A Feature-Rich & Reliable Accounting Software for the Church

Who We Are?

Based in Los Angeles, a team of professionals strived to develop a custom solution to high-priced and inflexible accounting and inventory management solutions. Exploring market needs and available solutions, it was found that despite charging a lot of dollars, current solutions only give access to limited features and lack scalability. Hence, ZarMoney came into existence with a promise to offer a variety of accounting and inventory management capabilities to businesses worldwide.

What Our Accounts Receivable Software Has to Offer

Understanding Church Accounting Software

Selecting the right church accounting software is a lot more than evaluating its cost and features. The primary function of this software is to maintain clear and accurate financial records. ZarMoney accounting software comprises specialized features to help churches and similar organizations manage their financial information that can range from funds, contributions, donations, payroll, and other church expenses, etc., and provide detailed financial reporting.

End-to-end Reporting

Churches need robust reporting with easy-to-read data to maintain their credibility among donors. It is one reason why many churches use ZarMoney accounting software to have insightful reporting into their every single receiving and spending.

Timely & Accurate Information Availability

ZarMoney is cloud-based accounting software that enables timely and accurate virtual reporting to churches. These timely reports are available to all the shareholders and church administrations, enhancing the church’s reputation as a trustworthy organization that adheres to the funding guidelines and regulations.

Budget-Friendly

Churches, unlike businesses, often have a limited budget due to the conviction that causes need funding more than overheads. ZarMoney is not only reliable accounting software, it is also the cheapest solution with no hidden fee or service charges. It is based on per user and feature pricing to allow churches the flexibility to choose access authorization, control levels, and services according to their affordability.

System Security

Accounting software houses the kind of financial information that is sacred to any given business or organization. However, when the donor information or funding streams are involved, the data sensitivity shoots up many notches. ZarMoney is packed with various security features that limit user access, provide selective authorization, and restrict read/edit permission in order to maintain the highest level of data protection.

