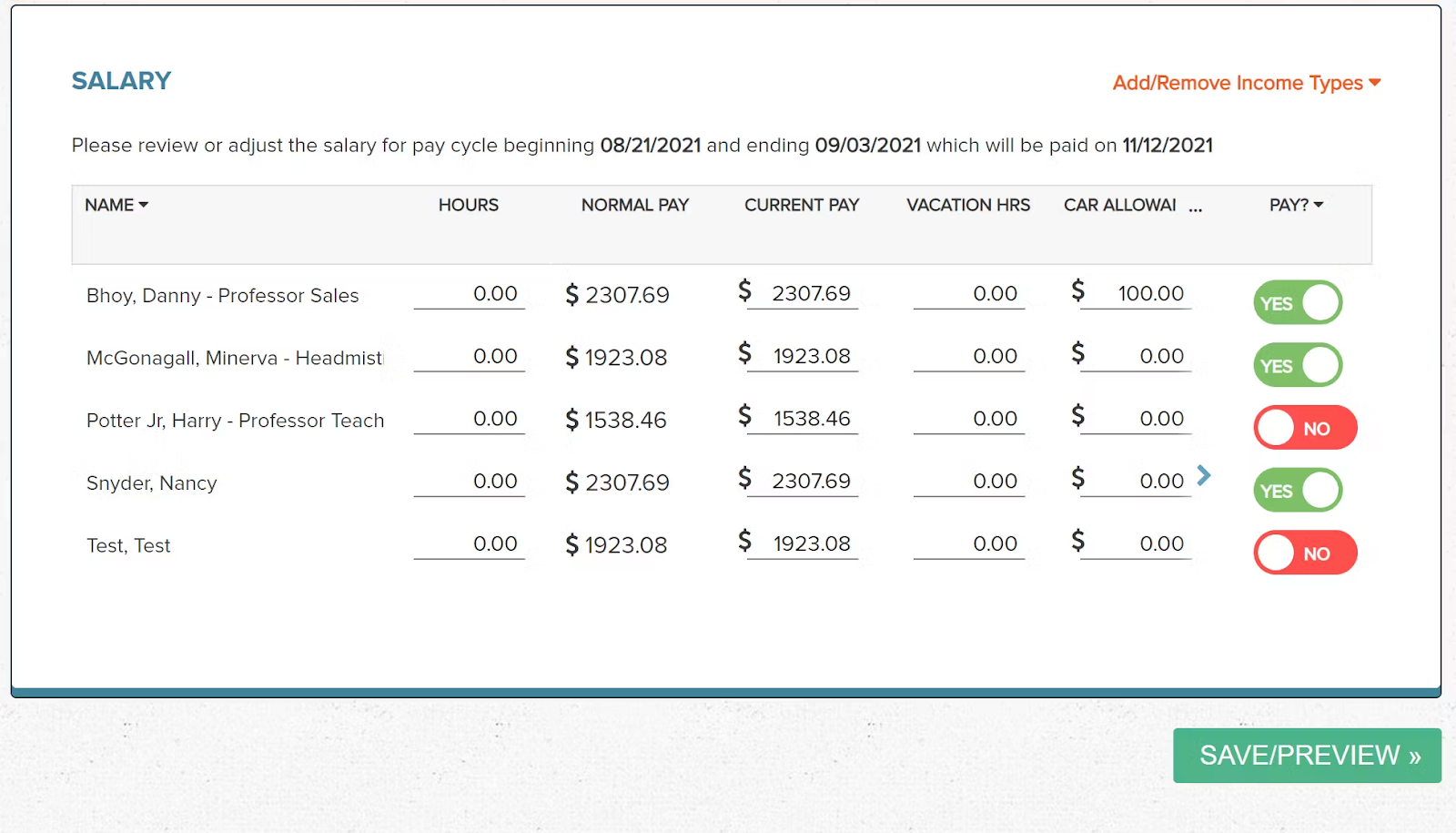

1. Full-Service Payroll

Gusto automatically calculates and pays state, local, and federal taxes. Moreover, it has autotuning capabilities for payroll, considering vacations, benefits, and other pay factors.

2. Employee Benefits Management

From health benefits to 401(k)s and 529 college savings, Gusto offers a broad suite of tools to manage a wide range of employee benefits.

