Best Accounting Software for Financial Advisors

As a financial advisor, you understand the importance of having efficient, reliable, and robust financial planning tools. In this competitive landscape, it's essential to choose the best financial planning software program for your needs. Today, we'll discuss why ZarMoney is the best accounting software for financial advisors.

After reading this article, you will have a clear understanding of how ZarMoney's advanced features, innovative financial management solutions, and superior client portal make it the ultimate choice for financial planning professionals.

Why ZarMoney?

Financial advisors are responsible for guiding their clients through various financial plans and strategies, such as retirement planning, tax planning, estate planning, and more.

To achieve this, they need a comprehensive financial planning software solution with advanced features to ensure efficient financial management.

ZarMoney enables advisors to create personalized financial plans, track investments, generate accurate accounting reports, and collaborate seamlessly with clients. With its emphasis on efficiency and effectiveness, ZarMoney provides a reliable tool for advisors to deliver exceptional service and help their clients achieve their financial goals with ease.

ZarMoney is a comprehensive financial planning solution. Let's explore the key features that make ZarMoney stand out.

ZarMoney's Superior Features

Now that we've introduced the some key features of ZarMoney let's delve deeper into why it excels at these features:

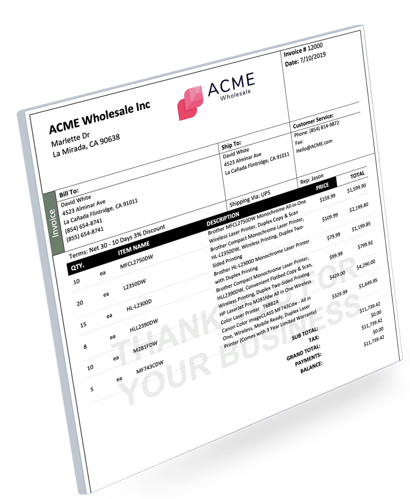

1. Comprehensive Reporting

ZarMoney offers comprehensive reporting capabilities, allowing users to generate a wide range of customized financial reports. These reports provide valuable insights into various aspects of financial performance, including income, expenses, assets, liabilities, and more.

ZarMoney offers a user-friendly interface and customizable accounting software options that enable financial advisors to present clear and concise reports to clients. These reports can aid in decision-making and financial analysis.

2. Divisions & Classes

ZarMoney's Divisions & Classes feature empowers businesses to enhance efficiency, speed, and profitability by effectively tracking and managing each division and/or location separately. This feature enables businesses to gain better insights into their operations, identify areas of strength and improvement, and make informed decisions to optimize performance.

By tracking divisions and classes, businesses can streamline processes, allocate resources more effectively, and drive overall growth and success.

3. Chart Of Accounts

ZarMoney's Chart of Accounts feature provides a comprehensive and organized list of accounts utilized by organizations for effective categorization and financial reporting. This feature allows businesses to systematically classify and track various financial transactions, ensuring accurate record-keeping and streamlined reporting processes.

By utilizing the Chart of Accounts, businesses can easily analyze their financial data, identify trends, and generate insightful reports that facilitate informed decision-making and financial transparency. The feature contributes to maintaining financial integrity and compliance while enabling efficient financial management.

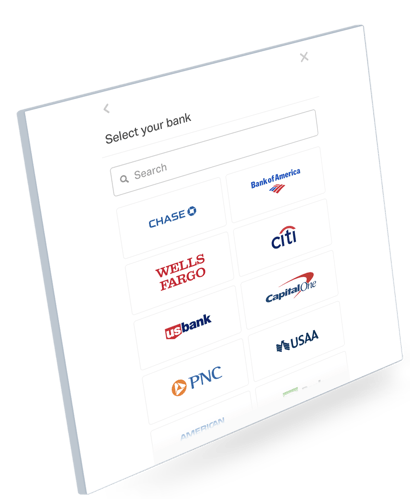

4. Bank Connection

ZarMoney's banking feature includes seamless integration with bank and credit card accounts, providing financial advisors with real-time access to accurate and comprehensive financial data. The integrated bank feed enables effortless synchronization of bank statements and transactions, simplifying financial planning.

