The 7 Best Accounting and Bookkeeping Software for Businesses

Whether you're a startup, a growing enterprise, or a well-established conglomerate, the right accounting and bookkeeping software can make all the difference in streamlining your financial operations. Our blog aims to help you find the best accounting and bookkeeping software for your business.

From dissecting the technical architecture of these solutions to evaluating their compliance with current regulations, we offer a comprehensive overview tailored for business professionals. We delve into user experience, data security, and scalability, providing objective assessments to help you identify the most appropriate platform for your organizational needs.

So, dive in to discover the tools and strategies that can turn numbers and spreadsheets into actionable insights for the sustainable growth of your enterprise.

1. ZarMoney

ZarMoney is a renowned accounting and bookkeeping software preferred by small to large-sized businesses worldwide.

It’s an easy-to-use and scalable software with various features and capabilities to keep your accounting and bookkeeping workflows streamlined without you having to rely on an excessive workforce. This is the reason why ZarMoney is currently sitting at the top of our recommendation list.

Features

- Accounting & bookkeeping

- Payable and receivable transactions

- Bank reconciliation

- Expense tracking

- Billing

- Automated taxation

- Online payments

- Funds transfer

- Related transactions

- Chart of accounts

- Bank connections

- Bank deposits

- Bulk data import

- Journal entries

- General ledger

- Income & balance sheet

- Profit and loss statement

- Alerts and reminders

- Reporting and analytics

- And more

Top 3 Features

ZarMoney comes with a wide range of features and capabilities for its users. Here are the 3 top features that make ZarMoney a top accounting and bookkeeping software.

1. Accounting & Bookkeeping

ZarMoney is a one-stop solution that facilitates businesses with seamless accounting and bookkeeping operations. The tool enables users to manage their sales and purchase processes effortlessly and keep records of transactions without spending excessive time on entry or worrying about errors in the process.

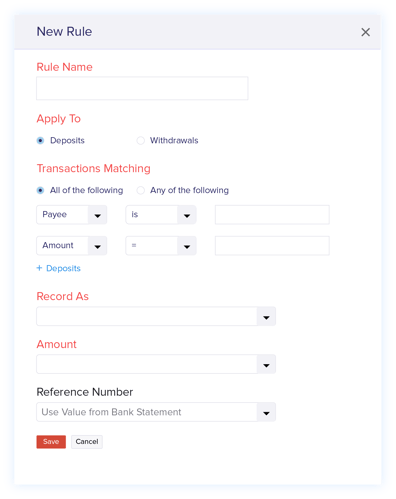

2. Account Reconciliation

ZarMoney facilitates its users with one-click account reconciliation - enabling them to authenticate and verify all the transactions without having to spend excessive time. The tool automates the reconciliation process so you can focus on other things and processes that matter the most.

3. Automated Taxation

The process of calculating and filing taxes is tedious and time-consuming. ZarMoney facilitates businesses to set their taxation process on autopilot - enabling users can calculate and file taxes automatically and hassle-free. You can also override this feature and execute the process manually if you prefer.

Pros

- Free trial

- Easy to use

- Easy to learn

- Scalable

- Simple user interface

- Multi-location support

- Multi-currency support

- Multi-login

- 9600+ bank connections

- Custom tax policies

- Access permissions

- External integrations

Cons

- No free plan

- U.S. and Canada bank connections only

Pricing

ZarMoney offers a variety of price plans - making it the best-suited solution for small to large size businesses and a scalable accounting & bookkeeping software. Here are the plans offered along with their price:

- Entrepreneur Plan: This plan costs $15 a month and offers standard features that ZarMoney has to offer.

- Small Business Plan: This plan costs $20 a month, supports 2 multi-logins, allows unlimited transactions, and comes with standard features.

- Enterprise Plan: This plan is best suited for large businesses and starts from $350 per month - supports 30+ users, offers custom features and specialized training along with dedicated support.

Integrations

- Zapier

- AutoEntry

- Authorize.Net

- Gusto

- Mailchimp

- Shopify

- Stripe

- And more

Rating

- Capterra: 4.73

- GetApp: 4.73

- G2: 4.73

Reviews

Customer Support Options

ZarMoney provides its users with three customer support options - email, chat, and call. Users can quickly contact ZarMoney’s help desk via email or resolve their queries by chatting with customer support representatives through 24/7 live support. Users are also provided with the on-call backing for urgent issues and concerns.