3. HR Tools and Compliance

Beyond just payroll, Gusto offers tools for HR, helping businesses draft contracts, maintain compliance, and even provides advisory services.

Pros of Gusto

- Clean, intuitive user interface, making it effortless for businesses without dedicated HR personnel

- Built-in time tracking tools, making the whole payroll process more streamlined

- Integrations with famous accounting, time tracking, and HR tools

Cons of Gusto

- The more refined features are only available in the higher pricing tiers

- Not as fitted for larger enterprises

- Some users report a longer setup time due to integrations and initial configurations

Supported Platforms

Gusto is cloud-based and offers a mobile app for iOS and Android, ensuring accessibility and flexibility.

Pricing

Gusto's pricing is tiered, starting with a basic payroll package and scaling up to include more HR features. Each tier has a base price plus a per-employee charge.

Final Verdict on Gusto

Gusto, an alternative to QuickBooks payroll, is an excellent pick for small to medium businesses looking for a comprehensive yet user-friendly payroll and HR solution.

Its focus on automation and compliance alleviates much of the usual payroll stress, but the price can increase with more employees and features.

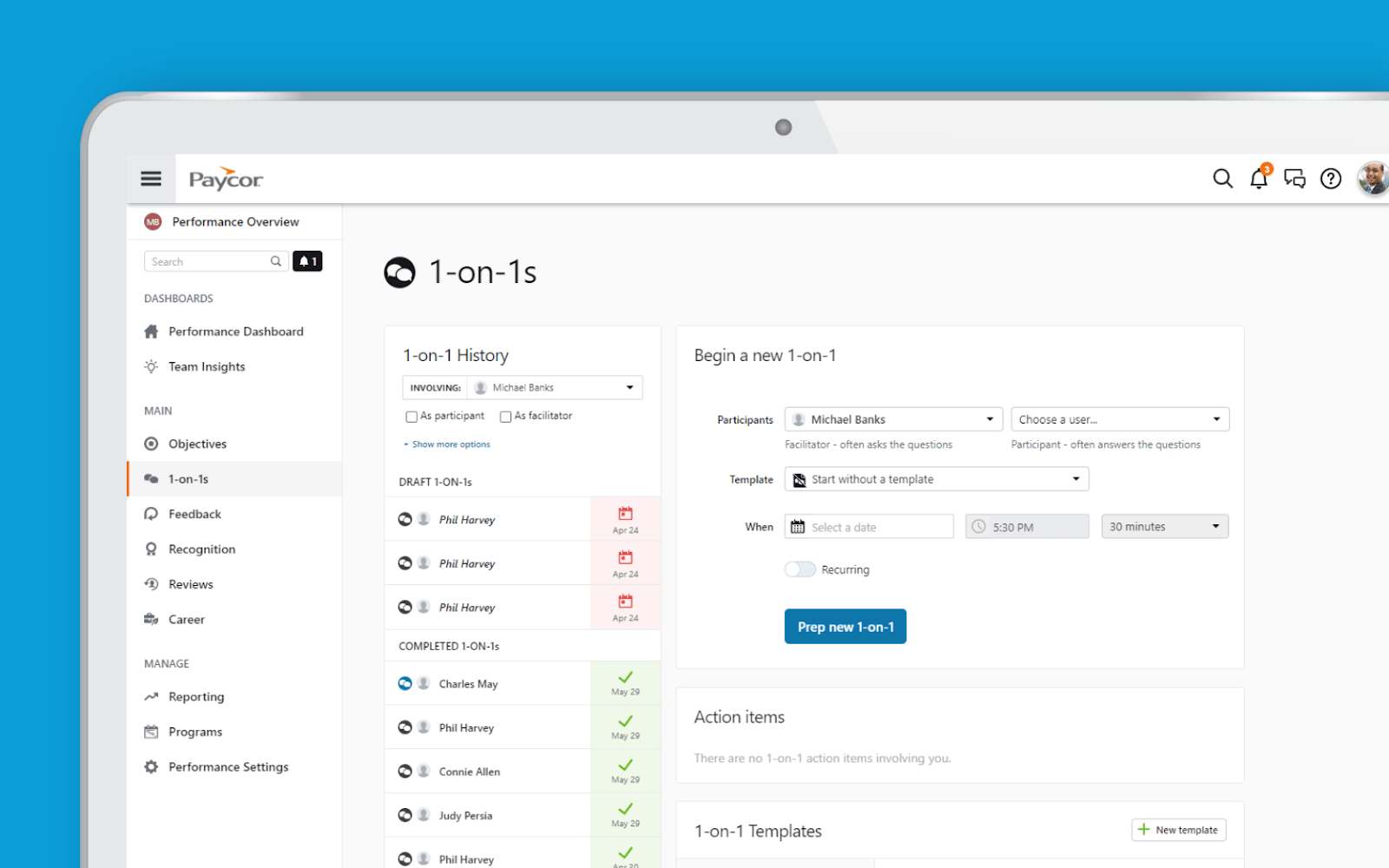

6. Paycor

Paycor is an all-in-one human capital management platform designed to assist businesses in all aspects of employee management, from recruiting to retirement.

With a blend of advanced features and intuitive design, Paycor aims to simplify HR tasks for various businesses.

Features

- Payroll & tax compliance

- HR & benefits administration

- Time & attendance

- Recruiting & onboarding

- Learning & development

- Reporting & analytics

Top 3 features of Paycor

1. Robust Payroll and Tax Compliance

Paycor provides comprehensive payroll processing with features such as automated tax compliance, wage garnishment, and detailed analytics.

