FreshBooks vs Quickbooks vs ZarMoney: A Detailed Review

Looking for the right accounting software for your business?

We are here to end your worries and guide you step by step in choosing the best accounting software to help you kick-start your business and yield maximum profit from it.

Accounting software is an efficient tool designed to record and report a business's financial operations. The right type of accounting software for your business can work miracles in streamlining repetitive and time-consuming workflows.

Deploying the right accounting solution ensures smooth cash flow management, efficient billing, and streamlined reporting to help you analyze your business's financial health and growth.

This article provides an in-depth analysis of the features offered by FreshBooks, Quickbooks, and ZarMoney's features to help you choose the right fit for your business type.

FreshBooks vs. Quickbooks vs. ZarMoney

In this section, we have compared all the features of FreshBooks vs. Quickbooks vs. ZarMoney to give you a complete view of their capabilities - helping you choose a solution that works best for you.

|

|

ZarMoney |

Quickbooks Online |

FreshBooks |

|

Customers & Account Receivable |

|||

|

Create and Email Invoices |

|

|

|

|

Recurring Invoices |

|

|

|

|

Mileage Tracking |

× |

|

|

|

Credit Limit & Credit Hold |

|

× |

× |

|

Accept Online Payments |

|

|

|

|

Receive ACH Payments |

|

|

|

|

Quotes/Estimates |

|

|

|

|

Sales Orders |

|

× |

|

|

Order Status |

|

× |

|

|

Quick Sales/Sales Receipt |

|

|

|

|

Customer Statement |

|

× |

|

|

Scheduler |

|

× |

× |

|

Accept Pre-Payments |

|

× |

× |

|

Payment Terms |

|

|

|

|

Notification via Text & Email |

|

× |

|

|

Vendors & Account Payable |

|||

|

Purchase Orders |

|

|

|

|

Bills |

|

|

|

|

Expenses |

|

|

|

|

Automatic Matching |

|

|

|

|

Print Checks |

|

|

|

|

Approve Bills |

|

× |

|

|

Payment Discounts |

|

× |

|

|

Receipt Attachment |

|

|

|

|

Related Transactions |

|

× |

|

|

Automatic Expense Recording |

|

|

|

|

Productivity |

|||

|

Customizable Dashboard |

|

× |

|

|

Collaborate With Your Team |

|

× |

|

|

File Attachment |

|

|

|

|

Access from Everywhere |

|

|

|

|

Mobile App |

Coming soon |

|

|

|

Internal Notes |

|

× |

|

|

Advance User Permissions |

|

× |

|

|

Restricted IP Access |

|

× |

|

|

Notification via Text & Email |

|

× |

|

|

Organize Customers With Custom Fields |

|

× |

× |

|

Inventory |

|||

|

FIFO Cost Methods |

|

|

|

|

Inventory Management |

|

|

|

|

Manage Multiple Warehouses |

|

× |

× |

|

2 Step Warehouse Transfer |

|

× |

× |

|

Price Level |

|

|

× |

|

Barcode |

|

× |

× |

|

Customizable Units of Measures |

|

× |

|

|

Real-Time Inventory Data |

|

|

|

|

Product Category |

|

|

× |

|

Customizable Product Fields |

|

× |

× |

|

Item Tracking and History |

|

|

|

|

Compare Received Inventory With PO’s |

|

× |

× |

|

Create Pick Lists |

|

× |

|

|

Split Transactions With Enhanced Inventory Receiving |

|

× |

× |

|

Accounting |

|||

|

Bank Connections |

|

|

|

|

Account Reconciliation |

|

|

|

|

Chart of Account |

|

|

|

|

Profit & Loss |

|

|

|

|

Sales Tax |

|

|

|

|

Bank Deposits |

|

|

|

|

Import Bank Transactions |

|

|

|

|

Divisions & Classes |

|

|

× |

|

Fund Transfers |

|

|

|

|

Journal Entries |

|

|

|

|

Reporting |

|||

|

Insight™ |

|

× |

× |

|

1099 Reporting |

|

|

|

|

Balance Sheet |

|

|

|

|

Trial Balance |

|

|

|

|

Statement of Cash Flow |

Coming Soon |

|

|

|

Account Receivable (A/R) |

|

|

|

|

Account Payable (A/P) |

|

|

|

|

Comprehensive Reporting |

|

|

|

Features and Capabilities of Top 3 Accounting Software

Let's start by introducing you to the basic features and capabilities of the top 3 accounting software to help you pick the software most suitable for your unique business needs.

