The Best Accounting Software for Your Business

Who We Are?

Based in Los Angeles, a team of professionals strived to develop a custom solution to high-priced and inflexible accounting software. Exploring market needs and available solutions, it was found that despite charging a lot of dollars, current solutions only give access to limited features and lack scalability. Hence, ZarMoney came into existence with a promise to offer a variety of flexible and custom accounting solutions to businesses around the globe.

Accounting Solutions for Real Estate Businesses

Web-Based Accounting Software

Access all your business financial data from anywhere you want. Our easy-to-use web-based accounting software that helps you generate seamless business invoices, track expenses, manage bills, reconcile bank statements, and create visually stunning financial reports on the go.

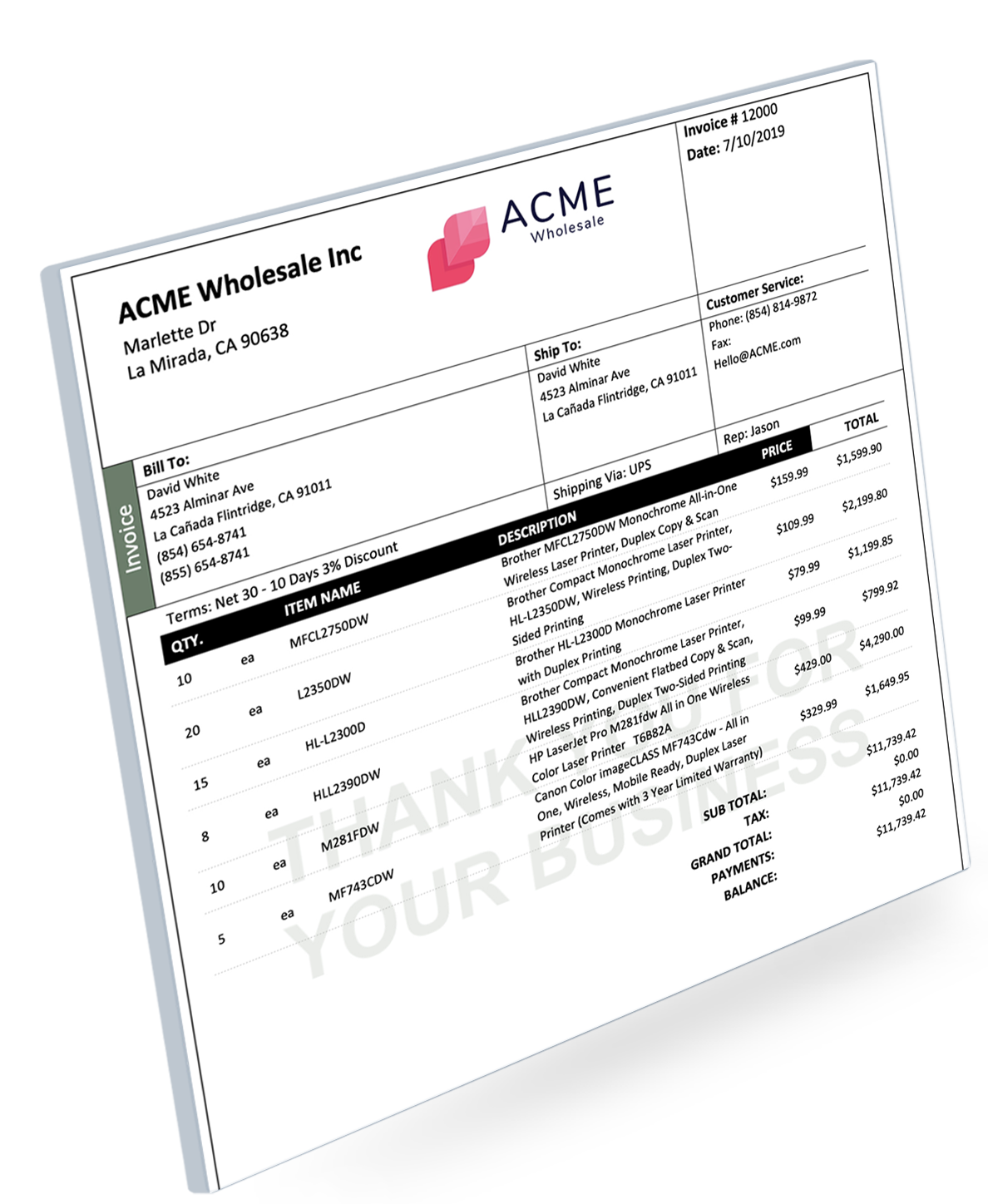

Seamless Invoicing and Billing

Billing customers doesn’t get easier than this. With ZarMoney, you can generate custom invoices online - best suited for your business needs. Generate invoices yourself or activate the auto-billing cycle. Add ‘Pay Now’ option - enabling customers to pay directly from the invoice received. Accept Debit & Credit Cards via PayPal, Stripe & more.