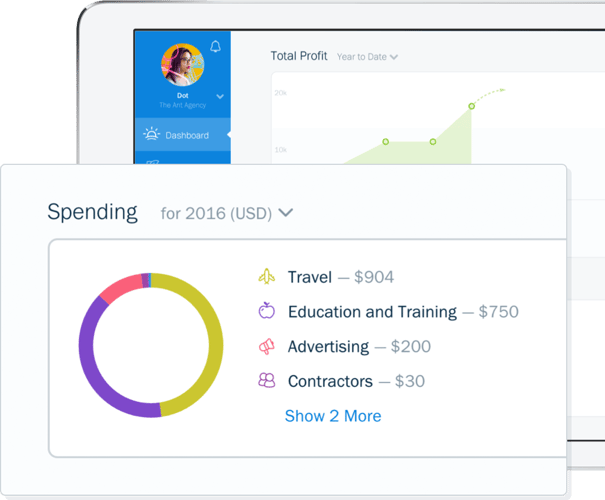

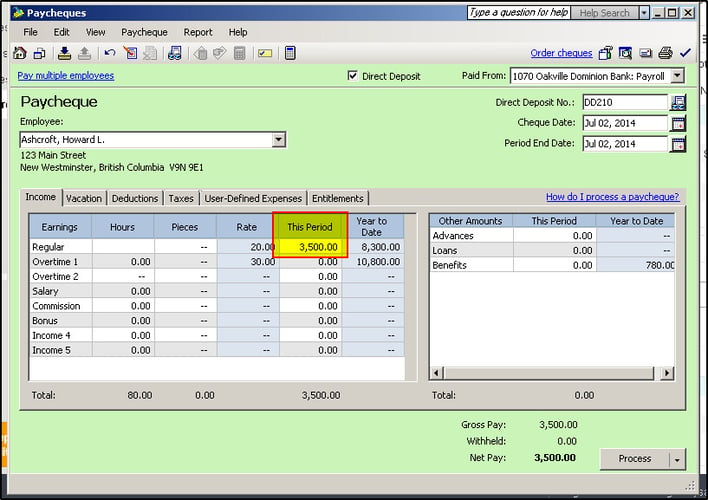

Product Screenshots

Bottom Line

With a variety of features offered and an average rating of 4.73 on leading tech forums, ZarMoney stands tall at the number 1 spot on our recommendation list. The tool is web-based, feature-rich, easy-to-use, simple to learn, scalable, and affordable - making it a worthy choice to be considered by small to large size businesses.

2. Quickbooks Online

Quickbooks Online stands tall on the second spot of our best accounting and bookkeeping software list. It’s a one-stop accounting platform - preferred by companies worldwide.

Quickbooks Online is one of the market leaders due to the wide range of features and capabilities that come with it. Furthermore, the tool offers a variety of integration options for external apps - facilitating workflows other than accounting and bookkeeping.

Features

- Payable & receivable transactions

- ACH payment processing

- Account reconciliation

- Invoicing and billing

- Expense tracking

- Forecasting or budgeting

- Bank deposits

- Online payments

- Tax calculation

- Chart of accounts

- Reporting and analytics

- And more

Top 3 Features

Quickbooks online is a multi-purpose accounting solution. Here are the top 3 features from a variety of capabilities that this software has to offer.

1. ACH Payments

ACH payments are also known as Automated Clearing House payments that correspond to an online electronic payment platform - responsible for moving transaction amounts between banks. Quickbooks Online facilitates its users with the ability to process ACH payments without any hassle.

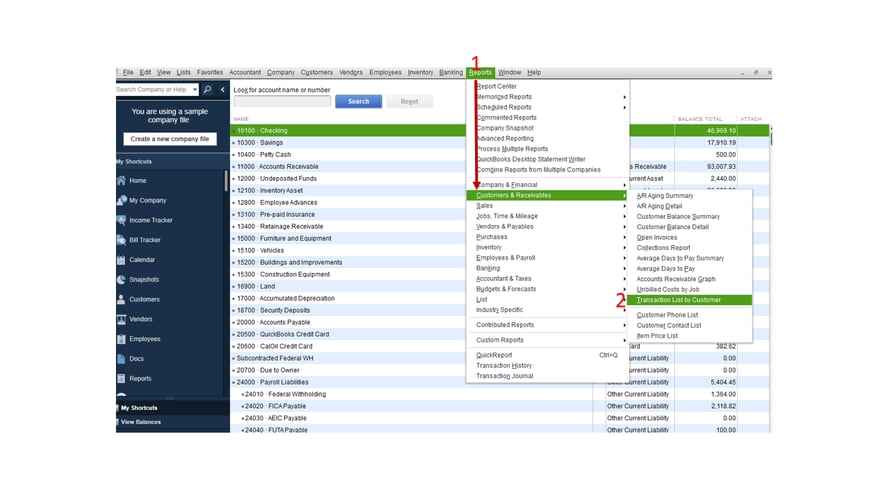

2. Chart of Accounts

Chart of accounts makes information understandable - facilitating users with glimpse accounting operations at their fingertips. This saves time otherwise spent on analyzing comprehensive data and compiling reports to make informed decisions. With Quickbooks Online, you don’t need to hire expert accountants or consultants to set up charts of accounts for you.

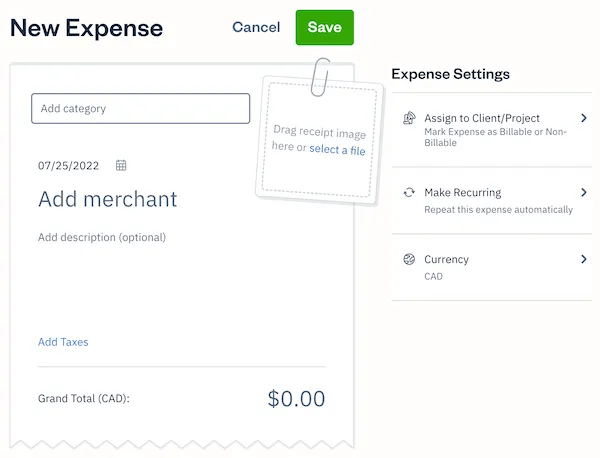

3. Expense Tracking

Quickbooks Online facilitates its users with an expense tracking feature. This allows companies to track and record their expenses and automatically adjust the amounts in invoices. This saves businesses from a lot of number crunching and menial work - facilitating them with an accurate picture of their profitability. The tool also facilitates users with mileage tracking capability - using GPS technology to calculate the distance covered and record an expense accordingly.