1. ZarMoney

ZarMoney is a top-notch accounting software that includes all the features a business needs to run its finances efficiently. It is a one-stop accounting solution that can be used for both small and large businesses.

Organizations can manage their finances and inventories effortlessly with ZarMoney’s powerful features as it helps businesses and directs them to a profitable route. The software assists the users in creating and sending invoices instantly. Further, the “Pay Now” option makes receiving payments easier and saves time.

ZarMoney smartly equips your business to provide quotes and accurate estimates by using its product-specific parameters and a visible dashboard. From managing bills, expenses, purchases, and sales orders to printing checks and reporting, ZarMoney is a one-stop solution with a user-friendly interface that helps you stay on top of all accounting workflows.

2. FreshBooks

FreshBooks is another robust accounting software that is specifically designed to provide expert accounting services to growing businesses. It was awarded as a “Leader in the Fall 2017 Small-Business Accounting Grid Report” based on customer satisfaction and market performance.

FreshBooks allows you to send invoices to your clients and receive timely payment for your product or service. It deals with all types of accounting documents and invoices and is very flexible and user-friendly in terms of approach.

Moreover, its time tracking feature keeps you informed, thereby enabling you to accurately invoice your bill according to the worth of the service provided. FreshBooks also has a mobile app that helps you track your accounting processes anywhere, anytime.

3. Quickbooks

Quickbooks is a feature-rich accounting software offered by Intuit. It allows you to manage your business accounts from anywhere effortlessly. With its user-friendly interface, getting started and managing your finances becomes much more manageable.

Of the numerous features offered by Quickbooks, some of the most important ones include creating and sending invoices and estimates, receiving notifications for overdue invoices, organizing expenses, payment tracking and recording of sales, customized tax for businesses, balance sheets, and P&Ls.

Moreover, the highly visual dashboards and real-time reports help you to get a bird’s eye view of all the financial processes thereby allowing you to gain full control of operations. Quickbooks is a software built to meet all the accounting needs of your business and integrates with almost 80+ partner apps, making it more feasible for you to use it along with your other favorite apps.

Know What You Are Looking For

Many people think that Quickbooks, FreshBooks, and ZarMoney are designed for the similar purpose of managing accounts for businesses, but this is commonly misperceived.

ZarMoney

ZarMoney is an intuitive accounting software that provides full-scale accounting services for small, medium, and large-sized businesses - facilitating users with all the features needed to start and progressively grow a business. It is best known for its collaboration, invoicing, productivity, inventory management, and user-friendly interface.

FreshBooks

FreshBooks, on the other hand, is best suited for small to medium-sized businesses that are usually service-based - helping them easily track expenses and revenue.

Quickbooks

Quickbooks is a perfect fit for businesses focusing on selling products and needing scalable, fully functional accounting software.

Invoicing Capabilities

ZarMoney

ZarMoney allows you to use various ready-to-use invoicing templates or create one best suited for your needs from scratch. You can also modify existing invoice templates to fit the requirements best. It enables its users to automate billing by generating and dispatching invoices within seconds.

ZarMoney allows you to manage invoices digitally and effortlessly track the status of bills or approve invoices. In addition, ZarMoney offers accounts reconciliation capabilities along with payable and receivable management.

FreshBooks

FreshBooks offers a customizable design for invoices with an integrated click-to-pay feature for online invoices. Billable hours are directly pulled from the timekeeping feature.