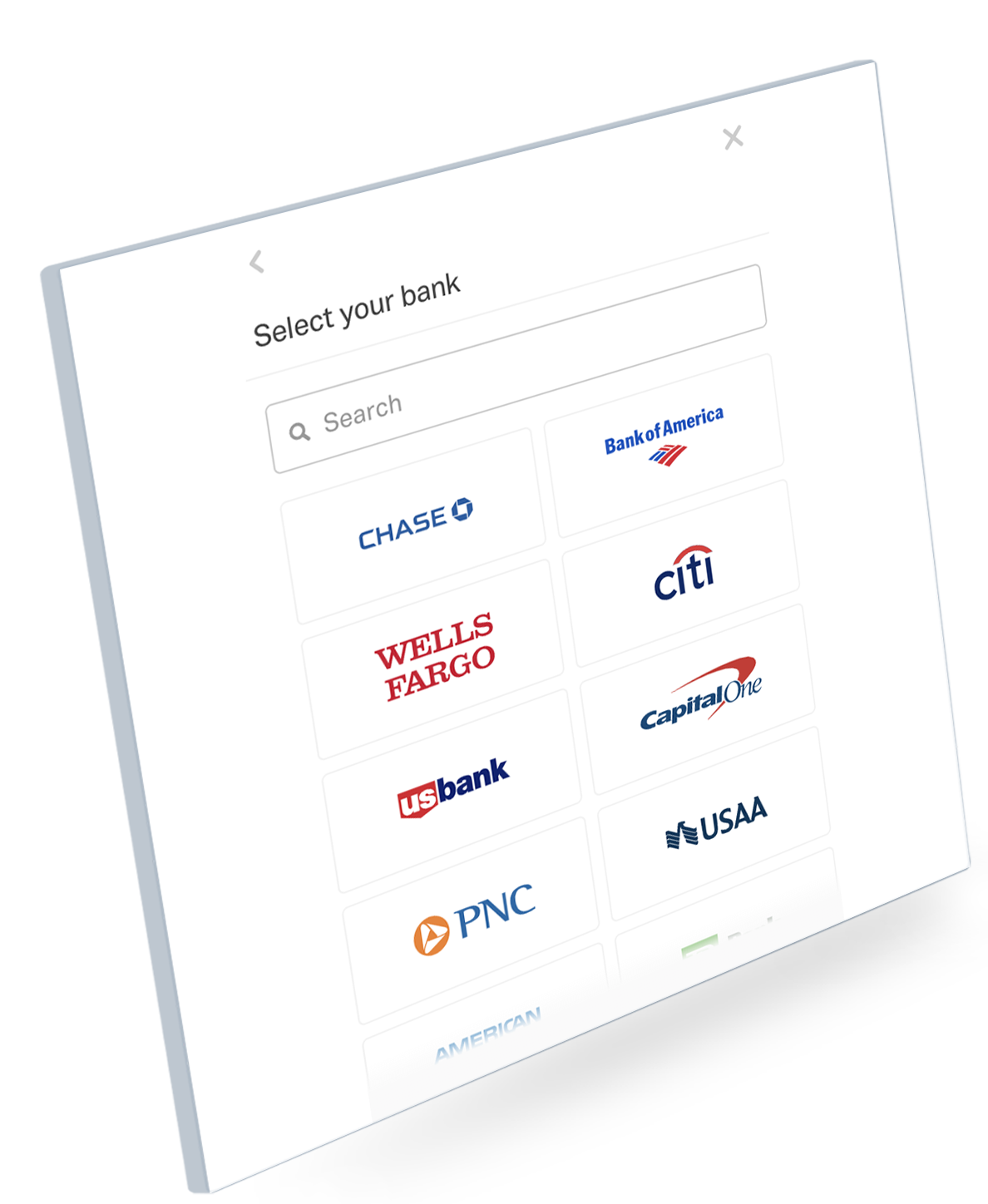

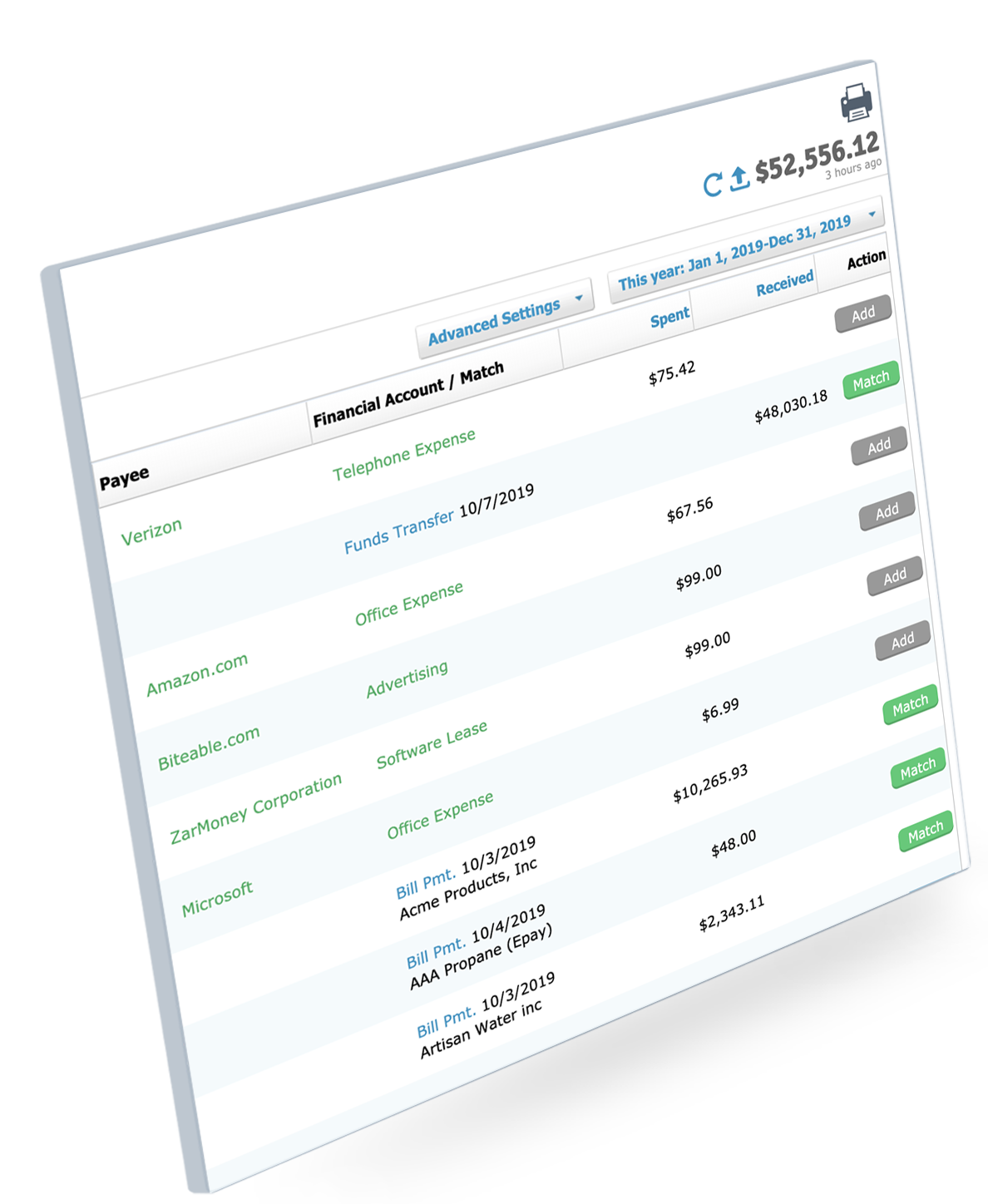

Bank Synchronization

ZarMoney brings automatic bank synchronization to your business. Accept, review, edit, and reconcile records from your bank transactions on a need basis. Our online accounting software facilitates connections with 9600 different financial institutions in the US and Canada - supporting a variety of transaction options.

Account Reconciliation

No detail goes unnoticed with our accounting software’s reconciliation feature. We bring account reconciliation to your fingertips - facilitating you to identify any underlying discrepancies with ease and get a bird’s eye view of your business transactions along with cash positions to make data-driven decisions.