Systematic Bookkeeping

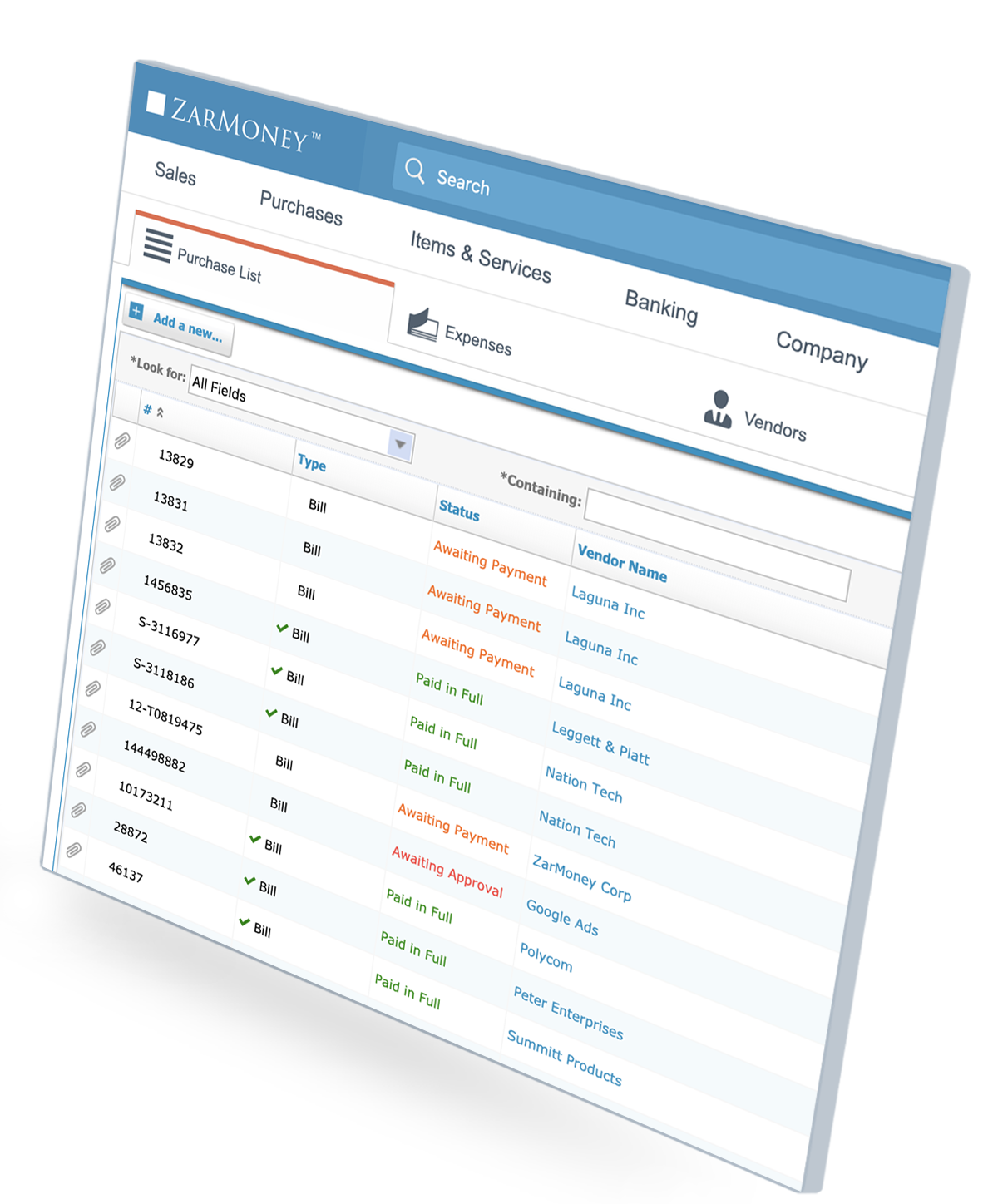

Bookkeeping is essential to keep the church’s funding and expenses organized. The donors and stakeholders require accurate information about fund utilization to determine transparency and general rules compliance. ZarMoney supports wide-ranging financial organization features, including bill management, payroll execution, online payments, imported bank transactions, automatic expense categorization, spend analogous, etc., to help churches with streamlined bookkeeping.