Another intriguing feature offered by FreshBooks is automatic invoicing, which automatically generates invoices of billable hours and recurring bills. Data fields can be re-adjusted with the drag-and-drop feature. Further, the tool allows users to follow up with clients or send payment reminders.

Quickbooks

Quickbooks gives you control to customize invoice design. Moreover, the tool allows clients to pay directly from the invoice through the click to pay feature. In addition, Quickbooks integrates with third-party tools like Google Calendar and TSheets to extract billable hours and add them to the invoices. In addition, automated recurring payments and reminders for overdue payments are also possible with Quickbooks.

Inventory Management

ZarMoney

ZarMoney lives up to its market expectations by providing you with advanced inventory management features. It efficiently tracks your stock levels across different warehouses, supports automated inventory management through its barcode system, and links the inventory database with your POS to instantly update your records after each transaction.

ZarMoney’s alerts and notifications keep users up to date with inventory levels in real-time - enabling you to make informed restocking decisions and ensuring that you don’t have to face the problems like over or under-stocking.

FreshBooks

FreshBooks has recently added inventory tracking to its services. It allows you to easily track your inventory and it automatically updates the stock amount on every successful sale. However, it does have a few integrations that offer basic inventory management.

Quickbooks

Quickbooks has a robust, built-in inventory tracking feature, which enables you to track inventory and timely make purchase orders for specific products based on the inventory output report. Therefore, ensuring that you never have to face errors resulting from over or underselling of the stock.

Ease of Use

ZarMoney

ZarMoney’s UI is simple and easy to understand. The accounting solution doesn’t bombard users with a lot of command operations and bulky menu bars. The flow is logical and users can get familiar with the tool in no time. ZarMoney gives users freedom of customization and allows them to navigate through different features with just a couple of clicks.

Quickbooks

Quickbooks is equipped with a modern UI specifically designed to be user-friendly, especially for those who lack a strong accounting background. The downside is that some of the features can be hard to find and users might need to access the help feature to explore the hidden capabilities of the tool.

FreshBooks

FreshBooks' new design is specifically designed for self-employed individuals. According to Mike McDerment, CEO and co-founder of FreshBooks:

“The new FreshBooks is designed to be the most ridiculously easy to use accounting software ever built — yet still packed with powerful features for self-employed professionals. This isn’t innovation for innovation’s sake. This is about making it easier for self-employed professionals to succeed because it’s hard enough being out on your own serving your clients.”

Reporting and Analytics

ZarMoney

ZarMoney’s reporting capabilities are a bit advanced compared to its counterparts. The tool provides in-depth insights to facilitate informed decisions. ZarMoney gives you the following report options:

FreshBooks

FreshBooks' reporting focuses on profit margins, with the main focus on payment collections and taxation. FreshBooks generates profit and loss reports, which are important for any business that saves a lot of time and makes your tax season stress-free. As of now, FreshBooks offers the following reporting options:

Quickbooks

Quickbooks' reporting feature allows you to access custom reports, most of which cover the accounting domain. Each group of reports consists of sub-reports that provide all the necessary details you or your accounting team needs for proper analysis. The downside is that many of the reports need manual input. As of now, Quickbooks offers the following report option

Let's Talk Integrations

When deciding on which accounting software to use, one of the most important features to consider is the tool’s ability to integrate with other software.

Since robust integrations are vital to optimizing and improving the tool’s efficiency, let's explore the integrations of the three solutions we’ve been discussing.

ZarMoney

ZarMoney comes with great integrations as well. It offers integrations with thousands of apps allowing you to keep using the software you need for the successful running of your business and that too hitch-free. Some of the important apps supported by ZarMoney are Shopify, Stripe, PayPal, Zapier, Gusto, Authorize.Net, Mailchimp, AutoEntry, WePay, and more.

FreshBooks

FreshBooks integrations allow you to connect with the apps you use effortlessly. This not only automates your workflows but also saves you time to focus on other key areas of your business. There are currently 21 categories of apps that FreshBooks can connect with including Analytics, Payments, Payroll, Tax Help, Customer Support, Lead Tracking, and Marketing. Some of the top picks include Gusto, Stripe, Zapier, Bench, G Suite, and Fundbox.