Pros

- Offers a free trial

- Easy to use

- Easy to navigate

- Scalable

- No steep learning curve

- Multiple user support

- Multi-currency support

- Supports external integrations

Cons

- Expensive compared to other alternatives

- Not suitable for small businesses or startups

- Poor customer support

Pricing

Quickbooks Online offers four different price plans to its users - Simple Start, Essential, Plus, and Advanced.

- Simple Start Plan: This plan costs $25 per month and offers basic accounting and bookkeeping capabilities.

- Essential Plan: This plan costs $50 per month, offers multi-user support, and facilitates users with standard features.

- Plus Plan: This plan costs $80 per month, offers multi-login capability, supports up to 5 users, and comes with standard accounting and bookkeeping features.

- Advanced Plan: This plan costs $180 per month, comes with multi-login capability, and offers all advanced features of Quickbooks Online.

Integrations

- Zapier

- AR Collect

- Invoice Sherpa 2.0

- PayPal

- Squarespace

- PayTraQer

- Mailchimp

- Freshdesk

- Gusto

- Eventbrite

- TaxDome

- And more

Rating

- Capterra: 4.4

- GetApp: 4.3

- G2: 4.0

Reviews

Customer Support Options

Quickbooks Online offers 3 support options to its users - help desk, live chat, and on-call support. You can either email your concerns to their help desk representatives or reach out to their customer support via 2/7 live chat. Quickbooks Online also entertains on-call inquiries of its users and provides urgent support on call.

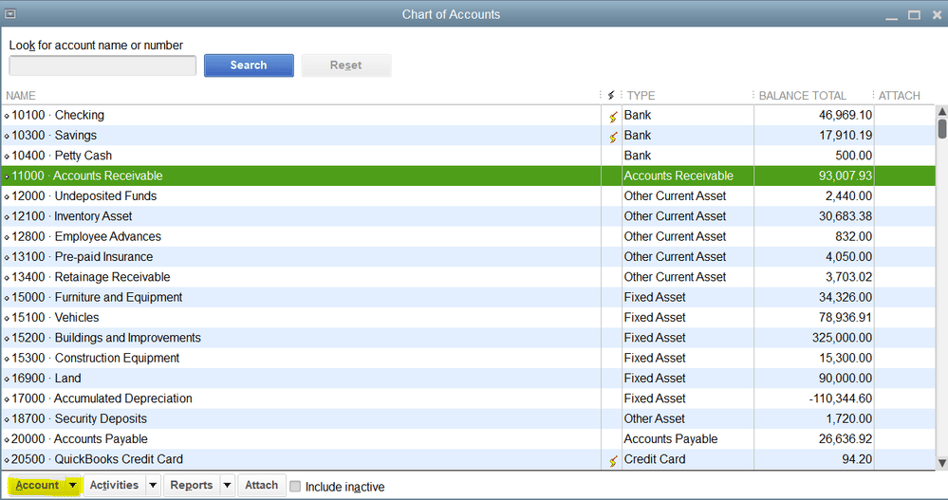

Product Screenshots

Bottom Line

With an average rating of 4.26, Quickbooks Online is second on our recommendation list. It’s a web-based accounting solution that offers handy features - facilitating users to automate menial processes like bookkeeping. With 4 different price plans to choose from, Quickbooks Online is an accounting and bookkeeping solution worth considering in 2021.

3. Freshbooks

At the third spot on our recommendation list of accounting and bookkeeping software comes Freshbooks - a leading web-based solution preferred by companies worldwide.

Freshbooks is a feature-packed and flexible accounting solution that helps companies automate tedious processes like bookkeeping effortlessly.

You can also track your expenses and estimate profitability without any hassle. Freshbooks lets users set the taxation process on autopilot, reconcile statements, and more.

Features

- Accounting & bookkeeping

- Expense tracking

- Spending control

- Payable & receivable transactions

- Account reconciliation

- Automatic billing

- Financial projections

- Tax automation

- General ledger

- Balance sheet

- Chart of accounts

- Alerts and reminders

- Reporting and analytics

- And more

Top 3 Features

In this section, we will explore the 3 of the most important features offered by Freshbooks to its users.

1. Accounting & Bookkeeping

Freshbooks facilitates businesses with seamless accounting and bookkeeping capabilities. The tool enables users to automate tedious and time-consuming processes - allowing them to utilize the resource capacity much more efficiently.

2. Spending Control

The spending control feature of Freshbooks is critically important for organizations concerned about their budget utilization or have a limited budget for spending. Freshbooks enables you to come up with a smart strategy and control the spendings of your company to acknowledge fruitful outcomes.