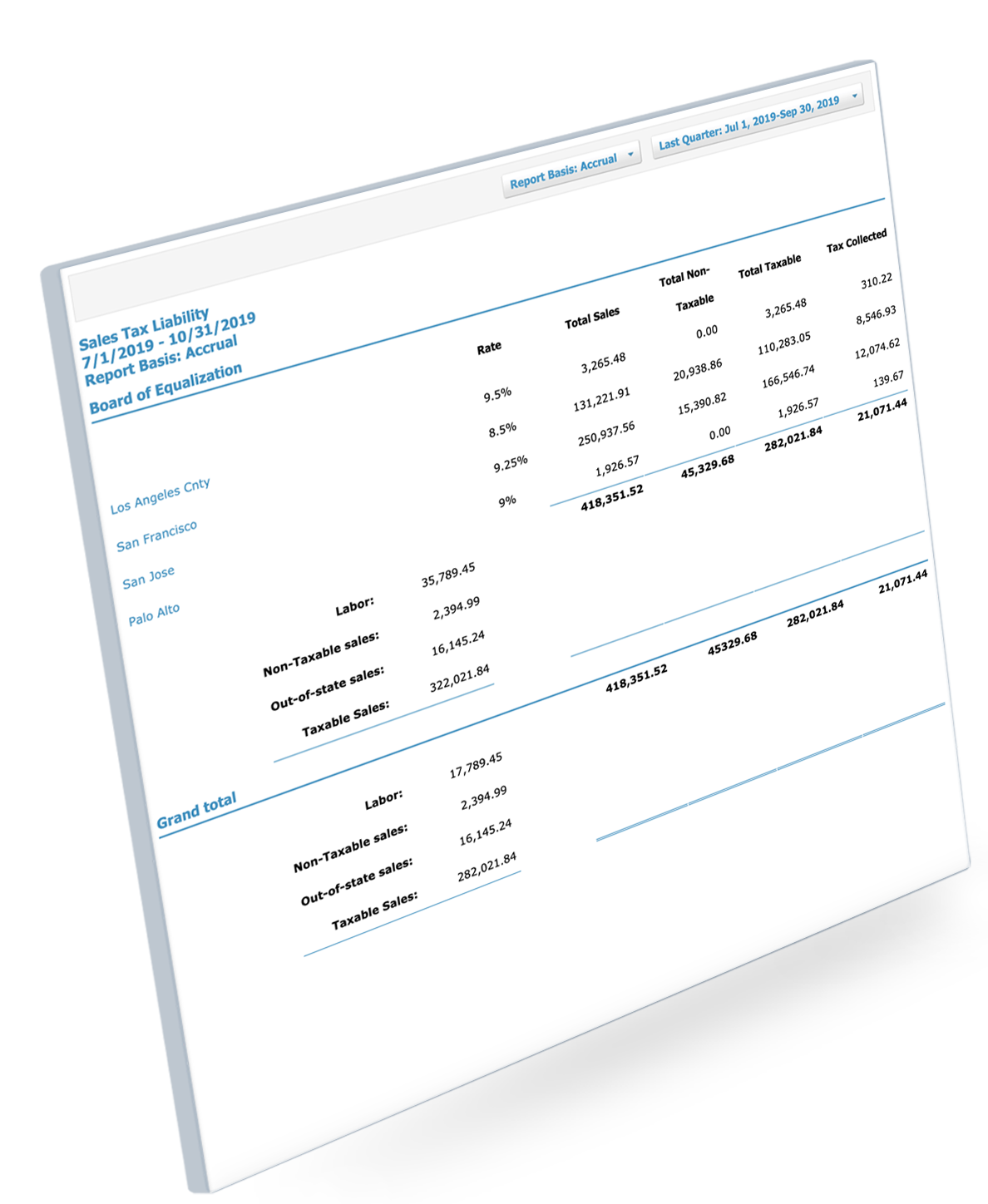

Automated Tax Calculation & Payment

ZarMoney automatically calculates taxes on your behalf and prepares tax filing reports for your business. You can override this feature and do it manually if you prefer it this way. You can also associate respective tax zones to different locations, stores, and customers to stay compliant as per the regulations in different regions.