An All-in-One Accounting Software for the Church

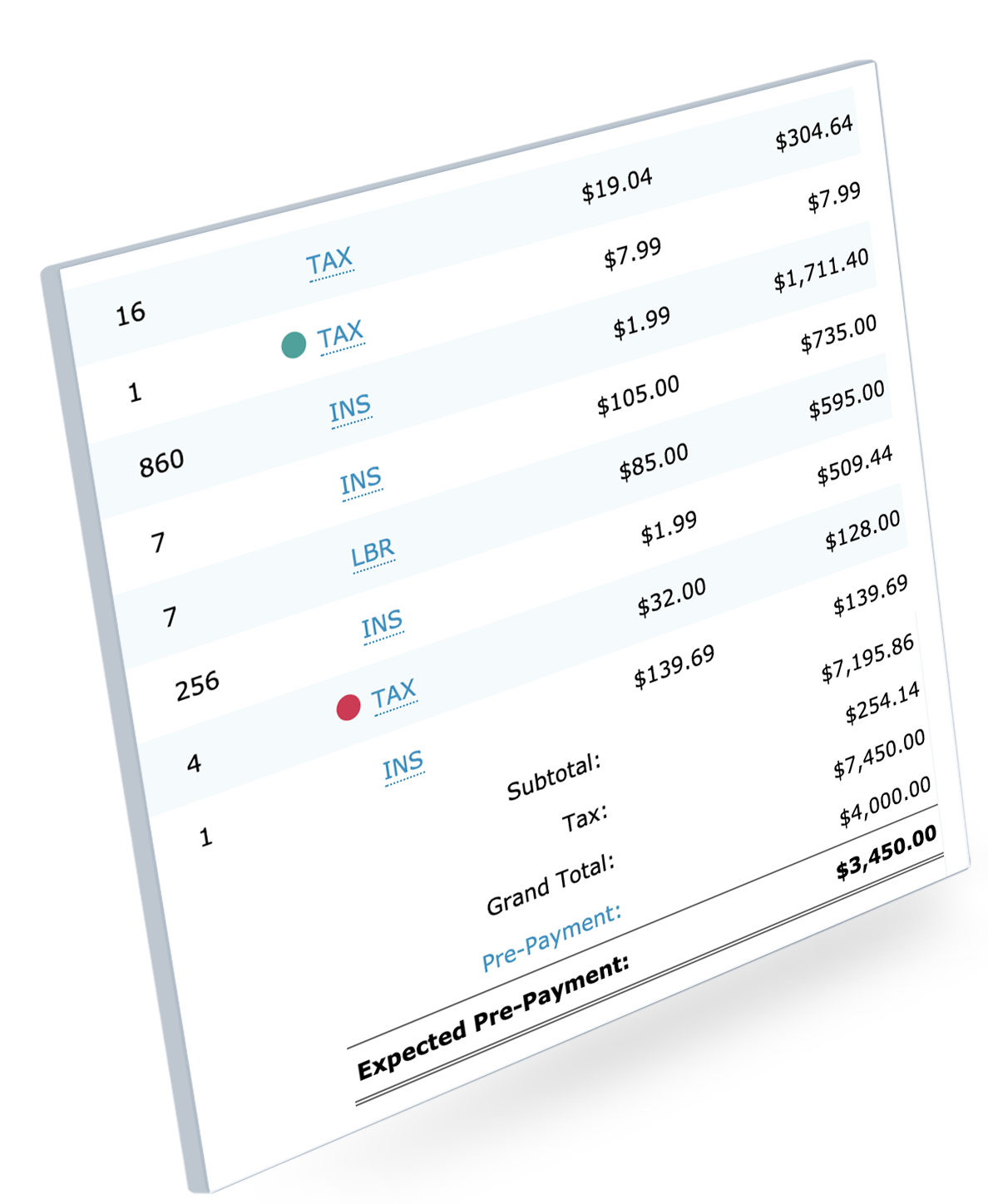

Online Invoicing

Create professional invoices, get paid faster.

Automated Billing

Keep your bills up-to-date and never miss a payment.

Inventory Management

Gain complete visibility of your global inventory.

Online Payments

Accept payments online from anywhere in the world.

Bank Connections

Import your bank transactions automatically.

Quotes/Estimates

Create, print, and email quotes or estimates seamlessly

Purchase Orders

Optimize your ordering process and reduce costs.

Online Order Management

Manage the order life-cycle efficiently and hassle-free.