Quickbooks

Quickbooks offers over 400 integrations to help you automate work and let users focus on things that matter most. To ensure complete visibility and control over your financial operations, Quickbooks allows integration with banks, payment software, e-commerce platforms, and CRMs. Moreover, supported integration options for other helpful tools like PayPal and ReceiptBank keep you updated with all the necessary details concerning payments.

Price Plans

ZarMoney

ZarMoney has three types of pricing plans to offer - entrepreneur, small business, and enterprise. The entrepreneur plan is built for a single user. It charges $15 per month, making it the most economical accounting software available.

The small business plan includes 2 users and charges 10$ for each additional user. It offers unlimited transactions, full access to all features, and 24/7 customer support.

Lastly, the enterprise plan is designed for businesses that require thirty or more members to access the accounting solution.

In addition to the standard features, ZarMoney offers a few additional features for its enterprise customers, including Implementation assistance, a dedicated account representative, custom training, and priority support.

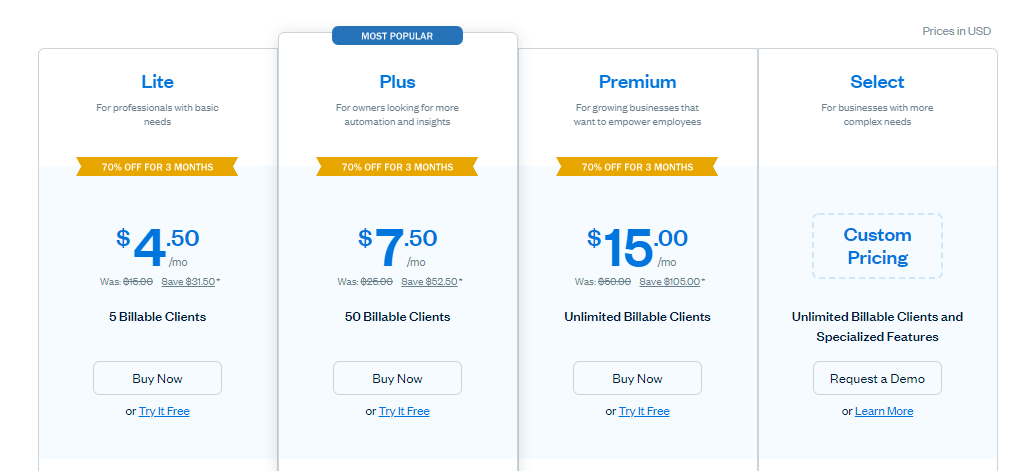

FreshBooks

FreshBooks is a perfect choice if you have a limited budget and don’t have to manage a lot of clients. For solopreneurs having 5 or less than 5 clients can use its Lite version. This plan allows you to create invoices, create estimates, track your time, accept credit card payments, conduct online bank transfers, and get tax reports.

The Plus Plan is designed for growing businesses. In addition to the features offered by Lite Plan, Plus Plan allows you to manage up to 50 clients, get unlimited proposals and schedule late fees.

Thirdly, the Premium Plan helps you manage 500 clients and offers optional add-ons such as advanced payments (charged $20 monthly) and other team members who can use your account (charged $10 per person).

Moreover, if you are working at a large scale and have greater accounting needs, FreshBooks offers a customized plan tailored to serve your needs best.

Quickbooks

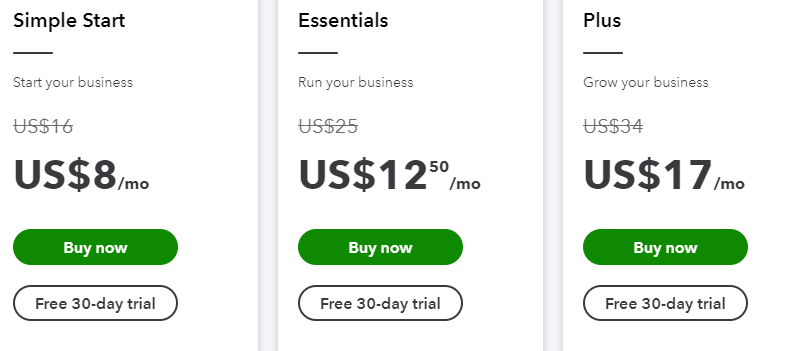

Quickbooks offers three types of pricing plans to address your different needs. The Simple Start plan is a Self-Employed plan that allows you to track your expenses and income, estimate taxes, and organize receipts.