2. Unified HR and Benefits Administration

The platform supports benefits administration, PTO tracking, and performance management. Users can onboard new hires, administer benefits, and track employee performance, all within the same system.

3. Talent Development and Recruiting

Paycor offers tools for creating an applicant tracking system, employee onboarding processes, and continuous learning and development.

Pros of Paycor

- Offers a wide variety of HR solutions beyond just payroll, such as recruitment and performance management tools

- Tailored solutions for specific industries, ensuring more targeted functionalities

- Robust analytics and reporting tools that aid businesses in strategic decision-making

Cons of Paycor

- The vast range of features can be overwhelming for businesses looking for a basic payroll solution

- The pricing structure can be a bit complicated with various modules and add-ons

- Initial setup and training might be required due to the platform's complexity

Supported Platforms

Paycor is a cloud-based solution accessible via web browsers on various devices. They also provide mobile apps for iOS and Android, making it easy for managers and employees to access crucial HR tools.

Pricing

Paycor uses a customized pricing standard, so you must contact their sales section for a quote. The cost will vary depending on the size of your organization and the specific modules you wish to use.

Final Verdict on Paycor

Paycor is a holistic solution for businesses wanting more than just a payroll service and serves as an alternative to QuickBooks Payroll. While its extensive features benefit comprehensive HR management, companies merely looking for payroll services might find it excessive.

However, for medium to large enterprises or industries with specific needs, Paycor provides a rich toolset that can address a myriad of HR challenges.