3. Expense Tracking

Companies can track and record their expenses automatically using Freshbooks. This enables users to accurately calculate profitability and account for all relevant transactions. The software facilitates users to track business expenses in real-time and adjust the billable amounts in invoices with ease.

Pros

- Free trial

- Easy to learn

- User friendly

- Multi-language support

- Multi-platform support

- Currency conversion

- Device compatibility

- Prompt customer support

- External integrations

Cons

- Offers fewer features compared to other alternatives

- Slightly expensive

Pricing

Freshbooks facilitates its users to choose from 4 different price plans - Lite, Plus, Premium, and Custom.

- Lite Plan: The plan costs $7.5 per month and facilitates users with very basic features.

- Plus Plan: The plan costs $12.5 per month, offers standard features to users, and is best suited for small companies or startups.

- Premium Plan: The plan costs $25 per month, offers advanced features, and is best suited for medium to large-sized companies.

- Custom: This is a custom plan where the price is dictated by the quotation sent by you with your business requirements.

Integrations

- Zapier

- GoogleDrive

- Mailchimp

- Hubspot

- Gusto

- Calendly

- Zendesk

- PayPal

- Stripe

- Square

- And more

Ratings

- Capterra: 4.5

- GetApp: 4.5

- G2: 4.5

Reviews

Customer Support Options

Freshbooks offers three support options to its users. People can reach out to them either via email, chat, or call. They offer help desk and live chat support for standard queries and concerns. The urgent issues are addressed by their customer support representatives through on-call support.

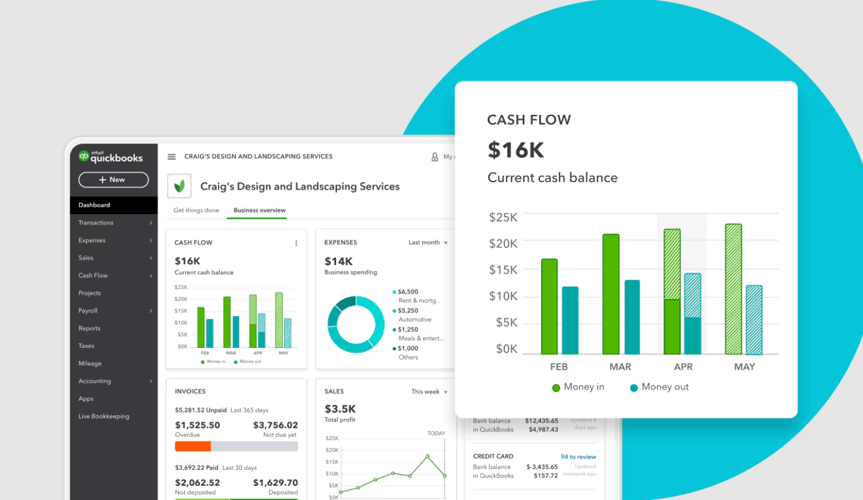

Product Screenshots

Bottom Line

With an average rating of 4.5, Freshbooks is an accounting and bookkeeping software worth recommending. It currently sits at the third spot on our recommendation list. Freshbooks is a scalable solution that offers a wide range of features and is easy-to-use software. Being a web-based accounting solution, it can be accessed from anywhere in the world through a device of your choice, all you need is an internet connection.

4. Xero

At the fourth spot on our recommendation list, we have Xero - an online accounting and bookkeeping software preferred by businesses around the globe.

Xero is a feature-rich alternative to consider when it comes to streamlining accounting or bookkeeping workflows. It’s one of the industry leaders and facilitates users with features like accounts management, bookkeeping, expense tracking, billing management, and more.

Features

- Accounting & bookkeeping

- ACH payment processing

- Payable & receivable transactions

- Cost tracking

- Expense tracking

- Asset tracking

- Auto billing

- Budgeting

- Cash management

- Online payments

- Bank deposits

- Cash flow management

- Expense tracking

- General ledger

- Profit and loss statements

- Tax automation

- And more

Top 3 Features

Xero comes with a variety of features, however, the below-mentioned are the ones that top the charts.

1. Cost Tracking

This feature enables users to calculate the cost associated with a process or overall operations of the business - facilitating companies to come up with accurate feasibility. Cost tracking facilitates businesses to highlight the need for further investment and ensure smart utilization of funds.

