8 Accounts Receivable Automation Practices to Consider in 2024

Are you looking for the best practices for account receivable automation in 2023? Well, if yes, then look no further because, in this article, we will be discussing all you need to know about the tried and tested AR best practices. Keep on reading to find out more

Automating your accounts receivable is the best way to streamline the processing of large volumes of client invoices. A suitable AR automation enhances the AR process's efficiency and decreases human errors. So to help you make the right decisions, let's discuss all the details and essential things you need to know about accounts receivable automation.

The lifeblood of every organization is its cash flow. It means that a flourishing company is making sure its due payments are collected on time. However, delays, wrong policies, and human errors can bring down a business in the blink of an eye.

This is why companies need to ensure efficient invoicing and quick dispute resolution. And all this can be ensured easily with the help of an efficient automated workflow process. In addition, the accounts receivable procedure helps you see your company's financial health and acts as a way to analyze and estimate a company's liquidity.

How Accounts Receivable Automation Can Help Businesses!

Ineffective automation can lead to bad accounts receivable management, which can only problematize the procedure due to human blunders, delays, and inaccuracies leading to severely obstructed collections. In the current era, incorporating automation for accounts receivable is essential and must be well planned because only then it can be beneficial to your business.

The traditional accounts receivable process includes manual "touchpoints" at every point along the way; Invoices are developed, printed, and sent but can be slow in reaching the client, the data is analyzed, customer follow-ups are needed, and Accounts receivables are manually monitored, and much more. With the development of accounts receivable softwares, businesses are now able to automate many of these unproductive and time-consuming tasks.

This generally begins with the credit risk management procedure by digitizing the current evaluation of a client's creditworthiness. Then, it advances to the invoicing process. Advanced accounts receivable automation softwares like ZarMoney can easily extract data from other platforms to digitally create and distribute invoices to clients. In addition, some significant benefits of accounts receivable automation include saving time and efforts, lowering bad debt,, and showing predictable cashflows.

8 Best Practices for Accounts Receivable Automation To Consider In 2023

Here are the tried and tested accounts receivable automation best practices in 2023;

1. Streamline the Payment Procedure

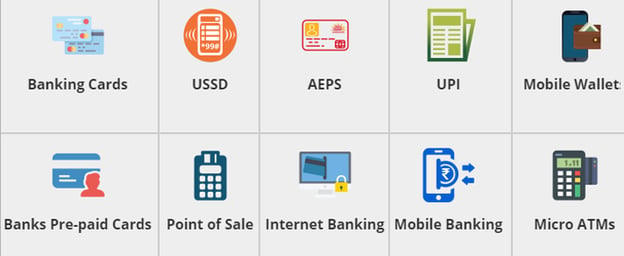

A practical approach to enhance customer experience is to accept different payment methods. This way, you are also able to avoid unnecessary payment frustration. Offering alternative payment options like credit/debit cards, ACH, Electronic Funds Transfers (EFT), etc., can be really beneficial for your business. Another excellent way is to offer online payment methods and add the portal's link on the invoice. It will make it much easier for clients to pay quickly and safely.

To efficiently do this, you can also utilize the incredible services of softwares like Zarmoney that lets you manage invoices, receive payments, and stay up-to-date with the receivables easily. Overall, receiving digital payments and convenient payment methods is one of the top accounts receivable automation best practices, as proved by a research conducted by an accounts receivable automation vendor.

In that research, it was found that 64% of firms shifted away from physical invoices to account receivable automation. Plus, 67% of firms started receiving more digital payments after the Covid-19 pandemic.

Pro Tip: Implement shorter payment terms

Usually, using shorter payment terms urges the customers to pay faster. A shorter payment term denotes decreasing payment time from 30 or 60 days to 10 days. The reason is that the sooner you collect your money back, the better it is.

2. Adopt an effective collection plan

Develop an effective collection plan by adopting a clear collection strategy and make it your priority. This is considered one of the best account receivable automation practices in 2023 because when you have an automated AR and when any account goes into the overdue column, the AR team will be able to see all the outstanding accounts through the system.

First, it will start the AR process following established collection guidelines. Then, it will electronically generate and send accurate invoices to the clients. In addition, you can also set up automated email reminders to subtly notify the clients that their payment is due. You can also enhance how your email reminders look by using kind words and laying out payment options.