The simple plan enables you to maximize your tax deductions, send estimates, accept payments and manage more than 1,000 contractors.

The essentials plan allows you to manage bills, track time, and add up to three users simultaneously. Finally, the Plus plan equips your business with the ability to extract comprehensive reports, track the profitability of your projects, send estimates, and track inventory.

Final Verdict

The solutions discussed in this article offer a variety of features to help you easily manage accounting workflows. However, each software has its own set of capabilities and limitations. Therefore, you need to work around the most suitable features and choose a solution that suffices.

The right bookkeeping and accounting software will depend on your specific needs: expense tracking, inventory management, or customized invoicing. ZarMoney is a great accounting software to cater to a business's financial needs. On the other hand, QuickBooks provides an extensive list of features best suited for medium- and large-sized businesses.

WhereasFreshBooks is an excellent option for solopreneurs and small businesses, it is a much more vital accounting tool to cater to a business's financial needs.

This may sound a bit biased, but ZarMoney might be one of the best accounting software to exist - providing users with various features at an affordable price. We have provided you with a detailed comparison of the tools based on their features - providing you with all the data you need to make an informed decision.

Frequently Asked Questions (FAQs)

1. How Do These Software Options Compare in Terms of Billable Clients?

From an accounting perspective, managing billable clients effectively is crucial. Most cloud-based accounting software offers various payment options to handle billable clients efficiently. Some even provide unlimited invoicing, ensuring you can scale your client base without hassle.

2. Do They Offer Inventory Management and Tracking?

Inventory management is an essential feature for businesses that deal with physical goods. Some financial management software options offer advanced inventory tracking functionalities. These features enable you to maintain optimal stock levels, reducing both overhead and shortage issues.

3. What Are the Customized Invoicing Features Available?

Invoicing is often a cornerstone for small businesses. The majority of these platforms offer customized invoices, allowing you to tailor them according to your brand’s look and feel. This is particularly beneficial for business owners who want to maintain a consistent brand image.

4. Can I Track Expenses with These Platforms?

Tracking expenses is vital for any business. Most accounting software platforms offer an expense tracking feature, which helps categorize and manage your expenditures. Some even allow you to take pictures of your receipts for easier expense feature use.

5. How User-Friendly Are These Platforms?

An intuitive user interface is key for those who may not have extensive accounting experience. Most of these platforms offer easy-to-use dashboards aimed to make financial management as straightforward as possible.

6. Are There Any Mobile Access Capabilities?

Mobile access has become increasingly important for business owners on the go. Most of these bookkeeping and accounting software offer mobile apps or mobile-responsive websites. This feature enables you to manage your accounts anytime, anywhere.

7. How Do They Handle Bank Reconciliation?

Bank reconciliation is another feature you would want your accounting software to have. Most of these software options can sync with your business bank account, making it easier to match transactions and ensure that your books are accurate.

8. How Flexible Are the Payment Methods Offered?

From a financial management perspective, the range of payment methods you can offer to your clients can make a significant difference. Most software options allow multiple payment methods, from credit cards to bank transfers, enhancing your clients' convenience.

9. Can I Generate Financial Reports?

Understanding your business’s financial health is crucial. Almost all accounting software options provide a range of financial reports. These reports can give you valuable insights into your income, expenses, and overall financial status.

10. Is It Possible to Track Project Profitability?

Tracking project profitability is essential for businesses that work on a project basis. Some platforms offer this advanced feature, allowing you to allocate resources more effectively and make data-driven decisions.