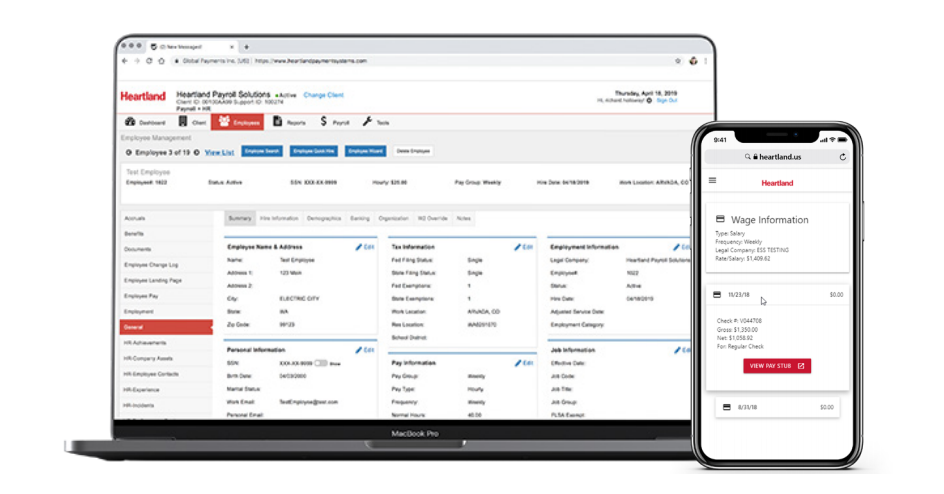

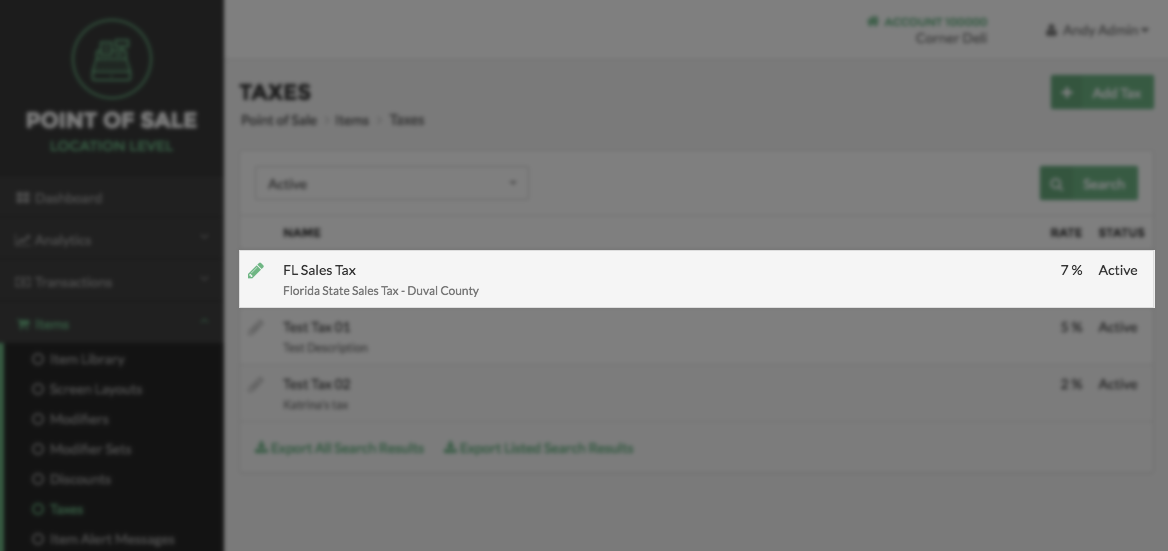

7. Heartland Payroll

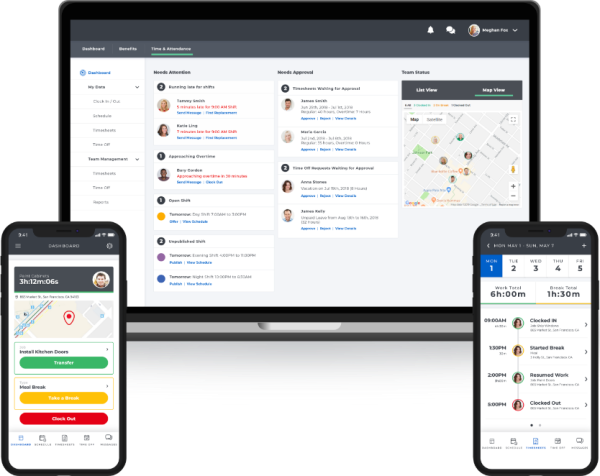

Heartland Payroll is a comprehensive payroll and HR solution catering to businesses of all sizes. Beyond payroll, it offers tax management, HR services, time tracking, and more.

Features

- Payroll processing

- Tax management

- Time & attendance

- HR services

- Employee self-service

Top 3 features of Heartland Payroll

1. Seamless Payroll Processing

Effortlessly process payroll and view in-depth reports to ensure accuracy and compliance.

2. Tax Management

Automatic tax computation and filings, ensuring businesses stay compliant without added hassle, making it a compelling alternative to QuickBooks payroll.

3. Integrated Time Tracking

Allows real-time employee time and attendance tracking, seamlessly integrating with payroll processing.

Pros of Heartland Payroll

- Direct integration with POS systems, which is great for businesses like restaurants

- Comprehensive suite of services, combining HR, payroll, and time tracking

- Dedicated service representative for each client, ensuring personalized service

Cons of Heartland Payroll

- The user interface might seem obsolete compared to newer platforms

- Some users have mentioned rare glitches with the system

- Customization choices might be limited for complex payroll setups

Supported Platforms

Heartland Payroll is cloud-based and can be accessed through web browsers. They also offer mobile functionalities for effortless access.