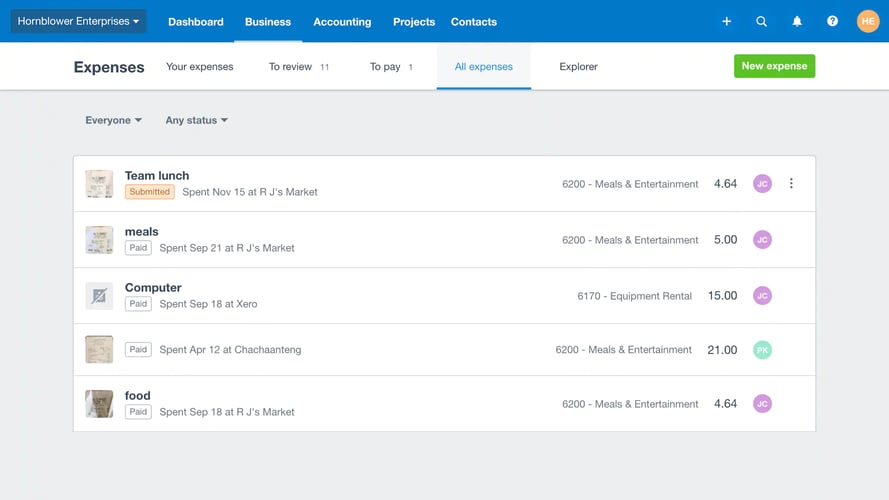

2. Expense Tracking

Expense tracking gives businesses the ability to track expenses in real-time and adjust the billable amount in invoices. This not only facilitates businesses to maximize revenue via the due receivables but also enables them to come up with an accurate estimation of the company's profitability.

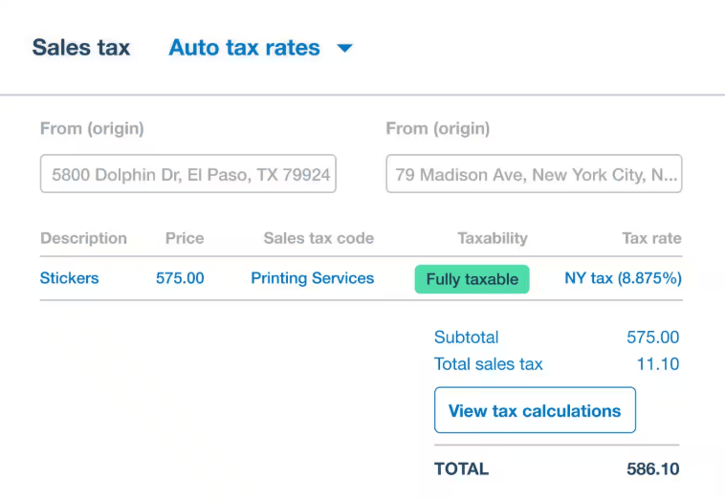

3. Tax Automation

Xero facilitates its users with tax automation capabilities. This allows you to manage taxation workflows with ease. With Xero, businesses are authorized to configure custom policies and tax regulations as per the corresponding regions. The software will automatically calculate and apply taxes based on the set policies on respective transactions. The feature also automates the tedious process of calculating and filing returns.

Pros

- Free trial

- Affordable

- Scalable

- Real-time bank feeds

- Multi-channel management

- Multi-currency support

- Multi-location support

- External integrations

- Device compatibility

Cons

- Lackluster support

- Steep learning curve

Pricing

Xero has three price plans to offer - Early Plan, Growing Plan, and Established Plan.

- Early Plan: This plan is best suited for small businesses and startups. It costs $5.5 per month and facilitates its users with basic features.

- Growing Plan: This plan is best suited for small to medium-sized businesses. It costs $16 per month and facilitates its users with standard features.

- Established Plan: This plan is best suited for medium to large-sized businesses. It costs $31 per month and facilitates its users with all the advanced capabilities of Xero.

Integrations

- Zapier

- Hubspot

- Gusto

- Mailchimp

- Dropbox

- PayPal

- Stripe

- Rippling

- Square

- GoogleDrive

- Eventbrite

- And more

Rating

- Capterra: 4.4

- GetApp : 4.3

- G2: 4.5.

Reviews

Customer Support Options

Xero facilitates its users with three support options - help desk, live chat, and on-call inquiry. Users can reach out to customer service representatives via chat or call for urgent concerns. You can also email your issues to their help desk if they’re not that urgent and can wait.

Product Screenshots

Bottom Line

With an average rating of 4.3 on leading tech platforms and review sites, Xero currently sits at the fourth spot on our recommendation list. It’s one of the globally acclaimed accounting and bookkeeping solutions preferred by small to large-sized businesses. If you’re looking for feature-rich accounting software that’s simple and easy to use then Xero is a solution worth considering.

5. Sage Accounting

Currently standing at the fifth spot on our recommendation list, Sage Accounting is a renowned accounting and bookkeeping software preferred by organizations around the globe.

The software offers a wide range of features, such as cash flow management, billing, invoice management, online payments, and real-time reporting, along with the ability to automate bookkeeping processes and reduce manual data entry.

Sage Accounting also supports third-party integrations for external apps to facilitate workflows other than accounting.

Features

- Accounting & bookkeeping

- ACH payments processing

- Payable & receivable transactions

- Account reconciliation

- Automated billing

- Budgeting

- Cashflow management

- Cash management

- Expense tracking

- Fraud detection

- Profit and loss statements

- Tax calculation & management

- And more

Top 3 Features

Among all the features that Sage has to offer, the below-mentioned are the top 3 worth listing.

1. Automated Billing

With Sage Accounting, businesses can automate their billing cycle with ease. The platform enables users to set invoicing cycles on autopilot - making billing effortless without having to rely on menial tasks or operations.

2. Fraud Detection

Sage Accounting enables users to detect fraud or other unauthorized activities concerning financial workflows. The solution gives you a detailed audit trail to ensure that no transactions or records miss your eye.

3. Tax Calculation & Management

With Sage Accounting, you can calculate and manage your taxes with ease. The tool enables users to either set the tax calculation process on autopilot or calculate them manually and file returns.