Pro Tip: To create a smart collection plan, you can utlize the help of ZarMoney. With ZarMoney, you can easily build a smart and automated collection process for receivable payments. Doing this will enhance your cash flows by configuring reminders and alerts for potential customer payments.

In addition, ZarMoney also enables you to centrally record all the accounts receivable activity on the cloud, which is very useful. Plus, you can also get detailed account receivable reports along with balance sheets and profit & loss statements.

3. Ensure seamless integration of tech stack

Almost every company has set payment terms and has accounting software in place. Then they decide that the functionality is restricted in some ways, and they should probably go for a more comprehensive billing software to accomplish hypergrowth. So once you make this decision, it is essential to see if the tool you are buying can integrate seamlessly into your already existing tech stack.

If the answer is yes, then you know that the tool is an excellent fit for you; just like Zarmoney, that has the ability to smoothly integrate with almost all major tech stacks, making your account receivable problem solving a smooth process. In addition, it lets you avoid/reduce payment failures, get comprehensive reporting, and reduce everyday work. This is why it it one of the top accounts receivable automation best practices.

4. Create accurate invoices

An essential part of receiving timely payments is to send your customers a sales invoice in an accurate manner. If the invoices in your organization need customer or project manager's authorization, then add this to your recovery procedure. Overall it is highly important to make sure that your invoices are clear and accurate. Inaccurate information such as the wrong price or order number will cause a delay in receiving payment and automatically stop the payment procedure.

5. Assure fast dispute resolution

One of the major causes of non-payments is disputes. By monitoring the disputes, you can understand their cause and then try to resolve them as quickly as possible. An important thing you should never forget is to ensure smooth business processing is that unresolved disputes or delayed dispute resolution only lead to further delays and complications. So always make sure that you have a way to resolve your disputes quickly. For that, you can also use the assistance of companies like ZarMoney. They are well trusted for their AR automation services. With ZarMoney, you also get to have an accurate view of your AR and provide a superior customer experience.

6. Involve your accounting department

Deciding to purchase an automation software is a pretty high-level decision. So you have to carefully understand the tool before buying it. And your accounting team understands the account receivable the most, so a great practice is to involve your accounting team in the decision-making.

This is because the accounting team is well aware of the ins and outs of your accounting workflows and so they can make calculated and best-fitting decisions. In addition, you should also get your accounting team to clarify and reconcile workflows.

7. Set penalties on late payers

The concept of late payment charges is a tried and tested practice that pushes the clients to pay you as soon as possible. If not, then they will at least try to communicate with you if they are unable to pay as quickly as possible.

The late payment penalty policies can be decided upon in the initial contract between both you and the customer. It is convenient, more manageable, and quicker to compute the late payment interest with softwares like ZarMoney. So you can utilize the services offered by this tool as well to streamline your account receivable procedures.

8. Credit analysis and accounts receivable insurance

When your clients are unreachable for a long time, and you have tried everything you could possibly do to reach them, then considering an insurance company is one of the best practices. These insurances are powerful because they can help reduce your credit worries and rescue the company against unforeseen losses induced by the accounts receivable records.

With their help, you can avoid bad debts easily by choosing the right markets and customers. The insurance companies also offer credit risk management solutions for businesses that are operating globally. This includes risk monitoring, risk management, fraud cover, credit insurance, debt collection, and more. Nonetheless, ensuring that your clients are insured from the beginning is one the top accounts receivable automation best practices.

Final Verdict

In today's digital era, businessmen need to consider using accounts receivable automation best practices like the ones mentioned in our article to ensure smooth processing of their business and build a reliable name in their industry.

Doing this will pay off in the long run while saving a ton of your company's valuable time, resources, and money. Along with this, you should also ensure that you place your client at the core of your AR process. The sooner your company receives the payments, the better it is. So make sure that you utilize the above-mentioned best practices for accounts receivable automation.

This way, none of your invoices will be sitting for a long, and your business processes will go on smoothly, ultimately allowing your business to grow faster and create a reliable name in the industry. In addition, tools like ZarMoney also provide efficient accounts receivable features that can further boost your business's streamlining and seamless processing.