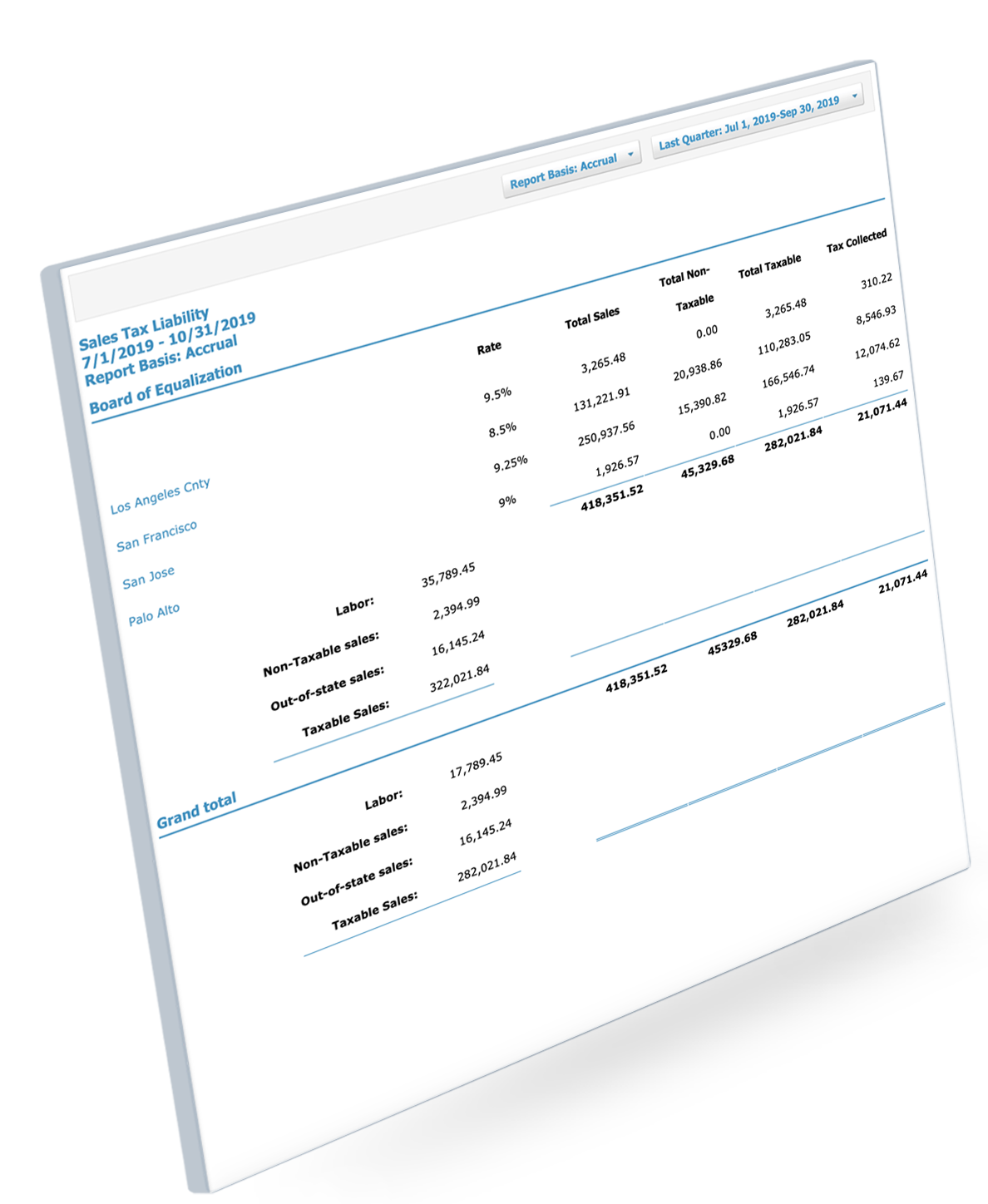

Auto Tax Calculation

Automate your sales tax calculation as per the regional laws.

Reporting

Create visually stunning financial reports.

Multi-Users

Access permissions and role-based entry system for users.

Reconciliation

Identify discrepancies and reconcile statements with ease.

.png)

Top 20 Accounting Software on Capterra

Top 20 Accounting Software on Capterra

2020 Best Functionality & Features by GetApp

2020 Best Functionality & Features by GetApp

2020 Best Ease of Use Award by Capterra

2020 Best Ease of Use Award by Capterra

2020 Best Value Award by Capterra

2020 Best Value Award by Capterra

Top-Rated Accounting Software by SoftwareWorld

Top-Rated Accounting Software by SoftwareWorld

2020 Best Customer Support by Software Advice

2020 Best Customer Support by Software Advice

Top 20 Accounting Software on Capterra

Top 20 Accounting Software on Capterra

2020 Best Functionality & Features by GetApp

2020 Best Functionality & Features by GetApp

2020 Best Ease of Use Award by Capterra

2020 Best Ease of Use Award by Capterra

2020 Best Value Award by Capterra

2020 Best Value Award by Capterra

Top-Rated Accounting Software by SoftwareWorld

Top-Rated Accounting Software by SoftwareWorld

2020 Best Customer Support by Software Advice

2020 Best Customer Support by Software Advice