Pricing

Pricing for Heartland Payroll is custom-based, and businesses must reach out for a personalized quote.

Final Verdict on Heartland Payroll

Heartland is a trusted name in the payment industry, and its payroll solution reflects its commitment to quality and reliability.

The software suits businesses looking for a one-stop payroll and HR solutions shop.

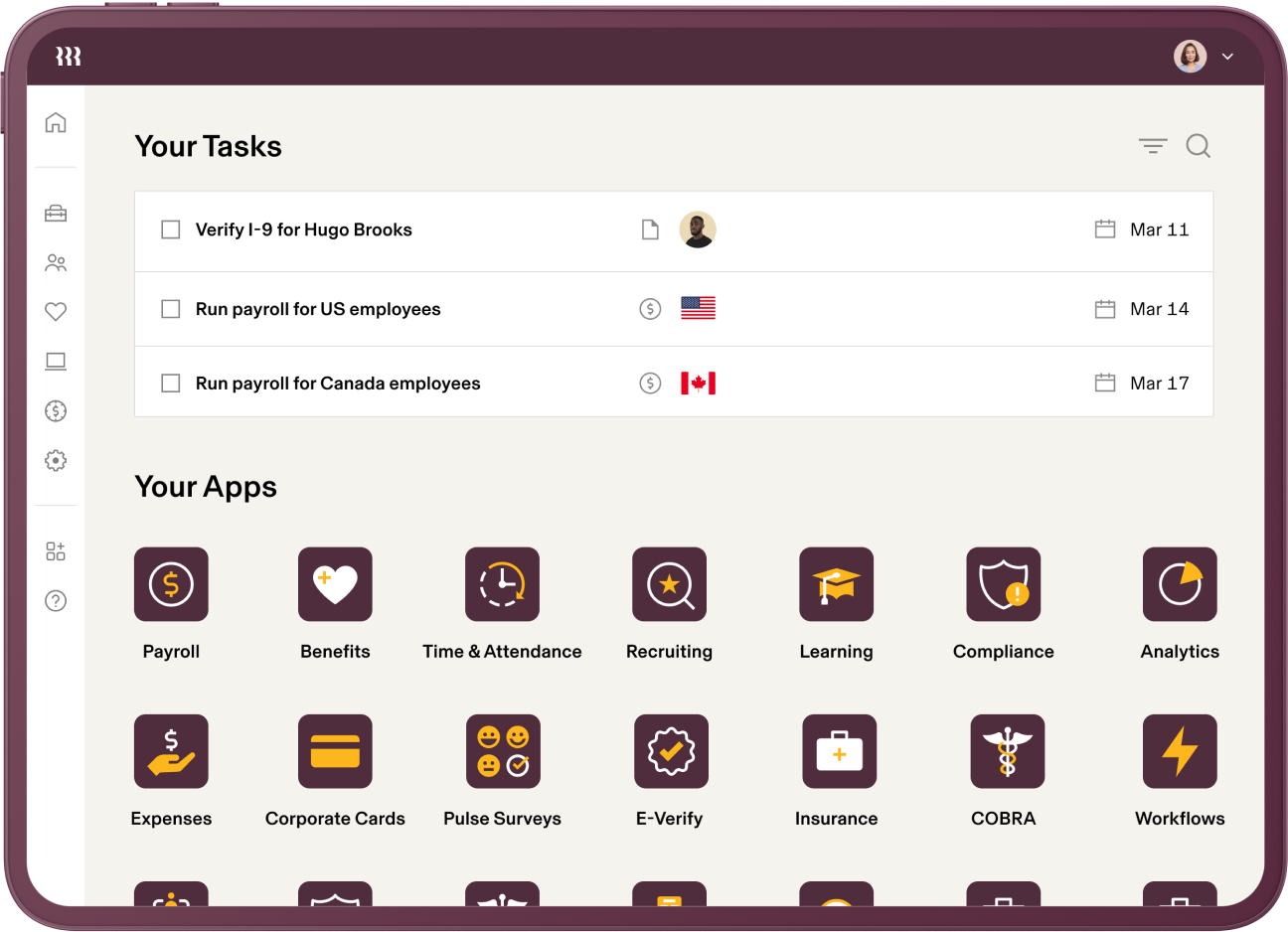

8. Rippling

Rippling is a modern platform that combines various HR functions, from payroll to IT management, under one roof.