Pros

- Free trial

- Simple user interface

- Detailed reporting

- Audit trail

- Personalization features

- Alerts and notifications

- Multi-currency support

- Multi-company management

Cons

- Limited price plans

- Steep learning curve

- Poor customer service

Pricing

Sage Accounting offers 2 price plans at the moment - Sage Accounting Start and Sage Accounting Plan.

- Sage Accounting Start: The plan costs $10 per month and facilitates users with basic features and limited capabilities.

- Sage Accounting Plan: The plan costs $25 per month and offers standard features that Sage Accounting has to offer.

Integrations

- AutoEntry

- Stripe

- SyftAnalytics

- nettTracker

- BillBjorn

- Clarity

- EposNow

- 9Spokes

- ePages

- And more

Ratings

- Capterra: 4.1

- GetApp: 3.8

- G2: 3.8

Reviews

Customer Support Options

Sage Accounting offers three support options - help desk, live chat, and on-call support. Users can reach out to the customer service representatives via email where their queries are addressed by the help desk. For urgent queries, you can either contact the support via live chat or get your issues resolved via professionals on-call.

Product Screenshots

Bottom Line

Sage Accounting currently sits at the fifth spot on our recommendation list. Though the solution has a lower average rating compared to its alternatives, the tool facilitates its users with a wide range of features and is preferred by some of the leading businesses worldwide. Considering all the positives and negatives associated with this accounting and bookkeeping software, it is without a doubt worthy to be considered as a feature-rich option when seeking accounting and bookkeeping solutions.

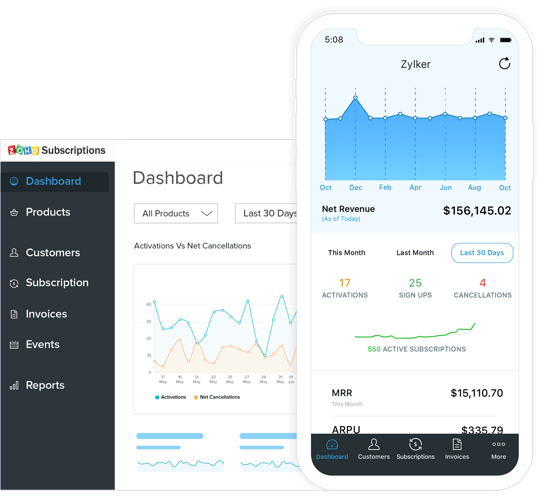

6. Zoho Books

At the sixth spot on our recommendation list, we have Zoho Books - a globally preferred web-based accounting and bookkeeping software that facilitates its users with a variety of features, external integrations, support options, and more. Due to the flexibility of its price plans, Zoho Books is a scalable solution best suited for small to large-sized businesses for automating accounting and bookkeeping workflows.

Features

- Accounting & bookkeeping

- ACH payments processing

- Payable & receivable transactions

- Bank reconciliation

- Invoicing & billing

- Cash management

- Financial analysis

- Online payments

- Expense tracking

- General ledger

- Income statement

- Balance sheet

- Profit and loss statements

- Tax management

- Reporting and analytics

- And more

Top 3 Features

Zoho Books offers a wide range of features and capabilities. Here are some of the important perks associated with this accounting solution.

1. ACH Payments Processing

Zoho Books facilitates its users with automated clearing house payments support. This enables them to seamlessly move transaction amounts between banks. You don’t have to rely on additional tools or access multiple platforms to process the transactions - Zoho Books serves as a one-stop solution for businesses.

2. Payable & Receivable Transactions

Zoho Books enables its users to manage payable and receivable transactions effortlessly. The platform makes it easier for businesses to keep a track of the amount to be paid to vendors in exchange for the purchases made along with the amount to be received by customers in exchange for products or services provided.

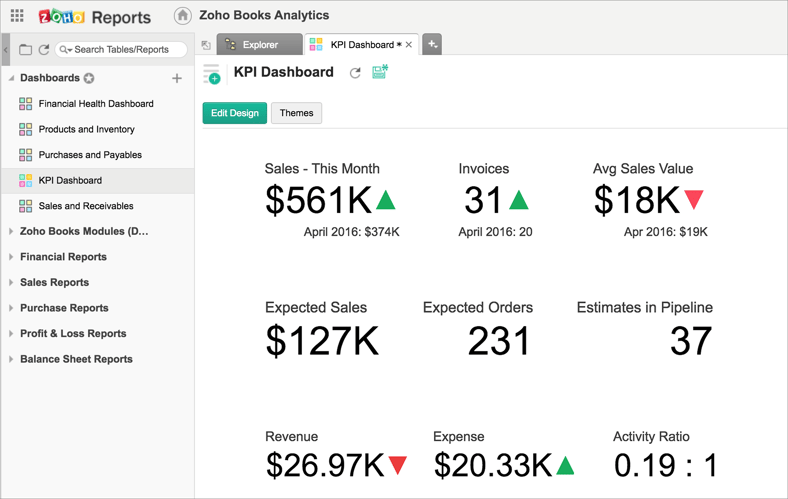

3. Financial Analysis

Zoho Books enables users to dive deep into the data and perform financial analysis to make informed decisions by analyzing complex data. The tool facilitates businesses to compile detailed and visually appealing dashboards - making complicated trends easy to understand for businesses and concerned stakeholders.