By automating data retrieval, ZarMoney saves valuable time for advisors and reduces the risk of errors associated with manual data entry. With its robust integration capabilities, ZarMoney ensures advisors have access to the latest information, facilitating accurate and efficient financial planning for their clients.

5. Journal Entries

ZarMoney's Journal Entries feature allows users to record and manage financial transactions with detailed information, such as date, accounts involved, and transaction amounts. This feature facilitates accurate and systematic tracking of financial activities, ensuring proper documentation and organization of business transactions.

Users can easily create, review, and edit journal entries, maintaining a reliable and auditable record of financial transactions within ZarMoney.

6. Scalability

ZarMoney ensures scalability for financial planners, catering to firms of all sizes. With its advanced plans and features, it accommodates the growth of your business. As your client base expands, you can effortlessly scale your financial planning capabilities to meet the rising demands.

ZarMoney supports the financial health of your business by providing a flexible and adaptable platform that evolves with your needs. Whether you're a small firm or a larger enterprise, ZarMoney empowers financial planners to effectively manage and serve their clients as their business expands.

7. Comprehensive Support

ZarMoney provides comprehensive support through its dedicated customer service team, ensuring a seamless experience while using the software. Whether you have questions or concerns or encounter any issues, the support team can assist you.

With their expertise and prompt assistance, you can quickly resolve any challenges that may arise, allowing you to maximize the benefits of ZarMoney and streamline your financial planning process without interruption.

8. Integration with Other Software

ZarMoney integrates with other financial planning software programs and tools, facilitating effortless data exchange and compatibility. This streamlined integration enables financial advisors to efficiently manage multiple aspects of their client's financial lives.

By connecting ZarMoney with other software solutions, advisors can enhance their capabilities, streamline workflows, and ensure comprehensive financial planning and management.

9. Continuous Updates and Improvements

ZarMoney remains at the cutting edge of financial planning software solutions, demonstrating its commitment to continuous updates and improvements. By regularly enhancing its features, ZarMoney ensures that it aligns with the evolving needs of financial advisors and their clients.

With ZarMoney, users can trust that they are accessing a forward-thinking software solution that evolves alongside their industry and technology advancements.

10. Flexible Pricing

ZarMoney provides flexible pricing options to cater to the diverse needs and budgets of financial advisors. With various plans available, advisors can choose the pricing option that aligns with their specific requirements. This flexibility enables them to access the powerful tools and features offered by ZarMoney without straining their budget.

By offering customizable pricing, ZarMoney ensures that financial advisors can effectively manage their client's financial planning needs without compromising on the quality and capabilities of the software.

Comparing ZarMoney with Competitors

To further demonstrate ZarMoney's superiority, let's compare it with two popular competitors: Xendoo and ForwardAI.

The following table highlights the key features that set ZarMoney apart from these competitors:

|

Feature |

ZarMoney |

Xendoo |

ForwardAI |

Bench |

Wave |

|

Comprehensive Reporting |

✅ |

✅ |

❌ |

✅ |

❌ |

|

Divisions and Classes |

✅ |

❌ |

❌ |

❌ |

✅ |

|

Chart Of Accounts |

✅ |

✅ |

❌ |

❌ |

✅ |

|

Bank Connection |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Journal Entries |

✅ |

❌ |

❌ |

✅ |

✅ |

As the table demonstrates, ZarMoney offers a more comprehensive range of features compared to its competitors, making it the best choice for financial advisors seeking a powerful and efficient financial planning software solution.

Best of the Best

1. ZarMoney

ZarMoney is the best accounting software for financial advisors, providing a comprehensive cloud-based investment management platform with advanced analytics, expense tracking, and customizable financial reports. It ensures compliance with industry regulations, supports client risk tolerance assessments, and includes AI-powered features for better investment strategies. With bank account integration, client billing, and portfolio insights, ZarMoney helps advisors streamline financial planning processes and manage investment portfolios effectively.

2. Xendoo

Xendoo is a business accounting solution designed for financial institutions needing basic platform access with expense tracking tools, budgeting tools, and financial reports for clients. While it offers client satisfaction tracking and cash flow analysis, it lacks advanced planning capabilities, estate planning software, and investment management features, making it more suitable for general bookkeeping rather than investment-focused firms.