It's designed for businesses looking to centralize their employee systems and processes.

Features

- Payroll automation

- Employee management

- Benefits administration

- IT automation (Device Management)

- Time & attendance

Top 3 features of Rippling

1. Unified HR and IT Platform

Manage employee data, payroll, benefits, devices, apps, and more from a single medium.

2. Automated Onboarding/Offboarding

Automate tasks like provisioning email accounts, setting up software, and payroll setups for new employees.

3. Flexible Benefits Administration

Offers comprehensive benefits management, including health insurance and more.

Pros of Rippling

- Deep integrations with other apps and services allow for an interconnected ecosystem

- Offers a comprehensive set of features beyond just payroll, including device management and software provisioning

- Current and intuitive user interface that simplifies complex tasks

Cons of Rippling

- It might be overkill for little businesses that only need basic payroll functionalities

- The vast array of features could have a steeper learning curve for some users

- Pricing can be on the higher side for bigger teams

Supported Platforms

Rippling is cloud-based and can be accessed via web browsers. They also provide mobile applications for both iOS and Android for on-the-go access.

Pricing

Rippling provides custom pricing based on the business's specific needs, so you'd have to contact their sales team for a precise quote.

Final Verdict on Rippling

Rippling, as an alternative to QuickBooks Payroll, is a powerful and flexible platform perfect for businesses that need more than just payroll services. It's all-in-one system saves time and decreases the annoyance of juggling multiple platforms.

However, smaller companies might find it overwhelming and should consider the features against their requirements.

Table Comparison

|

Features / Software |

Zarmoney |

Paylocity |

Wagepoint |

Paychex Flex |

Heartland Payroll |

Rippling |

Gusto |

Paycor |

|

Online Payroll Processing |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

HR Management |

✅ |

✅ |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Time & Attendance |

✅ |

✅ |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Benefits Administration |

✅ |

✅ |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Tax Compliance |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Employee Self-Service Portal |

✅ |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

After comparing all apps, it's evident that ZarMoney surpasses its competitors in many areas, making it the top choice for businesses.

Best of the Best

1. Gusto

Often lauded for its user-friendliness and comprehensive payroll features, Gusto offers a full suite of services that cater to a wide range of businesses.

Its intuitive interface, transparent pricing, and additional HR tools make it a favorite among many small to medium-sized companies.

2. Rippling

Rippling stands out as a modern market entrant in the market due to its unified approach to HR and IT.

By offering tools that span payroll, onboarding, benefits administration, and IT management, it's a holistic solution for businesses looking to streamline various operational aspects.

3. Paylocity

Paylocity stands out as one of the top three best payroll alternatives to QuickBooks, not just for its payroll processing capabilities but for its holistic approach to employee management. With its unique fusion of time tracking, benefits handling, and a comprehensive employee self-service portal, Paylocity offers businesses a superior and intuitive platform that caters to all their HR and payroll needs.

Conclusion

Selecting the right accounting software can significantly influence your business operations. And while all the options on this list have their merits, ZarMoney stands out with its unparalleled blend of features and affordability. Dive in and give it a try.

Your enterprise deserves nothing but the best!

Frequently Asked Questions (FAQs)

1. What are the uses of best alternatives to QuickBooks payroll?

They offer broad accounting and payroll management solutions, aiding in financial reports, tax management, and employee payroll.

2. What is the best alternative to QuickBooks payroll?

It's a software or platform offering features and functionalities that closely match or surpass those QuickBooks Payroll provides.

3. What creates the best alternative to QuickBooks payroll?

A combination of user-friendly charachteristitcs, affordability, and reliable support.

4. What to look for in the best alternative to QuickBooks payroll?

Important features include customizable financial reports, an intuitive interface, cloud-based access, and a robust support system.

5. Is ZarMoney comparable to QuickBooks payroll in terms of features?

ZarMoney offers many features, some of which overlap with QuickBooks Payroll. However, each software has its unique strengths. It's vital to consider the specific functionalities you need and then decide.

6. How do these alternatives handle payroll taxes?

Most reputable payroll software, often sought as alternatives to QuickBooks Payroll, will offer features to calculate, withhold, report, and remit payroll taxes. However, the specific processes and user experience can differ, so it's crucial to ensure the chosen platform meets your comfort and compliance needs.