Pros

- Offers a free plan

- Ease-of-use

- Easy setup

- Affordable

- Supports other Zoho apps

- External integrations

- Multi-currency support

- Multi-location support

- Learned customer support

Cons

- Reporting can be a bit difficult for newbies

- Doesn’t sync with bank accounts in real-time

Pricing

Zoho Books has four price plans to offer - Free Plan, Standard Plan, Professional Plan, and Premium Plan.

- Free Plan: A very basic plan for professionals or businesses that are just getting started. The plan doesn’t charge anything and is available for businesses with revenue less than $50K per annum.

- Standard Plan: The plan costs $12 per month, offers standard features, supports up to 3 connections, and is best suited for small businesses.

- Professional Plan: The plan costs $24 per month, comes with advanced features, supports up to 5 connections, and is best suited for small to medium-sized businesses.

- Premium Plan: The plan charges $36 per month, comes with top-tier Zoho Books features, supports up to 10 connections, and is best suited for large businesses.

Integrations

- Authorize.Net

- Stripe

- PayPal

- Worldpay

- Braintree

- Razorpay

- Paytm

- 2Checkout

- All Zoho Apps

- And more

Ratings

- Capterra: 4.4

- GetApp:4.4

- G2: 4.5

Reviews

Customer Support Options

Zoho Books has three customer support options - email help desk, live chat, and on-call support. Users of Zoho Books can reach out to the customer support representatives for their queries and concerns via any of the mediums aforesaid.

Product Screenshots

Bottom Line

Zoho Books is one of the reputable accounting and bookkeeping solutions. With an average ranking of 4.46, the software currently holds the sixth spot on our recommendation list. With a variety of price plans it offers, Zoho Books is a scalable accounting solution best suited for not only businesses but also independent professionals or freelancers.

7. Patriot Accounting

On the seventh and final spot of our recommendation list, we have Patriot Accounting, a feature-rich accounting solution that is worthy to be considered by businesses.

Patriot Accounting is a web-based solution that helps businesses automate tedious and time-consuming processes like accounting and bookkeeping.

The software offers a wide range of features and capabilities to facilitate the accounting and bookkeeping workflows of small to medium-sized businesses.

Features

- Accounting and bookkeeping

- Account reconciliation

- Auto billing

- Budgeting

- Cash management

- Expense tracking

- Financial reporting

- Online payments

- Invoice processing

- General ledger

- Profit and loss statements

- Tax management

- Alerts and notifications

- Reporting and analytics

- And more

Top 3 Features

Here are the 3 most important features offered by Wave Accounting that may come in handy to non-profit organizations.

1. Account Reconciliation

Comparing the financial records of your business with the recorded transactions facilitated by the bank can be a time-consuming task. However, it holds utmost significance for running businesses smoothly as it enables you to detect unusual transactions, frauds, and accounting errors. Patriot Accounting enables users to check, verify, and reconcile bank statements with ease. The tool facilitates you with an automated account reconciliation feature - allowing you to check that figures or transaction amounts are in agreement and accurately recorded.

2. Expense Tracking

This feature of Patriot Accounting facilitates users to track expenses without any hassle. It comes in handy when preparing invoices as the tool automatically incorporates billable expenses without you having to do it manually. Further, the feature gives you an accurate representation of your revenue as no expenses go unnoticed.

3. Cash Management

Patriot Accounting also comes in handy for managing cash flows. The tool enables users to keep a record of collections without them having to record the transactions manually. This saves a lot of effort and menial work otherwise incurred on managing the cash transactions for businesses.

Pros

- Free trial

- Easy to setup

- Simple user interface

- Alerts and notifications

- Reporting and analytics

- Good customer support

Cons

- No multi-currency support

- Fewer features compared to alternatives

- Doesn’t support third-party integrations

- Limited price plans

Pricing

- Patriot Accounting offers fewer price plans compared to other alternatives in the industry. The tool facilitates its users with two price plans only - Basic Accounting Plan and Premium Accounting Plan.

- Basic Accounting Plan: The plan costs around $15.00 per month and comes with the standard features of the tool.

- Premium Accounting Plan: The plan costs around $25.00 per month and comes with all the advanced features that Patriot Accounting has to offer.

Integrations

- The official website of Patriot Accounting, along with other research sources and review sites, doesn’t display any information regarding the software supporting third-party app connections.

Ratings

- Capterra: 4.7

- GetApp: 4.9

- G2: 4.7

Reviews

Customer Support Options

Patriot Accounting offers three customer support options. Users can either reach out to a customer support representative with their queries via email, chat, or call. This gives users the freedom to choose their preferred medium for customer support whether it’s helpdesk, live chat, or on-call support.