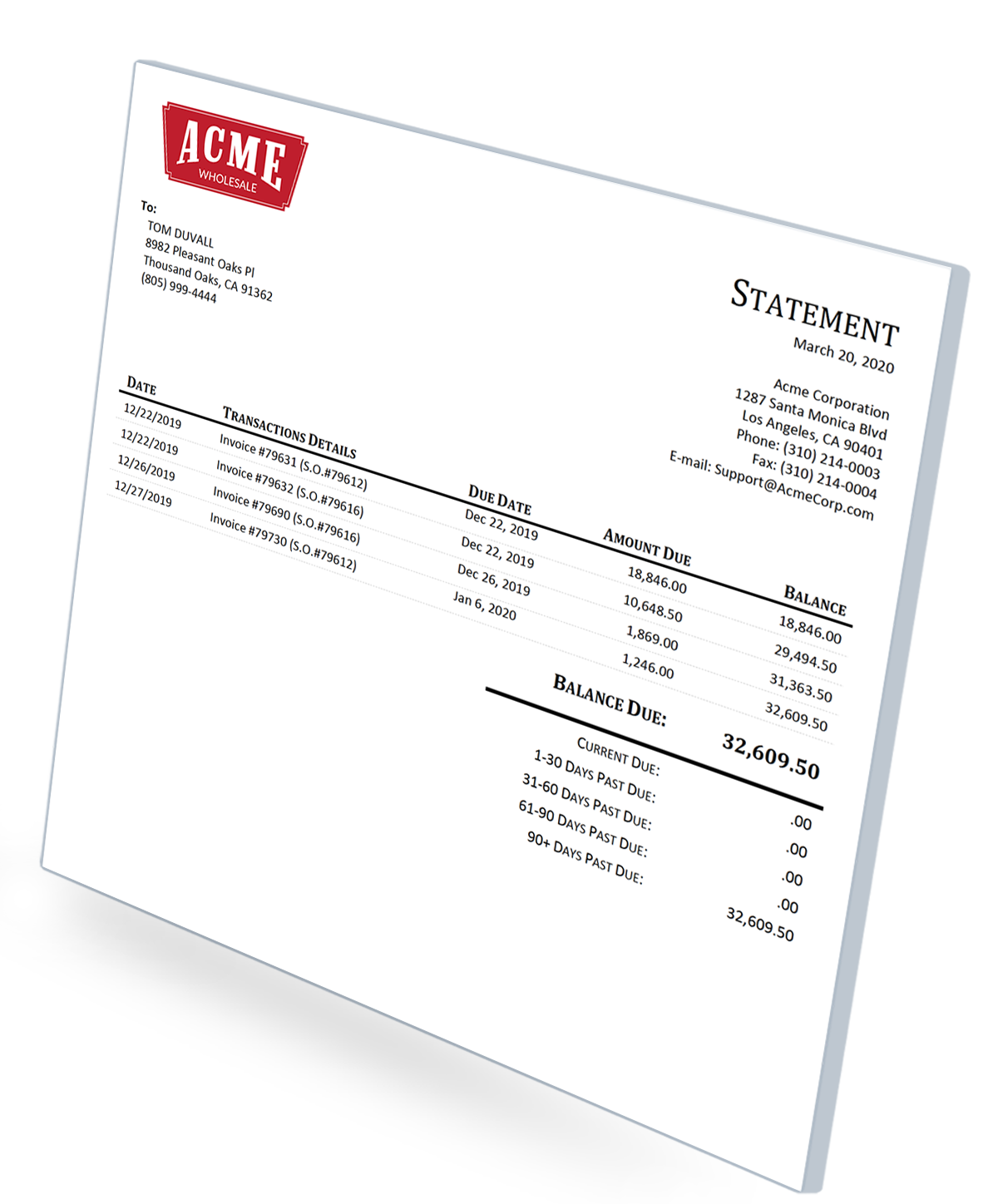

Dynamic Statements

Double-check reported transactions and actual bank statements with just a click. ZarMoney brings data annotation and comparison to your fingertips. Create balance sheets, cash flow statements, and custom earnings reports best suited for your business needs with ease.

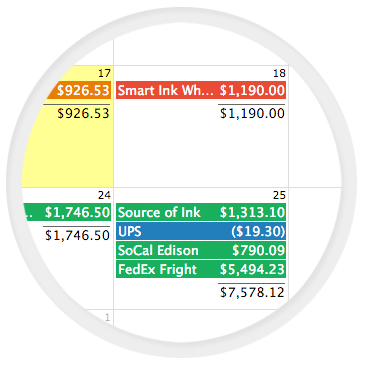

Payables Calendar

Manage your cash flow with ease via ZarMoney’s payables calendar. Upload invoices, add receipts, print checks in bulk, pay multiple vendors at once, and simplify recurring payments. ZarMoney makes it easy to track payables - enabling you to create payments from the available balance without any hassle.

Financial Reporting

Make predictions and automate the tedious process of reporting financial data. Derive actionable insights from the data points and create visually stunning financial reports with ZarMoney. Our accounting software enables you to extract historical data and create comprehensive reports to fuel your data-driven decisions.

Our Accounting Software Facilitates You With

Online Invoicing

Create professional invoices, get paid faster.

Automated Billing

Keep your bills up-to-date and never miss a payment.

Inventory Management

Gain complete visibility of your global inventory.

Online Payments

Accept payments online from anywhere in the world.

Bank Connections

Import your bank transactions automatically.

Quotes/Estimates

Create, print, and email quotes or estimates seamlessly

Purchase Orders

Optimize your ordering process and reduce costs.

Online Order Management

Manage the order life-cycle efficiently and hassle-free

Auto Tax Calculation

Automate your sales tax calculation as per the regional laws.

Reporting

Create visually stunning financial reports.

Multi-Users

Access permissions and role-based entry system for users.

Reconciliation

Identify discrepancies and reconcile statements with ease.

.png)

Top 20 Accounting Software on Capterra

Top 20 Accounting Software on Capterra

2020 Best Functionality & Features by GetApp

2020 Best Functionality & Features by GetApp

2020 Best Ease of Use Award by Capterra

2020 Best Ease of Use Award by Capterra

2020 Best Value Award by Capterra

2020 Best Value Award by Capterra

Top-Rated Accounting Software by SoftwareWorld

Top-Rated Accounting Software by SoftwareWorld

2020 Best Customer Support by Software Advice

2020 Best Customer Support by Software Advice