ZarMoney: Accounting Software for Independent Contractors/Sole Proprietors

As an independent contractor or sole proprietor, keeping track of your finances is essential for running your business efficiently. From handling invoices and managing personal expenses to tracking payments and staying organized for tax time, having the right accounting software is important.

ZarMoney is a powerful accounting software for independent contractors/sole proprietors that simplifies every aspect of financial management. Whether you’re juggling multiple clients or trying to maintain clear records for taxes, ZarMoney provides all the tools you need to succeed.

Why ZarMoney is the Best Accounting Software for Independent Contractors/Sole Proprietors

Independent contractors and sole proprietors often deal with fluctuating income, irregular work schedules, and a need for organized bank accounts and expense tracking. With ZarMoney, you can automate these processes, save time, and stay on top of your business finances.

ZarMoney Features for Independent Contractors and Sole Proprietors

Here’s an overview of the key accounting features that make ZarMoney the best accounting software for independent contractors/sole proprietors:

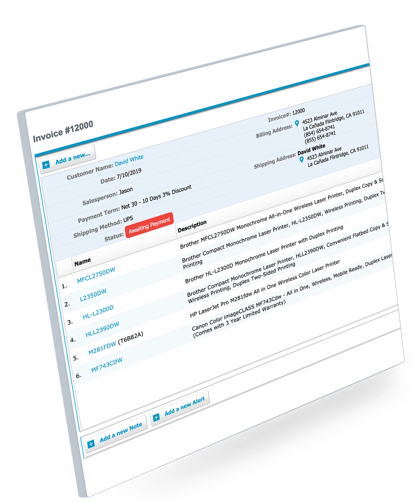

1. Automated Invoicing for Quick Payments

Handling invoicing for multiple clients can be time-consuming, especially when you’re balancing several projects. ZarMoney simplifies this with automated invoicing, allowing you to create customizable invoices for each client. You can set up recurring invoices, track online payments, and even automate payment reminders to avoid late payments. This means less time on admin tasks and more time focused on growing your business.

2. Expense Tracking and Bank Reconciliation

![]()

Keeping track of expenses is important for self-employed professionals. With ZarMoney’s expense tracking feature, you can easily categorize all business expenses, ensuring that your records are accurate for tax deductions. ZarMoney also offers bank account connections and bank reconciliation tools, making it easy to sync your bank transactions with the software and verify your financial data.

3. Real-Time Financial Insights for Better Control

Knowing where your business stands financially is essential for making intelligent decisions. ZarMoney provides real-time dashboards that give you an overview of your cash flow, expenses, and revenue. These real-time financial reports help you stay informed and make adjustments as needed, ensuring you have complete control over your finances.

4. Tax Preparation Made Easy

ZarMoney makes tax time much simpler by organizing all your financial data in one place. With detailed reports on income, expenses, and tax deductions, you can prepare your quarterly taxes quickly and accurately. You’ll be able to claim your business expenses and ensure that your financial statements are organized and ready when needed.

5. Easy Integration with Other Tools

If you’re using other tools for time tracking or client management, ZarMoney integrates easily with third-party systems, ensuring a smooth flow of data between platforms. This makes it a perfect all-in-one solution for managing your client profiles, payments, and expenses.

ZarMoney vs. Competitors: QuickBooks and Xero Comparison

Here’s how ZarMoney compares to popular accounting platforms like QuickBooks and Xero for independent contractors and sole proprietors:

|

Feature |

ZarMoney |

QuickBooks |

Xero |

|

Automation of Financial Tasks |

✅ |

✅ |

✅ |

|

Integration Capabilities |

✅ |

✅ |

✅ |

|

Customizable Reporting |

✅ |

✅ |

❌ |

|

Real-time Data and Analytics |

✅ |

❌ |

✅ |

|

Project-Based Accounting |

✅ |

❌ |

✅ |

Conclusion

For independent contractors and sole proprietors, managing finances doesn’t have to be stressful.

ZarMoney simplifies everything from invoicing to expense tracking, helping you stay organized and prepared for tax time. With real-time financial insights, smooth integrations, and affordable pricing, ZarMoney is the best accounting software for independent contractors/sole proprietors.

Whether you’re a freelancer, consultant, or small business owner, ZarMoney ensures your finances are under control so you can focus on growing your business.

Frequently Asked Questions About Choosing Accounting Software for Independent Contractors/Sole Proprietors

1. Why do independent contractors and sole proprietors need accounting software?

Accounting software helps simplify accounting tasks, automating processes like invoicing, tracking expenses, and preparing for tax time.

2. How does ZarMoney simplify invoicing for contractors?

ZarMoney automates invoicing, allowing you to customize templates, set up recurring invoices, and track payments easily.

3. Can ZarMoney handle multiple bank accounts and credit cards?

Yes, ZarMoney integrates with multiple bank accounts and credit cards, making it easy to track transactions and reconcile accounts.

4. What makes ZarMoney better than QuickBooks and Xero?

ZarMoney offers similar or better features like real-time reporting and easy integration at a more affordable price, making it the best choice for independent contractors and sole proprietors.

5. Does ZarMoney offer real-time financial insights?

Yes, ZarMoney provides real-time financial and tax reports and dashboards, helping you stay informed about your cash flow, expenses, and revenue.

6. Can ZarMoney integrate with time tracking tools?

Yes, ZarMoney integrates with time tracking systems, making it easy to track billable hours and include them in client invoices.

7. Is ZarMoney secure for handling sensitive financial data?

ZarMoney offers top-tier security features, including encryption and role-based access, ensuring your financial data is protected.

8. How much does ZarMoney cost?

ZarMoney starts at $20/month, offering a cost-effective and feature-rich solution for independent contractors and sole proprietors.

9. Can ZarMoney help with tax deductions?

Yes, ZarMoney’s expense tracking feature allows you to categorize expenses for easy tax deductions, ensuring you maximize your savings.

10. Does ZarMoney offer a free trial?

Yes, ZarMoney offers a 30-day free trial, allowing you to explore all the features before committing to a subscription.