Product Screenshots

Bottom Line

With an average rating of 4.8 on leading tech review sites and communities, Patriot Accounting is the last solution on our recommendation list. Despite it having a huge rating, some factors are affecting its ranking on our list - top of the list are fewer features compared to alternatives and the inability to support third-party apps. Overall, Patriot Accounting is a decent software worth considering for small to medium-sized businesses seeking decent accounting solutions.

|

Features |

ZarMoney |

QuickBooks Online |

FreshBooks |

Xero |

Sage Accounting |

Zoho Books |

Patriot Accounting |

|

Expense Tracking |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Real-Time Updates |

✅ |

✅ |

❌ |

✅ |

❌ |

✅ |

✅ |

|

Balance Sheets |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Financial Reports |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Time Tracking |

✅ |

✅ |

✅ |

❌ |

❌ |

✅ |

❌ |

|

Bank Transactions |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

|

Inventory Tracking |

✅ |

✅ |

❌ |

✅ |

❌ |

✅ |

❌ |

|

Project Management |

❌ |

❌ |

✅ |

✅ |

❌ |

✅ |

❌ |

|

Cloud Based Software |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

Best of the Best

1. ZarMoney

ZarMoney is an extraordinary accounting program tailored to streamline the financial tasks of businesses, including those in the finance industry. This cloud-based accounting software features real-time updates for inventory tracking, making it easier for business owners to manage raw materials, finished goods, and waste.

ZarMoney offers unlimited users and the convenience of connecting multiple bank accounts, simplifying bank transactions. Its double-entry accounting system ensures accuracy in financial statements, including balance sheets and loss statements.

Overall, ZarMoney is a comprehensive accounting tool especially useful for businesses with complex inventory systems.

2. QuickBooks Online

QuickBooks Online is one of the market's most renowned small-business accounting software options. Its strong accounting features include expense tracking, time tracking, and comprehensive financial reporting.

For businesses, QuickBooks Online offers specialized inventory tracking tools, capturing every detail from purchase to sale in real time. The software’s user-friendly interface is perfect for those without an accounting background.

With QuickBooks, you can also manage unlimited invoicing, which becomes extremely handy during tax season. Its cloud-based software allows for easy access, requiring only an internet connection to check the financial health of your business.

3. Zoho Books

Zoho Books is a robust online accounting software that offers a wide range of accounting services tailored for small to medium-sized businesses. Specialized in double-entry accounting, Zoho Books allows you to manage your business’s financials with accuracy. Its real-time updates on inventory and cash flow provide a transparent view of your business’ financial health.

Expense Management is a breeze with Zoho Books, as is project management, which is ideal for bakeries operating on a project-based model. The software supports unlimited users and offers a variety of monthly plans, making it a versatile choice for businesses of all sizes.

Final Verdict

Choosing the right accounting and bookkeeping software is a pivotal decision for any business owner. The right tool not only simplifies complex financial tasks but also provides invaluable insights into the financial health of your enterprise.

These cloud-based software solutions are designed to bring efficiency, transparency, and scalability to your accounting operations, enabling you to focus more on your core business activities and less on paperwork.

From monthly plans suitable for small businesses to advanced features that accommodate larger operations, these accounting systems adapt to your needs, offering a powerful ally in managing your financial landscape. Always remember, that the most informed decision is one that aligns with both your accounting tasks and business objectives.

Frequently Asked Questions (FAQs)

1. Are real-time updates essential for accounting software?

Real-time updates are critical for capturing instantaneous financial tasks and transactions, providing an accurate snapshot of your business’s financial health.

2. What is double-entry accounting, and why is it important?

Double-entry accounting ensures that for every debit, there is a corresponding credit. This brings a balance and high accuracy to your financial reports and statements.

3. How secure is cloud-based accounting software?

Cloud-based software often comes with robust security features, ensuring the safety of your financial data. Always check the security protocols of the accounting tool you're considering.

4. Can I integrate my bank accounts with these accounting systems?

Most top-tier business accounting software options allow you to integrate multiple bank accounts, streamlining bank transactions and financial reporting.

5. Do these tools offer expense tracking features?

Expense tracking is a standard feature among the best accounting software, helping you monitor costs and improve your cash flow.

6. What are the basic plans available?

Basic plans usually cover fundamental accounting features such as balance sheets, invoicing, and simple financial reports. Always check the monthly plans for specific details.

7. Is an internet connection necessary for online accounting software?

An internet connection is essential for cloud-based accounting software to sync data and provide real-time updates.

8. Can I generate financial statements using this software?

Absolutely, these accounting platforms allow you to generate various financial statements, aiding in better business decisions.

9. How useful is the time tracking feature during tax season?

Time tracking can be immensely helpful during tax season for calculating labor costs, thereby affecting your loss statements.

10. What does unlimited invoicing mean?

Unlimited invoicing allows you to generate an unlimited number of invoices, optimizing the invoicing process and making it easier during peak times like tax season.

Switch to ZarMoney: The Freshbooks Alternative that Elevates Your Accounting. Experience unlimited invoicing, seamless time tracking, and more. Start Now!

About Us

ZarMoney is a Los Angeles-based Financial Software company. Our team consists of savvy Financial and Tech experts who have meticulously designed this cloud-based accounting software. Geared towards both small businesses and large corporations, we're committed to elevating your financial management experience.

Switch to ZarMoney: The Freshbooks Alternative that Elevates Your Accounting. Experience unlimited invoicing, seamless time tracking, and more. Start Now!