3. ForwardAi

ForwardAi is a financial planning software tool that focuses on cash-flow-based planning and scenario analysis for wealth managers and financial advisors. It provides risk assessment tools, asset performance tracking, and financial planning services to help advisors monitor market trends and create actionable plans. However, it lacks comprehensive tax planning capabilities, investment strategies, and collaboration features, making it less effective for firms handling complex tax situations or portfolio insights.

Conclusion

ZarMoney stands out as the best accounting software for financial advisors, offering a comprehensive range of advanced features to ensure efficient financial management and client satisfaction. With superior financial planning tools, a user-friendly client portal, powerful wealth management capabilities, seamless integration with bank and credit card accounts, and customizable reports, ZarMoney provides the ultimate financial planning software solution for financial advisors.

By choosing ZarMoney, you'll be well-equipped to provide exceptional financial planning services to your clients, assisting them in securing their financial future and achieving their financial objectives. Invest in ZarMoney today and experience the difference it can make for your advisory firm. FAQ

FAQ

1. What should I consider when choosing the best accounting software for financial advisors?

When selecting accounting software for financial advisors, consider the range of financial planning tools available, integration with bank and credit card accounts, wealth management features, and customizable reporting capabilities. You should also consider the software's ease of use, client portal, and customer support.

2. Is ZarMoney suitable for both small and large financial advisory firms?

Yes, ZarMoney is suitable for both small and large financial advisory firms. It offers scalability and advanced plans to accommodate different-sized firms' growth and varying needs. So whether you're a small firm or a larger enterprise, ZarMoney empowers financial advisors to effectively manage and serve their clients as their business expands.

3. Does ZarMoney provide comprehensive support for financial advisors using their accounting software?

ZarMoney prioritizes customer support for financial advisors, providing prompt assistance and expertise to address any questions, concerns, or issues, ensuring a seamless experience and uninterrupted financial planning process.

4. Does ZarMoney prioritize continuous updates and improvements in its accounting software?

Yes, ZarMoney is committed to regularly enhancing its features, aligning with industry and technology advancements, and ensuring users access a forward-thinking software solution that adapts to their changing requirements.

5. What are some additional benefits of choosing ZarMoney for Financial Advisors?

Some additional benefits of choosing ZarMoney include scalability for firms of all sizes, comprehensive customer support, integration with other software programs, continuous updates and improvements, flexible pricing options, and comprehensive training and resources.

6. How does ZarMoney help financial advisors with investment management and financial planning?

ZarMoney provides financial advisors with advanced financial planning tools, allowing them to track investment portfolios, analyze financial reports, and generate insights for informed investment decisions. With real-time insights, portfolio tracking, and integration with bank accounts, advisors can efficiently manage client finances while ensuring compliance with industry regulations.

7. Can financial advisors use ZarMoney for tax planning and regulatory compliance?

Yes, ZarMoney supports tax planning and compliance with industry standards by providing automated tax calculations, expense tracking tools, and customizable financial reports. Advisors can manage deductible expenses, track client finances, and generate detailed reports for tax filing, ensuring regulatory compliance and accuracy in financial planning.

8. Does ZarMoney offer risk assessment tools for financial advisors?

ZarMoney includes risk assessment tools that help financial advisors assess client risk tolerance, analyze investment strategies, and develop actionable financial plans. With real-time collaboration and advanced analytics, advisors can perform cash flow analysis, scenario analysis, and stress-test plans to create comprehensive financial strategies.

9. How does ZarMoney improve client relationships and engagement for financial advisors?

ZarMoney offers a client portal that enhances client relationships by providing secure access to financial reports, invoices, and investment performance data. Advisors can share reports for clients, monitor financial situations, and communicate financial goals effectively, ensuring a more interactive and transparent client experience.

10. Can ZarMoney support wealth managers and financial institutions handling multiple clients?

Yes, ZarMoney is designed to support wealth managers and financial institutions managing multiple clients and investment portfolios. With its cloud-based investment management platform, financial advisors can track financial accounts, monitor alternative investments, and generate detailed reports while ensuring compliance with industry regulations and financial planning services.